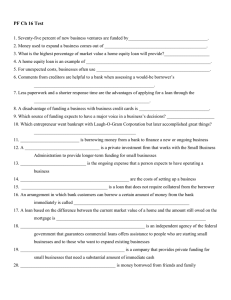

Bank Credit Management TUTORIAL 10 1. Explain the three major steps involved in the process of structuring credit facilities. I. ● ● ● ● ● ● Understand the borrower’s needs What is the basis (need) for the loan. For example: Increase in raw materials costs. Amount. Understand how much does the borrower needs to borrow and whether the amount is reasonable. Tenure (Principle of Tenure Matching). Understand how long does the borrower have to borrow and the tenure should match to the cash flow. Types of credit facilities required. For example, for import raw materials, is better to require trade facility instead of overdraft. Any collateral offered (Principle of Asset Protection). Any other info related to the customer requirements. II. Match borrower’s needs with existing/repackaged credit products /facilities ● ● Credit officers must be well versed about the bank’s product and services. Give borrower the credit facility which it needs and not “something else” that cannot meet its needs. In other word, design the appropriate loan such as determination of the types of loan, duration of loan and amount of interest in light of risks associated with the loan. Repackaged credit products that can meet needs if necessary (consider rescheduling the loan to within borrower’s repayment capacity) If borrower’s needs cannot be met, provide feedback to higher management for product development. (self initiative) III. Negotiation of terms /conditions /collateral ● Credit officers must also be good negotiators to ensure that the financial institutions’ interest is taken care of. Prepare preliminary term sheet for discussion with applicant on terms which are “negotiable” and those which are “non-negotiable.” 2. Why is proper and appropriate structuring of facilities for the borrower important from a lender’s perspective? What are the objectives a lender is hoping to achieve? From a lender’s perspective, loans that are properly structured will have lower probability of defaults by the borrowers. ● ● ● Ensure types of credit facilities remain relevant. Borrowers’ needs are unique and change with changing environment, namely industry and economic conditions. Due to lending risks, a properly structured credit facility will provide sufficient control. Many loans failed because the Principle of Control was either not introduced or if introduced, not followed. Maximise risk-return business relationship – high risk high return namely higher interest spread. 3. Identify and discuss at what stage(s) of a business concern is/are funding required. Initial stage for the purchase of raw materials Raw materials are materials that used in the primary production or manufacturing of goods. When initially purchased raw material for use, it has recorded the purchase in the accounting records at cost. This entry consists of a debit to raw materials and a credit to account payable. Work-in-progress stage where value added activities are carried out A work-in-progress (WIP) is the cost of unfinished goods in the manufacturing process including labor, raw materials and overhead cost. WIP are considered to be a current asset on the balance sheet. Generally, this stage is processing the materials that are still in unaltered form, prior to being placed into production. Sale of finished goods stage The selling component of this expense line is related to the direct and indirect costs of generating revenue. Direct expenses including the exact point-of-sale for a product or service. For example, sales commission, transaction costs, and direct labor. Meanwhile, indirect costs are incurred either before or after the sale made. For example, salaries, utilities and marketing costs. 4. Identify and discuss the three common business cycles used in the analysis of working capital requirements. Analysis of working capital requirements requires evaluation of 3 common business cycles ● Business operating cycle – time taken from purchase of raw materials until receipt of cash ● Capital investment cycle - purchase of productive assets e.g. machinery, equipment to produce goods for sale and recovery of such costs spread over a “series of operating cycles.” ● Cash cycle – time period when cash is paid out to the time it is received Business operating cycle · outlines a typical business work flow process · initial operation stage · final stage for goods sold or provision of services · until collection of receivables Capital Investment Cycle To understand the capital investment cycle, need to consider 3 aspects: ● The specific fixed assets required by borrower for its operations ● Estimated costs of the machines – bank needs to know the cost of a new machine, whether a second hand market exists for the machine and what is its resale value ● Estimated economic life span of the fixed assets – bank can structure the loan tenure and assess reasonableness of depreciation policy (loan tenure shorter or equal to lifespan) Cash Cycle ● Define as the cash that begins with payment for raw materials and ends with receipt of cash on goods sold. ● Shorter the number of days in this cycle, means more amount of available cash (less time capital is tied up in the process), and lessen the need to borrow, hence less interest payable. Cash cycle increase, financing amount and tenure increase, interest increase ● Also known as the cash conversion cycle or cash flow cycle ● Looks at the amount of time needed to sell inventory, to collect receivables and length of time the company has to pay its bill