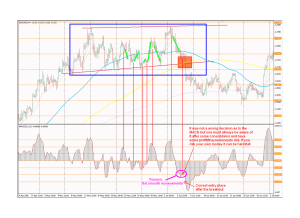

WORK OF ART ADVANCED PRICE ACTION AND ADVANCED MARKET MARKER METHOD Mastering the Inner Game of Wealth-Forex Financial Market. “THE ADVANCED FORMULAR FOR TOTAL SUCCESS” Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CONTENTS: CHAPTER ONE: ACCUMULATION o o o o Accumulation/Consolidation Assian Range Highs and Lows Strike Zones CHAPTER TWO: PATTERNS o Candlesticks Patterns o Charts Patterns o Trade Management CHAPTER THREE: MARKET TIMINGS o Session Timings o London Session o US Session CHAPTER FOUR: LEVELS o Intraday Levels o Three Day Levels o Moving Averages CHAPTER FIVE: MARKET CONDITION o Accumulation/Consolidation o Stop Hunts o Trend CHAPTER SIX: FUNDEMENTALS o NFP o FOMC Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba INTRODUCTION TO ADVANCED To understand and master Advanced Price Action and Advanced Market Marker Method you really need to study what happened previously. Then observe what is happening in at that moment and then project and anticipate what is the next possible Move or Event. “Simple and easy come on don’t left behind. If one man can do it other man can do it.”Why not you? From the standpoint of the Market Conditions. I want you to picture this, it’s real and its true and it’s happening on your charts day in and day out. There we go. “The WEATHERMAN knows where the wind is blowing from, sees the high and low pressure systems forming over the land, and knows the temperature variation, cold front, hot front and warm front. Then what does he do? He will say something like, based on that conditions “tomorrow, the weather in Polokwane will be mostly cloudy, slight chance of shower and possibly sunny in the afternoon.” How does he know that?well,from studying the previous data and seeing what the current weather conditions is at the moment(and these days, their predictions and anticipations is more reliable due to advanced computer models and weather satellites in the space).Another good example is GEOLOGICAL EXPLORATION and/or EXPLOTAITION in the mining industry . TRADERS are like that.so let me introduce you what I personally know to be TRUE about the MARKET CONDITIONS without any indicator and/or robots. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER ONE: ACCUMULATION o Accumulation/Consolidation: US session closes at 23H00.From 23H00 – 02H00 there is nothing goes on, on the market its Dad Gap. ASSIAN SESSION start at 02H30.From 02H00-02H30 is Gap time, is when MM comes in duty to get the instruction. Most of the Accumulation phase goes into ASSIAN SESSION. They will hold the Accumulation phase through ASSIAN SESSION till about 07H00 – 08H00.Assian session ends at 09H00. o Assian Range: Less Than 50 Pips: Ideal Assain Range is 50 Pips or less.it sets the trading zones and makes stop hunts easier to see. More Than 50 Pips: IF assian Range is blown out, your job is to re bracket and re analyze consolidation prior to the London open. IF assian Range is blown out 100-150 Pips you must re bracket the last quarter to one third of the assian range and understand the next possible move or Event. Trading zones: Trading zone is set 25-50 Pips higher or lower than the Assain Range: The reason is most of traders put the stop loss 25-50 Pips higher or lower than the Assain Range. Price may be shifted 25 pips or higher again in order to gain greater accumulation of positions. It is normal to expect that reversal will occur somewhere between 20 -50 pips higher or lower than assian range. IF Assain Range spikes down the next slightly move is at London open second leg formation and rise. Setups occur in the last quarter to just outside the assian range. Sometimes between 08H00 -10H00, they will breakout of assain range in three swipes (vector candles). Setups occur at the last hour 08H00 -09H00 of assain session or first 2 -3 hours (09H00-12H00) of London session open. Trading zones will be worked 30 – 90 minutes or up to 2 hours once the high or low is reached. These setups can occur earlier or later than this time, discretion and judgement are required when deciding to take this trade or not. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba o Highs and Lows HOD and LOD –HOW and LOW : How they handle the initial HOD and LOD is the whole business. To win in the market you should only take trades when the high or low is cleared. HOD and LOD is worked 30 -90 minutes or up to two hours once the HOD and LOD is reached. The strongest support point is LOD and LOW. The strongest resistance point is the HOD and HOW. Strongest reversal point is when the hod and lod is formed. The Hod or how are the real resistances, because is on mm ability to trap traders and snack their cash (based on money). The lod or low are the real support, because is on mm ability to trap traders and snack their cash (based on money). You must understand where the price is in relation to highs or lows to be successful. Previous HOD and LOD Marker: The high and low from previous day is used by mm to trap the traders. It is significant to know how price acts at these levels the following day. These levels will often line up with other support or resistance zones. At other times price might approach but not quiet reach the previous high or low: This tells you that the current price is already on the correct side. Expect the price to bounce up or down. This often occurs around the time of London open, ideal time is first 2 – 3 hours. For instance: if high already formed and there are position trapped, they will not push price above it again, but will then approach it perhaps even a spike with enlarged spread and pull away again. This become another piece of puzzle to help identify where the strike zone are likely to be formed. When they pin the yesterday’s high or low that is the evidence that they are picking orders on yesterday high or low. (They do this by widening spread too). Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba Reversal Behaviour at HOD and LOW: Mm induce traders to take wrong directional moves by using aggressive moves near high or low of the day: When you see these at the right time of the day you know that reversal is imminent. Another observation during this time the spread is widening. The following candlesticks patterns need to occur at or near the hod and low, their presence confirms the setups: High test candlesticks patterns – occurs at the price of yesterday’s high, as price reaches yesterday’s high a reversal pattern is seen. Low test candlestick patterns – is exactly the same as the high retest candlesticks patterns except that refers to the price action. Extended stop hunt – is followed by a reversal and slower trend that continues against that extended stop hunt trend towards the opposite high or low for the day (true trend).if you identify that after a period of time the extended stop hunt has not led to reversal then you should scratch the trade, an appropriate period is 2 hours following by the second leg of m or w formation. Sometimes you will see small pause in the form of pullback in the middle, its stop hunt that usually used to identify the strike zones. Validity of HOD and LOD: HOD Validity (High Re-test): If you have identified hod correctly then provided price stays within these parameters: As long as the price stays below the high after your entry then the entry remains valid. The trade is still good when the high is not bridged on the return. When price goes near the level and fails to break it you have setup. If high is broken however the trade taken on the basis becomes invalid. LOD Validity (Low Re-test): Low validity is exactly the same as high validity. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba o Strike Zones Strike zone is an area where price will find intraday support or resistance. Tend to be areas where they are multiple of things coming together providing a confluence of signals. It becomes a place where there are possible setups and exits. Things to look for to form strike zones are: Assian range less than 50 pips What level are you at? Has there been a quick move out of assian range and were 3 swipes (vectors)? Has there been a sideways price movement for 30 -90 minutes following the first strike? Has yesterday’s high or low worked? Is there an m or w patterns visible? Is there an half a batman pattern visible? Is there evidence in a straight away trade pattern? Are there reversal candlesticks patterns coinciding with stars formation, spikes candles and RR? Is there support and resistance identified from one of the EMAs 50 and 200? Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER TWO: PATTERNS Candlesticks Patterns It is important to understand that Candlesticks patterns can only be defined at the close of the candle. The most important thing to understand about the candlesticks patterns and price action is that in the right time of market conditions, they have strong signals. The mentioned candlesticks patterns need to occur at or near the hod and lod, their presence confirms a setups. 10 most profitable candlesticks patterns every traders needs to know: Morning star Evening star Doji Rail Road Tracks Vector candles (3 pushes high/low) Spikes candles: 2 pins to high/low 3 pins to high/low Extended stop hunt Stars Formation and Doji: They are considered to be an extention of RR formation. Holds the level open the spread, induces traders to take continuation. The hod and lod is held for additional 15 minutes allows the dealer to flash across or grab a few more contracts. Rail Road Track: They are an m or w pattern that has occurred more quickly and thus has the same effect. Get in grab the money and create immediate draw down and panic. They trick traders to go in the direction of the first candle but it is snatched quickly on the next candle. Vector candles: It’s an extension of the initial low or high. Its three swipes to the hod or lod. Usually forms the first leg or the second leg of the reversal patterns. Spike candles: Used to activate the pendings and trigger the stops. These candles are often seen in the first leg of a reversal setups. Are often seen at level three of the three day cycle. Trap and create draw down. Normally occurs when retesting the previous high or low, pullback, RR, 200EMA, 50EMA, Support and Resistance at the right times of market conditions have strong signals. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba When the candles spike at the appropriate time, it’s extending the high or low for the session (07H00-10H00), Ideal time 10H00.When it is pulled back the high or low is formed. o Charts Patterns: Identify the patterns and how they handle it and what is supposed to look like is the whole business. Patterns are the same no matter what time frames. Types of Charts patterns 10 most profitable chart patterns every traders needs to know: M Formation. W Formation. Triple Top. Triple Bottom. Head and Shoulder. Inverse Head and Shoulder. Half –A-Batman. Inverse Half –A-Batman. Straight-Away Trade. 33 Trades. M and W Formation: The best trade is into session and Multi session M or W formation, it allows you to grab close to HOD and LOD. An M or W pattern is a frequently identified pattern and is particularly good reversal patterns and it is the same at opposite ends of spectrum. There always come back to form second leg of m or w patterns. Most of the time MM will repeat the level on the near mess. Some setups offer 20 -30 pips pullbacks. Second leg setups – the second leg can take out the first leg as long as its closes on the pins (spikes candles), if it does not closes on the pins it must be RR Formation. This means that instead of London session being responsible for creating HOD or LOD for a period of time ,this responsibility could passed to assain and/or US sessions, so it is very important to interpret. Kinds of trades you can hold – if you catch mid-week reversal with big M or W patterns of two sessions, thus the kind of trade you can hold. If you decide you will focus on the multi session Big M or W patterns spread over a day or two days then convert a spot trade to a swing trade and hold for two and half days to three days (200EMA Pullback). Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba Triple Top and Bottom: The better trade is when they hit price levels three times and each subsiquate swipes is not taken out. If they hit it three times expect a major move. Head and Shoulder: This pattern commonly occurs at level 3 peak formations high or low. Level 3 often causes the formation of head and shoulders patterns, which is special patterns of M or W Formation; you should Buy or Sell on the second shoulder. Half –A-Batman: This pattern commonly occurs at level 1 consolidation after the peak formation high or low and it is similar to straight away trades. A pattern occurs when the second leg of M or W has failed. Patterns occurs where an M or W formation would normally occur, but there have been an adequate build-up of volumes already to make the expenses involved in the second leg necessary. Straight-Away Trade: This is the most difficult formation to recognize contemporaneously. The patterns trapped moves are made in the previous day or previous session. So when the consolidation concludes the price moves into the true trend without a stop hunt, it is the stop hunts that we usually use to identify the strike zones. The formation is leading up to nfp, its trap moves might occur as much as two days earlier followed by extended consolidation. Key features of straight Away trade formation to develop – occurs after level 1 consolidation from the peak formation and also occurs on 50EMA pullback after peak formation. 33 Trades: 33 TRADE refers to having 3 levels of rise over 3 days in combination with a level 3 rise on intraday charts .if this is identify is a strong sell signal.in this areas is possible that a final consolidation will last longer than usual and the day will close at or near the high, this observations provide additional evidence that reversal is imminent. As an example – if you observe that you in 3 day rise following a peak formation low and during level 3 move of 3 day cycle you also able to observe 3 levels of movement on intraday cycle, then a reversal is imminent. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba o Trade Management Managing stops: A stop loss of 23 pips below or above the HOD or LOD should be used. A stop loss of 7 – 10 pips can be used above or below the second leg of M or W Patterns. If 32 pips of profits is seen adjust stop loss to break even. In order to trade multiple contracts with little to no draw down second leg entries must be mastered. If the spot trade is captured at mid-week reversal, it can be converted to swing trade for 3 days. The stop loss must be brought in below or above the consolidation zones after the stop hunts have cleared. Take Trades without Fear of Loss: Simply buy or sell third level stop triggers on the second leg of M or W Patterns. Always buy or sell the consolidation levels when the market comes to rest. Buy or sell at peak formation at level 3 Trade only on closed candles with multiple confirmations when the signal appears. Sell upward stop hunts - if they the stops high Buy downward stop hunts - if they the stops low Always be prepared for one more move towards the stops. Four kinds of Trades looking for: Kinds of trades looking for which is 90%+ accurate and will not fail: Stop Hunt High - M Formation Stop Hunt Low - W Formation Straight Away Drop Straight Away Rise Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER THREE: MARKET TIMINGS o Session Timings Best time to trade: Assian to London: Setups occurs at the last hour of Assian session from 08H00 – 09H00 or first 2 – 3 hours of London session open from 09H00 – 12H00. Session change-over is from 09H00 – 09H30. Most telling candles is from 09H30 – 09H45. Ideal time to trade is at London open first 2 – 3 hours 09H00 – 12H00. London to US: Setups occurs at the last hour of London session from 14H00 – 15H00 or first 2 – 3 hours of US session open from 15H00 – 18H00. Session change-over is from 15H00 – 15H30. Most telling candles is from 15H30 – 15H45. Ideal time to start trade US session is 14H00. o London Session London Opener Assian Session Ends at 09H00 and London Session Start at 09H30.From 09H00 – 09H30 is Gap time, is when the Assian MM and London MM discusses about their moves. Between 09H00 – 09H30 you might see second leg or start making first leg. The Brinks trade is when the first leg or second leg of M or W is formed on 09H15 -09H45 candlesticks. They jam you during session change-over. At start of London session the first moves is to pick up the pending orders and destroy the breakout traders. They widen the swing early and pick up the pending orders and validate any fib patterns and take them out. Between 09H00-10H00, an ideal time is 09H30-09H45, they make an aggressive moves towards the high and extend the initial high of the day. That moves are comprise of three individuals pushes, three individual pushes is a psychological barrier for human behaviour.the three pushes ensures the mm that you will infact chase that trade. Three individual pushes makes you thinks, based on human psychology, fear and greedy, things that drives the market, ensures that you will take wrong postion.mm do it because it works. When they get orders pilled on, they quickly pull off 20-25 pips and they repeat the level and fail to break it, they might throw spikes to grab orders. They will then make three levels of drop. Three levels of drop will take 6-8 hours with 20-25 pips pullbacks and 5070 pips swing per level. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba o US Session US Session Opener: London Session Ends at 15H00 and US Session Start at 15H30.From 15H00 – 15H30 is Gap time, is when the London MM and US MM discusses about their moves. Between 15H00 – 15H30 you might see second leg or start making first leg. The Brinks trade is when the first leg or second leg of M or W is formed on 15H15 -15H45 candlesticks. They jam you during session change-over. They use news to complete the levels. They throw spikes to the low and trap traders and reverse back into the range and ends day with consolidation to start new cycle the following day. US Session Reversal : This is essentially a reversing trade that occurs following opportunity coming out of London Session. It is important to maintain the level during this period, this will be the key features telling you whether or not a reversal is likely. Us session does offer good opportunities, sometimes they hold the level at London session and make M or W patterns and start us session. 90% of the time during us session they re-test M or W Patterns. It has the following characteristics: HOD and LOD have already formed. Price will be at level 3 forming a reversal candlesticks patterns. Price has pulled away from the moving averages. Profit target is 50EMA or middle of the Range, you are likely to get 40 – 50 pips or less. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER FOUR: LEVELS o Intraday Levels The cycle is 24 hours cycle and changes within that 24 hours period based on how the contracts are sets. The intraday cycle patterns are identical to the 3 day cycle. The Levels can be described under the following headings: Peak Formation High Level 1 and Consolidation Level 2 and Consolidation Level 3 and Consolidation Peak Formation Low Peak Formation High: The highest formation on the chart is the peak formation, price will pull away quickly and form out the M Pattern. Level 1 and Consolidation: Level 1 and its correction is driven by MM and characterized by fast moves. The consolidation zones often involve 20 – 30 pips swing in both directions in an effort to accumulate positions and hit stops. This makes the ultimate movement to the next level easier for the MM with no buying or selling pressure being exerted by the wider market place. Level 2 and Consolidation: Leve 2 and its correction is market driven in the absence of MM support. Instead it is driven by emotional traders who enter the market. Because this is not driven by MM the size of the move tends to be smaller. This is because the retail-traders don’t have access to the size of traders or the coordinated effort to move price at will. Level 3 and Consolidation: Level 3 and its correction see a return of Market Marker. This is area of profit taking from MM, where further movement in the direction of the technical trend is encouraged before stops are trigged. Traders can become panicked and confused. During 3 levels MM will buy from traders to create positions and the heaviest volumes are seen at the third level. Peak Formation Low: The lowest formation on the chart is the peak formation, price will pull away quickly and form out the W Pattern. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba Three Day Levels : If you have identified peak formation for the week expect two more stop hunts in line with the peak formation. The Levels can be described under the following headings: Peak Formation High Level 1 and Consolidation Level 2 and Consolidation Level 3 and consolidation Peak Formation Low Peak Formation High: The highest formation on the chart is called the peak formation. Price will pull away quickly and form out the M charts patterns. Level 1 and Consolidation: After falling away from the M Pattern, price falls into a new zone and reaches a level 1 consolidation. During consolidation zone they hit stops down and hit stops up and then drop price again. Never trade against peak formation out of level 1 consolidation, it’s the most common place for a straight away trade to develop. Because MM already have what they needed, which is traders trapped from the previous reversal. Level 2 and Consolidation: After falling away from level 1 consolidation price drops to level 2 and then into new area of level 2 consolidation. Again they hit stops down and hit stops up and then drop price again to level 3. Level 3 and consolidation: Having reached level 3 the objective is little different. A price will be dropped in order to demonstrate further bearish movement by satisfying various criteria of traders. Then they will pull away quickly and move price up and book a profit. Level 3 will appear disorganized with price chopping back and forth, usually within a wide range, and then you should also be aware that a reversal is imminent. If you having difficulties of identifying what level you are currently in, then identify the previous level 3 and will give a point of reference depending on whether or not price has been coming to level 3 zone from above or below and what has happened since. This level 3 often causes the formation of Head and Shoulder pattern which is special pattern of M or W Formation. You should buy or sell on the second shoulder. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba Peak Formation Low: Following level 3 a new peak formation low is defined and cycle start again. This becomes an area where you are aiming to buy with MM even though all other indicators and prior learning will have told you that this is still in a sell zone. So you will be buying against what you have learnt previously against the rest of the world, you will be buying against the trend. Moving Averages: When moving averages used in the appropriate context of MM can give you: True reading of market direction A reading of market momentum Entries and exits signals, take profit targets. Moving support and resistance points. Separation of moving averages exhibits level 3.a crossover of EMAs can be used as sell or buy signals when viewed in the right context of the market conditions. Since we trade with two higher timeframes than our entry window.it is helpful to understand the 200EMA on M15 charts represent the current position of the 50EMA on H1 charts. On the H1 chart the 200EMA represents the current position of the 50EMA on a H4 chart. 50 EMA: Is a balance line shows intraday trend. Gives a straight away trade signals, likely 50EMA pullback. Acts as a support and resistance. Us reversal trade, profit target is 50EMA or middle of the range. 200EMA: It is a home base defining the longer term trade trend. Price will always returns home base. Acts as a support and resistance. If the pattern M or W occurs right on the 200EMA, the trade has very high likelihood of success. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER FIVE: MARKET CONDITION o Market conditions They are three market conditions that you will be able to identify and are Accumulation/Consolidation, Stop Hunt and Trend. As a trader your job is to identify the conditions and apply the appropriate action. As a trader is simple you apply the appropriate reaction to his action. Patterns will almost always reveal a reversal setups, unless its time out (appropriate period is two hours). No indicator can replace your ability to identify the patterns and the levels. o Accumulation/Consolidation Sets the initial highs and lows. Price trades between the range and collects the contracts. Its choppy market and we call this level 3 behaviour. Anticipate the stop hunts, vector candles. Holds the levels and bringing other crosses up or down, or bring other majors in line with it to get everything in level 3. During the Accumulation/Consolidation zones from 02H30 -08H00 you should count the levels first and look for: 1. Look for previous High or Lows. 2. Look for assain range less than 50 pips. 3. Look for reversal candlesticks patterns (vectors candles). 4. Look for assian range if its spikes up or down. 5. Look for M or W patterns. 6. Look for support or resistance at 50EMA or 200EMA. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba o Stop Hunts False and fast moves against their real intentions. Fast and false moves session ending and beginning. Its aggressive moves out of assian range up or down. Its gets all traders who are emotional going in the wrong direction. When the stop hunts is appear wait for signal or setup. Most powerful stop hunts normally occurs at session changeover from 09H00 – 10H00 and 15H00 – 16H00. Stop hunts has two main objectives: 1. Take out the existing stops. 2. Encourage traders to commit to positions in a direction that is opposite to where the real trend is going to be. When stop hunts appears simply count the levels and wait the following to happen: 1. Trading zone: Wait price to show you vector candles out of assian range. Wait price to set trading zones 25 – 50 pips higher or lower than Assian range. 2. Previous highs and lows: Wait price to repeat the level or come back to yesterday high or low. Wait price to retest previous highs or lows. Wait price to show RR at yesterday’s high or low. Wait price to show 2 pins at yesterday’s high or low. Wait price to show 3 pins at yesterday’s high or low . Wait price to show RR at HOD and LOD. Wait price to show 2 pins at HOD and LOD. Wait price to show 3 pins at HOD and LOD. Wait price to come back to US high or low Wait price to come back to London high or low. 3. Patterns: Wait price to show Multi – session M or W. Wait price to show Into session M or W. Wait price to show second leg of M or W. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba Wait price to show RR on second leg of M or W. Wait price to show 2 pins on second leg of M or W. Wait price to show 3 pins second leg of M or W. Wait price to show Extended stop hunt at session changeover. Wait price to retest INNER M or W with RR or Spikes (pullback). Wait price to show COLOUR of your direction at second leg of M or W. 4. Moving averages: Wait price to show M or W at 200EMA. Wait price to show RR at 50EMA or 200EMA. Wait price to show 2 Pins at 50EMA or 200EMA. Wait price to show 3 Pins at 50EMA or 200EMA. o Trend Trend is slow and steady relentless fall or rise of 3 levels 6 – 8 hours in duration and can continues through both sessions. Once the signal or setup is cleared trend will start. Count the levels, trade and MAXIMISE your profits. It’s almost always involves 20 – 30 pips pullbacks swings up or down in an effort to accumulates contracts and makes the next levels easier with no selling or buying pressure. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba CHAPTER SIX: FUNDEMENTALS o NFP NFP should be traded at 15H30 – 15H35 because at 14H30 they will make spikes to the High OR Low then pullback and at session changeover ,they will make the second leg formation or do something. o FOMC FOMC is used to complete the patterns or levels. Authored by: Mr. Herbert Kgasago & Dr. Sammy Mashaba