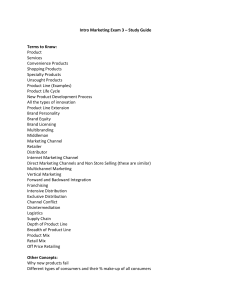

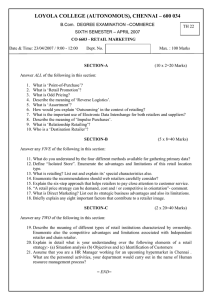

Retail Marketing Management: Principles & Practice

advertisement