Bond Issuance, Convertible Bonds, Debt Restructuring Assignment

advertisement

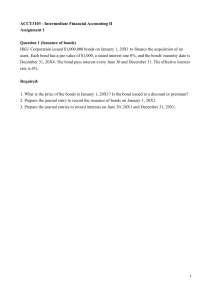

ACCT3103 - Intermediate Financial Accounting II Assignment 1 Question 1 (Issuance of bonds) HKU Corporation issued $1,000,000 bonds on January 1, 20X1 to finance the acquisition of an asset. Each bond has a par value of $1,000, a stated interest rate 8%, and the bonds' maturity date is December 31, 20X4. The bond pays interest every June 30 and December 31. The effective interest rate is 6%. Required: 1. What is the price of the bonds at January 1, 20X1? Is the bond issued at a discount or premium? 2. Prepare the journal entry to record the issuance of bonds on January 1, 20X1. 3. Prepare the journal entries to record interests on June 30, 20X1 and December 31, 20X1. 1 Question 2 (Convertible bonds) Greenwood Company sold $5,000,000, 5-years, 10% first-mortgage bonds on January 1, 20X1, with an effective interest rate of 8%. Interests were paid semi-annually, and the bonds were redeemable between June 30, 20X3 to June 30, 20X5, at 101, and thereafter until maturity at 100. The bond also includes a convertible feature allowing the bondholders to convert the bonds into ordinary shares as follows: ▪ Until June 30, 20X3, at the rate of six shares for each $1,000 bond. ▪ ▪ From July 1, 20X3, to June 30, 20X5, at the rate of five shares for each $1,000 bond. After June 30, 20X5, at the rate of four shares for each $1,000 bond. Assuming the company used the with-and-without method to account for the bond sale and book value approach for the conversion. A similar debt instrument without the option feature is issued at 12% yield. Required: 1. Prepare the journal entry to record the issuance of the bonds on January 1, 20X1. 2. Prepare the journal entry to record the conversion of $1,500,000 bonds into ordinary shares on June 30, 20X2. The market price of the ordinary share is $50 per share. 3. Prepare the journal entry to record the redemption of $1,000,000 face value of bonds on December 31, 20X4. 2 Question 3 (Debt restructuring) The Perry National Bank has a note receivable of $30,000,000 from the Mogren Company that it is carrying at face value and is due on December 31, 20X2. Interest on the note is payable at 8% each December 31. The last interest Mogren Company paid was on December 31, 20X1 and Mogren has financial difficulty in meeting the payment obligations. On January 1, 20X3, the company asked the bank to modify the terms of the note because of its financial difficulties. After negotiation the bank agreed to: ▪ ▪ ▪ ▪ Forgive the interest accrued for the year just ended. Reduce the stated interest rate to 6%. Reduce the unpaid principal amount to $22 million and to be repaid at the end of 20X4. Assume the effective interest rate for Mogren Company at the time of the restructuring remains at 10%. Required: Prepare the journal entries by Mogren Company necessitated by the restructuring of the debt on (1) January 1, 20X3, (2) Dec 31, 20X3, and (3) December 31, 20X4. 3 Question 4: Bond issued in-between interest payment dates Titania Co. sells $600,000 of 12% bonds on June 1, 20X1. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 20X6. The bonds yield 10%, selling for $638,780. On October 1, 20X2, Titania buys back $300,000 worth of bonds for $315,000 (which includes accrued interest). Give entries through October 1, 20X2. Required: (Round to the nearest dollar.) Prepare all of the relevant journal entries from the time of sale until the date indicated. Amortize premium or discount on interest dates and at the year-end on Dec 31 of the year. (Assume that reversing entries were made.) 4 Present value of a single amount of $1 5 Present value of annuity of $1 6