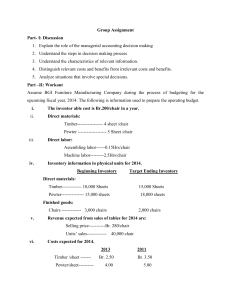

Stander Furniture Business Report: Costing, Budgeting, Analysis

advertisement

Prepared by: Section (02) Premananda Sarkar 1120806030 Md Imran Khan 1120917030 Md.Mazbahul Hossain 1120433030 Joy Saha 1210200030 Letter of Transmittal August 09, 2014 …………………………. Department of Business Administration North South University, Bangladesh Subject: Submission of the report. Dear Madam, We are very pleased to submit this report on “Stander Furniture” as you have authorized us to in this semester. We are honored to prepare this report under your guidance since it gave us the opportunity to know the current status of furniture business in our country. We tried our level best to accumulate the information for you as comprehensively as possible. We will be obliged to provide further clarification on this report whenever necessary. Sincerely Yours, Table of content Page no. 5 Abstract Introduction 6 Manufacturing process of our product 6 Determine the maximum production possible 7 Estimate all cost related to our product 7-9 Analyze each cost of our product 9 Appropriate allocation base and determine the unit product cost Determine prime, conversion and full cost 10-11 Select different cost drivers and determine unit product cost 12-13 Prepare and compare product-line profitability report under simple and ABC costing. Forecast demand and sales of our product and prepare revenue budget and production budget Prepare direct material usage, dissect material purchase, direct labor cost, MOH cost, ending inventory and COGS budget Prepare a budget income statement 13-14 Determine the break-even point , break-even revenue and margin of safety 22-23 Sensitivity analysis 23-24 11-12 14-15 16-20 20-22 Abstract Our company is new company in market. It is very difficult for us settle up in market. We tried to make our business objectives and goal very clear. We have forecasted our sale, production, cost of goods sold, ending inventory budget and other essential forecasting. We think the projection we made can be achieved if we stick to our plan. For now our company is much small but in future we will try to expand our business. We know that small company like us is very difficult to survive in such competitive market. With help of our skilled labor and providing quality product we think we can have better position in market. To start something is a great challenge. We need support from our suppliers as well as the customers. Without their help it will impossible to achieve our goal. They are the main driver of our business. We know there are lots of furniture shops available in market. We will create our competitive advantage by standard and attractive product. Introduction: Stander furniture is a new business unit in the market we have established this business unit before few months ago with an aim to be a success full entrepreneur. We have chosen the furniture market for some specific reason one of the main reason to choose this business is that it has got a large number of customer. As we have said earlier it is a new business unit so at first we a just manufacturing only one product which having the high demand in the market. We have chosen the first product as the chairs because chairs have a high demand in the market. We have selected the design of the chair as simple as possible because a simple chair has more possibility of sale than a designed chair. Company information: Stander furniture is a new business in the market which was established before one month ago. This company is located in block-f road -1 basundharabaridhara Dhaka Product information: We are manufacturing the stander chair in our company. The chair is a symbol of simplicity. It is an ordinary chair made of wood and coted of fine burnished color. Manufacturing process: We purchase the wood from the different whole sealer and store it in our warehouse. In selection of wood we are very concuss. We only select the best quality timber. After collecting the timber and preserving it in the nicely we start our manufacturing process. In manufacturing process we first slice the timber after an acute measurement of slice are send to the deigning department to design it nicely. When deign are made we assemble different part of our chair to give a nice shape. After that we burnished it with the burnished color. These are the process we gone through the manufacturing part. Determine the maximum production possible: We have six labors in our company. All four members will be engaged in production. Our factory will open up 5 days in a week. So there are only 5 working days and each day will consist of 8 working hours. Every four labor will work in factory 8 hours in a day and 5 days in a week. Each chair will take 5 hours of a labor so 1day production (48 labor hours ÷ 5hours per chair) 9.6 chairs / day 1 week production ((48 labor hours × 5) ÷ 5hours per chair) 48 chairs / week 1 month production (48 chairs per week × 4 week per month) 192 chairs / month So the maximum production possible in a month is 128 chairs. / 192 chairs Estimate all cost: Direct material: Material Input/unit cost/unit Wood: 1.5 septet per chair 1200tk Pin: 250 gm 30tk Burnish: 0.167 liter 150tk Total direct material cost 1380tk Direct labor: Product Chair DLHs/unit 5 hour cost/hour 50 total 250tk Hour/day Salary total day/month 8 total labor 6 20 48000tk Manufacturing overhead (MOH): total Variable MOH: Gum (30𝑡𝑘 × 121𝑢𝑛𝑖𝑡) 3630tk Fixed MOH: Electricity 1500tk Rent 15000tk Repair cost 1000tk Total MOH 21130tk 𝑻𝒐𝒕𝒂𝒍 𝒊𝒏𝒅𝒊𝒓𝒆𝒄𝒕 𝒄𝒐𝒔𝒕 Indirect Cost rate = 𝑻𝒐𝒕𝒂𝒍 𝒅𝒊𝒓𝒆𝒄𝒕 𝒍𝒂𝒃𝒐𝒓 𝒉𝒐𝒖𝒓𝒔 = 21130 960 = 22.01 or 22tk/DLH * Manufacturing overhead rate = = 𝑻𝒐𝒕𝒂𝒍 𝒎𝒂𝒏𝒖𝒇𝒂𝒄𝒕𝒖𝒓𝒊𝒏𝒈 𝒐𝒗𝒆𝒓𝒉𝒆𝒂𝒅 𝑻𝒐𝒕𝒂𝒍 𝒅𝒊𝒓𝒆𝒄𝒕 𝒍𝒂𝒃𝒐𝒓 𝒉𝒐𝒖𝒓 ?? 21130 605 cost/hour 50 total = 34.9tk/DLH =35tk/DLH * Indirect cost allocated= 22 tk/DLH* 5DLH * Budgeted MOH per unit = 𝑇𝑜𝑡𝑎𝑙 𝑏𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑀𝑂𝐻 𝑇𝑜𝑡𝑎𝑙 𝑈𝑛𝑖𝑡 21130𝑡𝑘 = 121/𝟏𝟗𝟐? =174.62tk/unit =175tk/unit ???????? * Total manufacturing cost per unit: Input unit cost / input unit Total Direct material: Wood: 1.5 septet 800tk 1200tk Pin: 0.250 kg 120tk 30tk Burnish: 0.167 liter 900tk 150tk Direct labor hour: 5 DLHs 50tk 250tk 110 MOH 175tk? Total Manufacturing cost per unit 1740tk Analyze each cost: Cost objects Cost Type Wood Direct and Variable cost Pin Direct and Variable cost Burnish Direct and Variable cost Labor Direct and Fixed cost Gum Indirect and Variable cost Electricity Indirect and Fixed cost Rent Indirect and Fixed cost Repair cost Indirect and Fixed cost Appropriate allocation base and determine the unit product cost: Unit product cost : Direct Material per unit 1380 Direct Labor per unit 250 MOH per unit 175 Unit product cost 1805tk Direct material: Material Input/unit cost/unit Wood: 1.5 septet per chair 1200tk Pin: 250 gm 30tk Burnish: 0.167 liter 150tk Total direct material cost 1380tk Direct labor: Product Chair DLHs/unit 5 hour cost/hour 50 250tk 48000tk Salary Manufacturing overhead (MOH): total total Variable MOH: Gum (30𝑡𝑘 × 121/𝟏𝟗𝟐 /𝑢𝑛𝑖𝑡) Fixed MOH: 3630/5760tk Electricity 1500tk Rent 15000tk Repair cost 1000tk Total MOH 21130tk / Determine the prime cost, conversion cost and full cost: Prime cost: Direct M + DL 166980(121/192*1380) +48000 =198980 Conversion Cost: Direct Labor + MOH 48000+21130 ???=53130 Full cost: Fixed cost +Fixed cost???? Fixed cost = 166980 +48000 + 3630/5760tk Fixed cost = 1500 +15000 +1000 =17500 Full Cost = 202610 + 17500 =377610 Selecting different cost driver: = 202610 cost Activity Cost pool Driver Estimated Overhead Total cost driver cost per unit NO. of unit GUM produced 3630/5760 121 30 1500 121 12.4 15000 121 124 1000 32000 0.03 no.of unit Electricity produced no. of unit Rent produced total direct labour Repair cost cost Moh Unit product Cost under ABC costing direct material per unit 1380 Direct Labor per unit 250 MOH per 166.43 166.43 unit Unit product cost 1796.43 The cost driver of gum is No. of unit produced because by dividing no. of unit produced we know the quantity of using gum. The reason for choosing cost driver of Electricity and rent is also the same. The reason choosing for choosing cost driver of repair cost is Direct labor hour because in repair cost direct labor is used. Product-line profitability: Simple costing system Revenue Cost of goods sold 253000 ( 198515tk) Packing cost (2000) Operating income 52485 Operating income / revenue 20.7% ABC costing system Revenue Cost of goods sold Packing cost 253000 ( 198515tk) (2000) Ordering (1000) Operating income 51485 Operating income / revenue 20.3% Pricing strategy and determine the price of our product: In our company we will use cost based pricing for our product. We are producing a common product but there can be difference in the materials used in production. We are using quite standard materials like wood where in many company producing chair by plywood or other nondurable material. In the wood there also lot of quality and segmentation. There is low quality wood as well as high quality wood. So normally we are using high quality wood. Apart from that we can use any kind of wood according to order. We are using stainless pins to attach up the parts of chair. Lot of company use normal pins for the chair. Those pins get damage in few days when those come in touch of air and water. We have also skillful workers to make the chairs. There are lot of price difference due to attractive design and quality of work. If there is difference in the worker or labor there must be difference in the product as well as in price. Because of all the conditions we will make quality products and calculate all the cost incurred due to make one unit product. After having per unit product cost we will add up a rational and competitive amount of profit aimed by our company. We want to run our company in a long run so in our pricing system we tried to maintain long run sustainability. If we do not charge a very high price we will be able to grab more and more customer. If we can generate more customers our business will grow day by day. For that reason we will price our product at a rational profit margin. For now we are concerning Hatil and Akhtar furniture our competitor. Though they are really big company compared to us. But we think we have the quality product like they have. So as a beginner or growing company we kept our price or profit margin pretty low compared to Hatil and Akhtar Furniture. That will help us to have good demand in market. Revenue Budget: Product Unit selling price/unit Chair 110 2300tk total 253000tk Production budget: Total unit Budgeted unit sales 110 Add: target ending finished goods inventory (10% of sales unit) 11 Unit to be produced 121 Direct material usages Budget: Physical unit budget Wood Pin Burnish Direct material to be used: Wood (1.5×121) Pin (0.25 × 121) Burnish (0.167 × 121) 181.5 30.25 20.21 Total Total quantity of direct material to Be used in production 181.5 30.25 20.21 Cost budget Direct material to be used: Wood (181.5 × 800) 145200 Pin (30.25 × 120) 3630 Burnish (20.21 × 900) 18189 Total cost of direct material to be Used in production 167019 Direct material purchase Budget: Physical unit budget Wood Pin Burnish Production requirement of direct material 181.5 30.25 20.21 Add: Target ending direct material Inventory (15% of total material used in production) Purchased Cost budget 27.225 208.725 4.5375 34.7875 3.0315 23.2415 Total Direct material to be purchased: Wood (208.725 × 800𝑡𝑘) 166980 Pin (34.7875 × 120𝑡𝑘) 4175 Burnish (23.2415 × 900𝑡𝑘) 20917 Total cost of direct material to be purchased 192072 Direct labor cost Budget: Unit Chair 121 DLHs/Unit 5 Total DLHs Hourly rate 605 Manufacturing Overhead Budget: 50 total Variable MOH: Gum (30𝑡𝑘 × 121𝑢𝑛𝑖𝑡) 3630tk Fixed MOH: Electricity 1500tk Total 30250 Rent 15000tk Repair cost 1000tk Total fixed cost 17500 Total MOH 21130tk Manufacturing overhead rate = = 𝑻𝒐𝒕𝒂𝒍 𝒎𝒂𝒏𝒖𝒇𝒂𝒄𝒕𝒖𝒓𝒊𝒏𝒈 𝒐𝒗𝒆𝒓𝒉𝒆𝒂𝒅 𝑻𝒐𝒕𝒂𝒍 𝒅𝒊𝒓𝒆𝒄𝒕 𝒍𝒂𝒃𝒐𝒓 𝒉𝒐𝒖𝒓 21130 605 = 34.9tk/DLH =35tk Budgeted MOH per unit = = 𝑇𝑜𝑡𝑎𝑙 𝑏𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑀𝑂𝐻 𝑇𝑜𝑡𝑎𝑙 𝑈𝑛𝑖𝑡 21130𝑡𝑘 121 =174.62tk/unit =175tk/unit Total manufacturing cost per unit: Input unit Direct material: cost / input unit Total Wood: 1.5 septet Pin: 0.250 gm Burnish: 0.167 liter 900tk 50tk 5 DLHs 50tk 250tk Direct labor hour: 800tk 1200tk 120tk 30tk MOH 175tk Total Manufacturing cost per unit 1805tk Ending inventory Budget: Total Direct material: Wood (22.225 × 800𝑡𝑘) 17780 Pin (4.5375 × 120𝑡𝑘) 545 Burnish (3.0315 × 900𝑡𝑘) 2728 Total ending inventory cost 21053tk Cost of goods sold Budget: Total Beginning finished goods inventory Add: Cost of goods manufactured: Direct material 167019tk Direct labor 30250tk MOH 21100tk Total cost of goods manufactured 218369tk Goods available for sale 218369tk Less: ending finished goods inventory (11 × 1805𝑡𝑘) (19855tk) Cost of goods sold 198515tk Budgeted Income statement: Traditional format: 𝒕𝒌 Revenue Less: COGS 𝒕𝒌 253000 (198515) 54485tk Gross profit 54485 Less: operating expense Variable manufacturing cost Fixed manufacturing cost 3300 17500 Total operating expense (20800) Net operating income 33685tk Contribution format: 𝒕𝒌 Sales (110× 2300) 253000 Less: Variable cost Gum (30𝑡𝑘 × 110𝑢𝑛𝑖𝑡) (3300) Contribution margin 249700 Less: Fixed cost Rent 15000 Electricity 1500 Repair cost 1000 Total 17500 Operating income 232200 Breakeven point: Unit contribution margin = selling price per unit- variable cost per unit =2300-30 =2270 Total Contribution margin (CM) = unit CM × quantity sold = 2270× 110 = 249700 𝑻𝒐𝒕𝒂𝒍 𝑪𝑴 Contribution margin revenue (CMR) = 𝑻𝒐𝒕𝒂𝒍 𝒔𝒂𝒍𝒆𝒔 𝟐𝟒𝟗𝟕𝟎𝟎 = 𝟐𝟓𝟑𝟎𝟎𝟎 =0.98 Breakeven unit: Q= = 𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡+𝑂𝐼 𝑈𝑛𝑖𝑡 𝐶𝑀 𝟏𝟕𝟓𝟎𝟎+𝟑𝟑𝟔𝟖𝟓 𝟐𝟐𝟕𝟎 =22.54 Breakeven point= 22.54 × 2300tk = 51842tk Breakeven revenue: Sales = 𝑂𝐼+𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡 𝐶𝑀𝑅 17500+33685 = 0.98 = 52230 Margin of safety (MOS) = total sales- breakeven point = 253000-51842 = 201158tk Margin of safety (%) = = 𝑀𝑂𝑆 𝑇𝑜𝑡𝑎𝑙 𝑠𝑎𝑙𝑒𝑠 201158 253000 × 100 = 79% The risk is low because the MOS is 79%. Sensitivity analysis: Here is the sensitivity analysis of our company. There are some changes in direct material cost and units sold. The scenarios having different changes and what impact bring on operating income. The scenarios are having both increase and decrease in operating profit. What if Scenario Master Budget Units Sold 110 Selling Price Direct Material Cost 2300 151800 Scenario 1 110 2300 174570 Scenario 2 104 2300 143520 Scenario 3 121 2300 166980 Budgeted Operating Income Change in % 33685 81.4 % 6280 Decrease 30% 23530 Decrease 16.06% 39095 Increase Scenario 3 is 10% increase in units sold. This scenario brings 16.06% increase in operating profit. So this scenario is beneficial for the company. Other scenarios having decrease in operating profit so those are not beneficial for company.