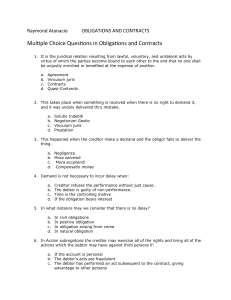

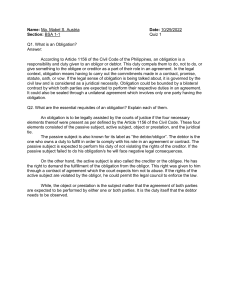

CIVIL LAW REVIEW 2 2ND SEMESTER SY 2017-2018 (FOR EXCLUSIVE USE OF UNIVERSITY OF SAN AGUSTIN COLLEGE OF LAW) By: ATTY. MICHAEL S. MARGARICO PRESCRIPTION (Articles 1106 to 1155) PRESCRIPTION Is a mode of acquiring ownership and other real rights thru the lapse of time in the manner and under the conditions laid down by law, namely, that the possession should be: (a) in the concept of an owner; (b) public; (c) peaceful; (d) uninterrupted; (e) adverse. Classification of PRESCRIPTION: Acquisitive pr escription (prescription of ownership and other real rights) a.1. Ordinary prescription; (a) - Requires possession in good faith and with just title for 10 years. a.2. Extraordinary prescription. - Ownership and other real rights over immovable property are acquired through uninterrupted adverse possession thereof for 30 years, without need of title or of good faith. Extinctive pr escription (“liberatory prescription”, prescription of action) (Statute of Limitations) It is not a mode of acquiring ownership. It involves loss of the right to file a case or action due to the lapse of time (prescriptive period) (b) ACQUISITIVE PRESCRIPTION EXTINCTIVE PRESCRIPTION 1. Requires as an essential element a 1. Requires a negative element positive fact which is possession by inaction of the owner; one who is not the owner; 2. Purpose is to produce the 2. Purpose is to acquisition of ownership and other extinction of rights; real rights; produce the 3. Applicable only to real rights which 3. Applicable to all kinds of right, are susceptible of possession; whether real or personal; 4. Results to acquisition as well in the 4. Results in the extinction of a real or extinction of a real right. personal right. LACHES: (Estoppel by Laches) Is failure or neglect, for an unreasonable and unexplained length of time, to do that which, by exercising due diligence, could or should have done earlier; it is negligence or omission to assert a right within a reasonable time, warranting a presumption that the party entitled thereto either has abandoned it or declined to assert it. However courts will not be bound by strictures of the statute of limitations or laches when manifest wrong or injuries would result thereby. (Cristobal vs. Melchor, 78 SCRA 175) PRESCRIPTION LACHES 1. Is concerned with FACT OF DELAY; 1.Is concerned DELAY; 2. Is a matter of time; 2. Is principally a question of inequity of permitting a claim to be enforced, this inequity being founded on the same change in the condition of the property or the relation of parties; 3. Is statutory; 3. Not statutory; 4. Applies at law; 4. Applies in equity; 5. Based on fixed time. 5. Not based on fixed time. with EFFECT OF ISSUE: Is the claim already barred by prescription and laches? Even if we squarely deal with the issues of laches and prescription, the same must still fail. Laches is principally a doctrine of equity which is applied to avoid recognizing a right when to do so would result in a clearly inequitable situation or in an injustice.This doctrine finds no application in this case, since there is nothing inequitable in giving due course to respondents’ claim. Both equity and the law direct that a property owner should be compensated if his property is taken for public use.Neither shall prescription bar respondents’ claim following the long-standing rule "that where private property is taken by the Government for public use without first acquiring title thereto either through expropriation or negotiated sale, the owner’s action to recover the land or the value thereof does not prescribe.” When a property is taken by the government for public use, jurisprudence clearly provides for the remedies available to a landowner. The owner may recover his property if its return is feasible or, if it is not, the aggrieved owner may demand payment of just compensation for the land taken. For failure of respondents to question the lack of expropriation proceedings for a long period of time, they are deemed to have waived and are estopped from assailing the power of the government to expropriate or the public use for which the power was exercised. What is left to respondents is the right of compensation. Who May Acquire Prescription: Property or Rights by (a) Those who can make use of the other modes of acquiring ownership; (b) Even minors and other incapacitated persons (like the insane) Prescription, both acquisitive and extinctive, runs against: (Art. 1108) (1) Minors and other incapacitated persons who have parents, guardians or other legal representatives; (2) Absentees who have administrators, either appointed by them before their disappearance, or appointed by the courts; (3) Persons living abroad, who have managers or administrators; (4) Juridical persons, subdivisions. except the State and its NO PRESCRIPTION! (a) Between husband and wife; (b) Between parents and children during the minority or insanity of the latter; (c) Between guardian and ward during continuance of the guardianship; the (d) Against the State except with reference to patrimonial property. Requisites for Renunciation of Property Acquired by Prescription: (Art. 1112) 1) Renouncer must have the capacity to alienate property; 2) The property acquired must have already been obtained; (the right to prescription in the future cannot be renounced, since manifestly, this would be contrary to public policy) 3) The renouncing must be made by the owner of the rights; (not by mere administrator or guardian for he does not own the property) 4) The renouncing must not prejudice the rights of others such as creditors. Forms of RENUNCIATION: (a) may be express or implied (tacit); (b) requires no consent on the part of the person to be benefited; (c) requires no solemnities or formalities; DEVELOPMENT BANK OF THE PHILIPPINES (DBP) versus THE HONORABLE MIDPAINTAO L. ADIL, Judge of the Second Branch of the Court of First Instance of Iloilo and SPOUSES PATRICIO CONFESOR and JOVITA VILLAFUERTE (G.R. No. L-48889 May 11, 1989) FACTS: On February 10, 1940 spouses Patricio Confesor and Jovita Villafuerte obtained an agricultural loan from the Agricultural and Industrial Bank (AIB), now the Development of the Philippines (DBP), in the sum of P2,000.00, Philippine Currency, as evidenced by a promissory note of said date whereby they bound themselves jointly and severally to pay the account in ten (10) equal yearly amortizations. As the obligation remained outstanding and unpaid even after the lapse of the aforesaid ten-year period, Confesor, who was by then a member of the Congress of the Philippines, executed a second promissory note on April 11, 1961 expressly acknowledging said loan and promising to pay the same on or before June 15, 1961. Said spouses not having paid the obligation on the specified date, the DBP filed a complaint dated September 11, 1970 in the City Court of Iloilo City against the spouses for the payment of the loan. ISSUE: Whether of not the right to prescription may be renounced or waived. RULING: There is no doubt that prescription has set in as to the first promissory note of February 10, 1940. However, when respondent Confesor executed the second promissory note on April 11, 1961 whereby he promised to pay the amount covered by the previous promissory note on or before June 15, 1961, and upon failure to do so, agreed to the foreclosure of the mortgage, said respondent thereby effectively and expressly renounced and waived his right to the prescription of the action covering the first promissory note. This Court had ruled in a similar case that – ... when a debt is already barred by prescription, it cannot be enforced by the creditor. But a new contract recognizing and assuming the prescribed debt would be valid and enforceable ... . Thus, it has been held — Where, therefore, a party acknowledges the correctness of a debt and promises to pay it after the same has prescribed and with full knowledge of the prescription he thereby waives the benefit of prescription. All things which are within the commerce of men are susceptible to prescription, unless otherwise provided. Property of the State or any of its subdivision not patrimonial in character shall not be the object of prescription. (Art. 1113) Patrimonial (Article 421) - All other property of the State, which is not intended for public use nor for the development of the national wealth. - It is wealth owned by the State in its private or proprietary capacity. - It is property over which the state has the same rights and of which it may dispose, to the same extent as private individuals. A tract of land formerly low and swampy, but gradually raised by the action of the sea, is not susceptible of prescription, and may therefore be recovered by the government despite the construction thereon of a warehouse and a wharf. The land is part of public domain. (Insular Government vs. Aldecoa and Co., 19 Phil. 505) Republic vs. Metro Index Realty and Development Corp. ( 675 SCRA 439, G.R. No. 198585, July 2, 2012) Properties of the public dominion are not susceptible to prescription and that only properties of the State that are no longer earmarked for public use, otherwise known as patrimonial, may be acquired by prescription. it is jurisprudentially clear that the thirty (30)-year period of prescription for purposes of acquiring ownership and registration of public land under Section 14(2) of P.D. No. 1529 only begins from the moment the State expressly declares that the public dominion property is no longer intended for public service or the development of national wealth or that the property has been converted into patrimonial. Simply put, it is not the notorious, exclusive and uninterrupted possession and occupation of an alienable and disposable public land for the mandated periods that converts it to patrimonial. The indispensability of an official declaration that the property is now held by the State in its private capacity or placed within the commerce of man for prescription to have any effect against the State cannot be overemphasized. Things or properties that CANNOT BE ACQUIRED by PRESCRIPTION: (a) Properties which are part of public domain; (b) Those protected under the Torrens Title; (c) Movables acquired thru a crime; (d) Those outside the commerce of man; (e) Properties of spouses, parents and children, wards and guardians, under the restrictions imposed by law. Specific provisions on prescription found elsewhere in the Code, or in special laws, prevail over the provisions of the Chapter on Prescription. This is particularly true in the instances when specific periods of prescription are provided for. (Art. 1115) ACQUISITIVE PRESCRIPTION (a) Ordinary Acquisitive Prescription: Requires possession of things in good faith and with just title for the time fixed by law. (b) Extraordinary Acquisitive Prescription: Acquisition of ownership and other real rights without need of title or of good faith or any other condition. Requisites Common to ORDINARY and EXTRAORDINARY ACQUISITIVE PRESCRIPTION: (a) Capacity of acquirer to acquire by prescription; (b) Capacity of the loser to lose by prescription; (c) Object must be susceptible of prescription; (d) lapse of required period of time the possession must be: 1. 2. 3. 4. in concepto de dueno (concept of an owner); public (not clandestine or non-apparent) peaceful (not thru force, violence or intimidation); continuous or uninterrupted. Requisites present PRESCRIPTION: ONLY to ORDINARY Acquisitive a) The possession must be in good faith; b) The possession must be by virtue of a just title.; c) The possession must be 4 years if the object is movable; 10 years if it is immovable. Requisites present ONLY to EXTRAORDINARY Acquisitive PRESCRIPTION: a) Period of possession must be 8 years if movable; 30 years is immovable. Acquisitive prescription is a mode of acquiring ownership by a possessor through the requisite lapse of time. In order to ripen into ownership, possession must be in the concept of an owner, public, peaceful and uninterrupted. Thus, mere possession with a juridical title, such as, to exemplify, by a usufructuary, a trustee, a lessee, an agent or a pledgee, not being in the concept of an owner, cannot be ripen into ownership by acquisitive prescription. unless the juridical relation is first expressly repudiated and such repudiation has been communicated to the other party. Acts of possessory character executed due to license or by mere tolerance of the owner would likewise be inadequate. Possession, to constitute the foundation of a prescriptive right, must be en concepto de dueno, or, to use the common law equivalent of the term, that possession should be adverse; if not, such possessory acts, no matter how long, do not start the running of the period of prescription.(SOTERA PAULINO MARCELO, GABRIELA M. ANGELES, SIMEONA CUENCO, EMILIA MARCELO and RUBEN MARCELO versus COURT OF APPEALS, FERNANDO CRUZ and SERVANDO FLORES, G.R. No. 131803 April 14, 1999) What is GOOD FAITH in so far as PRESCRIPTION is concerned? ANSWER: The good faith of the possessor consists in the reasonable belief that the person from whom he received the thing was the owner thereof, and could transmit his ownership. (Art. 1127) He is deemed a possessor in good faith who is not aware that there exists in his title or mode of acquisition any flaw which invalidates it. (Art. 526) What is a “JUST TITLE” in so far as PRESCRIPTION is concerned? ANSWER: For purposes of prescription, there is just title when the adverse claimant came into possession of the property through one of the modes recognized by law for the acquisition of ownership or other real rights, but the grantor was not the owner or could not transmit any right. Possession is Interrupted for Purposes of Prescription: (a) NATURALLY Interrupted when through any cause it should cease for more than 1 year; Old possession is not revived if a new possession should be exercised by the same adverse claimant. (b) CIVILLY Is produced by judicial summons to the possessor. Judicial summons shall be deemed not to have been issued and shall not give rise to interruption: (1) If it should be void for lack of legal solemnities; (2) If the plaintiff should desist from the complaint or should allow the proceedings to lapse; (3) If the possessor should be absolved from the complaint. In all these cases, the period of the interruption shall be counted for the prescription. Lands registered under the Torrens System cannot be acquired by prescription but this rule can be invoked only by one under whose name it was registered. No title to registered land in derogation of that of the registered owner shall be acquired by prescription or adverse possession. (AlcantaraDaus vs. De Leon, 404 SCRA 74 [2003]) Prescription is unavailing not only against the registered owner but also against his hereditary successors. (Gallardo vs. IAC, G.R. No. 67742, Oct. 29, 1987) Movables possessed through a crime can never be acquired through prescription by the offender. (Art. 1133) In the computation of time necessary for prescription the following rules shall be observed: (Art. 1138) (1) The present possessor may complete the period necessary for prescription by tacking his possession to that of his grantor or predecessor in interest; (2) It is presumed that the present possessor who also the possessor at a previous time, continued to be in possession during intervening time, unless there is proof to contrary; was has the the (3) The first day shall be excluded and the last day included. Principle of Tacking of Possession Possession of the present possessor shall be tacked or added to the possession of his predecessor-in-interest to complete the period of prescription for purposes of acquiring ownership. PRESCRIPTION OF ACTION A MORTGAGE action prescribes after 10 years (Art. 1142) On August 23, 1995, more than fourteen years from the time the loan became due and demandable, respondent bank filed a petition for extrajudicial foreclosure of mortgage of petitioners’ property. On October 18, 1995, the property was sold in a public auction by Sheriff Arthur Cabigon with Philippine Veterans Bank as the lone bidder. On April 26, 1996, petitioners filed a complaint with the RTC, Cebu City, to declare the extra-judicial foreclosure and the subsequent sale thereof to respondent bank null and void. ISSUES: 1) Whether or not the period within which the respondent bank was placed under receivership and liquidation proceedings may be considered a fortuitous event which interrupted the running of the prescriptive period in bringing actions; and (2) Whether or not the demand letter sent by respondent bank’s representative on August 23, 1985 is sufficient to interrupt the running of the prescriptive period. RULINGS: One characteristic of a fortuitous event, in a legal sense and consequently in relations to contract, is that its occurrence must be such as to render it impossible for a party to fulfill his obligation in a normal manner. Respondent’s claims that because of a fortuitous event, it was not able to exercise its right to foreclose the mortgage on petitioners’ property; and that since it was banned from pursuing its business and was placed under receivership from April 25, 1985 until August 1992, it could not foreclose the mortgage on petitioners’ property within such period since foreclosure is embraced in the phrase "doing business," are without merit. While it is true that foreclosure falls within the broad definition of "doing business," that is: …a continuity of commercial dealings and arrangements and contemplates to that extent, the performance of acts or words or the exercise of some of the functions normally incident to and in progressive prosecution of the purpose and object of its organization. It should not be considered included, however, in the acts prohibited whenever banks are "prohibited from doing business" during receivership and liquidation proceedings. When a bank is declared insolvent and placed under receivership, the Central Bank, through the Monetary Board, determines whether to proceed with the liquidation or reorganization of the financially distressed bank. A receiver, who concurrently represents the bank, then takes control and possession of its assets for the benefit of the bank’s creditors. A liquidator meanwhile assumes the role of the receiver upon the determination by the Monetary Board that the bank can no longer resume business. His task is to dispose of all the assets of the bank and effect partial payments of the bank’s obligations in accordance with legal priority. In both receivership and liquidation proceedings, the bank retains its juridical personality notwithstanding the closure of its business and may even be sued as its corporate existence is assumed by the receiver or liquidator. The receiver or liquidator meanwhile acts not only for the benefit of the bank, but for its creditors as well. The following rights, among others specified elsewhere in this Code, are not extinguished by prescription: (1) To demand a right of way; (2) To bring an action to abate a public or private nuisance; (3) Action to demand partition of a co-ownership; (4) Action to have the will probated; (5) Quieting of title so long as the plaintiff is in possession of the property; (6) The right to demand support, but installments on support in arrears may prescribe; (7) An action to recover property expressly placed in trust unless the trust has been repudiated; (8) An action brought by a buyer of land to compel the seller to execute the proper deed of conveyance does not prescribe, provided the buyer is still in possession; (9) An action by the registered owner of land to recover possession of said land; (10) The right of the applicant for registered land to ask for the writ of possession does not prescribe. The following actions must be brought within ten years from the time the right of action accrues: (Art. 1144) (1) Upon a written contract; (2) Upon an obligation created by law; (3) Upon a judgment. Examples of Obligations Created by Law: The obligation to pay indemnity for a legal right of way. If the right of way of a public road was acquired in 1914, the claim for payment of the same brought to the Auditor General only in 1955 has prescribed, especially where, due to the loss of the papers during the war, the Government cannot be sure that no payment has been made. (Rosario vs. Auditor-General, L-11817, April 30, 1958) The following actions must be commenced within six years: (1) Upon an oral contract; (2) Upon a quasi-contract. The following actions must be instituted within four years: (1) Upon an injury to the rights of the plaintiff; (2) Upon a quasi-delict; However, when the action arises from or out of any act, activity, or conduct of any public officer involving the exercise of powers or authority arising from Martial Law including the arrest, detention and/or trial of the plaintiff, the same must be brought within one (1) year. Esconde vs. Barlongay (G.R. No. 67583, July 31, 1987) An action for reconveyance of real property on the ground of fraud must be filed within four years from the discovery of fraud. Such discovery is deemed to have taken place from the issuance of an original certificate of title. The following actions must be filed within one year: (1) For forcible entry and detainer; (2) For defamation. Prescription of Actions are interrupted when; (1) The actions are filed in court; (2) There is a written extrajudicial demand by the creditors; (3) There is any written acknowledgment of the debt by the debtor. SPS. SALUSTIANO OCA and FLORA O. OCA, versus COURT OF APPEALS, REPUBLIC PLANTERS BANK (formerly Republic Bank) and the PROVINCIAL SHERIFF OF RIZAL (G.R. No. L-84841 October 30, 1992) FACTS: On January 1963, Salustiano Oca executed a general loan and collateral agreement which constitutes a "continuing agreement, applying to any and all future as well as existing transactions" of plaintiffs-appellees with the defendant-appellant bank pursuant to which "as security for any and all loans, advances, credits, etc." the plaintiffs gave a lien on property of any kind, which may come to the possession or custody of the Bank. On February 12, 1963, plaintiffs-appellees spouses Oca executed a mortgage in favor of appellant Bank over two (2) parcels of lands covered by T.C.T. 66428 (Manila) and TCT 106211 (Rizal) as security for a loan in the amount of P200,000.00 as principal and "those that the mortgagee may extend to the mortgagors, including interest and expenses or other obligations owing to the mortgagee" as well as "the credit accommodations obtained from the mortgagee by S.R. Oca Logging Industry, Inc." On May 11, 1966, a promissory note in the sum of P3,017,721.66 was signed by Salustiano Oca in his capacity as President of S.R. Oca Logging Industry, Inc. and in his own behalf, together with his wife Flora O. Oca in her own behalf. Said promissory note is payable on or before May 11, 1967. The corporation's and the personal undertaking of the spouses Oca's obligation covered by the promissory note was transferred into a time loan designated as time loan No. 043. On August 12, 1971, the Bank sent a demand letter for the payment of time loan No. 043 in the sum of P4,830,478.95 as of July 31, 1971 to S.R. Oca Logging Industry, Inc. On July 13, 1977, the Bank sent a demand letter to "Mr. Salustiano R. Oca, President and General Manager of North Mindanao Bay Woods Exports" for the payment of the promissory note dated May 11, 1966 in the amount of 7,889,269.29 computed as of June 8, 1977. In May of 1978, the property located in Manila covered by TCT 103316 was foreclosed and sold at public auction for the sum of P195,000.00 with the Bank as the highest bidder. ISSUE: Whether or not the right of respondent Bank to extrajudicially foreclosure the mortgage had prescribed. RULINGS: Under the terms found therein. Time Loan No. 43 matured on May 12, 1967. The tolling of the prescriptive period within which respondent Bank had to file the foreclosure action began to run on said date, when petitioners failed to fully pay the time loan. On August 12, 1971, respondent Bank made an extrajudicial demand upon S.R. Oca Logging Industry, Inc. to settle the time loan, a copy of which was furnished petitioner Salustiano R. Oca by registered mail. Two other demand letters were sent by respondent Bank: one dated March 13, 1973 addressed to S.R. Oca Logging Industry, Inc., and another dated July 13, 1977 addressed to petitioner Salustiano R. Oca as President and General Manager of North Mindanao Bay Woods Exports. These letters sent by respondent Bank to petitioners and/or S.R. Oca Logging Industry, Inc. effectively stopped the tolling of the prescriptive period. As correctly observed by the Court of Appeals: It is true that the mortgage actions prescribe after ten (10) years (Article 1142, New Civil Code). However, its running has effectively been interrupted by written demands from the Bank as well as the written acknowledgment issued by Salustiano Oca himself. Thus, the institution of extrajudicial foreclosure proceedings by respondent Bank in 1977 was not yet barred by prescription. William Alain Miailhe vs. Court of Appeals and Republic of the Philippines (G.R. No. 108991, March 20, 2001) FACTS: That plaintiffs were the former registered owners of three parcels of land located at J.P. Laurel St., San Miguel, Manila with an aggregate area of 5,574.30 square meters, and a one (1) storey building erected thereon, formerly covered by Transfer Certificate of Title No. 80645 of the Register of Deeds of Manila; That the above-mentioned properties had been owned by and in the possession of plaintiffs and their family for over one hundred (100) years until August 1, 1976; That on August 1, 1976, during the height of the martial law regime of the late President Ferdinand Marcos, Republic of the Philippines, through its armed forces, forcibly and unlawfully took possession of the aforesaid properties from defendants; That Republic of the Philippines, through its armed forces, continued its lawful and forcible occupation of the premises from August 1, 1976 to August 19, 1977 without paying rentals, despite plaintiffs' demands therefor; That meanwhile, the Office of the President showed interest in the subject properties and directed defendant DBP to acquire for the government the subject properties from plaintiff; That on or about August 19, 1977, through threats and intimidation employed by defendants, plaintiffs, under duress, were coerced into selling the subject properties to defendant DBP for the grossly low price of P2,376,805.00 or about P400.00 per square meter; That defendant DBP, in turn, sold the subject properties to [Respondent] Republic of the Philippines, through the Office of the President, in 1982; That the only factor which caused plaintiffs to sell their properties to defendant DBP was the threats and intimidation employed upon them by defendants; That after the late President Marcos left the country on February 24, 1986 after the EDSA revolution, plaintiffs made repeated extrajudicial demands upon defendants for the return and reconveyance of subject properties to them, the last being the demand letters dated 24 October 1989; That despite demands, defendants unjustifiably failed and refused, and still unjustifiably fail and refuse, to return and reconvey the subject properties to plaintiff, hence, the complaint. ISSUE: Whether or not petitioner's extrajudicial demands interrupted the period of prescription. RULING: The suit before the trial court was an action for the annulment of the Contract of Sale on the alleged ground of vitiation of consent by intimidation. The reconveyance of the three parcels of land, which the petitioner half-heartedly espouses as the real nature of the action, can prosper only if and when the Contract of Sale covering the subject lots is annulled. Thus, the reckoning period for prescription would be that pertaining to an action for the annulment of contract; that is, four years from the time the defect in the consent ceases. The foregoing clearly shows that the alleged threat and intimidation, which vitiated petitioner's consent, ceased when Marcos left the country on February 24, 1986. Since an action for the annulment of contracts must be filed within four years from the time the cause of vitiation ceases, the suit before the trial court should have been filed anytime on or before February 24, 1990. In this case, petitioner did so only on March 23, 1990. Clearly, his action had prescribed by then. Interruption of Prescription Petitioner asserts that the extrajudical demands pleaded in the Complaint legally interrupted prescription in accordance with Article 1155 of the Civil Code, which states: "ART. 1155. The prescription of actions is interrupted when they are filed before the court, when there is extrajudicial demand by the creditors, and when there is any written acknowledgment of the debt by the debtor." In other words, petitioner claims that because he is covered by the term "creditor," the above-quoted provision is applicable to him. We are not persuaded. Petitioner himself avers that "the use of the terms 'creditor' and/or 'debtor' in Article 1155 of the Civil Code must relate to the general definition of obligations.” He then asserts that "an obligation is a juridical relation whereby a person (called the creditor) may demand from another (called the debtor) the observance of a determinate conduct, and in case of breach, may obtain satisfaction from the assets of the latter.” He also defines "credit" as the right to demand the object of the obligation. From his statements, it is clear that for there to be a creditor and a debtor to speak of, an obligation must first exist. In the present case, there is as yet no obligation in existence. Respondent has no obligation to reconvey the subject lots because of the existing Contract of Sale. Although allegedly voidable, it is binding unless annulled by a proper action in court. Not being a determinate conduct that can be extrajudically demanded, it cannot be considered as an obligation either. Since Article 1390 of the Civil Code states that voidable "contracts are binding, unless they are annulled by a proper action in court," it is clear that the defendants were not obligated to accede to any extrajudicial demand to annul the Contract of Sale. In the absence of an existing obligation, petitioner cannot be considered a creditor, and Article 1155 of the Civil Code cannot be applied to his action. Thus, any extrajudicial demand he made did not, or will not, interrupt the prescription of his action for the annulment of the Contract of Sale. PRESCRIPTION OF ACTIONS ONE YEAR TWO (2) YEARS THREE (3) YEARS FOUR (4) YEARS Impugning the legitimacy of a child if the husband or heirs reside in the same city or municipality where the child is born. Impugning the legitimacy of a child if the husband or heirs do not reside in the same city or municipality where the child is born Impugning the legitimacy of a child if the husband or heirs reside in another country. Action based on Quasi-delict. Money claims in labor cases Any action based on injury to the rights of the plaintiff. Ejectment Cases Defamation Revocation of Donation for Acts of Ingratitude FIVE (5) YEARS SIX (6) YEARS EIGHT (8) YEARS TEN (10) YEARS All actions whose periods are not fixed in the NCC or special laws. Actions based on verbal contracts. Actions to recover movables. (w/o prejudice to Arts. 559, 1505 & 1133) Actions based on written contracts. Annulment of marriages. Actions based on quasi-contracts. Actions based on obligations created by law. Legal separation Actions upon judgment. Actions to declare incapacity of heir to succeed. Mortgage actions. Enforcement of warranty against eviction for co-heirs Actions for reconveyance based on implied trust OBLIGATIONS and CONTRACTS (Articles 1156 – 1422) Definition: Obligation is a juridical necessity to give, to do or not to do. (Art. 1156) An obligation is a juridical relation whereby a person (called the creditor) may demand from another (called the debtor) the observance of a determinate conduct (the giving, doing or not doing), and in case of breach, may demand satisfaction from the assets of the latter. Makati Stocks Exchange Inc., et. al. vs. Campos (G.R. No. 138814, April 16, 2009) The terms right and obligation in respondent’s Petition are not magic words that would automatically lead to the conclusion that such Petition sufficiently states a cause of action. Right and obligation are legal terms with specific legal meaning. A right is a claim or title to an interest in anything whatsoever that is enforceable by law. An obligation is defined in the Civil Code as a juridical necessity to give, to do or not to do. For every right enjoyed by any person, there is a corresponding obligation on the part of another person to respect such right. Thus, Justice J.B.L. Reyes offers the definition given by Arias Ramos as a more complete definition: An obligation is a juridical relation whereby a person (called creditor) may demand from another (called the debtor) observance of a determinative conduct (the giving, doing or doing), and in case of breach, may demand satisfaction from assets of the latter. the the not the The Civil Code enumerates the sources of obligations: Art. 1157. Obligations arise from: (1) Law; (2) Contracts; (3) Quasicontracts; (4) Acts or omissions punished by law; and(5) Quasidelicts. Therefore, an obligation imposed on a person, and the corresponding right granted to another, must be rooted in at least one of these five sources. The mere assertion of a right and claim of an obligation in an initiatory pleading, whether a Complaint or Petition, without identifying the basis or source thereof, is merely a conclusion of fact and law. A pleading should state the ultimate facts essential to the rights of action or defense asserted, as distinguished from mere conclusions of fact or conclusions of law. Thus, a Complaint or Petition filed by a person claiming a right to the Office of the President of this Republic, but without stating the source of his purported right, cannot be said to have sufficiently stated a cause of action. Also, a person claiming to be the owner of a parcel of land cannot merely state that he has a right to the ownership thereof, but must likewise assert in the Complaint either a mode of acquisition of ownership or at least a certificate of title in his name. (Makati Stocks Exchange Inc., et. al. vs. Campos ) Elements of an Obligation: (1)An active subject (called the obligee or creditor) – the possessor of a right; he in whose favor the obligation is constituted; (2) A passive subject (called the obligor or debtor) – he who has the duty of giving, doing, or not doing; (3) The object or prestation – the subject matter of the obligation; (4)The efficient cause (the vinculum juris or juridical tie) the reason why the obligation exists. Ang Yu Asuncion vs. Court of Appeals (G.R. No. 109125, December 2, 1994 [238 SCRA 602]) In the law on sales, the so-called "right of first refusal" is an innovative juridical relation. Needless to point out, it cannot be deemed a perfected contract of sale under Article 1458 of the Civil Code. Neither can the right of first refusal, understood in its normal concept, per se be brought within the purview of an option under the second paragraph of Article 1479, aforequoted, or possibly of an offer under Article 1319 9 of the same Code. An option or an offer would require, among other things, a clear certainty on both the object and the cause or consideration of the envisioned contract. In a right of first refusal, while the object might be made determinate, the exercise of the right, however, would be dependent not only on the grantor's eventual intention to enter into a binding juridical relation with another but also on terms, including the price, that obviously are yet to be later firmed up. Prior thereto, it can at best be so described as merely belonging to a class of preparatory juridical relations governed not by contracts (since the essential elements to establish the vinculum juris would still be indefinite and inconclusive) but by, among other laws of general application, the pertinent scattered provisions of the Civil Code on human conduct. Even on the premise that such right of first refusal has been decreed under a final judgment, like here, its breach cannot justify correspondingly an issuance of a writ of execution under a judgment that merely recognizes its existence, nor would it sanction an action for specific performance without thereby negating the indispensable element of consensuality in the perfection of contracts. It is not to say, however, that the right of first refusal would be inconsequential for, such as already intimated above, an unjustified disregard thereof, given, for instance, the circumstances expressed in Article 19 of the Civil Code, can warrant a recovery for damages. The final judgment in Civil Case No. 87-41058, it must be stressed, has merely accorded a "right of first refusal" in favor of petitioners. The consequence of such a declaration entails no more than what has heretofore been said. In fine, if, as it is here so conveyed to us, petitioners are aggrieved by the failure of private respondents to honor the right of first refusal, the remedy is not a writ of execution on the judgment, since there is none to execute, but an action for damages in a proper forum for the purpose. CONCEPT OF PRESTATION A prestation is an obligation more specifically, it is the subject matter of an obligation – and may consist of giving a thing, doing or not doing a certain act. Things to be delivered in an obligation TO GIVE: (a) The thing may be real or personal property; (b) Consumable or non- consumable; (c) fungible or non-fungible; (d) generic or determinate things. What is the degree of diligence required of a person in the performance of an obligation? ANSWER: Every person obliged to give something is also obliged to take care of it with the proper diligence of a good father of a family, unless the law or the stipulation of the parties requires another standard of care. (Art. 1163) Sources of obligations (Art. 1157) a. Law (Obligation ex lege) – like the duty to pay taxes and support one’s family. b. Contracts (Obligation ex contractu) – like the duty to repay a loan by virtue of an agreement; c. Quasi – contracts (Obligations ex quasi-contractu) – like the duty to refund an “over-change” of money because of the quasi-contract of solution indebiti or “undue payment.” c.1. Negotiorum Gestio (unauthorized management) c.2. Solution Indebiti (undue payment) d. Acts or omission punishable by law; (Obligations ex maleficio or ex delicto) – like the duty to return a stolen carabao. Civil liability arising from a crime: d.1. restitution; d.2. reparation of damage cause; d.3. indemnification for consequential damages. e. Quasi-delicts.(Obligation ex quasi –delicto or ex quasimaleficio) – like the duty to repair damage due to negligence. * A quasi-delict is a fault or an act of negligence or omission of care which causes damages to another, there being no pre-existing contractual relations between the parties. (culpa aquiliana) A. LAW (OBLIGATIONS EX LEGE) The law says “obligations derived from law are not presumed” This merely means that the obligations must be clearly set forth in the law. B. CONTRACTS (Obligations Ex Contractu) While obligations arising from a contract have the force and effect of a law between the parties, this does not mean that the law is inferior to contracts. This is because before a contract can be enforced, it must be valid , and it cannot be valid if it is against the law. Moreover, the right of the parties to stipulate is limited. Bautista vs. De Borja (L-20600, October 28, 1966, 18 SCRA 474) FACTS: On or about 27 January 1960, defendant purchased from plaintiff certain personal properties all valued at P83,800.00, for which the former made a down payment of P12,570.00 and agreed to pay the balance of P71,230.00 in eleven (11) monthly installments starting from 28 February 1960; that defendant executed a chattel mortgage contract over the same personal properties to secure the payment of the unpaid balance of the purchase price, covered by several promissory notes. That the parties agreed that in case defendant should violate any condition thereof, and/or fail to pay any and demandable note, plaintiff would be entitled to take possession of said personal properties, to extra-judicially foreclose said mortgage, in which event defendant is liable to pay 25% of the total amount due as liquidated damages and attorney's fees. That defendant failed to pay his obligations; that plaintiff applied to the Sheriff of Cotabato for the extrajudicial foreclosure of said mortgage but the latter could not proceed with the auction sale because defendant failed and refused, despite demands made therefor, to deliver and surrender said personal properties. Whereupon, plaintiff prayed that defendant be ordered (a) to deliver said personal properties, and/or that the provisional remedy of replevin be issued upon the filing of the requisite bond; (b) to pay the sum of P20,217.52, as liquidated damages and attorney's fees; and (c) in the event of non-delivery of said personal properties, to pay the sum of P71,230.00 plus interest thereon at the rate of 12% per annum from 28 February 1960 until the same is fully paid; plus costs of the suit. In due time, after summons, defendant Marino A. Bautista filed, on 2 April 1962, a motion to dismiss the complaint, on the grounds that(a) there is another action pending between the same parties for the same cause, which Marino A. Bautista, together with a certain Leopoldo Jalandoni, as plaintiffs filed against G. A. Machineries, Inc., as defendant, in the Court of First Instance of Manila for accounting and damages; and (b) that the filing of the complaint by G. A. Machineries, Inc., in Bulacan constitutes multiplicity of suits, which is not allowed by the Rules of Court. Plaintiff submitted, on 24 April 1962, its opposition to said motion, to which opposition defendant Bautista presented, on 30 April 1962, his reply. To this reply defendant joined a supplemental motion to dismiss, setting forth as additional ground therefor that venue was improperly laid, since plaintiff and defendant have expressly stipulated in their sales and chattel mortgage contracts that "in case of any litigation arising (t)herefrom or in connection (t)herewith, the venue of action shall be in the City of Manila, Philippines.“ ISSUE: IS THE STIPULATION UNDER THE CONTRACT AS TO THE VENUE OF LITIGATION VALID? The parties do not dispute that, in the written contracts sued upon, it was expressly stipulated that "in case of any litigation arising (t)herefrom or in connection (t)herewith, the venue of action shall be in the City of Manila, Philippines". We note that neither party to the contracts reserved the right to choose the venue of action as fixed by law (i.e., where the plaintiff or defendant resides, at the election of the plaintiff (par. [b], Section 2, Rule 4, Revised Rules of Court), as is usually done if the parties purported to retain that right of election granted by the Rules. Such being the case, it can reasonably be inferred that the parties intended to definitely fix the venue of action, in connection with the written contracts sued upon, in the proper courts of the City of Manila only, notwithstanding that neither party is a resident of Manila. The Rules expressly sanction such stipulation by providing that "by written agreement of the parties the venue of action may be changed or transferred from one province to another" (Section 3, Rule 4, Revised Rules of Court), and, as aptly held in the case of Central Azucarera de Tarlac vs. De Leon, 56 Phil. 169, — By said agreement the parties waived the legal venue, and such waiver is valid and legally effective, because it was merely a personal privilege they waived, which is not contrary to public policy or to the prejudice of third persons. It is a general principle that a person may renounce any right which the law gives unless such renunciation is expressly prohibited or the right conferred is of such nature that its renunciation would be against public policy. It appearing that the action was brought in a place other than that fixed by the parties in their valid written contracts; that the ground of improper venue is clear and patent on the record of the case, the written contracts having been attached and made an integral part of the complaint; that the impropriety of the venue was properly and timely raised in the motion to dismiss; and that a writ of prohibition is a proper remedy when a trial court erroneously denies a motion to dismiss based on the ground of improper venue we are constrained to rule that the trial court acted with grave abuse of discretion in denying petitioner's motions to dismiss based on the above-stated ground.” C. QUASI-CONTRACTS A quasi-contract is that juridical relation resulting from a lawful, voluntary, and unilateral act, and which has for its purpose the payment of indemnity to the end that no one shall be unjustly enriched or benefited at the expense of another. Negotiorum Gestio (unauthorized management) Takes place when a person voluntarily takes charge of another’s abandoned business or property without the owner’s authority. Reimbursement must be made to the gestor for necessary and useful expenses, as a rule. Solution Indebiti (undue payment) Takes place when something is received when there is no right to demand it, and it was delivered thru mistake. D. OBLIGATIONS EX DELICTO or EX MALEFICIO An accused in a criminal case may be sued CIVILLY whether or not he is found guilty or is acquitted. But the victim cannot recover damages in both cases. (Elcano vs. Hill, 77 SCRA 98) BUENAVENTURA BELAMALA versus MARCELINO POLINAR (L24098, Nov. 18, 1967) FACTS: Buenaventura Belamala is the same offended party in Criminal Case No. 1922 filed before the CFI Bohol, against Mauricio Polinar for Frustrated Murder; That on May 24, 1954, the complaint for Frustrated Murder was filed in the Justice of the Peace of Clarin, Bohol against Mauricio Polinar, et al, and when said case was remanded to the Court of First Instance of Bohol, the Information on said Criminal Case No. 1922 was filed on March 12, 1955; That on May 28, 1966, the CFI of Bohol rendered a decision thereof, convicting the said Mauricio Polinar of the crime of serious physical injuries and sentenced him to pay to the offended party Buenaventura Belamala, the amount of P990.00, plus the amount of P35.80 as indemnity the amount of P1,000.00 as moral damages; That on June 18, 1956, the accused Mauricio Polinar appealed to the Court of Appeals from the decision of the Court of First Instance of Bohol; That on July 27, 1956, while the appeal of said Mauricio Polinar was pending before the Court of Appeals, he died; and that there was no Notice or Notification of his death has ever been filed in the said Court of Appeals; That the decision of the Court of Appeals in said Criminal Case No. 1922, has affirmed the decision of the Court of First Instance of Bohol, in toto, and said decision of the Court of Appeals was promulgated on March 27, 1958; but said Mauricio Polinar has already died on July 27, 1956 ISSUE: Whether or not the civil liability of an accused of physical injuries who dies before final judgment, is extinguished by his demise, to the extent of barring any claim therefor against his estate. RULING: Article 33 of the Civil Code establishes a civil action for damages on account of physical injuries, entirely separate and distinct from the criminal action. Art. 33. In cases of defamation, fraud, and physical injuries, a civil action for damages, entirely separate and distinct from the criminal action, may be brought by the injured party. Such civil action shall proceed independently of the criminal prosecution, and shall require only a preponderance of evidence. Assuming that for lack of express reservation, Belamala's civil action for damages was to be considered instituted together with the criminal action, still, since both proceedings were terminated without final adjudication, the civil action of the offended party under Article 33 may yet be enforced separately. Such claim in no way contradicts Article 108, of the Penal Code, that imposes the obligation to indemnify upon the deceased offender's heirs, because the latter acquired their decedents obligations only to the extent of the value of the inheritance. Hence, the obligation of the offender's heirs under Article 108 ultimately becomes an obligation of the offender's estate. The appellant, however, is correct in the contention that the claim should have been prosecuted by separate action against the administrator, since the claim is patently one "to recover damages for an injury to person or property”. Belamala's action can not be enforced by filing a claim against the estate because the rule explicitly limits the claims to those for funeral expenses, expenses for last sickness, judgments for money and "claims against the decedent, arising from contract, express or implied;" and this last category (the other three being inapposite) includes only "all purely personal obligations other than those which have their source in delict or tort" (Leung Ben vs. O'Brien, 38 Phil. 182, 189-194) and Belamala's damages manifestly have a tortious origin. To this effect was our ruling in Aguas vs. Llemos, L-18107, Aug. 30, 1962. E. OBLIGATIONS EX QUASI-DELICT or EX QUASI- MALEFICIO A quasi-delict is a fault or act of negligence or omission of care which causes damages to another, there being no pre-existing contractual relations between parties. Requisites for QUASI-DELICT to exist: (a) There must be fault or negligence attributable to the person charged; (b) There must be damage or injury; (c) There must be a direct relation of cause and effect between the fault or negligence on the one hand and the damage or injury on the other hand. Nature and Effect of Obligations A. Obligation to give 1. A determinate or specific thing * A thing is said to be specific or determinate when it is capable of particular designation. Kinds of delivery: (a) Actual delivery (or tradition) Where physically, the property changes hands. (b) Constructive delivery; Where the physical transferred is implied. Kinds of Constructive Delivery: 1) Traditio Simbolica (symbolical tradition) – keys of a warehouse or a car was given. 2) Traditio Longa Manu (delivery by mere consent or the pointing out of the object) – Ex. Pointing out of the car, which is the object of the sale. 3) Traditio Brevi Manu ( Delivery by the short hand; that kind of delivery whereby a possessor of a thing not as an owner, becomes the possessor as owner) – Ex. A tenant already in possession buys the house he is renting. 4) Traditio Constitutom Possesorium ( the opposite of brevi manu; thus the delivery whereby a possessor of a thing as an owner, but in some other capacity (like a house owner, who sells a house, but remains in possession as tenant of the same house) 5) Tradition by the execution of legal forms and solemnities (Like the execution of a public instrument in selling land) Duties of the DEBTOR: a. To deliver the thing which he has obligated himself to give; b. To take care of the thing with the proper diligence of a good father of a family; c. To deliver all accessions and accessories; d. To pay damages in case of breach of obligation 2. An indeterminate or generic thing * A thing is generic or indeterminate when it refers only to a class, to a genus, and cannot be pointed out with particularity. Duties imposed to the DEBTOR: a. To deliver a thing which must be neither of superior nor inferior quality; b. To pay damages in case of breach of the obligation. Another important difference between a generic and a specific obligation is that a specific obligation, that is an obligation to deliver a specific thing, is as a rule, extinguished by a fortuitous event or act of God. On the other hand, generic obligations are never extinguished by fortuitous event. Remedies of the Creditor when Debtor fails to comply with his obligation: 1. Demand specific performance of the obligation (for both generic or specific); 2. Demand rescission or cancellation; 3. Demand damages either with or without either of the first two. B. Obligation to do or not to do Positive Personal Obligations – If a person is obliged to do something fails to do it, the same shall be executed at his cost. (Art. 1167) Remedies of a Creditor: (a) To have the obligation performed at debtor’s expense; (b) Obtain damages. Negative Personal Obligations – When the obligation consists in not doing, and the obligor does what has been forbidden him, it shall also be undone at his expense. (Art. 1168) Remedies of a Creditor: (a) Undoing of a prohibited thing; (b) Payment of damages. C. Breaches of Obligations Acts or Omissions resulting to breach of obligations (Art. 1170) 1) Default or mora; 2) Fraud (deceit or dolo) – intentional evasion of fulfillment; 3) Negligence (fault or culpa); 4) Violation of the terms of the obligations (violatio) (unless excused in proper cases by fortuitous events) Essential Requisites of Actions for Damages in case of breach of contract: (a) The existence of a perfected contract; (b) The breach thereof by the obligor / debtor; (c) The damages which the obligee / creditor sustained due to such breach. Other Effects of Breach: (a) The obligor may be liable even if there was fortuitous event or the creditor may be required to bear the loss; (b) There may be liability to pay interest, 1. Default, delay or mora – no default unless creditors makes a demand; exceptions (Art. 1169) * It signifies the idea of delay in the fulfillment of an obligation or non-fulfillment of an obligation with respect to time. a. Mora solvendi – Delay of the debtor or obligor to perform his obligation. a.1. mora solvendi ex re – debtor’s default in real obligations; a.2. mora solvendi ex persona – debtor’s default in personal obligations. There is no mora solvendi in negative obligations; Requisites of Mora Solvendi: (1) The obligation must be due, enforceable and already liquidated or determinate in amount; (2) There must be non-performance; (3) There must be demand unless demand is not required; (4) The demand must be for the obligation that is due. Effects of Mora Solvendi: 1) If the debtor is in default, he may be liable for interest or damages; 2) He may also bear the risk of loss; 3) He is liable even for a fortuitous event. b. Mora accipiendi – or the delay of the obligee or creditor to accept the delivery of the thing which is the object of the obligation. c. Compesatio morae – delay of the parties in reciprocal obligations. Ordinary Delay (Legal Delay) Distinguished from DEFAULT Ordinary delay is different from legal delay (default) The first merely non-performance at the stipulated time; default is that delay which amounts to a virtual nonfulfillment of the obligation. (As a rule, to put a debtor in default, there must be a demand for fulfillment, the demand being either judicial or extrajudicial. PROBLEM: A promissory note was executed by the debtor in favor of the creditor, binding himself to pay the latter on or before January 1, 2015. If the debtor fails to pay the loan on the said date, can he now be considered in default in the payment of his obligation? ANSWER: No, because in order for the debtor to be considered in default in the payment of his obligation, there must be demand. If no demand is made the debtor cannot be considered in default. (Art. 1169) Malayan Insurance Co., Inc. vs. The Honorable Court Of Appeals and Aurelio Lacson (G.R. No. L-59919 November 26, 1986) FACTS: Lacson is the owner of a Toyota NP Land Cruiser, Model 1972, bearing Plate No. NY-362 and with engine Number F-374325. Said vehicle was insured with defendant company Under "private car comprehensive" policy No. BIFC/PV-0767 for a one year period, from Dec. 3, 1974 to Dec. 3, 1975. On Dec. 1, 1975, plaintiff caused the delivery of subject vehicle to the shop of Carlos Jamelo for repair. On Dec. 2, 1975 while the vehicle was in Carlos Jamelo's shop, a certain Rogelio Mahinay, together with his other co-employees in the shop, namely Johnny Mahinay, Rogelio Macapagong and Rogelio Francisco took and drove the Toyota Land Cruiser, as a result of which it met with an accident at Bo. Taculing Bacolod City, causing damage thereto, in an estimated amount of P21,849.62. Shop-owner Carlos Jamelo reported the incident to the police and later on instituted a criminal case for Qualified Theft against his employees who had taken plaintiff's vehicle. Plaintiff sought indemnification under his insurance policy from defendant company but the latter refused to pay on the ground that the claim is not covered by the policy inasmuch as the driver of the insured vehicle at the time of the accident was not a duly licensed driver. This act of defendant company prompted Plaintiff to file a civil case for damages docketed as Civil Case No. 12447 of the CFI of Negros Occidental. Defendant in its answer raised among other things as affirmative and special defenses that plaintiff has no cause of action, claim is not covered by the insurance policy, and non-joinder of indispensable party. After trial the Court a quo rendered a favorable judgment for the plaintiff. On appeal the Court of Appeals affirmed said decision and denied a motion for reconsideration. ISSUE: Whether or not petitioner is liable for interest from filing of the complaint and not from the date of decision or its finality. RULING: Respondent has sufficiently established his demand for the award of damages plus interest as sanctioned under Arts. 1169, 1170 and 2209 of the Civil Code. Thus, a debtor who is in delay (default) is liable for damages (Art. 1170) generally from extrajudicial or judicial demand (Art. 1169) in the form of interest. (See Art. 2209, Civil Code). Santos Ventura Hocorma Foundation, Inc. vs. Ernesto V. Santos and Riverland, Inc. (G.R. No. 153004, November 5, 2004) FACTS: Ernesto V. Santos and Santos Ventura Hocorma Foundation, Inc. (SVHFI) were the plaintiff and defendant, respectively, in several civil cases filed in different courts in the Philippines. On October 26, 1990, the parties executed a Compromise Agreement 4 which amicably ended all their pending litigations. The pertinent portions of the Agreement read as follows: 1. Defendant Foundation shall pay Plaintiff Santos P14.5 Million in the following manner: a. P1.5 Million immediately upon the execution of this agreement; b. The balance of P13 Million shall be paid, whether in one lump sum or in installments, at the discretion of the Foundation, within a period of not more than two (2) years from the execution of this agreement; provided, however, that in the event that the Foundation does not pay the whole or any part of such balance, the same shall be paid with the corresponding portion of the land or real properties subject of the aforesaid cases and previously covered by the notices of lis pendens, under such terms and conditions as to area, valuation, and location mutually acceptable to both parties; but in no case shall the payment of such balance be later than two (2) years from the date of this agreement; otherwise, payment of any unpaid portion shall only be in the form of land aforesaid; Immediately upon the execution of this agreement and receipt of the P1.5 Million, Santos shall cause the dismissal with prejudice of Civil Cases Nos. 88-743, 1413OR, TC-1024, 45366 and 18166 and voluntarily withdraw the appeals in Civil Cases Nos. 4968 (C.A.-G.R. No. 26598) and 88-45366 (C.A.-G.R. No. 24304) respectively and for the immediate lifting of the aforesaid various notices of lis pendens on the real properties aforementioned provided, however, that in the event that defendant Foundation shall sell or dispose of any of the lands previously subject of lis pendens, the proceeds of any such sale, or any part thereof as may be required, shall be partially devoted to the payment of the Foundation's obligations under this agreement as may still be subsisting and payable at the time of any such sale or sales; In compliance with the Compromise Agreement, Santos moved for the dismissal of all civil cases filed. He also caused the lifting of the notices of lis pendens on the real properties involved. For its part, petitioner SVHFI, paid P1.5 million to Santos, leaving a balance of P13 million. Subsequently, SVHFI sold to Development Exchange Livelihood Corporation two real properties, which were previously subjects of lis pendens. Discovering the disposition made by SVHFI, Santos sent a letter to the petitioner demanding the payment of the remaining P13 million, which was ignored by the latter. Meanwhile, on September 30, 1991, the Regional Trial Court of Makati City, Branch 62, issued a Decision6 approving the compromise agreement. On October 28, 1992, respondent Santos sent another letter to petitioner inquiring when it would pay the balance of P13 million. There was no response from petitioner. Consequently, Santos applied with the Regional Trial Court of Makati City, Branch 62, for the issuance of a writ of execution of its compromise judgment dated September 30, 1991. The RTC granted the writ. Thus, on March 10, 1993, the Sheriff levied on the real properties of petitioner, which were formerly subjects of the lis pendens. Petitioner, however, filed numerous motions to block the enforcement of the said writ. The challenge of the execution of the aforesaid compromise judgment even reached the Supreme Court. All these efforts, however, were futile. On November 22, 1994, petitioner's real properties located in Mabalacat, Pampanga were auctioned. In the said auction, Riverland, Inc. was the highest bidder for P12 million and it was issued a Certificate of Sale covering the real properties subject of the auction sale. Subsequently, another auction sale was held on February 8, 1995, for the sale of real properties of petitioner in Bacolod City. Again, Riverland, Inc. was the highest bidder. The Certificates of Sale issued for both properties provided for the right of redemption within one year from the date of registration of the said properties. On June 2, 1995, Santos and Riverland Inc. filed a Complaint for Declaratory Relief and Damages7 alleging that there was delay on the part of petitioner in paying the balance of P13 million. They further alleged that under the Compromise Agreement, the obligation became due on October 26, 1992, but payment of the remaining P12 million was effected only on November 22, 1994. Thus, respondents prayed that petitioner be ordered to pay legal interest on the obligation, penalty, attorney's fees and costs of litigation. ISSUE: Whether the respondents (SANTOS et. al) are entitled to legal interest. RULING: Petitioner SVHFI alleges that where a compromise agreement or compromise judgment does not provide for the payment of interest, the legal interest by way of penalty on account of default or delay shall not be due and payable, considering that the obligation or loan, on which the payment of legal interest could be based, has been superseded by the compromise agreement. Furthermore, the petitioner argues that the respondents are barred by res judicata from seeking legal interest on account of the waiver clause in the duly approved compromise agreement. Respondents profer that their right to damages is based on delay in the payment of the obligation provided in the Compromise Agreement. The Compromise Agreement provides that payment must be made within the two-year period from its execution. This was approved by the trial court and became the law governing their contract. Respondents posit that petitioner's failure to comply entitles them to damages, by way of interest. A compromise is a contract whereby the parties, by making reciprocal concessions, avoid a litigation or put an end to one already commenced. It is an agreement between two or more persons, who, for preventing or putting an end to a lawsuit, adjust their difficulties by mutual consent in the manner which they agree on, and which everyone of them prefers in the hope of gaining, balanced by the danger of losing. The general rule is that a compromise has upon the parties the effect and authority of res judicata, with respect to the matter definitely stated therein, or which by implication from its terms should be deemed to have been included therein. This holds true even if the agreement has not been judicially approved. In the case at bar, the Compromise Agreement was entered into by the parties on October 26, 1990. It was judicially approved on September 30, 1991. Applying existing jurisprudence, the compromise agreement as a consensual contract became binding between the parties upon its execution and not upon its court approval. From the time a compromise is validly entered into, it becomes the source of the rights and obligations of the parties thereto. The purpose of the compromise is precisely to replace and terminate controverted claims. Delay as used in this article is synonymous to default or mora which means delay in the fulfillment of obligations. It is the non-fulfillment of the obligation with respect to time. In order for the debtor to be in default, it is necessary that the following requisites be present: (1) that the obligation be demandable and already liquidated; (2) that the debtor delays performance; and (3) that the creditor requires the performance judicially or extrajudicially. In the case at bar, the obligation was already due and demandable after the lapse of the two-year period from the execution of the contract. The two-year period ended on October 26, 1992. When the respondents gave a demand letter on October 28, 1992, to the petitioner, the obligation was already due and demandable. Furthermore, the obligation is liquidated because the debtor knows precisely how much he is to pay and when he is to pay it. The second requisite is also present. Petitioner delayed in the performance. It was able to fully settle its outstanding balance only on February 8, 1995, which is more than two years after the extrajudicial demand. Third, the demand letter sent to the petitioner on October 28, 1992, was in accordance with an extra-judicial demand contemplated by law. Verily, the petitioner is liable for damages for the delay in the performance of its obligation. This is provided for in Article 1170 of the New Civil Code. When the debtor knows the amount and period when he is to pay, interest as damages is generally allowed as a matter of right. The complaining party has been deprived of funds to which he is entitled by virtue of their compromise agreement. The goal of compensation requires that the complainant be compensated for the loss of use of those funds. This compensation is in the form of interest. In the absence of agreement, the legal rate of interest shall prevail. Maceda, Jr. versus DBP (G.R. No. 174979, August 11, 2010) PAYMENT OF INTEREST: The charging of interest is used in two senses: (a) When the obligation is breached, and it consists in the payment of a sum of money, i.e., a loan or forbearance of money, the interest due should be that which may have been stipulated in writing. In the absence of stipulation, the rate of interest shall be 12% per annum to be computed from default; (b) When the obligation, not constituting a loan or forberance of money, is breached, an interest on the amount of damages awarded may be imposed at the discretion of the court at the rate of 6% per annum. Nacar vs. Gallery Frames and / or Felipe Bordey Jr. (G.R. No. 189871, August 13, 2013) When the obligation is breached, and it consists in the payment of a sum of money, i.e., a loan or forbearance of money, the interest due should be that which may have been stipulated in writing. Furthermore, the interest due shall itself earn legal interest from the time it is judicially demanded. In the absence of stipulation, the rate of interest shall be 6% per annum to be computed from default, i.e., from judicial or extrajudicial demand under and subject to the provisions of Article 1169 of the Civil Code. When an obligation, not constituting a loan or forbearance of money, is breached, an interest on the amount of damages awarded may be imposed at the discretion of the court at the rate of 6% per annum. No interest, however, shall be adjudged on unliquidated claims or damages, except when or until the demand can be established with reasonable certainty. Accordingly, where the demand is established with reasonable certainty, the interest shall begin to run from the time the claim is made judicially or extrajudicially (Art. 1169, Civil Code), but when such certainty cannot be so reasonably established at the time the demand is made, the interest shall begin to run only from the date the judgment of the court is made (at which time the quantification of damages may be deemed to have been reasonably ascertained). The actual base for the computation of legal interest shall, in any case, be on the amount finally adjudged. Medel vs. Court of Appeals [(359 Phil. 829) G.R. No. 131622, November 27,1998] The SC ruled that the stipulated interest rate of 66% per annum or 5.5% per month on a P500,000.00 was excessive, unconscionable and exorbitant, hence, contrary to morals if not against the law and declared such stipulation void. Toring vs. Spouses Ganzon-Olan [(568 SCRA 379) G.R. No. 168782, October 10, 2008] The SC found the stipulated interest rates of 3% and 3.81% per month on a P10 million loan to be excessive and reduced the same to 1% per month. Chua vs. Timan [(562 SCRA 146) G.R. No. 170452, August 13,2008] The stipulated interest rates of 7% and 5% per month, which are equivalent to 84% and 60% per annum, respectively, were reduced by the SC to 1% per month or 12% per annum. The SC said that the stipulated interest rates of 3% per month and higher are excessive, unconscionable and exorbitant, hence, the stipulation was void for being contrary to morals. Spouses Mallari vs. Prudential Bank [G.R. No. 197861, June 5, 2013] Parties are free to enter into agreements and stipulate as to the terms and conditions of their contract, but such freedom is not absolute. As Article 1306 of the Civil Code provides, "The contracting parties may establish such stipulations, clauses, terms and conditions as they may deem convenient, provided they are not contrary to law, morals, good customs, public order, or public policy." Hence, if the stipulations in the contract are valid, the parties thereto are bound to comply with them, since such contract is the law between the parties. In this case, petitioners and respondent bank agreed upon on a 23% p.a. interest rate on the P1.7 million loan. The SC ruled that the interest rate of 23% or 24% per annum is not unconscionable or excessive. DEMAND Demand is indespensable before the obligor can be considered to be in delay. Demand can either be judicial or extrajudicial. Thus, sending a letter demanding compliance with an obligation is sufficient, However, even if there was no such letter or prior verbal demand, it is sufficient that there be a judicial demand. In other words filing of a case in court is sufficient. DEMAND IS NOT NEEDED BUT DEBTOR IS IN DEFAULT: 1) When the law so provides; 2) When the obligation expressly so provides; 3) When time is of the essence of the contract; 4) When demand would be useless, as when the obligor has rendered it beyond his power to perform; 5) When the obligor has expressly acknowledged that he really is in default. 2. Fraud in the performance of obligation a) Waiver of future fraud is void (Art. 1171) Classification of Fraud: Fraud in obtaining consent (may be causal or merely incidental) THE INTERNATIONAL CORPORATE BANK vs. SPOUSES GUECO [G.R. No. 141968, February 12, 2001 (369 SCRA 36)] Fraud has been defined as the deliberate intention to cause damage or prejudice. It is the voluntary execution of a wrongful act, or a willful omission, knowing and intending the effects which naturally and necessarily arise from such act or omission; the fraud referred to in Article 1170 of the Civil Code is the deliberate and intentional evasion of the normal fulfillment of obligation. We fail to see how the act of the petitioner bank in requiring the respondent to sign the joint motion to dismiss could constitute as fraud. True, petitioner may have been remiss in informing Dr. Gueco that the signing of a joint motion to dismiss is a standard operating procedure of petitioner bank. However, this can not in anyway have prejudiced Dr. Gueco. The motion to dismiss was in fact also for the benefit of Dr. Gueco, as the case filed by petitioner against it before the lower court would be dismissed with prejudice. The whole point of the parties entering into the compromise agreement was in order that Dr. Gueco would pay his outstanding account and in return petitioner would return the car and drop the case for money and replevin before the Metropolitan Trial Court. The joint motion to dismiss was but a natural consequence of the compromise agreement and simply stated that Dr. Gueco had fully settled his obligation, hence, the dismissal of the case. Petitioner's act of requiring Dr. Gueco to sign the joint motion to dismiss can not be said to be a deliberate attempt on the part of petitioner to renege on the compromise agreement of the parties. It should, likewise, be noted that in cases of breach of contract, moral damages may only be awarded when the breach was attended by fraud or bad faith. The law presumes good faith. Dr. Gueco failed to present an iota of evidence to overcome this presumption. In fact, the act of petitioner bank in lowering the debt of Dr. Gueco from P184,000.00 to P150,000.00 is indicative of its good faith and sincere desire to settle the case. If respondent did suffer any damage, as a result of the withholding of his car by petitioner, he has only himself to blame. Necessarily, the claim for exemplary damages must fail. In no way, may the conduct of petitioner be characterized as "wanton, fraudulent, reckless, oppressive or malevolent." PHILIPPINE BANKING CORPORATION vs. Dy [G.R. No. 183774, November 14, 2012 (685 SCRA 567)] Fraud comprises "anything calculated to deceive, including all acts, omissions, and concealment involving a breach of legal duty or equitable duty, trust, or confidence justly reposed, resulting in damage to another, or by which an undue and unconscientious advantage is taken of another." In this light, the Dys' and Sps. Delgado's deliberate simulation of the sale intended to obtain loan proceeds from and to prejudice Philbank clearly constitutes fraudulent conduct. As such, Sps. Delgado cannot now be allowed to deny the validity of the mortgage executed by the Dys in favor of Philbank as to hold otherwise would effectively sanction their blatant bad faith to Philbank's detriment. Fraud in performing contract which may be either; Dolo Causante (Causal Fraud) Those deceptions or misrepresentations of a serious character employed by one party and without which the other party would not have entered a contract. Dolo Incidente (Incidental Fraud) Those which are not serious in character and without which the other party would still have entered into the contract. LYDIA L. GERALDEZ versus HON. COURT OF APPEALS and KENSTAR TRAVEL CORPORATION (G.R. No. 108253 February 23, 1994) FACTS: Petitioner came to know about private respondent from numerous advertisements in newspapers of general circulation regarding tours in Europe. She then contacted private respondent by phone and the latter sent its representative, Alberto Vito Cruz, who gave her the brochure for the tour and later discussed its highlights. The European tours offered were classified into four, and petitioner chose the classification denominated as "VOLARE 3" covering a 22day tour of Europe for $2,990.00. She paid the total equivalent amount of P190,000.00 charged by private respondent for her and her sister, Dolores. Petitioner claimed that, during the tour, she was very uneasy and disappointed when it turned out that, contrary to what was stated in the brochure, there was no European tour manager for their group of tourists, the hotels in which she and the group were bullited were not first-class, the UGC Leather Factory which was specifically added as a highlight of the tour was not visited, and the Filipino lady tour guide by private respondent was a first timer, that is, she was performing her duties and responsibilities as such for the first time. ISSUE: Whether or not private respondent acted in bad faith or with gross negligence in discharging its obligations under the contract. RULINGS: After thorough and painstaking scrutiny of the case records of both the trial and appellate courts, we are satisfactorily convinced, and so hold, that private respondent did commit fraudulent misrepresentations amounting to bad faith, to the prejudice of petitioner and the members of the tour group. By providing the Volare 3 tourist group, of which petitioner was a member, with an inexperienced and a first timer tour escort, private respondent manifested its indifference to the convenience, satisfaction and peace of mind of its clients during the trip, despite its express commitment to provide such facilities under the Volare 3 Tour Program which had the grandiose slogan "Let your heart sing. Veering to another line of defense, private respondent seeks sanctuary in the delimitation of its responsibility as printed on the face of its brochure on the Volare 3 program, to wit: RESPONSIBILITIES: KENSTAR TRAVEL CORPORATION, YOUR TRAVEL AGENT, THEIR EMPLOYEES OR SUB-AGENTS SHALL BE RESPONSIBLE ONLY FOR BOOKING AND MAKING ARRANGEMENTS AS YOUR AGENTS. Kenstar Travel Corporation, your travel Agent, their employees or sub-agents assume no responsibility or liability arising out of or in connection with the services or lack of services, of any train, vessel, other conveyance or station whatsoever in the performance of their duty to the passengers or guests, neither will they be responsible for any act, error or omission, or of any damages, injury, loss, accident, delay or irregularity which may be occasioned by reason (of) or any defect in . . . lodging place or any facilities . . . .” While, generally, the terms of a contract result from the mutual formulation thereof by the parties thereto, it is of common knowledge that there are certain contracts almost all the provisions of which have been drafted by only one party, usually a corporation. Such contracts are called contracts of adhesion, because the only participation of the party is the affixing of his signature or his "adhesion" thereto. In situations like these, when a party imposes upon another a readymade form of contract, and the other is reduced to the alternative of taking it or leaving it, giving no room for negotiation and depriving the latter of the opportunity to bargain on equal footing, a contract of adhesion results. While it is true that an adhesion contract is not necessarily void, it must nevertheless be construed strictly against the one who drafted the same. This is especially true where the stipulations are printed in fine letters and are hardly legible as is the case of the tour contract involved in the present controversy. Yet, even assuming arguendo that the contractual limitation aforequoted is enforceable, private respondent still cannot be exculpated for the reason that responsibility arising from fraudulent acts, as in the instant case, cannot be stipulated against by reason of public policy. Consequently, for the foregoing reasons, private respondent cannot rely on its defense of "substantial compliance" with the contract. This fraud or dolo which is present or employed at the time of birth or perfection of a contract may either be dolo causante or dolo incidente. The first, or causal fraud referred to in Article 1338, are those deceptions or misrepresentations of a serious character employed by one party and without which the other party would not have entered into the contract. Dolo incidente, or incidental fraud which is referred to in Article 1344, are those which are not serious in character and without which the other party would still have entered into the contract. Dolo causante determines or is the essential cause of the consent, while dolo incidente refers only to some particular or accident of the obligations. The effects of dolo causante are the nullity of the contract and the indemnification of damages, and dolo incidente also obliges the person employing it to pay damages In either case, whether private respondent has committed dolo causante or dolo incidente by making misrepresentations in its contracts with petitioner and other members of the tour group, which deceptions became patent in the light of after-events when, contrary to its representations, it employed an inexperienced tour guide, housed the tourist group in substandard hotels, and reneged on its promise of a European tour manager and the visit to the leather factory, it is indubitably liable for damages to petitioner. Fraud in the performance of Pre- Fraud in the Perfection of a contract. existing obligation. a. Present only performance of obligation; during the a. Present only at the time of the birth a pre-existing of the obligation; b. Employed for the purpose of b. Employed for the purpose of evading the normal fulfillment of an securing the consent of the other obligation; party to enter into a contract; c. Results in the non-fulfillment or c. It is the reason for the other party breach of the obligation; upon whom it is employed for entering into the contract, results in the vitiation of his consent. d. Gives rise to a right of the creditor d. Gives rise to a right of the innocent or obligee to recover damages from party to ask for the annulment of the the debtor or obligor. contract if the fraud is causal (dolo causante) or to recover damages if it is incidental (dolo incidente) 3. Negligence (culpa) in the performance of obligation a) Diligence normally required is ordinary diligence or diligence of a good father of a family b) Exception: common carriers which are required to exercise extraordinary diligence Negligence or culpa – is the omission of that diligence which is required by the nature of obligation and corresponds with the circumstances of the persons, of the time and the place. What is a PROXIMATE CAUSE? ANSWER: It is that adequate and efficient cause which in the natural order of events, and under the particular circumstances surrounding the case would naturally produce the event. What is the EFFECT OF CONTRIBUTORY NEGLIGENCE? ANSWER: The contributory negligence of the victim is not a bar to recovery of damages but it may be considered as a circumstance to mitigate liability, if the proximate cause of the accident was still the negligence of the defendant. However, if the accident is caused by the victim’s negligence and imprudence, he shall be solely responsible for the consequence of his imprudence. What is the meaning of the latin maxim “DAMNUM ABSQUE INJURIA”? ANSWER: The literal meaning is Damage Without Injury. This means that although a victim suffered physical damage or injury, the same is not considered a “legal injury” which entitles him to damages. What is the test to determine whether or not a person is negligent? ANSWER: Would a prudent man foresee harm to the person injured as a reasonable consequence of the course about to be pursued? If so, the law imposes a duty on the actor to refrain from that course, or to take precaution against its mischievous results , and the failure to do so constitutes negligence. Reasonable foresight of harm, followed by the ignoring of the admonition born of this provision, is the constitutive fact of negligence. DOLO CULPA (a) There is deliberate intention to (a) Although voluntary still there is no cause damage or prejudice; deliberate intent to cause damage; (b) Liability arising from dolo cannot (b) Liability due to negligence may be be mitigated or reduced by the courts; reduced in certain cases; (c) Waiver of an action to enforce (c) Waiver of an action to enforce liability due to future fraud is void. liability due to future culpa may in certain sense be allowed. Kinds of Culpa Classified Source of the Obligation: according to the 1. Culpa Contractual (Contractual Negligence) – or that which results to a breach of contract; 2. Culpa Aquiliana (Civil Negligence or tort or quasidelict) 3. Culpa Criminal (Criminal Negligence) – or that which results in the commission of a crime or a delict. CULPA CONTRACTUAL CULPA AQUILIANA CULPA CRIMINAL (a) Negligence is merely incidental, incident to the performance of an obligation already existing because of a contract; (a) Negligence here is (a) Negligence here is direct, substantive and direct, substantive and independent; independent of a contract; (b) There is a preexisting obligation(a contract, either express or implied) (b) No pre-existing obligation (except of course the duty to be careful in all human actuations) (b) No pre-existing obligation (except the duty never to harm other). (c) Proof neededpreponderance of evidence. (c) Proof needed preponderance of evidence. (c) Proof needed in a crime – proof beyond reasonable doubt. CULPA CONTRACTUAL CULPA AQUILIANA CULPA CRIMINAL (d) Defense of “good father of a family” in the selection and supervision of employees is not a proper complete defense in culpa contractual (though this may mitigate damages) (d) Defense of “good father, etc.” is a proper and complete defense in so far as employees or guardians are concerned in culpa aquiliana. (d) This is not a proper defense in culpa criminal. Here the employees guilt is automatically the employer’s civil guilt, if the former is insolvent. CULPA CONTRACTUAL CULPA AQUILIANA CULPA CRIMINAL (e) As long as it is proved that there was a contract, and that it was not carried out, it is presumed that the debtor is at fault, and it is his duty to prove that there was no negligence in carrying out the terms of the contract; (e) Ordinarily, the victim has to prove the negligence of the defendant. This is because his action is based on alleged negligence on the part of defendant; (e) Accused is presumed innocent until the contrary is proved., so prosecution has the burden of proving the negligence of the accused; (f) Source of liability is (f) Source of liability is (f) Source of liability is breach of contract. defendant’s negligent the criminal act. act or omission itself. Can Tort Liability Arise if There is Contractual Relationship between Parties? ANSWER: Yes, in the case of Air France vs. Carrascoso (L21438, September 28, 1966), a passenger was ousted from his first class accommodation and was compelled to take a seat in the tourist compartment. He was allowed to recover damages from the carrier notwithstanding the fact that the relation between the carrier and passenger is contractual both in origin and nature. The Court held that the act itself of breaking the contract creates a tort liability. Also in the case of Julian C. Singson and Ramona del Castillo vs. BPI and Santiago Frexas (L-24837, June 27, 1968) the bank clerk committed a mistake that caused the freezing of the current account of Julian Singson. As a result, the checks were dishonored. The Bank apologized to Singson and restored the checking account. Nevertheless, Singson sued the bank for damages. The bank interposed the defense that there could be no liability for negligence or quasi-delict on account of the contractual relations between the bank and Singson, and that the error was immediately corrected. The Court held that Singson can recover damages from the bank despite the existence of contractual relations between the parties because the act itself that breaks the contract may also be a tort or quasidelict. FORTUITOUS EVENTS: Is an event which cannot be foreseen or which even if foreseen is inevitable. General Rule For Fortuitous Events; No liability for a fortuitous event (caso fortuito). Exceptions: 1. When expressly declared by law; 2. When expressly declared by stipulation or contract; 3. When the nature of the obligation requires the assumption of risk; 4. When there is delay. 5. If the Obligor is guilty of Bad Faith (for having promised to deliver the same thing to two or more persons who do not have the same interest – as when one is not the agent merely of the other.) 6. Where the thing to be delivered is generic. Essential Characteristics of a Fortuitous Event: a. The cause must be independent of the will of the debtor; b. Impossibility of foreseeing or impossibility of avoiding it, even if foreseen; c. The occurrence must be such as to render it impossible for the debtor to fulfill his obligation in a normal manner. ROBERTO C. SICAM and AGENCIA de R.C. SICAM, INC. Versus LULU V. JORGE and CESAR JORGE (G.R. No. 159617, August 8, 2007) FACTS: From September to October 1987, Lulu V. Jorge (respondent Lulu) pawned several pieces of jewelry with Agencia de R. C. Sicam located at No. 17 Aguirre Ave., BF Homes Parañaque, Metro Manila, to secure a loan in the total amount of P59,500.00. On October 19, 1987, two armed men entered the pawnshop and took away whatever cash and jewelry were found inside the pawnshop vault. The incident was entered in the police blotter of the Southern Police District, Parañaque Police Station. ISSUE: Whether or not the incident of robbery is considered as a fortuitous event which relieves / exempts one from any form of liability. RULING: Fortuitous events by definition are extraordinary events not foreseeable or avoidable. It is therefore, not enough that the event should not have been foreseen or anticipated, as is commonly believed but it must be one impossible to foresee or to avoid. The mere difficulty to foresee the happening is not impossibility to foresee the same. To constitute a fortuitous event, the following elements must concur: (a) the cause of the unforeseen and unexpected occurrence or of the failure of the debtor to comply with obligations must be independent of human will; (b) it must be impossible to foresee the event that constitutes the caso fortuito or, if it can be foreseen, it must be impossible to avoid; (c) the occurrence must be such as to render it impossible for the debtor to fulfill obligations in a normal manner; and, (d) the obligor must be free from any participation in the aggravation of the injury or loss. The burden of proving that the loss was due to a fortuitous event rests on him who invokes it. And, in order for a fortuitous event to exempt one from liability, it is necessary that one has committed no negligence or misconduct that may have occasioned the loss. It has been held that an act of God cannot be invoked to protect a person who has failed to take steps to forestall the possible adverse consequences of such a loss. One's negligence may have concurred with an act of God in producing damage and injury to another; nonetheless, showing that the immediate or proximate cause of the damage or injury was a fortuitous event would not exempt one from liability. When the effect is found to be partly the result of a person's participation -- whether by active intervention, neglect or failure to act -- the whole occurrence is humanized and removed from the rules applicable to acts of God. Robbery per se, just like carnapping, is not a fortuitous event. It does not foreclose the possibility of negligence on the part of herein petitioners. In Co v. Court of Appeals, the Court held: It is not a defense for a repair shop of motor vehicles to escape liability simply because the damage or loss of a thing lawfully placed in its possession was due to carnapping. Carnapping per se cannot be considered as a fortuitous event. The fact that a thing was unlawfully and forcefully taken from another's rightful possession, as in cases of carnapping, does not automatically give rise to a fortuitous event. To be considered as such, carnapping entails more than the mere forceful taking of another's property. It must be proved and established that the event was an act of God or was done solely by third parties and that neither the claimant nor the person alleged to be negligent has any participation. In accordance with the Rules of Evidence, the burden of proving that the loss was due to a fortuitous event rests on him who invokes it — which in this case is the private respondent. However, other than the police report of the alleged carnapping incident, no other evidence was presented by private respondent to the effect that the incident was not due to its fault. respondent. A police report of an alleged crime, to which only private respondent is privy, does not suffice to establish the carnapping. Neither does it prove that there was no fault on the part of private respondent notwithstanding the parties' agreement at the pre-trial that the car was carnapped. Carnapping does not foreclose the possibility of fault or negligence on the part of private respondent.” Just like in Co, petitioners merely presented the police report of the Parañaque Police Station on the robbery committed based on the report of petitioners' employees which is not sufficient to establish robbery. Such report also does not prove that petitioners were not at fault. Evidently, no sufficient precaution and vigilance were adopted by petitioners to protect the pawnshop from unlawful intrusion. There was no clear showing that there was any security guard at all. Or if there was one, that he had sufficient training in securing a pawnshop. Further, there is no showing that the alleged security guard exercised all that was necessary to prevent any untoward incident or to ensure that no suspicious individuals were allowed to enter the premises. In fact, it is even doubtful that there was a security guard, since it is quite impossible that he would not have noticed that the robbers were armed with caliber .45 pistols each, which were allegedly poked at the employees. Significantly, the alleged security guard was not presented at all to corroborate petitioner Sicam's claim; not one of petitioners' employees who were present during the robbery incident testified in court. Furthermore, petitioner Sicam's admission that the vault was open at the time of robbery is clearly a proof of petitioners' failure to observe the care, precaution and vigilance that the circumstances justly demanded. Petitioner Sicam testified that once the pawnshop was open, the combination was already off. Considering petitioner Sicam's testimony that the robbery took place on a Saturday afternoon and the area in BF Homes Parañaque at that time was quiet, there was more reason for petitioners to have exercised reasonable foresight and diligence in protecting the pawned jewelries. Instead of taking the precaution to protect them, they let open the vault, providing no difficulty for the robbers to cart away the pawned articles. The preponderance of evidence shows that petitioners failed to exercise the diligence required of them under the Civil Code. Roberto Juntilla versus Clemente Fontanar, Fernando Banzon and Berfol Camoro (G.R. No. L-45637 May 31, 1985) FACTS: Plaintiff was a passenger of the public utility jeepney bearing plate No. PUJ-71-7 on the course of the trip from Danao City to Cebu City. The jeepney was driven by defendant Berfol Camoro. It was registered under the franchise of defendant Clemente Fontanar but was actually owned by defendant Fernando Banzon. When the jeepney reached Mandaue City, the right rear tire exploded causing the vehicle to turn turtle. In the process, the plaintiff who was sitting at the front seat was thrown out of the vehicle. Upon landing on the ground, the plaintiff momentarily lost consciousness. When he came to his senses, he found that he had a lacerated wound on his right palm. Aside from this, he suffered injuries on his left arm, right thigh and on his back. Because of his shock and injuries, he went back to Danao City but on the way, he discovered that his "Omega" wrist watch was lost. Upon his arrival in Danao City, he immediately entered the Danao City Hospital to attend to his injuries, and also requested his fatherin-law to proceed immediately to the place of the accident and look for the watch. In spite of the efforts of his father-in-law, the wrist watch, which he bought for P 852.70 could no longer be found. Petitioner Roberto Juntilla filed Civil Case No. R-17378 for breach of contract with damages before the City Court of Cebu City, Branch I against Clemente Fontanar, Fernando Banzon and Berfol Camoro. ISSUE: Whether or not the blowing out of a tire resulting to the vehicular accident is a fortuitous event. RULING: In the case at bar, there are specific acts of negligence on the part of the respondents. The records show that the passenger jeepney turned turtle and jumped into a ditch immediately after its right rear tire exploded. The evidence shows that the passenger jeepney was running at a very fast speed before the accident. There is also evidence to show that the passenger jeepney was overloaded at the time of the accident. While it may be true that the tire that blew-up was still good because the grooves of the tire were still visible, this fact alone does not make the explosion of the tire a fortuitous event. No evidence was presented to show that the accident was due to adverse road conditions or that precautions were taken by the jeepney driver to compensate for any conditions liable to cause accidents. The sudden blowing-up, therefore, could have been caused by too much air pressure injected into the tire coupled by the fact that the jeepney was overloaded and speeding at the time of the accident. In the case at bar, the cause of the unforeseen and unexpected occurrence was not independent of the human will. The accident was caused either through the negligence of the driver or because of mechanical defects in the tire. Common carriers should teach their drivers not to overload their vehicles, not to exceed safe and legal speed limits, and to know the correct measures to take when a tire blows up thus insuring the safety of passengers at all times. National Power Corporation vs. The Court Of Appeals [ G.R. Nos. 103442-45, May 21,1993 (225 SCRA 415)] If upon the happening of a fortuitous event or an act of God, there concurs a corresponding fraud, negligence, delay or violation or contravention in any manner of the tenor of the obligation as provided for in Article 1170 of the Civil Code, which results in loss or damage, the obligor cannot escape liability. The principle embodied in the act of God doctrine strictly requires that the act must be one occasioned exclusively by the violence of nature and all human agencies are to be excluded from creating or entering into the cause of the mischief. When the effect, the cause of which is to be considered, is found to be in part the result of the participation of man, whether it be from active intervention or neglect, or failure to act, the whole occurrence is thereby humanized, as it were, and removed from the rules applicable to the acts of God. (1 Corpus Juris, pp. 1174-1175). Thus it has been held that when the negligence of a person concurs with an act of God in producing a loss, such person is not exempt from liability by showing that the immediate cause of the damage was the act of God. To be exempt from liability for loss because of an act of God, he must be free from any previous negligence or misconduct by which that loss or damage may have been occasioned. Radio Communications of the Philippines Inc. vs. Verchez [481 SCRA 384 (2006)] For the defense of force majeure to prosper, it is necessary that one has committed no negligence or misconduct that may have occassioned the loss. When the effect is found to be partly the result of a person's participation - whether by active intervention, neglect or failure to act - the whole occurence is humanized and removed from the rules applicable to the acts of God. The receipt of the principal by the creditor, without reservation with respect to the interest, shall give rise to the presumption that said interest has been paid. The receipt of later installment of a debt without reservation as to prior installment, shall likewise raise the presumption that such installments have been paid. (Art. 1176) Remedies breach: available to creditor in cases of 1. Specific performance a) Substituted performance by a third person on obligation to deliver generic thing and in obligation to do, unless a purely personal act. 2. Rescission (resolution in reciprocal obligations) 3. Damages, in any event 4. Subsidiary remedies of creditors (Art. 1177) a) Accion subrogatoria (subrogatory action) – that is exercise all rights and actions except those inherent in the person (like parental authority, right to revoke donations on the ground of ingratitutde, hold office, carry out an agency.) b) Accion pauliana –impugn or rescind acts or contracts done by the debtor to defraud the creditors. KINDS OF OBLIGATIONS Kinds of Obligations: (a) Pure and Conditional; (b) Obligations with a Period; (c) Alternative and Facultative Obligations; (d) Joint and Solidary Obligations; (e) Divisible and Indivisible Obligations; (f) Obligations with a Penal Clause. PURE AND CONDITIONAL OBLIGATIONS A. Pure (Arts. 1179-1180) – One whose effectivity or extinguishment does not depend upon the fulfillment or nonfulfillment of a condition or upon the expiration of a term or period, and which, as a consequence, is characterized by the quality of immediate demandability. B. Conditional (Art. 1181) – An obligation is said to be conditional when its effectivity is subordinated to the fulfillment or non-fulfillment of a future and uncertain fact or event. CONDITION It is an uncertain event which wields an influence on a legal relationship. TERM or PERIOD That which necessarily must come whether the parties know when it will happen or not. D EMANDABILITY OF PURE AND CONDITIONAL OBLIGATIONS: (1) PURE OBLIGATIONS are demandable at once without need to wait for a future event or time; (2) CONDITIONAL OBLIGATIONS are demandable depending if the condition is resolutory or suspensive. If the condition is resolutory it is demandable but it is not immediately demandable if the condition is suspensive. Classification of Conditions: 1. Suspensive Condition – When the fulfillment of the condition results in the acquisition of rights arising out of the obligation. Be it noted that what characterizes an obligation with a suspensive condition is the fact that its efficacy or obligatory force is subordinated to the happening of a future and uncertain event; if the suspensive condition does not take place, the parties would stand as if the conditional obligations had never existed. Example A in his last will & testament will give some property to B provided that A would die within a certain period . A did not die during said period. Since the suspensive condition was not complied with, B is not entitled to inherit. (Natividad vs. Gabino, 36 Phil. 663) Heirs of Spouses Sandejas vs. Lina [G.R. No. 141634, February 5, 2001, (351 SCRA 183)] When a contract is subject to a suspensive condition, its birth or effectivity can take place only if and when the condition happens or is fulfilled. Thus, the intestate court's grant of the Motion for Approval of the sale filed by respondent resulted in petitioners' obligation to execute the Deed of Sale of the disputed lots in his favor. The condition having been satisfied, the contract was perfected. Henceforth, the parties were bound to fulfil what they had expressly agreed upon. Court approval is required in any disposition of the decedent's estate per Rule 89 of the Rules of Court. Reference to judicial approval, however, cannot adversely affect the substantive rights of heirs to dispose of their own pro indiviso shares in the co-heirship or co-ownership. In other words, they can sell their rights, interests or participation in the property under administration. A stipulation requiring court approval does not affect the validity and the effectivity of the sale as regards the selling heirs. It merely implies that the property may be taken out of custodia legis, but only with the court's permission. It would seem that the suspensive condition in the present conditional sale was imposed only for this reason. The non-compliance of a suspensive condition is not a breach, casual or serious, but simply an event which prevented the obligation from acquiring obligatory force. [Buot vs Court of Appeals, 357 SCRA 846 (2001)] 2. Resolutory condition – When the fulfillment of the condition results in the extinguishment of rights arising out of the obligation. Example: I’ll give you my car now but should you pass the bar, the donation will not be effective. If you pass the bar you must return the car to me. SUSPENSIVE CONDITION RESOLUTORY CONDITION 1. If fulfilled the obligation arises or 1. If fulfilled becomes effective; extinguished; the obligation is 2. If not fulfilled no juridical relation 2. If not fulfilled the juridical relation is created; is consolidated; 3. Rights are not yet acquired but 3. Rights are already acquired, but there is hope of expectancy that subject to the threat of extinction. they will soon be acquired. Jose M. Javier and Estrella F. Javier vs. Court of Appeals and Leonardo Tiro (G.R. No. L-48194 March 15, 1990) FACTS: Private respondent is a holder of an ordinary timber license issued by the Bureau of Forestry covering 2,535 hectares in the town of Medina, Misamis Oriental. On February 15, 1966 he executed a "Deed of Assignment“ in favor of herein petitioners. At the time the said deed of assignment was executed, private respondent had a pending application, dated October 21, 1965, for an additional forest concession covering an area of 2,000 hectares southwest of and adjoining the area of the concession subject of the deed of assignment. Hence, on February 28, 1966, private respondent and petitioners entered into another "Agreement" wherein private respondent hereby agrees and binds himself to transfer, cede and convey whatever rights he may acquire,, over a forest concession which is now pending application and approval as additional area to his existing licensed area under O.T. License No. 391-103166, situated at Medina, Misamis Oriental. On November 18, 1966, the Acting Director of Forestry wrote private respondent that his forest concession was renewed up to May 12, 1967 under O.T.L. No. 391-51267, but since the concession consisted of only 2,535 hectares, he was therein informed that: In pursuance of the Presidential directive of May 13, 1966, you are hereby given until May 12, 1967 to form an organization such as a cooperative, partnership or corporation with other adjoining licensees so as to have a total holding area of not less than 20,000 hectares of contiguous and compact territory and an aggregate allowable annual cut of not less than 25,000 cubic meters, otherwise, your license will not be further renewed. Consequently, petitioners, now acting as timber license holders by virtue of the deed of assignment executed by private respondent in their favor, entered into a Forest Consolidation Agreement on April 10, 1967 with other ordinary timber license holders in Misamis Oriental, namely, Vicente L. De Lara, Jr., Salustiano R. Oca and Sanggaya Logging Company. Under this consolidation agreement, they all agreed to pool together and merge their respective forest concessions into a working unit, as envisioned by the aforementioned directives. This consolidation agreement was approved by the Director of Forestry on May 10, 1967. The working unit was subsequently incorporated as the North Mindanao Timber Corporation, with the petitioners and the other signatories of the aforesaid Forest Consolidation Agreement as incorporators. On July 16, 1968, for failure of petitioners to pay the balance due under the two deeds of assignment, private respondent filed an action against petitioners, based on the said contracts, for the payment of the amount of P83,138.15 with interest at 6% per annum from April 10, 1967 until full payment, plus P12,000.00 for attorney's fees and costs. ISSUE: Whether or not the conditions for the enforceability of the obligations of the parties failed to materialize. RULING: We agree with petitioners that they cannot be held liable thereon. The efficacy of said deed of assignment is subject to the condition that the application of private respondent for an additional area for forest concession be approved by the Bureau of Forestry. Since private respondent did not obtain that approval, said deed produces no effect. When a contract is subject to a suspensive condition, its birth or effectivity can take place only if and when the event which constitutes the condition happens or is fulfilled. If the suspensive condition does not take place, the parties would stand as if the conditional obligation had never existed. The said agreement is a bilateral contract which gave rise to reciprocal obligations, that is, the obligation of private respondent to transfer his rights in the forest concession over the additional area and, on the other hand, the obligation of petitioners to pay P30,000.00. The demandability of the obligation of one party depends upon the fulfillment of the obligation of the other. In this case, the failure of private respondent to comply with his obligation negates his right to demand performance from petitioners. Delivery and payment in a contract of sale, are so interrelated and intertwined with each other that without delivery of the goods there is no corresponding obligation to pay. The two complement each other. Moreover, under the second paragraph of Article 1461 of the Civil Code, the efficacy of the sale of a mere hope or expectancy is deemed subject to the condition that the thing will come into existence. In this case, since private respondent never acquired any right over the additional area for failure to secure the approval of the Bureau of Forestry, the agreement executed therefor, which had for its object the transfer of said right to petitioners, never became effective or enforceable. Constructive Fulfillment of Suspensive Condition (Art. 1186) If the obligor voluntarily prevents the fulfillment of the suspensive condition, the condition is deemed fulfilled. The requisities for constructive fulfillment to be present are as follows: (a) The intent of the obligor to prevent the fulfillment of the condition; and (Mere intention of the debtor to prevent the happening of the condition or to place ineffective obstacles to its compliance, without actually preventing the fulfillment, is insufficient.) (b) The actual prevention of fulfillment. Effect of the happening of suspensive condition or resolutory condition (Art. 1187) a) Extent of retroactivity * Fulfillment of suspensive condition – retroacts to the day the obligation was constituted. * No retroactivity with reference to 1. fruits and interests (fruits referred to natural, industrial and civil fruits.) unless there is a contrary intent. 2. period of prescription. Potestative - When the fulfillment of the condition depends upon the will of a party to the obligation. (a) Potestative on the part of the DEBTOR: a.1. If also suspensive – both the condition and the obligation are VOID, for the obligation is really illusory. a.2. (b) If also resolutory – VALID. Potestative on the part of the CREDITOR: - VALID Casual – When the fulfillment of the condition depends upon chance and / or upon the will of the third person; Ex. “I will pay you if I win the lotto prize.” Mixed - When the fulfillment of the condition depends partly upon the will of a party to the obligation and partly upon chance and / or will of a third person. Ex. “I’ll pay you if I can sell my house.” International Hotel Corporation vs. Joaquin Jr. et. al. (G.R. No. 158361, April 10, 2013) There is no question that when the fulfillment of a condition is dependent partly on the will of one of the contracting parties, or of the obligor, and partly on chance, hazard or the will of a third person, the obligation is mixed. The existing rule in a mixed conditional obligation is that when the condition was not fulfilled but the obligor did all in his power to comply with the obligation, the condition should be deemed satisfied. (a) Possible – when the condition is capable of realization according to nature, law, public policy, or good customs; (b) Impossible – When the condition is not capable of realization according to nature, law, public policy, or good customs; Ex. To make a dead man alive. (c) Illegal – When the condition is prohibited by good customs, public policy, law etc. Ex. To execute a person or rob a house. NOTE: Impossible and illegal conditions are VOID. EFFECTS: (a) If the condition is to do an impossible or illegal thing BOTH the condition and the obligation are VOID; (b) If the condition is NEGATIVE, that is not to do the impossible, just disregard the condition but the obligation remains; (c) If the condition is NEGATIVE, that is not to do an illegal thing, both the condition and the obligation are VALID. (a) Positive – When the condition involves the performance of an act; The condition that some event happen at a determinate time shall extinguish the obligation as soon as the time expires or if it has become indubitable that the event will not take place. (Art. 1184) Ex. I’ll give you my land if you marry Aling Dionisia before the year ends. If by the end of the year, Aling Dionisia is already dead, or you have not yet married her, the obligation is extinguished. (b) Negative – When the condition involves the non- performance of an act. The condition that some event will not happen at a determinate time shall render the obligation effective from the moment the time indicated has elapsed, or if it has become evident that the event cannot occur. If no time has been fixed, the condition shall be deemed fulfilled at such time as may have probably been contemplated, bearing in mind the nature of the obligation. (Art. 1185) Example of Negative Conditions: Manny agreed to deliver an Hermes Bag to Aling Dionisia provided that Aling Dionisia will not marry his D.I. boyfriend up to 2017. If 2017 expires without Aling Dionisia marrying her D.I. boyfriend, the obligation of Manny to deliver the Hermes Bag arises. a) Divisible – When the condition is susceptible of partial realization; (b) Indivisible – When the condition is not susceptible of partial realization; (a) Conjunctive – When there are several conditions, all of which must be realized; (b) Alternative – When there are several conditions, one of which must be realized; (a) Express – When the condition is stated expressly; (b) Implied – When the condition is tacit. Effect of improvement, loss or deterioration of specific thing before the happening of a suspensive condition in obligation to do or not to do (Art. 1189). 1. If the thing is lost without the fault of the debtor, the obligation shall be extinguished; 2. If the thing is lost through the fault of the debtor, he shall be obliged to pay damages; it is understood that the thing is lost when it (1) perishes; (2) goes out of commerce; (3) disappears in such a way that its existence is unknown; or (4) it cannot be recovered; 3. When the thing deteriorates without the fault of the debtor, the impairment is to be borne by the creditor; 4. If it deteriorates through the fault of the debtor, the creditor may choose between (a) the rescission of the obligation; and its fulfillment, with indemnity for damages in either case; 5. If the thing is improved by its nature, or by time the improvement shall inure to the benefit of the creditor; 6. If it is improved at the expense of the debtor, he shall have no other right granted to the usufructuary. (entitled to useful & necessary expenses) Effect of improvement, loss or deterioration upon fulfillment of a RESOLUTORY condition: Rules on Loss Without the fault - obligation is extinguished otherwise, the person who is obliged to return will be liable for damages. Rules on Deterioration Without fault - the person who is supposed to receive shall bear the deterioration otherwise, he will be entitled to damages. Rules on Improvement Improvements due to nature or through time - the person whom the thing will be returned will get the improvement. Improvements through the expense of the person who will return person is entitled to reimbursement for necessary expenses for the preservation of the thing. Effects When Resolutory Condition is fulfilled: 1. The obligation is extinguished; 2. Because the obligation is extinguished and considered to have no effect, the parties should restore to each other what they have received; 3. Aside from actual things received, the fruits or the interests thereon should also be returned after deducting the expenses made for their production, gathering and preservation; 4. The rules given in Art.1189 will apply to whoever has the duty to return in case of the loss, deterioration, or improvement of the thing. RECIPROCAL OBLIGATIONS: The obligation or promise of each party is the consideration for that of the other. The performance of one obligation is conditioned on the fulfillment of the other obligation. Right to rescind is implied in reciprocal obligations. Right to Rescind Means the right to cancel the contract or reciprocal obligations in case of non-fulfillment on the part of one. The choice belongs to the injured party; either (i) to ask for the fulfillment or the (ii) rescission of the obligations. Characteristics of the Right to rescind; 1. It exists only in reciprocal obligations; 2. It can be demanded only if the plaintiff is ready, willing, and able to comply with his own obligation and the other is not; 3. The right to rescind is not absolute; A. Trivial causes or slight breaches will not cause rescission; B. If there be a just cause for fixing the period within which the debtor can comply, the court will not decree rescission; C. If the property is now in the hands of an innocent third party who has lawful possession of the same. 4. The right to rescind needs judicial approval in certain cases, and in others does not need such approval; 5. Judicial approval is needed when there has already been delivery of the object; 6. Judicial approval is not needed when there has been no delivery yet. 7. The right to rescind is implied to exist and therefore, need not be expressly stipulated upon. (Art.1191); 8. The right to rescind may be waived, expressly or impliedly. On July 23, 1999, respondent filed a complaint in the Regional Trial Court (RTC), Branch 257 of Parañaque City, for breach of contract, rescission of contract, damages and issuance of a writ of preliminary attachment. In the complaint, respondent claimed that, despite full payment, petitioner (1) failed to deliver the stall units on the stipulated date; (2) opened its own food and snack stalls near the cinema area and (3) refused to accommodate its request for the rescission of the contract and the refund of payment. In its answer, petitioner admitted respondent's full payment of the contract price but denied that it was bound to deliver the stalls on October 1, 1997. According to petitioner, the contract was clear that it was to turn over the units only upon completion of the mall. It likewise claimed that, under the contract, it had the option to offer substitute stalls to respondent which the latter, however, rejected. ISSUE: Whether or not respondent can exercise its right to seek the rescission of the contract executed with petitioner. RULING: The right of rescission is implied in every reciprocal obligation where one party fails to perform what is incumbent upon him while the other is willing and ready to comply. Certainly, petitioner's failure to deliver the units on the commencement date of the lease on October 1, 1997 gave respondent the right to rescind the contract after the latter had already paid the contract price in full. Furthermore, respondent's right to rescind the contract cannot be prevented by the fact that petitioner had the option to substitute the stalls. Even if petitioner had that option, it did not, however, mean that it could insist on the continuance of the contract by forcing respondent to accept the substitution. Neither did it mean that its previous default had been obliterated completely by the exercise of that option. One final note. Petitioner's extreme bad faith in dealing with respondent was too glaring for the Court to ignore. Petitioner’s lack of good and honest intentions, as well as the evasive manner by which it was able to frustrate respondent's claim for a decade, should not go unsanctioned. Parties in a contract cannot be allowed to engage in double-dealing schemes to dupe those who transact with them in good faith. OBLIGATIONS WITH A PERIOD OR TERM Period Is a certain length of time which determines the effectivity or the extinguishment of obligations. A day certain is understood to be that which must necessarily come, although it may not be known when. Requisites for a Valid PERIOD or TERM: (a) It must refer to the future; (b) It must be certain but can be extended; (c) It must be physical and legally possible, otherwise the obligation is void. PERIOD CONDITION 1. In their fulfillment; 1. In their fulfillment: A period is an event which must A condition is an uncertain event. happen sooner or later; at a date known before hand, or at a time which cannot be determined 2. With reference to time; A period always refers to the future; 2. With reference to time; A condition may under the law refer even to the past; 3. As to influence on the obligation; A period fixes the time or the efficaciousness of an obligation. 3. As to influence on the obligation; A condition causes an obligation to arise or to cease. Different Kinds of Terms or Periods: Definite – the exact date or time is known and given; Indefinite – something that will surely happen but the date of happening is unknown; Legal – a period is granted under the provisions of the law; Conventional or Voluntary – period agreed upon or stipulated by the parties; Judicial – the period or term fixed by the courts for the performance of an obligation or for its termination; Ex die – a period with a suspensive effect. Here the obligation begins only from a day certain, in other words, upon arrival of the period. In diem – a period or term with a resolutory condition effect. Up to a time certain, the obligation remains valid, but upon arrival of said period the obligation terminates. Anything paid or delivered before the arrival of the period, the obligor being unaware of the period or believing that the obligation has become due and demandable, may be recovered, with the fruits and interests. (Art. 1195) DELIVERY BY MISTAKE Requisites: (1) The obligation involved is an obligation to give; (2) The period is for the benefit of the creditor and debtor; (3) The obligor delivered before the period; and (4) The obligor is not aware of the period or he believes that the obligation has become due and demandable. 1. Presumption that period is for the benefit of both debtor and creditor (Art.1196) * The term or period is for the benefit of both the debtor and creditor. The debtor cannot pay prematurely while the creditor cannot demand prematurely. Exceptions: a. Term is for the benefit of the debtor alone. Debtor is required to pay only at the end but he may pay even before. b. Term is for the benefit of the creditor alone. Creditor can demand at any time even before the term expires, and he cannot be compelled to accept payment from the debtor prior to the stipulated period. If the obligation does not fix a period, but from its nature and the circumstances it can be inferred that a period was intended, the courts may fix the duration thereof. The courts shall also fix the duration of the period when it depends upon the will of the debtor. In every case, the courts shall determine such period as may under the circumstances have been probably contemplated by the parties. Once fixed by the courts, the period cannot be changed by them. (Art. 1197) PACIFIC BANKING CORPORATION and CHESTER G. BABST vs. THE COURT OF APPEALS, JOSEPH C. HART and ELEANOR HART (G.R. No. L-45656, May 5, 1989) FACTS: On April 15, 1955, Joseph and Eleanor Hart discovered an area consisting of 480 hectares of tidewater land in Tambac Gulf of Lingayen which had great potential for the cultivation of fish and saltmaking. They organized Insular Farms Inc., applied for and, after eleven months, obtained a lease from the Department of Agriculture for a period of 25 years, renewable for another 25 years. Subsequently, Joseph Hart approached businessman John Clarkin, then President of Pepsi-Cola Bottling Co. in Manila, for financial assistance. On July 15, 1956, Joseph Hart and Clarkin signed a Memorandum of Agreement pursuant to which: a) of 1,000 shares out-standing, Clarkin was issued 500 shares in his and his wife's name, one share to J. Lapid, Clarkin's secretary, and nine shares in the name of the Harts were indorsed in blank and held by Clarkin so that he had 510 shares as against the Harts' 490; b) Hart was appointed President and General Manager as a result of which he resigned as Acting Manager of the First National City Bank at the Port Area, giving up salary of P 1,125.00 a month and related fringe benefits. Due to financial difficulties, Insular Farms Inc. borrowed P 250,000.00 from Pacific Banking Corporation sometime in July of 1956. On July 31, 1956 Insular Farms Inc. executed a Promissory Note of P 250,000.00 to the bank payable in five equal annual installments, the first installment payable on or before July 1957. Said note provided that upon default in the payment of any installment when due, all other installments shall become due and payable. This loan was effected and the money released without any security except for the Continuing Guaranty executed on July 18, 1956, of John Clarkin, who owned seven and half percent of the capital stock of the bank, and his wife Helen. Unfortunately, the business floundered and while attempts were made to take in other partners, these proved unsuccessful. Nevertheless, petitioner Pacific Banking Corporation and its then Executive Vice President, petitioner Chester Babst, did not demand payment for the initial July 1957 installment nor of the entire obligation, but instead opted for more collateral in addition to the guaranty of Clarkin. As the business further deteriorated and the situation became desperate, Hart agreed to Clarkin's proposal that all Insular Farms shares of stocks be pledged to petitioner bank in lieu of additional collateral and to insure an extension of the period to pay the July 1957 installment. Said pledge was executed on February 19, 1958. Less than a month later, on March 3,1958, Pacific Farms Inc, was organized to engage in the same business as Insular Farms Inc. The next day, or on March 4, 1958, Pacific Banking Corporation, through petitioner Chester Babst wrote Insular Farms Inc. giving the latter 48 hours to pay its entire obligation. On March 7, 1958, Hart received notice that the pledged shares of stocks of Insular Farms Inc. would be sold at public auction on March 10, 1958 at 8:00 A.M. to satisfy Insular Farms' obligation. On March 8, 1958, the private respondents commenced a case by filing a complaint for reconveyance and damages with prayer for writ of preliminary injunction before the Court of First Instance of Manila docketed as Civil Case No. 35524. On the same date the Court granted the prayer for a writ of pre- preliminary injunction. On September 28, 1959 Joseph Hart filed another case for recovery of sum of money comprising his investments and earnings against Insular Farms, Inc. before the Court of First Instance of Manila, docketed as Civil Case No. 41557. ISSUE: Whether or not an agreement to extend the time of payment, in order to be valid, must be for a definite time. RULING: The rule which states that there can be no valid extension of time by oral agreement unless the extension is for a definite time, is not absolute but admits of qualifications and exceptions. The general rule is that an agreement to extend the time of payment, in order to be valid, must be for a definite time, although it seems that no precise date be fixed, it being sufficient that the time can be readily determined. (8 C.J. 425) In case the period of extension is not precise, the provisions of Article 1197 of the Civil Code should apply. In this case, there was an agreement to extend the payment of the loan, including the first installment thereon which was due on or before July 1957. As the Court of Appeals stated: ...-and here, this court is rather well convinced that Hart had been given the assurance by the conduct of Babst, Executive Vice President of Pacific Bank, that payment would not as yet be pressed, and under 1197 New Civil Code, the meaning must be that there having been intended a period to pay modifying the fixed period in original promissory note, really, the cause of action of Pacific Bank would have been to ask the Courts for the fixing of the term; Definite or indefinite period: Instances when courts may fix the period (Art. 1197) a.1. When the duration depends upon the will of the debtor; Ex. “when my means permit me to do so” “as soon as possible” “as soon as I have money”. a.2. When the obligation does not fix a period but from its nature and circumstances it can be inferred that a period was intended by the parties. Ex. “A lease contract which does not fix a period or duration”, A contract to construct a house which does not fix how long will it take to construct. (b) Creditor must ask court to set the period before he can demand payment In order that the seller could have a valid cause of action, it is essential that there must have been a stipulated period within which the payment would have become due and demandable. If the parties themselves could not come into an agreement, the courts may be asked to fix the period of obligation under Art. 1197 of the Civil Code. (Sps. Edrada vs. Sps. Ramos, G.R. No. 154413, August 31, 2005) Instances when debtor losses benefit of period (Art. 1198) 1. When after the obligation has been contracted, he becomes insolvent, unless he gives a guaranty or security for the debt; Note: Insolvency referred to does not have to be judicially declared; it is sufficient for him to find a hard time paying off his obligations because of financial reverses that have made his assets less than his liabilities. 2. When he does not furnish to the creditor the guaranties or securities he has promised; 3. When by his own acts he has impaired said guaranties or securities after their establishment, and when through a fortuitous event they disappear, unless he immediately gives new ones equally satisfactory; 4. When the debtor violates any undertaking in consideration of which the creditor agreed to the period; and; 5. When the debtor attempts to abscond. ALTERNATIVE & FACULTATIVE OBLIGATIONS Alternative & Facultative (Art. 1199) Alternative Obligations – refers to those juridical relations which comprehend several objects or prestations which are due, but the payment or performance of one of them would be sufficient; Facultative Obligations – refer to those juridical relations where only one object or prestation has been agreed upon by the parties to the obligation, but the obligor may deliver or render another in substitution. ALTERNATIVE FACULTATIVE 1. As to object due; Several object are due. If one of the prestations is illegal, the others may be valid and the obligation remains. 1. As to Object due; Only one object is principally due. If the principal obligation is void then it is no longer necessary to give the substitute. 2. As to compliance; May be complied by the delivery of one of the objects or by the performance of one of the prestations which are alternatively due; 2. As to compliance; May be complied with by the delivery of another object or the performance of another prestation in substitution of that which is due; 3. As to right of choice; The right to choice may pertain to the debtor (General Rule), creditor (When expressly granted), or to a third person (When expressly granted); 3. As to right of choice; The right to choice only pertains to the debtor; ALTERNATIVE FACULTATIVE 4. As to effect of fortuitous loss; The loss or impossibility of all of the objects or prestations which are due without any fault of the debtor is necessary to extinguish the obligation; 4. As to effect of fortuitous loss; Loss or impossibility of the object or prestation which is due without any fault of the debtor is sufficient to extinguish the obligation; 5. As to the effect of culpable loss; The culpable loss of any of the objects which are alternatively due before the choice is made may give rise to a liability on the part of the debtor. 5. As to the effect of culpable loss; The culpable loss of the object which the debtor may deliver in substitution before the substitution is effected does not give rise to any liability on the part of such debtor. However, if the loss happened after the substitution, the debtor is liable for damages. As a general rule, the right to choose belongs to the debtor. By way of exception it may belong to the creditor when such right has expressly granted to him. In what form does the debtor communicate his / her choice? need to ANSWER: Since the law requires no specific form, it is believed that the choice can be communicated orally or in writing, expressly or impliedly, such as by performance of one of the obligations. Once notice has been made that a choice has been done, the obligation becomes a simple obligation to do or deliver the object selected. Requisites for the making of the Choice: (a) Made properly so that the creditor or his agent will actually know; (b) Made with full knowledge that a selection is indeed being made; (c) Made voluntarily and freely; (d) Made in due time, that is, before or upon maturity; (e) Made to all proper persons; (f) Made without conditions unless agreed to by the creditor; (g) May be waived, expressly or impliedly. When are the parties bound by the choice or selection? ANSWER: The parties are bound by the choice or selection from the very moment that it has been communicated by the party who has the right to make it to the other party. Limitation on the Debtor’s Choice; 1. Prestations which are impossible; 2. Unlawful; 3. Or which could not have been the object of the obligations; The creditor shall have a right to indemnity for damages when, through the fault of the debtor, all the things which are alternatively the object of the obligation have been lost, or the compliance of the obligation has become impossible. The indemnity shall be fixed taking as a basis the value of the last thing which disappeared, or that of the service which last became impossible. Damages other than the value of the last thing or service may also be awarded. (Art. 1204) When the choice has been expressly given to the creditor, the obligation shall cease to be alternative from the day when the selection has been communicated to the debtor. Until then the responsibility of the debtor shall be governed by the following rules: (Art. 1205) (1) If one of the things is lost through a fortuitous event, he shall perform the obligation by delivering that which the creditor should choose from among the remainder, or that which remains if only one subsists; (2) If the loss of one of the things occurs through the fault of the debtor, the creditor may claim any of those subsisting, or the price of that which, through the fault of the former, has disappeared, with a right to damages; (3) If all the things are lost through the fault of the debtor, the choice by the creditor shall fall upon the price of any one of them, also with indemnity for damages. JOINT AND SOLIDARY OBLIGATIONS Joint and Solidary Obligation JOINT OBLIGATION – Each obligor / debtor answers only for a part of the whole liability and to each obligee belongs only a part of the correlative rights. “To each his own” SOLIDARY OR JOINT AND SEVERAL OBLIGATIONS – The relationship between the active and the passive subjects is so close that each of the former or of the latter may demand the fulfillment of or must comply with the whole obligations. “One for all, all for one” GENERAL RULE: Obligations are joint. Exceptions: 1. When there is a stipulation in the contract that the obligation is solidary; 2. When the nature of the obligation requires liability to be solidary; 3. When the law declares the obligation to be solidary. NATURE AND EFFECTS OF JOINT OBLIGATIONS. a) Unless the nature of the obligation or the stipulation indicates the contrary, the shares of each debtor or creditor shall be considered equal; b) Default or delay of one debtor will not affect the other; c) Other debtors may not be compelled to perform all the obligations. Instances liability: were the law imposes solidary a. Obligations arising from tort; b. Obligations arising from quasi-contracts; c. Legal provisions regarding the obligations of devisees and legatees; d. Liability of principals, accomplices and accessories of a felony; e. Bailees in commodatum. Inciong Jr. vs. Court of Appeals [G.R. No. 96405, June 26, 1996, (257 SCRA 578)] Section 4, Chapter 3, Title I, Book IV of the Civil Code states the law on joint and several obligations. Under Art. 1207 thereof, when there are two or more debtors in one and the same obligation, the presumption is that the obligation is joint so that each of the debtors is liable only for a proportionate part of the debt. There is a solidary liability only when the obligation expressly so states, when the law so provides or when the nature of the obligation so requires. Because the promissory note involved in this case expressly states that the three signatories therein are jointly and severally liable, any one, some or all of them may be proceeded against for the entire obligation. The choice is left to the solidary creditor to determine against whom he will enforce collection. Consequently, the dismissal of the case against Judge Pontanosas may not be deemed as having discharged petitioner from liability as well. As regards Naybe, suffice it to say that the court never acquired jurisdiction over him. Petitioner, therefore, may only have recourse against his comakers, as provided by law. May an obligation be joint on the side of the creditors and solidary on the side of the debtors or vice-versa? ANSWER: Yes, in such cases, the rules applicable to each subject of the obligation should be applied, the character of the creditors or the debtors determining their respective rights and liabilities. Ex. A and B are joint debtors of C,D,E, & F, solidary creditors to the amount of P10,000.00. How much can C collect from A? ANS: C is solidary creditor, so presumably he can collect the whole debt. But since A is only a joint debtor, C entitled to collect P5,000.00 from A. REPUBLIC GLASS CORPORATION and GERVEL, INC. versus LAWRENCE C. QUA (G.R. No. 144413, July 30, 2004) FACTS: Republic Glass Corporation ("RGC") and Gervel, Inc. ("Gervel") together with respondent Lawrence C. Qua ("Qua") were stockholders of Ladtek, Inc. ("Ladtek"). Ladtek obtained loans from Metropolitan Bank and Trust Company ("Metrobank") and Private Development Corporation of the Philippines ("PDCP") with RGC, Gervel and Qua as sureties. Among themselves, RGC, Gervel and Qua executed Agreements for Contribution, Indemnity and Pledge of Shares of Stocks ("Agreements"). The Agreements all state that in case of default in the payment of Ladtek’s loans, the parties would reimburse each other the proportionate share of any sum that any might pay to the creditors. Under the same Agreements, Qua pledged 1,892,360 common shares of stock of General Milling Corporation ("GMC") in favor of RGC and Gervel. The pledged shares of stock served as security for the payment of any sum which RGC and Gervel may be held liable under the Agreements. Ladtek defaulted on its loan obligations to Metrobank and PDCP. Hence, Metrobank filed a collection case against Ladtek, RGC, Gervel and Qua. During the pendency of Collection Case, RGC and Gervel paid Metrobank P7 million. Later, Metrobank executed a waiver and quitclaim dated 7 September 1988 in favor of RGC and Gervel. Based on this waiver and quitclaim,9 Metrobank, RGC and Gervel filed on 16 September 1988 a joint motion to dismiss Collection Case against RGC and Gervel. Accordingly, RTC-Branch 149 dismissed the case against RGC and Gervel, leaving Ladtek and Qua as defendants. In a letter dated 7 November 1988, RGC and Gervel’s counsel, Atty. Antonio C. Pastelero, demanded that Qua pay P3,860,646, or 42.22% of P8,730,543.55, as reimbursement of the total amount RGC and Gervel paid to Metrobank and PDCP. Qua refused to reimburse the amount to RGC and Gervel. Subsequently, RGC and Gervel furnished Qua with notices of foreclosure of Qua’s pledged shares. Qua filed a complaint for injunction and damages with application for a temporary restraining order, to prevent RGC and Gervel from foreclosing the pledged shares. Although it issued a temporary restraining order on 9 December 1988, RTC-Branch 63 denied Qua’s "Urgent Petition to Suspend Foreclosure Sale." RGC and Gervel eventually foreclosed all the pledged shares of stock at public auction. Thus, Qua’s application for the issuance of a preliminary injunction became moot. Trial in Foreclosure Case ensued. RGC and Gervel offered Qua’s Motion to Dismiss in Collection Case of Metro Bank as basis for the foreclosure of Qua’s pledged shares. On 12 January 1996, RTC-Branch 63 rendered a Decision in Foreclosure Case ordering RGC and Gervel to return the foreclosed shares of stock to Qua. However, on RGC and Gervel’s Motion for Reconsideration, RTCBranch 63 issued its Order of 3 May 1996 reconsidering and setting aside the 12 January 1996 Decision. On 6 March 2000, the Court of Appeals rendered the questioned Decision setting aside the 3 May 1996 Order of RTC-Branch 63 and reinstating the 12 January 1996 Decision ordering RGC and Gervel to return the foreclosed shares of stock to Qua. ISSUE: Whether payment of the entire obligation is an essential condition for reimbursement. RULING: Court of Appeals’ ruling that the parties’ liabilities under the Agreements depend on the full payment of the obligation. RGC and Gervel insist that it is not an essential condition that the entire obligation must first be paid before they can seek reimbursement from Qua. RGC and Gervel contend that Qua should pay 42.22% of any amount which they paid or would pay Metrobank and PDCP. RGC and Gervels’ contention is partly meritorious. Payment of the entire obligation by one or some of the solidary debtors results in a corresponding obligation of the other debtors to reimburse the paying debtor. However, we agree with RGC and Gervel’s contention that in this case payment of the entire obligation is not an essential condition before they can seek reimbursement from Qua. The words of the Agreements are clear. Whether the solidary debtor has paid the creditor, the other solidary debtors should indemnify the former once his liability becomes absolute. However, in this case, the liability of RGC, Gervel and Qua became absolute simultaneously when Ladtek defaulted in its loan payment. As a result, RGC, Gervel and Qua all became directly liable at the same time to Metrobank and PDCP. Thus, RGC and Gervel cannot automatically claim for indemnity from Qua because Qua himself is liable directly to Metrobank and PDCP. If we allow RGC and Gervel to collect from Qua his proportionate share, then Qua would pay much more than his stipulated liability under the Agreements. In addition to the P3,860,646 claimed by RGC and Gervel, Qua would have to pay his liability of P6.2 million to Metrobank and more than P1 million to PDCP. Since Qua would surely exceed his proportionate share, he would then recover from RGC and Gervel the excess payment. This situation is absurd and circuitous. Contrary to RGC and Gervel’s claim, payment of any amount will not automatically result in reimbursement. If a solidary debtor pays the obligation in part, he can recover reimbursement from the codebtors only in so far as his payment exceeded his share in the obligation. This is precisely because if a solidary debtor pays an amount equal to his proportionate share in the obligation, then he in effect pays only what is due from him. If the debtor pays less than his share in the obligation, he cannot demand reimbursement because his payment is less than his actual debt. To determine whether RGC and Gervel have a right to reimbursement, it is indispensable to ascertain the total obligation of the parties. At this point, it becomes necessary to consider the decision in Collection Case on the parties’ obligation to Metrobank. To repeat, Metrobank filed Collection Case against Ladtek, RGC, Gervel and Qua to collect Ladtek’s unpaid loan. RGC and Gervel assail the Court of Appeals’ consideration of the decision in Collection Case because Qua did not offer the decision in evidence during the trial in Foreclosure Case subject of this petition. RTC-Branch 62 rendered the decision in Collection Case on 21 November 1996 while Qua filed his Notice of Appeal of the 3 May 1996 Order on 19 June 1996. Qua could not have possibly offered in evidence the decision in Collection Case because RTCBranch 62 rendered the decision only after Qua elevated the present case to the Court of Appeals. Hence, Qua submitted the decision in Collection Case during the pendency of the appeal of Foreclosure Case in the Court of Appeals. As found by RTC-Branch 62, RGC, Gervel and Qua’s total obligation was P14,200,854.37 as of 31 October 1987. During the pendency of Collection Case, RGC and Gervel paid Metrobank P7 million. Because of the payment, Metrobank executed a quitclaim in favor of RGC and Gervel. By virtue of Metrobank’s quitclaim, RTC-Branch 62 dismissed the Collection Case against RGC and Gervel, leaving Ladtek and Qua as defendants. Considering that RGC and Gervel paid only P7 million out of the total obligation of P14,200,854.37, which payment was less than RGC and Gervel’s combined shares in the obligation, it was clearly partial payment. Moreover, if it were full payment, then the obligation would have been extinguished. Metrobank would have also released Qua from his obligation. RGC and Gervel also made partial payment to PDCP. Proof of this is the Release from Solidary Liability that PDCP executed in RGC and Gervel’s favor which stated that their payment of P1,730,543.55 served as "full payment of their corresponding proportionate share" in Ladtek’s foreign currency loan. Moreover, PDCP filed a collection case against Qua alone in the Regional Trial Court of Makati, Branch 150. Since they only made partial payments, RGC and Gervel should clearly and convincingly show that their payments to Metrobank and PDCP exceeded their proportionate shares in the obligations before they can seek reimbursement from Qua. This RGC and Gervel failed to do. RGC and Gervel, in fact, never claimed that their payments exceeded their shares in the obligations. Consequently, RGC and Gervel cannot validly seek reimbursement from Qua. Joint (divisible) obligation Concurrence of two or more creditors and or two or more debtors Characteristics: a. Each creditor can demand only for the payment of his proportionate share of the credit, while each debtor can be held liable only for the payment of his proportionate share of the debt; b. A joint creditor cannot act in representation of the other creditors, while a joint debtor cannot be compelled to answer for the acts or liability of the other debtors. Joint indivisible obligation: 1. Obligation cannot be performed in parts but debtors are bound jointly; 2. In case of failure of one joint debtor to perform his part (share), there is default but only the guilty debtor shall be liable for damages Characteristics: a. The obligation is joint but since the object is indivisible, the creditor must proceed against all the joint debtors for compliance is possible only if all the joint debtors would act together; b. Demand must therefore be made on all joint debtors; c. If any one of the debtors does not comply with his obligation the same will give rise to indemnity for damages; d. If any of the joint debtors be insolvent, the other shall not be liable for his share; e. If there be joint creditors, delivery must be made to all, and not merely to one , unless that one be specifically authorized by the others; f. Each joint creditor is allowed to renounce his proportionate credit. Solidary Obligation * The obligation is solidary in the following cases: a. When the obligation expressly so states or there is a stipulation in the contract that obligation is solidary; b. When the law requires solidarity; c. When the solidarity; nature of the obligations requires SOLIDARY INDIVISIBILITY 1. Refers to the tie between the 1. Refers to the nature of obligations; parties; 2. Needs at least two debtors or 2. May exist even if there is only one creditors; debtor and only one creditor; 3. The fault of one is the fault of the 3. The fault of one is not the fault of others. others. Different Kinds of Solidarity; Active ( among the creditors); Passive (among debtors); Mixed (among the creditors and the debtors at the same time) Payment made by one of the solidary debtors extinguishes the obligation. If two or more solidary debtors offer to pay, the creditor may choose which offer to accept. He who made the payment may claim from his codebtors only the share which corresponds to each, with the interest for the payment already made. If the payment is made before the debt is due, no interest for the intervening period may be demanded. When one of the solidary debtors cannot, because of his insolvency, reimburse his share to the debtor paying the obligation, such share shall be borne by all his codebtors, in proportion to the debt of each. (Art. 1217) A,B,C, & D are solidary debtors of E to the amount of P12,000.00. A paid E the whole amount of P12,000.00. It is clear that A is entitled to reimbursement for now A has become the creditor for reimbursement. Are B, C, and D considered the solidary debtors of A? ANSWER: No, with reference to the reimbursement, B, C and D are not solidary debtors of A but merely joint debtors of A. Effect of Loss or Impossibility: (a) If without fault – NO LIABILITY (b) If with fault – THERE IS LIABILITY AND DAMAGES PLUS INTEREST (c) Loss because of a fortuitous event after default – THERE WILL BE LIABILITY BECAUSE OF THE DEFAULT DIVISIBLE & INDIVISIBLE OBLIGATIONS Divisible and indivisible (Art. 1225) Divisible obligations - one capable of partial performance. Ex. To deliver 200 kilos of sugar. 1. Indivisible obligations – one not capable of partial performance. Ex. To deliver a specific car. 2. Obligations that are deemed INDIVISIBLE: (a) Obligations to give definite things; (Ex. To give this car) (b) Those which are not susceptible for partial performance; (c) Even if the thing is physically divisible, it may be indivisible if so provided by law; (d) Even if the thing is physically divisible, it may be indivisible if such was the intention of the parties concerned. Obligations That are Deemed Divisible: (a) When the object of the obligation is the execution of a certain number of days of work; (Ex. When the laborer is hired to work for 10 days.) (b) When the object of the obligation is the accomplishment of work by metrical units. (Ex. When a laborer is hired to construct a street 3 meters wide and 50 meters long) (c) When the purpose of the obligation is to pay a certain amount in installments. (Ex. When a debtor is required to pay in 10 annual installments.) (d) When the object of the obligation is the accomplishment of work susceptible of partial performance. OBLIGATIONS WITH A PENAL CLAUSE Obligations with a penal clause (Arts. 1226, 12281230) Definition: 1. It is a coercive means to obtain from the debtor compliance by the creditor; 2. A penal clause is an accessory undertaking to assume greater liability in case of breach. It is attached to obligations in order to insure their performance. PRINCIPAL PURPOSES OF THE PENAL CLAUSE: 1) INDUCEMENT; a penal clause helps ensure the performance of an obligation; 2) PUNITIVE; punishment for non-compliance. 3) DETERRENCE AND RETRIBUTION; 4) TO FIX IN ADVANCE THE DAMAGE THAT MAY BE AWARDED IN ORDER TO DO AWAY WITH PROOF THEREOF LATER. Exceptions to the GENERAL RULE that the PENALTY takes the place of indemnity for damages and for the payment of Interest: (1) When there is an express stipulation to the effect that damages or interest may still be recovered, despite the presence of a penalty clause; (2) When the debtor refuses to pay the penalty imposed in the obligation; (3) When the debtor is guilty of fraud or dolo in the fulfillment of the obligation. Continental Cement Corp. vs. Asea Brown Boveri Inc. [G.R. No. 171660, October 17, 2011, 9659 SCRA 137)] Under Article 1226 of the Civil Code, the penalty clause takes the place of indemnity for damages and the payment of interests in case of non-compliance with the obligation, unless there is a stipulation to the contrary. In this case, since there is no stipulation to the contrary, the penalty in the amount of P987.25 per day of delay covers all other damages (i.e. production loss, labor cost, and rental of the crane) claimed by petitioner. Petitioner is not entitled to recover production loss, labor cost and the rental of crane. The debtor cannot exempt himself from the performance of the obligation by paying the penalty, save in the case where this right has been expressly reserved for him. Neither can the creditor demand the fulfillment of the obligation and the satisfaction of the penalty at the same time, unless this right has been clearly granted him. However, if after the creditor has decided to require the fulfillment of the obligation, the performance thereof should become impossible without his fault, the penalty may be enforced. (Art. 1227) Is it required to establish that actual damages is incurred in order that the penalty may be demandable? ANSWER: NO, Proof of actual damages suffered by the creditor is not necessary in order that the penalty may be demandable. (Art. 1228) Florentino vs. Supervalue Inc. [G.R. No. 172384, September 12, 2007, (533 SCRA 156)] As a general rule, courts are not at liberty to ignore the freedoms of the parties to agree on such terms and conditions as they see fit as long as they are not contrary to law, morals, good customs, public order or public policy. Nevertheless, courts may equitably reduce a stipulated penalty in the contracts in two instances: (1) if the principal obligation has been partly or irregularly complied with; and (2) even if there has been no compliance if the penalty is iniquitous or unconscionable in accordance with Article 1229 of the Civil Code which clearly provides: Art. 1229. The judge shall equitably reduce the penalty when the principal obligation has been partly or irregularly complied with by the debtor. Even if there has been no performance, the penalty may also be reduced by the courts if it is iniquitous or unconscionable. In ascertaining whether the penalty is unconscionable or not, this court set out the following standard in Ligutan v. Court of Appeals,to wit: The question of whether a penalty is reasonable or iniquitous can be partly subjective and partly objective. Its resolution would depend on such factor as, but not necessarily confined to, the type, extent and purpose of the penalty, the nature of the obligation, the mode of breach and its consequences, the supervening realities, the standing and relationship of the parties, and the like, the application of which, by and large, is addressed to the sound discretion of the court. xxx. In the instant case, the forfeiture of the entire amount of the security deposits in the sum of P192,000.00 was excessive and unconscionable considering that the gravity of the breaches committed by the petitioner is not of such degree that the respondent was unduly prejudiced thereby. It is but equitable therefore to reduce the penalty of the petitioner to 50% of the total amount of security deposits. It is in the exercise of its sound discretion that this court tempered the penalty for the breaches committed by the petitioner to 50% of the amount of the security deposits. The forfeiture of the entire sum of P192,000.00 is clearly a usurious and iniquitous penalty for the transgressions committed by the petitioner. The respondent is therefore under the obligation to return the 50% of P192,000.00 to the petitioner. When penalties may be reduced: (1) When there was partial compliance; (2) When there was compliance but it was irregularly done; (3) When the penalty is inquitous or unconscionable. EXTINGUISHMENT OF OBLIGATIONS Obligations are extinguished: (1) By payment or performance; (2) By the loss of the thing due; (3) By the condonation or remission of the debt; (4) By the confusion or merger of the rights of the creditor; (5) By compensation; (6) By Novation; Other causes of extinguishment of obligations, such as annulment, rescission, fulfillment of a resolutory condition, and prescription. PAYMENT OR PERFORMANCE PAYMENT OR PERFORMANCE Payment or Performance (Arts. 1232-1238) Is a mode of extinguishing obligations which consist of: a. The delivery of money; b. The performance in any other manner of an obligation. (Ex. Performance of a service) For payment to properly exist, the creditor has to accept the same, expressly or impliedly. Payment for valid reasons may properly be rejected. Special Forms of Payment: (a) Application (or imputation) of payment; (b) Dation in payment (Dacion en pago or datio in solutom) (c) assignment in favor of creditors (cession); (d) tender of payment and consignation. Requisites of a Valid Payment: (a) The very thing or service contemplated must be paid; (b) Fulfillment must be complete. Estoppel or the Creditor is barred to question incomplete performance: (i) There was incomplete or irregular performance; (ii) The creditor accepted the incomplete or irregular perfomance; (iii) The creditor did not protest or object. How Payment or Performance is Made: a. If the debt is a monetary obligation, by delivery of the money. The amount paid must be full, unless of course otherwise stipulated in the contract; b. If the debt is the delivery of a thing or things, by delivery of the thing or things; c. If the debt is the doing of a personal undertaking, by the performance of said personal undertaking; d. If the debt is not doing of something by refraining from doing the action. Payment must be made to: (a) The person in whose behalf the obligation was constituted;(Creditor) (b) The person authorized to receive; (c) To the successors-in-interest (like the heirs). Capacity of the PAYEE: Payment to an incapacitated person is generally not effective. Exception: If the incapacitated person kept what was paid or he is benefitted thereby: Example: Payment to a minor is not effective. However if the obligation is to deliver a house and the minor kept or used the house after delivery, then payment is valid. BURDEN OF PROOF: (a) An alleged creditor has the burden of showing that a valid debt exists; (b) Once he does this, the debtor has the burden of proving that he has paid the same. Thus, a promissory note is still in the creditor’s possession, the presumption is that it has not yet been paid. Means of Proving Payment: One good proof is the presentation of receipt. SPOUSES AGNER vs. BPI Family Savings Bank Inc.(G.R. No. 182963, July 3, 2013) Jurisprudence abounds that, in civil cases, one who pleads payment has the burden of proving it; the burden rests on the defendant to prove payment, rather than on the plaintiff to prove non-payment. When the creditor is in possession of the document of credit, proof of non-payment is not needed for it is presumed. Respondent's possession of the Promissory Note with Chattel Mortgage strongly buttresses its claim that the obligation has not been extinguished. As held in Bank of the Philippine Islands v. Spouses Royeca: x x x The creditor's possession of the evidence of debt is proof that the debt has not been discharged by payment. A promissory note in the hands of the creditor is a proof of indebtedness rather than proof of payment. In an action for replevin by a mortgagee, it is prima facie evidence that the promissory note has not been paid. Likewise, an uncanceled mortgage in the possession of the mortgagee gives rise to the presumption that the mortgage debt is unpaid. The creditor is not bound to accept payment or performance by a third person who has no interest in the fulfillment of the obligation, unless there is a stipulation to the contrary. Whoever pays for another may demand from the debtor what he has paid, except that if he paid without the knowledge or against the will of the debtor, he can recover only insofar as the payment has been beneficial to the debtor. (Art. 1236) Whoever pays on behalf of the debtor without the knowledge or against the will of the latter, cannot compel the creditor to subrogate him in his rights, such as those arising from a mortgage, guaranty, or penalty. (Art. 1237) The 3rd person may pay the creditor: (a) With the knowledge and consent of the debtor: Payor (3rd person) is entitled to REIMBURSEMENT and SUBROGATION to such rights as guaranty, penalty or mortgage. (b) Without the debtor’s knowledge or against his will. The payor is not entitled to SUBROGATION as he is only allowed to BENEFICIAL REIMBURSEMENT. JOJO borrowed P1M from NOYNOY as proven by a Promissory Note executed by the former in favor of the latter in January 1, 2014. MAR acted as the guarantor. In the subject Promissory Note, JOJO promised to pay NOYNOY on or before June 30, 2014. When the debt matured, FRANK paid the entire debt. The payment was made with the consent of JOJO. (a) What are the rights of FRANK as a result of the payment? (b) If FRANK proceeds against JOJO for reimbursement for the amount paid to NOYNOY and JOJO cannot pay by reason of insolvency, can FRANK proceed against MAR? (c) Supposed, NOYNOY on April 15, 2014, condoned ½ of the debt and on June 30, 2014, FRANK not knowing the condonation / remission, paid the entire amount to NOYNOY, who accepted the payment. The payment was made without the knowledge and consent of JOJO. What are the rights of FRANK as a result of the payment? ANSWER: (a) FRANK has the following rights: a.1. Demand reimbursement from JOJO for the entire amount paid; a.2. He is now subrogated to all the rights of NOYNOY, not only against the debtor, but even against 3rd persons such as those arising from a guaranty, mortgage or penalty. (b) If FRANK proceeds against JOJO for reimbursement and the latter cannot pay by reason of insolvency, he can now proceed against the guarantor, MAR for reimbursement; (c) FRANK can demand reimbursement in the amount of P500T from JOJO because NOYNOY had already condoned ½ of the obligation. Consequently, JOJO was benefited by the payment only to the extent of ½. He can recover the other P500T from NOYNOY because of the principle of “unjust enrichment”. SUBROGATION Means the act of placing somebody into the shoes of the creditor, hence, enabling the former to exercise all the rights and actions that could have been exercised by the latter. Transfers to the person subrogated the credit with all the rights thereto appertaining, either against the debtor or against 3rd persons, be they guarantors or possessors of mortgages, subject to stipulation in a conventional subrogation. SUBROGATION REIMBURSEMENT 1. Recourse can be had to the 1. There is no such recourse; mortgage or guaranty or pledge; 2. The debt is extinguished in one sense, but a new creditor, with exactly the same rights as the old one appears on the scene; 2. The new creditor has different rights, so it is as if there has indeed been an extinguishment of the obligation; 3. There is something more than a 3. There is only a personal action to personal action of recovery. recover the amount. The debtor of a thing cannot compel the creditor to receive a different one, although the latter may be of the same value as, or more valuable than that which is due. In obligations to do or not to do, an act or forbearance cannot be substituted by another act or forbearance against the obligee's will. (Art. 1244) Dation in Payment (Dacion en Pago) It is a special form of payment whereby property alienated by the debtor to the creditor in satisfaction of a debt in money. (Art. 1245) Manresa – Is the transmission of the ownership of a thing by the debtor to the creditor as an accepted equivalent of the performance of an obligation Requisites of Dacion en Pago: (a) Instead of the original prestation, another prestation is performed; (b) The original prestation that is due and the one performed are different; (c) The parties agreed that the performance of the different prestation extinguishes the obligation. Conditions under which Dacion en Pago would be VALID: (a) Consent of the creditor; (b) It must not be prejudicial to the other creditor; (c) T h e d e b t o r m u s t n o t h a v e b e e n d e c l a r e d insolvent by a judicial decree. Example: MR. DUTERTE is obligated to pay MR. CAYETANO the amount of P1M. Later MR. CAYETANO accepted the proposal of MR. DUTERTE to deliver his Toyota Fortuner instead of paying the amount of P1M. delivery of the Toyota Fortuner constitutes dacion en pago. Tan Shuy vs. Maulawin [G.R. No. 190375, February 8, 2012,(665 SCRA 604)] There is Dation in Payment when property is alienated to the creditor in satisfaction of a debt in money; Dation in Payment extinguishes the obligation to the extent of the value of thing delivered, either as agreed upon by the parties or as may be proved, unless the parties by agreement - express or implied, or by their silence - consider the thing as equivalent to the obligation, in which case the obligation is totally extinguished. PROBLEM: Manny is indebted to Floyd in the amount of P25,000.00. Instead of payment of money, Manny delivered to Floyd an Ipad tablet valued at P20,000.00. Did the delivery of the Ipad tablet extinguished the obligation of Manny? ANSWER: It depends, it is a rule that even if the thing is of lesser value than the obligation, if the parties agree that the obligation is totally extinguished, then the obligation is totally extinguished. Otherwise, dation in payment may extinguish the obligation only to the extent of the value of the thing delivered. SALE DATION IN PAYMENT 1.There is no pre-existing obligation; 1. There is a pre-existing credit; 2. This give rise to obligations; 2. This extinguishes obligations; 3. The cause or consideration here is the PRICE (from the viewpoint of the seller / vendor); or the obtaining of the OBJECT (from the viewpoint of the buyer; 3. The cause or consideration here, from the viewpoint of the debtor in dation in payment is the extinguishment of his debt; from the viewpoint of the creditor, it is the acquisition of the object offered in credit 4. There is a greater freedom in the 4. There is less determination of the price; determining the price; freedom in SALE DATION IN PAYMENT 5. The giving of the price may 5. The giving of the object in ieu of the generally end the obligation of the credit may extinguish completely or buyer. only partially the credit (depending on the agreement) PHILIPPINE LAWIN BUS, CO., MASTER TOURS & TRAVEL CORP., MARCIANO TAN, ISIDRO TAN, ESTEBAN TAN and HENRY TAN versus COURT OF APPEALS and ADVANCE CAPITAL CORPORATION (G.R. No. 130972, January 23, 2002) FACTS: On 7 August 1990 plaintiff Advance Capital Corporation, extended a loan to defendant Philippine Lawin Bus Company in the amount of P8,000,000.00 payable within a period of one (1) year. The defendant, through Marciano Tan, its Executive Vice President, executed Promissory Note No. 003, for the amount of P8,000,000.00 "To guarantee payment of the loan, defendant Lawin executed in favor of plaintiff the following documents: (1) A Deed of Chattel Mortgage wherein 9 units of buses were constituted as collaterals: (2) A joint and several UNDERTAKING of defendant Master Tours and Travel Corporation dated 07 August 1990, signed by Isidro Tan and Marciano Tan: and (3) A joint and several UNDERTAKING dated 21 August 1990, executed and signed by Esteban, Isidro, Marciano and Henry, all surnamed Tan . "Out of the P8,000,000.00 loan, P1,800,000.00 was paid. Thus, on 02 November 1990, defendant Bus Company was able to avail an additional loan of P2,000,000.00 for one (1) month under Promissory Note 00028. "Defendant LAWIN failed to pay the aforementioned promissory note and the same was renewed on 03 December 1990 to become due on or before 01 February 1991, under Promissory Note 00037. "On 15 May 1991 for failure to pay the two promissory notes, defendant LAWIN was granted a loan re-structuring for two (2) months to mature on 31 July 1991. "Despite the restructuring, defendant LAWIN failed to pay. Thus, plaintiff foreclosed the mortgaged buses and as the sole bidder thereof, the amount of P2,000,000.00 was accepted by the deputy sheriff conducting the sale and credited to the account of defendant LAWIN. "Thereafter, on 27 May 1992, identical demand letters were sent to the defendants to pay their obligation. Despite repeated demands, the defendants failed to pay their indebtedness which totaled of P16,484,992.42 as of 31 July 1992. "Thus, the suit for sum of money, wherein the plaintiff prays that defendants solidarily pay plaintiff as of July 31, 1992 the sum of (a) P16,484,994.12 as principal obligation under the two promissory notes Nos. 003 and 00037, plus interests and penalties: (b) P300,000.00 for loss of good will and good business reputation: (c) attorney’s fees amounting to P100,000.00 as acceptance fee and a sum equivalent to 10% of the collectible amount, and P500.00 as appearance fee; (d) P200,000.00 as litigation expenses; (e) exemplary damages in an amount to be awarded at the court’s discretion; and (f) the costs. In answer to the complaint, defendants-appellees assert by way of special and affirmative defense, that there was already an arrangement as to the full settlement of the loan obligation by way of Sale of the nine (9) units passenger buses the proceeds of which will be credited against the loan amount as full payment thereof; or in the alternative. ISSUE: Whether there was dacion en pago between the parties upon the surrender or transfer of the mortgaged buses to the respondent. RULING: In dacion en pago, property is alienated to the creditor in satisfaction of a debt in money. It is "the delivery and transmission of ownership of a thing by the debtor to the creditor as an accepted equivalent of the performance of the obligation." It "extinguishes the obligation to the extent of the value of the thing delivered, either as agreed upon by the parties or as may be proved, unless the parties by agreement, express or implied, or by their silence, consider the thing as equivalent to the obligation, in which case the obligation is totally extinguished. In this case, there was no meeting of the minds between the parties on whether the loan of the petitioners would be extinguished by dacion en pago. The petitioners anchor their claim solely on the testimony of Marciano Tan that he proposed to extinguish petitioners’ obligation by the surrender of the nine buses to the respondent acceded to as shown by receipts its representative made. However, the receipts executed by respondent’s representative as proof of an agreement of the parties that delivery of the buses to private respondent would result in extinguishing petitioner’s obligation do not in any way reflect the intention of the parties that ownership thereof by respondent would be complete and absolute. The receipts show that the two buses were delivered to respondent in order that it would take custody for the purpose of selling the same. The receipts themselves in fact show that petitioners deemed respondent as their agent in the sale of the two vehicles whereby the proceeds thereof would be applied in payment of petitioners’ indebtedness to respondent. Such an agreement negates transfer of absolute ownership over the property to respondent, as in a sale. Thus, in Philippine National Bank v. Pineda we held that where machinery and equipment were repossessed to secure the payment of a loan obligation and not for the purpose of transferring ownership thereof to the creditor in satisfaction of said loan, no dacion en pago was ever accomplished. GENERAL RULE: PAYMENT OR PERFORMANCE MUST BE COMPLETE. Exceptions: Partial Performance / Payment is allowed. (a) When there is a stipulation to this effect; (b) When the different prestations conditions or different terms; are subject to different (Ex. A debt payable in installments) (c) When a debt is in part liquidated and in part unliquidated in which case performance of the liquidated part may be insisted upon either by the debtor or the creditor; (Ex. The D owes C P500 plus damages. Even if the amount of damages has not yet been ascertained, the P500 is already known or liquidated. This is already demandable and payable.) (d) When a joint debtor pays his share or the creditor demands the same; (This is a complete payment of his share, but still a partial fulfillment of the whole obligation.) (e) When a solidary debtor pays only the part demandable because the rest are not yet demandable on account of their being subject to different terms and conditions; (f) In case of compensation, when one debt is larger than the other, it follows that a balance is left; (g) When work is to be done by parts. Where should an obligation be paid? (Art. 1251) (a) The place designated in the obligation; or (b) The place where the thing was at the moment the obligation was constituted in the absence of an express stipulation and if the undertaking is to deliver a determinate thing; or (c) Place of domicile of the debtor in case the delivery involves an indeterminate / generic thing. APPLICATION OF PAYMENT Defined as the designation of debt to which payment must be applied when the debtor has several obligations of the same kind in favor of the same creditor. REQUISITES: (a) There must be two or more debts; (b) The debt must be of the same kind; (c) The debts are owed by the same debtor in favor of the same creditor thus, there must be ONLY ONE debtor and ONLY ONE creditor; (d) All debts must be due; (e) The payment is not enough to extinguish all debts. It is the debtor who is given by the law the right to select which of his debts he is paying. RULES ON APPLICATION a) The debtor shall designate the debt to which payment shall be applied. The right to specify which among various obligations to the same creditor is to be satisfied first rests with the debtor; b) The debt indicated in creditor's receipt if the debtor did not designate and the debtor did not object; c) If there is no designated debt in accordance with the above stated rules application shall be deemed made by operation of law as follows; (1) Payment shall be applied to the interest first before application to the principal; (2) Payment shall be applied to ; 1st: the debt that is most onerous; 2nd: If debts are of the same terms and conditions and burden payment shall be applied in proportion to the debt. If the debt produces interest, payment of the principal shall not be deemed to have been made until the interests have been covered. (Art. 1253) PAYMENT BY CESSION / ASSIGNMENT IN FAVOR OF CREDITORS Is a special form of payment whereby the debtor abandons all of his property for the benefit of his creditors in order that from the proceeds thereof the latter may obtain payment of their credits. R E Q U I S I T E S o f C E S S I O N / V O L U N TA R Y ASSIGNMENT: (a) There must be two or more debts; (b) There must be two or more creditors; (c) Complete or partial insolvency of debtor; (d) Abandonment of all debtor's properties not exempt from execution unless exemption is validly waived by debtor in favor of creditors; (e) Acceptance or consent on the part of creditors for it cannot b e imposed on an unwilling creditors. EFFECTS OF ASSIGNMENT: CESSION / VOLUNTARY (a) The creditors do not become the owners; they are merely assignees with authority to sell; (b) The debtor is released up to the amount of the net proceeds of the sale, unless there is a stipulation to the contrary. The balance remains collectible; (c) Creditors will collect credits in the order of preference agreed upon, or in default of agreement, in the order ordinarily established by law. DACION EN PAGO CESSION a. Does not affect ALL the properties; a. In general, affects ALL properties of the debtor; b. Does not require plurality creditors – one debtor & creditor; the of b. Requires more than one creditor; c. Only the specific or concerned c. Requires the consent of ALL the creditor’s consent is required; creditors; d. May take place during the solvency d. Requires full or partial insolvency; of the debtor; e. Transfers ownership upon delivery – e. Does not transfer ownership – extinguishes obligations delivery merely effect assignment to dispose the properties; f. This is really an act of novation. f. Not an act of novation When an obligation becomes due and demandable but the creditor refuses to accept payment, what remedies are available to the debtor? ANSWER: If the creditor to whom tender of payment has been made refuses without just cause to accept it, the debtor shall be released from responsibility by the consignation of the thing or sum due. Tender of payment and consignation (Arts. 12561261) * Tender of payment consist in the manifestation made by the debtor to the creditor of his decision to comply immediately with his obligation. Consignation, on the other hand, refers to the deposit of the object of the obligation in a competent court in accordance with the rules prescribed by law after refusal or inability of the creditor to accept the tender of payment. REQUISITES OF A VALID TENDER OF PAYMENT: (1) The tender must be made to the creditor; (2) The payment tendered must be complete, regular and identical; (3) The payment must not only be complete but must also include accessory obligations like payment of interest; (4) The obligation must be due; and (5) The tender must be unconditional. ESSENTIAL REQUISITES OF CONSIGNATION: (a) Existence of a valid debt; (b) Valid prior tender, unless tender is excused; (c) Prior notice of consignation (before notice); Without such notice consignation is VOID. (d) Actual consignation (notice) (e) Subsequent notice of consignation. Consignation must be made: 1) By depositing the very object that is due and not another; 2) With the proper judicial authority which in certain case may include the sheriff; 3) Accompanied by proof that tender had been duly made, unless tender is excused and the first notice of consignation had already been sent. EFFECT OF DEPOSIT: The property is in custodia legis hence, exempted from attachments and execution. Spouses Bonrostro vs. Spouses Luna (G.R. No. 172346, July 24, 2013) Tender of payment "is the manifestation by the debtor of a desire to comply with or pay an obligation. If refused without just cause, the tender of payment will discharge the debtor of the obligation to pay but only after a valid consignation of the sum due shall have been made with the proper court." "Consignation is the deposit of the proper amount with a judicial authority in accordance with rules prescribed by law, after the tender of payment has been refused or because of circumstances which render direct payment to the creditor impossible or inadvisable." "Tender of payment, without more, produces no effect." "To have the effect of payment and the consequent extinguishment of the obligation to pay, the law requires the companion acts of tender of payment and consignation." As to the effect of tender of payment on interest, noted civilist Arturo M. Tolentino explained as follows: When a tender of payment is made in such a form that the creditor could have immediately realized payment if he had accepted the tender, followed by a prompt attempt of the debtor to deposit the means of payment in court by way of consignation, the accrual of interest on the obligation will be suspended from the date of such tender. But when the tender of payment is not accompanied by the means of payment, and the debtor did not take any immediate step to make a consignation, then interest is not suspended from the time of such tender. x x x x (Emphasis supplied) When shall consignation without tender of payment produce payment? (a) When the creditor is absent or unknown or does not appear; (b) When he is incapacitated to receive the payment at the time it is due; (c) When without just cause, he refuses to give a receipt; (d) When two or more persons claim the same right to collect; (e) When the title of the obligation has been lost. LOSS OF THE THING DUE Loss of determinate thing due or impossibility or difficulty of performance (Arts. 1262, 1266-1267) * Defined as: Means that the thing which constitutes the object of the obligations perishes, or goes out of commerce of man, or disappears in such a way that its existence is unknown or it cannot be recovered. In its broad sense, it means impossibility of compliance with the obligation through any cause. Requisites: a. The thing which is lost is determinate; b. The thing is lost without any fault of the debtor. If the thing is lost through the fault of the debtor, the obligation is transformed into an obligation to indemnify the obligee or creditor for damages; c. The thing is lost before the debtor has incurred in delay. Exceptions to the rule that loss or destruction of the thing due shall extinguish obligation: (a) When by law, the obligor is liable for fortuitous events; (b) When by stipulation, the obligor is liable even for fortuitous events; (c) When the nature of the obligation requires the assumption of risk; (d) When the loss of the thing is due partly to the fault of the debtor; (e) When the loss of the thing occurs after the debtor has incurred in delay; (f) When the debtor promised to deliver the same thing to two or more persons who do not have the same interest; (g) When the obligation is generic; (h) When the debt of a certain and determinate thing proceeds from a criminal offense. Osmena III vs. Social Security of the Philippines (G.R. No. 165272, September 13, 2007, [533 SCRA 313]) Under the law on obligations and contracts, the obligation to give a determinate thing is extinguished if the object is lost without the fault of the debtor. And per Art. 1192 (2) of the Civil Code, a thing is considered lost when it perishes or disappears in such a way that it cannot be recovered. In a very real sense, the interplay of the ensuing factors: a) the BDO-EPCIB merger; and b) the cancellation of subject Shares and their replacement by totally new common shares of BDO, has rendered the erstwhile 187.84 million EPCIB shares of SSS "unrecoverable" in the contemplation of the adverted Civil Code provision. With the above consideration, respondent SSS or SSC cannot, under any circumstance, cause the implementation of the assailed resolutions, let alone proceed with the planned disposition of the Shares, be it via the traditional competitive bidding or the challenged public bidding with a Swiss Challenge feature. At any rate, the moot-and-academic angle would still hold sway even if it were to be assumed hypothetically that the subject Shares are still existing. This is so, for the supervening BDO-EPCIB merger has so effected changes in the circumstances of SSS and BDO/BDO Capital as to render the fulfillment of any of the obligations that each may have agreed to undertake under either the Letter-Agreement, the SPA or the Swiss Challenge package legally impossible. When the service has become so difficult as to be manifestly beyond the contemplation of the parties, total or partial release from a prestation and from the counter-prestation is allowed. (Osmena III vs. Social Security of the Philippines) So vs. Food Fest Land Inc. (G.R. No. 183628, April 7, 2010) As for Food Fest’s invocation of the principle of rebus sic stantibus as enunciated in Article 1267 of the Civil Code to render the lease contract functus officio, and consequently release it from responsibility to pay rentals, the Court is not persuaded. Article 1267 provides: Article 1267. When the service has become so difficult as to be manifestly beyond the contemplation of the parties, the obligor may also be released therefrom, in whole or in part. This article, which enunciates the doctrine of unforeseen events, is not, however, an absolute application of the principle of rebus sic stantibus, which would endanger the security of contractual relations. The parties to the contract must be presumed to have assumed the risks of unfavorable developments. It is, therefore, only in absolutely exceptional changes of circumstances that equity demands assistance for the debtor. Food Fest claims that its failure to secure the necessary business permits and licenses rendered the impossibility and nonmaterialization of its purpose in entering into the contract of lease, in support of which it cites the earlier-quoted portion of the preliminary agreement dated July 1, 1999 of the parties. The cause or essential purpose in a contract of lease is the use or enjoyment of a thing. A party’s motive or particular purpose in entering into a contract does not affect the validity or existence of the contract; an exception is when the realization of such motive or particular purpose has been made a condition upon which the contract is made to depend. The exception does not apply here. It is clear that the condition set forth in the preliminary agreement pertains to the initial application of Food Fest for the permits, licenses and authority to operate. It should not be construed to apply to Food Fest’s subsequent applications.(So vs. Food Fest Land Inc.) CONDONATION OR REMISSION OF DEBT Condonation or remission of debt (Art. 1270) * Defined as: Is an act of liberality by virtue of which the obligee, without receiving any price or equivalent, renounces the enforcement of the obligation as a result of which it is extinguished in its entirety or in that part or aspect of the same to which the remission refers. Gratuitous abandonment by the creditor of his right. REQUISITES: (a) There must be an agreement since acceptance of the offer is required; (b) The parties must be capacitated and must consent; (c) There must be a subject matter / object of remission otherwise, there would be nothing to condone; (d) The cause or consideration must be liberality for remission is ESSENTIALLY GRATUITOUS. Otherwise, the act may be a dation in payment, or a novation, or a compromise; (e) The obligation remitted must have been demandable at the time of remission; (f) The remission must not be inofficious; (g) Formalities of a donation are required in the case of an express (not implied) remission; (h) Waivers or remissions are not to be presumed generally. They must be clearly and convincingly shown, either by express stipulation, or by acts admitting of no other reasonable explanations. The delivery of a private document evidencing a credit, made voluntarily by the creditor to the debtor, implies the renunciation of the action which the former had against the latter. If in order to nullify this waiver it should be claimed to be inofficious, the debtor and his heirs may uphold it by proving that the delivery of the document was made in virtue of payment of the debt. (Art. 1271) CONFUSION OR MERGER DEFINITION: The merger of characters of creditor and debtor in the same person by virtue of which the obligation is extinguished. It is the meeting in the same person of the qualities of creditor and debtor with respect to one and the same obligation. REQUISITES: (1) The merger of the characters of creditor and debtor must be in the same person; (2) That it must take place in the person of either the principal creditor or principal debtor; (3) That it must complete and definite; (4) The very obligation involved must be the same or identical. EXAMPLE OF MERGER: A makes a check payable to bearer, and hands the check to C, who hands it to D who finally hands it to A. Here A owes himself, a clear case of merger, and hence the obligation of A is extinguished. COMPENSATION DEFINITION: A mode of extinguishing in their concurrent amount those obligations of persons who in their own right are creditors and debtors of each other. A figurative operation weighing two obligations simultaneously in order to extinguish them to the extent in which the amount of one is covered by the amount of the other. REQUISITES: (a) There must be two parties, who in their own right, are principal creditors and principal debtors of each; (b) Both debts must consist in money, or if the things due are fungibles (consumables), they must be of the same kind and quality; (c) Both debts must be due; (d) Both debts must be liquidated and demandable; (e) There must be no retention or controversy commenced by third persons over either of the debts and communicated in due time to the debtor; (f) The compensation must not be prohibited by law. Lao vs. Special Plans Inc. (G.R. No. 164791, June 29, 2010) The Civil Code provides that compensation shall take place when two persons, in their own right, are creditors and debtors of each other. In order for compensation to be proper, it is necessary that: (1) Each one of the obligors be bound principally and that he be at the same time a principal creditor of the other; (2) Both debts consist in a sum of money, or if the things due are consumable, they be of the same kind, and also of the same quality if the latter has been stated; (3) The two debts are due; (4)The debts are liquidated and demandable;(5) Over neither of them be any retention or controversy, commenced by third parties and communicated in due time to the debtor. Petitioners failed to properly discharge their burden to show that the debts are liquidated and demandable. Consequently, legal compensation is inapplicable. A claim is liquidated when the amount and time of payment is fixed. If acknowledged by the debtor, although not in writing, the claim must be treated as liquidated. When the defendant, who has an unliquidated claim, sets it up by way of counterclaim, and a judgment is rendered liquidating such claim, it can be compensated against the plaintiff’s claim from the moment it is liquidated by judgment. COMPENSATION CONFUSION / MERGER 1. As to the number of persons: 1.As to the number of persons: There must be two persons who in There is only one person in whom their own right, are creditors and is merged the qualities of creditor and debtors of each other; debtor; 2. As to the number of obligations: There must be at least two. 2. As to the number of obligations: There is only one. NOVATION NOVATION: Is the substitution or change of an obligation by another, resulting in its extinguishment or modification, either by changing its object or principal conditions, or by substituting another in place of the debtor, or by subrogating a third person in the rights of the creditor. It is one of the modes of extinguishing obligations through the creation of a new one effected by the change or substitution of an obligatory relation by another with the intention of substantially extinguishing or modifying the same. Requisites: (a) There is an existence of a previous valid contract; (b) Agreement of the parties to the new contract; (c) The extinguishment of the old obligation; (d) Validity of the new one. ANIMUS NOVANDI Novation is never presumed, and the animus novandi, whether totally or partially, must appear by express agreement of the parties, or by their acts that are too clear and unmistakable. EMILLA M. URACA, CONCORDIA D. CHING and ONG SENG, represented by ENEDINO H. FERRER versus COURT OF APPEALS, JACINTO VELEZ, JR., CARMEN VELEZ TING, AVENUE MERCHANDISING, INC., FELIX TING AND ALFREDO GO (G.R. No. 115158, September 5, 1997) FACTS: The Velezes were owners of the lot and commercial building in question located at Progreso and M.C. Briones Streets in Cebu City. Petitioners were lessees of said commercial building. On July 8, 1985, the Velezes through Carmen Velez Ting wrote a letter to petitioners offering to sell the subject property for P1,050,000.00 and at the same time requesting petitioners to reply in three days. On July 10, 1985, petitioners through Atty. Escolastico Daitol sent a reply-letter to the Velezes accepting the aforesaid offer to sell. On July 11, 1985, petitioner Emilia Uraca went to see Carmen Ting about the offer to sell but she was told by the latter that the price was P1,400,000.00 in cash or manager's check and not P1,050,000.00 as erroneously stated in their letter-offer after some haggling. Emilia Uraca agreed to the price of P1,400,000.00 but counter-proposed that payment be paid in installments with a down payment of P1,000,000.00 and the balance of P400,000 to be paid in 30 days. Carmen Velez Ting did not accept the said counter-offer of Emilia Uraca although this fact is disputed by Uraca. No payment was made by petitioners to the Velezes on July 12, 1985 and July 13, 1985.On July 13, 1985, the Velezes sold the subject lot and commercial building to Avenue Group for P1,050,000.00 net of taxes, registration fees, and expenses of the sale. At the time the Avenue Group purchased subject property on July 13, 1985 from the Velezes, the certificate of title of the said property was clean and free of any annotation of adverse claims or lis pendens. On July 31, 1985 petitioners filed the instant complaint against the Velezes. On August 1, 1985, petitioners registered a notice of lis pendens over the property in question with the Office of the Register of Deeds. On October 30, 1985, the Avenue Group filed an ejectment case against petitioners ordering the latter to vacate the commercial building standing on the lot in question.Thereafter, petitioners filed an amended complaint impleading the Avenue Group as new defendants (after about 4 years after the filing of the original complaint). The trial court found two perfected contracts of sale between the Velezes and the petitioners involving the real property in question. The first sale was for P1,050,000.00 and the second was for P1,400,000.00. In respect to the first sale, the trial court held that "due to the unqualified acceptance by the plaintiffs within the period set by the Velezes, there consequently came about a meeting of the minds of the parties not only as to the object certain but also as to the definite consideration or cause of the contract.“ And even assuming arguendo that the second sale was not perfected, the trial court ruled that the same still constituted a mere modificatory novation which did not extinguish the first sale. Hence, the trial court held that "the Velezes were not free to sell the properties to the Avenue Group." The CA held that there was a perfected contract of sale of the property for P1,050,000.00 between the Velezes and herein petitioners. It added, however, that such perfected contract of sale was subsequently novated. Thus, it ruled: "Evidence shows that was the original contract. However, the same was mutually withdrawn, cancelled and rescinded by novation, and was therefore abandoned by the parties when Carmen Velez Ting raised the consideration of the contract by P350,000.00, thus making the price P1,400,000.00 instead of the original price of P1,050,000.00. Since there was no agreement as to the 'second' price offered, there was likewise no meeting of minds between the parties, hence, no contract of sale was perfected.“ The Court of Appeals added that, assuming there was agreement as to the price and a second contract was perfected, the later contract would be unenforceable under the Statute of Frauds. It further held that such second agreement, if there was one, constituted a mere promise to sell which was not binding for lack of acceptance or a separate consideration. ISSUE: WHETHER OR NOT THERE WAS A VALID NOVATION OF THE FIRST CONTRACT. RULING: The lynchpin of the assailed Decision is the public respondent's conclusion that the sale of the real property in controversy, by the Velezes to petitioners for P1,050,000.00, was extinguished by novation after the said parties negotiated to increase the price to P1,400,000.00. Since there was no agreement on the sale at the increased price, then there was no perfected contract to enforce. The Court notes that the petitioners accepted in writing and without qualification the Velezes' written offer to sell at P1,050,000.00 within the three-day period stipulated therein. Hence, from the moment of acceptance on July 10, 1985, a contract of sale was perfected since undisputedly the contractual elements of consent, object certain and cause concurred. Thus, this question is posed for our resolution: Was there a novation of this perfected contract? Article 1600 of the Civil Code provides that "(s)ales are extinguished by the same causes as all other obligations, . . . ." Article 1231 of the same Code states that novation is one of the ways to wipe out an obligation. Extinctive novation requires: (1) the existence of a previous valid obligation; (2) the agreement of all the parties to the new contract; (3) the extinguishment of the old obligation or contract; and (4) the validity of the new one. The foregoing clearly show that novation is effected only when a new contract has extinguished an earlier contract between the same parties. In this light, novation is never presumed; it must be proven as a fact either by express stipulation of the parties or by implication derived from an irreconcilable incompatibility between old and new obligations or contracts. After a thorough review of the records, the SC find this element lacking in the case at bar. As aptly found by the Court of Appeals, petitioners and the Velezes did not reach an agreement on the new price of P1,400,000.00 demanded by the latter. In this case, the petitioners and the Velezes clearly did not perfect a new contract because the essential requisite of consent was absent, the parties having failed to agree on the terms of the payment. True, petitioners made a qualified acceptance of this offer by proposing that the payment of this higher sale price be made by installment, with P1,000,000.00 as down payment and the balance of P400,000.00 payable 30 days thereafter. Under Art. 1319 of the Civil Code, such qualified acceptance constitutes a counteroffer and has the ineludible effect of rejecting the Velezes' offer. Indeed, petitioners' counter-offer was not accepted by the Velezes. It is well-settled that “an offer must be clear and definite, while an acceptance must be unconditional and unbounded, in order that their concurrence can give rise to a perfected contract.“ In line with this basic postulate of contract law, "a definite agreement on the manner of payment of the price is an essential element in the formation of a binding and enforceable contract of sale.”Since the parties failed to enter into a new contract that could have extinguished their previously perfected contract of sale, there can be no novation of the latter. Consequently, the first sale of the property in controversy, by the Velezes to petitioners for P1,050,000.00, remained valid and existing. TRANSPACIFIC BATTERY, CORPORATION and MICHAEL G. SAY versus SECURITY BANK & TRUST CO. (G.R. No. 173565, May 8, 2009) FACTS: Transpacific, represented by its officers, Michael G. Say, Josephine G. Say and Myrna Magpantay, entered into a Credit Line Agreement4 with the Bank. Consequently, the officers in behalf of Transpacific applied for 9 letters of credit (LC) with the Bank to facilitate the importation and/or purchases of certain merchandise, goods and supplies for its business. The Bank issued the corresponding LCs to Transpacific. Transpacific then executed and delivered to the Bank, as entrustor 9 trust receipt agreements. With for the release of the imported merchandise and supplies in its favor, with the aforementioned officers, binding themselves to be solidarily liable with Transpacific to the Bank for the value of the merchandise and supplies covered by the trust receipts. In his answer, Michael countered that the obligation had already been paid or if not totally paid, the same is very minimal. He further contended that said obligation had already been extinguished by novation when the Bank restructured the obligation of Transpacific. He also claimed that the Bank is guilty of laches for its inaction for an unreasonable length of time. The trial court ruled in favor of the Bank, on appeal the Court of Appeals affirmed the Decision of the trial court. The Court of Appeals’ decision centered on the finding that there was no novation in the restructuring of the obligation, therefore, the individual petitioners as solidary debtors cannot be exonerated from the obligation of Transpacific. ISSUE: Whether or not the obligation under the trust receipts was novated by the restructuring agreement. RULING: Novation is a mode of extinguishing an obligation by changing its objects or principal obligations, by substituting a new debtor in place of the old one, or by subrogating a third person to the rights of the creditor. Novation is never presumed, and the animus novandi, whether totally or partially, must appear by express agreement of the parties, or by their acts that are too clear and unmistakable. The extinguishment of the old obligation by the new one is a necessary element of novation, which may be effected either expressly or impliedly. The contracting parties must incontrovertibly disclose that their object in executing the new contract is to extinguish the old one. Upon the other hand, no specific form is required for an implied novation, and all that is prescribed by law would be an incompatibility between the two contracts. The test of incompatibility is whether the two obligations can stand together, each one having its independent existence. If they cannot, they are incompatible and the latter obligation novates the first. Corollarily, changes that breed incompatibility must be essential in nature and not merely accidental. The incompatibility must take place in any of the essential elements of the obligation, such as its object, cause or principal conditions thereof; otherwise, the change would be merely modificatory in nature and insufficient to extinguish the original obligation. Undoubtedly, there is no express novation since the restructuring agreement does not state in clear terms that the obligation under the trust receipts is extinguished and in lieu thereof the restructuring agreement will be substituted. Neither is there an implied novation since the restructuring agreement is not incompatible with the trust receipt transactions. Indeed, the restructuring agreement recognizes the obligation due under the trust receipts when it required "payment of all interest and other charges prior to restructuring." With respect to Michael, there was even a proviso under the agreement that the amount due is subject to "the joint and solidary liability of Spouses Miguel and Mary Say and Michael Go Say." While the names of Melchor and Josephine do not appear on the restructuring agreement, it cannot be presumed that they have been relieved from the obligation. The old obligation continues to subsist subject to the modifications agreed upon by the parties. The circumstance that motivated the parties to enter into a restructuring agreement was the failure of petitioners to account for the goods received in trust and/or deliver the proceeds thereof. To remedy the situation, the parties executed an agreement to restructure Transpacific’s obligations. The Bank only extended the repayment term of the trust receipts from 90 days to one year with monthly installment at 5% per annum over prime rate or 30% per annum whichever is higher. Furthermore, the interest rates were flexible in that they are subject to review every amortization due. Whether the terms appeared to be more onerous or not is immaterial. Courts are not authorized to extricate parties from the necessary consequences of their acts. The parties will not be relieved from their obligations as there was absolutely no intention by the parties to supersede or abrogate the trust receipt transactions. The intention of the new agreement was precisely to revive the old obligation after the original period expired and the loan remained unpaid. Well-settled is the rule that, with respect to obligations to pay a sum of money, the obligation is not novated by an instrument that expressly recognizes the old, changes only the terms of payment, adds other obligations not incompatible with the old ones, or the new contract merely supplements the old one. Milla vs. People [664 SCRA 309, (2012)] Novation is never presumed , and that animus novandi, whether totally or partially, must appear by express agreement of the parties, or by their acts that are too clear and unequivocal to be mistaken. Philippine National Bank vs. Soriano [682 SCRA 243, (2012)] With respect to obligations to pay a sum of money, the obligation is not novated by an instrument that expressly recognizes the old, changes only the terms of payment, adds other obligations not incompatible with the old ones, or the new contract merely supplements the old one. Azarcon vs. People (G.R. No. 185906, June 29, 2010) Iloilo Traders Finance Inc. vs. Heirs of Oscar Soriano Jr. (G.R. No. 149683, June 16, 2003) on novation teaches: "Novation may either be extinctive or modificatory, much being dependent on the nature of the change and the intention of the parties. Extinctive novation is never presumed; there must be an express intention to novate; in cases where it is implied, the acts of the parties must clearly demonstrate their intent to dissolve the old obligation as the moving consideration for the emregence of a new one. Implied novation necessitates that the incompatibility between the old and new obligation be total on every point such that the new obligation is completely superseded by the new one. The test of incompatibility is whether they can stand together, each one having an independent existence; if they cannot and are irreconcilable, the subsequent obligation would also extinguish the first. An extinctive novation would thus have the twin effects of first, extinguishing an existing obligation and second, creating a new one in its stead. This kind of novation presupposes a confluence of four essential requisites: (1) a previous valid obligation; (2) an agreement of all parties concerned to a new contract; (3) the extinguishment of the old obligation; and (4) the birth of a valid new obligation. Novation is merely modificatory where the change brought about by any subsequent agreement is merely incidental to the main obligation (e.g. a change in interets rates or an extension of time to pay); in this instance, the new agreement will not have the effect of extinguishing the first but would merely supplement it or supplant some but not all of its provisions. What is EXPROMISION & DELEGACION? ANSWER: If the substitution of debtors is effected with the consent of the creditor at the instance of the new debtor even without the knowledge or against the will of the old debtor, it is called EXPROMISION. If the substitution of debtors is effected with the consent of the creditor at the instance of the old debtor with the concurrence of the new debtor it is called DELEGACION. Requisites of EXPROMISION: a) The initiative must come from the third person who will be the new debtor; b) The new debtor and the creditor must consent; c) The old debtor must be excused or released from his obligation. Example: BINAY owes NOYNOY P10,000.00. JOHNNY a friend of BINAY, approaches NOYNOY and tells him “I will pay you what BINAY owes you. From now on, consider me your debtor, not BINAY. BINAY is to be excused. Requisites of DELEGACION: a) The initiative comes from the old debtor; b) All the parties concerned must consent or agree which means there must be consent from the new debtor and acceptance of the creditor. Example: If BINAY tells NOYNOY, “My friend JOHNNY will pay my debt. I therefore wish to be released from my obligation.” and both JOHNNY and NOYNOY agree, this would be a correct example of delegacion. The PARTIES in DELEGACION: (a) The delegante – the original debtor (b) The delegario – the creditor (c) The delegado – the new debtor EXPROMISSION DELEGACION 1. The initiative does not come from 1. The initiative comes from the old the old debtor; debtor; 2. Consent of the old debtor, the 2. Consent of the old debtor is not creditor, and the third person are present and not even necessary; present; 3. The debtor is released; 3. The debtor is released; 4. Insolvency of the new debtor 4. Insolvency of the new debtor revives the obligation of the debtor if; before and after the novation does (a) Insolvency is anterior - existing at not revive the obligation of the debtor. the time of novation; and (b) of public knowledge or known to the debtor. Requisites to hold the OLD DEBTOR liable if the NEW DEBTOR is insolvent: (a) The insolvency was already existing and of public knowledge at the time of delegation; (b) Or the insolvency was already existing and known to the debtor at the time of delegation. If the new obligation is void, the original one shall subsist, unless the parties intended that the former relation should be extinguished in any event. (Art. 1297) SUBROGATION: It is the transfer of all the rights of the creditor to a third person. Thus, this involves novation by changing the creditor. It is the substitution of one person by another with reference to a lawful claim or right, so that he who is substituted succeeds to the rights of the other in relation to a debt or claim including its remedies or securities. EFFECTS OF SUBROGATION: (1) The third person acquires the right that the creditor may have against the debtor (the right to demand payment); (2) The right to proceed against the debtor or any security like thr right to forclose any mortgage. Malayan Insurance Co., Inc. vs. Alberto [G.R. No. 194320, February 1, 2012, (664 SCRA 791)] Subrogation is the substitution of one person by another with reference to a lawful claim or right, so that he who is substituted succeeds to the rights of the other in relation to a debt or claim, including its remedies or securities. The principle covers a situation wherein an insurer has paid a loss under an insurance policy is entitled to all the rights and remedies belonging to the insured against a third party with respect to any loss covered by the policy. It contemplates full substitution such that it places the party subrogated in the shoes of the creditor, and he may use all means that the creditor could employ to enforce payment. We have held that payment by the insurer to the insured operates as an equitable assignment to the insurer of all the remedies that the insured may have against the third party whose negligence or wrongful act caused the loss. The right of subrogation is not dependent upon, nor does it grow out of, any privity of contract. It accrues simply upon payment by the insurance company of the insurance claim. The doctrine of subrogation has its roots in equity. It is designed to promote and to accomplish justice; and is the mode that equity adopts to compel the ultimate payment of a debt by one who, in justice, equity, and good conscience, ought to pay. Kinds of SUBROGATION: (a) From the viewpoint of cause or origin: a.1. conventional or voluntary subrogation – This requires an agreement; and the consent of the original parties and of the creditor; a.2. legal subrogation – This takes place by operation of law. Ex. There is automatic subrogation if the insurer, in property insurance, paid the insured. The insurer is subrogated to all the rights of the insured. (b) From the viewpoint of extent: b.1. Total subrogation; b.2. Partial Subrogation. It is presumed that there is legal subrogation: (Art. 1302) (1) When a creditor pays another creditor who is preferred, even without the debtor's knowledge; (2) When a third person, not interested in the obligation, pays with the express or tacit approval of the debtor; (3) When, even without the knowledge of the debtor, a person interested in the fulfillment of the obligation pays, without prejudice to the effects of confusion as to the latter's share. When a creditor pays another creditor who is preferred, even without the debtor's knowledge. Example: GLORIA has two creditors; NOYNOY, who is a mortgage creditor for P1M; and FIDEL, who is an ordinary creditor for P500T. FIDEL without GLORIA’s knowledge paid GLORIA’s debt of P1M to NOYNOY. Here FIDEL will be subrogated in the rights of NOYNOY. This means that FIDEL will himself now be a mortgage creditor for P1M and an ordinary creditor for P500T. When a third person, not interested in the obligation, pays with the express or tacit approval of the debtor Example: GLORIA owes NOYNOY P1M secured by a mortgage. MIKE, a classmate and ex-boyfriend of GLORIA and having no connection with the contract at all, paid NOYNOY the P1M with GLORIA’s approval. When, even without the knowledge of the debtor, a person interested in the fulfillment of the obligation pays, without prejudice to the effects of confusion as to the latter's share Example: GRACE owes CHIZ P1M secured by a mortgage and by a guaranty of RUDY. If RUDY even without GRACE’s knowledge, pays CHIZ the P1M, RUDY will be subrogated in CHIZ’s place. But of course the guaranty is extinguished. THANK YOU!