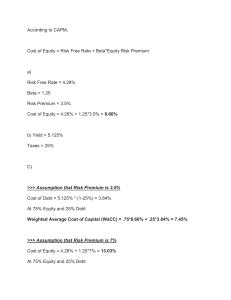

Cost of Capital Cost of Capital • Cost of capital of a company is a combination of – Cost of Equity – Cost of Debt • Cost of Debt • Cost of bank loan • Cost of bonds • Other forms of debt Cost of Capital • Every business is financed through a mix of Debt (borrowed funds) and Equity (owned funds) financing. • How much of each component should be used depends on the riskiness of the business • Equity is much more expensive than debt • Debt on the other hand while being cheaper, results in a liability or obligation that must be serviced. Interest on Debt though is tax deductible, unlike equity. • Here, we discuss the cost-related aspects of each form of capital and how the capital structure determines what the Cost of Capital is for your business. • why determining an accurate Cost of Capital is important. Cost of Debt • Cost of loan – Interest cost on loan – Other costs of loan • Cost of bond • Cost of other forms of debt: Cost of Preferred stock Cost of Debt Coupon Rate Maturity Book Value of Price (% of Par Debt (in Millions) Value) YTM 3.25% 2008 72 96.00 5.02 7.00% 2012 187 108.00 5.36 6.30% 2018 143 100.10 6.20 7.25% 2024 497 104.00 6.45 7.60% 2024 200 112.00 6.41 7.65% 2017 297 114.00 6.41 Cost of Equity • Cost of Equity (Ke) is the minimum rate of return which a company must earn to convince investors to invest in the company's common stock at its current market price. It is also called cost of common stock or required return on equity. • There are two commonly used methods to calculate cost of equity: CAPM and DDM Cost of Equity - DDM • Start with the DGM: D 0 (1 g) D1 P0 R -g R -g Rearrange and solve for R: D 0 (1 g) D1 R g g P0 P0 • Where D1 is the dividend per share expected over the next year, P0 is the current stock price and g is the dividend growth rate. Dividends in next period equals dividends per share in current period multiplied by (1 + growth rate). Growth rate is equal to the sustainable growth rate which is the product of retention ratio and return on equity Cost of equity - CAPM • In the capital asset pricing model, cost of equity can be calculated as follows: • Cost of Equity = Risk Free Rate + Equity Risk Premium • Equity risk premium is the product of the stock's beta coefficient and the market risk premium. The Cost of Equity • From the firm’s perspective, the expected return is the Cost of Equity Capital: R i R β ( R M R ) F i F • To estimate a firm’s cost of equity capital, we need to know three things: 1. The risk-free rate, RF 2. The market risk premium, R M RF Cov ( Ri , R M ) σ i , M 2 3. The company beta, β i Var ( R M ) σM Cost of Equity: Example • Suppose the stock of Stansfield Enterprises, a publisher of PowerPoint presentations, has a beta of 1.5. The firm is 100% equity financed. • Assume a risk-free rate of 5% and a market risk premium of 10%. • What is the appropriate discount rate for an expansion of this firm? R RF βi ( R M RF ) R 5 % 1 . 5 10 % R 20 % Cost of Equity • The Dybvig Corp. common stock has a beta of 1.17. If the risk free rate is 3.8 percent and the expected return on the market is 11 percent, what is its cost of equity? Cost of Equity Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows + Beta - Measures market risk X Type of Business Operating Leverage Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium Industry Beta and Cost of Equity • It is frequently argued that one can better estimate a firm’s beta by involving the whole industry. • If you believe that the operations of the firm are similar to the operations of the rest of the industry, you should use the industry beta. • If you believe that the operations of the firm are fundamentally different from the operations of the rest of the industry, you should use the firm’s beta. • Do not forget about adjustments for financial leverage. Determinants of Beta • Nature of the business • Operating leverage refers to the sensitivity to the firm’s fixed costs of production. • Financial leverage is the sensitivity to a firm’s fixed costs of financing. • The relationship between the betas of the firm’s debt, equity, and assets is given by: bAsset = Debt Debt + Equity × bDebt + Equity Debt + Equity × bEquity • Financial leverage always increases the equity beta relative to the asset beta. Nature of Business and Beta • High beta sectors – – – – – – Automobiles Sector Materials Sector Information Technology Sector Consumer Discretionary Sector Industrial Sector Banking Sector • Low beta sectors – – – – – Consumer Staples Beverages HealthCare Telecom Utilities Equity Beta and Asset Beta The asset beta (unlevered beta) is the beta of a company on the assumption that the company uses only equity financing. In contrast, the equity beta (levered beta, project beta) takes into account different levels of the company's debt/capital structure. Beta Adjustment Unlevered Beta • Unlevered Beta = βL/ (1 + ((1 – t) x (D/E))) • Levered Beta = βU x (1 + ((1 – t) x (D/E))) • Example: Beta = 1.2, D/E = 2/3, t = 30%, and new D/E = 3/2 Capital Structure and Beta: Example Consider Grand Sport, Inc., which is currently allequity financed and has a beta of 0.90. The firm has decided to lever up to a capital structure of 1 part debt to 1 part equity. Since the firm will remain in the same industry, its asset beta should remain 0.90. However, assuming a zero beta for its debt, its equity beta would become twice as large: bAsset = 0.90 = 1 × bEquity 1+1 bEquity = 2 × 0.90 = 1.80 Capital Budgeting & Project Risk Suppose the Conglomerate Company has a cost of capital, based on the CAPM, of 17%. The risk-free rate is 4%, the market risk premium is 10%, and the firm’s beta is 1.3. 17% = 4% + 1.3 × 10% This is a breakdown of the company’s investment projects: 1/3 Automotive Retailer b = 2.0 1/3 Computer Hard Drive Manufacturer b = 1.3 1/3 Electric Utility b = 0.6 average b of assets = 1.3 When evaluating a new electrical generation investment, which cost of capital should be used? Cost of Debt • Advance Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to maturity that is quoted at 95 percent of face value. The issue makes semiannual payments and has coupon rate of 7 percent. What is the company’s pre-tax cost of debt? If the tax rate is 35 percent, what is the after tax cost of debt? Cost of Capital with Debt • Consider a firm having a debt of Rs.40 million and equity of Rs.60 million. The firm pays a 15% rate of interest on its new debt and has a beta of 1.41. The risk premium in market is 9.5% and the current T-bill rate is 10%. What is the WACC? • What happens to WACC if corporate tax rate is 30%? The Cost of Capital • The Weighted Average Cost of Capital is given by: rWACC = Equity Debt × rEquity + × rDebt ×(1 – TC) Equity + Debt Equity + Debt S B rWACC = × rS + × rB ×(1 – TC) S+B S+B • Because interest expense is tax-deductible, we multiply the last term by (1 – TC). Managing Cost of Capital • Increase liquidity – Brokerage fees – Bid-ask spread • Reduce adverse selection – Stock split – Reduce information assymetry