Cambridge AS Economics 9708 Examiner Report June 2022

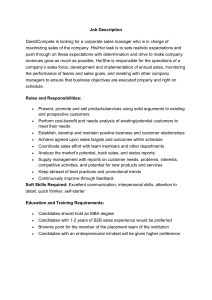

advertisement