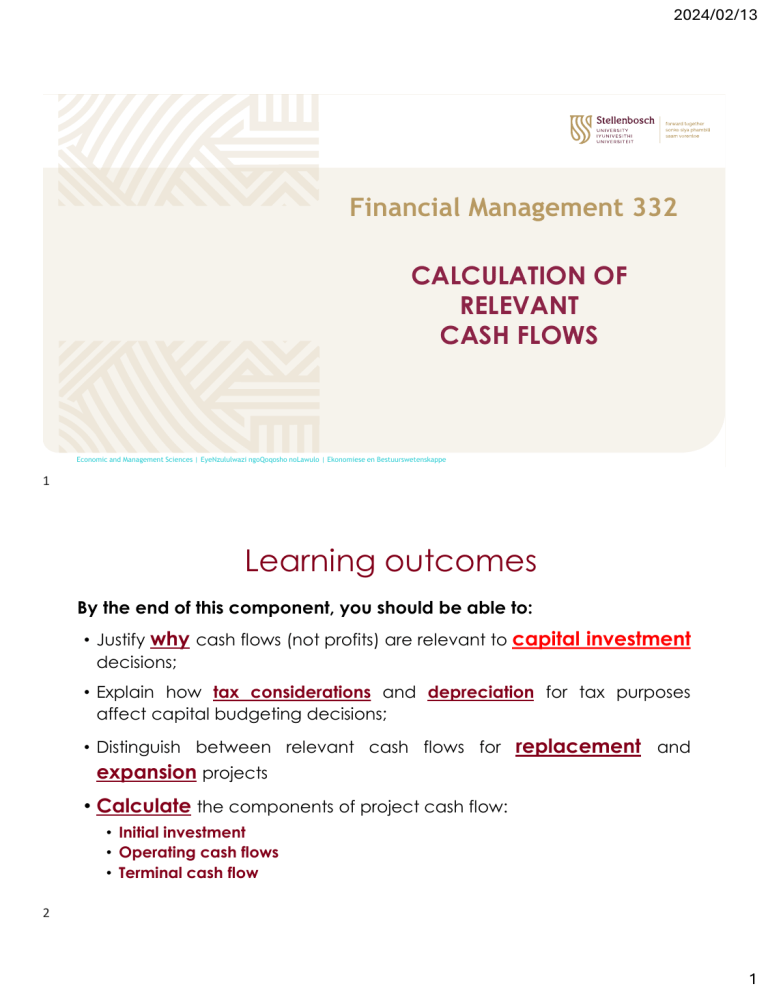

2024/02/13 Financial Management 332 CALCULATION OF RELEVANT CASH FLOWS Economic and Management Sciences | EyeNzululwazi ngoQoqosho noLawulo | Ekonomiese en Bestuurswetenskappe 1 Learning outcomes By the end of this component, you should be able to: • Justify why cash flows (not profits) are relevant to capital investment decisions; • Explain how tax considerations and depreciation for tax purposes affect capital budgeting decisions; • Distinguish between relevant cash flows for replacement and expansion projects • Calculate the components of project cash flow: • Initial investment • Operating cash flows • Terminal cash flow 2 1 2024/02/13 Introduction • Objective: Forecast CASH FLOWS associated with a capital investment project • Considers a single project within a firm • Estimate the cash flows that are expected to result from accepting to invest in a project 3 Introduction Capital investment: Investing large sums of money in a project with expectation of generating future cash flows that will be sufficient to warrant the initial investment ➢ Before managers acquire new capital assets, they need to be sure investment will yield positive NPV • Main focus of capital budgeting? Process of evaluating projects Need to focus on calculating cash flows ➢ Required to evaluate capital investments to determine if they contribute to shareholders’ wealth maximisation 4 2 2024/02/13 Difference between profit & cash flows When investigating financial feasibility: ▪ Information required often from Statement of Profit or Loss ▪ Focus only placed on cash flow of project, NOT profit ▪ Reason: profit represents accounting item calculated based on accounting guidelines ▪ Profit does not necessarily represent cash flow Another distinction between profit and cash flow: ▪ Profits calculated for certain period of time ▪ Cash flows determined on specific point in time (when cash is physically received or spent) 5 Estimating relevant cash flows Relevant cash flows: ▪ Cash flow that leads to change in overall future cash flows ▪ Direct consequence of accepting a project ▪ Incremental cash flows Evaluation of expansion activities: ▪ Focus placed on cash flows associated with new project Evaluation of replacement activities: ▪ Comparison between: Current cash flow and ▪ Cash flow after replacement took place ▪ 6 3 2024/02/13 Estimating relevant cash flows Sunk costs ▪ Unrecoverable past costs ▪ Excluded when determining project’s incremental contribution to overall cash flow of business Opportunity costs ▪ Value of most valuable alternative given up if investment is undertaken ▪ Included as part of relevant cost 7 Estimating relevant cash flows Finance costs ▪ Already included in company’s cost of capital ▪ Excluded when calculating relevant cash flows Inflation and tax ▪ After-tax cash flows ▪ Company tax (27%); VAT (15%); Capital gains inclusion (80%) 8 4 2024/02/13 Components of cash flows • Initial investment • Operating cash flow • Terminal cash flow Operating cash flows +R8 000 +R10 000 +R12 000 +R14 000 +R16 000 Terminal cash flow +R15 000 T1 T2 T3 T4 T5 - R40 000 Initial investment Distinction between replacement and expansion projects 9 Calculating the initial investment Include ALL costs required before production / sales from project can proceed Total up-front costs (installed cost) ▪ Cost of investment (land, building, equipment) ▪ Shipping, transport and installation costs ▪ Training costs of employees Any change in net working capital resulting from project represents a cash flow Calculated on an after-tax basis (VAT should be included) 10 5 2024/02/13 Calculating the operating cash flows Capital investment: • Represents investment in fixed assets required for operating activities • Utilising assets will generate cash flows After initial investment is made: • Series of cash flows usually generated over the project lifetime Major objective: • Identify projects in which sufficient cash inflows will be generated to justify initial investment 11 Calculating the terminal cash flow • Cash flows that relate only to the final stage of the project lifetime • Realised upon termination of the project Three common categories: ▪ Estimated after-tax sales proceeds from old/existing asset ▪ Shut-down costs (removal, repairs) ▪ Recovery of the NWC investment made at beginning of project lifetime (as part of the initial investment) 12 6 2024/02/13 Calculating the relevant cash flow for an expansion project • Expansion project: • • Additional capital investment Expected to increase existing level of operations • Focus placed on the cash flows associated with the new project • Need to consider potential impact on cash flow from existing projects 13 Initial investment for expansion project Relevant cash flow determined by considering: • additional cash flows • that will result from new project Total cost of the new asset (xxxx) Purchasing price (xxx) +Shipping and installation cost (xxx) ±Change in net working capital (xxxx) Initial investment (xxxx) 14 7 2024/02/13 Operating cash flow for expansion project • Need to convert profit from the SPL to cash flow • Starting point: EBIT = Profit before finance cost and tax • Recalculate tax based on EBIT to determine NOPAT • Add back depreciation; amortisation Income − Expenses EBITDA − Depreciation EBIT − Taxes NOPAT + Depreciation Annual operating cash flows NEW xxx (xxx) xxx (xxx) xxx (xxx) xxx xxx xxx 15 Terminal cash flow for expansion project After-tax sales proceeds: • Determine proceeds from selling the asset (sales proceeds minus removal cost, etc.) • Compare to book value to determine total profit/loss • Calculate taxes: • Capital gains tax • Accounting tax asset….. After-tax proceeds from sale of old asset NEW xxxx asset….. Proceeds from sale of old asset xxx ± Tax on sale of old asset asset….. xxx ± Change in net working capital Terminal cash flow (xxxx) (xxxx) 16 8 2024/02/13 CLASS EXAMPLE CASH FLOW PROBLEM 1 17 Calculating the relevant cash flow for a replacement project • Additional capital investment compared to proceeds from existing investment ➢ Expected to result in a existing level of operations change from the • Focus placed on the difference in cash flows generated with the new project compared to the existing project (incremental cash flows) 18 9 2024/02/13 Initial investment for replacement project • Not sufficient to focus only on cash flows associated with new asset • Also need to consider what effect removal of existing asset has on company’s cash flows Total cost of new asset Purchasing price +Shipping and installation cost ±Change in net working capital (xxxx) (xxx) (xxx) –After-tax proceeds sale of old asset Proceeds from sale of old asset xxx ±Tax on sale of old asset xxx ±Change in net working capital Incremental initial investment (xxxx) xxxx (xxxx) (xxxx) 19 Operating cash flow for replacement project • Comparison between the after-tax operating cash flows generated by the existing and new projects: Income Income − Expenses − Expenses EBITDA EBITDA − Depreciation − Depreciation EBIT EBIT − Taxes − Taxes NOPAT NOPAT + Depreciation + Depreciation Annual operating cash flows Annual operating cash NEW xxx (xxx) xxx (xxx) xxx (xxx) xxx xxx xxx flows OLD xxx (xxx) xxx (xxx) xxx (xxx) xxx xxx xxx • Incremental after-tax cash flows shows if: ➢ Replacement (new asset) cuts costs or ➢ Provides higher income than old asset 20 10 2024/02/13 Terminal cash flow for replacement project • Relevant cash flow is incremental terminal cash flow • Calculations for both the new and old asset required After-tax proceeds from sale of old newasset asset newasset asset Proceeds from sale of old xxx new asset ± Tax on sale of old asset xxx ± Change in net working capital (xxxx) Terminal cash flow (xxxx) oldasset asset After-tax proceeds from sale of old Proceeds from sale of old oldasset asset xxx ± Tax on sale of old oldasset asset xxx ± Change in net working capital Terminal cash flow xxxx xxxx (xxxx) (xxxx) 21 Capital gains tax • Provision for capital gains tax not necessary when assets are sold at prices less than their original cost prices • Is possible, however, that an asset can be sold at price in excess of not only its book value, but also in excess of its original purchase price • In such a situation, transaction will also be exposed to capital gains tax 22 11 2024/02/13 Tax calculations NB: Unless specified otherwise • Value added tax (VAT) = 15% • Corporate tax rate = 27% • Capital gains tax inclusion rate = 80% 23 CLASS EXAMPLE CASH FLOW PROBLEM 2 24 12 2024/02/13 Conclusion • The focus should be placed on cash flows, and not profit, when capital projects are appraised. • Sunk costs and additional financing costs should not be included when determining a project’s relevant cash flows. • In contrast, opportunity costs, inflation and taxes should be included when estimating a project’s relevant cash flows. 25 Conclusion • Although the procedure differs slightly when estimating cash flows for an expansion project and a replacement project, projects usually consist of three types of cash flows, namely: • Initial investment; • Operating cash flows during the life of the project; and • A terminal cash flow. • In those cases where assets are sold for more than their original cost price, the resulting capital gain will be taxable. 26 13