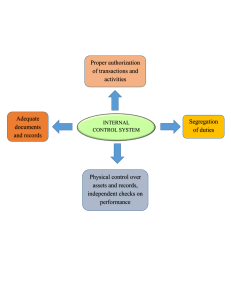

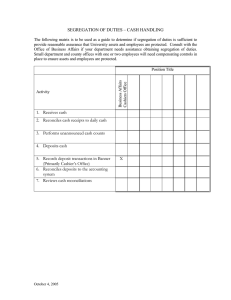

ICM – SALIH AHMED ISLAM INTERNAL CONTROL MANUAL A. Segregation of Duties The purpose of this Internal Control Manual is to provide guidance on implementing and maintaining effective segregation of duties within an organization. Segregation of Duties (SoD) is a key internal control that helps to prevent errors, fraud, and mismanagement of an organization's resources. It involves dividing critical tasks among different individuals or departments to ensure that no single person has the ability to perform actions that could lead to unauthorized transactions or manipulation of financial records. 1. Principles of Segregation of Duties There are four primary principles that form the foundation of SoD: a. Authorization: The process of approving transactions, activities, or decisions. b. Custody: The process of holding, managing, and safeguarding assets. c. Recording: The process of maintaining accurate and timely financial and operational records. d. Reconciliation: The process of reviewing and comparing records to ensure accuracy and completeness. Organizations can minimize the risk of fraud and errors by ensuring that no single individual has the ability to initiate, approve, and record transactions without oversight. 2. Implementing Segregation of Duties To implement effective SoD, organizations should: a. Identify critical tasks and processes that require segregation, such as cash handling, purchasing, payroll, and financial reporting. b. Analyze the current division of responsibilities among employees and departments. c. Establish clear roles and responsibilities for each employee and department. d. Assign duties to different individuals or departments to minimize the potential for unauthorized activities or manipulation of records. e. Regularly review and update the assignment of duties to ensure ongoing effectiveness. 1 ICM – SALIH AHMED ISLAM 3. Monitoring and Compliance To ensure the effectiveness of SoD, organizations should: a. Implement a system for monitoring compliance with SoD policies and procedures. b. Conduct regular audits and reviews to identify potential weaknesses or areas for improvement. c. Train employees on the importance of SoD and their specific roles and responsibilities. d. Maintain a clear and up-to-date organizational chart that outlines the division of responsibilities. e. Establish a process for reporting and investigating potential violations of SoD policies. 4. Overcoming Challenges Small organizations or those with limited resources may face challenges in implementing effective SoD. In these cases, organizations should: a. Use technology to automate processes and establish controls that minimize the risk of unauthorized transactions. b. Implement compensating controls, such as regular management reviews, to provide additional oversight where full segregation of duties is not possible. c. Engage external auditors or consultants to provide independent review and oversight of critical processes. 5. Developing a Segregation of Duties Matrix To better visualize and manage the division of duties, organizations should create a Segregation of Duties Matrix. This matrix should: a. List all critical tasks and processes that require segregation, organized by functional area (e.g., finance, human resources, procurement, sales, etc.). b. Identify the roles and responsibilities associated with each task, including authorization, custody, recording, and reconciliation. c. Assign specific employees or departments to each role, ensuring that no single individual holds multiple conflicting responsibilities. 2 ICM – SALIH AHMED ISLAM d. Include cross-functional dependencies and interactions to highlight potential risks or areas of overlap. e. Be reviewed and updated regularly to reflect changes in organizational structure, staffing, or processes. 6. Managing Segregation of Duties in a Digital Environment As organizations increasingly rely on technology and digital systems, it is important to adapt SoD principles to these environments. To ensure effective SoD in a digital context, organizations should: a. Implement access controls that restrict employees' ability to perform conflicting tasks within digital systems (e.g., an employee responsible for authorizing purchases should not have access to modify vendor records). b. Use system logs and audit trails to monitor employee activities and identify potential breaches of SoD policies. c. Implement multi-factor authentication and other security measures to protect against unauthorized access and manipulation of digital records. d. Regularly review and update access permissions to ensure that employees have the appropriate level of access based on their roles and responsibilities. 7. Mitigating Risks Associated with Segregation of Duties Despite the implementation of effective SoD, organizations may still face residual risks due to unforeseen circumstances or human error. To mitigate these risks, organizations should: a. Establish a strong internal control environment that includes policies, procedures, and training programs that support and reinforce the importance of SoD. b. Implement a robust system of checks and balances, including periodic reconciliations and independent reviews, to identify and address potential discrepancies or violations of SoD policies. c. Encourage a culture of transparency and accountability, where employees feel empowered to report potential issues or concerns without fear of retaliation. d. Develop a contingency plan for situations where temporary exceptions to SoD policies may be necessary (e.g., due to employee absences or emergencies). 3 ICM – SALIH AHMED ISLAM 8. Continuous Improvement and Evolution As organizations grow and evolve, their SoD needs will also change. To ensure the ongoing effectiveness of SoD policies and procedures, organizations should: a. Regularly assess the adequacy and effectiveness of their SoD controls through internal audits, self-assessments, and external reviews. b. Identify and implement best practices and industry standards to enhance their SoD policies and procedures. c. Continuously adapt their SoD framework to align with changes in organizational structure, processes, and technology. d. Leverage data analytics and other tools to identify trends, patterns, and areas of potential risk or improvement related to SoD. B. Segregation of Duties in the Finance Department Proper implementation of Segregation of Duties (SoD) within the department can help minimize the risk of fraud, errors, and mismanagement. The following outlines the key tasks and processes within the Finance Department that should be segregated to maintain effective internal controls. Accounts Payable a. Invoice Processing Review and approval of invoices: This duty should be assigned to an employee who verifies the accuracy and validity of invoices before they are paid. Invoice data entry: A different employee should be responsible for entering the invoice data into the accounting system. Payment authorization: A third employee should be responsible for authorizing payments after verifying the legitimacy of the invoices and the accuracy of the data entry. b. Vendor Management Vendor setup and maintenance: One employee should be responsible for setting up and maintaining vendor accounts in the accounting system. 4 ICM – SALIH AHMED ISLAM Vendor payment processing: A different employee should be responsible for processing payments to vendors, ensuring that no one person has control over both vendor accounts and payments. Accounts Receivable a. Billing Sales order processing: The responsibility of processing sales orders should be assigned to one employee. Invoice generation: A different employee should be responsible for generating and sending invoices to customers. b. Cash Receipts and Deposits Cash receipt recording: One employee should be responsible for recording cash receipts in the accounting system. Bank deposit preparation: A separate employee should be responsible for preparing and depositing cash receipts into the organization's bank account. Payroll a. Employee Data Maintenance Employee data entry: One employee should be responsible for entering and updating employee information in the payroll system. Pay rate and deduction approvals: A different employee, such as a manager or supervisor, should be responsible for approving pay rates, salary changes, and deductions. b. Payroll Processing Payroll calculation and processing: One employee should be responsible for calculating and processing payroll payments. Payroll review and authorization: A separate employee, typically a manager or supervisor, should be responsible for reviewing and authorizing payroll payments before they are disbursed. Financial Reporting a. Record Keeping 5 ICM – SALIH AHMED ISLAM Journal entry preparation: One employee should be responsible for preparing journal entries for financial transactions. Journal entry approval: A different employee should be responsible for reviewing and approving journal entries before they are posted to the general ledger. b. Financial Statement Preparation Financial statement preparation: One employee should be responsible for preparing financial statements. Financial statement review and approval: A separate employee, usually a higher-level manager or executive, should be responsible for reviewing and approving the financial statements before they are distributed or published. Asset Management a. Asset Recording Asset data entry: One employee should be responsible for entering and updating asset information in the organization's asset management system. Asset verification and approval: A different employee should be responsible for verifying the accuracy of asset data and approving any changes. b. Asset Reconciliation Physical asset verification: One employee should be responsible for periodically verifying the existence and condition of physical assets. Asset reconciliation: A separate employee should be responsible for reconciling physical asset counts with the asset management system. C. Segregation of Duties in the HR Department Implementing effective Segregation of Duties (SoD) within the HR Department can help minimize the risk of errors, fraud, and mismanagement. The following outlines the key tasks and processes within the HR Department that should be segregated to maintain effective internal controls. Recruitment and Selection a. Job Posting 6 ICM – SALIH AHMED ISLAM Job description creation: One employee should be responsible for creating and reviewing job descriptions before posting. Job advertisement: A different employee should be responsible for posting job advertisements on various platforms to ensure a fair and transparent recruitment process. b. Applicant Screening Initial screening: One employee should be responsible for screening applications and selecting potential candidates for interviews. Interview scheduling: A separate employee should be responsible for scheduling interviews with selected candidates. c. Candidate Selection Interviewing: Ideally, a panel of interviewers should be used to minimize bias in the selection process. Hiring decision: The final hiring decision should be made collectively by the panel or approved by a higher-level manager to ensure a fair and unbiased selection process. Employee Onboarding a. New Hire Documentation Document collection: One employee should be responsible for collecting and verifying required documentation from new hires, such as proof of eligibility to work and tax forms. Employee file creation: A separate employee should be responsible for creating and maintaining employee files, ensuring that all required documentation is properly filed. b. Orientation and Training Orientation scheduling: One employee should be responsible for scheduling and coordinating new hire orientation sessions. Training assignment: A different employee should be responsible for assigning and tracking required training for new hires. Compensation and Benefits 7 ICM – SALIH AHMED ISLAM a. Payroll Data Maintenance Payroll data entry: One employee should be responsible for entering and updating payrollrelated data, such as salary changes and deductions, in the payroll system. Payroll data approval: A separate employee, such as a manager or supervisor, should be responsible for approving any changes to payroll data before they are processed. b. Benefits Administration Benefits enrollment: One employee should be responsible for enrolling employees in benefit plans and maintaining accurate records of employee benefit selections. Benefits invoice review and approval: A different employee should be responsible for reviewing and approving invoices from benefit providers, ensuring that charges align with employee selections and contract terms. Performance Management a. Performance Appraisal Performance review completion: Supervisors or managers should be responsible for completing employee performance reviews. Performance review approval: A higher-level manager or HR representative should be responsible for reviewing and approving performance appraisals to ensure fairness and consistency. b. Employee Development Development plan creation: Supervisors or managers should work with employees to create individual development plans. Development plan approval and tracking: An HR representative should be responsible for approving development plans and tracking employee progress. Employee Relations a. Employee Grievance Handling 8 ICM – SALIH AHMED ISLAM Initial grievance intake: One HR representative should be responsible for receiving and documenting employee grievances. Grievance investigation: A different HR representative or a designated investigator should be responsible for conducting impartial investigations into employee grievances. b. Disciplinary Action Disciplinary recommendation: Supervisors or managers should be responsible for recommending disciplinary actions based on documented performance or conduct issues. Disciplinary action approval: A higher-level manager or HR representative should be responsible for reviewing and approving disciplinary actions to ensure fairness and consistency. D. Segregation of Duties in the Purchasing Department The Purchasing Department is responsible for acquiring goods and services to support an organization's operations. Implementing effective Segregation of Duties (SoD) within the Purchasing Department can help minimize the risk of errors, fraud, and mismanagement. The following outlines the key tasks and processes within the Purchasing Department that should be segregated to maintain effective internal controls. Supplier Selection and Management a. Supplier Evaluation Supplier identification: One employee should be responsible for researching and identifying potential suppliers based on the organization's needs and requirements. Supplier evaluation: A different employee should be responsible for assessing potential suppliers based on factors such as quality, price, reliability, and compliance with industry standards. b. Supplier Contract Negotiation Contract negotiation: One employee should be responsible for negotiating contracts with suppliers, including pricing, terms, and conditions. Contract approval: A separate employee, usually a higher-level manager or executive, should be responsible for reviewing and approving supplier contracts before they are signed. c. Supplier Performance Monitoring 9 ICM – SALIH AHMED ISLAM Performance tracking: One employee should be responsible for tracking supplier performance against contract terms and agreed-upon performance indicators. Supplier review and feedback: A different employee should be responsible for conducting periodic reviews of supplier performance and providing feedback to suppliers for continuous improvement. Purchase Requisition and Order Processing a. Purchase Requisition Creation Requisition creation: Employees from various departments should be responsible for creating purchase requisitions based on their department's needs. Requisition approval: A designated approver, such as a manager or supervisor, should be responsible for reviewing and approving purchase requisitions before they are processed. b. Purchase Order Creation and Issuance Purchase order preparation: One employee in the Purchasing Department should be responsible for preparing purchase orders based on approved requisitions. Purchase order authorization: A separate employee, typically a higher-level manager or executive, should be responsible for reviewing and authorizing purchase orders before they are issued to suppliers. Receiving and Inspection a. Goods Receiving Receipt of goods: One employee should be responsible for receiving goods at the organization's facility and verifying the accuracy and condition of the delivery. Receiving documentation: A different employee should be responsible for creating and maintaining receiving documentation, such as packing slips and delivery receipts. b. Goods Inspection and Acceptance Inspection: One employee should be responsible for inspecting the received goods for quality, quantity, and compliance with the purchase order specifications. Goods acceptance: A separate employee should be responsible for reviewing the inspection results and accepting or rejecting the goods based on the inspection findings. 10 ICM – SALIH AHMED ISLAM Invoice Processing and Payment a. Invoice Verification Invoice review: One employee should be responsible for reviewing supplier invoices for accuracy and completeness, comparing them to the purchase order and receiving documentation. Invoice approval: A different employee should be responsible for approving invoices for payment after verifying their accuracy and completeness. b. Payment Processing Payment preparation: One employee should be responsible for preparing payments to suppliers based on approved invoices. Payment authorization: A separate employee should be responsible for authorizing payments to suppliers, ensuring that only valid and approved invoices are paid. 11