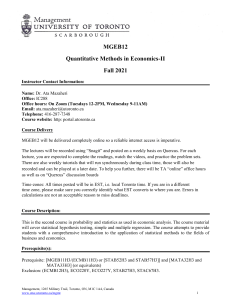

MGFC30 Introduction to Derivative Markets Winter 2024 Instructor Contact Information: Name: Dr. Ata Mazaheri Office: IC288 Office hours: Wednesdays 2-3PM, Thursday 10-11AM Email: ata.mazaheri@utoronto.ca Telephone: 416-287-7348 Course website: http: portal.utoronto.ca Course Delivery In person Course Description: Since 1970s there has been considerable growth in markets for derivative instruments – futures, swaps, and options. This growth has only accelerated in the post 1990s with the advent of the new risk management tools. Using these instruments, individuals and institutions can achieve different objectives; they can hedge against a particular type of risk, or they can alter the distribution of the returns on their portfolios in certain ways. There is enormous line of literature – mostly current - on futures, swaps, and options. While at first glance the theory appears advanced and difficult, in reality it is quite logical and increasingly accessible. This course intends to introduce you to the theory and application of the derivatives market. It attempts to provide you the required skills to value and to employ futures, swaps, and options. The course studies the derivatives markets in two main parts. The first part examines the structure of futures and forward markets as well as issues related to the pricing of such contracts and their hedging, it will end with a short introduction to swaps. In the second part, options markets, strategies, pricing and position analysis are studied. Course Objectives When you finish this course, you will learn: • How to use the futures to hedge risk. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 1 • • • • • How to price futures contracts. How to price and use “plain vanilla” interest swap contracts. How to trade options and how to construct option strategies. How to use binomial tree and Black-Scholes model to price options. How to trade and price exotic options. A combination of lecture, problem sets, and assignments is used to illustrate the various topics of study. You will be required to study the presented material thoroughly. Prerequisite(s): MGFB09H3 (Principles of Finance) or MGTC02Y (Introductory and Intermediate Finance), plus MGEB11H (Quantitative Methods in Economics I) or MGEB09Y (Quantitative Methods in Economics). The co-requisite is MGTC09H3 (Intermediate Finance). Those who have taken RSM435H or the previous MGT438 (Futures and Options Markets) on St. George Campus are not allowed to take this course. Textbook/Required Course Materials: Fundamentals of Futures and Options Markets, 9th Edition, by John Hull (Pearson, 2017). Lecture Notes and Other Announcements: • Lecture notes are posted on the portal several days ahead of the lecture. It is important to read them before attending each lecture. It is necessary to try the assigned problems after each lecture before attending the next lecture. • Supplemental sample problems will be posted on the website. Some of those questions will be taken during the tutorials. Practice the questions before attending the scheduled tutorial sessions. • Obviously, we cannot cover every part of the course during lectures. I expect you to have studied and learned the assigned parts in the textbook. Evaluation and Grading: Component Weight/Value Due Date Test-1 20% TBA Test-2 20% TBA 1 Group Assignments 10% April 5 Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 2 Final 50% TBA Coverage • • • • Test-1: Week-1 to the end of Week-5 lecture. (Please refer to the detailed Schedule) Test-2: Week-6 to Week-9. (Please refer to the detailed Schedule) Final Exam: Inclusive of all the material learned in the lecture. The Assignment is done within groups 5 or 6. Aids Allowed for Term Tests and Final Exam • The term tests as well as the final are closed book assessments. • You are allowed one side of a one standard paper help sheet (hand-written) and the use of a nonprogrammable calculator. Policy on Missed Assignments/Examinations: There will be no makeup test. If you miss a term test for any reason, the final exam will be re-adjusted for the total of 70%. No documentation is required. If you miss both term tests, the second miss will be automatically zero. Policy on Re-Grading _______________________________________________________________________________ If, after looking over your term tests, and reviewing you answers and comparing it with the posted solutions, you feel that there has been a material error or omission in the marking of your term test, you must observe the following procedures: 1. Create a typed note containing the following: (i) Your names, (ii) Your Student Number, (iii) Your email address, so I can communicate with you (iv) The criterion (criteria) against which you believe you have been graded incorrectly, or an explanation of why the marker has overlooked or misunderstood your answer's merits, or has re-acted too severely to your answer's short-comings. Hand-written submissions will not be considered. 2. Deliver your re-grading requests to me in class one week after the test is handed back. No re-grading requests will be considered either before or after that time. 3. Re-grading will be based only on what you submit in writing, not what you might say in person. Marks are not the subject of "discussion" or negotiation. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 3 4. Your test will be re-considered, based on your written comments and clarifications. Re-grading means that your answer(s) will be re-evaluated and a new grade may be assigned. This means that it is possible to lose marks as well as to gain marks through re-grading. Therefore, please do not submit your materials for re-grading unless you are confident that a grading error occurred. Keep in mind that the re-grade is meant for mistakes in grading. It is not a forum for arguing about the criteria used, or the points allocated to the criteria. 5. Addition Errors or minor petition: If there is an error in totaling up your mark or that you have a minor petition on a single part of the Test (say only part (a) of Q2), then you may write this on the cover of your Test paper material and hand it to me on the due date. No written petition is required. SIMULATION — RPM INVESTMENT CHALLENGE The purpose of your simulation project is to introduce realism in learning. A group of five or six students will perform the task of setting up and managing an options portfolio (students may also form a smaller group as they wish, but the minimum size should be two). Through trading derivatives on formal exchanges, students are expected to learn and appreciate the workings of the derivatives markets, and to apply their knowledge and wisdom in the investment world. The virtual investment project will be done using the Rotman Portfolio Manager (RPM) platform. [http://rpm.rotman.utoronto.ca/] The RPM is an application that allows students to manage a fantasy portfolio of stocks, options, futures, bonds, and foreign exchange. The software connects the student to North American Exchanges and provides market quotes, security filtering, advanced trading features, custom benchmarking, and attribution analysis so that students can manage and analyze their portfolios in real time. This powerful simulation gives students an opportunity to experience and explore portfolio management in a very realistic and robust setting. The investment game will start on January 29, 2024 (Monday) and end on March 29 (Friday) 2024. Each account will be endowed with $5,000,000Cdn virtual money, and participants will have access to stocks (North American as well as international), options, futures, futures options, bonds, currencies, and mutual funds. In this simulation, students are required to trade only derivatives: options, futures and options on futures. Overall Instructions and Requirements Each group will maintain a trading account with an initial endowment of $5,000,000Cdn. Students are allowed to trade derivatives only. The position limit is 50%, meaning that you cannot invest more than 50% of your capital in a single security. Day trading will be allowed. All groups will be subject to the same investment restrictions set out by RPM regarding margin requirements and transaction costs. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 4 To register your account, follow the instructions provided in a separate file posted on the Quercus. Note each group need to purchase one account. The objective of your trading strategy – obviously – is to maximize your return. For that matter you can trade (buy or sell) any derivative (options / futures) you wish using any strategy you have in mind. You can use any information, any judgment, or any gut feelings. In summary: you can do whatever wish with any derivative. The overall evaluation of the project is based on two components: First, 5% is awarded to the best performing portfolio. Having said that, I will use a little bit of my own discretion on this. For instance, if the best performing portfolio returns only a 6%, then I will be very hesitant to give 5% to this group. To earn the credit based on portfolio performance, groups must meet the following requirements: • • • Execute a minimum of 15 transactions throughout the simulation. Deploy at least 50% of the initial capital (i.e., you must invest at least half of your initial capital). Send my TA an email message of several sentences each week before class, informing me what you have done with your portfolio and why you took the action (or no-action). There will be 0.5 deduction for a missed weekly Email. Second: 5% is awarded based on a final report of 1200-1300 words. The report is due on April 8 and should be written in accordance to the guideline that will be posted on the portal. In general, it will provide a summary explaining the investment strategies, the success and the failures of the adopted strategy. It can also discuss what are the most valuable lessons you have learnt. In summary: • • The 10% mark is based on your performance as well the strategy applied and explained in your write-up. Portfolio performance will be based solely on the closing value at the end of the simulation. The history of portfolio performance does not matter. Several popular resources for stock analysis and trading strategies: • • • http://www.barchart.com http://www.marketwatch.com http://www.bnn.ca/ Good luck and Enjoy! Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 5 Statement on Equity, Diversity, and Inclusion (EDI) The University of Toronto is committed to equity, human rights and respect for diversity. All members of the learning environment in this course should strive to create an atmosphere of mutual respect where all members of our community can express themselves, engage with each other, and respect one another’s differences. U of T does not condone discrimination or harassment against any persons or communities. If you have questions or concerns on issues related to EDI, please contact the Equity, Diversity and Inclusion Office: https://www.utsc.utoronto.ca/edio/ Office Hours: Office hours for individual consultation with students who have problems or questions that cannot be discussed in the class sessions will be announced by the instructor in Quercus. Questions relating to administrative, registration, degree/program requirements should be directed to the academic advising team: Management programs/courses: mgmtss@utsc.utoronto.ca. Economics programs/courses: ecoss.utsc@utoronto.ca. UTSC Library: Management students can access library services at The BRIDGE, located in IC 108. The BRIDGE offers programs and services to support students, staff, and faculty in their studies, research projects, and experiential learning initiatives. https://www.utsc.utoronto.ca/thebridge/ Visit The BRIDGE to: • • • • • • Access the finance & data lab, including specialized software and Bloomberg terminals Participate in events and competitions Get research and data analytics help Access data and academic research tools and tutorials Get support in entrepreneurship and the New Venture Program Learn more about Work Integrated Learning To find out more about the UTSC Library’s support for students visit: https://utsc.library.utoronto.ca/ For all other inquiries, please email thebridge@utsc.utoronto.ca or email your Liaison Librarian, Mariana Jardim mariana.jardim@utoronto.ca Health & Wellness Centre: Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 6 The Health & Wellness Centre provides professional and confidential medical, nursing, counselling, health promotion, and education services to all UTSC students. These services are offered in a safe, caring, respectful, and empowering environment that is directed toward optimizing your personal, academic, and overall wellbeing.. To access these services, please use the following url: https://www.utsc.utoronto.ca/hwc/ and when visiting the Health & Wellness Centre, please bring a valid T-card and Health card. Academic Advising and Career Centre: The Academic Advising and Career Centre (AA&CC) at UTSC integrates developmental advising, learning/study skills, career counselling, and employment coaching. To reach out to them please use the following url: https://www.utsc.utoronto.ca/aacc/ Quercus – UTSC Learning Management System To access Quercus, please visit: https://q.utoronto.ca If you need help getting started? Visit the Quercus Help Page to access tip-sheets and other helpful resources. For additional questions, contact the Ed Tech team at quercus@utsc.utoronto.ca. For frequently asked questions, please visit: https://www.utsc.utoronto.ca/technology/faq-students AccessAbility Services The University provides academic accommodations for students with disabilities in accordance with the terms of the Ontario Human Rights Code. This occurs through a collaborative process that acknowledges a collective obligation to develop an accessible learning environment that both meets the needs of students and preserves the essential academic requirements of the University’s courses and programs. Students with diverse learning styles and needs are welcome in this course. If you have a disability that may require accommodations, please feel free to approach me and/or the Accessibility Services office. https://www.utsc.utoronto.ca/ability/welcome-accessability-services The Centre of Teaching and Learning The Centre for Teaching and Learning (CTL) is available to support you in your writing, math and stats, and English language needs. It offers online and in-person tutoring and consultations and has a variety of helpful resources. English Language Development Centre: The English Language Development Centre (ELDC) helps students develop the critical thinking, vocabulary and academic communication skills essential for achieving academic and professional success. Personalized support includes: RWE (for academic writing); Communication Cafés (oral); Discussion Skill-Building Cafés; Vocabulary Cafés; seminars/workshops; personal ELD consultations; drop-in sessions. https://www.utsc.utoronto.ca/ctl/english-language-development-support Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 7 The Writing Centre: The Writing Centre (TWC) offers invaluable services to students (learn to become a better writer!) and offers many different kinds of help: drop-in sessions, individual consultations, workshops, clinics, and online writing handouts. https://www.utsc.utoronto.ca/ctl/writingsupport Other Support: For more information regarding other academic support from the university, please visit CTL’s Student Resource Centre at AC313 or check out https://www.utsc.utoronto.ca/ctl/academiclearning-support. Policy on Re-Grading _______________________________________________________________________________ If, after looking over your term tests, and reviewing you answers and comparing it with the posted solutions, you feel that there has been a material error or omission in the marking of your term test, you must observe the following procedures: 1. Create a typed note containing the following: (i) Your names, (ii) Your Student Number, (iii) Your email address, so I can communicate with you (iv) The criterion (criteria) against which you believe you have been graded incorrectly, or an explanation of why the marker has overlooked or misunderstood your answer's merits, or has re-acted too severely to your answer's short-comings. Hand written submissions will not be considered. 2. Deliver your re-grading requests to me in class one week after the test is handed back. No re-grading requests will be considered either before or after that time. 3. Re-grading will be based only on what you submit in writing, not what you might say in person. Marks are not the subject of "discussion" or negotiation. 4. Your test will be re-considered, based on your written comments and clarifications. Re-grading means that your answer(s) will be re-evaluated and a new grade may be assigned. This means that it is possible to lose marks as well as to gain marks through re-grading. Therefore, please do not submit your materials for re-grading unless you are confident that a grading error occurred. Keep in mind that the re-grade is meant for mistakes in grading. It is not a forum for arguing about the criteria used, or the points allocated to the criteria. 5. Addition Errors or minor petition: If there is an error in totaling up your mark or that you have a minor petition on a single part of the Test (say only part (a) of Q2), then you may write this on the cover of your Test paper material and hand it to me on the due date. No written petition is required. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 8 Statement on Equity, Diversity, and Inclusion (EDI) The University of Toronto is committed to equity, human rights and respect for diversity. All members of the learning environment in this course should strive to create an atmosphere of mutual respect where all members of our community can express themselves, engage with each other, and respect one another’s differences. U of T does not condone discrimination or harassment against any persons or communities. If you have questions or concerns on issues related to EDI, please contact the Equity, Diversity and Inclusion Office: https://www.utsc.utoronto.ca/edio/ Statement on AI The knowing use of generative artificial intelligence tools, including ChatGPT and other AI writing and coding assistants, for the completion of, or to support the completion of, an examination, term test, assignment, or any other form of academic assessment, may be considered an academic offense in this course. Academic Misconduct Students should note that copying, plagiarizing, or other forms of academic misconduct will not be tolerated. Any student caught engaging in such activities will be subject to academic discipline ranging from a mark of zero on the assignment, test or examination to dismissal from the university as outlined in the academic handbook. Any student abetting or otherwise assisting in such misconduct will also be subject to academic penalties. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 9 Detailed Course Outline: TOPIC READINGS Assignment Week-1 Introduction Chapter 1 1.1, 1.2, 1.3, 1.4, 1.6 Week-2 Futures Market Hedging Strategies Using Futures Chapter 2 Chapter 3 Week-3 Interest Rates & Duration Chapter 4 Week-4 Determination of Forwards and Futures Prices Chapter 5 Week-5 Interest Rate Futures Chapter 6 2.16, 2.17, 2.23 3.1, 3.3, 3.5 Problem Set-1 4.1, 4.5, 4.7 Problem Set-2 5.2, 5.5, 5.6, 5.7 Problem Set-3 6.1, 6.2 Problem Set-4 Week-6 Test-1 Swaps Chapter 7 Week-7 Options Markets: Mechanisms and Properties Chapter 9 Chapter 10 Week-8 Trading Strategies Chapter 11 Week-9 Binomial Trees Chapter 12 Week-10 Test-2 The Black-Scholes-Merton Model Chapter 13 Week-11 Week-12 Options on Stock Indices, Currencies and Futures Exotic Options Final Review Chapter 15 Chapter 22 7.1, 7.3 Problem Set-5 9.1, 9.4, 9.6, 9.25 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.23, 10.25 Problem Set-6 11.2, 11.3, 11.6, 11.20 Problem Set-7 12.1, 12.3, 12.5, 12.20 Problem Set-8 13.2,13.4,13.5,13.6, 13.20,13.23, 13.24 Problem Set-9 15.1, 15.2, 15.28 22.1, 22.3 Problem Set-10 Note: Chapter references are to John C. Hull’s textbook. Management, 1265 Military Trail, Toronto, ON, M1C 1A4, Canada www.utsc.utoronto.ca/mgmt 10