9-708-414

REV: FEBRUARY 8, 2010

RAMON CASADESUS-MASANELL

CELSO FERNANDEZ

MORITZ JOBKE

Launching Telmore (A)

In September 2001, analysts were pessimistic about the future of the new no-frills entrants in the

mobile phone industry in Denmark (see Exhibits 1 and 2 for statistics on Denmark). Mette S. Ahorlu,

from IDC, claimed that the new entrants were not capable of attracting the profitable heavy users.1

Instead, new entrants were only drawing customers who could not afford additional services. “None

of these small companies will ever make a profit,” she claimed.2 Other experts echoed Ahorlu’s

concerns. They expected a shift toward value-added services in which new entrants would find it

difficult to compete.

Actual results supported the negative outlook. Telmore, the first mover and most promising of the

new entrants, had signed a mere 32,400 subscribers by June 2001, capturing a market share of 0.4%.

These figures were far from the 250,000 subscribers that some experts estimated to be the break-even

level for new service providers.3 Telmore had entered the Danish mobile telecom market in October

2000 as a service provider on the network of TDC, the dominant player. Telmore bought minutes

from TDC and resold them to end users in a no-frills service model.

The Danish mobile industry was rapidly evolving. New players were entering the market, and

new services were under development. Subscriber penetration had been increasing rapidly to 63% at

the end of 2000, and incumbents had spent a small fortune in upgrading their infrastructures to offer

additional functionality to customers. Many uncertainties surrounded Telmore: Was this market too

competitive and complex for a small start-up? Could Telmore find its niche in the market? And if so,

how much of a threat was Telmore to TDC?

Evolution of Mobile Phone Industry in Denmark

In the late 1990s, the mobile telecommunications industry grew rapidly across the world. In

Europe, the Nordic countries were leading the way in acceptance of wireless communications as

measured by mobile phone lines per resident. By 2000, penetration of the Danish mobile market had

jumped from 27% in 1998 to 63%, but Denmark still trailed its Nordic peers, among which Finland

was leading with 74%.4 By comparison, the United States had a wireless penetration of 39% in 2000.5

________________________________________________________________________________________________________________

Professor Ramon Casadesus-Masanell and Celso Fernandez (MBA 2007) and Moritz Jobke (MBA 2007) prepared this case. This case was

developed from published sources. HBS cases are developed solely as the basis for class discussion. Cases are not intended to serve as

endorsements, sources of primary data, or illustrations of effective or ineffective management.

Copyright © 2007, 2008, 2010 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call

1-800-545-7685, write Harvard Business School Publishing, Boston, MA 02163, or go to http://www.hbsp.harvard.edu. No part of this

publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means—electronic,

mechanical, photocopying, recording, or otherwise—without the permission of Harvard Business School.

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Launching Telmore (A)

As in the rest of Europe, the technical standard for mobile communication in Denmark was the

digital Global System for Mobile Communications, or GSM. The existence of a single standard

enabled travelers across Europe to access mobile services in any country and allowed handsets to be

used on all networks. GSM was generally referred to as a second-generation (2G) technology. GSM

networks were built through a cellular structure with radio towers at the center of each cell. The size

of an individual cell depended on factors such as physical profile of the cell, radio frequency, and

traffic volume and could range from several hundred feet to several miles.

While Denmark’s flat geographic profile allowed for a relatively efficient deployment of network

infrastructure, its low population density in some areas raised the necessary investments per user for

a full-coverage network. Building a network, hence, required substantial financial resources, making

the physical infrastructure by far the single largest asset of an operator. Industry experts estimated

that a basic GSM network plus radio licenses for a new entrant in Denmark would cost DKK1.5 to

DKK2.0 billion in 1998. Additional investments were required to add data services and maintenance

and to increase capacity for new subscribers and area coverage for scarcely populated areas. In fact,

market leader TDC Mobil spent DKK528 million in 1999 and DKK815 million in 2000 on its Danish

mobile network for capacity enhancement and mobile data services after having installed the initial

network in 1992 (900Mhz band) and 1997 (1800Mhz band).6 On top of the network infrastructure,

additional capital was required to fund complex customer care and billing systems, which in the case

of TDC Mobil were estimated to cost another DKK100 to DKK200 million.7 Equity analysts from

Danske Equities put a price tag of DKK2 billion to DKK3 billion on the greenfield infrastructure

investment for an average Danish GSM player.8

In addition to the network operators that owned the physical infrastructure, a number of service

providers had recently entered the market. Service providers offered mobile phone services to their

customers under their own brand, but actually used the vast majority of the network infrastructure of

one or more partnering operators and effectively resold their services. Service providers emerged for

two reasons: first, the Danish regulatory agency forced operators to open their networks for

competition and, second, service providers could offer network operators an additional distribution

channel to improve the use of their massive fixed-asset base.

In 2000, industry participants saw the future of mobile telecommunications primarily in the

opportunities offered by higher-bandwidth network standards such as GPRS and UMTS/WCDMA.

Higher data rates allowed operators to provide so-called value-added services such as mobile

Internet and e-mail, premium-content text messages, and video telephony, which were expected to

deliver substantial incremental sales over the voice- and text-message offering then in place. These

expected additional sources of revenue were also an important element in the stock-market valuation

of mobile operators.

The new services would not come for free: on the one hand, GPRS (which was considered a 2.5G

technology) required a relatively small additional investment in the network infrastructure that

enabled a six-fold increase in data transfer rates over GSM. On the other hand, UMTS/WCDMA was

based on a different technology and required an entirely new network and additional frequency

licenses, but offered data rates at least 40 times faster than GSM. UMTS frequency licenses were

expected to be on the auction block in Denmark in the fall of 2001.9 Because the capital requirements

for a full UMTS network were expected to significantly exceed those for a GSM network, operators

were under pressure to take a huge bet on the future direction of the market very soon.

2

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

708-414

Players/Network Infrastructure

In 2000, four operators—TDC, Sonofon, Mobilix, and Telia—owned at least some network assets,

and a fifth, 3G, was about to complete its network infrastructure. With four 2G operators, Denmark

was already considered a crowded market. Similarly sized markets such as Finland and Norway only

had three and two operators, respectively. This structural feature of the market, combined with a

regulatory agency that aggressively enforced competition among players, had led to a relatively lowprice and high-usage environment in Denmark.10

TDC was by far the dominant player with 42% market share of subscribers (see Exhibit 3). It was

the mobile communications business of the former state-owned Tele Danmark. TDC provided

primarily fixed-line and wireless communication services in Denmark and had a sizable international

business that accounted for 41.5% of its revenues in 2000. The traditional domestic fixed-line

business, however, continued to be the major driver of operating cash flow with a 54% share of

EBITDA. The mobile business in Denmark contributed DKK4,232 million in revenues (9% of overall

revenues) and DKK1,524 million in EBITDA (12% of total) in 2000 (see Exhibit 4).11

The number-two player, Sonofon, with a 24% market share, was a joint venture between the

Norwegian incumbent telecommunications company Telenor, which owned 53.5%, and BellSouth,

which owned 46.5%. Telenor had acquired stake in Sonofon in June 2000 for DKK14.7 billion from

Danish GN (Great Nordic). Like TDC, Sonofon had entered the Danish GSM market in 1991 by

securing one of the two licenses initially granted.12

The number-three player, Mobilix, a joint venture of France Telecom’s Orange and several

financial investors, had entered the Danish market with its own network only in 1998 and had since

captured 15% of the market. By 2000, Mobilix’s network technically covered 89% of Denmark’s

population. Mobilix was known to be heavily EBITDA negative.13

Telium, the smallest Danish operator with an 8% share of subscribers, was a subsidiary of the

Swedish Telia. Telia had entered the Danish market in 1996, first using TDC’s network, then building

its own infrastructure. Telia’s Danish operations generated DKK377 million in sales and lost DKK398

million on an EBITDA basis in 2000.14

Among the existing service providers, only Debitel, a subsidiary of the German Debitel, had

reached a relevant market share of 5% of subscribers. Debitel was using the networks of both Sonofon

and TDC.

Products

The market for mobile telephony was split into two main segments, postpaid and prepaid,

depending on when the customer actually paid her usage charges. Postpaid customers entered into a

contract with their provider and received a monthly bill for their phone usage during the previous

billing period. The maximum permitted length of a postpaid phone contract in Denmark was six

months, after which a customer was free to either cancel or extend the contract for another six

months. Prepaid users maintained a cash balance with the provider from which usage charges were

deducted in real time. Customers could recharge this balance (“top-up”) by buying vouchers at cellphone shops and other retail locations like convenience stores or gas stations.

Just as in other European markets, Danish phone users paid only for outgoing calls. Incoming

calls were free of charge to the recipient. The recipient’s operator, however, demanded a so-called

termination fee from the operator of the caller. The termination fees for mobile networks were set at

3

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Launching Telmore (A)

approximately DKK1.1 per minute (DKK0.16 less than the previous year) and DKK0.1 per minute for

the wireline network in 2000 by the Danish telecommunications authority.15,16 Termination fees

accounted for 10% to 15% of an operator’s revenues.

Most rate plans charged the customers based on the actual length of their calls or the number of

text messages. Per-minute rates for calls varied by destination (same mobile network [“on-net”],

other mobile network [“off-net”], and fixed line) and time (weekday business hours, weekday

evenings/nights, and weekends). Off-net calls during peak hours were typically the most expensive,

and fixed-line calls during off-peak hours were the least expensive. The exact definition of on- and

off-peak hours varied by provider and sometimes even between rate plans of the same provider.

The customer and product segmentation was mainly driven by usage intensity. For low-call

volumes, selecting a prepaid rate plan, which came without a monthly subscription fee, was usually

the most economical choice for a customer. Once usage went beyond a certain threshold, however,

the benefit of the lower-per-minute prices of postpaid plans outweighed their monthly subscription

fee. Per-minute prices of postpaid rate plans typically declined as the monthly subscription fee

increased. Prepaid users generated, on average, lower revenues of DKK800 to DKK 1,400 per year in

2000, compared with the DKK3,500 to DKK4,500 of postpaid customers.17

Distribution Model

In 2000, mobile phone customers were almost exclusively acquired through retail stores in larger

towns and cities. Customers could walk into the store, browse the offering, and solicit advice on rate

plans and handsets. Once the customer chose a provider, rate plan, and handset, the sales assistant

would complete the necessary paperwork and hand out the cell phone and the provider’s SIM card.

The Danish market contained three types of shops. Operator-owned shops were those in which

the real estate was either leased or owned by the phone company and shop personnel were on the

payroll of the phone company. These shops were usually situated in premium locations, were

spacious and well-staffed, and offered only the rate plans of the particular operator. Exclusivebranded shops were similar to operator-owned stores in that they offered only the rate plans of one

phone company. They were, however, owned by a third party, were often slightly smaller, and were

located on less expensive real estate. Their owners regularly operated multiple shops that did not

necessarily all carry the same operator branding. Independent shops carried multiple-provider

brands and often displayed competing products next to one another. Both exclusive-branded and

independent stores had three sources of income: the ticket prices of the cell-phone packages that

customers purchased, commissions from providers for every rate plan sold, and a fixed fee from the

providers to support the shop’s local advertising activities.

When they signed up for the services of a provider, customers usually purchased a new handset.

Because the cost of most handsets was still prohibitively high, providers heavily subsidized the retail

ticket price by providing certain handsets at a steep discount to the shops. Handset subsidies

accounted for most of a provider’s subscriber acquisition costs, which on average were DKK400 to

DKK600 for prepaid customers and DKK1,300 to DKK1,600 for postpaid customers.18 To prevent

customers from using a subsidized handset with an SIM-card of another operator, providers applied

a so-called SIM-lock to the handset itself. This feature was intended to prevent the handset from

functioning with SIM-cards other than the provider’s own cards. Yet instructions on how to disable

SIM-locks were widely available; hence, the cost-effectiveness of the mechanism was debated.

4

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

708-414

Telmore

Telmore entered the Danish mobile telecom market in October 2000 as a service provider on

TDC’s network. It was founded by a team led by Frank Rasmussen and located on the outskirts of

Copenhagen.

Agreement with TDC

Before its launch, Telmore had struck an agreement with TDC to act as a service provider on

TDC’s network. TDC would charge Telmore a certain price per minute for using TDC’s network.

Wholesale prices varied significantly depending on the destination of the call and the time of the day.

Telmore would pay only DDK0.26 per minute for a call made inside TDC’s network at night, while

the price for an off-net call at peak hours would rise to DKK1.40 per minute. According to some

estimates, Telmore was paying an average of DKK0.50 per minute (see Exhibit 5). The wholesale cost

of a text message was roughly DKK0.18. Once Telmore reached a certain call volume threshold, the

price per additional minute on TDC’s network would start to decline. It was estimated that this

[discount would reach up to 20%] if Telmore reached 500,000 subscribers (see Exhibit 6).

Product

Telmore launched with only one rate plan. It was designed as a prepaid plan and charged a price

of DKK1.25 per minute for all national calls at all times and did not entail a monthly subscription fee.

The plan offered a price approximately 40% lower than that of other prepaid rate plans at the time.

The price for a text message was also low, DDK0.25 per message. Telmore’s price policy was notable

for two reasons. First, it represented a radical departure from the traditional approach of providing

multiple, more or less complex price plans tailored to different calling patterns. Second, Telmore

suffered a mismatch between a fixed revenue per minute and a widely variable wholesale cost per

minute depending on the destination and time of the call.

For their new Telmore connection, customers could choose to either be assigned a new telephone

number or carry over their existing number from another provider. The latter option had been made

possible by regulatory rules that mandated so-called mobile number portability to enhance effective

competition of providers.

Advertising

As a start-up, Telmore did not have the means to launch repeated conventional advertising

campaigns that could rival those of existing national providers. During the launch period, an ad was

aired on Danish television that emphasized Telmore’s cheap price and ease of use. The ad’s

catchphrase was simple: “I have just switched to Telmore.dk. The absolute cheapest pay as you go.”

After the launch, Telmore bet heavily on guerilla marketing campaigns. For example, in 2001

Telmore used posters showing a hand wiping dog excrement off a shoe with a prepaid card. On the

prepaid card, it was written: “Shit on your mobile operator, it pays off.” In another stunt, Telmore

parked a scooter in the private parking place of TDC’s CEO with “Minutes for a nickel, company car

of tinplate” written on it. When the police were called to remove the vehicle, they refused to do so at

first because the scooter did not qualify as a car and, hence, did not warrant towing. These stunts

were covered in the Danish press, giving Telmore plenty of publicity.

5

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Launching Telmore (A)

Distribution

Telmore did not have any physical retail network for distribution, but relied on an Internet-only

sign-up model. Its Web site was structured in a simple and intuitive fashion requiring just four steps

to register as a customer. After the sign-up was completed, Telmore would mail the SIM-card and a

simple manual to the new customer.

Telmore did not offer any handsets or any subsidies to its customers. Instead, Telmore relied on

customers being able to use their existing handset, which included the possibility that customers

would have to “unlock” their handset and use it with Telmore.a

Billing and Customer Care

Contrary to market practice, Telmore provided only one payment option: prepaid billing. In a

departure from the traditional prepaid model and its physical sale of top-up vouchers, Telmore

required its customers to reload their balance online by credit card, bank transfer, or an automatic

direct debit (a common practice for utilities in Europe). Additionally, for customers with a positive

payment history, outgoing calls would not be blocked once the customer’s balance had been

depleted; instead, the customer would be provided with a credit of up to DKK200 combined with

text-message reminders.

Telmore users did not receive paper bills. Instead, their balance of minutes was updated several

times daily online. Customers who wanted a physical copy of their statement could download a bill

in PDF format and print it.

Another limitation was the availability of customer-service reps. Telmore decided to have its own

customer-service center, but operators were available only from 8 a.m. to 10 p.m. on weekdays and

9 a.m. to 5 p.m. on weekends; traditional operators like TDC typically offered 24/7 customer

service.19

The company’s Web site was designed to funnel users to Web chat or e-mail for problem

resolution rather than phone-based or mail solutions. This was accomplished by making customerservice numbers and addresses difficult to find on the Web site, and by letting customers know that

response times were longer for those channels.20

Telmore cross-trained its staff to provide customer service in the event of a spike in demand.

It used a “red alert” system whereby if customer-service reps became overburdened, additional staff

from other functional areas would drop what they were doing and help provide customer service.

Even Frank Rasmussen, founder and CEO, answered the phone when the volume of incoming calls

spiked. This practice allowed Telmore to maintain much leaner customer-service staffing levels while

providing equivalent levels of service from a customer wait-time metric. Rasmussen claimed that the

company could serve 20,000 customers per rep versus only 2,000 for U.K.’s MVNO Virgin Mobile.21

Telmore used nonunionized students as its customer-service reps, with an average age of 24.22

These reps received a bonus, encouraging friendly, attentive, and fast customer service.23 Early on,

customer satisfaction was promising, but Telmore’s ability to provide the same level of service to a

wider customer base was uncertain.24

a Cell phones are typically “locked,” meaning that they only work with the issuing service provider. It was possible, however,

to unlock a phone by either entering a special code into it or reprogramming its firmware. Numerous Web sites such as

http://www.online-unlock.dk (promoted by MVNOs such as Telmore and CBB) offered unlocking services for a small fee

(about 5 EUR).

6

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

708-414

Infrastructure

As a service provider, Telmore did not own or operate any network infrastructure. Its operations

were thus reduced to customer acquisition, billing, and after-sale service. The company, with this

“bare-bone” infrastructure, was launched with only seven employees in 2000.

Because Telmore operated only a small subset of the functions of a network operator, its IT

operations were much simpler and required significantly less up-front investment. The company

owned a call rating and billing engine bundled with a CRM system, a voice-mail system, and a

customer acquisition and customer care Internet application only. The simplicity of Telmore’s

product offering further reduced the complexity of its IT needs compared with those of the system

architecture of traditional providers.25

A service provider bought bulk-minutes from the network operator and was billed according to

the purchase agreement. In order to bill its own customers and gather information about their calling

behavior, the network operator provided the service provider with call data records (CDR) that

contained each call’s essential information (both parties’ ID, time, and length). The service provider’s

rating engine interpreted this data and forwarded the price to the billing system. In a prepaid system

like Telmore’s, the call price was then deducted from the customer’s balance. With this mechanism

having to work essentially in real time, performance and scalability were key variables. When

Telmore realized that its original solution was unable to handle more than 30,000 customers, it took

the unusual step of developing a proprietary IT solution rather than purchasing one from a thirdparty provider. With a mere four people, Telmore developed its own IT system in less than six

months. The system proved to be so efficient and scalable that Telmore eventually decided to spin off

the system as a stand-alone company, CDRator, which developed its own business.

Human Resources

When Telmore was founded in 2000, it benefited from the buzz surrounding start-ups and built a

team of young, entrepreneurial, and qualified people. Because resources were limited, Telmore tried

to develop versatile employees, kept a flat organization, and shared profits with employees.

Throughout its organization, Telmore tried to avoid the development of specialized job

descriptions. Its IT employees, for instance, were mostly generalists who rotated through various

projects. By contrast, the infrastructure of a traditional operator would require a deep functional

expertise because of the sophistication of the processes and products offered. Generalists at Telmore

mastered most tasks, resulting in lower staffing levels, improved coordination across specialty areas,

and likely improved job satisfaction through greater task variety. Similarly, Telmore had only one

type of call-center operator—a generalist. Call centers of established operators typically had several

lines of operators who could address complex problems that the generalists were unable to handle.26

Owing partially to its short history and lean size, Telmore did not have much hierarchy between

CEO and call-center operators. Moreover, Telmore made sure that every single employee felt like an

integral part of the company. Operators were frequently asked to take part in cross-functional

projects intended to optimize processes across different groups or to further product development.

Shared economic rewards were also important to Telmore. Every year, 5% of the company’s

profits were shared equally among all of its employees. This practice helped build a sense of

community and created additional flexibility in Telmore’s cost structure.27 (See Exhibit 7 for

Telmore’s value chain.)

7

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Launching Telmore (A)

Early Results

The launch of Telmore was far from a success. Not only was it capturing a limited number of

customers, but these customers were spending less (see Exhibit 8). The average Telmore customer

was spending about DKK100 per month compared with TDC’s average of DKK230 per month.

Although some of the difference resulted from lower prices, Telmore customers used an average of

20% to 25% fewer minutes than TDC’s typical customers.28

Many uncertainties remained. It was clear that the customer base was insufficient to run a

successful business. Management was confident in its ability to keep costs under control and “break

even” with a small customer base (see Exhibit 9). However, the company’s ability to attract

customers was under question. Telmore was already providing significant discounts over TDC. Was

it too early to judge Telmore? Would further price reductions attract more customers, or would they

just squeeze margins? Would Telmore be able to attract valuable customers or just marginal

segments? Analysts had already made up their minds. European incumbents were paying close

attention to the Danish market to understand the magnitude of this new threat. Luckily for them,

there were very few reasons to be scared thus far.

8

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

Exhibit 1

708-414

Map of Europe

Source: University of Texas Libraries Web site, http://www.lib.utexas.edu/maps/europe/europe_pol_2004.jpg.

Courtesy of the University of Texas Libraries, The University of Texas at Austin.

Exhibit 2

Map of Denmark

Total Area: 16,638 sq. mi. 43,094 sq. km.

(slightly less than twice the size of

Massachusetts)

Population: 5,336,394 (July 2000 est.)

Languages: Danish, Faroese, Greenlandic

(an Inuit dialect), and German (small

minority). English is predominant

second language.

Literacy: 100%

Life Expectancy: 73.95 male, 79.27 female

(2000 est.)

GDP (per capita): $23,800 (1999 est.)

Currency:

Danish

1€ = 7.45 DKK

Kroner

(DKK).

Source: Gurteen Knowledge Web site, http://www.gurteen.com.

9

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Exhibit 3

Launching Telmore (A)

Penetration and Market Shares (subscribers '000)

H1 2000

1,420

790

450

208

2,869

TDC

Sonofon

Mobilix

Telia

Total network operators

Debitel

Telmore

Others

Total service providers

Total mobile subscribers

Mobile penetration

H2 2000

1,578

875

517

297

3,267

H1 2001

1,520

891

552

295

3,258

144

0

9

152

215

3

58

276

255

32

114

402

3,021

57%

3,543

66%

3,660

68%

Source: National IT and Telecom Agency, http://www.itst.dk, accessed April 2007, and “TDC,” Danske Equities, 2003, p. 4.

Exhibit 4

Mobile Telecommunications Financials, 2000 (DKK, millions)

TDC Mobil (domestic)

Sonofon

Mobilix (estimated)

Telia

Revenue

4,232

3,096

900 - 1,100

484

EBITDA

EBITDA-margin

1,524

36%

720

23%

negative

(511)

(105%)

Capex

815

278

Source: Annual Reports, SEC 20-F filings.

Exhibit 5

Off net

On net

Fixed line

TDC Wholesale Price (DKK per minute)

Off peak

0.70

0.26

0.26

Peak

1.40

0.52

0.52

Source: Compiled by casewriters based on data from the Danish National IT and Telecom Agency.

10

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

Exhibit 6

708-414

TDC Wholesale Price Structure, 2001 (DKK per minute)

Price

Retail price

~ 0.50

Wholesale price

~ 0.40

~ 500.000

subscribers

Volume

Source: Compiled by casewriters.

Exhibit 7

Unusual Features in Telmore’s Value Chain

Firm

Infrastructure

• Low overhead

• Fun working environment

• Community presence

Human Resource

Management

• Cross functional generalists

• Young workers

• Non unionized

• Incentive program (5%profits)

• Non hierarchical environment

• Diversity of projects

Technology and

IT

• Proprietary billing system

• Highly scalable

• Simple processes

• Focus on automation

•

•

•

•

•

•

•

•

Guerrilla marketing

No subsidies for handsets

Unlocking tours

Easy sign up through

internet

Transparent pricing

One price plan

Few services

Lower ARPU customers

Marketing and

customer acquisition

• High level of cooperation

• Low turnover (5-10%)

M

a

r

g

• Full mobile

functionality

• No network

• Lean operations

• Scalability

Operations

• Advanced payment

• Bank authentification

• Low fraud and credit

risk

• No bills

• No vouchers

• SMS balance alert

Billing

& Collection

• Free call center 9 – 21

• Reduced # rep/customer

• Significant use of email

and chat

• High incentives for reps

• Responsibility of all

employees

After-Sales Service

Source: Compiled by casewriters.

11

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

i

n

708-414

Exhibit 8

Launching Telmore (A)

Average Usage per Customer (units per month)

Minutes

TDC

Sonofon

Orange

Telia

Debitel

Telmore

H2 2000

70

81

70

53

63

22

H1 2001

70

94

54

47

50

54

Text messages

TDC

Sonofon

Orange

Telia

Debitel

Telmore

H2 2000

15

31

35

17

47

22

H1 2001

20

41

35

18

38

65

Source: Compiled by casewriters.

Exhibit 9

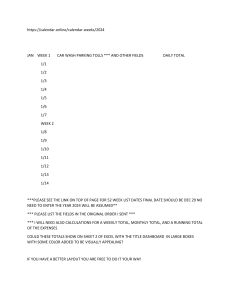

Profitability Estimates ('000 DKK per year, except for subscribers)

Subscribers

Revenue

Traffic costs

Other costs

25,000

21,750

13,050

13,607

50,000

43,500

26,100

19,439

EBITDA

(4,907)

(2,039)

100,000

87,000

52,200

29,453

200,000

174,000

104,400

53,550

400,000

348,000

208,800

107,100

5,348

16,050

32,100

Source: Compiled by casewriters.

12

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

Launching Telmore (A)

708-414

Notes

1

“Small Danish mobile companies only winning tiny market shares,” Børsen, September 12, 2001, p. 7.

2

Ibid.

3

Ibid.

4 “Nordic Telecom Weekly—No big bangs,” Danske Securities, September 7, 2001, p. 12, via Thomson

Research/Investext, accessed May 2007.

5 “Wireless Telecom Industry: Our Updated Outlook,” Prudential Securities, April 4, 2001, p. 27, via

Thomson Research/Investext, accessed May 2007.

6

TDC, 2000 Annual Report (Copenhagen: TDC, 2001), p. 35, http://tdc.com/publish.php?dogtag=tdccom_

ir_report_an_pre.

7

Ibid., p. 42.

8 P. Jessen and L. Horslund, “TDC—Trojan horses—a case study of the Danish mobile market,” Danske

Equities Company Report, November 26, 2003, p. 9, via Thomson Research/Investext, accessed November 2006.

9

TDC, 2000 Annual Report, p. 19, http://tdc.com/publish.php?dogtag=tdccom_ir_report_an_pre.

10 Michael Clemens, “Tele Danmark (TDC.CO),” Carnegie Company Report, January 25, 2000, p. 9,

via Thomson Research/Investext, accessed April 2007.

11

TDC, 2000 Annual Report., pp. 30-31, http://tdc.com/publish.php?dogtag=tdccom_ir_report_an_pre.

12

Telenor, 2000 Annual Report (Oslo: Telenor, 2001), p. 26, http://www.telenor.com/ir/reports/.

13

France Telecom 20-F filing, May 29, 2001, p. 29, via Thomson Research, accessed February 2007.

14

Telia, 2000 Annual Report (Stockholm: Telia, 2001), p. 9, http://www.teliasonera.com/reportarticle/0,28

65,l-en_h-13603,00.html.

15 David Rogerson, “The regulatory context for fixed mobile interconnection,” a presentation to the ITU

workshop, Ovum, September 2000, p. 8,

http://www.itu.int/osg/spu/ni/fmi/workshop/rogerson.pdf,

accessed April 2007.

16 Status 99. Chapter III – Status of the Telecommunications Sector Development. 4.6. Interconnect prices,

IT-og Telestyrelsen Minissteriet for Videnskab Teknologi og Udvikling, http://www.itst.dk/wimpdoc.asp?

page=tema&objno=95027905#III46, accessed April 2007.

17

WestLB, “Nach dem Goldrausch—Mobile Telekommunikation nach den Auktionen,” April 2001, p. 135,

via Thomson Research/Investext, accessed April 2007, and Bear Stearns, “The Cellular Review—November

2000,” Issue Three, November 22, 2000, pp. 36–37, via Thomson Research/Investext, accessed April 2007.

18

Ibid.

19

Telmore Web site, https://www.telmore.dk/help/index.jsp, accessed November 2006.

20

Telmore Web site, https://www.telmore.dk, accessed November 2006.

21 “The future or just another bubble?” Mobile Communications International, April 1, 2005, via ABI/Inform,

accessed November 2006.

22

Telmore Web site, https://www.telmore.dk/about/jobs.jsp, accessed December 2006.

23

Ibid.

24

Telmore Web site, https://www.telmore.dk/about/theCompany.jsp, accessed December 2006.

13

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.

708-414

Launching Telmore (A)

25

M. Conradi et al, “Mobile Virtual Network Operators: Key Issues,” Mondaq Business Briefing, March 3,

2006, http://www.mondaq.com/

26

N. Aquino, “More prefer no-frills phone service,” BusinessWorld, January 18, 2005, p. 17.

27

“Stor uenighed i Telmores ejerkreds,” Børsen, 20 September 2004.

28

P. Jessen and L. Horslund, “TDC—Trojan horses—a case study of the Danish mobile market,” Danske

Equities Company Report, November 26, 2003, pp. 4–5, via Thomson Research/Investext, accessed November

2006.

14

This document is authorized for use only in Debtanu Lahiri, Alison Holm's 2584-Strategy TA-TE at Universidade Nova de Lisboa (UNL) from Jan 2024 to Jul 2024.