+Scarcity

–Definition:We don’t have enough resources to satisfy all our wants

*Scarcity is a relative concept

*Scarcity won’t be solved even if the choice is made

*Scarcity → Competition (price+non-price competition) → Discrimination (winners+losers Aka

those who fail to meet the criteria won’t get the scarce goods)

Opportunity cost

–Definition:the highest-valued option forgone

Ans format:

E.g option chosen:(0) ; O.C:(a) ;option 1:(b)

[Change in values of options]

Q:Change in O.C ?

{A} aka (a)$ ++

The highest-valued option forgone changes from (a) to (b)

Since the value of (b) is lower than that of (a)

So the opportunity cost decreases

{B} aka (b)$ –

The highest-valued option forgone will still be (a)

The change {B} won’t affect the value of the highest-valued option forgone,it just lowers the

value of (0)

So the opportunity cost remains unchanged

{C} aka (b)$ +

Not necessarily remain unchanged

The value oif (b) increases if the value of (b) is higher than that of (a)

The opportunity cost of (0) may increase

*The opportunity cost doesn’t change when the value of the chosen option changes only

*The opportunity cost isn’t limited to 1 good only aka money included in O.C

*Changes →chosen option’s value +/–

→O.C value +/–

→chosen option’s value +/– → O.C value +/–

*Sunk cost aka historical cost

–Definition:cost incurred by a past option which isn’t no longer available now

→ XO.C

Opportunity cost=time cost + money cost

Ans format:

Q: Is everyone’s O.C the same?

No,as the highest-valued alternative use of time may be different

Q: good (a) $+ ; sb piqueuing to buy (a) = <c> ; payment to (a) + online = <b> ; Is it

necessary that ppl paid to (a) at a higher price total cost?

Full cost=time cost+money cost

The time cost of <b> is lower than those queuing all night

When difference in the time cost () is larger than that in the money cost (<b>)

Ppl paid to (a) may incur lower total cost

Money cost

Ans format

E.g English course:$600 (8 hrs total value)

Waiter wage per hr:$50

Q:Cost of Eng course?

The total cost will be the sum of the course fee and income forgone

(Cal. steps + marking)

Cost = $(600+50x8) = $1000

E.g A man owns an apartment $2 mil and lives in it (a)

Sell it and put the money into a bank 5% interest (b)

Rent out it at $8,000 a month

Q:O.C yearly of (a)?

The interest received = $2,000,000x5% = $100,000

The rental income = $8,000x12 = $ 96,000

O.C of (a) is (b),$96,000

*O.C can be anything tangible or intangible

Goods

–Definition:something at least someone wants OR something that can satisfy wants

–Anything → [Can satisfy wants?]

→No—------------------->Bads (Less is preferred)

→Yes—------------------> [Scarce?]

→yes→economic goods (more is preferred)

→no→free goods (more isn’t preferred)

Economic goods

–Definition:a good whose quantity isn’t sufficient/enough to satisfy all our wants

Ans format:

More of the (good) is preferred’

The goods produced from scarce resources which have alternative uses

Limited resources are used in production → opportunity cost involved in the production

Free goods

–Definition:a good whose quantity is sufficient/enough to satisfy all our wants

Ans format:

More of the (good) isn’t preferred

Opportunity cost doesn’t involve in the production

Must be free of charge

*A good that is free of charge =/= free good OR = economic goods

*A free good must be free of charge

Interest

–Definition:

(for borrower) cost of earlier availability of resources

(for lende) compensation the one receive in return for referring their consumption of

resources

*Caueses: 1.inflation ; 2.risk of not returning $ ; 3.earlier consumption

*Interest exists in any forms and in barter economies + monetary economies

*interest rate + → borrower doesn’t want to borrow $ → consume less

→ lender wants to lend $ → consume less

3 basic economic problems

A.What to produce

What goods to be produced with the resources?

How many to be produced? E.g amount,ratio,more

B.How to produce

What kind of production method? Aka how to produce “product

C.For whom to produce

Who has the goods produced

Where to distribute the goods? E.g discount

Traditional economy

Resources

allocation

command/planned

economy

Follow the ancestors Follow the

practice,traditions

government

+customs

guidance

Ownership of MOST

resources

Government owned

Market economy

Under the market OR price

mechanism

Privatedly owned

Private property rights

Defintion:Exclusive rights to use (a) + exclusive rights to receive income (b) + right to

transfer property (c)

(a)

The owner has the right to exclude from others from using his property

No one is allowed to use the owner’s property without the one’s permission

(b)

The owner has the right to exclude right to receive income generated from the one’s property

No one can generate income from the property without the owner’s permission

(c)

The owner has the right to transfer the one’s property to other ppl

**private property right → exchange

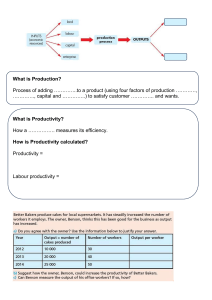

Production

–Definition:

process of turning input (factors of production OR resources used in production)

Into output (goods and services) to satisfy human wants

*Production involves a change in the form of resources,change in place,provision of service

–Consumption definition:process of using goods directly to satisfy human wants

Exchange

–Definition:situation in which ppl get what they want by giving sth in return in a market

Type of production

–Primary production definition:

The direct extraction of natural resources or the use of natural resources in the production

E.g. farming,fishing etc AKA give me that mf nature

–Secondary production definition:

Process of turning raw materials into final or semi-final goods

E.g. toys,watches,building etc AKA manufacturing

–Tertiary production definition:

All types of provision of service

E.g. police,education,investment etc AKA how may I serve u mf

Ans format:sub the question word into the definition

*GDP OR production value =/= employment

*production value % + OR – =/= exact amount + OR –

Interdependence of 3 types of production

Types of goods

Consumer goods definition:

goods made for final consumption OR satisfying consumers’ wants directly

–Captial goods definition:goods used in the production process OR producing other goods

*The way the goods are used determines that it’s consumer good OR producer good

–Private goods definition:goods that are excludable and rival in competition

–Excludable:not costly for one to prevent others from using it

–Rival:a person’s consumption’ll reduce the amount available to others

–Public goods vice versa

*public goods are concurrent (can be consumed by individualS at the same time)

Factors of production AKA input

Factor

Meaning

Return

capital

Man-made resources

interest

land

Natural resources

rent

labour

Human resources e.g. human effort,physical + mental

wage

entrepreneurship Human resources e.g. risk bearing + decision making

profit

Capital

Fixed capital

Resources that don’t change its form during production

e.g.machines,factories etc

Working capital

Resources that may change its form OR be used upduring production e,g,

raw materials

Liquid capital

Money used for production purpose

Capital formation AKA investment

–Definition:process of making capital goods

–Purpose:replace the existing depreciated capital + increase the production capacity

Capital consumption AKA depreciation

–The value of capital goods depreciate over time and thus needs frequent repairing +

replacement

Capital accumulation

–Definition:A net increase in the stock of capital goods

–Rate of capital formation’s faster than that of capital consumption

Land AKA natural resources

–Defintion:all natural resources in the original form that can be used in production

E.g. soil,minerals,power resources OR cruel oil

*supply of land doesn’t involve O.C as land is gift of nature

*supply of land may change over time but DEFINITELY NOT due to human efforts

*Land becomes capital when moved by human efforts

Entrepreneurship

–Definition:human efforts that make decisions (final decision) + bear production risks (Loss)

*Those who can’t be fired ARE the true entrepreneurs

Ans format:

(Sub) is the owner of (obj) and provides capital + bear business risk

Labour

–Defintion:human efforts,physical + mental efforts put in production

*Unit:man-hour,NOT no. of workers

Formula:Labour supply = No. of workers x No. of working hrs per worker

Unit:unit of output per man hour

Ans format:sub (sub) into the definition

Factors affecting the labour supply

1.size of population (larger population → larger labbour supply)

2.proportion of working population in total production

–large proportion of students OR elderly → smaller labour supply

3.no. of working hrs (more public holidays → samller labour supply)

4.monetary rewards (higher monetary rewards OR lower tax rate → larger labour supply)

5.retirement age ++ → larger labour supply

6.allowance – → larger labour supply

Formula: Average labour productivity = output / labour supply

Factors affecting the labour productivity

1.education and training

2.working environment

3.health of wages

4.rewards and benefits

5.technology level of the production goods

6.methods of organizing and managing labour

Labour mobility=geographical mobility (a) + occupational mobility (b)

(a) definition:willingness + ability of resources to be moved from one workplace to another

Factors affecting (a)

1.transport cost (transport cost++ → [time cost + money cost] + → (a) – )

2.economic condition (more unemployment → (a) + )

3.social unrest and political factors

4.government policy (immigration policy stricter → (a) – )

(b) definition:willingness + ability of resources to be moved from one occupation to another

Factors affecting (b)

1:money income and non-monetary factors (income low → (b) ++ )

2.difference in skill (specialized skills → (b) – )

3.license requirement (profession aka license needed → (b) – )

4.market information (more access to jobs → (b) ++ )

5.age of workers (older → can’t adapt to the new job fast → (b) – )

6.training programme (more → (b)++ )

Ans format:(a) OR (b) – , explanation based on the info offered → labour mobility + OR –

Division of labour

–Definitioin:workers can specialize in providing a particular good OR services

*Division of labour improves workers’ productivity (output per hr)

Type of division of labour

definiton

simple

A worker specializes in producing a particular good

Workers do OR depend on each other in the production

complex

A worker specializes in a particular production stage of a good OR

specializes in a particular role in teamwork

Workers depend on each other in the production

regional

A region specializes in producing a particular good or a particular

production stage of a good

Advantage (productivity ++)

1.practice makes perfect

2.choose the right person to do the job

3.saving of time

–less time to train a worker for a task than the whole process ; no need for workers to switch

between tasks

4.mechanization enabled

–easier to design machines to work with labour to do a simpler task

5.economy in the use of capital good

–1 tool’s enough for each worker but not whole set of tools,reducing the waste of idle tools

Disadvantage

1.Over-independence (firms)

–problem in 1 stage,whole production line gg

2.Standardized products → less choices (consumers)

–mechanization→design and style standardized

3.Boring OR monotonous job (workers)

–workers find it boring by repeating the same job → efficiency – ; productivity –

4.Loss of craftsmanship (workers)

–complex division of labour → traditional craftsmanship replaced

5.higher chance of unemployment (workers)

–complex division of labour → worker only knows 1 part of the production,trained in the

specific skills AKA not well-round → risk of unemployment ++

6.over-reliance (country)

–regional division of labour

[a]→ some countries specialize in some products → rely too much on the exports

[b]→ some countries rely too much on the import → if imports’re unstable → economy gg

Limitation

1.nature of product

–jobs that require one’s skill OR creative ideas e.g arts

2.size of market

–If size market’s too small to absorb the extra output → division of labour unnecessary

3.transportation cost AKA communication cost

–Transport network can’t meet the demand → regional division of labour restricted

–if transportation cost > gain from the trade → x trade

Production in short run and long run

–Fixed factors definition:factors of production that don’t change in quantity as output

changes

–Variable factors definition:factors of production that change in quantity as output changes

–Short run definition:a period when some factors’re fixed and some’re variable

*A firm can vary its variable factors to change its output level

–Long run definition:a period when all factors’re variable

*A firm can increase its employment of all factors to increase output

*For short run and long run,level of technology is assumed to be constant

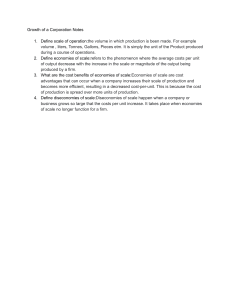

Economies and Diseconomies of scale

*ONLY IN LONG RUN

Cost per unit = Average cost (AC) ;

Economies of scale = production scale ++ ; Diseconomies of scale vice versa

Economies of scale → AC–

Optimal scale → AC at minimum

Diseconomies of scale → AC++

*AC at minimum =/= maximized profit of the firm

Economies of scale

–Definition:pros associated with large scale production

Internal economies of scale

–Definition:pros enjoyed by the a firm when the firm itself enlarges the scale of production

Internal economies of scale

1.Managerial economies of scale

Better management as higher degree of specialization can be employed

→ production – ; duplication of work –

2.Marketing economies of scale

The advertising and service cost can spread over a larger output

3.Marketing (Purchasing) economies of scale

Lower purchasing cost due to the discount received from the bulk purchase of raw materials

4.Financial economies of scale

Easier for larger firms to borrow money from banks and interest rate’re usually lower

5.Technical economies of scale

The cost of machinery can be spread over a larger output BUT large firms can utilize the

machines more fully and efficiently

6.Research and development economies of scale

More research and development better products OR production method

7.Risk-bearing economies of scale

Large firms can produce a greater variety of products

That allows them to spread risk through diversification of products

External economies of scale

–definition:pros enjoyed by a firm when other firms OR the industry enlarge the scale of

production

External economies of scale

1.Lower the transportation cost

Transport networth and other infrastructure will develop more quickly due to an increase in

demand (e.g from a large no. of firms)

2.Lower the marketing cost

Since firms advertise their products,more people will know about the industry and its

products → lower the firms’ cost of marketing

3.Lower the recruitment training cost

More workers’d be attracted to the industry

Various institutions may offer training courses for workers who want to join the industry

4.Lower the cost of purchasing materials

A networth of supplies and other supporting industries will be drawn in and lower the

average cost of individual firms

Diseconomies of scale

–Definition:cons associated with large scale production

Internal diseconomies of scale

–Defintion:cons arise when the firm itself becomes too large

1.Marketing diseconomies of scale

When the output of a firm is large enough to satisfy market demand,it will be difficult to

further expand scales

The money spent on advertising will have a limited effect

The average cost of marketing its products is thus higher

2.Managerial diseconomies of scale

When the structure of a firm becomes complicated,more communication and coordinate

problems within a firm arise

The complicated structure will also delay decisions and lower the efficiency of management

→average cost ++

3.Financial diseconomies of scale

When a firm becomes too large,the risk of lending additional loans to this firm will be higher

→captial can be obtained ONLY at a higher interest rate

→average cost ++

External diseconomies of scale

–Defintion:cons arise when other firms OR the industry become too large

(a) Excessive expansion of an industry → a drastic increase in the demand for factor inputs

→great increase in input prices e.g. wages,rent,prices of raw materials and machines etc

→a firm suffers a higher average cost of production

(b) Increasing concentration of business activities in a district

→a substantial increase in traffic in that area

→traffic congestion rises the transportation costs

→a firm suffers a higher average cost of transportation

Circular flow of economic activities

- - - - -> : money flow ; ——>: real flow

–firms definition:economic unit responsible for making production decisions

–households definition:economic unit responsible for making conumpstion decisions and

provides factors of production to the firms

*exchange is voluntary and mutually beneficial

*Sepcialization occurs

when different ppl or economies concentrate on producing different goods

*exchange →specialization

Positive and normative statement

Positive statement

–Definition:A descriptive statement that deals with what is,was and will be

Normative statement

–Definiton:A subjective statement that deals with what we ought to be

(value judjement involved good or bad)

Positive statement

Normative statement

-Value judgement not involved

-scientific and can be refuted by facts

-Value judgement involved

-Not scientific and can’t be tested

*No “should” used in the sentence

*”Good” or “bad” ; “should” used

Ans format

{A}

Positive statement

It is refuted by facts and doesn’t involve value judgement

{B}

Normative statement

It can’t be refuted and involves value judgement

Payment method

Ans format

Time rate

Pros

(employer)

Cons

(employer)

Pros

(employee)

Cons

(employee)

–Simple and

easier to cal.

Wages

–workers’

working

incentive tends

to be lower

–regular and

stable income

–work more or less

and still get the same

income

–turnover rate

decreases

–higher

supervision cost

–lower the cost

of monitoring

the quality of

products

Piece rate

–lower

supervision cost

–cost of cal.

–possibly get

wage payment’s higher income

high

with more

–irregular and

unstable income

–workers’

working

incentive tends

to be higher

AKA

productivity

decreases

Basic salary +

comission

–lower cost of

supervision

(B.S + C)

–workers’

working

incentive tends

to be higher

AKA

productivity

increases

–higher cost of

monitoring the

quality of the

products

efforts OR

better service

–cost of cal.

wage payment

is high

–fair payment

system,possibly

get higher

income with

more efforts

OR better

survice

–irregular and

unstable income

–share the risk

of business with

employees

Profit sharing

~(B.S + C)

~(B.S + C)

~(B.S + C)

~(B.S + C)

Tips

~(B.S + C)

~(B.S + C)

~(B.S + C)

~(B.S + C)

Business ownerships

Different forms of business ownerships

Private enterprises

Differences between private and public limited company

*public company can be listed OR NOT listed

Pros and cons of different forms of SOME business ownerships

*Wider SOURCES of capital BUT NOT total sum of capital

*profit tax rate high OR low =/= profit large OR small

*(Sole propietorship) pros:high incentive to work

*(Partnership) cons:responsible for partners’mistakes on business decision

*(Sole proprietorship & partnership) pros:closer relationship with staff and customers

Public enterprises

Features

Differences between government department and public corporation

Government department

Public corporation

Aim

Non-profit motive

Profit-motive

Ownership

Government

Government

Finance

–Gov. pays for all the

operating expense of the

department and collects all

revenues

–Long-term loan from gov. and then become

financially independent

–Money is collected by sale of goods and services

–The firm has the power to borrow + issue stock

Management

–Controlled by gov. and

employees’re civil servants

–Managed by a board of directors appointed by

gov.

–The firm has a separate legal entity

Liability

–Gov’s responsible for any

liability made by its

department

–Limited liability AKA gov. isn’t responsible for its

debts but annual accounts + reports must be

published

*Gov. departments e.g.Water Supplies Department,Fire Service Deparmtent

*Public corporations e.g.Hong Kong Tourism Board,Airport Authority Hong Kong,Hong Kong

Export Credit Insurance Corporation

*MTR is a PUBLIC LIMITED company that the gov. is one of the shareholders

Methods of raising capital

Owner’s

savings

Borrowing

from friends

or banks

Retained

earnings

Issuing bonds

AKA debentures

Issuing shares

Sole

proprietorship

yes

yes

yes

no

no

Partnership

yes

yes

yes

no

no

Private Ltd

company

yes

yes

yes

yes

yes

*(not to public)

Public Ltd

Company

uncertain

yes

yes

yes

yes

–Share definition:ownership of shareholders in a limited company

–Function:It entitles its holders to a share of the company’s profit

–Bonds AKA debentures definition:a certificate of debt issued to raise capital

–Function:It entitles its holders to earn interest until redemption on the maturity date

Differences between shares and bonds

Shares

Bonds

Holders

Shareholders = owners of the company Bondholders = creditors of the company

Return

–Shareholders receive dividends that

vary with the profit of the company

–Bondholders receive interest usually

fixed

–A lot of dividends are received if the

business’s successful BUT little or not

if profits’re low

–Bondholders can receive interest no

matter whether the company makes a

profit or not

Voting rights

–Shareholders have voting rights in

shareholders’ meetings OR Annual

General Meeting (AGM)

–Bondholders don’t have voting rights in

shareholders’ meetings OR Annual

General Meeting (AGM)

Priority in getting

back capital when

the company

liquidates

–Shareholders are the LAST to get

back their capital when the company

winds up

–Bondholders can get back their capital

before shareholders when the company

winds up

Maturity

Shares carry no maturity dates

Bond matures upon redemption

Order of getting repayment when a Ltd company liquidates (first to the last):

Account firm providing liquidation services (services) → government (taxes)

→ employees (wages) → bond holders AKA debenture holders (loans)

→ ordinary shareholders

Pros and cons of ISSUING shares OR bonds (to company)

Pros

Issuing shares over bonds

Issuing bonds over shares

–The company has no obligation to

pay a dividend to shareholders even

when there’s a profit

→no maturity date for ordinary

–Bondholders’re only the creditors of the

company

→the existing shareholders’ power of control over

shares,the company has no

redemption obligation to the shares

the company won’t be diluted

–No risk pf being taken over

–Reduce the debt-to-equity ratio

→easier to have more bank loans

Cons

–New shareholders may influence

company decisions

–The existing shareholders’ power of

control’ll be diluted

–Higher risk AKA easier to be taken

over as shares’re freely transferable

on the stock market

–There’s an obligation to pay fixed interest to

bondholders no matter the company makes a

profit or not

–Redemption obligation

→issuing more bonds raises the debt-to-equity

ratio

→more difficult to have more bank loans

Pros and cons of BUYING shares OR bonds (to investors)

Pros

Buying shares over bonds

Buying bonds over shares

–Dividend isn’t fixed ; if company doesn’t

huge profits

→dividend rate’ll often be higher

–Less risky in buying bonds ; bonds carry

a fixed rate of interest no matter the

company makes a profit or not

→stable return

–Voting rights in shareholders’ meetings OR

Annual General Meeting (AGM)

–Bondholders can claimrepayment prior

to shareholders if the company winds up

Cons

–More risky in buying shares ; dividend isn’t

fixed

→unstable return

–Shareholders’re the last to claim

repayment if the company winds up

–No voting rights in shareholders’

meetings OR Annual General Meeting

(AGM)

–Can’t earn more when the company

makes huge profits

Market

–Function:It enables buyers and sellers to have contact for business transaction

*market involves transactions of goods and services = product market

*market involves transactions of factor of production such as labour market and capital

market = factor market

Types of market structure

market structure → perfect competition

→imperfect competition →monoply

→oligoply

→monopolistic competition

*Criteria to identify the market structure

1.No.of buyers and sellers

2.Freedom of market entry and exit

3.Nature of goods and services

4.Availablitiy of market information

Features of market structure

Perfect competition

–Definition:An ideal market structure AKA IMPOSSIBLE TO EXIST

*All firms’re price takers

Market price is determined by market supply and demand

If a seller sets a (slightly) higher price,the one’ll lose all customers as other sellers are small

and not associated with others

Monopolistic competition

–Definition:many companies are present in an industry, and they produce similar but

differentiated products

Oligopoly

–Definition:only a few dominant sellers

*The action of each seller affects the profit of another.leading to immediate action of other

firms. AKA Interdependence among sellers

Each of the sellers has certain degree of monopoly power in the market = oligopolist

Monopoly

–Definition:only 1 seller of the product and no close substitute (monopolist)

*A monoplist still faces competition as the one may engage in price + non-price competition

E.g. advertising + quality improvement → revenue ++

No direct competition BUT the one still needs to compete with sellers selling

substitutes,producers using similar factors of production for resources AND others for the

monopoly right TO maintain its monopoly status

→the one may still suffer from a loss

*Sources of monopoly power

1.Government franchise (exlusive right granted by gov. to the only producer)

2.Oownership of superior resources

(natural resources OR properties X available to private frims)

3.Trademark,copyright AKA patent (new product patent)

4.Cartel and integration

5.High setup cost and natural monopoly (start-up capital requirement very large)

*Same products’re sold at different prices in different places

as different services OR some shops may offer better after-sale service

→heterogeneous products

The market informatio’s imperfect.Ppl don’t know all the pricing information of different

places

Different locations → different rental cost

Ans format:

{Heterogeneous goods} Sellers provide heterogeneous goods e.g (deducted from question)

{Imperfect market info} The market information is imperfect.The buyers and sellers don’t

know all about the market → they will collect information cost that involves information cost

Expansion and integration of firms

Expansion of firms

→horizontal expansion

→lateral expansion

→conglomerate expansion

→vertical expansion →vertical backward

→ vertical forward

Types of business growth

–Internal expansion definition:a firm expands within its existing operation and management

structure e.g. buying new offices,factories OR extending more branches

–external expansion (integration) definition:a firm expands by combining with other firms

*more than 1 firm are involved in the expansion

General motives of integration AND expansion

1.Enhance the market competitiveness of products

2.To take advantage of the brand name

→firms benefit from the good will of the company ; advertising cost –

3.Firms enjoy the benefits from economies of scale

Financial economies of scale

Get backcredit easily and enjoy a low interest rate

Managerial economies of scale

–Combine OR dissolved duplicated departments

→more efficient use of resources

–Higher degree of division of labour

Marketing economies of scale

–Bulk purchase related materials can enjoy more discounts

Horizontal expansion OR integration

–Definition:when a firm expands into a business that is engaged in producing the same OR

similar goods OR services,OR at the stage of production

Specific motives:

1.It can enlarge the market share and turn competitors into partners

2.It has greater power in affecting the price of the products

Lateral expansion OR integration

–Definition:when a firm expands into a business of producing related but not competitive

products

Specific motives:

1.Product diversification helps spread risk

2.Easier for the firm to make use of its brand name and offer extra products as the goodwill

can be extended to new products

Vertical integration OR expansion

–Definiton:when a firm expands into a business that is engaged in producing at different

stages of the production of the same product

{a} Vertical backward expansion OR integration

–Definition:When a firm expands into a business in a earlier / preceding stage of production

Specific motives

1.To ensure a steady supply of raw materials

→reduce the risk of production disruption caused by inadequate input supply

{b} Vertical forward expansion OR integration

–Definition:when a firm expands into a business in a later stage of production

Specific motives

1.To ensure a steady market outlets for the products

2.The firm can collect market information more easily and adapt to changes in market

demand supply

Conglomerate expansion

–Definition:when a firm expands into a business of engaging in totally different lines of

production

Specific motives

1.Product diversification helps spread risk