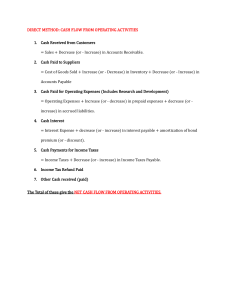

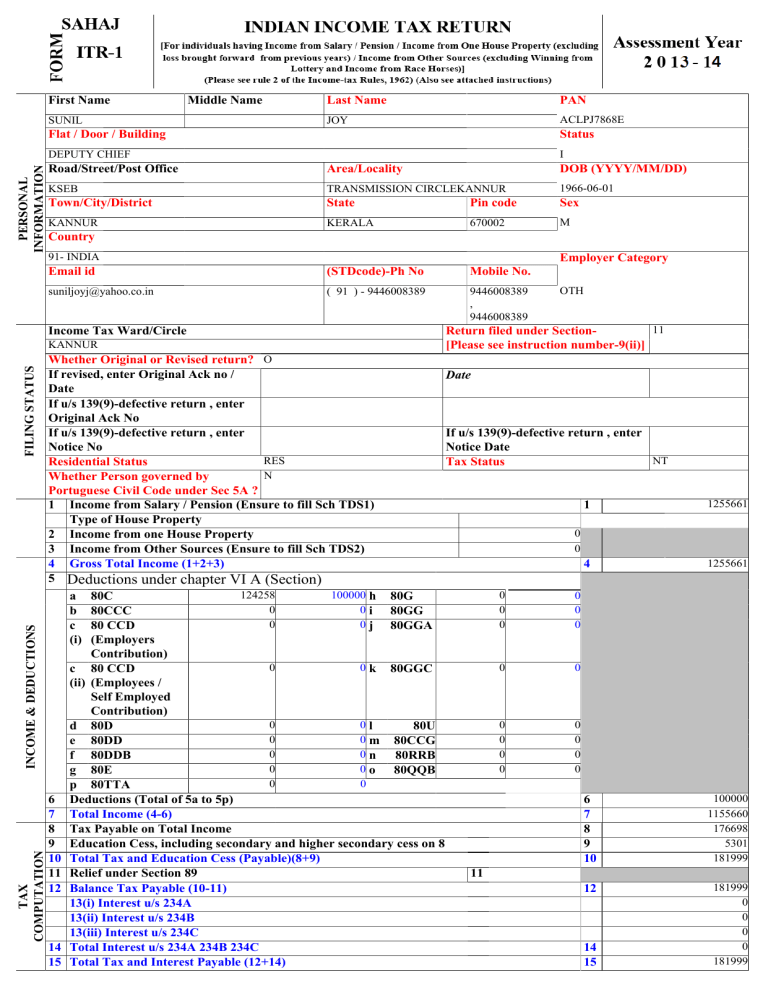

First Name SUNIL Middle Name Last Name PAN JOY ACLPJ7868E Flat / Door / Building Status I PERSONAL INFORMATION DEPUTY CHIEF Road/Street/Post Office Area/Locality DOB (YYYY/MM/DD) KSEB TRANSMISSION CIRCLEKANNUR 1966-06-01 Town/City/District State Pin code Sex KANNUR KERALA 670002 M Email id (STDcode)-Ph No Mobile No. suniljoyj@yahoo.co.in ( 91 ) - 9446008389 9446008389 , 9446008389 Country 91- INDIA Income Tax Ward/Circle TAX COMPUTATION INCOME & DEDUCTIONS FILING STATUS KANNUR Employer Category OTH 11 Return filed under Section[Please see instruction number-9(ii)] Whether Original or Revised return? O If revised, enter Original Ack no / Date Date If u/s 139(9)-defective return , enter Original Ack No If u/s 139(9)-defective return , enter If u/s 139(9)-defective return , enter Notice No Notice Date RES NT Residential Status Tax Status N Whether Person governed by Portuguese Civil Code under Sec 5A ? 1 Income from Salary / Pension (Ensure to fill Sch TDS1) 1 Type of House Property 0 2 Income from one House Property 0 3 Income from Other Sources (Ensure to fill Sch TDS2) 4 Gross Total Income (1+2+3) 4 5 Deductions under chapter VI A (Section) 124258 100000 h 80G 0 0 a 80C 0 0 0 0 b 80CCC i 80GG 0 0 j 80GGA 0 0 c 80 CCD (i) (Employers Contribution) 0 0 k 80GGC 0 0 c 80 CCD (ii) (Employees / Self Employed Contribution) 0 0l 0 0 d 80D 80U 0 0 m 80CCG 0 0 e 80DD 0 0n 0 0 f 80DDB 80RRB 0 0o 0 0 g 80E 80QQB 0 0 p 80TTA 6 Deductions (Total of 5a to 5p) 6 7 Total Income (4-6) 7 8 Tax Payable on Total Income 8 9 Education Cess, including secondary and higher secondary cess on 8 9 10 Total Tax and Education Cess (Payable)(8+9) 10 11 Relief under Section 89 11 12 Balance Tax Payable (10-11) 12 13(i) Interest u/s 234A 13(ii) Interest u/s 234B 13(iii) Interest u/s 234C 14 Total Interest u/s 234A 234B 234C 14 15 Total Tax and Interest Payable (12+14) 15 1255661 1255661 100000 1155660 176698 5301 181999 181999 0 0 0 0 181999 TAXES PAID REFUND 16 Taxes Paid a Advance Tax (from item 25) 16a 181999 b TDS (Total from item 23 + item 24) 16b c Self Assessment Tax (item 25) 16c Total Taxes Paid(16a + 16b + 16c) 17 17 18 Tax Payable (15-17) (if 15 is greater than 17) 18 19 Refund (17-15) if 17 is greater than 15 19 67072563983 20 Enter your Bank Account Number 21 Select Yes if you want your refund by direct deposit into bank account, select No if you want refund by cheque N 22 In case of direct deposit to your bank account give additional details SAV IFSC Code Type of Account SBTR0000324 23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] SI.NO Tax Deduction Name of the Employer Income chargeable Account Number under the (TAN) of the head Salaries Employer CHND00365B KERALA STATE ELECTRICITY BOARD 1255661 1 26 Exempt income for reporting purposes only 181999 0 Total Tax Deducted 181999 VERIFICATION xyz I, SUNIL JOY son/daughter of P M JOSEPH solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income- tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2013-14. Place KANNUR Date 2013-07-28 PAN ACLPJ7868E 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No. of TRP Name of TRP 28 If TRP is entitled for any reimbursement from the Government, amount thereof Counter Signature of TRP