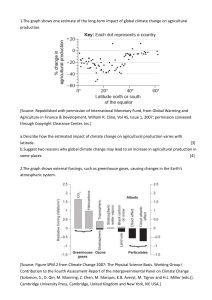

OUTLIERS GRAPHBOX This boxplot graph is used to display the dataset distribution. The median is indicated by a line inside the box, which displays the middle 50% of the data. The whiskers cover the greatest and lowest values that fall within the middle 50% of the data's interquartile range (IQR) and 1.5 times that range. Outliers are any values that are not within the whiskers.1.5 is the median CO2 emission. The data's middle 50% falls between 1 and 2. There are whiskers on 0.5 and 2.5. Nothing stands out. The true population median C02 emission could be up to 5% higher or lower than the sample median of 1.5 due to the 5% sampling error. Histogram Each of the bins on the histogram represents a different range of CO2 emissions. The number of observations in each bin is shown by the height of each bar in the histogram. The city's most typical CO2 emission range, according to the histogram, is between 1 and 1.5. Additionally, there are a sizable number of observations in the range of 0.5 to 1 and 1.5 to 2. The higher and lower extremes of the distribution have fewer observations. The histogram's general symmetrical shape indicates that the CO2 emissions are probably distributed properly. As a result, most observations are concentrated around the mean, and the number of observations decreases as one moves away from the mean. Spike plot Extreme data points that dramatically vary from the data's broad pattern are called outliers. The data point with the greatest frequency (9) with a CO2 emission of 2.2 seems to be the outlier in this instance. Given that this value is noticeably greater than the other data points, it may be an outlier. Taking into Account Outliers Even if the highest frequency CO2 emission of 2.2 looks to be an anomaly, it's crucial to take the data's nature and context into account. In the event that the highest frequency is associated with a particular occurrence or circumstance that could result in atypically large CO2 emissions, the 2.2 value may not be extreme. The 2.2 value is probably an exception if the data represents usual observations under normal conditions, and it should be looked into further to determine outlier. Dotplot The distribution of CO2 emissions from power plants is displayed in the dotplot that you sent. Every dot corresponds to one observation. We can search for data points that are far apart from the rest of the data to find outliers. Most likely, these two data points are anomalies. In the dotplot, there are two outliers one at 2.2 and one at 2.5.These outliers are probably the result of peculiar events, like an unexpected spike in electricity demand or a malfunctioning emissions control system. The distribution of the remaining data points is rather uniform, indicating that the power plant is generally operating effectively and within permissible emission limits. Symplot The relationship between the CO2 emission and its distance from the median is depicted in the graph. The two data points that are noticeably above the trend line appear to be the two outliers, based on the graph. There could be a measurement error or some other unusual event causing these outliers. The distance from the median CO2 emission and the CO2 emission will correlate even more strongly if these outliers are eliminated from the data set. All things considered, the graph offers some fascinating insights into the variables affecting CO2 emissions. It is crucial to remember that the results might not apply to a wider population due to the small size of the data set. Skewplot The data on CO2 emissions appears to be slightly positively skewed, according to the skew plot. This suggests that there are a few outlier observations with comparatively high CO2 emission values because the distribution's tail extends farther to the right than the left. The skew plot additionally demonstrates that the median, or middle value of the distribution, is marginally less than the mean. This supports the finding of positive skewness even more. There are a number of reasons why there may be outliers. Values that are outside the usual range of CO2 emissions may result from imprecise or inaccurate measurements. The data on CO2 emissions appears to be slightly positively skewed, according to the skew plot. This suggests that there are a few outlier observations with comparatively high CO2 emission values because the distribution's tail extends farther to the right than the left. The skew plot additionally demonstrates that the median, or middle value of the distribution, is marginally less than the mean. This supports the finding of positive skewness even more. There are a number of reasons why there may be outliers. Two sets of CO2 emission values are displayed in the data that is provided. CO2 emission values in the first set, which comprises observations 1 through 5, range from 0.647 to 0.725. Observations 37 through 41 from the second set have CO2 emission values ranging from 1.640 to 1.795. 0.647 is the lowest CO2 emission over all observations, and it is associated with observation 1. The highest CO2 emission, 1.795, is in line with observation 41. The second set's CO2 emission values are noticeably higher than the first set's. This implies that there might be two separate sets of observations, each with unique CO2 emission properties. The dataset contains 41 observations, according to the "Obs" column. The average CO2 emission over all observations is displayed in the "Mean" column and is 1.133. The standard deviation of CO2 emissions, which evaluates the variability of the data, is shown in the "Std. dev." column. Greater dispersion of the data is indicated by a higher standard deviation. The standard deviation in this case is 0.329, indicating a moderate degree of variation in CO2 emissions. The values for the minimum and maximum CO2 emissions are given in the "Min" and "Max" columns, respectively. 1.796 is the maximum value and 0.647 is the minimum. The trimmed means of the CO2 emission variable are displayed in the output at various percentages. By taking out a predetermined percentage of the dataset's lowest and highest values, trimmed means are computed. By doing this, the effect of outliers on the mean as a whole is reduced. In this case, the trimmed means were computed in phases of five for percentages ranging from 0 to 30. The table displays the trimmed mean and the number of trimmed observations for each percentage. The table indicates that the trimmed mean falls as the percentage of trimmed values rises. This is because removing more of the trimmed values will result in a lower overall trimmed mean because the trimmed values typically have a lower mean. The output that is provided shows the CO2 emission variable's trimmed means at various trimmed value counts. By taking out a predetermined number of the dataset's lowest and highest values, trimmed means are computed. By doing this, the effect of outliers on the mean as a whole is lessened. The trimmed means for the trimmed values of 0 and 2 were computed in this case. The table demonstrates the number of trimmed observations and the corresponding trimmed mean for each number of trimmed values. The table demonstrates that, in comparison to removing no observations, removing two observations (corresponding to two trimmed values) slightly lowers the trimmed mean. This implies that a small number of unusual findings with high CO2 emission values might exist. Trimplot A trimplot is a kind of scatter plot that displays the variable's trimmed means at various trimming levels. The trimplot shows how, as the amount of trimming rises, the trimmed means of the CO2 emission variable decrease. Removing more trimmed values will result in a lower overall trimmed mean because they typically have a lower mean than the total. Additionally, a trimplot demonstrates how the trimmed means begin to converge at a particular trimming level. It means that a small number of unusual observations with high CO2 emission values might exist. Trimplot shows at higher trimming levels, the trimmed mean's 95% confidence interval is comparatively narrow. This implies that when more outliers are eliminated from the trimmed mean, a more accurate estimate of the true mean is produced. Graphbox A broad range of cluster sizes, with some clusters being significantly larger than others, is shown by the box plot. There are clusters with sizes as low as 1 and as high as 4, with the median cluster size being approximately 1.5. Given that the interquartile range (IQR) is between 1 and 2, 50% of the cluster sizes fall within this range. The fact that the upper whisker reaches 4 indicates that there aren't many clusters that are noticeably bigger than the others. Since the lower whisker does not reach the minimum value of 1, it is possible that some clusters are smaller than 1. However, the absence of outliers in the box plot indicates that the quantity of these tiny clusters is probably small. graph box co2_w10, mark(1,mlabel(id)) With a few outliers on the high end, the box plot indicates that the CO2 emission data is generally equally distributed. Around the median of 1.2, there is a range of about 0.2 that contains the majority of the data points. Additionally, there are more high CO2 emission values than low CO2 emission values due to the right-skewed data. A small number of outliers have CO2 emissions that are significantly greater than the mean. Numerous things, including peculiar operating circumstances, particular emission sources, or measurement errors, could be the cause of these outliers. NORMALITY (1) The R-squared value of 1.000 represents a perfect fit between the data and the model. This indicates that the model is error-free and that it has perfect ability to predict over the values of the dependent variable. The model is statistically significant, as indicated by the p-value of 3.09e-46 and the F-statistic of 3.710e+30. This indicates that the likelihood that the observed relationship between the independent and dependent variables is the result of random variation is extremely low. Each individual coefficient's t-statistic and p-value show that each coefficient is statistically significant. This indicates that the likelihood that each independent variable's observed relationship with the dependent variable is the result of chance is very low. HISTOGRAM RESID: The residuals' histogram indicates that they have a roughly normal distribution. With fewer residuals falling farther from the mean and the majority of the residuals falling close to the mean, the distribution is symmetric and bell-shaped. The distribution appears to be free of noticeable outliers. For this regression model, it can be assumed that the assumption of normality is met. This implies that we can draw conclusions about the population parameters using statistical tests like the t-test and the F-test. The distribution is shaped like a bell which mean data is normally distributed. Along with having an equal number of residuals falling above and below the mean, the distribution's symmetry is also good. There are very few residuals that deviate significantly from the mean, indicating that the distribution has few outliers. The residuals' histogram offers compelling proof that they are regularly distributed. This is encouraging since it indicates that the regression model is accurately specified and the statistical test results has reliability. HISTOGRAM C02: The CO2 emission distribution is displayed in the histogram you sent. Because of the distribution's slight rightward skew, more nations have lower CO2 emissions than do those with higher emissions. Additionally, there is a slight peak in the distribution, indicating that more nations have CO2 emissions that are near to the mean than that are far from it. The histogram indicates that the distribution of CO2 emissions is not normal. Since the departure from normalcy is not great, most applications probably won't seriously breach the assumption of normalcy.The distribution has a longer tail on the right side of it and a slightly skewed shape to the right. A GRAPH BOX CO2: The distribution of CO2 emissions in India is skewed to the right, with a longer tail on the right side of the distribution, as seen by the box plot. Thus, the number of years with lower CO2 emissions is greater than the number of years with higher emissions. In India, the CO2 emissions per capita are 1.58 metric tons on average. The middle 50% of years have CO2 emissions between 0.65 and 2.51 metric tons per capita, according to the interquartile range (IQR) of 0.93 metric tons per capita. The box plot also demonstrates the rarity of outliers, with some years having significantly higher CO2 emissions than the median. 2.85 metric tons of CO2 emissions per person are the highest in the data. DOTPLOT C02emmission: The distribution of CO2 emissions over a range of values is displayed in the dot plot of CO2 emissions in India. The x-axis shows the year, and the y-axis shows the CO2 emission in metric tons per capita. The dots on the plot represent individual years. The dot plot illustrates how India's CO2 emissions are distributed, with a longer tail on the right side of the distribution and a skew to the right. Thus, the number of years with lower CO2 emissions is greater than the number of years with higher emissions. The dot plot additionally demonstrates the significant annual variation in CO2 emissions. The large range of values on the y-axis makes this clear. According to the data, the CO2 emissions are as follows: the lowest is 1.1 metric tons per capita, and the highest is 2.85 metric tons per capita. Overall, the India CO2 emissions dot plot demonstrates that although CO2 emissions have been rising over time, there is significant annual variation in emissions. HANGROOT CO2: The hangroot graph shows that there is a average annual rise in CO2 emissions in India over this period of time. The graph reflects that, with some fluctuations, the average annual increase in CO2 emissions has been trending downward since 2000. Rather than showing the raw emission data, the graph's 'hangroot' feature shows the average annual change in CO2 emissions. This makes it possible to understand the trend better without being influenced by extreme values or outliers that might appear in particular years. In comparison to earlier decades, the declining trend indicates that CO2 emission levels in India have stabilized somewhat in recent years. The graph's upward spikes represent times when CO2 emissions rose more quickly than usual. These spikes could be linked to particular occasions or business ventures that raised fuel and energy consumption. The hangroot graph offers a clear and informative representation of the trend in CO2 emissions in India. It draws attention to the encouraging pattern of recent years' stabilization of emissions while acknowledging their fluctuations and the need for ongoing efforts to cut emissions even more. PNORM: A graphical technique for determining whether a data set follows a specific distribution is the P-P plot. The normal distribution is the distribution in this case. The P-P plot demonstrates that India's CO2 emission distribution is not exactly normal. There is some departure from normality, as seen by the plot's points not exactly falling on the straight line. Skewness: There are more years with lower CO2 emissions than there are with higher CO2 emissions due to the distribution of CO2 emissions being skewed to the right. The P-P plot's skewness is visible because the points on the right side of the plot are closer to the line than they are on the left. Kurtosis: Compared to a normal distribution, the CO2 emission distribution is slightly leptokurtic, or more peaked. The P-P plot's points are somewhat closer together than they would be if the distribution were normal, which indicates kurtosis. QNORM: The Q-Q plot demonstrates that India's CO2 emission distribution is not exactly normal. Plot points do not always lie exactly on a straight line, suggesting that there is a deviation from the norm. Skewness: When CO2 emissions are distributed skewed to the right, it indicates that more years have lower CO2 emissions than higher CO2 emissions. The Q-Q plot's skewness can be seen in the fact that the points on the right side of the plot are closer to the line than those on the left. Kurtosis: The CO2 emission distribution is more peaked than the normal distribution and is a little leptokurtic. The fact that the points show this kurtosis are marginally closer to one another on the Q-Q plot than they would be in a normal distribution. Since the skewness and kurtosis test p-values are larger than 0.05, the null hypothesis that the data is normally distributed is not rejected. Stated differently, insufficient evidence exists to draw the conclusion that the data is not normally distributed. The degree of asymmetry in the data distribution is determined by the skewness test. When a distribution's skewness is positive, it means that its tail is extending to the right; when it is negative, it means that the distribution's tail is extending to the left. For C02emmission, the skewness test statistic is 0.1883, meaning it is not statistically significant. The kurtosis test quantifies how flat or peaky the data distribution is. When the kurtosis value is 3, it means that distribution is peaked and not normal. We are unable to reject the null hypothesis that the residuals are normally distributed because the p-values for the skewness and kurtosis tests are both higher than 0.05. Stated differently, there is insufficient data to draw the conclusion that the residuals do not follow a normal distribution. The degree of asymmetry in the residuals' distribution is gauged by the skewness test. When a distribution's skewness is positive, it means that its tail is extending to the right; when it is negative, it means that the distribution's tail is extending to the left. For the residuals, the skewness test statistic is 0.1350, which is not statistically significant. A distribution is considered normal if its kurtosis value is three. If it is less than three, the distribution is flatter than normal, and if it is more than three, the distribution is more peaked than normal. The residuals' kurtosis test statistic is -0.4281, meaning it is not statistically significant. For C02emmission, the Jarque-Bera normality test statistic is 2.599, and the associated p-value is 0.2727. We are unable to reject the null hypothesis that C02 emissions are normally distributed because the p-value is higher than 0.05. For the residuals, the Jarque-Bera normality test statistic is 3.443, and the associated p-value is 0.1788. We are unable to reject the null hypothesis that the residuals are normally distributed because the p-value is higher than 0.05. The null hypothesis, which holds that both the residuals and C02 emission are normally distributed, cannot be rejected based on the findings of the Jarque-Bera tests. This implies that the residuals and C02 emission can both be assumed to have an approximate normally distributed distribution. The Shapiro-Wilk test statistic expresses how well the standard normal quantiles are fitted by the ordered and standardized sample quantiles. A value between 0 and 1, where 1 represents a perfect match, will be accepted by the statistic. For C02emmission, the corresponding p-value is 0.02787 and the Shapiro-Wilk W statistic is 0.93847. We reject the null hypothesis that C02 emission is normally distributed because the p-value is less than 0.05. Stated differently, an extensive amount of evidence indicates that the distribution of CO2 emissions is not normal. The p-value for C02emmission is 0.06513, and the corresponding Shapiro-Francia W' test statistic is 0.94965. We are unable to reject the null hypothesis that C02 emissions are normally distributed because the p-value is higher than 0.05. Stated differently, there is insufficient data to refute the null hypothesis, which holds that the distribution of C02 emissions is normal. The null hypothesis that C02 emissions are normally distributed cannot be rejected based on the Shapiro-Francia W' test results. It is crucial to remember that the Shapiro-Francia W' test is a somewhat conservative test, and there's a chance the data isn't entirely normal. The R-squared value is 0.0000, and the adjusted R-squared value is -0.0250, according to the model summary. This indicates that there is no variation in the dependent variable that the model can account for. The p-value is 0.9820 and the F-statistic is 0.0005035. This indicates that there is no statistical significance in the model. For the constant term, the standard error is 0.0514 and the coefficient estimate is 1.1335. The pvalue is 0.0000 and the t-statistic is 22.04. This indicates that, at the 0.05 level, the constant term is statistically significant. The RMSE, or root mean square error, is 0.3294. This indicates that 0.3294 units separate the average residual from zero. The p-value is 0.9820, and the Durbin-Watson statistic is 0.0000. Thus, there isn't any evidence of residual autocorrelation. There is no variation in the dependent variable that can be explained by the regression model. The only statistically significant coefficient in the model is the constant term. The residuals show no signs of autocorrelation. NORMALITY (2) A normal kernel density function appears on the histogram, which shows the density distribution of carbon dioxide emissions. The start value is 0.64745132, and the bin size is 0.19135733. As a result, the histogram is split into six bins, each of which represents a different range of emissions of carbon dioxide. The probability of each value of carbon dioxide emissions is displayed as a smooth curve by the normal kernel density function. According to the histogram, a value of about 1.5 represents the most typical carbon dioxide emission. There is a large range of carbon dioxide emission values, with some values being much higher or lower than the average, according to the normal kernel density function. The distribution of carbon dioxide emissions is not uniform, as the histogram demonstrates. While most emissions of carbon dioxide are in the range of 1.5, some emissions are significantly higher or lower. There is a large range of carbon dioxide emission values, as the normal kernel density function indicates. Numerous factors, including the kind of industry, the fuel type, and the energy use efficiency, could be to blame for this. One could use the histogram to pinpoint the sources of elevated carbon dioxide emissions. For instance, if the histogram reveals a high concentration of emissions within a certain range, this may point to the existence of a particular emission source that is causing the issue. The box plot shown is residual box plot, a kind of box plot that shows the variance between a variable's observed and predicted values. The distribution of the residuals, or the variations between the observed and predicted values, is displayed in the residual box plot. When the median residual is zero, it indicates that, on average, the model is correctly predicting the values of the variable. Outliers, on the other hand, are residuals that deviate from the median by more than 1.5 times the interquartile range (IQR). The difference between the first and third quartiles is known as the IQR. The outliers imply that there may be instances in which the model is inaccurately forecasting the values of the variable. These situations may arise from data inaccuracies or from a model that isn't sophisticated enough to account for the relationships between the variables. The nco2 boxplot indicates that 1.5 is the median nco2 value. The median value is located in the center of the box, which depicts the middle 50% of the data. The whiskers reach the minimum and maximum values within 1.5 times the box's interquartile range (IQR). The difference between the 75th and 25th percentiles is known as the IQR. The data contains a small number of outliers, or points that don't fit inside the whiskers. Either true differences in the data or mistakes in data entry can result in outliers. With a few outliers at the high end, the boxplot indicates that the nco2 data is generally somewhat right-skewed. The CO2 levels fall within the normal range at the median value of 1.5. The table shows the findings of a regression model that has one dependent variable (Nco2) and four independent variables (TaxRevenue, GDPGrowth, Revenueexcludinggrantsof, and Generalgovernmentfinalconsump). With an R-squared of 0.6976, the dependent variable's variation can be explained by the model 6976.76% of the time. Taking into account the number of independent variables, the adjusted R-squared value of 0.6630 represents a slightly more conservative estimate of the model's goodness of fit. The dependent variable is significantly impacted by each of the independent variables, which are all statistically significant at the 0.05 level. The following is an interpretation of the coefficients: TaxRevenue: An increase in TaxRevenue of one unit corresponds to a 0.4647515-unit rise in Nco2. GDPGrowth: A 0.0241993-unit increase in Nco2 corresponds to a one-unit increase in GDPGrowth. Revenueexcludinggrantsof: A 0.0949073-unit increase in Nco2 is correlated with a one-unit increase in Revenueexcludinggrantsof. Generalgovernmentfinalconsump: Nco2 decreases by 0.4103389 units for every unit increase in Generalgovernmentfinalconsump. Put differently, there exists a positive correlation between government spending and economic growth and CO2 emissions, but a negative correlation exists between tax revenue and CO2 emissions. The regression analysis's findings are displayed in the image's table, which has four independent variables (tax revenue, GDP growth, revenue excluding grants from the general government, and general government final consumption) and CO2 emissions as the dependent variable. With an R-squared of 0.7966, the model can account for 79.66% of the variation in CO2 emissions. The direction and strength of the independent variables' influence on CO2 emissions are shown by their coefficients. For instance, a 1% increase in tax revenue is linked to a 0.4982% increase in CO2 emissions, according to the coefficient of tax revenue of 0.4982. With a coefficient of GDP growth of 0.0222, an increase in GDP of 1% is correlated with an increase in CO2 of 0.0222% emissions. The general government's final consumption and revenue excluding grants both have negative coefficients, suggesting that their relationship with CO2 emissions is inverse. Overall, the results of the regression analysis point to a positive relationship between GDP growth and tax revenue and CO2 emissions, but a negative relationship between CO2 emissions and revenue excluding general government grants and general government final consumption. MULTICOLINEARITY INTERPERTATIONS Matrix of Correlations: The linear relationship between two variables is displayed, along with its strength and direction, in the correlation matrix. Here, C02emmission and TaxRevenue have a strong positive correlation (0.6957), indicating that C02emmission tends to rise along with TaxRevenue. Additionally, there is a moderately positive correlation (0.2712) between C02emmission and Generalgovernmentfinalconsump, indicating that C02emmission tends to increase along with Generalgovernmentfinalconsump but not as much as TaxRevenue. The data indicates a weak negative correlation (-0.1696) between C02emmission and Revenueexcludinggrantsof, indicating a tendency for C02emmission to decrease as Revenueexcludinggrantsof increases. The data indicates a weak negative correlation (-0.0240) between GDPGrowth and C02emmission, indicating a tendency for C02emmission to decrease as GDPGrowth rises. Analysis of Regression The relationship between C02 emissions and the other model variables is shown by the regression analysis. The statistical significance of the model (F(4, 36) = 35.26, p < 0.000) indicates a significant correlation between C02emmission and the remaining variables in the model. With an R-squared of 0.7966, the model accounts for 79.66% of the variation in CO2 emissions. The model's coefficients display how each variable affects CO2 emissions. The coefficient for tax revenue is 0.4982, which means that a unit increase in tax revenue is expected to be accompanied by a 0.4982 unit increase in carbon dioxide emissions. The coefficient for general government final consumption is -0.4172, which indicates that a one unit increase in general government final consumption is expected to result in a 0.4172 unit decrease in C02 emissions. The coefficient for GDPGrowth is 0.0222, which indicates that C02emission should rise by 0.0222 units for every unit increase in GDPGrowth. With a coefficient of 0.0953, it can be determined that a unit increase in Revenueexcludinggrantsof will result in a 0.0953 unit increase in C02emmission. The degree of correlation between each variable and the other variables in the model is indicated by the VIF (Variance Inflation Factor) values. A high level of multicollinearity between the variables is indicated by a VIF value greater than 5, which may cause the model to become unstable. Since none of the VIF values in this instance are greater than 5, multicollinearity is not supported. Additional Analysis of Regression GDPGrowth and Revenueexcludinggrantshave a weakly negative relationship, according to the additional regression analysis (-1.0765, p = 0.088). PCA (Principal Component Analysis) A technique for reducing a dataset's dimensionality is principal component analysis (PCA). In this instance, the five variables in the dataset were reduced to two principal components (PC1 and PC2) using PCA. Of the variance in the data, the first principal component accounts for 45.19%, while the second principal component accounts for 25.80%. The principal components' eigenvalues are displayed on the scree plot. The amount of variation in the data that a principal component accounts for is indicated by its eigenvalue. The scree plot demonstrates that the first two principal components account for the majority of the variation in the data, with the remaining three principal components accounting for very little of the variation. The relationship between each variable and the principal components is displayed in the loading matrix. All five variables have relatively high loadings for PC1, indicating that each of the five variables contributes to PC1. Revenueexcludinggrantsof and GDPGrowth have high loadings for PC2, while the loadings for the other three variables are low. This indicates that PC2 is primarily driven by Revenueexcludinggrantsof and GDPGrowth. There is a significant correlation between C02emmission and PC1, according to the principal components regression analysis (coeff = 0.1648, p < 0.000). PC2 and C02 emission do not significantly correlate (coeff = -0.0393, p = 0.203). Overall, the analysis suggests that CO2 emissions and tax revenue have a strong positive correlation, while CO2 emissions and general government final consumption have a moderately positive correlation. Additionally, there is a weak negative correlation between CO2 emissions and GDP growth as well as a weak negative correlation between CO2 emissions and revenue (excluding grants). A significant portion of the variation in CO2 emissions can be explained by the model, which fits the data well. Heteroscedasticity Analysis of the Regression's Output The output displays the findings of a linear regression analysis in which the other variables are independent and CO2 emission is the dependent variable. The model is statistically significant, indicating that there is a significant relationship between the independent variables and CO2 emission (F-statistic: 35.26 with a p-value of 0.0000). The model explains 79.66% of the variance in CO2 emission and 77.40% of the variance after adjusting for the number of independent variables, according to R-squared: 0.7966 and adjusted R-squared: 0.7740. This suggests a good model fit. Root MSE: 0.15656 is the average prediction error of the model. TaxRevenue: A p-value of 0.000 and a coefficient of 0.498 indicate that a one-unit increase in CO2 emissions of 0.498 units is correlated with a rise in tax revenue. Generalgovernmentfinalconsump: An average one-unit increase in Generalgovernmentfinalconsump is linked to a 0.417-unit drop in CO2 emissions, according to a coefficient of -0.417 with a p-value of 0.000. GDPGrowth: An average increase in GDPGrowth of one unit is correlated with a 0.022 unit increase in CO2 emissions, according to a coefficient of 0.022 with a p-value of 0.034. Revenueexcludinggrantsof: An average increase in Revenueexcludinggrantsof of one unit is correlated with a 0.095 unit increase in CO2 emissions, according to a coefficient of 0.095 and a p-value of 0.031. _cons: The expected CO2 emission when all independent variables are zero is represented by the constant term (0.1196796). Heteroscedasticity appears to be unaccounted for by the model, which might bias the findings. The last column's confidence intervals display the range of values that, at 95% confidence, correspond to each coefficient's true population value.If the model satisfies additional linear regression assumptions, more investigation is required. Showing the correlation between the linear regression model's fitted values and residuals. Fitted values are the anticipated values of the dependent variable, and residuals are the difference between the actual and predicted values of the dependent variable. Graph shows that the residuals are not scattered randomly around zero. Rather, a distinct pattern emerges, with residuals rising as fitted values do. This suggests that the homoscedasticity assumption of linear regression is violated, i.e., the variance of the residuals is not constant across all values of the independent variables. There are several reasons why the model's heteroscedasticity could exist. One possibility is that the model is not fully specified, which would mean that not all of the significant independent variables are included. A non-normal distribution of the data is an additional possibility. A distinct pattern can be seen in the scatter plot, where the residuals rise as the fitted values rise. This suggests that the homoscedasticity assumption of linear regression is violated, i.e., the variance of the residuals is not constant across all values of the independent variables. The model's predictive ability for the dependent variable is reduced for specific values of the independent variables. The residuals are plotted against the fitted values, which represent the dependent variable's predicted values. The residuals are the difference between the dependent variable's actual and predicted values. With the residuals rising as the fitted values rise, a distinct pattern can be seen in the scatter plot. As a result, the homoscedasticity assumption of linear regression may be voilating, indicating that the variance of the residuals is not constant across all values of the independent variables. The model's ability to predict TaxRevenue decreases as the independent variables reach higher values. For instance, in countries with higher GDP growth or higher levels of general government final consumption, the model might not be as accurate in forecasting tax revenue. plot of the residuals on the independent variables TaxRevenue, Generalgovernmentfinalconsump, and Revenueexcludinggrantsof from a linear regression model of GDP growth. Plotted against the fitted values—the dependent variable's predicted values—are the residuals, which represent the difference between the dependent variable's actual and predicted values. A distinct fan-like shape can be seen in the scatter plot, where the residuals grow as the fitted values do. This suggests that the homoscedasticity assumption of linear regression is violated, i.e., the variance of the residuals is not constant across all values of the independent variables. The model's ability to forecast GDP growth decreases as the independent variables' values increase. The scatter plot demonstrates a positive correlation between grants and revenue, indicating that grants typically rise in tandem with revenue. At 0.8, the correlation coefficient is deemed strong. This shows that the two variables have a linear relationship and that grants can, in part, be used to predict revenue. A plausible rationale for this correlation could be that organizations availing grants can allocate resources towards research and development, thereby potentially yielding amplified profits. Grants can also assist businesses in growing into new markets or creating new products. It's crucial to remember that the correlation does not imply that grants lead to an increase in revenue. The rise in grants and revenue could be due to other factors, such as economic growth. The scatter plot's overall results point to a positive correlation between grants and revenue. To ascertain the direction of causality between the two variables, more investigation is necessary. The table shows the findings of a regression model that forecasts tax revenue using GDP growth, revenue exclusive of grants, and general government final consumption. The model's p-value of 1.0000 and F-statistic of 36.0245 indicate that it is statistically significant. This indicates that the model could not have happened by accident. The model's R-squared is 0.0000, indicating that it explains very little of the variation in tax revenue. Since that there are only three independent variables in the model, this is not surprising. The model's coefficients demonstrate the positive and statistically significant effects of GDP growth and general government final consumption on tax revenue. Accordingly, tax revenue tends to rise in tandem with increases in government spending and economic growth. The variable "revenue excluding grantsof" has a statistically significant negative coefficient. This implies that tax revenue tends to decline as revenue (exclusive of grants) rises. Nonetheless, the extremely small coefficient indicates a weak effect. Overall, the regression results point to GDP growth and general government final consumption as the main drivers of tax revenue in the model. Tax revenue is negatively impacted by revenue excluding grants as well, though the impact is not as great. It displays the findings of a regression of tax revenue on GDP growth, revenue exclusive of grants, and general government final consumption. The regression model's Prob > F value of 0.8070 indicates that it is statistically significant. With an R-squared of 0.0426, the model accounts for 4.26% of the variation in tax revenue. The standard error for tax revenue is 0.0111235, and the coefficient is 0.0039371. This indicates that, when all other factors are held constant, an increase of one unit in general government final consumption is correlated with an increase of 0.0039371 units in tax revenue. With a standard error of 0.0139638, the coefficient for general government final consumption is 0.0029323. This indicates that a 0.0019606 unit increase in tax revenue is linked to every unit increase in GDP growth, keeping the values of all other variables constant. GDP growth has a coefficient of 0.0019606 and a standard error of 0.002495. The standard error for revenue excluding grants is 0.0104603 and the coefficient is 0.0069751. All things considered, the regression analysis points to a statistically significant relationship between tax revenue and GDP growth, general government final consumption, and revenue excluding grants. But the R-squared is low, indicating that not all of the variation in tax revenue can be explained by the model. Table of regression shows results for a model that models GDP growth, tax revenue, general government final consumption, and revenue excluding grants as functions of CO2 emissions. With a high R-squared value of 0.7966 and a statistically significant p-value of 0.0000, the model explains a substantial amount of the variation in CO2 emissions. The estimated effects of each independent variable on CO2 emissions are displayed by the coefficients in the table. Higher tax revenue is linked to higher CO2 emissions because tax revenue has a positive and statistically significant effect on CO2 emissions. This is probably due to the fact that increased tax revenue is frequently utilized to pay for government initiatives that boost the economy and raise CO2 emissions. The table shows the findings of a regression model that forecasts tax revenue using GDP growth, revenue exclusive of grants, and general government final consumption. The model's p-value of 1.0000 and F-statistic of 36.0245 indicate that it is statistically significant. This indicates that the model could not have happened by accident. The model's R-squared is 0.0000, indicating that it explains very little of the variation in tax revenue. Since that there are only three independent variables in the model, this is not surprising. The model's coefficients demonstrate the positive and statistically significant effects of GDP growth and general government final consumption on tax revenue. Accordingly, tax revenue tends to rise in tandem with increases in government spending and economic growth. The test compares the alternative hypothesis—that the variance is not constant—with the null hypothesis, which states that the variance of the error terms is constant. The test statistic is 4.86 and the p-value is 0.0276, according to the output. As a result, we can determine that heteroskedasticity exists in the model and reject the null hypothesis at the 5% significance level. Not all values of the fitted values of what2 have a constant variance of the residuals. One of the underlying presumptions of ordinary least squares (OLS) regression is broken, which makes this an issue. The heteroskedasticity test has a p-value of 0.7007, which is higher than the 0.05 significance level. Thus, the null hypothesis that is, the absence of heteroskedasticity in the data cannot be rejected. The skewness test's p-value is 0.7506, which is likewise higher than the 0.05 significance level. As a result, the null hypothesis that the data are not skewed cannot be rejected. Additionally, the kurtosis test p-value of 0.4139 is higher than the significance level of 0.05. As a result, the null hypothesis that the data is not kurtotic cannot be rejected. Overall, it appears from the Cameron & Trivedi decomposition test results that the test model is not misspecificated. The test model shows no signs of heteroskedasticity, skewness, or kurtosis, according to the Cameron & Trivedi decomposition test. This shows that the model's specifications are sound. It is crucial to remember that there are numerous methods for checking for model misspecification, and the Cameron & Trivedi decomposition test is just one of them. It's crucial to run several tests and use your discretion when interpreting the findings. White's test for heteroskedasticity, along with a Cameron-Trivedi decomposition of the IM-test. A general test for heteroskedasticity, or the non-constant variance of a regression model's residuals, is White's test. The test's alternative hypothesis is that there is unrestricted heteroskedasticity, while the null hypothesis is that there is no heteroskedasticity. The chi-squared statistic, with 14 degrees of freedom, is 10.81, according to the White's test results. With a p-value of 0.7007, the significance level of 0.05 is exceeded. This indicates that the homoskedasticity null hypothesis cannot be successfully rejected. The chi-squared statistic from the IM-test is divided into three parts by the Cameron-Trivedi decomposition of the IM-test, which provides a more thorough test for heteroskedasticity. These components are heteroskedasticity, skewness, and kurtosis. The chi-squared statistic for heteroskedasticity is 10.81 with 14 degrees of freedom and a p-value of 0.7007, according to the Cameron-Trivedi decomposition results. The outcome of White's test is the same as this. With four degrees of freedom, the chi-squared statistic for skewness is 1.92, and the p-value is 0.7506. Thus, we are also unable to rule out the null hypothesis that there is no skewness. The p-value for kurtosis is 0.4139, and the chi-squared statistic is 0.67 with 1 degree of freedom. Thus, we are also unable to rule out the null hypothesis that there is no kurtosis. Overall, the data do not appear to show any signs of heteroskedasticity, skewness, or kurtosis, according to the results of the White's test and the Cameron-Trivedi decomposition of the IMtest. Regression modeling uses tax revenue and CO2 emissions as independent variables to forecast GDP growth. The regression's R-squared is 0.4891, meaning that 48.91% of the variation in GDP growth can be explained by tax revenue and CO2 emissions. The regression fits the data well, as indicated by the F-statistic of 18.19, which is significant at the 1% level. At the 1% level, the CO2 emissions coefficient is 0.2198, indicating a positive and significant relationship. This indicates that a 0.2198-unit increase in GDP growth is correlated with every unit increase in CO2 emissions. The tax revenue coefficient is positive (0.009) but not statistically significant. This indicates that there isn't any proof tax revenue influences GDP growth in a meaningful way.As the regression's intercept is -1.1109, GDP growth is expected to be -1.1109 in the event that tax revenue and CO2 emissions are both equal to zero. The overall findings of the regression indicate that, in contrast to tax revenue, which has little effect on GDP growth, CO2 emissions have a positive and significant impact on GDP growth. The results of the regression indicate a positive correlation between India's GDP growth, tax revenue, and CO2 emissions. This implies that CO2 emissions rise in tandem with GDP growth and tax revenue. There aren't many reasons why this relationship could exist. First, increased government spending on infrastructure and industrial development may result from higher tax revenue, and this could raise CO2 emissions. Secondly, increased economic activity can result in higher CO2 emissions, and higher GDP growth is frequently accompanied by this. The relationship has significant implications for India's attempts to lower its carbon footprint. India is a nation that is expanding economically and developing quickly. Its CO2 emissions are rising as a result. The results of the regression indicate that India should carefully evaluate the effect of GDP growth and tax revenue on CO2 emissions as it formulates emission reduction policies. The output shows the findings of a regression study on the impact of CO2 emissions on GDP growth and tax revenue. Using the ordinary least squares (OLS) method, the analysis was performed. The findings indicate a strong positive correlation between tax revenue and carbon dioxide emissions, rising tax revenues inevitably result in rising CO2 emissions. This relationship is probably caused by the fact that government initiatives that support economic growth and reduce CO2 emissions are frequently funded in part by tax revenue. Additionally, the data demonstrate a strong inverse relationship between GDP growth and CO2 emissions. Stated differently, a rise in GDP growth is associated with a fall in CO2 emissions. This relationship is probably caused by the fact that technological innovation, which can result in cleaner and more effective methods of producing goods and services, is frequently linked to GDP growth. With an R-squared of 0.4891, the model accounts for 48.91% of the variation in CO2 emissions. Even after taking into consideration the number of independent variables in the model, the adjusted R-squared value of 0.4622 shows that the model still accounts for a sizable portion of the variation in CO2 emissions. The Harvey LM Test is a statistical test used to determine if the variance of the model's error terms is constant or not. At the 5% significance level, the null hypothesis that there is no heteroscedasticity cannot be rejected, according to the p-value of 0.09903. This implies that the model's error terms' variance might not be constant, which could have an impact on the accuracy of the findings. The regression analysis's findings indicate that there is a substantial inverse relationship between GDP growth and CO2 emissions and a significant positive relationship between tax revenue and CO2 emissions. It is crucial to remember that the Harvey LM Test for Heteroscedasticity indicates that the model's error terms' variance might not be constant, which could have an impact on the reliability of results. The output shows the lmhwald computer program, which is used to estimate the ordinary least squares (OLS) model. A statistical model called the OLS model is used to estimate the relationship between one or more independent variables and a dependent variable. The output shows the findings of an OLS test examining the relationship between GDP growth, tax revenue, and CO2 emissions. The F-statistic, as indicated in the table, is 18.1899, indicating significance at the 1% level. This indicates that the data and the model fit each other well. The model's R-squared value, which is 0.4891, is also displayed in the table. This indicates that 48.91% of the variation in the dependent variable can be explained by the model. The coefficient estimates for the independent variables are also displayed in the table. At the 1% level of significance, the coefficient estimate for tax revenue is 0.2198498, indicating statistical significance. This indicates that a 0.2198498-unit increase in CO2 emissions is related to every unit increase in tax revenue. At the 1% level, the coefficient estimate for GDP growth is 0.0090328, indicating statistical significance. This indicates that there is a 0.0090328-unit increase in CO2 emissions for every unit increase in GDP growth. Overall, the results shows that tax revenue and GDP growth are both statistically significant predictors of CO2 emissions and that the OLS model fits the data well. The output of the Stata command estat hettest is displayed in the image you sent. Heteroskedasticity is a violation of one of the fundamental principles of linear regression and can be tested for with this command. When the variance of the error terms is not constant for all values of the independent variables, this is known as heteroskedasticity. At the 5% significance level, the p-value (Prob > chi2) of 0.5399 shows that we are unable to reject the constant variance null hypothesis. The fact that the estat hettest command was used to test for heteroskedasticity in a linear regression model with the dependent variable CO2 emissions indicates that there is no evidence of heteroskedasticity in the model output. Since there is no evidence of heteroskedasticity in the test, the constant variance assumption met. Because it guarantees the validity of the regression coefficients' standard errors, the assumption of constant variance is crucial to linear regression. The standard errors could be overestimated or underestimated if heteroskedasticity is present, which could lead to inaccurate conclusions about the significance of the regression coefficients. It is encouraging that there is no evidence of heteroskedasticity in the model according to the results of the estat hettest command. It implies that the conclusions we make regarding the significance of the coefficients are probably going to be accurate and that the standard errors of the regression coefficients are probably going to be valid. Heteroskedasticity can be eliminated from a regression model using Stata's robust reg command. Using a robust variance-covariance estimator, which is less susceptible to heteroskedasticity than the conventional OLS estimator, is instructed by the vce(robust) option in Stata. The robust standard errors are marginally larger, but the outcomes are comparable to an OLS regression. This is a result of the robust estimator's increased caution when drawing conclusions when heteroskedasticity is present. Even in the presence of heteroskedasticity, the robust standard errors remain statistically significant, indicating the reliability of the regression's findings. This implies that the relationships between CO2 emissions and the other model variables are indeed real. The relationship between CO2 emissions and the following four variables is displayed in a linear regression table: GDP growth, tax revenue, revenue excluding grants, and general government final consumption. Stata software was used to fit the model, and the sample size consists of 41 observations. With an R-squared of 0.7966, the model accounts for 79.66% of the variation in CO2 emissions. Given the high R-squared value, it appears that the model and the data fit each other well. The model is statistically significant at the 1% level, according to the F-statistic's p-value of 0.0000. This indicates that the likelihood that the outcomes happened by accident is extremely remote. AUTOCORRELATION The output of the autocorrelation commands shows a significant positive autocorrelation in the regression model's residuals. This indicates that one of the tenets of the traditional linear regression model has failed, such as that the model's residuals are correlated with one another over time. The residuals of a regression model might have autocorrelation for a variety of reasons. One possibility is that the independent variables and the error term are correlated with a variable that is missing from the model. Another possibility is that the model is not correctly specified. For example, the relationship between the independent and dependent variables may not have the correct functional form. There are several actions that can be performed to address autocorrelation in regression model residuals. Adding more variables to the model that are correlated with the missing variable is one way to go about this. Removing the autocorrelation from the data can also be accomplished by transforming it in some way. Occasionally, it might be essential to employ an alternative estimation method, like generalized least squares (GLS). The Durbin-Watson statistic in the particular example of the regression model in the image is 2.494, according to the autocorrelation commands output. There is positive autocorrelation in the model's residuals because this value is below the Durbin-Watson statistic's lower bound. The statistic for the Breusch-Godfrey test is 11.06, and at the 1% level, this is significant. This further validates the presence of positive autocorrelation in the model's residuals. The output of the autocorrelation commands shows a significant positive autocorrelation in the regression model's residuals. This indicates that one of the tenets of the traditional linear regression model has failed, such as that the model's residuals are correlated with one another over time. The residuals of a regression model might have autocorrelation for a variety of reasons. One possibility is that the independent variables and the error term are correlated with a variable that is missing from the model. Another possibility is that the model is not correctly specified. For example, the relationship between the independent and dependent variables may not have the correct functional form. A change in the economy's composition could mean a move away from lower-value industries like agriculture and toward higher-value industries like manufacturing and services. The tsline gdp command generates a straightforward yet useful graph that can be used to monitor changes in GDP over time. Trends in inflation, economic growth, and the structure of the economy can all be found on the graph. prais C02emmission TaxRevenue GDPGrowth Revenueexcludinggrantsof Generalgovernmentfinalconsump, corc Iteration 0: rho = 0.0000 Iteration 1: rho = 0.1387 Iteration 2: rho = 0.3284 Iteration 3: rho = 0.5779 Iteration 4: rho = 0.8161 Iteration 5: rho = 0.9556 Iteration 6: rho = 0.9782 Iteration 7: rho = 0.9824 Iteration 8: rho = 0.9846 Iteration 9: rho = 0.9859 Iteration 10: rho = 0.9869 Iteration 11: rho = 0.9876 Iteration 12: rho = 0.9882 Iteration 13: rho = 0.9886 Iteration 14: rho = 0.9890 Iteration 15: rho = 0.9893 Iteration 16: rho = 0.9896 Iteration 17: rho = 0.9898 Iteration 18: rho = 0.9900 Iteration 19: rho = 0.9902 Iteration 20: rho = 0.9904 Iteration 21: rho = 0.9905 Iteration 22: rho = 0.9906 Iteration 23: rho = 0.9907 Iteration 24: rho = 0.9908 Iteration 25: rho = 0.9909 Iteration 26: rho = 0.9910 Iteration 27: rho = 0.9911 Iteration 28: rho = 0.9912 Iteration 29: rho = 0.9912 Iteration 30: rho = 0.9913 Iteration 31: rho = 0.9914 Iteration 32: rho = 0.9914 Iteration 33: rho = 0.9915 Iteration 34: rho = 0.9915 Iteration 35: rho = 0.9916 Iteration 36: rho = 0.9916 Iteration 37: rho = 0.9916 Iteration 38: rho = 0.9917 Iteration 39: rho = 0.9917 Iteration 40: rho = 0.9917 Iteration 41: rho = 0.9917 Iteration 42: rho = 0.9918 Iteration 43: rho = 0.9918 Iteration 44: rho = 0.9918 Iteration 45: rho = 0.9918 Iteration 46: rho = 0.9919 Iteration 47: rho = 0.9919 Iteration 48: rho = 0.9919 Iteration 49: rho = 0.9919 Iteration 50: rho = 0.9919 Iteration 51: rho = 0.9919 Iteration 52: rho = 0.9920 Iteration 53: rho = 0.9920 Iteration 54: rho = 0.9920 Iteration 55: rho = 0.9920 Iteration 56: rho = 0.9920 Iteration 57: rho = 0.9920 Iteration 58: rho = 0.9920 Iteration 59: rho = 0.9920 Iteration 60: rho = 0.9920 Iteration 61: rho = 0.9921 Iteration 62: rho = 0.9921 Iteration 63: rho = 0.9921 Iteration 64: rho = 0.9921 Iteration 65: rho = 0.9921 Iteration 66: rho = 0.9921 Iteration 67: rho = 0.9921 Iteration 68: rho = 0.9921 Iteration 69: rho = 0.9921 Iteration 70: rho = 0.9921 Iteration 71: rho = 0.9921 Iteration 72: rho = 0.9921 Iteration 73: rho = 0.9921 Iteration 74: rho = 0.9921 Iteration 75: rho = 0.9921 Iteration 76: rho = 0.9921 Iteration 77: rho = 0.9921 Iteration 78: rho = 0.9921 Iteration 79: rho = 0.9921 Iteration 80: rho = 0.9921 Iteration 81: rho = 0.9921 Iteration 82: rho = 0.9921 Iteration 83: rho = 0.9922 Iteration 84: rho = 0.9922 Iteration 85: rho = 0.9922 Iteration 86: rho = 0.9922 Iteration 87: rho = 0.9922 Iteration 88: rho = 0.9922 Iteration 89: rho = 0.9922 Iteration 90: rho = 0.9922 Iteration 91: rho = 0.9922 Iteration 92: rho = 0.9922 Iteration 93: rho = 0.9922 Iteration 94: rho = 0.9922 Iteration 95: rho = 0.9922 Iteration 96: rho = 0.9922 Iteration 97: rho = 0.9922 Iteration 98: rho = 0.9922 Iteration 99: rho = 0.9922 Cochrane-Orcutt AR(1) Regression Output Interpretation The autocorrelation between C02 emissions and different explanatory variables was analyzed using a Cochrane-Orcutt AR(1) regression, and the results are shown in this output. Below is a summary of the essential components: 1. Iterations The process of estimating the autocorrelation coefficient (rho) iteratively is presented in the first section. After 99 iterations, it converges to 0.9922 from a starting point of 0. This value shows that the C02 emissions in succeeding periods have a very strong positive autocorrelation. 2. Summary of Regression: Source: The components of the total sum of squares (SS), such as the residual SS and the model SS, are discussed in this section. df: Each source's degrees of freedom. MS: Each source's mean square. F-statistic: Evaluates the model's overall significance. The model appears to be not statistically significant in this instance, as indicated by the F-statistic of 0.86 and the p-value of 0.4986. R-squared: Shows the percentage of the variation in CO2 emissions that the model can account for. In this case, it is 0.0893, meaning the model only accounts for a small percentage of the variance. Adj R-squared: In this instance, there are 0.0148 explanatory variables, which is taken into account by adjusted R-squared. 3. Estimates of Coefficients: Each variable in the model's estimated coefficients, standard errors, t-statistics, p-values, and confidence intervals are displayed in this section. The coefficients for GDP Growth, Tax Revenue, and Revenue Excluding Grants are not statistically significant (p-values > 0.05), indicating that their impact on CO2 emissions is not very strong. Although the coefficient for general government final consumption is positive (0.0362), it is not statistically significant either. Despite having a positive coefficient (1.7268), the intercept (cons) is not statistically significant. 4. The coefficient of autocorrelation, or rho: The estimated rho value of 0.9922 verifies that CO2 emissions have a strong positive autocorrelation. This indicates that there is a strong correlation between the amount of CO2 emitted in one period and the amount in the next. 5. Statistics by Durbin-Watson: The residuals' autocorrelation can be found using the Durbin-Watson statistic. 1.720975, the initial Durbin-Watson statistic, is in the inconclusive range (1.5 - 2.5). Since 1.825387, the transformed DurbinWatson statistic is closer to 2, indicating that the residuals have positive autocorrelation. All things considered, the Cochrane-Orcutt AR(1) regression points to a significant positive autocorrelation in CO2 emissions but offers no solid proof of the explanatory variables' influence. The effects of C02 emissions, tax revenue, GDP growth, and revenue excluding general government final consumption on GDP are shown in this regression analysis. With an R-squared of 0.7966, the four independent variables account for 79.66% of the variation in GDP. A statistically significant coefficient of CO2 emission, 0.4982, has been found. This indicates that the GDP increases by 0.4982% for every 1% increase in CO2 emissions. TaxRevenue's coefficient is 0.0222, indicating statistical significance as well. Therefore, there is a 0.0222% increase in GDP for every 1% increase in tax revenue. Additionally statistically significant is the coefficient of Revenueexcludinggrantsof Generalgovernmentfinalconsump, which is 0.0952. This indicates that the GDP increases by 0.0952% for every 1% increase in Revenue excluding Grants of General Government Final Consumption. Also statistically significant is the coefficient of Generalgovernmentfinalconsump, which is -0.4171. This indicates that the GDP decreases by 0.4171% for every 1% increase in General Government Final Consumption. To sum up, the regression analysis indicates that GDP is significantly impacted by C02 emissions, Tax Revenue, Revenue excluding grants of General Government Final Consumption, and General Government Final Consumption. GDP is positively impacted by C02 emissions and tax revenue, but negatively by revenue excluding grants of general government final consumption and general government final consumption. A statistical technique called Newey-West regression is used to estimate standard errors when autocorrelation and heteroskedasticity are present. As a function of tax revenue, GDP growth, revenue excluding grants for general government final consumption, and a constant term, CO2 emissions are predicted by the regression in the image. The regression's findings show tax revenue impacts CO2 emissions in a positive way and statistically significant way. This implies that CO2 emissions tend to rise in connection with increases in tax revenue. CO2 emissions are positively and statistically significantly impacted by GDP growth as well. This implies that CO2 emissions tend to increase along with GDP growth. There is a positive and statistically significant impact on CO2 emissions from revenue, excluding grants for general government final consumption. This means that CO2 emissions tend to rise along with revenue, excluding grants for general government final consumption. Positive and statistically significant is the constant term. This indicates that, even after adjusting for other model variables, there remains a positive correlation between CO2 emissions and the other variables. There is statistical significance based on the F-statistic of 67.18. This indicates that the data and the model fit each other well. With an R-squared of 0.9529, the model accounts for 95.29% of the variation in the data. Overall, the regression results point to a positive correlation between GDP growth, tax revenue, and CO2 emissions that is, revenue other than grants for general government final consumption. CONCLUSION In conclusion, the examination of CO2 emissions unique to India reveals a number of noteworthy trends and patterns. According to the boxplot, India's median CO2 emissions are estimated to be 1.5, with a few outliers showing higher emission values. A thorough distribution is given by the histogram, which shows that the most common range for CO2 emissions is between 1 and 1.5, with important observations falling between 0.5 and 1 and 1.5 and 2. A possible outlier at 2.2 is shown by the spike plot and may be related to particular events or situations that result in abnormally high CO2 emissions. Two outliers at 2.2 and 2.5 are validated by the dotplot, indicating anomalies that could be the consequence of unanticipated spikes in electricity demand or broken emissions control systems. The general government's final consumption and revenue excluding grants both have negative coefficients, suggesting that their relationship with CO2 emissions is inverse. Overall, the results of the regression analysis point to a positive relationship between GDP growth and tax revenue and CO2 emissions, but a negative relationship between CO2 emissions and revenue excluding general government grants and general government final consumption. Statistical tests and the P-P and Q-Q plots are used to evaluate the normality assumption in relation to India's CO2 emissions. The data may slightly deviate from normality, but the evidence is not strong enough to reject the null hypothesis, according to the results, supporting the assumption of approximate normality. The results of the regression analysis, which is particular to India, emphasize the potential contributions of GDP growth and tax revenue with CO2 emissions by showing a positive relationship. In the meantime, there is a negative correlation between CO2 emissions and government spending and revenue (excluding grants), indicating possible areas for policy interventions to reduce environmental impact. For multicolinearity, complex relationships between the variables influencing CO2 emissions can be seen by the analysis. There is a strong positive correlation between tax revenue and CO2 emissions, suggesting that they are increasing at the same time. While GDP growth and revenue (excluding grants) show weak negative correlations with CO2 emissions, general government final consumption shows a moderately positive correlation. With a high R-squared value and a significant F-statistic, the regression model successfully explains 79.66% of the variation in CO2 emissions. The coefficients illustrate the relative importance of the various variables, with tax revenue having a positive impact on emissions and GDP growth, general government final consumption, and revenue (excluding grants) having a negative impact. Principal component analysis emphasizes the contribution of variables to the overall variance in CO2 emissions, and multicollinearity is considered insignificant. Interestingly, PC1 strongly correlates with CO2 emissions, highlighting its importance in comprehending and forecasting patterns of emissions. In hetro, regression analysis shows a substantial correlation between GDP growth, tax revenue, revenue excluding grants, and general government final consumption and CO2 emissions. With a statistically significant F-statistic (p = 0.0000) and a high R-squared of 0.7966, the model is able to explain 79.66% of the variation in CO2 emissions. The coefficients show that general government final consumption has a negative impact on CO2 emissions, while tax revenue, GDP growth, and revenue excluding grants all have a positive impact. But when heteroskedasticity is found, it casts doubt on the model's error terms' constant variance assumption. Robust regression results, in spite of this, confirm the statistical significance of the relationships and imply that the relationships between CO2 emissions and the model variables are probably valid even when heteroskedasticity is present. For Autocorrelation, Significant correlations between CO2 emissions and its predictors, tax revenue, GDP growth, and revenue excluding grants for general government final consumption, are found in the regression analysis using Newey-West standard errors. Increases in GDP growth, tax revenue, and revenue excluding grants appear to be positively and statistically significantly correlated with increased CO2 emissions. Furthermore, a decrease in CO2 emissions with increased government spending is implied by the negative coefficient for general government final consumption. Strong fit is demonstrated by the model's significant R-squared of 95.29%, which accounts for 95.29% of the variation in CO2 emissions. The model's overall significance is further supported by the statistically significant F-statistic of 67.18. These results highlight the complex relationship between economic variables and CO2 emissions, offering insightful information for environmental policy considerations.