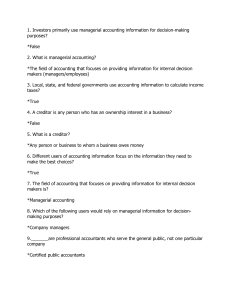

WEEK 1-3 (ULOa) Management Accounting. It measures, analyzes, and reports financial and non-financial information that helps managers make decisions to fulfill the goals of an organization. Financial Accounting. It focuses on reporting to external parties; measures and records business transactions and provides financial statements that are based on GAAP. Cost Accounting. It provides information for managerial accounting and financial accounting. 1.0 The Basic Objective of Accounting To provide (stakeholders) with useful information about a business enterprise to help them make rational economic decisions. To provide external users with useful financial information about the financial performance health, and cash flows of a business enterprise to help them make investment and credit decisions. To provide internal users with financial and non-financial information about a business enterprise that helps them make business decision and achieve its goals. The study of modern cost accounting yields insights into how managers and accountants can contribute to successfully running their businesses. 1.1 Financial Accounting, Management Accounting, and Cost Accounting Accounting systems take economic events and transactions, such as sales and materials purchases, and process the data into information helpful to managers, sales representatives, production supervisors, and others. Processing any economic transaction means collecting, categorizing, summarizing, and analyzing. Accounting systems provide the information found in the income statement, the balance sheet, the statement of cash flow, and in performance reports, such as the cost of serving customers or running an advertising campaign. Managers use accounting information to administer the activities, businesses, or functional areas they oversee and to coordinate those activities, businesses, or functions within the framework of the organization. Individual managers often require the information in an accounting system to be presented or reported differently. Example:Sales order information: Sales manager → total dollar amount of sales to determine the commissions to be paid Distribution manager → sales order quantities by geographic region and requested delivery dates to ensure timely delivery Manufacturing manager → quantities of various products & desired shipping date to develop effective production schedule. Companies create a database—sometimes called a data warehouse or info-barn, consisting of small, detailed bits of information that can be used for multiple purposes. Many companies are building their own Enterprise Resource Planning (ERP) systems → single databases that collect data and feed it into applications that support the company's business activities, such as purchasing, production, sales, and distribution. 1.1.1 Financial Accounting It focuses on reporting to external parties and measures and records business transactions and provides financial statements that are based on GAAP. 1.1.2 Managerial Accounting It measures, analyzes, and reports financial and non-financial information that helps managers make decisions to fulfill the goals of an organization. It is used to develop, communicate, and implement strategy. It is also used to coordinate product design, production, and marketing decisions and to evaluate performance. The information and reports generated do not have to follow set principles or rules. The key questions are always: -- How will this information help managers do their jobs better? -- Do the benefits of producing this information exceed the costs? Benefits > Costs 1.1.3 Comparing Managerial Accounting and Financial Accounting Both fields of accounting deal with the economic events of a business and require that the results of that company's economic events be quantified and communicated to interested parties. Reports such as balance sheets, income statements, and statements of cash flows are common to both fields of accounting. Management Accounting Purpose Information Primary users Financial Accounting of •Help managers make •Communicate organization’s decisions to fulfill an financial positions to investors, organization' goals banks, regulators and other outside parties •Special-purpose for a particular user for a specific •Help external users to make investment & credit decisions Internal users: managers of External users: the organizations at all levels banks, creditors, and suppliers investors, regulators, Focus emphasis and Current and Future-oriented Past-oriented (reports on 2010 (budget for 2011 prepared in performance prepared in 2011) 2010) Rules measurement reporting of Internal measures and reports and do not have to follow GAAP but are based on cost-benefit analysis Financial statements must follow GAAP, and be certified and regulated by external, independent auditors Time span and type •As frequent as needed Periodic (E.g. annual/quarterly) of reports financial reports, primarily on •Varies from hourly information the company as a whole to 15 to 20 years, with financial and non-financial reports on products, departments, territories, and strategies Behavioural implications Designed to influence the Primarily reports economic behaviour of mangers and events but also influences other employees behaviour because manager's compensation (bonuses) is often based on reported financial results Guideline for Focus is on relevance judging usefulness of information Focus is on Reliability Verification process Internal audit Independent-external audit 1.1.4 Cost Accounting Cost accounting provides information for managerial accounting and financial accounting. It measures, analyzes, and reports financial and non-financial information relating to the costs of acquiring or using resources in an organization -- E.g. calculating the cost of a product answers financial accounting's inventory-valuation needs and managerial accounting's decision-making needs (such as pricing and promotion). Collecting cost information is a function of the management decisions being made. Thus, the difference between managerial accounting and cost accounting is no so distinct, and it is often that both terms are used interchangeably. 1.1.5 Cost management Cost management is used to describe the approaches and activities of managers to use resources to increase value to customers and to achieve organizational goals. Decisions include whether to enter new markets, implement new processes, and change product designs. Information from accounting systems help managers to manage costs but are not cost management. Cost management includes decisions to incur additional costs. Example: To improve customer satisfaction and quality and to develop new products, with the goal of enhancing revenues and profits. 2.0 Strategic Decisions and the Managerial Accountant Strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives. Strategy describes how an organization will compete and the opportunities its managers should seek and pursue. Business follow one of two broad strategies: 1.Cost leadership strategy → providing quality products or services at low prices by judiciously managing their costs. 2.Product differentiation strategy → ability to offer differentiated or unique products or services that appeal to their customers and are often priced higher than the lesspopular products or services of their competitors. Managerial accountants work closely with managers in formulating strategy by providing information about the sources of competitive advantage. Strategic cost management describes cost management that specifically focuses on strategic issues. Managerial accounting information helps managers formulate strategy by answering questions such as: •Who are our most important customers, and how can we be competitive and deliver value to them? •What substitute product exist in the marketplace, and how do they differ from our product? •What is our most critical capability? Technology, production, or marketing? How can we leverage it for new strategic initiatives •Will adequate cash be available to fund the strategy, or will additional funds need to be raised? 3.0 Value Chain and Supply Chain Analysis and Key Success Factors Customers demand fair price as well as quality products delivered in a timely way. 3.1.1 Value-Chain Analysis Value chain is the sequence of business functions in which customer usefulness is added to the products. Six primary business functions: 1. new Research and development (R&D): Generating and experimenting with ideas related to products, services, or processes. ○HDTV and Blu-ray 2. and Design of products and processes: detailed planning, engineering, and testing of products processes. ○Flat screen, computer compatible, chip complexity, sizes, controls 3. and Production: procuring, transporting and storing (also called inbound logistic), coordinating, assembling (also called operating) resources to product a product or deliver a service ○Suppliers, make or buy, off-shoring 4. Marketing (sales): promoting and selling products/services to customers or potential customers. ○Advertising, promotion, pricing, availability 5. Distribution: processing orders and shipping products/services to customers (aka outbound logistics) ○Packaging, transportation mode, security, channels 6. Customer service: providing after-sales service to customers ○Timing, communication, repair, servicing Each of these business functions is essential to companies satisfying their costumers and keeping them satisfied and loyal over time. Companies use the term customer relationship management (CRM) to describe a strategy that integrate people and technology in all business functions to deepen relationships with customers, partners, and contributors. At different times and in different industries, one or more of these functions is more critical than others. Companies gain (in terms of cost, quality, and the speed of developing new products) if two or more of the individual business functions work concurrently as a team. Managers track the costs incurred in each value-chain category; their goal is to reduce costs and improve efficiency. Managerial accounting information helps managers make cost-benefit tradeoffs. 3.1.2 Supply-Chain Analysis Supply chain is the parts of the value chain associated with producing and delivering (production and distribution). Supply chain describe the flow of goods, services, and information from the initial sources of materials and services to the delivery of products to consumers, regardless of whether those activities occur in the same organizations or other organizations. Cost management emphasizes integrating and coordinating activities across all companies in the supply chain, to improve performance and reduce costs. Sample Supply Chain for a Cola Bottling company Suppliers of Ingredients → Manufacturer of Concentrate → Bottling Company → Distribution Company → Retail Company → Final Consumers 3.2 Key Success Factors Customers want companies to use the value chain and supply chain to deliver improving levels of performance regarding several (or even all) factors: 1. Cost and efficiency → companies face pressure to reduce cost. Managers must first understand the tasks and activities that cause costs to arise. They must also be aware of the price customers are willing to pay. From this target price, managers subtract the operating income they want to earn to arrive at the target cost (Price - Cost = Income). Managers strive to achieve the target cost by eliminating some activities and by reducing the costs of performing activities. 2. Quality → Customers expect high levels of quality. Total quality management (TQM) aims to improve operations throughout the value chain and to deliver products and service that exceed customer expectations. 3. Time → New product development time is the time it takes for new products to be created and brought to market. Customer-response time describe the speed at which an organization responds to customer requests which relates to customer satisfaction and loyalty. 4. Innovation → constant flow of innovative products/services is the basis for ongoing company success. Companies are increasingly applying the key success factors of cost and efficiency, quality, time, and innovation to promote sustainability—the development and implementation of strategies to achieve long-term financial, social, and environmental performance. Management accountants help managers track performance of competitors on the key success factors. •Competitive information serves as a benchmark and alerts managers to market changes. Companies are always seeking to continuously improve their operations. 4.0 Decision Making, Planning, and Control: The Five-Step Decision-Making Process To decide what to, managers works through the five-step decision making process 1. Identify the problem and uncertainties. 2. Obtain information → gathering information before making a decision helps managers gain a better understand of the uncertainties. 3. Make predictions about the future. 4. Make decisions by choosing among alternatives → When making decisions, strategy is a vital guidepost; many individuals in different parts of the organization at different times make decisions. Consistency with strategy binds individuals and time-lines together and provides a common purpose for disparate decisions. Aligning decisions with strategy enables an organization to implement its strategy and achieve its goals. Without this alignment, decisions will be uncoordinated, pull the organization in different directions, and produce inconsistent results. Steps 1 through 4 are collectively referred to as planning. Planning comprises selecting organization goals and strategies, predicting results under various alternative ways of achieving those goals, deciding how to attain the desired goals, and communicating the goals and how to achieve them to the entire organization. The most important planning tool when implementing strategy is a budget. A budget is the quantitative expression of a proposed plan of action by management and is an aid to coordinating what needs to be done to execute that plan. 5. Implement the decision, evaluate performance, and learn → Management accountants collect information to follow through on how actual performance compares to planned or budgeted performance (also referred to as score-keeping). The comparison of actual performance to budgetedperformance is the control or post-decision role of information. Control comprises taking actions that implement the planning decisions, deciding how to evaluate performance, and providing feedback and learning to help future decision making. Measuring actual performance informs managers how wellthey and their subunits are doing. Linking rewards to performance helps motivate managers. Learning is examining past performance (the control function) and systematically exploring alternative ways to make better-informed decisions and plans in the future. 5.0 Key Management Accounting Guidelines Three guidelines help management accountants provide the most value to their companies in strategic and operational decision making: Employ a cost-benefit approach, give full recognition to behavioural and technical considerations, and use different costs for different purposes. 6.0 Cost-Benefit Approach Managers continually face resource-allocation decisions, such as whether to purchase a new software package or hire a new employee. They use a cost-benefit approach when making these decisions: Resources should be spent if the expected benefits to the company exceed the expected costs. Managers rely on management accounting information to quantify expected benefits and expected costs although all benefits and costs are not easy to quantify. The cost-benefit approach is a useful guide for making resource-allocation decisions 7.0 Behavioural and Technical Considerations The technical considerations help managers make wise economic decisions by providing them with the desired information in an appropriate format and at the preferred frequency. Now consider the human (the behavioural) side of why budgeting is used. Budgets induce a different set of decisions within an organization because of better collaboration, planning, and motivation. The behavioural considerations encourage managers and other employees to strive for achieving the goals of the organization. Both managers and management accountants should always remember that management is not confined exclusively to technical matters. Management is primarily a human activity that should focus on how to help individuals do their jobs better 8.0 Different Costs for Different Purposes Managers should use alternative ways to compute costs in different decision-making situations, because there are different costs for different purposes. A cost concept used for the external-reporting purpose of accounting may not be an appropriate concept for internal, routine reporting to managers. 9.0 Organization Structure and the Management Accountant 9.1 Line and Staff Relationships Organizations distinguish between line management and staff management. Line management, such as production, marketing, and distribution management, is directly responsible for attaining the goals of the organization. Staff management, such as management accountants and information technology and human-resources management, provides advice, support, and assistance to line management. A plant manager (a line function) may be responsible for investing in new equipment. by A management accountant (a staff function) works as a business partner of the plant manager preparing detailed operating cost comparisons of alternative pieces of equipment. 9.2 The Chief Financial Officer and the Controller The chief financial officer (CFO)—also called the finance director in many countries—is the executive responsible for overseeing the financial operations of an organization. Their responsibilities include: Controllership—includes providing financial information for reports to managers and shareholders, and overseeing the overall operations of the accounting system Treasury—includes banking and short- and long-term financing, investments, and cash management Risk management—includes managing the financial risk of interest-rate and exchange-rate changes and derivatives management Taxation—includes income taxes, sales taxes, and international tax planning Investor relations—includes communicating with, responding to, and interacting with shareholders Internal audit—includes reviewing and analyzing financial and other records to attest to the integrity of the organization’s financial reports and to adherence to its policies and procedures The controller (also called the chief accounting officer) is the financial executive primarily responsible for management accounting and financial accounting. It should be clear that the successful management accountant must have technical and analytical competence as well as behavioural and interpersonal skills.