Financial Planning Document: Client Meeting & Analysis

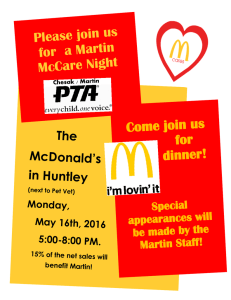

advertisement

Table of Contents Section 1: .............................................................................................................................. 2 Section 2: .............................................................................................................................. 4 Section 3: .............................................................................................................................. 7 Section 4: ............................................................................................................................ 11 Section 5: ............................................................................................................................ 13 Section 6: ............................................................................................................................ 16 Section 1: Dialogue: *Martin and Jessica enter the room* Advisor: Good morning, Martin and Jessica, it’s great to finally have a chance to sit down with the two of you. Martin & Jessica: It’s great to finally meet you as well. *They both shake hands with the advisor and take a seat at the desk* Advisor: What brings you guys in today, what are some topics you are looking to cover in today's session? Martin: My first priority is to get a RESP set up for Michael’s schooling, I would also like to look into life insurance as a precaution for my history of heart issues. I would like to retire in 10 years by the age of 65 and would like to maintain my current style of living following retirement. I want to make sure that I am on the right track here with all of my finances. Advisor: Alright, regarding Michael’s RESP and your retirement, do you have any wishes for his schooling or specific names in mind? What activities might you be taking part in following your retirement that you would need funds for? Martin: I want to make sure that Michael can have all the opportunities in the future that I didn’t have when I was young, Harvard or Yale would be one of my preferences. In regard to my retirement, I'm looking to maintain about 80% of my gross income. I wish to partake in golf as often as I can when I am retired, it is one of my passions. Advisor: Now would be a great time to start saving for Michael's schooling, the earlier the better especially if you are wanting him to attend a top-tier school. Looking at your account it looks like you got a great foundation and are definitely on track to your ideal retirement. I think we should look into some index funds in comparison to your mutual funds. These funds will help you to earn more as you are paying smaller management fees as it is not actively managed, what do you think? Martin: I think that would be a great idea, the returns look great. Advisor: Jessica, is there anything you would like to add, anything you’re looking to talk about? Jessica: Well, we also have our dog Hawley, and we want to make sure he is well looked after because of our busy work schedules. We like to balance our work lives with plenty of date nights and take 3 vacations a year and I would love to continue to take these vacations following Martin's retirement. Advisor: Well, concerning your dog Hawley we can definitely get the two of you set up with a pet insurance plan that you see fit. We can look into how much you are usually spending on your excursions and vacations each year and make an account with the appropriate funds to be drawn upon for vacations. Jessica: That sounds great, we should definitely make sure that happens! Advisor: Okay! Well, if that is all from the two of you today, I will have an email sent to you both within the next couple of days informing you of what we have put together and when we can meet again. Both of you have a wonderful day, and if you have any other questions, concerns, or something you forgot to mention please do not hesitate to give me a call or shoot me an email. Jessica: Thank you, it was a pleasure to finally meet you. Martin: Always a pleasure meeting with you, Tamara. ** Later that day you receive a call from Martin ** Advisor: Hello Martin, it's good to hear from you, is there something you needed to ask about? Martin: There is actually one more concern I would like to mention to you privately. In addition to what I would leave Jessica and Michael if I passed, I also want to leave some things to my other adult children Robert and Krystal. I would like to explore any options that will bypass my Will and ensure money is distributed to both Robert and Krystal as well. Advisor: That would not be a problem at all! It is quite common for a spouse with children from a separate marriage to have this concern. We will keep that in mind and definitely ensure the Wil can also be distributed to Robert and Krystal. Martin: That is great to know, I really appreciate it! Looking forward to our next meeting, Goodbye. Advisor: You take care Martin, let Jessica know I give her my best! Section 2: Martin: ESTJ I would categorise Martin as an extravert because he is outgoing and outspoken. I would categorise Martin in the sensing category because he pays attention to details and is a practical guy, likes the details and facts. Martin falls within the scope of thinking because he is not an emotional guy, he makes decisions based off of logic and reasonableness, making him a great CEO. I would put Martin into the judging category because he definitely is the type of guy to strictly follow rules and deadlines and is not very spontaneous. Highlight key characteristics of these identities, including the benefits and challenges you may face through this process. Martin: Assertive Outspoken Intimidating Benefit: Is financially literate Experienced investor Tech knowledge Challenge: May not be open to change Controlling Jessica: Quiet Creative Benefit: Easy going Hard worker Tech knowledge Challenge: Financially illiterate Does not want to take on much risk or anything complex Address the challenges and opportunities when working with each of the MBTI Identities. o Martin is very assertive and has a few years of investing experience and overall knowledge, he may be very close-minded on new ideas or not open to hearing other opinions. o An opportunity is that with his advanced knowledge you can talk about more complex strategies with him and find a great investment plan suitable to his wants and needs. o Jessica does not know much about finances nor is she interested in devoting time to it, she has her simple TFSA and RRSP with money automatically being deposited in them every month. This can be frustrating as it may not be the best plan to achieve their goals. o Jessica may not be open to new ideas as she may feel “comfortable” where she is, or by lacking the understanding she may fear of more complex plans Create a timeline and use it to confirm your understanding of the series of events. Highlight milestones (past and present) to assist you in the planning process. Katherine and Martin meet (33 years ago) Robert was born (25 years ago) Krystal was born (23 years ago) Katherine and Martin divorce (5 years ago) Jessica and Martin meeting (5 years ago) Michael’s birth (3 years ago) Michael attending Montessori (Current) Martin retirement (10 years) Michael's education post-secondary (15 years) Genogram Section 3: Part 2: 1. Investment Planning a. What is the risk profile of the principals involved? Martin RRSP - allocated in Emerging Markets funds. These are typically considered medium-high risk. Jessica RRSP - allocated in Balanced funds. These are typically considered low-medium risk funds. Martin TFSA - allocated in Emerging Markets funds. These are typically considered mediumhigh risk. Jessica TFSA - allocated in Money Market funds. These are typically considered low risk. 2. Retirement Planning a. Identify any Retirement planning issues that are currently in force or may arise in the future. Although Jessica may not think about retirement for another 20 years, Martin’s goal of 65 is quickly approaching. The clients will need to understand and accept the fact that they cannot keep living the current lifestyle for the rest of their lives unless they do not stop working. If they would like to retire on time, they should either allocate a lot more money to their savings starting immediately, or they will have to accept the fact that they will be living a lot more poorly when retirement comes around. The clients’ high spending is a concern: Car payments. Martin and Jessica own three vehicles totalling $61,602 in car payments a year. High amounts of spending towards Entertainment & Dining out, Clothing, personal care. $20,000 in spending annually on gifts. Retirement Accounts: They have very small retirement savings even at a later age. Although Jessica may not think about retirement for another 15 to 25 years, Martin has ten years left to make sure his retirement fund is enough to satisfy his desired lifestyle. b. Can the principals meet their retirement goals with their current structure? Use TVM to provide your response. Show your calculations as support. Credit card Debt 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛 𝐹𝑉 = 122500 (1 + 19.99 1 ) 12 𝐹𝑉 =124540.65 𝐼 = 124540.65 − 122500 𝐼 = 2040.65 On mortgage 𝐼 = 2645.17 Interest gained on RRSP & TFSA 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛 14 1 𝐹𝑉 = 191364 (1 + ) 12 𝐹𝑉 = 2232.58 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛 8 𝐹𝑉 = 25453(1 + ) 12 𝐹𝑉 = 169.68 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛 10 1 𝐹𝑉 = 34020 (1 + ) 12 𝐹𝑉 = 283.5 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛 2 1 𝐹𝑉 = 9067 (1 + ) 12 𝐹𝑉 = 15.11 𝐼 = (2040.65 + 2645.17) − (2232.58 + 169.68 + 283.5 + 15.11) = $-1984.95 They are losing $1984.95 in interest monthly compared to their debts vs investments. 3. Tax Planning a. Identify any potential tax issues that are currently in place or may arise in the future Martin and Jessica as a combined household are in an extremely high tax bracket right now. The priority should therefore be to focus on investing into the RRSP as much as possible within the working years, spread throughout to lower the bracket as much as possible. Since the TFSA is after tax dollars, RRSP should be first priority, TFSA second. In addition, if the clients want to save more for retirement than their RRSP and TFSA contribution room allow them to, then the clients can consider using a non-registered account. With this account, they may want to look into deferred growth options like unrealized capital gains. Upon redemption throughout retirement, they can realise the gains once they are in a lower bracket. With their very high bracket right now, the clients would not want to also be forced to report excess interest or dividend income; that would simply not be tax efficient when they had the option to just focus on deferred growth. 4. Risk Planning a. Identify any Risk Management issues that are currently in place or may arise in the future. They have a lot of their money invested into depreciating assets (cars). Martin’s RRSP and TFSA are both invested in fairly high risk (typically emerging markets funds are considered medium-high risk) investment classes. As Martin is approaching a later age, he may want to consider lowering his risk a bit. If by the time he converts his account to a RRIF and payment dates are at times when his investments are down, that can lead to less wealth. If Martin is set on staying in higher risk, he could look into global equity, or Canadian equity. Staying in developed markets rather than emerging markets may be more stable, and still in equities. 5. Estate Planning a. Identify any Estate Planning issues that are currently in place or may arise in the future. Martin should be prepared from possible disputes against his estate plan. As his adult children and ex are not a fan of his current spouse and child, they may make demands that may perhaps go against Martin’s will. In addition, Jessica may also make demands that are against Martin’s will. Martin should first decide on an estate executor and POA imminently. The same goes with Jessica. Without this, if one of the two were to suddenly die or become incapable of managing their own finances, malice or dispute may occur when dealing with their finances. There is no mention of a beneficiary in any of their TFSAs, RRSPs, and Bank Accounts. Part 3: Delivering Bad News a. Identify any Estate Planning issues that are currently in place or may arise in the future. Dialogue: SPIKES: Setting up, Perception, Invitation, Knowledge, Emotion/empathy, Strategy/summary Martin & Jessica: Good morning it’s great to see you again! Advisor: Martin, Jessica, it’s great to see the two of you as well. *Shakes hands and takes a seat in the office* Advisor: So, tell me, how have the two of you been doing since we last spoke, anything you are concerned about, or any questions you had for me? Martin: Nothing new for me to add, Jessica? Jessica: Still the same old things! Advisor: Okay Great! I just wanted to ask the two of you some questions before we get into things. How do you guys feel about your current financial situation? How do you feel about your current retirement goal? Martin: Well, we have both been making monthly deposits to our TFSA, although I have been noticing that our credit card bills are getting quite high recently. I think sometimes Jessica and I spend a bit too much and don’t notice it until we get our bill. Advisor: How have you managed the situation? Martin: We have not done anything about it as of now. We purchase the things we want and need and worry about paying off the credit cards later. We were actually going to seek some advice from you on how we could better handle some of our spending problems. Jessica: In addition, do you have any thoughts on our current retirement situation? Advisor: Your retirement plans definitely have to be looked over again, there are many issues with the spending of the lifestyle the two of you enjoy in comparison to how much money you have saved and will be earning during retirement. Perhaps looking into selling one of your SUVs to possibly free up some spending and saving room or finding another expense that perhaps you are willing to cut down on or drop. Jessica: Would selling the car be necessary? We value the luxury of having many highend vehicles in our possession. Advisor: The assets or lifestyle you value is completely up to you. Selling a vehicle is no more than just one idea of many that can help your retirement situation. You could always cut down on something like your vacations but that would be a decision for the two of you to make. Overall, it’s best to watch your spending. The more you are able to manage your budgeting, the less you will need to worry about affording retirement. Martin: Okay I understand what you are suggesting, and we will definitely talk over that together and come to a decision. Advisor: That sounds good I will leave that up to you, it is not much of a rush so don’t stress yourselves over it. Now if I could just grab your attention for a while, I wanted to cover the plan that we have developed for the two of you since we last spoke, Jessica: Yes, that would be great. Martin: I agree I am quite eager to see what other recommendations you have for us and how you have developed our financial plan. Advisor: Perfect! Then let’s take a look at what we have got. Section 4: 1. Investment Planning: ● Martin and Jessica have a total of $122,500 in credit card debt, which gains an interest of $2,040.65 a month. ● Martin has a TFSA invested in emerging market funds which is valued at $34,020 and gains 10% annually. So, a value of $283.5 will be earned for the next month. ● Jessica has a TFSA invested in money markets with a value at $9,067 and gains 2% annually. With a gain of $15.11 for the next month. ● Martin has a RRSP valued at $191,364 which earns him 14% annually. So next month he will gain $2,232.58 in his RRSP. ● Jessica’s RRSP is valued at $25,453 which earns her 8% annually. The next month she will gain $169.68 towards her RRSP. With a debt-to-income ratio for investments being $2,040.65/$2,700.87= 0.7555 or 75.55%. With that number they have a limited capability to save in case of emergency but at least they can earn more than their debts accrued. The goal is to increase interest earned on investments while paying off credit card debt. 2. Retirement Planning: Key Issues: They pay a lot annually towards Vehicle Financing for a family of only 2 drivers and own 3 vehicles. The First Car is a Porsche which costs Martin $1,933 Monthly. The Second Vehicle is the Lexus SUV which is $1,491 monthly covered by Martin and Jessica Jointly. The Third Vehicle is an Audi SUV costing $1,709 Monthly as well jointly covered by Martin and Jessica. This also raises their Monthly gas Expense to $700 Monthly, insurance to $450 a month and $257 a month in repair and maintenance. Which is a total of $1,407 a month on upkeep towards vehicles. Another key issue to address is their personal spending towards entertainment/dining out, clothing, and personal care is $2800 monthly between the family as a whole. They tend to spend $20,000/year on Gifts which is $1,667 Monthly. Due to age differences, it factors into Martin retiring earlier than Jessica which is in 10 years. Assuming Jessica is planning on retiring in 15 years. Martin’s family has a history of heart issues. Purchasing long term care insurance would be wise for Martin to reduce stress on his family and to make his life comfortable in the future. 3. Tax Planning: Key issues: Some issues Martin and Jessica have is not contributing enough towards their RRSP, which is at 5% currently. Michael’s RESP hasn't been created although he is 3 years old it would be wise to. Investing 2500$ a year into the RESP would provide them with the $500 CESG benefit up to a maximum of $7,200 in CESG. With long term care insurance being tax deductible Martin would find it beneficial to invest in LTCI. 4. Risk Management: Key issues: Martin should do some reconsidering in his investments as he has some high-risk holdings at the moment in his RRSP’s and his TFSA which could play a risky decline in his future asst wealth. He seems to be investing in more risky markets rather than Canadian trusted and funded ones which can still count as equity for him. Martin has a debt total of $75,000 and Jessica has $37,500 in debt owed to Financial Institutions. This is a very high debt ratio considering their luxurious lifestyle and expenses. The debts should be worked on being paid off slowly but surely as they have very high interest rates. 5. Estate Planning: Key issues: Since Jessica is Martin's most recent wife and they only have one kid together which is Matthew there seems to be a tension with the ex and his two older children. Martin is worried if he was to have a sudden death this would affect Jessica and Michael financially and mentally and he wants to make sure everything is set in place to help with this for future purposes. There is a high chance Martin could suddenly pass due to the high stress environment as his work is and due to family history of heart problems. These are the key issues Martin must resolve in his estate in order to fairly have it divided between all his children and spouse. Section 5: Investment Planning: I. II. III. IV. Martin makes an income of $250,000 so his RRSP contribution limit for 2021 would have been 27,830$. Jessica’s income is $100,000 so 100,000*0.18= $18,000 RRSP contribution limit for 2021. Open a RESP with Martin and Jessica as the subscriber and Michael as the beneficiary. Martin and Jessica will invest $2,500 into Michael’s RESP to receive the 500$ CESG. In terms of investment, we recommend SPY (S&P 500) NYSE ETF. The average return of the past 5Y for SPY is 12.41% so we can expect an annual return of 10%. Over the next 5 years we can expect a RESP balance of $23,146.83 Tax free. Martin and Jessica should increase their RRSP contribution to 8% of net income for the next 5 years. Martin going from $7,979 to $12,766.40 contributed annually, Jessica going from $3,542 to $5,667.20 contributed annually. With the increased amount on RRSP contribution, $6,912.6 extra will be tax deferred. Retirement Planning: Martin should sell the Audi SUV since Martin loves the Porsche car he has. Which would only make sense to keep one SUV only which sounds more reasonable because the Audi costs $1,709 monthly which is $20,505 yearly that could be put to the Retirement savings. In terms of the Monthly spendings on entertainment, clothing, and personal care. The Jacobs family should reconsider their spending on personal items and leisure in order to plan for retirement. As well as holidays and gifts. In order to save as much money as possible these are the solutions we recommend. I. Sell Audi SUV to save $1,709 monthly in Finance Payments. II. With the Audi SUV sold, savings of $150 in insurance a month, gas for the sold SUV would save $234 a month, as well as maintenance for the Audi is $86 a month. Being a total of $470 a month. III. The Jacobs family spends $20,000 in holidays and gifts. We would recommend not going on trips for the time being and spending on gifts for themselves and family members and hopefully bringing that yearly amount down to $1,200 a year for gifts between Martin, Jessica, and Michael. As well as save on pet travel. IV. Martin’s personal care should be 50$ a month for a haircut while Jessica’s should be 100$ a month which brings their amount from $300 to $150. V. Eating from home as a solution to their entertainment and dining out spending. From $1,000 a month to 300$ a month on out of home eating. VI. Martin spends $500 on clothing, while Jessica spends $1,000 on clothes a month. Bringing their spending habits down to around 500$ a month, $200 for Martin and $300 for Jessica. VII. Martin is 55 so his year for long term care insurance would be the age of 55. Recommending him to purchase a long-term care insurance plan before he is unable to. With all those recommendations, should be a savings of $3,229. Tax Planning: I. II. III. Increasing their RRSP contribution to 8% of their net income allowing them to have $6,912.6 tax deferred. Creating a RESP and investing $2,500+$500 CESG for the next five years. While having the RESP invested until Michael is 18 means he will have access to $60,036.92 at the age of 18. Tax deferred to Michael who will be a student who accrues little to no income. Purchasing Long term care insurance at the max age of 55 for Martin allows for him to use his premium payments as a tax deductible. On average for 2021 Long term care insurance was $2,080. Risk Management: Martin and Jessica have a large amount of credit cards that need to be settled first and Martin is getting closer to retirement than Jessica will. ● Martin should take his cash out of the emerging Markets within the next 5 years and place them into an RRIF as he is getting closer to retirement. This would be the safest place for cash investment considering the benefits of RRIF. ● With responsible spending and spending cut down Martin and Jessica should start taking about half the money that they now save monthly to put towards their debt. Therefore, they will pay off these debts 2x faster with larger lump sum payments and save on Interest. ● As mentioned in the retirement section follow those steps to reduce their risk of not being able to pay off their debt with the increasing interest of credit cards. ● Martin should pay his credit card debt at a rate of $2,500 a month in order to pay off the debt in 3 years and 6 months ● Jessica should pay $1,300 a month towards her credit card debt in order to pay off the balance in 3 years and 4 months. ● Continue to pay off the mortgage of home to use home as an asset in retirement in case of downsizing. ● Once debts are settled Martin and Jessica should consider safer investments in order to protect capital investments. Estate Planning: ● For the RRSP amount remaining in the case of death for Martin, the primary beneficiary should be Jessica Jacobs. Secondary beneficiary as Michael Jacobs. ● ● ● Home to be distributed to Jessica at the time of death and secondary beneficiary Michael Jacobs. As well as chequing and cash accounts remain in Martins name. TFSA of Martin beneficiaries split 50/50 to Robert and Krystal Jacobs. To earn tax free savings from their father in the untimely death of Martin. Martin should consider purchasing trusts for Robert and Krystal in the future to properly manage their payments to the beneficiaries over a period of time. At the moment it is not within their reach to purchase a trust. Section 6: Part 1 The plan to monitor the progress of the recommendations that were made regarding Martin and Jessica’s financial planning would be to meet on a regular basis, every 3 or 4 months would be ideal. This would allow for us to improve the plan and make any changes that seem fit as it plays out to see if it is still the most ideal recommendation for their finances whether it is investments, retirement, estate, or anything else that may arise. Part 2 Dialogue: *Coming to the end of the previous meeting following the sharing of the plan and recommendations made for the couple* Advisor: Do either of you have any questions or concerns regarding the plan we have implemented for the both of you? Martin: Nothing on my end, I am more than pleased with what you have shown to us! Jessica: I myself am really glad we have a way of helping pay off some of our credit card bills Martin: Now that you mention it, the decision to sell the Audi has really made quite a benefit toward our savings as well as now we are making higher deposits into our RRSP. Advisor: That’s wonderful to hear! Now let us talk about how we will continue to fill you in and keep in touch. We were thinking that meeting on a quarterly basis, for the time being, would be best suited for monitoring and filling you in on the plan, does something along every 3-4 months’ work for you? Martin: That would be great. I would love to be filled in on what is going on more than twice a year so that works for me. Jessica: Yup! That sounds good! Advisor: I am happy that you guys are happy. If you would be so kind as to pass along my service to any of your friends, family, or co-workers I would very much appreciate it. Martin: I would be more than happy to let my peers know of your service as your financial services are impeccable. Advisor: That's great to hear, I really appreciate that. I look forward to meeting with the two of you again and we will be sure to give you a heads up when we are looking to schedule a meeting in the future.