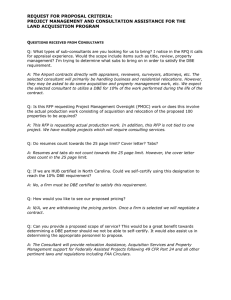

YOM POST GRADUATE COLLEGE DETERMINANTSOFPROJECTFAILURE; THE CASE OF PROJECTS FINANCED BY DEVELOPMENT BANK OF ETHIOPIASOUTHWESTADDIS ABABADISTRICT A RESEARCH PROPOSAL SUBMITTED TO DEPARTMENT OF MANAGEMENT IN PARTIALFULFILMENTOFTHEREQUIREMENTFORTHEAWARDOFMAST ERS OF BUSINESS ADMINISTRATION BY BY: BETELHAME ZEWDE:GSMEA/007/14A ADVISOR:Dr. MESERET (Ass. professor) January, 2023 ADDISABABA,ETHIOPIA DECLARATION I, the undersigned, declare that this thesis is my original work, prepared under the guidance of Meseret (Dr). All sources of materials used for the thesis have been duly acknowledged. I further confirm that the thesis has not been submitted either in part or in full to any other higher learning institution for the purpose of earning any degree. Betelhem Zewde ____ ___________________ Name Signature YOMPOSTGRADUATEDCOLLEGE, Addis Ababa January, 2023 YOM POSTGRADUATED COLLEGE SCHOOL OF GRADUATE STUDIES FACULTY OF BUSINESS DEPARTMENT OF MASTER OF BUSINESS ADMINISTRATION (MBA) DETERMINANTS OF FAILURE FOR PROJECTS FINANCED BY DEVELOPMENT BANK OF ETHIOPIA; A CASE STUDY IN SOUTH WEST ADDIS ABABA DISTRICT Submitted by: Betelhem Zewde Signature _________________Date______________ Approved by: Name of Advisor ________________________ Signature _________________Date________________ Name of Internal Examiner _____________ Signature _________________Date________________ Name of External Examiner_________________ Signature _________________Date________________ Name of Head of Department _________________ Signature _________________Date_____________ ACKNOWLEDGEMENTS I would like to express the deepest thankful to my Almighty God for finish this study. I would like to express the deepest appreciation to my advisor, Meseret (Dr), who has the attitude of genius for making this a meaningful learning process. Her guidance and encouragement throughout the process of formulating my ideas was invaluable and their ability to view things logically was serious to the success of this study and needs to be highly praised. Without her guidance and persistent help this thesis would not have been possible. I am also thankful to my friend Ashenafi Antenehe, who has helped me by sharing his idea for the preparation of this thesis. Last least, I would like to thank my Husband HailuTadesse for his encouragement and support throughout my life. 1 TABLEOFCONTENTS DECLARATION........................................................................................................................ 2 ACKNOWLEDGEMENTS ...................................................................................................... 1 TABLEOFCONTENTS ............................................................................................................. 2 ACRONYMS .............................................................................................................................. 5 Abstract ........................................................................................................................................ 6 CHAPTER ONE: INTRODUCTION ...................................................................................... 7 1.1. Background of the Study ............................................................................................... 7 1.2. Statement of the Problem .............................................................................................. 8 1.3. Research Questions ....................................................................................................... 9 1.4. Research Objective ...................................................................................................... 10 1.4.1. Main/General Objective: ...................................................................................... 10 1.4.2. Specific Objectives:.............................................................................................. 10 1.5. Significance of the Study ............................................................................................ 10 1.6. Scope of the Study ....................................................................................................... 10 1.7. Limitations of the Study .............................................................................................. 11 1.8. Organization of the Paper ............................................................................................ 11 CHAPTER TWO: REVIEW OF RELATED LITERATURE ............................................ 12 2.1. Introduction ................................................................................................................. 12 2.2. Definition and Concepts of projects and project failure ............................................. 12 2.3. Cause of Project Failure .............................................................................................. 15 2.4. Empirical Results and Facts ........................................................................................ 18 2.5. Conceptual Framework ............................................................................................... 21 CHAPTER THREE: RESEARCH METHODOLOGY ...................................................... 23 3.1. Introduction ................................................................................................................. 23 3.2. Description of the organization ................................................................................... 23 3.3. Research Design and Approach ...................................................................................... 23 2 3.3.1. Research Design .......................................................................................................... 23 3.3.2. Research Approach ..................................................................................................... 24 3.3.1. Quantitative Approach ................................................................................................. 24 3.3.2. Qualitative Research Approach ................................................................................... 24 3.4. Sources and Method of Data Collection ..................................................................... 24 3.4.1. Data Source and Collection ......................................................................................... 24 3.5. Target Population and Sampling Design ..................................................................... 25 3.5.1. Population of the study................................................................................................ 25 3.5.2. Sample size.................................................................................................................. 25 3.5.3. Sampling Technique .................................................................................................... 26 3.6. Method of Data Analysis............................................................................................. 27 3.6.1. Data Processing ........................................................................................................... 27 3.6.2. Data Analysis .............................................................................................................. 27 3.7. Reliability Test Validity of Research Instrument ........................................................ 28 3.8. Ethical Consideration .................................................................................................. 28 CHAPTER FOUR: RESULT AND DISCUSSIONS ............................................................ 29 Introduction ............................................................................................................................ 29 5.1. Summary of the Respondents ...................................................................................... 29 5.2. Ranking of Causes of Project Failure .......................................................................... 32 CHAPTER FIVE: .................................................................................................................... 41 CONCLUSION AND RECOMMENDATION ..................................................................... 41 5.2. Conclusion ................................................................................................................... 41 5.1. Recommendation ......................................................................................................... 42 REFERENCE ........................................................................................................................... 47 3 LIST OF TABLES Tables page Table 1: Sample Size Determination .......................................................................................................... 26 Table 2: Transformation matrix table. ........................................................................................................ 28 Table 3: Gender characteristics of respondents from bank side.................................................................. 29 Table 4: Project characteristics ................................................................................................................... 31 Table 5: RII of the factors affecting project failure: Bank side data ........................................................... 33 Table 6: RII of the factors affecting project failure: Borrowers side data .................................................. 33 4 ACRONYMS DBE: Development Bank of Ethiopia NPLs: Non Performing Loans KYC; Knowing Your Customer GDP – Growth domestic product IT – Information technology NBE - National Bank of Ethiopia RII-Relative Importance Index 5 Abstract The general objective of this study is to assess determinants of project failure in the case of DBE financed projects. The target population was projects financed by DBE through South West Addis Ababa District out of which, 154 projects were determined to be the sample size achieved using a formula. The sampling technique used was stratified sampling technique together with simple random sampling technique. In addition to this, Judgmental sampling technique was employed to select 58 respondents from DBE staff. The data collected from both the DBE staff and borrowers was analysed using the Relative Importance Index level of effect assessment model. The findings revealed that among the listed factors, “Inflation”, “Corruption”, and “Exchange rate” are the most influential factors contributing to projects failure. It was recommended that DBE shall take measures to mitigate inflation, manage exchange rate risks, and combat corruption together with a due attention and also develop mitigation tools to factors such as GDP, interest rates, due diligence, management problems, risk management, and supervision, as they also contribute to the overall borrowers’ experience and projects performance. This study advances the theory of failure behaviour and contributes to the foundation for future research aimed at improving understanding of DBE and its employee’s about project failure factors. Key words: Bank, Borrowers, Project failure Factors, Relative Importance Index (RII) 6 CHAPTER ONE: INTRODUCTION This chapter presents the background of the study, statement of the problem, research questions, study objectives (both general and specific objectives), hypothesis, significance, scope, organization of the study. 1.1. Background of the Study By converting savings from individuals, businesses, and governments into loans or investments, financial institutions serve as middlemen. They frequently serve as people's and businesses' main source of funding. The most important financial institutions include pension funds, insurance companies, security firms, mutual funds, and commercial banks (Peter and Keith, 2007).There is a difference between deposit-taking institutions (DTIs) and non-deposit-taking institutions (NDTIs). A few instances of institutions that accept deposits are banks. Most of their liabilities (assets to lenders) consist of deposits. These can be swiftly withdrawn and are usually part of the country's bmoney supply (Peter and Keith, 2007).A bank is a company that deals in currency and provides further financial services. Banks take in deposits, give out loans, and generate revenue. Development banks are state-backed financial institutions that concentrate on providing long-term loans to projects that are both financially successful and socially beneficial, according to Hüseyin, Derya, and Mehtap (2010). To make effective use of its resources, Ethiopia, a developing nation, has created and carried out a significant number of development projects involving both government and commercial development organizations. restricted financial resources, primarily from loans and international aid in addition to domestic savings. To guarantee the effective execution of these programmers, the government has set up a number of offices at the ministerial and agency levels. These offices offer technical support and project financing arrangements at lower interest rates because project finance has a far higher risk than traditional loans. The Ethiopia Development Bank was founded to further national development objectives as a strategic development finance organization. Because of this, the bank's purpose is to further national objectives by offering credit goods and services such warranty services, syndicated financing, new loans, extended loans, loan transfers, and redemptions, among other things. DBE offers credit for 7 loans that are short-, medium-, and long-term. The loan period will be determined based on the particular needs and project requirements (DBE Annual Report 2021/2022). The goal of the bank's lending procedure is to give consumers the finest possible service for the least amount of money and time. Four separate loan processing divisions are formed by this procedure, which combines the Credit, Project Appraisal, Loan Approval, and Restructuring teams and processes. The bank has to thoroughly examine and assess all development projects that have been submitted for funding in order to accomplish this goal. Furthermore, it guarantees the allocation of resources to economically viable development projects and the appropriate reinforcement of the procedures for repayment (DBE, 2008). Project failure is the DBE's main problem, as it raises the quantity and proportion of nonperforming loans. The suspension of interest on non-performing loans results in a large decrease in the bank's income and profitability, making this a double-edged sword that requires provision and other administrative costs. This negative fact harms the bank's standing and makes it more difficult for it to assist in the country's efforts to thrive. has an adverse effect on the bank's liquidity position, locks up its capital, and weakens its competitiveness both locally and internationally. As a result, it is incompatible with a development bank, which is expected to play a vital role in ensuring the bank's sustainability (DBE, 2009). 1.2. Statement of the Problem Carlos (2002) asserts that when a project fails to produce the desired results as anticipated, it is deemed a failure. Thus, in order for a project to be successful, it must be completed at the lowest feasible cost, with the desired quality, on schedule, and with the advantages outlined in the business case. A project may be deemed successful even though it has everything outlined in the comprehensive project plan if it is missing some essential components that are required by important stakeholders. According to Alex (2018) and Derartu (2020), in addition to the banks' credit management system, project-specific problems, changes in sociopolitical conditions, and shifts in macroeconomic variables could all contribute to the failure of bank-financed projects. Nonetheless, the empirical 8 literature does not investigate the significance of these explanatory variables in the particular scenario of the DBE South West District. Regardless of the reason behind the project's failure, it will raise the nation's sunk costs because fixed investments in the projects are made specifically for that purpose and are either difficult to liquidate or require significant switching costs. It also uses up loanable funds that the Bank could have used to support other projects that might be essential to the country's economic growth. As per the researcher’s knowledge, three are three empirical gaps in the literature in on project failure on DBE financed projects. Firstly, there is no empirical evidence on this topic with the South-west district under consideration. Secondly, there is a lack of study that shows failure of projects in accordance with the specific sector they are operating in which would have paved the way for more specific analysis about what sector is experiencing more failure. Lastly, of the research gaps is the lack of studies that indicate which factors are more influential in inducing project failure; which factor is more influential in determining project failure in DBE financed projects, so far as the researcher’s understanding. Therefore, the current study was conducted with the aim of empirically identifying and analyzing major factors that influence projects’ performance taking into account their sector and with the purpose of ranking identified factors as per their relative level of importance in instigating project failure. 1.3. Research Questions Considering the above problem statement, this study will focus on investigating major determinants of DBE South west Addis Ababa District financed project failures and support the Bank to meet its vision by addressing the following research questions. 1. What are the major socio political factors? 2. What are the major macroeconomic factors? 3. What are the major project specific factors? 4. What are the major credit management factors? 9 5. Which sector of investment/projects experience more failure? 1.4. Research Objective 1.4.1. Main/General Objective: The general objective of this study is to assess determinants of project failure in the case of DBE financed projects. 1.4.2. Specific Objectives: The study will have the following specific Objective 1. To examine the impact of macroeconomic factors. 2. To assess the impact of socio-political factors. 3. To examine the impact of project specific factors. 4. To assess the impact of the Bank’s credit management system. 5. To assess which sector of investment/project experience more project failure. 1.5. Significance of the Study The study acquired practical experience and more knowledge about the subject area and carrying out research more meticulously. In addition to that, the finding of the study can be utilized by the management of both the bank and the borrower so that the will be able to design appropriate strategies to take corrective action on such factors and avoid project failure. Plus, the study can be used as a reference for future researches. Overall, this research is useful input to the bank and the borrower since project failure is costly for Development Bank of Ethiopia and for the project owner as it takes their time, money, energy, and all resources spent on the project. 1.6. Scope of the Study The study you mentioned focuses on the factors that contribute to project failure in the Development Bank of Ethiopia (DBE) and how to avoid it. The study is limited to the projects financed by DBE, a development bank in Ethiopia, South West Addis Ababa District. The study 10 covers four categories of factors that may affect project failure: macro-economic factors, sociopolitical factors, project specific factors, and credit management related factors of the bank. The study does not consider other factors that may influence project performance and outcomes, such as environmental, technological, legal, or ethical factors. The study also does not evaluate the impact of project failure on the economic and social development of Ethiopia or on the financial performance and reputation of DBE. The study’s findings can be utilized by the management of both the bank and the borrower to design appropriate strategies to take corrective action on such factors and avoid project failure. The study can also be used as a reference for future research. Project failure is costly for DBE and for the project owner as it takes their time, money, energy, and all resources spent on the project. 1.7. Limitations of the Study There were some common limitations faced including limited access to information, time and budget constraints. In addition to that, the study is performed with only the selected South-west district which might impact generalizability and interpretation. Additionally, the variables included for analysis are not all-inclusive. The validity of the study constrained to the perceptions of the respondents. Plus, the factors of project failure is very crucial and need to be seen at country level, conducting the study as country level on all sectors, data, time and budget will be considered as constraint. 1.8. Organization of the Paper Organization of the Study is to provide a map that may guide readers through the reading and understanding of the thesis. This study has five chapters the first chapter introduces the background, statement of the problem, the research objectives and questions, significance of the study and the scope of the study. The second chapter focuses on both theoretical and empirical review of related literature and the third chapter deals with the research methodology. Chapter four deals with the data analysis and presentation and the fifth chapter contain the conclusion and recommendation of the study including the direction for further study. 11 CHAPTER TWO: REVIEW OF RELATED LITERATURE 2.1. Introduction This part of the study focuses on, the literature written by different authors and researches conducted by different scholars in project failure. The literature were acquired from books, various academic journals and different publications, annual report of the Bank, websites and other dependable sources that is relevant for these particular study. From the available materials, it can be point out the critical issues on the major cause of project failure is discussed in detail by using the theoretical and empirical perspectives. 2.2. Definition and Concepts of projects and project failure A project is fundamentally a brief endeavor started with the goal of producing a special good, service, or outcome. Temporary implies that there is a distinct and definite beginning and end; project management requires tailored activities to support these characteristics; as a result, how well the project performs in relation to its schedule—that is, whether it begins and ends on time—is a key metric of success. When something is unique, it means that it stands out from all other goods and services in some way. Projects are the most common form of investment since they include the use of financial resources to construct assets that would yield advantages over a long period of time; according to Shyam (2002).Projects are the cutting edge of development, notwithstanding that. The majority of developing nations implement their development strategies through projects. Project completion on schedule makes a significant contribution to an organization's competitive edge (Kariungi, 2014). Project failure is an international phenomena that has an impact on both the parties involved in the project and the entire economy of nations. When a project fails, there are a number of intricate problems involved, all of which are very important to the parties involved—in this example, the bank and its clients. These concerns relate to the right to collect expenses associated with delays or 12 the need to extend the project, with the ensuing right to recover costs associated with schedule revisions under the contract. In the instance of the Development Bank of Ethiopia, project failure wastes resources by requiring the processing of additional loans due to cost overruns and the rescheduling of loan repayments, and projects lose sizable market shares as a result of failure. Application of knowledge, skills, tools, and procedures to project activities in order to achieve project requirements is known as project management. It is achieved by using project cycle processes like initiating, planning, executing, managing, and closing. The main reason for starting a project is to achieve particular objectives. The purpose of structuring the assignment as a project is to concentrate the authority and responsibility for achieving the objectives on a single person (the project manager), a small group, or project team (Bakouros&Kelessidis; 2000). The World Bank, a significant financier of infrastructure projects in poor nations, defines project finance as the "use of non-recourse or limited-recourse financing" (2001, p. 3). In order to further clarify these two concepts, it is said that "lenders are only reimbursed from the cash flow created by the project, or, in the event of total failure, from the value of the project's assets, when a project is financed in a non-recourse manner. Additionally, lenders may have some limited recourse to a parent business that is funding a project's assets. It is useful to state the entire list of traits and draw comparisons between project finance and corporate finance in order to have a more complete understanding of project finance. Although not every project financing will have every trait, Bodnar (1996) offers the following list of typical features of project finance as a starting point. Capital-intensive: Project financings are frequently big-budget initiatives that call for millions to billions of dollars in debt and equity. Long-term and highly leveraged: The transactions tend to be extremely leveraged, with debt often making up 65% to 80% of capital in pretty typical situations. Project financing agreements often have terms of 15 to 20 years. Independent entity with a limited lifespan: Modern project financings typically rely on a newly 13 created legal entity, known as the project company, that exists just to carry out the project and has a limited lifespan to ensure that it does not serve any other purposes. Non-recourse or limited recourse financing: Because these recently formed businesses lack their own credit or operating records, lenders must concentrate on the cash flows of the particular project. This is the reason why "the financing is not primarily dependent on the value of the physical assets involved or collateral." In contrast to corporate funding, credit evaluation or investment decision making is therefore based primarily on the project's feasibility study and sensitivity to the impact of potential negative variables. Controlled dividend policy: To support a borrower with no credit history in highly leveraged projects, the income from the project is used to pay off the loan, cover operating costs, and return investors' equity. Typically, this agreement is legally binding. Numerous stakeholders playing important roles in the project's implementation are common. In this circumstance, the project business and the other partners must develop contractual agreements like turnkey agreements in order to allocate risk. Costly: Compared to more traditional corporate finance methods, raising funds through project finance is typically more expensive. The increased demand for data, oversight, and contractual agreements raises transaction costs. Additionally, the unique characteristics of the financial institutions have greater costs and may make the project's debt less liquid. Due to the fact that so many of the projects are in nations with a high political risk, margins for project financing frequently also contain premiums for these risks. According to Yescombe (2002), project financing is a technique for obtaining long-term debt for large projects and lending to them while relying solely on the cash flows produced by the project for repayment.Because the magnitude of the project may frequently be greater than the size of the balance sheets of the participating corporations, non-recourse or limited recourse financing is sometimes used (Fight). Therefore, project financing is a technique to shield the firm balance sheet from the additional costs of a failing project (Esty, 2004). 14 This indicates that the financial health of the financing organisation is more significantly impacted by project failure than that of the supporting businesses or promoters. Therefore, in order to decrease project failure and increase project success, the financing institutions conduct market, technical, financial, economic, and ecological analysis (Chandra, 2002). 2.3. Cause of Project Failure Researchers who focused on projects in general identified a number of reasons why projects fail. The following eight common management issues that result in project failure were identified by the Office of Government Commerce (OGC), a division of the Efficiency and Reform Group of the Cabinet Office in England, in 2005. • Lack of a clear line of responsibility between senior management, ownership, and leadership; • Unclear and ineffective stakeholder engagement; • Skills and knowledge gaps regarding project and risk management; • Insufficient focus on breaking development and implementation into manageable steps; • Appraisal of project proposals using current price rather than long-term money value; Low project team integration, poor grasp of the supply chain, and strained relationships with the sector. In other cases, McConnell (2010) determined the top five market factors that contribute to project failure by using IT projects as a case study. • Excluding customers: McConnell cites this as the main cause of project failure. A project is bound to failure when you complete it without the customer's input. When user or market needs are not met, the development process becomes a mindlessly controlled procedure, your team becomes "hostile" to project expectations, and you are unable to feel invested in the product without user engagement. • Unknowledgeable Requirements Set: When the project team delivers the product without having a clear concept of what the customer wants and without having any genuine knowledge of the requirements, the project will fail as a result of inadequate requirements management. • Scope Creep: The next leading cause of project failure is when the project's scope does not align with other restrictions like time and cost, which increases the likelihood that the project will be delayed and overbudget. 15 • Lack of a change control system: A change may result in the emergence of a novel circumstance in your project. Your staff won't be able to adapt to the new situation if no change controls mechanism is implemented. Your main goal is to establish a document flow for change requests and put in place a system to exchange and handle change requests because uncontrolled modifications would lead to project failure.. • Lack of Continuous Testing: When acceptance tests to determine whether the product satisfies business requirements are not run, a project will typically be deemed undesirable due to a lack of testers and their subpar abilities and knowledge. Poorly defined requirements, a lack of change control, poorly trained people, and a lack of testing time can all contribute to poor testing. The document "Why Do Projects Fail?" from the Mind Tools website summarised the aforementioned causes of project failure. It is shown below. • Addressing the incorrect business requirements will inevitably have a negative impact on how your project is viewed if it fails to deliver what the organisation actually requires. This is why it's crucial to undertake a thorough study of the company requirements. • Poor Implementation: Competence alone is insufficient for effective implementation. You must oversee the team, stakeholder communication, risks, issues, and scope. Inability to control everything that is within your control may result in poor implementation. • Poor governance: The project's governance bodies frequently back the project's proponents. They offer guidance, direction, and a critical assessment of the project's development. These governing bodies can also help by offering connections and information that facilitate your progress. The project may encounter difficulties if the initiative's promoter lacks enthusiasm for it or dislikes to refuse requests from organizations to broaden its scope. • Losing sight of the advantages of the project: Projects will contain a list of advantages to be delivered, and it is expected that these benefits would be precise, explicit, and measurable. However, there are occasions when project teams concentrate on minute planning, creating a new system, creating training materials, and outlining new processes, which do not offer the required advantages. • The surroundings alter: Business cases may become outdated in a dynamic environment before a project is fully implemented. To determine how to proceed in such a scenario, it is necessary to partially evaluate the initial needs and aims. This can lead to a change in the project's scope or even its cancellation. 16 Fabozzi and Nevitt (2000) provided a list of typical reasons for project failure in their book "Project Financing" with regard to projects sponsored by banks. The majority of these reasons for failure are comparable to the reasons described above. These are the reasons why bankfinanced project failure, in their opinion. Implementation delays, technical issues, losses due to uninsured property damage, loss of market competitive position, expropriation, poor management, inflation-related cost overruns, government intervention, contractor failure, price increases or insufficient raw materials, technological obsolescence, excessive collateral appraisals, and promoter financial insolvency are all factors that contribute to interest expense accumulation. Risks and reasons for failure for Bank-financed projects were divided into three primary categories by Yescombe (2002). • Macroeconomic causes – financial/economic factors outside the project's control; Commercial causes – factors inherent in the project itself or the market it works in; Political causes are those that are connected to governmental decisions or political influence. He claims that the term "commercial risk" encompasses hazards related to the execution and operation phases of various projects. The contractor could go out of business during the implementation phase, which would increase expenses and delay the project's revenue stream. The operation phase carries risk in the form of input shortages, decreased revenue, and managerial incompetence to manage the operation. The input shortage can happen because of price increase and low supply of the raw materials (quantity). This again leads to production decrease and a higher price of the product, which in return decreases the expected revenue. Revenue decrease can occurs as a result of a decrease in products quantity, demand decline and lack of raw materials. Price can also decline as a result of competitors’ price cutting, government imposing of price controls, tariffs or royalties. Due to rising prices and a lack of raw materials, there may be a shortage of inputs. Once more, this causes output to decline and the product's price to rise, both of which reduce expected income. A downturn in demand, a reduction in the number of products available, and a shortage of raw materials can all affect revenue. The price may also decrease as a result of price reductions by rival 17 businesses, price regulations implemented by the government, tariffs, or royalties. Financial risks that have not been effectively accounted for in the project formulation, such as changes in inflation, interest rates, and currency rates, can impair the project's viability, according to Yescombe's classification in 2002. Quasi-political risk, according to Yescombe (2002), is the danger that lower levels of government officials will interfere with projects, the government won't uphold its commitments, or the court system won't be impartial. The various hazards that were all mentioned above can result in a project failing. All studies' failure factors are essentially the same, with the exception of the occurrence of dimension variation. Yescombe (2002) moved the project risk/cause of project failure originating from the credit management of the financiers to other components when he divided the main Bank sponsored project risks/cause of project failure into three categories. 2.4. Empirical Results and Facts A related article by Mubila et al. (2002) about the African Development Bank has so far been discovered by the researcher. Due to the lack of research on the causes of failure of bank-financed projects, the researcher is forced to take into account studies conducted in the same way but on different projects, claiming that the cause of failure of projects can be very tight. related. Based on this knowledge, a review of IT project failure studies by two organizations – The Bull Survey (1998) and The Chaos Report (1995) – was conducted. In order to identify the main causes of the failure of projects in the banking sector, French computer and system integrator manufacturer Bull commissioned Spikes Cavell, an independent research firm, to carry out the project. conducted a survey in the United Kingdom in 1998. According to a project survey, deadlines were detected in 75% of cases. Project failure was attributed to over budget (55%) and failure to meet project requirements (37%). According to the main results of the survey, communication problems (57% of failed projects), lack of planning (39% of failed projects) and poor quality control (35% of failed projects) are top three reasons. Why did the project fail? The sample size and methodology for this landmark study included 365 IT leaders from 18 organizations of all sizes and across all industries. Cost overruns, overtime, and content omissions were all included in the project's evaluation criteria. Key findings from the opinion survey showed unmet requirements Unrealistic expectations, 12.4%, lack of user interaction, 13.1%, and lack of resources 9.9%, inadequate management support 9.3%, change of standards and criteria 8.7%, lack of preparation 8.1%. , don't need it anymore. Barriers to the project include lack of IT management (7.5%), technology illiteracy (4.3%), and other factors (9.9%). Mubila et al (2000) have done more or less similar research on the African Development Bank. They measure the success or failure of a particular project using project size, implementation lag, cost overruns, project economic rate of return, and human development metrics. people in their study. Project-specific explanatory variables were used in this model, including total project cost (used as an indicator of project size), percentage cost overrun, percentage overtime time and industry dummy variables. In addition, they take into account the country's macroeconomic performance, including the development of GDP, inflation rate and internal and regional policies, as well as macroeconomic indicators. variables that measure the state of the country's economy – population size, average economic growth and dummy variables for the distribution of customers by region have been added over the implementation period since 1974 until 1994 to see if these factors were related to project performance. As a result of their investigation into project underlying causes, large projects are less likely to fail, and cost and schedule overruns negatively impact project success. Projects in the transport, industrial, and agricultural sectors all have a higher success rate than projects in the social sector, which have a higher failure rate. All regions except North Africa have negative project success coefficients, indicating that the Northern region has a significantly higher probability of project success. In addition, they provided evidence to support their claim that the success of this initiative would benefit from an increase in the GDP of the host country. Population size is also comparable. Negative coefficients for the intercept and positive coefficients for the economic rate of return at the time of valuation are also obtained from simple ordinary least squares (OLS) estimates. (AERR), shows that economic return on completion (CERR) is generally lower than TREA, and economic return on completion is strongly related to economic return on appraisal. Furthermore, the regression results show that there 19 is no association between the economic rate of return at completion and the cost and time of excess as the explanatory variables of the level of economic profit at completion. This model was then extended by the researchers to explain the differences in project performance across economic sectors, and the parameter estimates for the industry variable showed no significant significance. To summarize the empirical evidence, in addition to the study of Mabila et al. (2000) conducted for the African Development Bank, other studies use survey methods and descriptive statistics respectively, suitable for qualitative data collection and analysis. Because Mubila et al. Considering that the projects had completed the project cycle for their study, they used the OLS regression model to correlate the economic rate of return on appraisal (AERR) with the economic rate of return on investment. economic to completion (CERR) in the scatter plot. They used probit models with live data and proxies to quantify the determinants in order to determine how closely each component relates to the probability of success or failure of projects funded by theAfrica Development Bank. According to an empirical literature analysis, the topic of bank-financed project failure is not a study priority, and it is challenging to find research that is comparable to this researcher's understanding in the case of the Development Bank of Ethiopia in particular. Despite this, the special nature of projects necessitates research into the factors that contribute to project failure in relation to the DBE's credit processing system, the particulars of the project, and the macroeconomic and sociopolitical situation of Ethiopia. Even still, Mubila et al.'s investigations on the Development Bank of Africa are not thorough in their list of explanatory factors for project failure. Due to a data issue, it is completely devoid of the factors from the Bank's credit processing system. Furthermore, because they only used projects that have previously been phased out as their data source, the observations used in their analysis are insufficient to explain the present causes of project This study, which also acts as an introductory study for DBE, will thereby close the research study gap in the area of cause for Bank-financed project failure in general. This study, in contrast to Mubila et al.'s study, has concentrated on operating projects in order to emphasize the present factors that contribute to project failure. Additionally, a lot of new explanatory variables are introduced to this study based on their significance. 20 2.5. Conceptual Framework A conceptual framework is very important in any research study being undertaken. It shows the relationship between the dependent variables and the independent variable (Kotter, 1995). This study addressed many extrinsic factors that influence investment projects failure. Conceptual framework has been drawn to show the link between the dependent and the independent variables Figure 1: Conceptual Framework Dependent Variable Independent Variables Macro-economic Factors Inflation, Interest rates, Exchange rates, GDP Socio-political factors Project Failure Corruption Project specific Factors Management problem Bank’s credit management system Risk Management Due Diligence Supervision Figure 2.1 Research Model (Adopted from Odhiambo, Charles, & Okello, 2020 and Muthoni, Mwangi, & Stephen, 2020) Macro-economic Factors: have to do with issues like inflation, money supply, growth in GDP, currency rates, interest rates among others, whose change might negatively affect investment projects. In addition, these include issues influencing the economic feasibility of the project including the changes in domestic economic conditions of the recipient country or inaccurate 21 project development plan due to unpredictable economic conditions. This may be caused by increased competition, decreased consumption, and regulatory changes requiring changes in selling price of the product or renegotiating concessions awarded to the project and would reduce the profit margin (Scandizzo, P.L. , 2021). Socio Political Factors as conceptualized in this study means the interference that may come from political offices and politicians that may have a negative influence on a project. These could be issues at the national level and regional level including inconsistency in policies, laws and regulations, and political instability. From development project’s perspective, these factors contribute to an environment of uncertainty on return of capital investment (Kwak et al., 2002).Good governance by those who assume political offices is presumed to have low corruption. Project specific Factor:-Within this category, management problem is expected to be the dominant factor and so is included alone. The concept of management problem here,even though this has a broad scope in interpretation, attempts to capture issues primarily concerning employees in terms of their self- direction, initiative, performance, know-how, quality, etc. this literally indicates the fact that the projects under consideration are expected to have competent manpower since the quality of employees is going to influence the effective use and implementation of other resources these projects possess. Credit Management System of DBE; Among major project failure determinants that emanate from credit management system of the Bank, over appraisals of collateral and appraisal of project proposals using current pricera ther than long-term money value are not considered for thisstudybecauseDBEprojectfinancingisnotcollateralbasedandtheBankusesdiscounted project worth assessment methods. Credit management system of the Bank, therefore, represented by project planning capacities, providing technical advice and over estimation of returns from the project.(Project Financing.https://www.dbe.com.et/index.php/services/project-financing) 22 CHAPTER THREE: RESEARCH METHODOLOGY 3.1.Introduction This chapter gives the details of the research approach. The research design is explained and illustrated. The target population is described as well as data collection instruments. Also included in the chapter is data collection procedures, methods of data analysis, operationalization of variables and ethical issues observed in the research. 3.2. Description of the organization Development Bank of Ethiopia is one of the state owned financial institutions engaged in providing short, medium and long-term credits over the last 107 years. Project financed by the Bank are carefully selected and prepared through appraised, closely supervised and systematically evaluated (Development Bank of Ethiopia website). The Bank finances SMEs up to Megaprojects, and its internal structuring is determined based on the size of the financing. The Bank has 22 districts & 99 branches and above 2400 permanent employee among from these, half of in head office. Mission: The Development Bank of Ethiopia is a specialized financial institution established to promote the national development agenda through development finance and close technical support to viable projects from the priority areas of the government by mobilizing fund from domestic and foreign sources while ensuring its sustainability. The Bank earnestly believes that these highly valued objectives can best be served through continuous capacity building, customer focus and concern to the wider environment. Vision: To be world class development bank that help to achieve Ethiopians economic transformation vision by 2030 3.3. Research Design and Approach 3.3.1. Research Design This study examined the factors that contribute to DBE-financed projects in the southwest Addis Ababa District by doing both descriptive and explanatory analyses. The data were described using descriptive statistics like tables and percentages, and the Relative Importance Index (RII) rank 23 approach was employed for explanatory analysis. The most significant factors affecting project failure were identified using this method 3.3.2. Research Approach 3.3.1. Quantitative Approach The quantitative component of this proposed study is to gather generalizable data regarding the reasons behind project failures funded by DBE. A standardized self-administered questionnaire will be used in the study's survey design, along with organized records evaluations. 3.3.2. Qualitative Research Approach With the aim of obtaining additional insight in addition to the information gained through the questionnaire, a qualitative approach was used. Using this approach an in-depth interview was conducted on respondents who have better experience in the bank, specifically managers. 3.4. Sources and Method of Data Collection 3.4.1. Data Source and Collection For successful completion of this study, both primary and secondary data were used as a source of obtaining required information. Accordingly, the primary data was acquired from sample respondents selected from both the bank and borrowers. Subsequently, self-administered, structured questionnaires were distributed to the bank employees after receiving permission from the bank to carry out the study. And same was done in distributing questionnaires to managers of the projects. In addition to that, as a primary source and method of data collection, interview was made with selected bank management staff including team manager, division manager, and district manager. The secondary data was obtained from projects’ files, recorded documents by the bank and different documents such as Credit Performance reports, annual reports, journals, articles, reference materials, different researches, various books, websites, and other published and unpublished records. 24 3.5. Target Population and Sampling Design 3.5.1. Population of the study DBE finances projects through the head office, districts, and branches. All branches of the bank are not on the same level in all aspects of the bank operation. On the bases volume of loan limitation, type of bank services and number of employees from higher level to lower level, the bank has classified as head office (corporate level), Districts and under each districts there are different branches of the bank which are graded as A, B. Since the bank has multiple districts that virtually operate independently to some extent as per their grade level, researching the entire districts and branches might not have been technically feasible or practical due to logistical challenges, geographical dispersion, operational differences, or similar issues. Plus, conducting the research on the entire bank would be resource-intensive in terms of time, budget, and data collection, the researcher focused on this specific district in order to be able to allocate resources more efficiently and effectively. So, focusing on South-West district only allowed for more manageable research scope. Hence, the target population of this study was projects under the operating unit South-West Addis Ababa District totaling 250 projects. 3.5.2. Sample size There were 250 projects in South-West Addis Ababa District by the time data was collected. Out of this, 154 projects were chosen as representative of the study population determined usingYamane’s(1967) formula as below. This is used to determine the sample size for this particular study with the assumption 95% confidence level, ,ande=0.05. The following formula is:-n = N/(1+N(e) ^2) n= N 1 + N(e)2 where ‘n’ is the required sample size, N is the population size and E is the level of percision Applying the above formula, 25 Using this formula, the total sample size needed is is achieved to be 153.846 which approximately is 154. Then, the following formula was used to determine the sample size for each stratum: nh = (Nh / N) * n whereNh is the size of stratum h, N is the total population size, and n is the total sample size. Using this formula, respondents from the projects were selected as follows, showing sample sizes for each stratum are: Table 1: Sample Size Determination Sr.no Sectors 1 Manufacture 2 Agriculture 3 Agro processing Total Total population Proportion Sample size 120 48.00 74.00 76 30.40 47.00 54 21.60 33.00 250 100.00 154.00 The determined sample size was inclusive of respondents from three different sectors namely manufacturing, agriculture, and agro-processing. All of these 154 projects were then represented by 154 managers from each project i.e. the study subjects randomly chosen for inclusion are all managers. The borrower side analysis was therefore made with the data obtained from these mangers. On the other hand, while determining respondents from the bank side, a total of 58 respondents, who areall managers at different levels of position as well, were included as a sample out of a total of 95 employees. 3.5.3. Sampling Technique The researcher used stratified sampling technique and then applied simple random sampling to select respondents randomly from each stratum(agro processing, Agriculture and manufacturing) for the purpose of collecting data from the borrower side using the 154 managers. Concenrining selecton of the 58 participants in the collection of data from the bank side, the sampling technique used was judgmental as the respondents were purposively selected so that those who are knowledgeable about these projects and the loaning environment could be included. 26 3.6. Method of Data Analysis 3.6.1. Data Processing After collecting data from primary sources it was appropriately checked. In addition to that in-house editing was made by the researcher to detect errors committed by respondents during completing the questionnaires and interviews. The data analysis methods and tools are performed using Microsoft Excel and SPSS software. 3.6.2. Data Analysis The Relative Importance Index (RII) rank algorithm was applied for analytical purposes. This approach was chosen because, by giving various elements weights and figuring out their RII scores, it is possible to identify and rank the factors that contribute to project failure according to their relative importance. Furthermore, percentages and frequency of analysis were employed. Excel and SPSS statistical applications were utilized for this. The statistical method used to analyze the data is relative importance index (RII). RII is a weighted average of the ratings given to each element by respondents that is used to measure and rank the significance and effect of the factors determining project failure and success. The RII has a value between 0 and 1, with higher values indicating greater significance or effect of the components. The following formula is used to compute the RII: RII = (5n5 + 4n4 + 3n3 + 2n2 + n1) / (5N) where n5 represents the number of respondents who rated a factor as extremely influential (5), n4 represents the number of respondents who rated a factor as influential (4), n3 represents the number of respondents who rated a factor as moderately influential (3), n2 represents the number of respondents who rated a factor as slightly influential (2), n1 represents the number of respondents who rated a factor as not influential (1), and N represents the total number of respondents. The RII is then used to rank the components in terms of importance and impact on project failure. The variables ranked in table 4 and table 5 above have different importance as to the influence on project failure. It is the result of analysis for the data obtained from DBE staff and borrower respondents. The comparison of RII to identify which factors are most influential is determined using the transformation matrix proposed by Chen et al. (2010) which categorizes RII result as 27 high (H) for results between 0.8 and 1.0, high (H-M) for results between 0.6 and 0.8 high to medium (M) for results between 0.4 and 0.6 to medium (M-L) for results between 0.2 and 0.4 to medium (L) for results between 0.0 and 0.2 to Low (see below table). Table 2: transformation matrix table. High (H) High-Medium (H-M) Medium (M) Medium-Low (M-L) Low (L) 0.8 < RII < 1.0 0.6 < RII < 0.8 0.4 < RII < 0.6 0.2 < RII < 0.4 0.0 < RII < 0.2 Source: Chen (2010). 3.7. Reliability Test Validity of Research Instrument Following data collection, the relevant test statistics were used to assess the data's validity and reliability. For this investigation, a construct composite reliability co-efficient (Cronbach alpha) of 0.7 or higher was deemed sufficient for all the constructs. Reliability coefficients of 0.7 and higher are considered acceptable (Rousson, Gasser, and Seifer, 2002). The study instrument's dependability was assessed using Cronbach Alpha. The study's Cronbach alpha value comes out to be 0.78, which means that the outcome is highly suitable to proceed with the regression. Authenticity Carefully crafted, straightforward questions that make it simple for respondents to answer every question will be used to establish the validity of the self-administered questionnaires and interviews. 3.8. Ethical Consideration The respondents in the study were assured of confidentiality of the information they provided. The respondents were not required to write their names in the questionnaires or interview schedules. No respondent was forced to participate except those that voluntary agreed to participate in the study. The researcher maintained humility and conducted the research with utmost honesty avoiding distortions and misleading data manipulation. The researcher also endeavored to arrive at conclusions based on objective inferences that are purely and blindly. 28 CHAPTER FOUR: RESULT AND DISCUSSIONS Introduction This chapter focuses on presentation and discussion of data collected using questionnaire, document analysis and interview. First, data that deals with respondent’s profile, including their current position in the bank and project, their experience in the banking and project area, and their educational qualifications will be presented. Next, document analysis and semi structured interview result upon macro-economic factors, socio-political factors, failure associated to project specific factors and credit management related factors discussed in detail 5.1. Summary of the Respondents There are two categories of respondents in this thesis bank staff and project staff. The total number of bank staff is 58while the total number of projects is154.The researcher has classified the bank staff by gender, education, marital status, age, work experience, and work experience with credit area; and classified the project staff by sector, region, size, project life, total investment amount, and status. Results are tabulated in a manner that shows the total number, sample size, sample percentage, responsive number, and responsive percentage for each classification. General characteristics of respondents from the bank side is summarized and presented in the following tables. Table 3: Gender characteristics of respondents from bank side Population Classification 1. Gender Male Female Total Number 2. Education Diploma Degree 29 Percentage 44 14 58 75.86% 24.14% 100.00% 1 17 1.72% 29.31% Masters Total 40 58 68.97% 100.00% 3. Marital Status Married Single Widowed Total 30 27 1 58 51.72% 46.55% 4. Age 25 years or less Between 26-30 Years Between 31- 40 Between 41- 50 Year 51 and above year Total 2 17 22 13 4 58 5. Work experience 5 years or less From 6-10years From 10-16 Years above 16 Years Total Source: Own survey 1.72% 100.00% 3.45% 29.31% 37.93% 22.41% 6.90% 100.00% 12 24 15 7 58 20.69% 41.38% 25.86% 12.07% 100.00% Respondents of the study were asked to indicate their gender. As per the findings, majority of them 44 (75.86%) of them were male, while 14 (24.14%) were female. Concerning educational background, out of the 58 samples 40 (68.97%) of the employees hold master’s degree, 17(29.31%) of them BA degree, while the rest 1(1.72%) of employee holds diploma indicating the fact that most of the employees are educated. Understanding the number of respondents who got married or not, it is found out that out of the 58 samples 30 (51.72%) of them are married, 27 (46.55%) of them single, and 1(1.72%) is widowed. Regarding age, 2 (3.45%)of the respondent fall within the age range of 25 years or less, and 27 (19.31%) of the respondent are between 26-30 years, 22 (37.93%) of them are between 31 -40, 13 (22.41%) of the respondent are between 41-50 years and also 4 (6.90%) of them are 51 and above. This indicates that the age distribution of workers is not concentrated in just younger or adult age. 30 According to the data, worker’s year of experience shows that 12 (20.69%) of the respondent have a work experience 5 or less than a year, and 24 (41.38%) of the respondent within 6-10 years, and15(25.86%) of the respondent have work experience of within 10-16years,and lastly 7(12.07%) of the respondent have work experience of above 16 years. This shows that most of the respondent is experienced. Again, the figures tabulated next show project staff respondents representing the total number of projects/subjects numbering 250. The projects’ sector of engagement, location of establishment, size, and periods of existence, total investment amount, and status is presented with the following tables. Table 4: Project characteristics Characteristics 1. Sector Agriculture Manufacture Agro- processing Total 2. Region Addis Ababa Oromia Total 3. Size Small Medium Large Total 4. Project life 3 Years 3-5 Years 5-10 Years 10-20 Years Total 5. Total investment less than 10 million birr Number Percentage 31 95 28 154 20.13% 61.69% 18.18% 100.00% 51 99 154 34.42% 65.58% 100.00% 37 83 34 154 24.03% 53.90% 22.08% 100.00% 18 45 58 33 154 11.69% 29.22% 37.66% 21.43% 100.00% 16 10.39% 31 10-50 million birr more than 50 million birr Total 6. Status New Expansion Total Source: Own survey 104 34 154 67.53% 22.08% 100.00% 81 73 154 52.60% 47.40% 100.00% According to the tabulated data above, the worker’s 95 (61.69%) of projects selected as a sample are in the manufacturing sector, 31 (20.13%) of them in the agricultural sector, and 28 (18.18%) in the agro-processing sector. This indicates that most of the projects financed by the bank are in the manufacturing sector followed by agriculture and agro-processing. And most of these financed projects, 99 (65.58), are located in Oromiya region whereas the rest 51 (34.42%) are located in the capital Addis Ababa. Concerning the size of them, most of the projects numbering 83 (53.90%) are medium sized, 37 (24.03%) are small sized, and the rest of the sample 34 (22.08%) are large sized projects. Projects, according to the data, have different period since their existence. 58 (37.66%) of the samples are within five to ten years, 45 (29.22%) of them within three to five years, 33 (21.43%) of them within ten to twenty years, and the rest 18 (11.69%) are three years. This indicates that most of the projects’ life is longer. Regarding the total investment these projects are worth, it’s been put in three different ranges, the largest majority i.e. 104 (67.53%) being a project worth of ten to fifty million birr, 34 (22.08%) being worth of more than fifty million birr, and the rest 16 (10.39%) being less than ten million birr indicating that most projects valued at high investment amount calling for the utmost care to be given to prevent failure. Of these sampled projects, more than half of the project financed are new numbering 81 (52.60%) out of 154 while the rest 73 (47.40%) are expansion. 5.2. Ranking of Causes of Project Failure Based on Development bank of Ethiopia staff the survey data, the RII of the factors affecting project failure are shown in Table 1. The table shows the factors, their ratings, 32 and their RII values in descending order. Table 5: RII of the factors affecting project failure: Bank side data Factors RII Inflation 0.893103 Corruption 0.872414 Exchange rate 0.851724 Due diligence 0.789655 Risk management 0.727586 Supervision 0.705263 Management problem 0.686207 GDP 0.651724 Interest Rate 0.627586 Rank 1 2 3 4 5 6 7 8 9 Source: Own survey, 2023 Table 6: RII of the factors affecting project failure: Borrowers side data Factors RII Rank Inflation 0.811350 1 Exchange rate Corruption 0.809245 0.800697 2 3 GDP 0.746099 4 Interest Rate 0.686667 5 Due diligence 0.605333 6 Management problem 0.592278 7 Risk management Supervision 0.565333 0.550667 8 9 Source: Own survey,2023 33 The two tables above show the Relative Importance Index (RII) of the factors affecting project failure from the bank side and borrower side, respectively. The RII is a measure of the relative importance of each factor in contributing to project failure. The RII values range from 0 to 1, with higher values indicating greater importance. The tables also show the rank of each factor based on its RII value. In interpreting the RII values, the researcher used the transformation matrix table by Chen (2010). The transformation matrix maps the RII values to a scale of High (H), High-Medium (HM), Medium (M), Medium-Low (M-L), and Low (L) based on the following ranges: High (H): 0.8 < RII < 1.0; High-Medium (H-M): 0.6 < RII < 0.8; Medium (M): 0.4 < RII < 0.6; MediumLow (M-L): 0.2 < RII < 0.4; and Low (L): 0.0 < RII < 0.2. Consequently, inflation, corruption, and exchange rate factors are classified as High (H) on the bank side. On the borrower side, inflation, exchange rate and corruption factors are classified as High (H).This suggests that these three factors are the most important in contributing to project failure from both the bank and borrower side. Factors that are classified as Medium (M) on the bank side include due diligence, risk management, supervision, management problem, GDP, and interest Rate whereas on the borrower side, GDP and interest rate factors are classified as Medium (M). This suggests that these factors are moderately important in contributing to project failure. Factors that are classified as Medium-Low (M-L) on the borrower side include due diligence, management problem, risk management, and supervision. This suggests that these factors are less important in contributing to project failure from the borrower side. Inflation is consistently ranked first demonstrating being the most influential factor on both the bank side and borrowers’ side having an RII of 0.893103 and 0.811350, respectively. Both values, according to Chen’s (2010) categorization, have a high level of influence indicating the fact that inflation is the top dominant factor greatly impacting projects’ performance. Consistent with this finding, Adamu (2013) and Daglas (2020) also identified inflation as the most critical 34 variable in defining projects’ performance. This is true because inflation increases the cost of materials/services above estimated cost by the appraisal unit of the bank. This indicates that high inflation rates can lead to increased costs of materials, labor, and financing, which can negatively impact project viability and profitability. Inflation is considered highly important in the organizational setting, indicating that it is a significant factor that DBE should closely monitor and manage inflationary trends to mitigate its impact on financed projects’ financial performance. This, on the other hand, means that the higher inflation will make borrowers struggle with rising costs as a result of it narrowing their profit margin. This will eventually make them unable to repay their loan properly. Inflation, in addition to the bank and the borrower, reduces consumer purchasing power because since the financed project’s product will cost more than it did in the past. This will lead a drop in consumer spending which again leads to lower demand to their products and so lower sales revenues for the projects. . Corruption, the next most influential factor ranked second from the bank side and third from the borrower’s side with RII value of 0.872414 and 0.800697, respectively, is "corruption”. The values, despite having varying ranking, are both labeled as High project performance influencing factor, based on the transformation matrix. Corruption is ranked within the top three on both sides showing its significant impact. The study carried out by Derartu (2020), Alex (2018) and Daglas (2020) also revealed similar finding concluding that DBE financed projects are highly triggered to failure by corruption. This finding shows dishonest or unethical practices that involve the misuse of power or authority for personal gain. Corruption can undermine project implementation, hinder decision-making processes, and lead to misallocation of resources, ultimately contributing to project failure. Corruption increases costs incurred in the implementation of projects and their operation once implemented as it includes cost of the bribe and the inflated unfair contract price. Projects DBE finances are influenced and fail as a result of corruption because it, as several references indicate, leads to cost overruns, uncertainty introduced by it, its eroding effect on purchasing power, its effect on contractual obligations, and overall economic activities, all increasing the likelihood of projects failure. Exchange rate is another important factor in affecting project failure, as it is ranked third in the bank side and second in the borrowers’ side resulting in 0.851724 and 0.800697 RII values.Here again, both are levelled as highly influential factors as per Chen’s categorization. The high level 35 of influence this factor has on project performance was also found to have similar result with the study by Adamu (2013). The finding indicates the fact that projects financed by DBE use majorly capital goods purchased from abroad. For this reason, exchange rate is highly influential factor in project failure. This is another crucial factor that DBE needs to consider, as it can have a significant impact on its financial performance and international transactions. It is an indicator that exchange rate fluctuations can significantly impact on its operation. Exchange rate fluctuations can have adverse effects on projects, especially those involving international transactions. Unfavorable exchange rate movements can increase project costs, affect cash flows, and create financial uncertainties, making it challenging to manage projects effectively.In addition to this, owing to exchange rate increases, a project that seemed more economic and feasible at the time of feasibility analysis or appraisal changes would change the entire profitability of projects leading to failure. These findings also mean that these projects’ competitive position was significantly affected. Due diligence is reasonably important as indicated by the RII values 0.789655 from the bank side and 0.605333 from the borrower’s side. What the finding tells is that both factors have high to medium influence level, as per Chen (2010). However, despite having the same range in range of influence categorization, due diligence is ranked fourth in the bank side analysis and sixth in borrowers. This shows that due diligence assessment carried out by the bank does not meticulously and thoroughly address all aspects about the borrowers. This can mislead the bank and create the opportunity to advance a loan to a borrower who otherwise would not have been eligible to take a loan. Such inaccuracies lead to have a client with non-creditworthy characters and thus the project the bank financed is deemed to fail. Insufficient due diligence can result in inadequate risk assessment, poor decision-making, and inadequate project planning, increasing the likelihood of project failure. The study carried out by Adamu (2013) also revealed similar finding concluding that DBE financed projects are triggered to failure by improper Due Diligence assessment. Risk management resulted with RII value of 0.727586 and 0.565333 from the bank side and borrowers side responses. The first RII indicated that risk management has high to medium level of influence whereas the borrower’s side RII value indicates a medium level of influence on 36 project failure, taking Chen’s (2010) classification into consideration. The study by Derartu (2020)had shown related finding that poor risk management practices of the bank is influential in affecting projects’ performance. This suggests that DBE is having less effective strategies that involve borrowers to identify, assess, and mitigate risks that may affect their operations. This factor is also related to the fact that DBE has failed to identify and analyze all potential risk areas and their impact on financed projects. A problem associated with risk management is a factor that causes problems in projects performance. Effective risk management is crucial for project success. Inadequate risk identification, assessment, and mitigation strategies can expose projects to various uncertainties and threats, leading to cost overruns, delays, and ultimately project failure. Supervision has a medium influence in project failure as per the RII result 0.705263 from the bank side whereas the borrower’s side has RII of 0.550667. Chen (2010) identified the values to be in a high to medium and a medium influence, respectively. This indicates that the supervision activity of the bank is weak highlighting how lack of supervision by DBE will also weaken the efficiency and productivity of financed projects, sooner or later ensuing errors and gaps in handling budget and equity releases and schedule overruns. It is found out that proper supervision and monitoring mechanisms are necessary for ensuring compliance, performance, and accountability within the bank. This indicates that there is lack of guidance and direction, poor decision-making, inadequate monitoring and control, lack of support to borrowers, poor communication and collaboration all with the ability to impede progress, hinder decision-making, and ultimately lead to project failure. Adequate supervision and monitoring of project activities are essential to ensure compliance with plans, specifications, and quality standards. Inadequate supervision can result in poor workmanship, deviations from project requirements, and compromised project outcomes. Supervision was also found to be moderately influential (Daglas, 2020). Management problems are considered to have high to medium level of influence on project performance as the RII 0.686207from the bank side and 0.592278 from the borrower’s side indicate, using Chen’s 2010 transformation. This indicates that DBE should address and resolve any issues related to its management practices to ensure smooth operations. Addressing and resolving management problems are crucial for the bank’s effectiveness. These management 37 problems, which were also supported via the finding by Adamu (2013), encompass a range of issues, including ineffective leadership, poor decision-making, inadequate communication, and lack of coordination. These problems can disrupt project progress, hinder problem-solving, and negatively impact project outcomes. Gross Domestic Product/GDP/ which represents the overall economic performance of the country, is considered to have high to medium level of influence on project performance as the RII 0.651724 from the bank side and High level of influence from the borrower’s side with RII of 0.746099 indicate, using Chen’s 2010 transformation. This suggests that DBE should consider economic indicators when making strategic decisions. This indicates the fact that monitoring and considering the overall economic performance, as represented by GDP, is important for the bank to make informed strategic decisions. This maybe indicated by reduced demand for the projects’ products during periods of low GDP growth, market instability, funding constraints, and the like affecting projects’ performance negatively. A weak or declining GDP can indicate an unfavorable business environment, reduced investment opportunities, and limited financial resources, which can contribute to project failure. Interest Rate, having RII 0.627586 from the bank side and RII 0.686667 from the borrowers side is obtained which, as per Chen, indicate that interest rate of the bank has a high to medium influence on projects’ failure as it can impact borrowing costs and investment returns, influencing borrowers’ financial health which finally prompts project failure. Here again, Adamu in his 2013 study indicated that interest rates influence the cost of borrowing and financing for projects. Higher interest rates can increase project costs, affect cash flow, and make it more challenging to secure funding, potentially leading to project failure. The study carried out by Adamu (2013), also revealed similar finding concluding that DBE financed projects are highly triggered to failure by Interest Rate. Overall, the results suggest that inflation, corruption, and exchange rate are the most important factors contributing to project failure from both the bank and borrower side. This information can be used to inform policies and practices aimed at reducing project failure rates in the future. 38 On the other hand, the secondary data analysis made about which sector of investment is experiencing more failure taking into account three years of data from 2021 to 2023revealed that the year 2021 and 2022 were dominated by project failure incident from primarily agricultural sector followed by the manufacturing and agro-processing, sequentially. The year 2023, up until this data had been collected, also exhibited occurrences of project failure with agricultural sector still being ahead, the agro-processing sector coming forward leading the manufacturing sector. Agro-processing was better than the manufacturing sector in the previous two years but fall off in its credit performance in 2013.The manufacturing sector, same with the year 2021 but contrary to the year 2022,came at three in suffering from project failure. It is quite clear that agricultural sector has particularly been experiencing the greater project failure in the entire span of years considered. The other two sectors were also in distresses, the manufacturing sector with relatively better performance in 2023 and the agro-processing sector with a relatively worse performance in the latest year 2023. The presentation and discussion of findings made so far is the result of the survey made through standard questionnaires. The next discussion is made out of the interview with the DBE staff. The interview result is presented in a collective form since several of the responses were essentially alike and in brief to make the discussion more concise and comprehensible for readers. Several of the interviewees indicated that macro-economic factors, such as, in addition to the factors responded via the questionnaire,the existence of rivalry; market problem, and economic growthhave put influence on projects’ performance, the first two having a negative impact and eventually leading projects to failure. Of the socio-political factors prompting projects’ failure, political instability, low productivity of labors, unfulfilled of infrastructure and utility, government interference, running of projects below the required number of manpower, and educational background are important influences. 39 Project specific factors thought to be influencers in projects performance and critical in causing failure, according to the interviewees, include existence of missed items, and longtime taken in implementation, management failure, shortage of raw material, diversion of fund into unintended purpose, lack of well-though out business plan, conflict between shareholders in case of PLC and SC and spouse in sole proprietorship, under estimation of complexity of projects, cash flow over estimation and the occurrence of losses due to failure to buy insurance. As per the interview data collected and transcribed for analysis, credit management related factors that influence performance of a project are several. Weak project performance eventually leading to default, according to the data with regard to credit management, usually happens as a result of poor supervision, follow-up, and inspection by the bank, improper due diligence assessment report or KYC, delay in disbursement of loan and equity by the bank, changing the bank policy and procedure from time to time. 40 CHAPTER FIVE: CONCLUSION AND RECOMMENDATION 5.2. Conclusion This study focused on identifying and analysing factors that influence projects performance financed by Development Bank of Ethiopia, taking South West Addis Ababa district as a case. The study sought to examine the influences of macro-economic factors, socio-political factors, project specific factors and credit management related factors on the relative importance of the factors for failure of projects financed by the Development Bank of Ethiopia. In order to carry out the study, 154 sample subjects were determined using a formula from which respondents were selected through stratified and simple random sampling. Data was collected using a standardized questionnaire and interview for selected management level respondents from the bank. The collected data was analysed using Relative Importance Index. As per the findings: Inflation is consistently ranked as the most influential factor on both the bank side and borrowers’ side, indicating its significant impact on project failure. Inflation, one of the macro-economic factors, has been found to be the most and the first factors influencing projects’ performance typically instigating projects failure because the selling price of machineries and raw materials increase as the prices of goods and services inflate in the world, including Ethiopia. Exchange rate is another important factor affecting project failure, as it is ranked within the top three on both sides. Exchange rate, the other macro-economic factor is also found to be most influential in shaping projects’ performance in that projects’ depend on the country’s exchange rate for its import demand for manufacturing items and raw materials. Corruption is also consistently ranked high on both sides, suggesting that it is a critical factor contributing to project failure. Corruption is a critical concern for DBE and so implementing robust anti-corruption measures and promoting ethical practices are essential to maintain integrity and trust. Corruption is the other most influential variable that is found to be a factor in influencing 41 DBE financed projects’ failure. It is understood that as the corruption level increases, as it is typically the case, the more likely that projects are expected to fail. This has got to do with several stakeholders involved in the line of projects implementation and operation. The rest of the factors including due diligence, risk management, and supervision are factors that are consistently ranked lower on both sides, relative to the top three, indicating their relatively lesser impact on project failure. However, they are still found to be significantly influential as well but to a lesser extent than the three mentioned above. This doesn’t mean they are worth less attention than the three. It is about prioritization on which factor needs an urgent resolution and which can follow. On the other hand, other than the findings through the questionnaire, the interview result relived that in addition to the three most influential factors namely inflation, exchange rate, and corruption, shortage of working capital, marketing problem, political instability, shortage of raw material, poor supervision follow-up and inspection by the bank, improper due diligence assessment or KYC, delay in disbursement of loan and equity by the bank to be significant are influential factors leading to project failure. 5.1. Recommendation The recommendation the researcher provides is based on the findings taking into account the factors impact not just over project’s failure itself but on the bank’s mandate to handle the issue as well. So, in order to improve the situation whereby the three factors i.e. inflation, exchange rate and corruption are major and influential reasons, it is recommended that DBE addresses these factors in its lending practices. Specially, immediate measures should be taken to mitigate inflation, manage exchange rate risks, and combat corruption. Moreover, attention should be given to factors such as GDP, interest rates, due diligence, management problems, risk management, and supervision, as they also contribute to the overall borrowers’ experience and projects performance. By addressing these factors, DBE can enhance its lending processes and better meet the needs of borrowers while lowering the probability of projects’ failure. 42 Regarding inflation, the bank together with concerned organs for that matter, should mitigate the impact of inflation by implementing strategies such as inflation hedging or cost control measures to minimize its negative effects on project outcomes. The bank should also strengthen anti-corruption measures and promote transparency in project operations to reduce the risk of corruption-related failures. Concerning exchange rate, the bank should be monitoring and managing exchange rate fluctuations effectively to minimize their adverse effects on project viability and maintaining competitiveness and financial stability. DBE should prioritize efforts to prevent and address corruption within its operations. While due diligence, risk management, supervision and the rest are ranked lower than the three, it is still important to maintain their standards and ensure they are adequately addressed to mitigate potential risks. The bank should enhance its due diligence practice by digitizing and automating the due diligence processes, for instance, by creating a comprehensive digital strategy for regulatory compliance and reporting. This assessment shall also be performed with all possible means to accurately know the customer and its background in borrowing and business background. Effective risk management should be planned and carried out with adequate risk identification, assessment, and mitigation strategies incorporated. The bank should make sure that the risk management process is designed and capable of disclosing all uncertainties and threats in detail. Regarding supervision, it is recommended that the make sure that its employees engaged in the supervision work of financed projects are capable of establishing and maintaining honest and close relationship with the staff of the borrower as the relationship, once developed to a good mutual understanding, can encourage the borrower and its staff reveal the existence of threat or any other difficulties. In addition to that, the bank should adequately supervise and monitor activities of financed projects to make sure that the everything is as per the contract agreement entered between the two parties there by ensuring that plans, specifications, and quality standards 43 are in compliance. With respect to management problems, it is recommended that the bank make sure the project is run and administered by leaders with effective decision-making and coordination skills. The bank shall also ensure that the preject management aspects of financial activities after the project is financed, project planning, leading, and controlling activities are managed by advanced system, competent managers, and professionals. The bank shall be aware of the timings where weak or declining GDP is occurring and manage its lending practice. Managing lending practices during times of declining GDP requires, among others, a combination of prudent risk management, portfolio diversification, flexibility in loan restructuring, tightened credit standards, cost control and efficiency improvement, and proactive adaptation to changing circumstances. By implementing these strategies, the bank can navigate challenging economic conditions more effectively. Regarding interest rates, the bank should work with borrowers to closely understand their unique needs and financial circumstances, conduct a thorough risk assessment of the project before offering financing, monitor and support the progress of the financed projects, and offer borrowers ongoing support, such as regular financial reviews, performance evaluations, and help putting risk management strategies into practice. Banks can assist in identifying and quickly resolving any concerns connected to interest rate swings by being active throughout the project lifecycle. Aligned with the above recommendation, the following additional recommendation shall be considered by the concerned in order to reduce project failure. DBE, apart from strategies that may be exercised by the government/ National Bank of Ethiopia/ such as monetary and fiscal policies, can enhance supply-side of the economy by enhancing productivity and reducing bottlenecks in the production process which will finally reduce inflationary pressures. The bank can also employ strategies to promote export oriented projects to benefit from the 44 increasing exchange rate. This is because, contrary to the fact that projects will definitely get hurt from the increased import prices as a result of increased exchange rate as there is no stronger domestic currency, the weaker currency can boost exports and economic competitiveness in the international market. It is important to create awareness about the negative impact of corruption on project failure. This can be done by educating stakeholders about the risks of corruption and how to prevent it. It is also important to establish effective anti-corruption measures and to enforce them rigorously. By doing so, we can help ensure that projects are completed successfully and that resources are used efficiently. DBE shall be actively working on promoting research and development to find solutions for inflationary impacts, exchange rate variation drives, and corruption related hindrances to effective implementation and operation of projects. Upon the intervention of political leaders on projects, the bank as well the project promoter should create awareness upon the contributions of the project to the community. DBE has to incorporate in its appraisal study which shows the amount of foreign currency required for a project and pre-plan the source of foreign currency required annually. The total foreign currency requirement should be planned along with the Bank’s annual operational plan. Regarding marketing, banks must participate in search Target the market for project products by further consulting the developer by appointing people to carry out the credit process who are well-trained and experienced in marketing or form a marketing advisory group. The bank can solve the shortage of raw material. It would be better if the bank entered into a contract with the suppliers to supply them with raw materials. 45 The Bank’s follow up reports should also clearly show any cost and schedule variances. The Bank should design appropriate mechanism to check that clients coming to the Bank in request for project loans have the required equity contribution at hand so that they will contribute the equity immediately after loan contract signing and get into projects implementation. The fact that project failure is highly observed to occur in projects engaged in agricultural sector triggers the question of why? In addition to this sector, the other two sectors considered in the analysis, manufacturing and agro-processing, also are questionably performing as they have also encompass failed projects, specifically the agro-processing sector, taking our current context into account. Therefore, it is recommended that more scientific and rigorous research with project management and risk assessment issues being the focal point be carried out in the future. 46 REFERENCE Adamu Legesse (2013). Determinants of Failure for Projects Financed by DBE. Thesis submitted to Saint Mary University School of Graduate Studies. Carlos (2002). project success and failure Chen, E.A., Okudan, G.E., Riley, D.R. (2010). Sustainable performance criteria for construction method selection in concrete building. Autom. Constr. 19 (2), 235–244. Daglas Teferi (2020).Investment Projects Failure by DBE. Thesis submitted to Saint Mary University School of Graduate Studies Muthoni, M. I., Mwangi, L. W., & S. M. (2020), Credit management practices and loan performance. International Journal of Current Aspects in Finance, Banking and Accounting, Volume 2, Issue 1. Derartu Adugna (2020). Determinants Project Failure Financed by Development Bank of Ethiopia .Thesis Submitted to the School of Graduate Studies of Jimma University DBE (2021/22). Annual Performance Report. Addis Ababa, Ethiopia. DBE (2008/2009). Annual Performance Report. Addis Ababa, Ethiopia Esty, C. (2004). Modern Project Finance – A case book. New York: John Wiley & Sons Eric, M. (2010). Top 5 Project Failure Reasons or Why My Project Fails. Http://www.MyManagementGuide.com (Accessed on 4th of April, 2013) Fabozzi, F. and P. Nevitt (2000). Project Financing.7th Edition. London, UK: Euromoney Fasil, A. and Merhatbeb, T. (2009). Law of Banking, Negotiable Instruments, and Insurance. (Unpublished). Hüseyin Ö., Derya G., and Mehtap H. (2010). “The Role of Development Banking in Promoting Industrialization in Turkey,” Régionet Développement 32,154-178. Ika, L.A., Diallo, A., Thuillier, D., 2010. Project management in the international development industry: the project coordinator's perspective. International Journal of Managing Projects in Business. 3 (1), 61–93 47 Lauren Thomas. Revised on June 1,(2023). Sampling technique. Kariungi, (2014).Completion of project within schedule Kothari (2004). Research methodology: Methods and Techniques. New Delhi Kumar, (2005) as cited by Ndegwa, (2013).Validity refers to the ability of the instrument to measure Kwak, Y.H. and Ibbs, C.W., 2002. Critical success factors in international development project management. In Proceedings of the 2002 CIB W65 Symposium (pp. 1-10). https://home.gwu.edu/~kwak/Kwak_CIB65_2002.pdf Patanakul, P. &Shenhar, A. J. (2012). What project strategy really is: the fundamental building block in strategic project management. Project Management Journal, Vol.43, No1; pg. 4-20 Perkins, K. T. (2006). Knowledge: The Core Problem of Project Failure. Software Technology Support Center. Available fromhttp://www.stsc.hill.af.mil. (Accessed 26 Feb. 2010) Odhiambo, K. O., C. R., & Okello, S. L. (2020). Macro-Economic Risk Factors on Performance of Public Private Partnership Renewable Energy Projects. Journal of Finance and Economics, Vol. 8, No. 2, 47-56. Peter, H. and Keith, B. (2007). Financial markets and institution, 5th edition, England: Pearson Education Limited. Polany, Karl, (2001) The Great Transformation: The Political and Economic Origins of Our Time,Beacon Press, Boston, 2001 Creswell, J. W. (2003). Qualitative, quantitative, and mixed methods approaches (2nd ed.). Thousand Oaks, CA: Sage. Robert, F. and Vicki, S. (2003). Project Success and Failure: What is Success, What is Failure and How Can You Improve Your Odds for Success? Rousson, V., Gasser, T. and Seifert, B. (2002) Assessing Intrarater, Interrater and Test-Retest Reliability of Continuous Measurements. Statistics in Medicine Ryan, J.O. and Barry, M. (2005). The Legacy of Failed Global Projects: A Review and Reconceptualization of the Legal Paradigm. California: Stanford University 48 Sekaran, U. (2003) Research Methods for Business Scandizzo, P.L. (2021). Impact and cost–benefit analysis: a unifying approach. Journal of Economic Structures, 10(1), 10. https://doi.org/10.1186/s40008-021-00240-w Shyam (2002).projects are the cutting age of development Uma,S. (2003). Research methods for business: a skill building approach third Edition New York: John Wiley. Tom, C. (2002). Reasons Why Projects Fail. UK: Project Smart, CO. Warne L (1997). Organizational politics and project failure Yamane, T. (1967). Statistics: An Introductory Analysis. 2nd Ed., New York: Harper and Row. Yescombe, E.R, (2002). Principles of project finance. London, UK: Academic Press. 49 Appendix-1 YOM POSTGRADUATED COLLEGE DEPARTMENT OF MASTER OF BUSINESS ADMINISTRATION Dear Valued Respondent Questionnaire to be filled by the Bank Clients First thanks for your time and voluntariness to fill questionnaire for the purpose of academic research on Determinants of failure for projects financed by Development Bank of Ethiopia; a case study in South West Addis Ababa district, Since your responses are crucial effect on the research result to be reliable, please try to reply carefully as per the intention of each question and be sure that your responses are keeping confidentially. Thus, be confident and fill the questions according to the instructions. You can choose more than one for each of the question. Directions • No need to write your name, • If you have any question, please contact me on 0912185654. BORROWER'S CHARACTERISTICS 1. What is the sector of your project? agriculture Manufacture mining Agro- processing construction sector of your project 2. What is the region of your project? Addis Ababa Oromia region of your project 3. What is the size of your project? small medium large size of your project 4. What is the life cycle time of your project? (re-payment period) 3 Years 3-5 Years 5-10 Years life cycle time of your project 5. What is the total investment of your project? less than 10 million birr 10-50 million birr total investment 6. What is the status of your project? New Expansion Status of your project 50 more than 50 million birr 10-20 Years 2: project failure related questions 1. To what extent do you think the following factors influenced the failure or success of your project? (Please rate each factor on a five-point Likert scale ranging from 1 (not influential)2 (slightly influential) 3(moderately influential) 4 (influential) and 5 (very influential)) not slightly moderately influential influential influential 1 2 3 Macro-economic Factors Inflation Exchange rate Interest rate GDP growth Socio-political factors Corruption Project specific Factors Regulation Due diligence assessment report or KYC Bank’s credit management system Supervision Risk management 51 influential very influential 4 5 Appendix-1 YOM POSTGRADUATED COLLEGE DEPARTMENT OF MASTER OF BUSINESS ADMINISTRATION Dear Valued Respondent Questionnaire to be filled by the Banks managers and other expertise First of all let me thank you for sharing your time and information with me. Currently, I am pursuing my Masters (MA) program at the department of business administration, my research is entitled Determinants of failure for projects financed by Development Bank of Ethiopia. Your kind cooperation in giving me and/or my research assistants an interview is highly appreciated. I want to assure you that the information you give me will be completely confidential and will be used exclusively for our study, and I will not be taking down your name so your answers will be anonymous. Directions • No need to write your name, • If you have any question, please contact me on 0912185654 I: Demographic Information PART I: Demographic Information 1. Sex: Male 2. Age: 25 years or less Female Between 26-30 Years Between 41- 50 Year 51 and above year 3. Marital status : Married 4. Education Level : Between 31- 40 Single Diploma 5. Work Experience : 5 years or less Divorced Degree Masters From 6-10years 16 above Years 52 Widowed From11-15 year Work Experience with Credit Area:-2 years from 2-5 Years more than 5 years 2: project failure related questions 1. To what extent do you think the following factors influenced the failure of project? (Please rate each factor on a five-point Likert scale ranging from 1 (not influential)2 (slightly influential) 3(moderately influential) 4 (influential) and 5 (very influential)) not slightly moderately influential influential influential 1 2 3 Macro-economic Factors Inflation Exchange rate Interest rate GDP growth Socio-political factors Corruption Project specific Factors Regulation Due diligence assessment report or KYC Bank’s credit management system Supervision Risk management 53 influential very influential 4 5 PART 3 : Interview on Determinants of failure for projects financed by Development Bank of Ethiopia South West Addis Ababa District;(For The District managers ) Would you Please tell me determinants of failure for projects financed by DBE projects South West Addis Ababa Districts? From your point of view, which of the ones you mentioned would mainly or predominantly determines the failure of the project; Would you please tell me the impact of project failure in the case of projects financed by DBE projects South West Addis Ababa Districts? According to your observation, which sector is the most likely to face project failure? Please list out in descending order. 54 What is your contribution or what kind of support do you provide before the projects are failed? What are the possible solutions or Recommendations do you think would prevent project failures? 55 Frequency Table for client Inflation Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 83 32 0 22 13 5 4 3 2 1 Rate*Frequ ency(a) 415 128 0 44 13 600 Sample size*Highes t rate(b) c=a/b=R II 750 0.8 Sample size*Highes t rate(b) c=a/b=RII 750 0.792 exchange rate Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 75 34 13 16 12 5 4 3 2 1 Rate*Frequ ency(a) 375 136 39 32 12 594 Interest Rate Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 62 19 12 36 21 56 5 4 3 2 1 Sample Rate*Frequ size*Highes ency(a) t rate(b) c=a/b=RII 310 76 36 72 21 515 750 0.68667 GDP Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 54 26 40 11 10 5 4 3 2 1 Rate*Frequ ency(a) 270 104 120 22 10 526 Sample size*Highes t rate(b) c=a/b=RII 750 0.70133 Corruption Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 69 34 13 13 19 5 4 3 2 1 Sample Rate*Frequ size*Highes ency(a) t rate(b) c=a/b=RII 345 136 39 26 19 565 750 0.75333 Regulation Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 9 49 43 25 24 Sample size*Highes t rate(b) c=a/b=RII 750 0.592 Sample Rate*Frequ size*Highes ency(a) t rate(b) 5 150 c=a/b=RII 5 4 3 2 1 Rate*Frequ ency(a) 45 196 129 50 24 444 Due diligence Valid Very influence Frequency Rate 30 57 Influence moderately Influence slightly influence not influence Total 40 16 32 32 4 3 2 1 160 48 64 32 454 750 0.60533 Sample size*Highes t rate(b) c=a/b=RII 750 0.55067 Supervision Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 20 32 29 29 40 5 4 3 2 1 Rate*Frequ ency(a) 100 128 87 58 40 413 Risk management Valid Very influence Influence moderately Influence slightly influence not influence Total Frequency Rate 20 40 21 32 37 58 5 4 3 2 1 Sample Rate*Frequ size*Highes ency(a) t rate(b) c=a/b=RII 100 160 63 64 37 424 750 0.56533 Frequency Table for Staff Inflation Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 36 5 180 16 4 64 4 1 1 3 2 1 12 2 1 259 c=a/b=RII 750 0.345333333 Exchange rate Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 30 5 150 18 4 72 6 3 1 3 2 1 18 6 1 247 c=a/b=RII 750 0.329333333 Interest rate Valid Very influence Influence moderately Influence slightly influence not influence Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 8 5 40 18 4 72 9 20 3 3 2 1 59 27 40 3 c=a/b=RII Total 182 750 0.242666667 GDP Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 10 5 50 17 4 68 15 10 6 3 2 1 45 20 6 189 750 c=a/b=RII 0.252 Corruption Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 30 5 150 24 4 96 0 3 1 3 2 1 0 6 1 253 c=a/b=RII 750 0.337333333 Regulation Valid Very influence Influence moderately Influence slightly influence Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 9 5 45 29 4 116 7 4 3 2 60 21 8 c=a/b=RII not influence Total 9 1 9 199 750 0.265333333 Due diligence Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 23 5 115 17 4 68 13 2 3 3 2 1 39 4 3 229 c=a/b=RII 750 0.305333333 Supervision Valid Very influence Influence moderately Influence slightly influence not influence Total Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 9 5 45 33 4 132 3 3 9 3 2 1 9 6 9 201 750 c=a/b=RII 0.268 Risk management Valid Very influence Influence moderately Influence slightly influence Sample size*Highest Frequency Rate Rate*Frequency(a) rate(b) 10 5 50 34 4 136 5 1 3 2 61 15 2 c=a/b=RII not influence Total 8 1 62 8 211 750 0.281333333