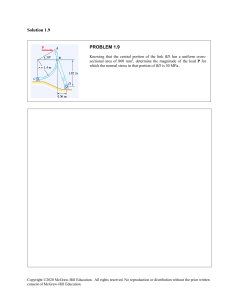

Chapter 2 Asset Classes and Financial Instruments Bodie, Kane, and Marcus Essentials of Investments Eleventh Edition 2.1 Asset Classes Fixed Income Asset Classes Equity Derivatives Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 2 2.1 Fixed Income: Money Markets Money Markets Fixed Income Capital Markets Asset Classes Equity Derivatives Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 3 2.1 The Money Market • Subsector of the fixed-income market • Short-term • Liquid • Low risk • Often have large denominations Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 4 2.1 The Money Market: Treasury Bills • Treasury Bills (Similar in SA) • Issuer: Governments • Maturity: 4, 13, 26, or 52 weeks (91 and 180 days in SA) • Liquidity: High • Default risk: None • Interest type: Discount (NB to differentiate discount rate from add-on rate and effective rate) Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 5 2.1 The Money Market: Certificates of Deposit (CDs) • Certificates of Deposit (CDs) • Issuer: Depository institutions (Banks) • Maturity: Varies, typically 14-day minimum • Liquidity: CDs of 3 months or less are liquid • Interest type: Add-on rate Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 6 2.1 The Money Market: Commercial Paper • Commercial Paper (CP) • Issuer: Large creditworthy corporations, financial institutions • Maturity: Maximum up to 360 days, usually 1-2 months • Liquidity: CP of 3 months or less is more liquid • Default risk: Unsecured, rated, mostly high quality • Interest type: Discount • New Innovation: Asset-backed commercial paper Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 7 2.1 The Money Market: Instruments • Bankers’ Acceptances • Purchaser authorizes a bank to pay a seller for goods at later date (time draft) • When purchaser’s bank “accepts” draft, it becomes contingent liability of the bank ( and marketable) • Federal Funds • Depository institutions must maintain deposits with Federal Reserve Bank in US (at SARB in SA) • Federal funds—trading in reserves held on deposit at Federal Reserve (called reserve funds (or interbank market) in SA) • Federal Funds rate = key interest rate for US economy (called interbank overnight call deposit rates in SA – not publicly available) • Estimate = South African Benchmark Overnight Rate (SABOR) in SA • NB! SABOR < Repo rate - see SA rates slide Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 8 2.1 The Money Market: Instruments • Eurodollars • Dollar-denominated (time) deposits held outside U.S. • Pay higher interest rate than U.S. deposits • LIBOR (London Interbank Offer Rate) • Rate at which large banks in London (and elsewhere) lend to each other (usually 112 months) • Base rate for many loans and derivatives • In SA: JIBAR Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 9 Eurodollar versus Libor on usd Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 10 2.1 The Money Market: Repurchase Agreements • Repurchase Agreements (RPs) • Short-term sale of securities + promise to repurchase at higher price • RP is a collateralized loan • Many RPs are overnight • “Term” RPs may have a 1-month maturity • Reverse RPs • Lending money; obtaining security title as collateral • “Haircuts” may be required Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 11 2.1 The Money Market: Brokers’ Calls • Brokers’ Calls • Call money rate applies for investors buying stock on margin • Loan may be “called in” by broker Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 12 Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 13 Figure 2.2 Spreads on CDs and Treasury Bills 5.0 OPEC I 4.5 4.0 Financial crisis Percentage points 3.5 OPEC II 3.0 Penn Square 2.5 Market crash 2.0 1.5 LTCM 1.0 0.5 Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 0.0 14 2.1 The Money Market: Instrument Yields • NB for Assessment: Be able to convert MM yields. • Yields on money market instruments not always directly comparable • Factors influencing “quoted” yields • Par value vs. investment value • 360 vs. 365 days assumed in a year (366 leap year) • Simple vs. compound interest Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 15 2.1 The Money Market: Treasury Bills Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 16 2.1 The Money Market: Treasury Bills • Bank Discount Rate (T-bill quotes) r BD = $10,000 − P $10,000 x 360 n $10,000 = Par rBD = bank discount rate P = market price of the T-bill n = number of days to maturity • Example: 90-day T-bill, P = $9,875 r BD = $10,000 - $9,875 $10,000 360 = 5% × 90 Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 17 2.1 The Money Market • Nominal annual yield (Nominal Annual Compounded rates) • Can’t compare discount instruments (e.g. T-bill) that use discount rate (i.e. d) directly to add-on instruments (e.g. NCD) that use nominal rates (i.e. NAC) • Return is based on par value (for d) vs. price paid (for NAC) • Example with annual compounding: • Return =R500; Par is R10000; Maturity = 1 year (360 day-count) so n = 1 and compound frequency is once (i.e. m = 1) • Calculate the Nominal Annual Compounded Annually (NACA) • Discount price is R10000-R500 = R9500 • d = R500/R10000 = 5% • Nominal yield (i.e. NACA) = R500/R9500 = 5.26% Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 18 2.1 The Money Market • Nominal annual rates (NAC) • Can’t compare discount instruments (e.g. T-bill) directly to add-on instruments (e.g. NCD) • Others NAC rates: Nominal Annual Compounded Semi Annually (NACSA) when m = 2 Nominal Annual Compounded Quarterly (NACQ) when m = 4 Nominal Annual Compounded Weekly (NACW) when m = 52 Nominal Annual Compounded Daily (NACD) when m = 360 • You should be able to convert discount rate to make it comparable (i.e. convert d to NAC or NAC to d to compare instruments) • Click here to see easy method for converting Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 19 2.1 THE MONEY MARKET • Bond Equivalent Yield (a NAC but with 365 day-count so BEY = NAC365) Can’t compare T-bill directly to bond • 360 days (for d) vs. 365 days (for BEY) • Return is figured in par (for d) vs. price paid (for BEY) • Example with annual compounding: • Return =R500; Par is R10000; Maturity = 1 year (360 day-count) so n = 1 and compound frequency is once (i.e. m = 1) • Discount price is R10000-R500 =R9500 • d = R500/R10000 = 5% • NAC360 = R500/R9500 = 5.263% • NAC365 (i.e. BEY) = R500/R9500 x 365/360 = 5.336% You should be able to adjust discount rate or NAC to make it comparable to BEY instruments Click here to see easy method for converting 2.1 THE MONEY MARKET • Bond Equivalent Yield (BEY): Example Using Sample T-Bill but compound frequency of 4 (i.e. m = 4) FV = Face value of TB = 10000 P = price of the T-bill d = 5% 90 = number of days in compound period m = compound frequency (quarterly = 360/90 = 4) so NAC = ? and BEY = ? • TB discount price = 10000 – (0.05 x 90/360) = 9875 • Nominal yield (i.e. Nominal Annual Compounded Quarterly (NACQ in this case): NACQ = FV − P 360 × P • NACQ = 90 10,000 − 9,875 × 9,875 360 90 = 5.0633% BEY in this case: BEY = FV − P 365 × P BEY 90 = 10,000 − 9,875 365 × 9,875 90 For method without using P and FV, see slides below = 5.1336% INTEREST CALCULATIONS • • • Possible to convert rates without knowing P or FV Discount rate (d) < Nominal yield (NAC) < BEY < AEY Discount rate = d (e.g. 5% p.a. for 90 day instrument = 0.25 of a year, so: n = 0.25). Need n for time value of money calculations (see this linked slide) • Compounding frequency in a year = 360/90, so: m = 4. We need m for interest rate conversions. • Nominal Annual rate Compounded m times per year (e.g. NACQuarterly (NACQ)) 𝑑= d= 𝑁𝐴𝐶 × 100 𝑁𝐴𝐶 1+( ) 𝑚 0.050633 1+( 0.050633 ) 4 = 5% × 100 Very NB! 𝑁𝐴𝐶𝑄 = d= 𝑑 𝑑 1−( ) 𝑚 0.05 0.05 1−( 4 ) × 100 × 100 = 5.0633% INTEREST CALCULATIONS • Possible to convert rates without knowing P or FV • • Discount rate (d) < Nominal yield (NAC) < BEY< AEY Money Market: Compounding frequency in a year = 360/90, so: “money market m” = mm = 4. Bond Market: Compounding frequency in a year = 365/90, so: “bond market m” = mb = 4.0555. 𝑚𝑏 𝐵𝐸𝑌 = 𝑁𝐴𝐶 × × 100 𝑚𝑚 So: NAC360 → BEY365: • See textbook example • • = 0.050633 × 𝑑= d= 𝐵𝐸𝑌 𝑚𝑚 × × 100 𝐵𝐸𝑌 𝑚 𝑏 1+( 𝑚 ) 𝑏 0.051336 0.051336 1+( 4.0555 ) × = 5% 4 × 4.0555 100 𝐵𝐸𝑌 = 4.0555 × 100 = 5.1336% 4 𝑑 𝑑 1 − (𝑚 ) × 𝑚𝑏 × 100 𝑚𝑚 𝑚 d= 0.05 0.05 1−( 4 ) × 4.0555 × 4 = 5.1336% 100 𝐵𝐸𝑌 = 𝑑 𝑑 1 − (𝑚 ) × 𝑚𝑏 × 100 𝑚𝑚 𝑚 d= 0.0007 0.0007 1−(1.4694) × 1.4898 × 1.4694 = 0.0710% 100 This is 0.070%, so in decimal format it is 0.00070 mm = 360/245 =1.4694 mb = 365/245=1.4898 𝐵𝐸𝑌 = 𝑑 𝑑 1 − (𝑚 ) × 𝑚𝑏 × 100 𝑚𝑚 𝑚 d= 0.0018 0.0018 1−(1.0084) × 1.0224 × 1.0084 = 0.1828% 100 This is 0.18%, so in decimal format it is 0.0018 mm = 360/357 =1.0084 mb = 365/357=1.0224 2.1 THE MONEY MARKET • Annualise nominal rates to include compound interest = Effective Annual Yield (EAY) or Annual Effective Yield (AEY) d = 5% • Example from previous slide: NACQ = 5.0633% BEY = 5.1336% • 𝐴𝐸𝑌360 = (1 + 𝐹𝑉 −𝑃 360 ) 90 𝑃 − 1 = (1 + 10000 −9875 360 ) 90 9875 −1 𝑨𝑬𝒀𝟑𝟔𝟎 = 5.1602% • 𝐴𝐸𝑌365 = (1 + 𝐹𝑉 −𝑃 365 ) 90 𝑃 − 1 = (1 + 10000 −9875 365 ) 90 9875 −1 𝑨𝑬𝒀𝟑𝟔𝟓 = 5.234% For method without using P and FV, see slides below INTEREST CALCULATIONS • AEY360 = (1+NAC/mm)mm -1 AEY360= 1 + 𝑁𝐴𝐶 𝑚𝑚 𝑚𝑚 AEY360= 1 + − 1 × 100 0.050633 4 4 − 1 × 100 = 5.1602% • or: if discount rate is used: AEY360= 1 − 𝑑 −𝑚𝑚 𝑚𝑚 AEY360= 1 − − 1 × 100 0.05 −4 4 − 1 × 100 = 5.1602% • or: if FV formula is used n PV(1+AEY) = FV (where n = investment period) 9875 (1+AEY) 0.25 = 10000 Thus: AEY = (10000/9875)(1/0.25) -1 = 5.1602% From previous example: FV = R10000 PV = 10000-(10000x0.05x(90/360)) = R9875 n = 90 days = 0.25 years INTEREST CALCULATIONS • AEY365 = (1+NAC/mm)mb -1 AEY365 = (1+BEY/mb)mb -1 AEY365= 1 + 𝑁𝐴𝐶 𝑚𝑏 𝑚𝑚 AEY365= 1 + AEY365= 1 + − 1 × 100 0.050633 4.0555 4 − 1 × 100 0.051336 4.0555 4.0555 − 1 × 100 = 5.234% or: if discount rate is used: AEY365= 1 − 𝑑 −𝑚𝑏 𝑚𝑚 AEY365= 1 − 0.05 −4.0555 4 − 1 × 100 − 1 × 100 = 5.234% • 𝑚𝑏 AEY365= 1 + − 1 × 100 = 5.234% • 𝐵𝐸𝑌 𝑚𝑏 or: if FV formula is used n PV(1+AEY) = FV (where n = investment period) 9875 (1+AEY) 0.24657 = 10000 Thus: AEY = (10000/9857)(1/0.24657) -1 = 5.234% From previous example: FV = R10000 PV = 10000-(10000x0.05x(90/360)) = R9875 n = 90 days = 90/365 = 0.24657 years MAKE SURE YOU CAN YOU DO THESE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. d NAC NAC d d BEY BEY d d AEY360 AEY360 d d AEY365 AEY365 d NAC BEY BEY NAC NAC AEY360 AEY360 NAC NAC AEY365 AEY365 NAC BEY AEY365 AEY365 BEY BEY AEY360 AEY360 BEY 2.1 The Money Market: Instrument Yield Money Market Instrument Instrument Yield Treasury Bills Discount Certificates of Deposit Bond Equivalent Yield or NAC Commercial Paper Discount Bankers’ Acceptances Discount Eurodollars Bond Equivalent Yield or NAC Federal Funds Bond Equivalent Yield Repurchase Agreements Discount Reverse RPs Discount Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 30 2.2 Fixed Income: Capital (Bond) Markets Money Markets Fixed Income Capital Markets Asset Classes Equity Derivatives Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 31 2.2 THE BOND MARKET • Capital Market—Fixed-Income Instruments • Government Issues—U.S. Treasury Bonds and Notes • • • • Variation: Treasury Inflation Protected Securities (TIPS) • • • Bonds vs. notes Interest type Risk Principal adjusted for increases in the Consumer Price Index Agency issues (federal government) (Just Read) Municipal bonds (Just Read) Figure 2.3 Listing of Treasury Issues For SA bonds, see: http://www.sharenet.co.za/free/gilts.phtml Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 33 2.2 The Bond Market: Private Issue • Corporate Bonds • Investment grade vs. speculative grade • Mortgage-Backed Securities • Backed by pool of mortgages with “pass-through” of monthly payments; covers defaults • Collateral • Traditionally all mortgages conform, since 2006 Alt-A and subprime mortgages are included in pools • Private banks purchased and sold pools of subprime mortgages • Issuers assumed housing prices would continue to rise • See diagrams on next 2 slides (explain ABS (i.e. MBS) and CDOs in 2-3 sentences each. Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 34 2.2 The Bond Market • Mortgage-Backed Securities • Private banks purchased and sold pools of subprime mortgages • Issuers assumed housing prices would continue to rise Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 35 Simple ABSs and CDOs MBS Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 36 Figure 2.6 Mortgage-Backed Securities Outstanding Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 37 Figure 2.7 Asset-Backed Securities Outstanding Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 38 Figure 2.9 The U.S. Fixed-Income Market Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 39 2.3 Equity Money Markets Fixed Income Capital Markets Asset Classes Equity Derivatives Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 40 2.3 Equity Securities: Instruments • Equity Securities • Common stock • Residual claim • Limited liability • Preferred stock • Priority over common • Fixed dividends: Limited gains • Nonvoting • Tax treatment: Dividends Withholdings Tax (DWT) of 15% in SA Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 41 2.3 Equity Securities: Instruments • Depository receipts • American Depositary Receipts (ADRs), also called American Depositary Shares (ADSs) • Certificates traded in the U.S. representing ownership in foreign security • Also in SA: See article on BB and http://www.jse.co.za Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 42 2.3 Equity Securities: Returns • Capital gains and dividend yields • Buy a share of stock for $50, hold for 1 year, collect $1 dividend, and sell stock for $54 What were dividend yield, capital gain yield, and total return? Total Return PSell PBuy Div PBuy $54 50 1 10% $50 Div $1 Dividend Yield 2% PBuy $50 Capital Gains Yield PSell PBuy PBuy $54 50 8% $50 Total return = Dividend yield + Capital gain yield = 2% + 8% = 10% Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 43 Figure 2.8 Listing of stocks traded on NYSE Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 44 2.4 Stock and Bond Market Indexes • Uses • Track average returns • Compare performance of managers • Base of derivatives • Factors in constructing/using index • Representative? • Broad/narrow? • How is it constructed? Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 45 2.4 Stock and Bond Market Indexes • Examples of Indexes—USA • Dow Jones Industrial Average (30 stocks) • Standard & Poor’s 500 Composite • NASDAQ Composite (>3,000 firms) • Wilshire 5000 (>6,000 stocks) • Examples of Indexes—SA • ALSI • ALSI 40 • INDI • FINI Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 46 2.4 Stock and Bond Market Indexes Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 47 2.4 Stock and Bond Market Indexes https://www.sashares.co.za/jse-top-40/#gs.wn6r4r Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 48 2.4 Stock and Bond Market Indexes •Constructing Market Indexes • Weighting schemes Price-weighted average: Computed by adding prices of stocks and dividing by “divisor” Market value-weighted index: Return equals weighted average of returns of each component security, with weights proportional to outstanding market value Equally weighted index: Computed from simple average of returns Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 49 2.4 Stock and Bond Market Indexes • Construction of Indexes • How are stocks weighted? • Price weighted (DJIA) • Market value weighted (S&P 500, NASDAQ) • Equally weighted (Value Line Index) • How much money do you put in each stock in the index? Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 50 2.4 STOCK AND BOND MARKET INDEXES Stock Price-Weighted Series • Price0 Quantity0 P1 Q2 A $10 40 $15 40 B 50 80 25 160 C 140 50 150 50 Time 0 index value: (10 + 50 + 140)/3 = 200/3 = 66.7 Time 1 index value: (10 + 25 + 140)/Denom = 66.67 Denominator = 2.624869 Time 1 index value: (15 + 25 + 150)/2.624869 = 72.38 Other problems: • • • • • • Similar % change movements in higher-price stocks cause proportionally larger changes in the index Splits arbitrarily reduce weights of stocks that split in index 2.4 STOCK AND BOND MARKET INDEXES Stock • Price1 Quantity1 P2 Q2 A $10 40 $15 40 B 50 80 25 160 C 140 50 150 50 Market Value-Weighted Series IndexV = (15 40) (25 160) (150 50) (10 40) (50 80) (140 50) • This value could be anything (e.g. 50236). It is the index value from the previous period 100 106.14 Equal-Weighted Series • Let’s assume you invest $300 in each (15 30) (25 12) (150 2.143) 100 119.05 IndexE = (10 30) (50 6) (140 2.143) • NB! Easier way for Equal-weighted Index: Calculate % change in each share’s market value and then simply average the % changes 2.4 STOCK AND BOND MARKET INDEXES Case 1 Stock • P1 Q1 P2 Case 2 Q2 P2 Q2 A $10 40 $12 40 $10 40 B 100 80 100 80 100 80 C 50 200 50 200 60 200 Why do the two differ? • Case 1: 20% change in price of small-cap firm IndexV = • (12 40) (100 80) (50 200) 100 100.43 (10 40) (100 80) (50 200) Let’s assume you invest $100 in each stock (12 10) (100 1) (50 2) 100 106.67 IndexE = (10 10) (100 1) (50 2) 2.4 STOCK AND BOND MARKET INDEXES Case 1 Stock • P1 Q1 P2 Case 2 Q2 P2 Q2 A $10 40 $12 40 $10 40 B 100 80 100 80 100 80 C 50 200 50 200 60 200 Case 1 VW = 100.43 Case 1 EW = 106.67 Why do the two differ? • Case 2: 20% change in price of large-cap firm IndexV = (10 40) (100 80) (60 200) 100 110.86 (10 40) (100 80) (50 200) • Assume $100 investment in each stock (10 10) (100 1) (60 2) 100 106.67 IndexE = (10 10) (100 1) (50 2) ALSI INDEX IN SA When you hear on the radio that the JSE All Share Index rose 0,75%, you have an indication of the value by which the market rose that day. The All Share Index is a market capitalisation weighted index, which means price movements of bigger companies have more importance. For example, a gain of 2% by PPC (JSE:PPC) on a given day means a lot more than, say, a 5% fall in the price of tiny brick maker Brikor (JSE:BIK). An index attempting to measure what the market is doing will obviously give more weight to PPC. Old fashioned stock market indices measured the change in the total market capitalisations of all shares on the market. Bigger market caps correctly had more influence. But a large number of companies are controlled outright, which means a large percentage of their shares never trade. Today's more sophisticated indices take account of that fact. Modern indices, such as the JSE/FTSE All Share Index, eliminate shares owned by founders, their families, directors and employee share schemes, also those locked up in strategic holdings or owned by government. They count only the "free float". Because of share price moves, every quarter some shares move into the Alsi 40 and others move out. While there are always 40 shares in the Alsi 40, those ranking from 35-40 are regarded as a buffer. To cater for new entrants, those ranking from 40-45 are kept in a reserve list. All those ranking above 35 at the end of a quarter are automatically included and those that fall below 46 are dropped. Those between 35 and 46 are the JSE's reserve list to allow for comings and goings. The indices are calculated every 15 seconds by computer. To that extent the indices are live and can be plotted minute by minute by intra-day traders. The indices have become more important in the past ten years as more and more investment funds track the market. On the grounds that it is difficult to beat the market, more and more funds simply "buy the market". They mirror various stock market indexes. A well-known local index tracker is Satrix. A company whose share price rises and finds itself suddenly in the Alsi 40, gets a second whammy as investment funds become obliged to buy its shares. A company that drops out will quickly experience selling pressure. The top 40 shares therefore trade at a premium. Which is all very nice for the companies and their managements - but it means it is difficult for an investor to find neglected bargains in the Alsi 40. DISTRIBUTION (MARKET CAPITALISATION) WEIGHTS ON THE FTSE/JSE ALL SHARE INDEX OF https://www.sashares.co.za/jse-top-40/#gs.wn6r4r 2.5 Derivative Markets • Derivative Asset/Contingent Claim • Security with payoff that depends on the price of other securities • Call Option • Right to buy an asset at a specified price on or before a specified expiration date • Put Option • Right to sell an asset at a specified exercise price on or before a specified expiration date Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 58 2.5 Derivative Markets • Options • Futures • Basic Positions • Call (Buy/Sell?) • Put (Buy/Sell?) • Basic Positions • Long (Buy/Sell?) • Short (Buy/Sell?) • Terms • Exercise price • Expiration date • Terms • Delivery date • Deliverable item Copyright © 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 59