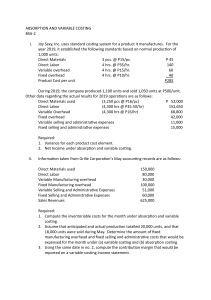

01140561 2-2566 Exercise 6-1 (15 minutes) 1. Under absorption costing, all manufacturing costs (variable and fixed) are included in product costs. Direct materials ............................................................ Direct labor.................................................................. Variable manufacturing overhead .................................. Fixed manufacturing overhead ($60,000 ÷ 250 units) .... Absorption costing unit product cost.............................. $100 320 40 240 $700 2. Under variable costing, only the variable manufacturing costs are included in product costs. Direct materials ............................................................ Direct labor.................................................................. Variable manufacturing overhead .................................. Variable costing unit product cost .................................. $100 320 40 $460 Page1 Note that selling and administrative expenses are not treated as product costs under either absorption or variable costing. These expenses are always treated as period costs and are charged against the current period’s revenue. 01140561 2-2566 Exercise 6-2 (20 minutes) 1. Fixed manufacturing overhead cost deferred in inventory = 25 units in ending inventory × $240 per unit* = $6,000 * $60,000 ÷ 250 units = $240 per unit 2. The variable costing income statement appears below: Sales ............................................................ Variable expenses: Variable cost of goods sold (225 units sold × $460* per unit) ............. Variable selling and administrative expenses (225 units × $20 per unit) ........................ Contribution margin ...................................... Fixed expenses: Fixed manufacturing overhead..................... Fixed selling and administrative expenses .... Net operating income .................................... * Variable cost of goods sold per unit: Direct materials ............................................. Direct labor ................................................... Variable manufacturing overhead ................... Variable costing unit product cost ................... $191,250 $103,500 4,500 60,000 20,000 108,000 83,250 80,000 $ 3,250 $100 320 40 $460 Page2 The difference in net operating income between variable and absorption costing can be explained by the deferral of fixed manufacturing overhead cost in inventory that has taken place under the absorption costing approach. Note from part (1) that $6,000 of fixed manufacturing overhead cost has been deferred in inventory to the next period. Thus, net operating income under the absorption costing approach is $6,000 higher than it is under variable costing. 01140561 2-2566 Exercise 6-9 (30 minutes) 1. a. Under variable costing, only the variable manufacturing costs are included in product costs. Year 1 Year 2 Direct materials .................................... Direct labor .......................................... Variable manufacturing overhead .......... Variable costing unit product cost .......... $25 15 5 $45 $25 15 5 $45 Note that selling and administrative expenses are not treated as product costs; that is, they are not included in the costs that are inventoried. These expenses are always treated as period costs. 1. b. Sales .......................................................... Variable expenses: Variable cost of goods sold @ $45 per unit . Variable selling and administrative @ $2 per unit ................................................. Total variable expenses ................................ Contribution margin..................................... Fixed expenses: Fixed manufacturing overhead ................... Fixed selling and administrative ................. Total fixed expenses .................................... Net operating income (loss) ......................... Year 1 $2,400,000 $3,000,000 1,800,000 2,250,000 80,000 1,880,000 520,000 100,000 2,350,000 650,000 250,000 250,000 80,000 80,000 330,000 330,000 $ 190,000 $ 320,000 2. a. The unit product costs under absorption costing: Page3 Direct materials .................................... Direct labor .......................................... Variable manufacturing overhead .......... Fixed manufacturing overhead .............. Absorption costing unit product cost ...... Year 2 Year 1 Year 2 $25 $25.00 15 15.00 5 5.00 *5 **6.25 $50 $51.25 * $250,000 ÷ 50,000 units = $5 per unit. ** $250,000 ÷ 40,000 units = $6.25 per unit. 01140561 2-2566 Exercise 6-9 (continued) 2. b. The absorption costing income statements appears below: Year 1 Year 2 Sales (see requirement 1(b)) ................... $2,400,000 $3,000,000 Cost of goods sold .................................. *2,000,000 **2,550,000 Gross margin .......................................... 400,000 450,000 Selling and administrative expenses ......... 160,000 180,000 Net operating income .............................. $ 240,000 $ 270,000 * 40,000 units × $50 per unit = $2,000,000 ** (40,000 units × $51.25 per unit) + (10,000 units × $50 per unit) = $2,550,000 3. The net operating incomes are reconciled as follows: Units in beginning inventory ........................ + Units produced ........................................ − Units sold ................................................ = Units in ending inventory ......................... Fixed manufacturing overhead in ending inventory (10,000 units × $5 per unit) ....... Deduct: Fixed manufacturing overhead in beginning inventory (10,000 units × $5 per unit) .................................................. Manufacturing overhead deferred in (released from) inventory .......................... Page4 Variable costing net operating income ........ Add (deduct) fixed manufacturing overhead cost deferred in (released from) inventory under absorption costing ........................ Absorption costing net operating income .... Year 1 Year 2 Year 1 Year 2 0 50,000 40,000 10,000 $50,000 10,000 40,000 50,000 0 $ 0 50,000 $50,000 $(50,000) Year 1 Year 2 $190,000 $320,000 50,000 $240,000 (50,000) $270,000 01140561 2-2566 Problem 6-21 (30 minutes) 1. Total Company Amount % Sales ............................................... $750,000 100.0 Variable expenses ............................ 336,000 44.8 Contribution margin ......................... 414,000 55.2 Traceable fixed expenses .................. 228,000 30.4 Territorial segment margin ................ 186,000 24.8 Common fixed expenses* ................. 150,000 20.0 Net operating income ....................... $ 36,000 4.8 Sales Territory Northern Southern Amount % Amount % $300,000 100 156,000 52 144,000 48 120,000 40 $ 24,000 8 $450,000 100 180,000 40 270,000 60 108,000 24 $162,000 36 *378,000 – $228,000 = $150,000 Product Line Page5 Sales ............................................ Variable expenses ........................... Contribution margin ........................ Traceable fixed expenses ................. Product line segment margin ........... Common fixed expenses* ................ Sales territory segment margin ........ *$120,000 – $70,000 = $50,000 Northern Territory Amount % $300,000 100.0 156,000 52.0 144,000 48.0 70,000 23.3 74,000 24.7 50,000 16.7 $ 24,000 8.0 Paks Amount % $50,000 100 11,000 22 39,000 78 30,000 60 $ 9,000 18 Tibs Amount % $250,000 100 145,000 58 105,000 42 40,000 16 $ 65,000 26 01140561 2-2566 Problem 6-21 (continued) 2. Two insights should be brought to the attention of management. First, compared to the Southern territory, the Northern territory has a low contribution margin ratio. Second, the Northern territory has high traceable fixed expenses. Overall, compared to the Southern territory, the Northern territory is very weak. Page6 3. Again, two insights should be brought to the attention of management. First, the Northern territory has a poor sales mix. Note that the territory sells very little of the Paks product, which has a high contribution margin ratio. This poor sales mix accounts for the low overall contribution margin ratio in the Northern territory mentioned in part (2) above. Second, the traceable fixed expenses of the Paks product seem very high in relation to sales. These high fixed expenses may simply mean that the Paks product is highly leveraged; if so, then an increase in sales of this product line would greatly enhance profits in the Northern territory and in the company as a whole.