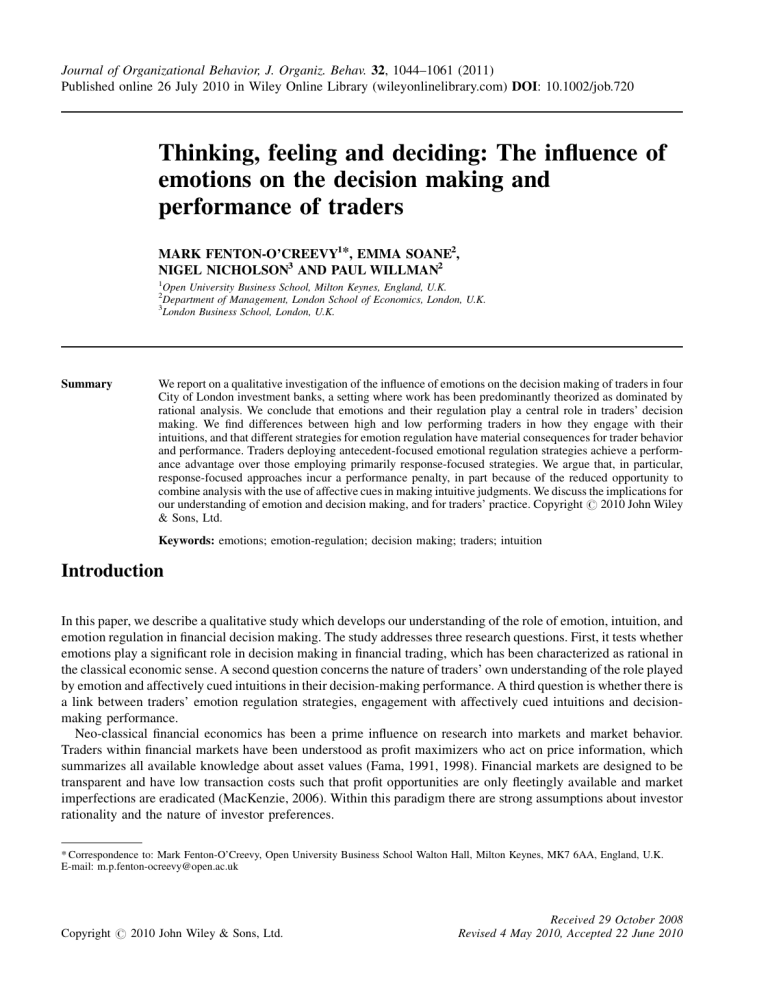

J Organ Behavior - 2011 - Fenton‐O'Creevy - Thinking feeling and deciding The influence of emotions on the decision

advertisement