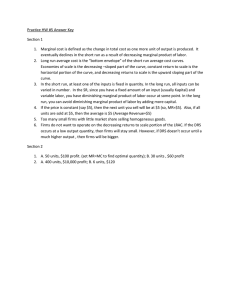

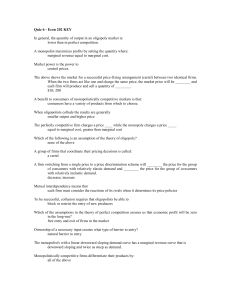

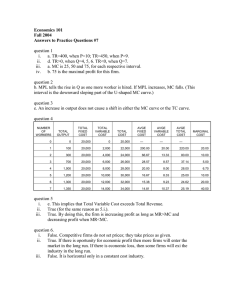

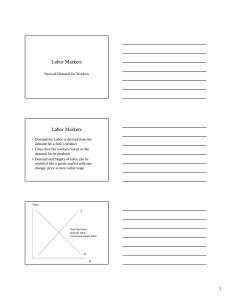

Economics Unit 7: Utility: Total utility: the overall satisfaction that is derived from the consumption of all units of a good over a given time period marginal utility – the additional utility derived from the consumption of one more unit of a particular good. When price of good decrease, the marginal utility/P will increase Change in price of good cause movement along demand curve Assumption: - Marginal utility theory assumes that consumer ranking their wants and assign value of satisfaction gained from consuming good. - Law of diminishing marginal utility Indifference curves and budget lines Indifference curves show combination two goods that give consumer equal satisfaction or utility. Slope downward represent fall in quantity consumed of one good is accompanied by increase consumption of other good for the same level of satisfaction The slope of the indifference curve represents the extent to which the consumer is willing to substitute one good for another. when consuming large amounts of good Y, the consumer is willing to give up rather more of this good/ The rate at which the consumer is willing to substitute one good for another is known as the marginal rate of substitution. Budget line graph If price of X has fall, more can be purchasing this level of income. The graph shows good x’s price fall by halve, which means they can buy twice the original amount. As price X is fall relative to Y, they will substitute X for Y. Substitution effect of price change. Fall in price of good X allow consumer have more money to spend on other good, real income increased Consumer may buy even more of good X. Income effect If the price of good X increases, this means that consumers have less spending power. The loss of spending power is represented by a new budget line B2. less of good X can now be consumed with the same level of income. - A movement along I1 to point E2. This is the substitution effect - A shift downwards to a lower indifference curve I2 moving from E2 to E3. This is the income effect, so-called because the consumer has less spending power due to the increase in price of good X Income effect has been eliminated by removing the reduction in real income through including an imaginary budget line that is parallel to the new budget line but at a tangent to the original indifference curve. Show a fall in price level of Good X - Substitution effect has move from E1 to E2 due to drop in price of good X - Income effect is positive as they have more real income, which move from l1 to l2, higher indifference curve Good x is inferior good: - As real income increase, consumer will buy more expensive, quality good instead of X. Which cause income effect to be negative, but can’t outweighs the substitution effect For Giffen good, demand fall as price fall and increase as price increase. Such as staple food as rice and wheat flour. As price of staple food increase, real income decreased. Income effect will greater than substitution effect Limitation: - When there is two good and income is fixed when there are hundreds of products they can choose from - Consumer act rationally - ‘indifference’ implies that consumers are willing to accept any combination of the two goods as represented by an indifference curve. However, consumers express their wants and needs in terms of preference or rank order, and not indifference Efficiency and market failure: Economic efficiency: scarce resources are being used in the ‘best’ possible way. Most wants are being met with those scarce resources. Productive Efficiency: firms produce at the lowest cost, making best use of resource Allocative efficiency: produce combination of good and services that are most wanted by consumer. Give maximum satisfaction at their current income. represents the additional benefit derived from the consumption of one more unit of a particular good At X, more of both good can be produce with the available resource – productive inefficiency. At Y produced the maximum amount of product with the available resource – productive efficiency Firm will produce at the lowest cost to stay competitive, this will lead to productive efficiency Allocative efficiency exist price of product is equal to marginal cost of production. Cost of producing one more unit of output. The seventh unit cost 8 dollars but only valued at 5 dollars by the consumer, same applied for fifth and sixth output. Competitive market can lead to allocative efficiency, firm will produce products that are most desirable by the consumers relative to cost of production. There are two motivations: - to make the greatest possible profit will push firms to produce such products highest possible demand and revenue - in competitive markets will be forced to produce those products most demanded by consumers. If firms do not produce these goods, other firms will step in and do so. This can cause business to close Pareto optimally: - impossible to make someone better off without making someone else worse off - can be represent using PPC curve, on the line, its impossible to increase output of good X without reduce good Y state of pareto optimally - any point in PPC, possible to increase of good X without reduce good Y pareto inefficient Dynamic efficiency: - Resources are reallocated in such a way that output increases relative to the increase in resources. - achieved when a firm meets the changing needs of it market by introducing new production processes - Investment will be high initially, the payback after the investment like research, technology will come later - A long-run concept - Will shift the LRAC curve down when being dynamic efficient Market failure: - Market failure exists whenever a free market, left to its own devices and totally free from any form of government intervention, fails to make the best use of scarce resources. - When the interaction of supply and demand doesn’t lead to productive or allocative efficiency no efficient allocation of resource Private costs and benefits, externalities and social costs and benefits Externality: - Concept of when people who are not involve with the transaction of good and services that are affected by the decision. Those people are call third parties Negative externalities occur when the consumption/production of a good produces a cost to society which is greater than that incurred by an individual consumer/producer. This is sometimes described as a negative ‘spill-over’ effect. ***** A positive externality is where the side effects provide unexpected benefits to the third parties Private cost: Cost incur by the business who carry out an action either as producer or consumer Private benefit: Receive directly by those who produce or consume service Example: A airplane business, private cost for producer is cost of operating the airplane, private cost for consumer would be ticket cost. Private benefit for producer would be revenue gain, for consumer would be able to travel to places External Cost and benefit: - Consequences of externality arise from particular action - Fall on the third party Social costs = Private costs + External costs Social benefits = Private benefits + External benefits When private cost doesn’t match social cost or private benefit doesn’t match social benefit distort the efficient allocation of resource. Market cant produce at best allocation of resource When social benefit exceed private benefit positive externality A market is not efficient when there is externality Negative production externality: - External cost is shown as MEC Marginal social cost is shown as MSC Marginal private cost is the supply curve of the firm Marginal private benefit = marginal social benefit so is equal to demand Optimum level output is when the marginal social cost is equal to marginal social benefit. However, the actual output is at Q1 is where marginal private cost equal marginal private benefit - Xyz is the deadweight welfare loss due to overproduction Positive production externality: - Marginal social cost will be lower than the marginal private cost - Assuming no consumption externality. MPB = MSB - Socially optimum output is at MSB = MSC - Business will produce at Q1 where MPC = MPB, which there is underproduction Negative consumption externality: - The marginal social benefit is lower than marginal private benefit due to the marginal external cost - Optimum level output is at Q when MSB = MSC - However business will produce at Q1 where MPC = MPB, result to overconsumption Positive consumption externality: - MSB is greater than MPB due to the positive marginal external benefit - Optimum output is at Q when MSB = MSC, but output at Q1 when business produce at MPB = MPC. Asymmetric information: - When buyer doesn’t have information that the seller has and vice versa Two types: - Hidden characteristic, when one party know more about a situation than the other. Outcome is called adverse selection. Example: Buyers of used cars may end up purchasing more low-quality cars in the market, reducing the market for good quality vehicles. - Hidden action, when one party take action that other party can’t observe which affect both of them, known as moral hazard. Apply in the case of a bank loan where the person who has obtained the loan takes a bigger risk in setting up a business. Cost benefit analysis: - takes a much wider view than a financial appraisal. - Take into account social cost and benefit 4 stages Identification: - Identify all relevant cost and benefit of project, include external, private cost and benefit - problems when it comes to identifying external costs and benefits. Putting monetary value: - Putting monetary value on cost and benefit - Easier if there are already market prices available - However, for other variables, its difficult to assign value such as time Forecasting future: - estimate costs and benefits over many years Decision making: - results of the earlier stages are drawn together to aid decision making - If value of benefit exceed cost, then project is worthwhile - Project with highest benefit: cost ratio is most likely to go ahead Types of cost, revenue and profit, short-run and longrun production As number of workers goes up, marginal product goes down due to law of diminishing return. Adding more worker is in a short-term way for increase output Rising marginal cost and average variable cost is indication of diminishing return As output increase, AFC decrease and AVC will increase. Eventually, it will outweighs the effect of AFC falling, causing ATC to rise To increase 100 to 200 goods, relatively less labor and capital require per unit output, this is increasing return to scale Increasing amount of capital and labor is need to produce 100 more of goods, gap increase indicate decreasing return to scale Economies of scale: - LRAC slopes upwards after the minimum point. beyond a certain size, a firm’s costs per unit of output may increase as the scale of output continues to increase. This situation is one of diseconomies of scale. - Economies of scale can only accrue to a firm in the long run. - firm’s output is rising proportionally faster than the inputs, which means that the firm is getting increasing returns to scale Technical economies: - advantages gained directly in the production process through more efficient production methods - Example: Increase speed of transporting so that no idle and flow production faster Purchasing economies: - Bulk buying, buy large amount of cheaper average total cost Marketing economies: - Promote product at larger amount of air time, transport and warehouse cost can be reduced where customer require service on large scale Managerial economies: - Expert can hired to manage more operation Financial economies: - Better and cheaper access to loan from bank Diseconomies: - a firm can expand its scale of output too much, with the result that average costs start to rise - problems of management co-ordination of large complex organizations and the effect that size and poor communications, worker not feeling valued Price taker: - competitive market the firm has no control over the price of its goods - firm’s demand curve will be horizontal and its revenue will depend entirely on the amount of goods sold Price maker: - If the firm chooses to increase output, price will fall; if it decides to reduce output, price is expected to increase. - firm’s demand curve is its average revenue curve. Profit: - What left when revenue deduct total cost Normal profit: - Minimum return business must have to stay in business Supernormal profit: - Signal for other business to enter Subnormal profit: - Profit earn is less than normal profit Different market structures Perfect competition: - Firms are price takers and there is perfect information for all firms in the market - Many firms, freedom of entry into the industry with all firms producing identical products. Imperfect competition Monopolistic competition: - Monopolistic competition is where there are many firms and freedom of entry - firms have some control over the product and its price. Firms are price makers. Oligopoly: - few firms and they have market power to erect barriers to entry to deter competition from new firms. - Product are wide ranging - Firms are price makers as they have some control over price depending on the market power of competitors. Monopoly: - Single seller in market - Price maker o Barrier to entry: Legal barrier: - Under license by government Market barrier: - Advertising and branding from large company Cost barrier: - High fixed cost - Economies of scale allow to lower average cost. - Predator pricing: eliminate new firm enter a business by cut price - Limit pricing: eliminate firm about to enter by setting low price Barrier to exist: - Some cost like research cant be convert back to money If cost is higher than revenue, the firm is about to exist industry. As long as price revenue cover the average variable cost, the firm would make a loss equal to fixed cost. Called shutdown price. Only hope is market price will rise to increase revenue. Where the revenue is lower than costs in the long run, firms will leave the industry. If many firms leave, the effect will be a reduction in the overall market supply. This will raise the market price, giving the rest of business opportunity to produce and make normal profit. Supernormal profit is only in the short run. Its existence act as an incentive for new firm to enter the market. Absence of barrier of entry will make them enter easily and increase total supply. Market price will fall and supernormal profit will diminish. When it goes, new entry will stop, and existing one will be covering their cost model of perfect competition is the most efficient market structure in the long run Monopolistic competition: Successful advertising will shift the demand curve to the right and will reduce the price elasticity as consumer will feel there are less close substitute. large number of competitors using a combination of price competition and nonprice competition to try to increase their market power. If there are few barriers to entry, then their success will only be temporary. In the short run, the profit-maximizing firm will be seen to make supernormal profits. However, new firm will join which will shift the demand to the left. This will happen until all industry are making normal profit. Firms operate above the ATC point so its inefficient. firm is not allocatively efficient as P > MC. Oligopoly Total output is concentrated in few firms Decision taken by firm are independent, Firms must decide their market strategy to compete with close rivals High barrier of entry Product may be differentiated or undifferentiated Concentration ratio is sum of the market share percentage held by the largest specified number of firms in an industry. It ranges from 0% to 100%, and an indicates the degree of competition in the industry. Low concentration ratio in an industry would indicate greater competition among the firms in that industry. ***** It is calculated by adding together the total sales for each of the specified number of largest firms in the industry. (E.g. a 4 firm concentration ration takes the sales of the largest 4 firms) That sum is then divided by the total sales of the industry and converted to a percentage. (2) ***n Are price maker, but it could lead to price war. They should only start price war if cost of production is significantly lower than competitor Suppose a firm increases its price. This will not be followed by all firms as they have little to gain since their revenue is likely to fall. If price is reduced, there will be the same reaction from all firms. Again, revenue will fall. Prices will tend to stay the same and to change little over time. Price rigidity oligopolist will be better off concentrating on non-price competition to increase revenue. Collusion in oligopoly: Is an informal agreement, firms agree to a form of competitive behavior which benefits the firms. *** Large firm cooperative with rival, informal collusion is not illegal and usually take form of price leadership. where firms automatically follow the lead of one of the groups. The objective is to maximize the profits of the whole group by acting as a single seller. Sufficient market power to determine price change cartel is a formal price or output agreement between firms in an industry to restrict competition. It’s illegal. By joining a cartel and agreeing prices, firms are operating as a single seller and maximizing their profit Monopoly: a legal monopoly is when a firm has more than 25% of the total market; if this share exceeds 40% then the monopoly is said to be ‘dominant’. profit-maximizing monopolist would choose the output where MC = MR. There is no long run or short run because there Is no incentive for business to move away from MC = MR, Price discrimination occurs where the monopolist chooses to split up the output and sell it at different prices to different customers Natural monopoly: Where monopoly has overwhelming cost advantage At quantity Q, firm will making supernormal profit. But if behave like a competitive firm, it would be where price equal long run marginal cost, at Q1. This is loss making, however government will provided subsidy as they are providing essential goods. Monopoly vs perfect competition The monopoly output is lower than in perfect competition. The price in monopoly is higher than it is in perfect competition. The monopolist is making short- and long-run supernormal profit. The firm in perfect competition is productively efficient, producing the optimum output. It is also allocatively efficient, producing where price = MC. The monopolist captures consumer surplus and turns it into supernormal profit. Consumer surplus in monopoly is less than in perfect competition due to the higher price that is charged by a monopolist. The deadweight loss is the sum of the loss of the total consumer surplus and producer surplus. It is shown by the shaded area. deadweight loss is significant because the monopolist is gaining at the expense of consumers through converting some of the consumer surplus into producer surplus. Monopolist do not have the same control over costs, there may be too many workers or capital is not being used efficiently. Growth and survival of firms Internal growth: - Retain profit from business and reinvest to increase productive capacity External growth: - joining with others via takeovers or mergers. - Takeover bid objective is to own 51% of the total and have control of business - Quicker and cheaper Diversification: - Sell wide range of product Integration: - a merger whereby two firms agree to join up with each other, or acquisition or purchase whereby one firm takes over control of another. Horizontal integration: Merger of business in the same industry to reap benefit economies of scale, reduce competition Vertical integration: Firms grow forward or backward of its production stage Cartel: A formal agreement by firms to operate collectively to raise price or limit output to reduce competition/control the market *** Possibility of price war where one firm break rank to capture bigger market share If some firm have higher cost of production, resulting in fewer profit due to agreed fixed price Principal-agent problem When one agent make decision on behalf of another person. The agent, through a day-to-day involvement in the firm, has more information than the principal. This difference is an example of asymmetric information and moral hazard. The problem is that the principal does not know how the agent will act; the principal is also not sure that the agent will act in the principal’s best interests. In the case of a firm’s growth, the agent may have plans and a strategy that differ from those of the principal. The agents may decide to act in their own interest. If successful, the agents stand to gain prestige and enhance their own career development. The principal is not fully aware of what the growth plans involve. This is called the agency cost Differing objectives and policies of firms Why firm doesn’t operate at profit maximization: - difficult to identify this output may not be long term interest of business, to avoid government regulatory may attract new entrant into industry damage relationship between stakeholder and firm, the firm’s workforce and consumer as they see shareholder earn large returns - Firm could become a target for takeover bid Other objective of firm: Survival: - minimising losses to develop a revised strategy to stay in business - limit to the time and to the scale of losses that can be tolerated. If a firm is not covering its variable costs, then closure would be a sensible outcome. Profit satisficing: - reasonable or minimum level of profit, sufficient to satisfy the shareholders but also to keep the stakeholders happy - Worker will expect pay rise, consumer expect price fall - Profit satisficing can also be a feature of firms that have enjoyed a high market share over a long period of time. Complacency can lead to firms losing focus Sale maximization: - maximize the volume of sales rather than the total revenue from sales. Sales maximization will lead to greater output Revenue maximization: - Managerial salaries and bonuses are usually based on total revenue, not profits. Sales can be easily and regularly monitored - The firm may produce where MC > MR provided MR > 0 since total revenue will increase. Price discrimination: First degree: firm sells each unit of a product to a different consumer, charging each the price consumer willing to pay Example: A car dealer is likely to weigh up just what a potential customer might be willing to pay for a second-hand car Second degree: consumers are only willing to purchase more of a product if price falls as more and more units are bought. Third degree: discriminate between consumers and is based on the presumption that groups of consumers have a different price elasticity of demand. low price elasticity of demand need the product and can be expected to pay a higher price for it than consumers whose demand is more price elastic. Total revenue would be 120 by 3 x 40 = 120, total cost would be 45 x 3 = 135, making a loss of 15 dollars. If output is sold separately for price consumer willing to pay, total revenue would be 60 + 50 +40= 150, making supernormal profit of 15. Price discrimination will only work where consumers have a different willingness to purchase or have different price elasticities of demand for the product. Other pricing policies: Limit pricing: setting a lower short-run price to deter new firms from entering their market. At this new price, the established firm no longer maximizes profits, the low price act as a barrier of entry. Predatory pricing: setting a price that is so low that the new firm has no alternative but to match it, to force new firm out of business. Price leader ship: All firms in the market accept the price that is set by the leading firm, which is often the firm with the largest market share or is the brand leader. avoiding price competition yet maximizing total profits for all firms. However small firm, their costs are higher, matching a price decrease could result in sustained losses and the eventual exit of smaller rivals from the market. Firm A is the lower cost producer and price leader. It maximizes its profits at point A where MC = MR. Its output OA is sold at price PA. Firm B’s ideal price is at PB, but if it fixes price here, it will not be able to compete with A’s lower price When PED = 1 , MR will be = 0 and total revenue is maximized, if PED < 1, MR will be negative reducing the total revenue. A firm choosing to maximize its revenue would raise output beyond MC = MR until MR had fallen to zero Unit 8 Government policies to achieve efficient resource allocation and correct market failure Negative production externality Use tax to stop negative production MSC = MPC + tax The total tax paid is equal to the area P2P1yz, of which the consumer’s share of the burden is PP1yx and the producer’s share is P2Pxz. Cant estimate how much to tax green tax will not be effective if the demand for the product being taxed has a price inelastic demand Regulation setting standards that restrict the amount of polluted waste that can be legally dumped. Property right how owners can use their assets. If a polluting firm has property rights, then those who are affected by its activities could pay the polluter to reduce the scale of activity. In principle the polluter would require payment equal to the loss of profit Pollution permit polluting firms are provided with a permit to produce a given level of pollution. Negative consumption externality Specific indirect tax: Negative consumption externalities created by one group of consumers reduce the private benefit of others, due to external cost, MSB is lower than MPB The market Equilibrium is at MPB = MPC, at Q By imposing indirect tax equal to zy, the supply curve shift left market price increase to P1 result in fall in quantity to Q1. Optimum level output is at Q1 where MSC = MSB impose a minimum price on products that generate negative externalities of consumption production quotas. This involves limiting the quantity of goods that is produced Positive production Externality MSC is lower than MPC. Market Equilibrium is at QP, optimum output is at MSC = MPB at Q1, so its underproduction. Government should give subsidy equal to external benefit to increase quantity produced to Q1. Size of subsidy is P2P1YZ Or to increase demand of the good, by provision of information Positive consumption externality Equilibrium is at MPC = MPB at QP, the marginal external benefit added to MPB to give MSB. Government give subsidy shift supply curve to right from S to S1. Optimum output level is at Q1 where MPB sold at price P1 Nudge theory presenting choices in a better way, people make better decisions. achieving beneficial economic and social outcomes without the need for regulations Causes and consequence of government failure: Imperfect information lack of information about the true cost or value of a negative externality. difficult to trace the source of the pollution. The wrong level of tax will lead to the wrong level of production and an even greater inefficiency in the use of resources government must provide the right amount of goods. If it does not estimate the level of demand accurately, then the wrong amount will be produced or funded inefficient allocation of resources Unintended consequence: undesirable intentions can create inefficiencies. imposition of taxes can distort incentives, high income tax can create disincentives for people to work harder and so gain more income. pays benefits to unemployed workers. If benefits paid are too high, there may be no incentive for the unemployed to look for work Policy conflict: increase existing inequality. example, a tax on energy use that aims to reduce harmful emissions of greenhouse gases will have different effects on different groups of people. This could be seen as unfair and increasing inequality in society. subsidies on the costs of fossil fuels. These encourage production and their use in coal-fired power stations, both of which contribute increased environmental pollution. It might keep workers in jobs but its inconsistent with the need for more sustainable policies. Equity and redistribution of income and wealth Equity: Distribute resource fairly among people, there are two aspect, Horizontal equity: people with same circumstance should pay same level of taxation. Vertical equity: Taxes should be fairly apportioned between rich and poor in society Equality: Equality is about treating everyone in the same way. Equality aims to promote fairness, but it can only work if everyone starts from the same position and needs the same help. It is the ideal of everyone being truly equal Poverty: families do not have enough money or access to resources to be able to experience a reasonable standard of living. includes not only having food and housing, but also access to decent education, healthcare, water supply and sanitation. Extreme poverty: living on less than 1.9 dollars a day Absolute poverty: when household income is below a certain level that makes it impossible for a person or family to meet the basic needs of life such as food, housing, water, healthcare and education. Relative poverty: income of a household with the average income for their country where its less than the average or 50%. Household have money to meet basic need. Benefit of Money raised through the tax system is then paid to low-income persons and families in order to increase their disposable income: Mean tested benefit: Only paid to those on low income, most in need. This can create disincentive to work. Its call poverty trap when financially worse off when one or more of members are working rather than living off the range of benefits available to them. Universal benefit: Paid out to everyone in certain category, often age-related regardless of income. This mean they are also paying to those who are not in needed and tend to be more expensive Universal basic income: unconditional cash payment made at regular intervals by the government regardless of earnings or employment status. Reduces poverty and income inequality while encouraging those receiving to enter or stay in employment. Negative income tax: a way of dealing with the weaknesses of means-tested and universal benefits. Example: Tax rate is 25%, everyone receive annual benefit of 4000 dollars. If tax paid is less than received annual benefit negative income tax, they receive the difference between tax paid and annual benefit. For high income earner, then this is the amount of tax they have to pay. Labor market forces and government intervention marginal revenue product (MRP) is the extra revenue earned by the firm when it employs one more worker firm should continue to hire labor as long as the additional worker adds more to revenue than to the firm’s costs. Factor determine demand for labor: Wage rate: rise in the wage rate will increase labour costs and is likely to lead to a fall in the quantity of labor demanded by a firm Productivity: If productivity increase, output increase, labor becoming more attractive resource for firm and increase in demand for labor Demand for product: When demand for product is higher, firm will need more worker. Demand curve will shift right Individual supply of labor as the wage rate increases, more people are willing to offer their services to employers. Beyond a certain point, there is a trade-off between work and leisure. Individuals may decide that they would prefer to work less and have more time for leisure. labor supply to a firm or industry the number of workers wanting to supply their labor increases with the wage rate that is offered. Elastic and inelastic supply curve Long run supply of labor Factor Size of population: increase in the overall supply of labor mainly due to higher birth rates and improved medical care for young children. Labor participation rate: More students are continuing their studies at university, a further cause of a declining labor participation rate or worker choose early retirement Tax and benefits level: High tax rate will cause disincentive to work and withdraw from labor market Immigration and emigration: Perfect market: Each firm therefore purchases labour until the value of the marginal revenue product equals the wage rate. When there is increase in demand for labour, employment increase from L to L1, The wage rise from W to W1 When there is increase in supply of labor, supply will shift right, this will cause downward effect on the wages. As the number of workers increases, so their marginal productivity falls, as does the value of their marginal revenue product. Wages are reduced for all worker, but employment rise Imperfect market Trade union Trade union could set an minimum wage above equilibrium wage. At this wage, more worker is likely to work at Lc. However, job offer are less to Lu. High labour cost could make employer go out of business Government intervention minimum wage is a national minimum wage. it does not take into account variations in the cost of living in a country. very difficult for workers to survive on the minimum wage alone unless long hours are worked. Monopsony single or dominant buyer, Wage differential: An occupation that is in high demand and low supply will pay a higher wage rate than one where there is an abundant supply of workers. Wage difference between job. Example: pilot get pay more than cabin attendant, cabin attendant get pay more than worker cleaner the airplane Causes: Bargaining: Member of strong professional organization like trade union, action by pilot have substantial impact on airplane’s revenue Education and training: Some occupations, especially those in healthcare, legal services and teaching, require workers to undergo a long period of training. Skilled and unskilled worker: Skilled worker will likely to get paid more than unskilled one as supply for skilled is less while demand is higher. Marginal revenue product for skilled one Is higher because it will lead to higher output Male and female worker: men are still paid more than women in many occupations. on average the MRP of women is lower than that of men. The MRP is lower because there are more women in low-paid occupations that generate low marginal revenue to a firm. Hours of work: Part-time workers on average are paid lower wage rates than fulltime workers. there is usually a large pool of part-time workers in a local labor market. Many part-time workers are women. Government policy: Governments try to recruit more doctors and nurses to fill in for the increased demand for such professionals. This shortage of supply widens the differential between these workers and others in similar occupations transfer earnings: this is the minimum payment necessary to keep labor in its present use. economic rent: any payment to labor which is over and above transfer earnings at W, wage rates below this there are workers who are willing to offer their services to employers, at any wage rate from zero upwards, workers will join the labor market, until at wage W, L quantity of labor is available. Below W any wages they get over and above what they will accept is their economic rent. case of superstars can be explained. labor supply curve is perfectly inelastic; their earnings consist entirely of economic rent. workers with a perfectly elastic supply, such as many unskilled workers and others in menial jobs, have no economic rent as their earnings consist entirely of transfer earnings. Employers can hire an infinite supply of labor at the market wage W The circular flow of income Multiplier: shows the relationship between an initial change in spending and the final rise in GDP Change in income / change in injection Closed economy Mps = 1 / marginal propensity to save OR 1 / 1 - mpc Mpc = change in consumption / change in income if a person receives an extra £100 of income and spends £ 70, mpc will be 0.7 and mps will be 1 − 0.7 = 0.3 closed economy with government sector There is extra injection, G(government spending) and extra withdrawal T (tax) Multiplier = 1 / mps + mrt Mrt = marginal rate of tax, marginal propensity to tax Open economy with government sector Most realistic model as it includes all four possible sectors (households, firms, the government and the foreign trade sector) C + I + G + (X − M) = Y, and injections equal withdrawals, which is now where I + G + X = S + T + M 1 / mps + mrt + mpm Mpm = marginal propensity to import Saving is defined as disposable income minus consumption. Aps = saving / income Average propensity to save. As income rises, the actual amount saved and aps tend to increase. The rich usually have a higher aps than those with low incomes. Mps = change in saving / change in income Income rise = mps rise Apc = consumption / income As people can either save or consume, apc will be equal to 1 – aps. The rich will have lower mpc and higher mps. Multiplier: 1 / 1 – MPC OR 1 / MPS Marginal rate of tax is the extra proportion income paid in tax Mrt = change in tax / change in income Marginal propensity to import Mpm = change in import / change in income The level of national income in an economy is determined where aggregate demand equals aggregate supply Aggregate expenditure = consumption (C), investment (I), government spending (G) and net exports; that is, exports minus imports (X − M) If aggregate expenditure exceeds current output, firms will seek to produce more They will employ more factors of production and GDP will rise. Whereas if aggregate expenditure is below current output, firms will reduce production. If aggregate expenditure rise due to consumption and investment increase, output will increase GPD increasing A change in the total spending on a country’s goods and services will result in national income changing by the size of the injection times the multiplier. Example: multiplier is 2.5, if their spending rise by 500b, the nation income will rise by 1250b. consumption function indicates how much will be spent at different levels of income. C = a + bY, where C is consumption, a is autonomous consumption (that is the amount spent even when income is zero and which does not vary with income), b is the marginal propensity to consume and Y is disposable income. For example, if C = $100 + 0.8Y and income is $1000, the amount spent will be $100 + 0.8 × £1000 = $900 savings function is the reverse of the consumption function and is given by the equation: S = –a + sY S is saving, s is the marginal propensity to save, Y is income and a is autonomous dissaving (that is, how much of their savings people will draw on when their income is zero; this amount does not change as income changes). sY is induced saving (that is, saving that is determined by the level of income) if S = −$200 + 0.2 × $4000 = $600. average propensity = saving / income = 600/ 4000 = 0.15 apc = 1 – 0.15 = 0.85 Investment that is undertaken independently of changes in income is known as autonomous investment. For example, a firm may buy more capital goods it is more optimistic about the future or because the rate of interest has fallen. Induced investment is illustrated by movement along the expenditure line. This is because induced investment is investment that is influenced by changes in income Accelerator theory: investment depends on the rate of changes in income (and therefore consumer demand), and that a change in GDP will cause a greater proportionate change in investment. If GDP is rising, but at a constant rate, induced investment will not change. This is because firms can continue to buy the same number of machines each year to expand capacity. However, a change in the rate of growth of income can have a very significant influence on investment. The table shows that when demand for consumer goods rises by 25% (from 800 to 1000) in the second year, demand for capital goods rises by 200% (from 1 to 3). However, an increase in demand for consumer goods does not always result in a greater percentage change in demand for capital goods. For instance, firms will not buy more capital goods if they have spare capacity or if they do not expect the rise in consumer demand to last Economies do not often operate at the full employment level of national income. At any particular time, they may be producing where total spending is above or below that needed for national income to equal potential output. inflationary gap will occur if aggregate expenditure exceeds the potential output of the economy. In such a situation, not all demand can be met, as there are not enough resources to do so Excess demand will drive up the price level Graph shows that an economy is in equilibrium at a GDP of Y, which is above the level of output, X Distance ab represent inflationary gap government may seek to reduce an inflationary gap by cutting its own spending and/or raising taxation in order to reduce aggregate expenditure. equilibrium level of GDP may also be below the full employment level. In this case, there is said to be a deflationary gap. Graph shows that the lack of aggregate expenditure results in an equilibrium level of GDP of Y, below the full employment level of X. There is a deflationary gap of vw. deflationary gap is increased government spending financed by borrowing. 1. The economic ideas of John Maynard Keynes were formulated in the 1930s. In October 1929, the United States stock market crashed, followed by the Great Depression. 2. The traditional economic model of supply and demand couldn’t be used because it did not show factors like total consumption in an economy. Keynes instead invented The Keynesian diagram. 3. Unemployment is bigger, The horizontal axis usually represents national income or real GDP. The vertical axis often represents aggregate expenditure or total spending in an economy. 4. National income is the total income by the country. "Determination" often refers to finding the value of a variable or solving a problem based on given conditions. In the context of Keynesian economics, "National Income Determination" refers to the model that aims to determine the equilibrium level of national income where aggregate expenditure equals national income. 5. 45-degree line is a line of reference and shows all those points where aggregate expenditure and output are equal. It indicates that vertical axis measurement is equal to horizontal axis measurement. 6. If expenditure is less than income or level of output, then there will be unsold good in the market. If expenditure is greater than level of output, this will emptied all the shelves of goods, and firms will produce more output to meet the expenditure, could also cause inflation. 7. It could shift upward or downward, factor such as tax, investment, export import, consumer confident, government policy… 8. Consumption is a function of disposable income. It depends on various factors such as income levels, consumer preferences, expectations, and government policies. consumption function indicates how much will be spent at different levels of income. 9. Autonomous consumption and expenditure are independent of income levels, while induced consumption and expenditure depend on income changes. Similarly, autonomous saving is the portion of savings that is not influenced by changes in income, while induced saving depends on income fluctuations 10.Autonomous components remain constant regardless of income changes, whereas induced components vary based on income levels.