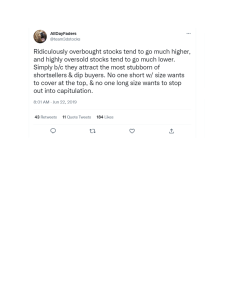

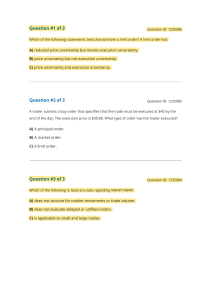

Nitish Kumar Jee …. VWAP basis Intraday and Positional Trade Why I am putting effort? Most of the retailers do not know much about stock market, other than the rosy picture created by media and other sources of information. They do trading and become accidental investor on the basis of various so called ‘analysts/paid tips providers’ available in market. I have been through this phase and know the pain of loosing your capital (hard earned money) due knowledge less behavior. There was nobody to guide me properly, without right practical knowledge stock market is the weapon of self-destruction and other than wealth will leads to loss of conviction/respect/family. That’s why I am putting efforts; my efforts are to save retails with best of my ability. To be discussed to day • • How to do trade What can happen with you when you are in trade When we want to do trade, following questions will arise – • What to buy or sell? • At what price to buy or sell? • Where to exit from trade? • Why I am taking any particular trade? • What will happen with me when I am in trade? When we knows the answers of above questions, we will do something batter with us. Today we will try to find answers. General trader most of the time is not capable to hold profit but will hold loss and will keep averaging it. Stock will fall from our entry point and will start rising from exit point. This is very common phenomenon. The reason behind is our emotions. Every retailor has a breaking point. Example – Airtel start falling and when it touched 400 people start panicking and then he took turn and rest is story now it is around 490. Is there a way to sort this out? What to buy and sell and how to hedge? Let find out – I will discuss – • Intraday Trade / Positional Trade on the basis of VWAP. • Option buying • Option hedging and how to make it profitable. • How to do adjustment in options and how to minimize risk to almost zero. Most of the things not just in market but on earth works on average so while trading we will pay special attention on average price. It will lead to turn our trade secure and profit ratio will be bigger. If we pay due attention on average price, there is a possibility of 80-85% time trade will give us profit. We will work on VWAP (Volume weighted average price) it will give us better visibility on average price; (some trading platform has VWAP mentioned as ATP). First Mantra – • When price is above VWAP, don’t take sell trade and when price is below VWAP don’t take buy trade. In other terms, when price is below VWAP we will take only sell trade and when price is above VWAP we will take only buy trade. This is applicable especially to new traders. Nitish Kumar Jee …. VWAP basis Intraday and Positional Trade How to use VWAP in intraday trade – • • • • Do not trade for first 1 hour. After 01 hour, check market trend on 01Day that is daily time frame using HM. If red line is below green line it is uptrend and when red line is above green line it is in downtrend. So it is defined here weather we will take position of CE or PE. Then further use 1hr time frame and check what HM system telling us that is buy or sell. (if HM is above 50, market will not ready for big correction). HM will predict fall or rise usually 2 hours before real event. Follow the trend. • Then 30 Minute time-frame can be used for entry and exit - entry price always has to be as close as possible to the VWAP line price. • Other confirmation for positional trade can be from 20SMA – daily time frame; If price is above 20SMA, market is not ready for big correction. For day trading 20SMA – 02hour time frame also can be used. Price above 20SMA is BUY-CE and below 20SMA is BUY-PE. • • If we are following above method for entry still there is a possibility of getting trapped, if market is behaving the way shown beside. To avoid this we will not do NAKED trading but will do HEDGE, we can increase the volume but no NAKED trading. How to do HEDGE trade – Example with steps – Point to remember -- HEDGE is insurance. • • • • Let’s consider nifty is at 12682 and Our daily time frame HM, 20SMA daily chart, 01 Time frame HM has confirmed up-trend. We will choose nearest OTM of that time, here it will be 12700. Check the chart of 12700 CE on 30 minute time frame and use price of 12700CE as close as possible to VWAP line price. STOP LOSS for CE buy will be 01 candle close below Nitish Kumar Jee …. VWAP basis Intraday and Positional Trade • • • VWAP on 15 minutes chart. To avoid loss due STOPLOSS hit we will do hedge by selling OTP 12800CE. (We use hawa and chips concept here to control our risk). Here maximum loss will be 01 to 05 points, which can be controlled by holding the position or buy PE, if trend changes or selling 01 more lot (depends on where price is sustaining below of above VWAP) or how far is our selling price. To maximize the margin, first do buy trade in positional and then do sell trade in MIS or intraday and later convert sell trade to positional. *********Same trade sequence will be for STOCK trading********* Points to keep in mind – • • • • • Do not enter when price is falling (when buying CE) on small time frame, wait for the price to settle down. Same concept applied for steep fall or rise that is a big candle green or red, wait for the price to settle. Option is Dynamic, we need to learn the art to play with it and find how to save capital. When VIX is rising (3 to 4% intraday), they buying both CE and PE option have potential to give good money. When VIX is in convergence, then selling CE and PE option has potential to give good money.