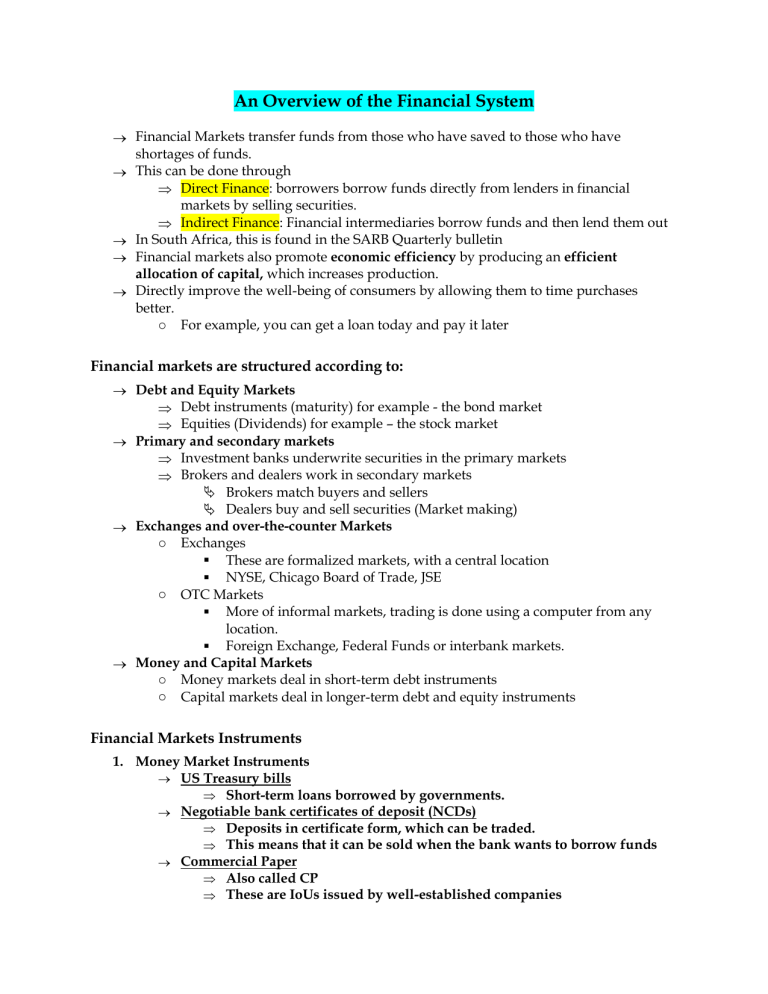

An Overview of the Financial System Financial Markets transfer funds from those who have saved to those who have shortages of funds. This can be done through Direct Finance: borrowers borrow funds directly from lenders in financial markets by selling securities. Indirect Finance: Financial intermediaries borrow funds and then lend them out In South Africa, this is found in the SARB Quarterly bulletin Financial markets also promote economic efficiency by producing an efficient allocation of capital, which increases production. Directly improve the well-being of consumers by allowing them to time purchases better. o For example, you can get a loan today and pay it later Financial markets are structured according to: Debt and Equity Markets Debt instruments (maturity) for example - the bond market Equities (Dividends) for example – the stock market Primary and secondary markets Investment banks underwrite securities in the primary markets Brokers and dealers work in secondary markets Brokers match buyers and sellers Dealers buy and sell securities (Market making) Exchanges and over-the-counter Markets o Exchanges These are formalized markets, with a central location NYSE, Chicago Board of Trade, JSE o OTC Markets More of informal markets, trading is done using a computer from any location. Foreign Exchange, Federal Funds or interbank markets. Money and Capital Markets o Money markets deal in short-term debt instruments o Capital markets deal in longer-term debt and equity instruments Financial Markets Instruments 1. Money Market Instruments US Treasury bills Short-term loans borrowed by governments. Negotiable bank certificates of deposit (NCDs) Deposits in certificate form, which can be traded. This means that it can be sold when the bank wants to borrow funds Commercial Paper Also called CP These are IoUs issued by well-established companies o In South Africa, this is called a promissory note. Federal funds and security repurchase Reserves: These are funds that commercial banks have deposited with the reserve bank. These reserves are borrowed overnight using the: Interbank rate, SABOR or Zaronia Repo rate Interbank Rate Repo rate has a period of 7 days The interbank rate has a period of 1 day When banks borrow using the repo rate they need security When they borrow from each other in the overnight markets they do not need security It is cheaper for banks to borrow from each other because there is no security required in the overnight markets and also the interbank rate is less than the repo rate most of the time. 2. Principal Money Market instruments o Corporate stocks In South Africa this is equity o Residential mortgages Also known as home bonds or residential bonds o Corporate bonds This is used by companies borrowing funds for a long time. o Long-term loans for U.S Government U.S government agency securities State and local government bonds U.s government securities o Bank commercial loans Loans that banks obtain o Consumer loans Loans that consumers obtain from banks. o Commercial and farm mortgages Loans that farmers obtain Internationalization of Financial Markets Foreign Bonds: o Bonds sold in a foreign country and denominated by that country's currency. o Example: Borrow in another country in that country's currency South African companies like SASOL sell bonds in the US to raise U.S. dollars, they can do this if they want to expand in the US. Eurobond: o A bond denominated in a currency other than the country in which it is sold Example: South African company selling bonds in Australia to raise U.S. dollars. Eurocurrencies o Foreign currencies are deposited in banks outside the home country. Eurodollars: these are US dollars deposited in banks outside the United States. EuroZar: these are ZARs deposited in London for example. The function of Financial Intermediaries The basic function of financial markets is to channel funds from savers who have excess funds to spenders who have a shortage of funds. 1. Transaction Costs / Liquidity services Time and money spent in carrying out financial transactions. Intermediaries can reduce transaction costs because they benefit from economies of scale due to expertise and size. Intermediaries provide liquidity services that make it easier for customers to conduct transactions. [Customers can withdraw their deposits anytime] e.g. Checking accounts to pay bills. 2. Risk sharing They sell less risky investments and then use the funds to purchase more risky investments. They earn a profit on the difference between the returns on risky assets they bought and the payments made on assets they sold. Also called asset transformation. They help individuals to diversify and thereby lower the amount of risk through low costs and asset pooling. 3. Asymmetric information This is when one party (lenders) does not know enough about the other party (borrowers) to make accurate decisions. Intermediaries are better equipped and can alleviate asymmetric information problems. This leads to two specific problems called adverse selection and moral hazard. Two forms 1) Adverse selection [Bad selection] → Occurs before the transaction → Borrowers who are most risky are more likely to be selected by lenders → Results in fewer loans to all as lenders hesitate to lend at all. 2) Moral hazard → Occurs after the transaction. → the risk that the borrower will engage in activities undesirable to the lender hence increase in the chance of default. → Reduces loans for all due hesitation to lend. → If there were no asymmetric information there could still be a moral hazard problem because the lender knows there might be a default and reducing such risk is too costly, therefore still a moral hazard. Types of Financial Intermediaries 1. Depository institutions (banks) o Largest and most diversified 2. Thrift institutions o Savings and loan associations → Not large in South Africa o Mutual savings banks → Not large in South Africa o Credit Unions o Smaller Financial Intermediaries & Societies in SA Stokvel → is the biggest in SA, however, they are more informal. Savings and loan association Co-operative Financial institutions → These are more formal forms of stokvels. 3. Contractual Savings institutions o Life insurance companies o Fire and casualty insurance companies → called short-term insurance in SA o Pension Funds, government retirement funds 4. Investment intermediaries o Finance companies → smaller finance companies o Mutual Funds → Called collective investment or unit trust in SA. This is a saving mechanism o Money market mutual funds → money market unit trusts o Hedge funds → collective (private) investments with a high risk What is Money? Money is an asset that allows you to get what you want. Money is anything that is generally accepted as payment of goods or services, or in the repayment of debts. Cheques are not money, because they are an instruction to the bank to transfer funds However, traveller's cheques are counted as money. Why? Savings deposits are an asset, that belongs to the depositor so they are money. Credit cards are not considered as money. Why? The money in the credit card does not belong to the depositor but to the bank. So when credit card holders use their cards, they create an obligation for themselves. Money is different from: Wealth Wealth is a total collection of items of property that serve to store value, including cash. Examples: Bonds, Cars, House, art, land etc. Money is a stock variable, meaning that it is an item in the balance sheet. Income Income refers to the flow of earnings per unit of time. This means that you earn it over time. Functions of Money [attributes of money] 1. Medium of exchange means that it is used as a means of payments eliminates the double coincidence of needs encourages specialization Conditions for Medium of exchange: Be easily standardized to ascertain the value Be widely accepted Must not deteriorate quickly Be divisible Must be easy to carry 2. Unit of account Allows us to be able to price things Money is used to measure value in the economy. Also reduces transaction costs 3. Store of Value Money is used to save purchasing power over time. However, other assets can serve this function with better returns as well. But money is still used to store value because it is the most liquid of all the stores of value. Even though money is used to store value, it does lose value over time due to inflation. Evolution of the Payment Systems 1. Commodity Money Example Gold Valuable, easily standardized, and divisible commodities 2. Fiat money Legal tender, by government decree. Based on trust 3. Checks An instruction to your bank to transfer money from your account Phased out or discontinued in South Africa. 4. Electronic payment Enables you to pay bills online. Saves time and cost Example EFT, 5. E-Money Substitute for cheques and paper money. Backed by Fiat currency, this is why it is different from crypto. Debit card Stored Value Card Smart cared E-Cash→ internet purchases E-Money: Potential Problem: Double spending, which is a risk that a cryptocurrency may be used twice or even more. However, this is solved by using cryptography and blockchain. Digital Currency Regulated or unregulated currency available only in electronic form 6. Virtual Currency Unregulated digital currency that is controlled by its developers or the founding organization Crypto currency Virtual currency that uses cryptography To secure and verify transactions and also, Facilitates the creation and control of new currency units. Not controlled by the government. Blockchain This is what makes crypto currencies secure. Blocks chained together via hashing To form a long historical record In a digital ledger called the "blockchain" Blocks This is where transactions that were made at a certain period are recorded. These blocks are then chained in a ledger to form what is called "blockchain" Hashing This is a way of using cryptography to secure transactions. This is a cryptography process that is used to Encode data of any length And then, convert it into a series of alphanumeric characters of fixed length. Mining This is the process of verifying and recording new Bitcoin transactions Miners verify transactions by solving a computational math problem And then the computer that solves the problem first, will earn the right to create a new block by submitting "proof of work". Advantages of Blockchain/Bitcoin Peer-to-peer- this means that there is no single person or group can control it. Immutable- this means that data entered in a blockchain is irreversible. No middleman- bitcoin does not need a third party such as banks to ensure the validity of transactions. Transparent- each node of the network(computer) has a copy of the distributed ledger to ensure the validity and accuracy of information. Transactions are permanently recorded, and the network's entire history is viewable to anyone. Will Bitcoin become money of the future? No, because as much as it functions well as a medium of exchange, it is a not a good store of value and unit of account because of its high fluctuation. Measuring Money Defined as currency plus deposits. Hence M = C + D In SA, Currency = paper money and coins in circulation – (less) cash-held bank vaults. Deposits = domestic, private non-bank deposits in banks exclude: Govt deposits held at commercial banks Foreign deposits held at commercial banks Vault cash The amount of currency in circulation is therefore known since it is currency is issued by the reserve bank. Also, since deposits are held by commercial banks, banks know the exact amount of deposits held by the nonbank private sector. Monetary Authorities in SA SARB and CPD(Corporation for public deposits) Depository institutions Registered commercial banks Mutual banks Landbank & Postbank Monetary aggregates Remember that money is a stock variable that can be measured. 1. M1A M1A = Cash(banknotes & coins) in circulation + Cheque and transmission deposits. Cheque & transmission deposits → no interest deposits mainly used to make payments e.g. my bank account with Capitec. In SA M1A counts for a small portion of M3. 1. M1 (Narrow definition of money) M1A + other demand deposits Other demand deposits → monetary deposits other than transaction and cash deposits. Other demand deposits→ are convertible into cash on demand and normally carry a payment facility. Example my TymeBank Goal Save Account In SA M1 constitutes a large portion of M3 3. M2(Broader definition of money) M1 + Deposits Deposits→ Short term deposits (1 - 31 days) Deposits→ Medium term deposits(32 - 180 days) Examples: Savings deposits, savings bank certificates, share investments and promissory notes amongst others. Cannot be converted into cash on demand, but only after a certain period of time. In SA M2 constitutes a large portion of M3 4. M3(A most comprehensive measure of money M2 + Long term deposits Much more stable than its components A better indicator of domestic spending Quantity theory, inflation and demand for money Quantity Theory of Money This is the theory of demand for money, It suggests that interest rates have no effect on the demand for money. Velocity and Money Equation The velocity of money: the average number of times per year that a dollar is spent buying the total amount of goods and services produced. 𝑃×𝑌 𝑣= , where 𝑃 × 𝑌 is the total spending 𝑀 The equation of exchange: 𝑀 × 𝑉 = 𝑃 × 𝑌, means that the quantity of money multiplied by the velocity of money gives you the total money spent in the economy/total income. Determinants of velocity Assumed to be constant in the short run Institutional and technological features would only affect velocity slowly over time. Credit cards mean less money and therefore a higher velocity. Demand for money 1 𝑀𝑑 = 𝑘 × 𝑃𝑌 where 𝑘 = 𝑣 This equation then suggests that the demand for money is a function of income and interest rates do not affect money demand. Quantity Theory of Money 𝑃 × 𝑌 = 𝑀 × 𝑉, suggests that the quantity of money leads to a proportional change in the price level. Quantity theory and inflation 𝜋 = ∆%𝑀 − %∆𝑌 Suggests that the inflation rate equals the growth of the money supply minus the growth of aggregate output. This theory is a good theory for explaining inflation in the long run but not in the short run. Governement budget constraint 𝐷𝐸𝐺 = 𝐺 − 𝑇 = ∆𝑀𝐵 + ∆𝐵 If the government deficit is financed by selling bonds, then there is not effect on MB or money supply. However, the deficit will increase if financed by high-powered money. Lastly, financing persistent deficits through high-powered money will lead to sustained inflation or hyperinflation like in Zimbabwe. Liquidity Preference Theory Shows the relationship between interest rate and the quantity of money the public is willing to hold. The theory states that interest rates are the price for money. According to Keynes, there are three reasons for the demand for money Transaction motive Precautionary motive Speculative motive 𝑃𝑌 Liquidity Preference Function: 𝑉 = 𝑓(𝑖,𝑌) This equation suggests that velocity is not constant, and that means changes in interest rates will affect velocity. Thus money supply is sensitive to interest rates. Factors that determine the demand for money Liquidity Trap It is when conventional monetary policy has no direct effect on aggregate spending because a change in money supply has no effect on interest rates. This happens when the nominal interest rates are zero and the demand for money is flat. In such a case, the 𝑀𝑑 line is flat and not sensitive at all to changes in money supply. This happened in Europe and the U.S after the financial crisis of 2008 This requires unconventional monetary tools to stimulate the economy. The behaviour of interest rates Chapter objective We understand how the overall level of nominal interest rates is determined and which factors influence their behaviour. Determinants of assets demand Wealth: total resources owned by an individual, including all assets. Expected Return: the return expected over the next period on one asset relative to another. Risk: the degree of uncertainty associated with the return on an asset relative to alternatives. Liquidity: the ease and speed with which an asset can be turned into cash relative to other assets. Theory of Portfolio Choice Tells us ukuthi how much of an asset would people hold in their portfolio. Holding all the other factors constants it states that: The quantity demanded of an asset is positively related to wealth The quantity demand of an asset is positively related to the expected return relative to other asset classes. The quantity demand of an asset is negatively related to the risk of its returns relative to other assets The quantity demanded of an asset is positively related to its liquidity relative to other assets. How nominal interest rates are determined? (1) The supply and demand for bonds Demand At lower prices (high-interest rates), the quantity demand for bonds will be higher, holding all the other factors constant. There is an inverse relation between bond prices and quantity demand for bonds Supply At the lower price (high-interest rates), the quantity supplied for bonds will be lower, holding all the other factors constant. There is a positive relationship between bond price and quantity supplied. Market equilibrium Bd = Bs defines the equilibrium (or market clearing) price and interest rate. Shifts in the demand for bonds Wealth An increase in the business cycle or Marginal propensity to save will shift bond demand to the left. Expected interest rate A higher expected interest rate lowers the expected return and hence the demand. Higher expected return on other assets lowers the demand for bonds Expected inflation Higher expected inflation leads to higher returns from other assets and lowers relative returns from bonds. Shifts in bond supply Expected inflation When inflation increases the real cost of borrowing falls. Changes in interest rates due to expected inflation, the Fisher effect When expected inflation rises, interest rates will also rise, this is called the Fisher effect. We do not know ukuthi by how much the bond quantity change, but interest rates will change by a certain amount. Changes in interest rates due to a business cycle expansion Amounts of goods and services rise with a corresponding increase in national income and business has more opportunities to expand, therefore they increase the supply of bonds. An increase in wealth will, via the theory of portfolio choice, increase the demand for bonds. Ambiguous change in interest rate but certain increase in quantity (2) Liquidity Preference Framework This is an alternative method of determining interest rates and was developed by John Maynard Keynes. This theory uses the demand and supply of money to determine the prevailing interest rate. This theory assumes that there are two types of assets in an economy, that is money and bonds which then equals the total wealth in the economy. The demand curve for money As interest rates rise the expected return of money falls relative to bonds and the demand for bonds increases. The supply curve: determined by the central bank Changes in Equilibrium Interest Rates in the Liquidity Preference Framework The money demand curve shifts because of: a. Income effect A higher level of income causes the demand for money at each interest rate to increase and the demand to shift to the right. b. Price level effect(inflation) A rise in the price level causes the demand for money to increase and the demand curve to shift to the right. Money supply shifts because of: Changes in money supply as determined by the central reserve. The response over Time to an Increase in Money Supply Growth The following graphs show how interest rates respond over time to an increase of the money supply. (a) The liquidity Effect is larger than other effects The liquidity effect dominates other effects, so the liquidity effect operates quickly to reduce interest rates. But as time goes the other effects kick in and start reversing the decrease, but not up to the initial level. Increase money supply to reduce interest rates. b) The liquidity effect is smaller than other effects and slow adjustment to expected inflation The inflation expectation effect is slow to adjust interest rates upwards, and then as time goes income, the inflation and price level effect also kick in. The result is that we see interest rates rising above the initial level over time. c) The liquidity effect is smaller than other effects and fast adjustment to inflation expectations Expected inflation kicks in immediately and overpowers the liquidity effect. This then results in an immediate rise in interest rates, which climb even further when income and price level effect kick in. Reduce money supply to reduce interest rates The Risk Term and Term Structure of Interest Rates Chapter Objective: To understand the sources and causes of interest rates fluctuations relative to one another Explain these fluctuations using the theories. 1. Risk Structure of interest rates Bonds with the same maturity have different interest rates due to: Default risk Liquidity Tax considerations 2. The term structure of interest rates Bonds with identical risk, liquidity and tax characteristics have different interest rates because the time remaining to maturity is different. When we plot these bonds with differing terms to maturity on a yield curve we get the following types of Yield Curves i. Upward sloping: long term rates are above short-term rates ii. Downward sloping: long term rates are below short-term rates iii. Flat: long term rates are the same as short-term rates We also see that(through empirical evidence):[Highly Testable] i. Interest rates on bonds of different maturities move together over time. This is explained by the expectations theory ii. When short-term rates are low, yield curves are more likely to have an upward slope, when short-term rates are high, yield curves are more likely to have a downward slope and be inverted. This is explained by the expectations theory iii. Yield curves are almost always upward-sloping. This is explained by the segmented markets theory Theories to explain the empirical evidence: [Highly Testable] a. Expectations theory The interest rate on a long-term bond will equal an average of short-term interest rates that people expect to occur over the life of the long-term bond. The key assumption is that buyers of bonds do not prefer one maturity over another, so they will not hold any quantity of a bond if its expected return is less than that of another bond with a different maturity. Treats bond with different maturities as perfect substitutes and thus have the same expected return. b. Segmented markets theory The interest for each bond with a different maturity is determined by the demand for and supply of that bond. Investors have preferences for bonds of one maturity over another. Bonds of different maturities are not substitutes at all c. Liquidity Premium & preferred habitat theory A mixture of expectations and market segments theory. The interest rate on a long-term bond will equal an average of short-term interest rates expected to occur over the life of the long-term bond plus the liquidity premium that responds to the supply and demand conditions of that bond. Bonds with different maturities are partial substitutes. Investors tend to prefer short-term bonds as they have lower interest rate risk. Investors must be offered a positive liquidity premium to induce them to hold longer-term bonds. Preferred habitat Theory Investors have a preference for bonds of one maturity over another They will be willing to buy bonds of different maturities only if they earn a somewhat higher expected return. Investors are likely to prefer short-term bonds over long-term bonds. Figure 5 The Relationship Between the Liquidity Premium (Preferred Habitat) and Expectations Theory Figure 6 Yield Curves and the Market’s Expectations of Future Short-Term Interest Rates According to the Liquidity Premium (Preferred Habitat) Theory