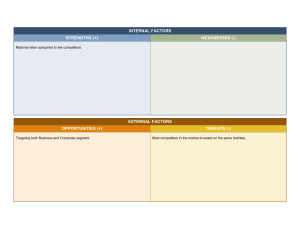

Introduction to the Case Study"BE Oil" is an intricate case study revolving around Quentin Bell, the CEO of a four-year-old shale oil company named BE Oil. The narrative unfolds amidst a challenging economic climate marked by significantly declining oil prices. This situation places Bell and his company at a critical juncture, necessitating a strategic reassessment of operations and future prospects. The case study delves deep into the historical, technological, and economic aspects of shale oil drilling, offering a comprehensive backdrop against which Bell's dilemma is set. It provides detailed insights into the shale oil industry, the impact of global oil price dynamics, and the specific operational considerations of BE Oil, including data about potential drilling sites in Colorado. Problem IdentificationThe core problem identified in the "BE Oil" case study is the decision Quentin Bell must make considering the plummeting oil prices. This drastic market shift threatens the financial viability and operational sustainability of BE Oil. Bell is confronted with several pressing challenges: 1. Economic Viability: Assessing whether continuing operations under the current economic conditions is financially sustainable for BE Oil. 2. Investment Decisions: Determining whether to invest in new wells in Colorado despite the uncertain future of oil prices. 3. Cost Management: Identifying ways to reduce costs and increase efficiency in drilling and production processes to mitigate the impact of lower oil prices. 4. Strategic Positioning: Considering long-term strategic positioning in the volatile oil market, including potential diversification or other risk mitigation strategies. Our analysis will aim to provide a detailed evaluation of these challenges, utilizing the quantitative and qualitative data presented in the case study. We'll explore the implications of various strategic choices, model the potential financial outcomes, and suggest a course of action based on economic principles, market analysis, and risk assessment. Analysis of the BE Oil HBR Case StudyStep 1: Formulating a Growth Path • Vision and Mission: The vision and mission of BE Oil will guide its long-term objectives and strategies. By analysing the company's history and Quentin Bell's initial goals, we can infer the company's aspirations for innovation, growth, and its place in the competitive oil market. • Strategic Aims: BE Oil's strategic aims likely involve establishing a robust position in shale oil production, optimizing extraction methods, and navigating the volatile oil market effectively. These aims must be revisited considering current challenges. Step 2: Understanding the Company • Company Culture and People: Insights into the workforce, management style, and organizational culture of BE Oil can be gleaned from the case study. This includes understanding Bell's leadership approach, employee morale, and the company's adaptability to change. • Priorities and Values: The priorities set by the company in response to past challenges, investment in technology, approach to risk, and ethical considerations will shape its response to the current crisis. Step 3: Developing a Timeline of Issues and Events • Historical Analysis: Constructing a timeline of BE Oil's major milestones, decisions, and market changes will provide a narrative of its growth and challenges. This includes the inception of the company, significant investments, previous market downturns, and strategic shifts. • Current Challenges: The precipitous drop in oil prices is the immediate challenge. The timeline will include recent market trends, changes in production technology, and competitive moves that impact BE Oil. • Predictive Outlook: Using the timeline to forecast potential future scenarios helps in strategizing. This might include anticipating market recovery, further declines, or shifts in energy policy and consumer behaviour. Implementing the Analysis • Data Utilization: Numerical analysis from the graphs, tables, and exhibits will be critical in understanding the financial implications of the oil price drop, cost structures, and potential returns on new investments. • Strategic Decision Making: Information from the company's history, culture, and current market position will inform strategic decisions. This includes whether to continue investing in Colorado wells, diversify, or restructure operations. • Solution Framework: The solutions will be structured around optimizing financial stability, maintaining competitive advantage, and preparing for future market fluctuations. As we proceed with this analysis, we'll aim to develop a comprehensive understanding of BE Oil's situation and strategic options. This will involve a detailed look at financial data, market trends, and internal company dynamics to recommend informed, actionable solutions. SWOT Analysis of BE OilThe SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis is a strategic planning tool that can help BE Oil understand its internal capabilities and external market environment. This analysis will aid in formulating strategies to address the central issue of declining oil prices and its impact on the company. Strengths • Innovative Drilling Techniques: BE Oil might possess advanced drilling technologies and innovative extraction methods that give it an edge over competitors in reducing costs and improving efficiency. • Experienced Leadership: Quentin Bell's leadership and the management team's experience in the oil industry could be a significant asset in navigating through market fluctuations. • Operational Flexibility: If BE Oil has a flexible operational structure, it can quickly adapt to changes in the market, like shifting to more profitable wells. Weaknesses • Financial Constraints: The plummeting oil prices likely strain BE Oil's financial resources, impacting its ability to invest in new projects or sustain operations in less profitable wells. • Dependence on Oil Prices: A heavy reliance on favourable oil market conditions can be a considerable weakness, especially during periods of volatility. • Limited Diversification: If BE Oil's portfolio is not diversified and is heavily focused on shale oil, it becomes more vulnerable to sector-specific downturns. Opportunities • Market Recovery: Any future recovery in oil prices could provide a significant boost to BE Oil's revenues and profitability. • Technological Advancements: Investing in new technologies could reduce operational costs and increase the efficiency of oil extraction. • Strategic Alliances: Forming partnerships with other firms could spread risk, provide additional capital, and offer new market opportunities. Threats • Continued Price Volatility: Ongoing fluctuations in oil prices can threaten the financial stability and planning capabilities of BE Oil. • Regulatory Changes: New environmental regulations or policies can increase operational costs or limit access to certain resources. • Competitive Pressure: Other firms might adopt more aggressive strategies or innovative technologies that could erode BE Oil's market position. Utilizing SWOT for Strategy Development• Leveraging Strengths: BE Oil can use its innovative drilling techniques and experienced leadership to navigate the current challenges more effectively and maintain a competitive edge. • Addressing Weaknesses: Identifying financial constraints and dependence on oil prices can lead to strategies focused on cost management and finding alternative revenue sources. • Capitalizing on Opportunities: The company can look for signs of market recovery to time its investments wisely and explore new technologies or partnerships to broaden its market scope and capabilities. • Mitigating Threats: By anticipating price volatility and regulatory changes, BE Oil can prepare contingency plans and diversify its risk to remain resilient. Porter's Five Forces Analysis for BE OilPorter's Five Forces framework is a powerful tool for understanding the competitive forces that shape the industry in which BE Oil operates. It helps in identifying how the dynamics of the oil industry influence BE Oil's strategic position and profitability. Here's how each of the five forces might affect BE Oil: 1. Threat of New Entrants • Capital Requirements: The oil industry requires significant capital investment for exploration, drilling, and infrastructure, which can deter new entrants. • Regulatory Barriers: Strict regulations and licensing requirements can also raise the barrier to entry. • Experience and Expertise: Established expertise and operational experience are crucial, giving existing companies like BE Oil an advantage over new entrants. Impact on BE Oil: High capital and regulatory barriers likely moderate the threat of new entrants for BE Oil, but it must stay vigilant about technological innovations that could lower these barriers. 2. Threat of Substitute Products • Alternative Energy Sources: The rise of renewable energy sources like solar, wind, and electric vehicles poses a long-term threat to the oil industry. • Price and Performance: The viability of substitutes often depends on their price and performance relative to oil. Impact on BE Oil: While currently moderate, the threat of substitutes could increase significantly over time as technology improves and environmental policies become stricter. 3. Bargaining Power of Buyers • Buyer Concentration: If a few buyers purchase most of the oil, their bargaining power increases. • Price Sensitivity: In a competitive market with relatively uniform product quality, buyers (like refineries and countries) may have significant power based on price sensitivity. Impact on BE Oil: If BE Oil sells to a market with few large buyers, it might face high bargaining power from buyers, impacting prices and margins. 4. Bargaining Power of Suppliers • Number of Suppliers: A limited number of equipment and service providers can increase suppliers' bargaining power. • Cost of Switching: High switching costs between suppliers can also empower them. Impact on BE Oil: If BE Oil relies on a few suppliers for drilling equipment or services, it may face high bargaining power from these suppliers, affecting its cost structure. 5. Industry Rivalry • Number of Competitors: A high number of competitors can increase rivalry, as firms seek to improve their market share and profitability. • Industry Growth: Slow growth can intensify competition as firms fight for a larger share of a stagnant market. • Price Wars: In the oil industry, price is a significant factor, and competitive pricing can lead to thin margins. Impact on BE Oil: High industry rivalry, especially during times of low oil prices, can pressure BE Oil to lower costs, innovate, and efficiently manage resources to maintain profitability. Applying Porter's Five Forces to BE OilBy analysing these five forces, BE Oil can develop strategies to: • Mitigate Threats: Such as by diversifying its energy portfolio to reduce the impact of substitutes or by forming strategic alliances to increase market power. • Leverage Power: Utilizing its bargaining position where possible, whether with suppliers or buyers, to negotiate better terms and improve margins. • Differentiate and Innovate: To stand out in a competitive market, focusing on efficiency, cost reduction, and potentially exploring untapped markets or technologies. Understanding the competitive environment through Porter's Five Forces helps BE Oil in crafting strategies that not only respond to its immediate challenges but also position it effectively for long-term sustainability and growth in the competitive oil industry. PESTEL Analysis of BE OilThe PESTEL framework provides a comprehensive look at the macro-environmental factors that affect an organization and its industry. For BE Oil, understanding these external factors is crucial for strategic planning and navigating the complex oil market. Here's how each element of PESTEL might impact BE Oil: Political Factors • Government Policies: Regulations regarding drilling, environmental protection, and exports can significantly affect BE Oil's operations and profitability. • International Relations: Geopolitical tensions and international agreements (like OPEC decisions) can influence oil prices and supply stability. • Subsidies and Tariffs: Governmental financial support for energy companies or tariffs on imported oil can impact market dynamics. Impact on BE Oil: Political decisions and relationships at both the national and international level play a critical role in the oil industry, affecting BE Oil's market access and cost structure. Economic Factors • Global Oil Prices: Fluctuations in global oil prices directly impact BE Oil's revenue and longterm planning. • Economic Growth: The economic growth of major oil-consuming countries affects demand for oil. • Exchange Rates: As oil transactions are typically in US dollars, exchange rate volatility can affect profitability for companies operating in different currencies. Impact on BE Oil: Economic conditions, including recessions, growth in emerging markets, and currency fluctuations, can significantly affect BE Oil's financial performance. Social Factors • Consumer Attitudes: Increasing environmental consciousness and a shift toward renewable energy sources can reduce demand for oil. • Population Growth: Higher population growth can lead to increased energy demand, potentially benefiting the oil industry. • Lifestyle Changes: Changes in how people work and travel, especially with more remote work and electric vehicles, can influence oil consumption patterns. Impact on BE Oil: Social trends and changes in consumer behavior can gradually reshape the market for oil, affecting demand and opening up new challenges and opportunities. Technological Factors • Innovation in Extraction: Advances in drilling and extraction technology can reduce costs and increase the efficiency of oil production. • Alternative Energy Technologies: The development of renewable energy technologies poses a long-term threat to the oil industry by providing substitutes. • Data Analytics and Automation: Technologies that improve data analysis and operational efficiency can provide a competitive edge. Impact on BE Oil: Staying abreast of technological changes is crucial for BE Oil to maintain cost-effectiveness and prepare for shifts in the energy landscape. Environmental Factors • Climate Change Policies: Regulations aimed at reducing carbon emissions can impact oil production and consumption. • Environmental Disasters: Spills and accidents can lead to costly clean-up efforts and damage the company's reputation. • Sustainability Practices: Increasing pressure to adopt more sustainable and environmentally friendly practices can influence operational methods and public perception. Impact on BE Oil: Environmental concerns and regulations are increasingly shaping the oil industry, necessitating a proactive and responsible approach from companies like BE Oil. Legal Factors • Regulatory Compliance: Compliance with a wide range of laws, from environmental regulations to safety standards, is mandatory and can be costly. • Litigation Risks: The oil industry is prone to legal disputes over issues like land rights, contracts, and environmental damage. • Intellectual Property: Protecting innovations in technology or processes can be crucial for maintaining a competitive advantage. Impact on BE Oil: Legal challenges can pose significant risks and costs, making understanding and adherence to legal requirements critical for BE Oil's operations and strategic planning. Applying PESTEL to BE OilUnderstanding these external factors helps BE Oil anticipate changes, adapt its strategies, and make informed decisions. By analysing the PESTEL factors, BE Oil can identify potential threats and opportunities, align its strategies with the external environment, and navigate the complex and ever-changing landscape of the oil industry. This holistic view is essential for sustaining growth, managing risks, and capitalizing on new possibilities. VRIO Analysis of BE OilThe VRIO framework is a tool for evaluating an organization's resources and capabilities to discover potential sources of sustained competitive advantage. It examines Value, Rarity, Imitability, and Organization. Here's how BE Oil might analyze its internal resources and capabilities: 1. Value • Resource: Skilled Workforce, Innovative Drilling Techniques, Strategic Oil Reserves. • Analysis: Resources that enhance efficiency, reduce costs, or improve product offerings add value. For BE Oil, having a skilled workforce and advanced drilling techniques likely enhance operational efficiency and productivity, making these resources valuable. 2. Rarity • Resource: Exclusive Drilling Rights, Proprietary Technology. • Analysis: Resources that are not widely available to competitors are rare. If BE Oil possesses unique drilling rights or proprietary technology, these would be considered rare and can provide a competitive edge. 3. Imitability • Resource: Company Culture, Brand Reputation, Technical Expertise. • Analysis: Resources that are difficult to imitate provide an advantage. A strong, unique company culture or a reputation for quality and reliability can be challenging for competitors to replicate. Similarly, a high level of technical expertise in oil exploration and extraction might be hard to imitate quickly. 4. Organization • Resource: Efficient Supply Chain, Effective Leadership, Strategic Partnerships. • Analysis: The organization's ability to capitalize on its resources is crucial. An efficient supply chain, effective leadership, and strategic partnerships are organizational capabilities that allow a company to fully exploit its valuable, rare, and costly-to-imitate resources. Applying VRIO to BE Oil• High on All 4 (Long-term Competitive Advantage): If BE Oil has resources that are valuable, rare, costly to imitate, and the company is organized to capture the value of these resources, it may enjoy a sustained competitive advantage. For example, proprietary drilling technology that significantly reduces costs would fall into this category if BE Oil is also structured to leverage this technology effectively. • High on Value, Rareness, and Imitability (Unused Competitive Advantage): If a resource is valuable, rare, and hard to imitate, but the organization isn't fully exploiting it, there's potential for competitive advantage that's not being used. For instance, if BE Oil has a groundbreaking extraction technique but hasn't scaled it effectively, it's an unused advantage. • High on Value and Rareness (Temporary Competitive Advantage): Resources that are valuable and rare but can be imitated might only offer a temporary edge. Exclusive drilling rights are a good example; they provide an advantage, but as they expire, competitors can potentially gain access. • Only Valuable (Competitive Parity): Resources that are valuable but neither rare nor hard to imitate do not provide a competitive advantage but are necessary to compete in the industry. Standard drilling equipment might fall into this category. • None (Competitive Disadvantage): If a resource isn't valuable, rare, or costly to imitate, and the organization isn't structured to capture any potential value, it might be a competitive disadvantage. An outdated, inefficient piece of equipment could be an example here. By conducting a VRIO analysis, BE Oil can understand which aspects of its business provide sustainable competitive advantages and which areas might require strategic development or rethinking. This understanding is crucial for making informed decisions and strategic planning. Value Chain Analysis of BE OilValue Chain Analysis is a strategic tool used to identify a company's primary and support activities that add value to its final product and analyze how they can be optimized for efficiency and effectiveness. For BE Oil, this analysis will help understand how each activity contributes to the company's operational success and competitive advantage. Primary Activities 1. Inbound Logistics: Activity: Acquiring raw materials, handling, storage, and transportation of drilling equipment and machinery. Value Addition: Efficient inbound logistics can reduce costs and ensure timely availability of resources. Strategy: Streamline supplier relationships, negotiate better rates, and improve inventory management. 2. Operations: Activity: Drilling, extraction, and initial processing of oil. Value Addition: Efficient operations ensure high productivity and lower operational costs. Strategy: Invest in innovative drilling techniques, improve operational workflows, and maintain high safety standards to reduce downtimes. 3. Outbound Logistics: Activity: Storing and then distributing the oil to buyers or refineries. Value Addition: Timely and efficient delivery can enhance customer satisfaction and reduce costs. Strategy: Optimize transportation routes, leverage logistics partners, and improve demand forecasting. 4. Marketing and Sales: Activity: Promoting the oil products to potential buyers and negotiating contracts. Value Addition: Effective marketing can lead to higher sales volumes and better prices. Strategy: Understand customer needs, develop strong sales channels, and create compelling value propositions. 5. Service: Activity: Providing support to customers, including maintenance and after-sale services. Value Addition: Good service increases customer loyalty and can lead to repeat business. Strategy: Offer reliable support, gather customer feedback, and continuously improve service offerings. Support Activities 1. Firm Infrastructure: Activity: Company-wide support systems, including management, planning, finance, and legal. Value Addition: A strong infrastructure enables effective decision-making and supports all other activities. Strategy: Invest in robust IT systems, effective governance structures, and risk management practices. 2. Human Resource Management: Activity: Recruiting, training, and retaining skilled employees. Value Addition: A skilled and motivated workforce drives productivity and innovation. Strategy: Develop competitive compensation packages, foster a positive work culture, and provide growth opportunities. 3. Technology Development: Activity: Research and development of new drilling methods and technologies. Value Addition: Technological advancements can lead to cost reductions and product improvements. Strategy: Invest in R&D, stay abreast of industry innovations, and foster a culture of continuous improvement. 4. Procurement: Activity: Purchasing inputs required for the company's operations, including equipment and services. Value Addition: Efficient procurement reduces costs and ensures quality. Strategy: Develop strong relationships with suppliers, negotiate better terms, and ensure timely procurement. Applying Value Chain Analysis to BE OilBy examining each of these activities, BE Oil can identify inefficiencies or areas for improvement and develop strategies that enhance value creation. For instance, by improving its inbound logistics, BE Oil can reduce costs associated with storing and moving drilling equipment. In operations, adopting cutting-edge technologies can reduce time and costs, enhancing overall productivity. Optimizing each activity not only enhances the performance of that activity but also has a positive ripple effect throughout the entire value chain. BE Oil can increase its competitive advantage by continuously analysing and improving these key areas, thereby providing superior value to its customers and stakeholders. BCG Matrix of BE OilThe Boston Consulting Group (BCG) Matrix is a strategic tool for portfolio management and helps in deciding where to allocate resources among various business units or investments based on their relative market shares and growth rates. For BE Oil, this analysis will help identify how to manage different segments of its operations or product lines. Steps in BCG Matrix Analysis for BE Oil: 1. Identify Relative Market Share: Calculate the market share of each of BE Oil's strategic business units (SBUs) compared to the largest competitor in that segment. High relative market share indicates a strong position, while a low share indicates a weaker position. 2. Identify Market Growth Rate: Determine the growth rate of the market in which each SBU operates. High growth rates indicate attractive, fast-growing markets, while low growth rates indicate mature or declining markets. 3. Place SBUs in One of Four Categories: Question Marks: High market growth rate but low market share. These units are uncertain and need a lot of cash to hold or gain market share. Stars: High market growth rate and high market share. Stars are leaders in business sectors that are growing rapidly. They require investment to maintain their position, but they also generate substantial funds. Cash Cows: Low market growth rate but high market share. These are mature, successful businesses with less need for investment. They generate more cash than what is needed to maintain market share. Dogs: Low market growth rate and low market share. These units typically "break even", generating barely enough cash to maintain the business's market share. Applying BCG Matrix to BE Oil• Question Marks: For BE Oil, any new ventures or experimental drilling projects in emerging markets might be considered Question Marks. They might have potential but need significant investment and strategic decision-making to become Stars or divest if unprofitable. • Stars: Any of BE Oil's highly successful drilling operations or contracts in fast-growing markets would be Stars. These are likely the primary focus for investment in technology and resources to capture the maximum benefit from growing markets. • Cash Cows: Mature oil fields or operations where BE Oil has a significant market share but is in a slow-growth industry would be Cash Cows. They require less investment and should be maintained efficiently to fund other segments of the business. • Dogs: Any underperforming assets or operations with low market share in low-growth areas can be considered Dogs. BE Oil might consider divesting these assets to reallocate resources more effectively. Strategies for Each Category• Question Marks: Decide whether to invest heavily to gain market share (turn into Stars) or divest. • Stars: Invest to maintain leadership and growth, as they have the potential to become Cash Cows when market growth slows. • Cash Cows: Maximize cash flow and profit with minimal investment. Use funds generated to support Question Marks and Stars. • Dogs: Minimize investment, divest or restructure to halt losses. For BE Oil, the BCG Matrix is a starting point for a deeper analysis. It will need to be combined with other strategic tools and detailed market analysis to make informed decisions about where to invest, develop, penetrate the market, or divest. This strategic approach will help BE Oil allocate resources efficiently and pursue opportunities that align with its overall corporate strategy. Ansoff Matrix for BE OilThe Ansoff Matrix is a strategic planning tool that provides a framework for BE Oil to devise strategies for growth by varying its products and markets. Here's how BE Oil might consider its strategic options within the Ansoff Matrix: 1. Market Penetration (Existing Markets, Existing Products) • Description: Focus on increasing the market share of BE Oil's current products in its existing markets. This can be achieved by attracting a competitor's customers, improving product quality, or reducing prices. • Application for BE Oil: BE Oil could intensify its efforts in its established markets by offering competitive pricing, enhancing customer relationships, or increasing marketing efforts to boost demand for its existing oil products. 2. Product Development (Existing Markets, New Products) • Description: Introduce new products or variations to the existing market. This strategy is about innovation and offering something new to current customers. • Application for BE Oil: BE Oil might invest in R&D to develop more efficient extraction technologies or introduce environmentally friendly or more refined oil products to meet the changing needs of the existing market. 3. Market Development (New Markets, Existing Products) • Description: Enter new markets or segments with the current product offerings. This can involve geographic expansion, targeting new customer segments, or venturing into new distribution channels. • Application for BE Oil: Explore new geographical regions where the demand for oil is growing or enter new industries that require oil as a raw material. They could also consider online marketplaces or partnerships to reach new customers. 4. Diversification (New Markets, New Products) • Description: Develop new products to serve new markets. This is the most risky strategy as it involves two unknowns - new product and new market. • Application for BE Oil: Diversify into renewable energy sources, such as wind or solar power, to reduce dependence on the oil market. Alternatively, they could venture into entirely different industries where they can leverage their existing expertise in drilling and extraction. Choosing the Right StrategyThe choice of strategy from the Ansoff Matrix for BE Oil depends on: • Risk Appetite: How much risk is BE Oil willing to take? Diversification is the riskiest, while market penetration is the least. • Market Conditions: What are the current and projected conditions of the oil market? This affects decisions on whether to focus on current products or diversify. • Company Resources: Does BE Oil have the financial and human resources to support expansion or diversification? • Competitive Landscape: What are the strengths and weaknesses of competitors, and where are the gaps in the market that BE Oil can exploit? By considering these factors and using insights from other strategic tools like SWOT, PESTEL, and Porter's Five Forces, BE Oil can select a strategy that aligns with its objectives and external environment. The chosen strategy should leverage BE Oil's strengths, mitigate its weaknesses, capitalize on opportunities, and defend against threats. Marketing Mix of BE OilThe marketing mix, often referred to as the 4Ps (Product, Price, Place, Promotion), is a tool that helps companies strategize on how to meet their market's needs and desires effectively. For BE Oil, a well-considered marketing mix can enhance its market presence, profitability, and customer satisfaction. Here's how each element can be analyzed and strategized: 1. Product • Analysis: Assess the range and features of the oil products BE Oil offers, including the quality, variety, and the unique value proposition. Consider how these products meet customer needs and how they stand out from competitors. • Strategy: BE Oil could focus on diversifying its product line to include more sustainable and eco-friendly oil products or invest in R&D to improve the efficiency and effectiveness of its current offerings. Ensuring that products meet the highest standards of quality and reliability is also essential. 2. Price • Analysis: Evaluate BE Oil's current pricing strategy. How does it compare to competitors? Understand how price-sensitive customers are and how pricing impacts their buying decision. Consider the costs, market demand, and competitive landscape. • Strategy: BE Oil could consider a pricing strategy that aligns with its market positioning. This might include premium pricing for high-quality products or competitive pricing to penetrate deeper into the market. It could also explore dynamic pricing strategies to adjust to market conditions and maximize profitability. 3. Place (Distribution) • Analysis: Look at how and where BE Oil's products are currently being sold. This includes distribution channels, market coverage, inventory management, transportation, and logistics. • Strategy: Strategies might include expanding into new markets or improving logistics to enhance product availability. BE Oil could also explore partnerships with local distributors for better market penetration or invest in direct sales channels like online platforms for wider reach. 4. Promotion • Analysis: Assess the current promotional activities of BE Oil, including advertising, sales promotions, public relations, and direct marketing. Understand what messages are being conveyed and how effectively they reach and influence the target market. • Strategy: BE Oil could develop an integrated marketing campaign that combines various promotional tools for a unified message. This might involve targeted advertising campaigns, enhanced public relations efforts for a better corporate image, sales promotions to stimulate quick demand, or direct marketing to reach customers more personally. Integrating the Marketing Mix For BE Oil, integrating these 4Ps effectively will require a deep understanding of its target market, competitive landscape, and internal capabilities. The strategies developed should not only aim at bringing out the desired response from the market but also at achieving long-term business objectives. The marketing mix should be flexible enough to adapt to changing market conditions and customer preferences while maintaining a consistent brand message and quality standard. By carefully analyzing and strategizing each element of the marketing mix, BE Oil can enhance its market position, customer satisfaction, and overall business performance. BE Oil Strategy: Implementing a Blue Ocean Approach The Blue Ocean Strategy represents a way for BE Oil to navigate beyond the intensely competitive (Red Ocean) market spaces and create new, uncontested market areas, thereby making the competition irrelevant. Here's how BE Oil can implement a Blue Ocean Strategy: 1. Reconstruct Market Boundaries: • Identify New Markets: Explore opportunities outside the traditional oil market, such as renewable energy or innovative energy solutions, where competition is less intense. • Redefine Customer Base: Look for new customer segments with unmet needs. This could involve targeting industries or regions that BE Oil has not previously focused on. 2. Focus on the Big Picture, Not the Numbers: • Strategic Vision: Develop a compelling vision that goes beyond competing. This vision should focus on breaking away from the competition and opening new market spaces. • Blue Ocean Idea: For BE Oil, this could mean developing a revolutionary eco-friendly extraction technology or offering energy solutions that combine oil with renewable resources to provide a unique value proposition. 3. Reach Beyond Existing Demand: • Noncustomers into Customers: Understand why certain groups have avoided the oil market and what could be offered to turn them into customers. • Widen Market Boundaries: For instance, providing comprehensive energy solutions that cater not just to immediate energy needs but also to environmental and sustainability concerns could attract a broader customer base. 4. Get the Strategic Sequence Right: • Buyer Utility: Ensure that any new idea or product offers exceptional utility and stands out in the market. • Price: Price innovatively to attract a broad spectrum of buyers. This might mean considering new pricing strategies that reflect the unique value offered. • Cost: Keep costs under control to ensure profitability. This could involve innovative processes, technology, or partnerships. • Adoption: Anticipate and overcome any hurdles to the adoption of the new strategy, whether they are organizational, technological, or cultural. 5. Overcome Key Organizational Hurdles: • Overcome the Cognitive Hurdle: Change the mindset within the company to embrace innovation and new market creation. • Resource Hurdle: Allocate resources strategically to areas with the highest potential for blue ocean creation. • Motivational Hurdle: Motivate all levels of the organization to commit to and support the blue ocean strategy. 6. Build Execution into Strategy: • Engage Employees: Engage all levels of the organization in the strategy for collective buy-in and execution. • Continuous Renewal: Continuously monitor the market and adapt the strategy as necessary, ensuring BE Oil stays ahead of emerging trends and potential new market spaces. By adopting a Blue Ocean Strategy, BE Oil can potentially unlock new growth and profitability avenues, moving away from the fiercely competitive and often commoditized traditional oil market. This strategy requires creativity, willingness to change, and a keen understanding of current and potential customers. It's a shift from competing to creating, from fighting over a shrinking profit pool to growing the market and creating new spaces of opportunity. Competitor Analysis of BE Oil A thorough competitor analysis will provide BE Oil with insights into the strategies, strengths, weaknesses, and potential moves of its rivals. This analysis will help BE Oil to anticipate competitor actions, exploit their weaknesses, and defend against their strengths. Here's how BE Oil can conduct a detailed competitor analysis: 1. Identifying Competitors: • Direct Competitors: These are companies operating in the same industry, offering similar products or services. For BE Oil, these would be other oil exploration and production companies. • Indirect Competitors: These include companies in alternative energy sectors or those offering substitute products. 2. Analysing Competitor Actions: • Strategies and Objectives: Understand the goals and strategies of competitors. Are they focusing on growth, stability, or retrenchment? What is their approach to innovation and market expansion? • Market Position: Compare the market share of BE Oil with its competitors. A high market share might indicate a strong position, but also potential threats from aggressive competitors aiming to increase their share. 3. Comparing Marketing Mix: • Product: What are the competitors offering? How does it compare with BE Oil's offerings in terms of quality, range, and innovation? • Price: How are competitors pricing their products? Are they using cost-based, value-based, or competition-based pricing strategies? • Place (Distribution): What channels are competitors using to distribute their products? How efficient is their supply chain? • Promotion: Analyse the promotional strategies of competitors. How are they positioning themselves in the market? What channels are they using for marketing and advertising? 4. Assessing Operational Aspects: • Supply Chain: Understand the efficiency and effectiveness of competitors' supply chains. Are there areas where BE Oil can improve to gain an edge? • Human Resources: Compare the talent, skills, and expertise available to competitors with that of BE Oil. Human capital is a critical asset in the industry. • Financial Strength: Assess the financial health of competitors. Strong financial resources can indicate the ability to withstand market downturns and invest in growth opportunities. 5. Opportunities and Threats: • Opportunities: Are there gaps left by competitors that BE Oil can exploit? This might include underserved markets, technological advancements, or innovative services. • Threats: What are the potential threats posed by competitors? This could include aggressive pricing strategies, market expansion, mergers and acquisitions, or new entrants. 6. Monitoring Competitors: • Keep a Pulse on Actions: Regularly monitor the activities of competitors, including any new product launches, changes in strategy, or market moves. • Anticipate Changes: Try to anticipate potential changes in competitor strategies and market dynamics. This can help BE Oil to be proactive rather than reactive. Understanding competitors is crucial for BE Oil to navigate the complex and competitive landscape of the oil industry. By continuously monitoring and analysing competitors, BE Oil can develop robust strategies that enhance its competitive position and ensure long-term growth and stability. Alternate Solution for BE Oil Case Study Corporate Level Strategy • Strategic Diversification: Analysis: If the primary strategy focused on enhancing current operations and market presence, the alternate strategy might involve diversifying BE Oil's portfolio to reduce dependency on volatile oil markets. Recommendations: Explore strategic diversification into renewable energy sources or other related sectors. This could include investing in solar, wind, or biofuels, or even branching into energy consultancy services. Future Outlook: This approach aims to reduce risks associated with the oil market and open new revenue streams, ensuring long-term sustainability and growth. Business Level Strategy • Cost Leadership: Analysis: If the original solution emphasized differentiation or market development, an alternate approach could be to become the lowest-cost producer in the industry. Recommendations: Focus on aggressive cost reduction strategies, such as optimizing operations, leveraging economies of scale, and adopting advanced technologies to reduce production costs. Alignment: Ensure this cost leadership strategy aligns with the corporate diversification plan, perhaps by finding synergies in cost-saving technologies that apply across both traditional and new business areas. Other Recommendations • Strategic Partnerships and Alliances: Analysis: Instead of going alone, BE Oil might benefit from forming strategic partnerships or alliances with companies in other sectors or industries. Recommendations: Look for potential partners in renewable energy, technology firms, or even competitors to share resources, knowledge, and market access. This could also involve joint ventures or mergers. Benefits: Partnerships can spread risk, provide new capabilities, and offer faster entry into new markets or technologies. Departmental/Individual Level Strategies • Change Management: Analysis: Diversification and cost leadership will require significant changes within the organization. Recommendations: Develop a strong change management plan to handle the transition. This should include training programs, a clear communication strategy, and measures to maintain employee morale and corporate culture. Implementation: Assign responsibilities and set clear goals and timelines for each department and key individuals to ensure that the change is as smooth and efficient as possible. Recommendations and Action Plan for BE Oil Based on the comprehensive analyses conducted, here's a synthesized set of recommendations and an actionable plan for BE Oil: 1. Leverage Strengths to Capture Opportunities (VRIO & PESTEL): • Focus on Innovative Technologies: Utilize advanced drilling techniques and technologies identified as strengths in the VRIO analysis to tap into the opportunities presented by the growing demand for efficient and environmentally friendly extraction methods (PESTEL). • Expand in Emerging Markets: Use its strong market position to explore and expand into emerging markets where there are opportunities for growth and less volatility (PESTEL). Action Steps: • Invest in R&D to improve extraction and drilling technologies. • Conduct market research to identify promising emerging markets and develop entry strategies. 2. Enhance Value-Creating Activities (Value Chain Analysis): • Optimize Operations: Streamline operations to reduce costs and improve efficiency. Focus on areas where BE Oil has significant control and can make quick improvements. • Improve Marketing and Sales: Enhance promotional strategies to better communicate the value proposition and engage with the target market effectively. Action Steps: • Implement process improvement programs focusing on cost reduction and efficiency. • Develop a new marketing campaign highlighting BE Oil's strengths and unique selling points. 3. Invest in Stars and Manage Cash Cows (BCG Matrix): • Invest in Stars: Allocate resources to high-growth areas where BE Oil has a strong market share. These are likely to become the future cash cows. • Maintain Cash Cows: Ensure that these areas continue to generate steady cash flow with minimal investment. Reinvest profits from cash cows into Stars and promising new ventures. Action Steps: • Identify the specific business units that are Stars and plan targeted investment strategies for each. • Conduct a review of cash cows to determine the optimal level of maintenance and profit extraction. 4. Divest Dogs and Reallocate Resources: • Divest Non-Performing Units: Identify the underperforming units classified as Dogs in the BCG Matrix and consider divesting them to free up resources. Action Steps: • Perform a thorough analysis to confirm which units are indeed Dogs and assess the feasibility of divestiture. • Plan and execute the divestiture process, ensuring minimal disruption to other business areas. 5. Utilize Marketing Mix for Target Market Engagement: • Product Strategy: Continue innovating and improving the product offerings to meet the changing needs of the market. • Price Strategy: Adopt flexible pricing strategies that reflect market conditions and BE Oil's value proposition. • Place Strategy: Expand distribution channels to ensure BE Oil's products are readily available where demand is highest. • Promotion Strategy: Develop targeted promotion campaigns to reach and persuade the target market. Action Steps: • Develop a new product roadmap with timelines for innovation and improvement. • Analyse pricing models and adjust based on market conditions and competitive analysis. • Evaluate and expand distribution networks. • Create and launch a new promotional plan focusing on key differentiators and value to customers. By focusing on its strengths and opportunities, enhancing value-creating activities, wisely managing its portfolio, and engaging effectively with the market through a well-crafted marketing mix, BE Oil can navigate the complexities of the industry and position itself for sustained growth and profitability. Each recommendation is accompanied by clear action steps to guide the implementation process, ensuring that these strategies move from plan to practice effectively.