Bartok Communications Case Study: Warburg Pincus Acquisition

advertisement

Bartok Communications

In early 2004 Warburg Pincus, one of the world’s successful private equity firms, was

considering the acquisition of Bartok Communications, a prominent Hungarian cable

company. Warburg Pincus was the first US private equity firm to make a commitment to

Europe. Since its first transaction in Europe in 1983, the firm had invested more than $2.5

billion in 64 transactions in 14 European countries. Warburg Pincus was also an

experienced investor in Eastern Europe, most notably in Slovakia and the Czech

Republic.

Warburg Pincus initially became interested in Bartok, knowing that the Hungarian cable

market was potentially very attractive, as it has been growing explosively over the past

several years. The original investor in Bartok was ARGUS Capital Partners - a CEE

private equity firm, whose strategy was to quickly assemble together a major cable

company through acquisitions of local cable operators. Now the firm wanted to exit this

investment because their fund was approaching the end of its life. Since Bartok was one

of the winners in their portfolio, the seller’s asking price for the company was 8.5 times

2003 EBITDA. Bartok was a fairly young company that was able to become one of the

major cable operators in the industry in a relatively short time span. However, WP

hesitated about a number of aspects relating to the potential deal. First, the transaction

was probably going to be small for Warburg Pincus. The firm generally invested in

companies with revenue of several hundred million dollars, whereas Bartok’s revenue

was projected to be approximately $37 million for 2004. A transaction of this size must

provide compelling returns in order to justify investment by the firm. Second, the

company was located in a less developed European country, which would complicate the

due diligence process and potentially create obstacles in obtaining debt financing.

Hungarian Cable TV Industry

The Hungarian cable industry, historically highly fragmented, has begun consolidating in

the past several years. The consolidation was initiated in the late 1990’s by the three

largest players: UPC Hungary, MatávkábelTV and Bartok. All three operators employed

similar strategy: 1) acquire local loop networks; 2) upgrade networks from loop to star in

order to combat piracy and offer more services, such as broadband internet;1 3) increase

prices as much as possible without breaching regulations; 4) improve content and

continue increasing average revenue per user (ARPU). However, the recently increased

attention of regulators (Hungary’s Competition Office; The National Communications

Authority) to the Hungarian cable industry together with Hungary’s recent membership

in the EU, which requires Hungarian regulatory regime to come in line with EU

requirements, implied that its regulatory environment could become tighter. As a result, it

was unclear how further price increases in the cable industry would be received by the

regulators.

1

Star network links individual subscriber via a direct connection that can be easily cut in case of piracy.

The operators in the Hungarian cable industry behave like local monopolies virtually

everywhere, apart from the capital city of Budapest, where there are parallel cable

networks. All cable operators have access to the same content at broadly comparable

prices, as they are supplied through a Hungarian cable association that negotiates with

content providers on their behalf. Since content providers are significantly larger in size

than the largest operators, only the three large players could go directly to the major

content suppliers to negotiate specific subscriber volume-based discounts that amount to

approximately 10-30%. Although there are no regulatory barriers to entry, the emergence

of new players is unlikely because of very high capital expenditure requirements. The

new entrant will inevitably be confronted by price competition from the incumbent and

most likely will find it virtually impossible to earn an adequate return on capital

investment. The cable industry in Hungary faces little threat from substitute offerings,

such as satellite or digital TV. Although satellite TV has better content, it is significantly

more expensive than cable TV. Digital TV is unlikely to grow significantly over the next

several years given the investment required by broadcasters as well as consumers.

Hungary is characterized by a relatively high cable TV penetration when compared to

other Eastern European markets. Cable networks can be further extended to cover more

households in additional residential areas, although this effort may not be economically

viable for most established operators. Further growth in the industry is expected to come

from developers of apartment complexes, as the government continues subsidizing

capital requirements for installation of cable networks in the new apartment blocs.

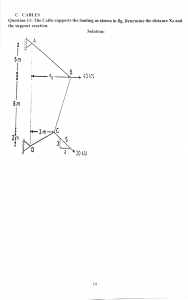

Exhibit 1 provides key historical data and projections for the Hungarian cable TV market.

The Bartok Opportunity

Bartok entered the Hungarian cable only in 1999 and, as a result, was in a weaker

position when compared to its rivals UPC Hungary and MatávkábelTV. Bartok provides

services to small towns and operates in only one of Hungary’s top twelve cities, as

compared to eleven cities served by UPC and nine cities served by MatávkábelTV. The

operator’s strategy to date has been focusing on acquisitions and upgrades of small cable

TV players in the regions. Going forward, the company was hoping to combine organic

growth with further acquisitions.

More than 90% of Bartok’s networks are not overlapped by other cable networks, thereby

allowing the operator to experience substantial growth. As of early 2004, the company

passed about 330,000 homes and attracted about 210,000 subscribers, which was

equivalent to a connection rate of 64%. Bartok recently undertook a series of technical

upgrades, with superior star/broadband network representing over 70% of all networks by

subscribers in 2004. Most remaining networks were scheduled for an upgrade over the

next two years.

During the past two years, Bartok enjoyed explosive revenue growth averaging 47% per

annum, with EBITDA margin averaging 42%. Management’s projections shown in

Exhibit 2 assumed that the revenue growth would slow in the future to approximately

2

10%. Future growth was assumed to come from both increased cable TV prices as well as

greater number of subscribers. In addition, management assumed improvements in

EBITDA margins, as they hoped that the price increases would not require significant

content enhancements, thereby keeping costs at approximately the same level. Moreover,

Bartok ’s executives expected capital expenditure to decrease, as most of the networks

had already been upgraded.

As Warburg Pincus management researched the opportunity of investing in Bartok, they

wondered if Warburg Pincus should at all go ahead with the transaction. They had

negotiated a loan package with an average cost of debt of 15% and were considering

financing 60% of the enterprise value with debt. Bartok expected to pay a tax rate of

35%. Warburg Pincus were worried whether the expected rates of return would justify the

risks that the Hungarian deal posed. Exhibit 3 provides information about private cable

transactions that took place in 2002 and 2003.

3

Exhibit 1: Key Statistics for Hungarian Cable TV Market, Actual and Projected

Population ('000)

Households ('000)

TV Households ('000)

Cable

Homes Passed ('000)

Homes Passed as % of TVHH

Basic Subs (000)

Basic Subs Growth

Pen of Homes Passed

Pen of TVHH (Basic Subs)

Avg Monthly Basic Rate

Basic ARPU Growth

Pay Cable

Total Pay TV Cable Subs ('000)

Growth

Avg Rev / Sub / Month

Pay Cable ARPU Growth

Broadband Internet

Ethernet / Cable Internet Subs ('000)

Growth

Avg Rev / Sub / Month

ARPU Growith

1997A

10,174

3,928

3,513

1998A

10,182

3,947

3,555

1999A

10,190

4,012

3,596

2000A

10,197

4,095

3,631

2001A

10,178

4,104

3,664

2002A

10,158

4,113

3,692

2003A

10,139

4,122

3,719

2004E

10,120

4,130

3,746

2005E

10,100

4,140

3,773

2006E

10,081

4,149

3,792

2007E

10,062

4,158

3,810

2008E

10,043

4,167

3,828

2009E

10,024

4,177

3,845

2010E

10,005

4,186

3,863

2011E

9,986

4,196

3,881

1,965

55.9%

1,277

65.0%

36.4%

$3.37

2,040

57.4%

1,428

11.8%

70.0%

40.2%

$3.47

3.0%

2,070

57.6%

1,511

5.8%

73.0%

42.0%

$3.58

3.2%

2,100

57.8%

1,605

6.2%

76.4%

44.2%

$4.00

11.7%

2,100

57.3%

1,596

-0.6%

76.0%

43.6%

$5.93

48.3%

2,226

60.3%

1,692

6.0%

76.0%

45.8%

$6.70

13.0%

2,338

62.9%

1,788

5.7%

76.5%

48.1%

$7.23

7.9%

2,408

64.3%

1,854

3.7%

77.0%

49.5%

$7.67

6.1%

2,456

65.1%

1,903

2.6%

77.5%

50.4%

$8.05

5.0%

2,505

66.1%

1,954

2.7%

78.0%

51.5%

$8.45

5.0%

2,555

67.1%

2,001

2.4%

78.3%

52.5%

$8.88

5.1%

2,606

68.1%

2,049

2.4%

78.6%

53.5%

$9.32

5.0%

2,632

68.5%

2,074

1.2%

78.8%

53.9%

$9.69

4.0%

2,659

68.8%

2,100

1.3%

79.0%

54.4%

$10.08

4.0%

2,685

69.2%

2,127

1.3%

79.2%

54.8%

$10.48

4.0%

2,153

1.2%

79.4%

55.2%

$10.90

4.0%

43

$5.86

51

18.6%

$5.86

0.0%

57

11.8%

$6.74

15.0%

71

24.6%

$7.28

8.0%

80

12.7%

$9.36

28.6%

93

16.3%

$10.86

16.0%

107

15.1%

$11.94

9.9%

121

13.1%

$12.78

7.0%

135

14.6%

$13.54

5.9%

156

15.6%

$14.36

6.1%

180

15.4%

$15.07

4.9%

205

13.9%

$15.83

5.0%

228

11.2%

$16.62

5.0%

252

10.5%

$17.28

4.0%

276

9.5%

$17.98

4.1%

301

9.1%

$18.69

3.9%

10

$24.25

-

20

100.0%

$39.82

64.2%

35

75.0%

$39.82

0.0%

58

65.7%

$35.84

-10.0%

87

50.0%

$28.67

-20.0%

126

44.8%

$25.80

-10.0%

177

40.5%

$24.51

-5.0%

234

32.2%

$23.53

-4.0%

285

21.8%

$22.59

-4.0%

333

16.8%

$21.69

-4.0%

370

11.1%

$20.82

-4.0%

407

10.0%

$20.20

-3.0%

436

7.1%

$19.59

-3.0%

-

-

-

2012E

9,967

4,205

3,898

2,712

Source: Kagan Eastern European Cable TV Guide (2003)

4

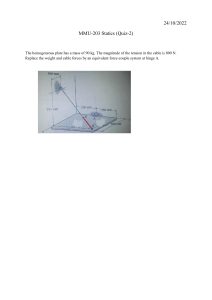

Exhibit 2: Management Projections for Bartok, February 2004

Revenue (M)

Revenue growth

EBITDA (M)

EBITDA margin

EBIT (M)

EBIT margin

CAPEX (M)

No of CATV Subsribers, EOY

No of Internet Subsrcribers, EOY

ARPU CATV

ARPU Internet

2002A

$18.8

58.5%

$7.8

41.4%

$4.1

21.5%

$9.6

2003A

$25.1

33.3%

$10.8

43.0%

$5.6

22.1%

$12.0

2004E

$37.6

49.9%

$14.4

38.3%

$8.4

22.3%

$17.6

2005E

$45.1

20.0%

$18.0

40.0%

$11.3

25.0%

$5.7

2006E

$54.1

19.8%

$21.9

40.5%

$14.9

27.5%

$5.7

2007E

$64.3

18.9%

$26.4

41.0%

$19.3

30.0%

$5.7

2008E

$72.8

13.2%

$30.2

41.5%

$23.7

32.5%

$5.7

2009E

$80.4

10.5%

$33.8

42.0%

$28.1

35.0%

$5.7

184,091

615

$7.7

$42.9

195,872

4,037

$10.0

$31.0

220,403

14,327

$12.4

$31.0

224,801

21,804

$14.0

$31.0

231,968

32,351

$15.5

$31.0

238,340

40,941

$17.5

$31.0

244,826

47,906

$19.0

$31.0

251,246

57,207

$20.0

$31.0

Source: Warburg Pincus Transaction Documents

Revenue: the total figure includes connection and installation fees

EOY – end of year

5

Exhibit 3: Cable Transactions 2002-2003

Announcement

Date

Name

Type

Country

Buyer

30 April 2003

TeleColumbus Group

Secondary

Buyout

Germany

BC Partners

24 April 2003

Com Hem

Buyout

Sweden

EQT Partners

05 February 2003

Eutelsat

Buyout

France

Eurazeo

EV (m)

EBITDA (m

est)

Multiple

€510

€90

5.7x

TeliaSonera

Skr 2,150

Skr 53

40.6x

France Telecom

€1,930

€506

3.8x

Seller

Deutsche Bank

01 February 2003

Est

Vidéocommunication

Buyout

France

SG Capital, Pehel

Industries

Fipares

€50

€17

2.9x

09 December 2002

Casema

Buyout

The

Netherlands

Providence,

Carlyle, GMT

Communications

France Telecom

€665

€85

7.8x

25 November 2002

Aster City Cable

Buyout

Poland

Argus, Emerging

Markets

Elektrim

Partnership, and Telekomunikacja

Hicks Muse

€110

€9.9

11.1x

Company Notes

Company Notes

Transaction Notes

The debt package amounted to €375m. The facility

TeleColumbus Group, comprising TeleColumbus GmbH and

TeleColumbus

Group

is a4 cable

levelservice

4 cable

service

provider

in Germany

with

than

a €170m

six-year loan

A at more

300bp over

TeleColumbus

Ost GmbH,

is a Level

provider

in comprises

Euribor, a €100m eight-year loan B at 367.5bp and a

Germany with more than 2.3 million cable customers and

2.3

million

cable

customers

and

revenues

of

around

€235m

and

a

profit

margin

of

revenues of around €235m and a profit margin of above 30% in €45m six-year revolver at 300bp. There is also a €60m

2002.

The group

in North,

West,

East and

South mezzanine

paying 4.5%

cash, 7.5% rolled-up

above

30%has

inoperations

2002. The

group

offers

broadband

cabletranche

television

programmes,

high

Germany comprising some 17 subsidiaries offering broadband

and warrants. Total net debt-to-EBITDA is less than 4x,

speed

internet

and internet

while senior net debt-to-EBITDA is about 3.2x.

cable

television

programmes,

high speedtelephony.

internet, internet

telephony and security services.

Based primarily in Stockholm, Com Hem is the largest cable TV The debt package amounted to Skr 800m. Many analysts

operator in Sweden and provides cable TV to 1.4 million

were surprised at the multiple that EQT paid for the

households

its basic in

tier Stockholm,

TV offering. The

company

also

is believed

that EQT

may help

Based with

primarily

com

Hem

is thecompany,

largesthowever

cable itTV

operator

in Sweden

offers approximately 70 pay TV and pay-per-view channels in a Com Hem to grow the customer base more aggressively,

and

provides

cable

TV

to

1.4

million

households

with

its

basic

tier

TV

offering.

As of

network which is 90% upgraded to enable digital TV

especially in the area of broadband internet. The

transmission.

Through

recent

investments

in the 72,000

cable network,

companysubscribers.

turned EBITDA positive

only in Q3 2002,

December

2002,

Com

Hem had

broadband

The company

netso

Com Hem offers more than 500,000 households broadband

the EV/EBITDA multiple may not be representative for

sales

amounted

to Skr2002,

1,017m

in 2002

but turned

EBITDA positive only in Q3 2002.

internet

access.

As of December

Com Hem

had 72,000

this deal.

broadband subscribers. The company's net sales amounted to

FX Conversion: 1 Skr = 0.1096 Euro

Skr 1,017m in 2002.

Eutelsat provides capacity on 23 satellite infrastructures offering Eurazeo purchased 19% stake of Eutelstat for €379m.

Under the terms of the deal, France Telecom will retain a

a portfolio of services including television and radio

broadcasting, professional video broadcasting, corporate

4% stake in Eutelsat as a financial investment and one

seat on its supervisory board. To accommodate the

networks, internet services and mobile communications. The

Eutelsat

provides

23 satellite

offering

a portfolio

of a special

company

is the first

in Europecapacity

to distributeinsatellite

televisioninfrastructures

of phone company's

wish, Eurazeo

has set up

DVB

standard (Digital

Video television

Broadcasting)and

for transmitting

digital holding company

that will purchase

services

including

radio broadcasting,

professional

video France Telecom's

television and has achieved a turnover of €659m. Based in

entire 23% stake in Eutelsat for €447 million. France

broadcasting

and corporate

communications.

in Paris,

Paris,

Eutelsat was founded

25 years ago.networks

With its fleetand

of mobile

Telecom

will then acquire 20%Based

in the holding

company

satellites, the company reaches four continents encompassing

for about €68 million. The holding company structure

with

its

fleet

of

satellites

the

company

reaches

four

continents.

Europe, the Middle East, Africa, Asia, eastern North America,

allows Eurazeo to have the benefits of being the largest

and South America.

single shareholder, in control of 23%, while its actual

direct holding in Eutelsat is only 19%.

The company is being acquired from Fipares, a

Strasbourg-based Est Vidéocommunication operates a cable

network

for more than 300,000

homes

in Eastern France, with operates

subsidiary of

de Strasbourg.

Newcothan

is

Strasbourg-based

Est

Vidéocommunication

a Electricité

cable network

for more

150,000 subscribers of analogue and digital TV and high speed controlled by Altice One and funded by the syndicate of

300,000

homes

in

Eastern

France,

with

150,000

subscribers

of

analogue

and

digital

internet services. The company achieved sales of €34m in 2002 investors. SG Capital Europe committed € 20m to

newco inachieved

return for a 40%

interest,

whilst Péchel

andTV

EBITDA

forecasted

in the

region ofservices.

€17m.

and ishigh

speed

internet

The company

sales

of €34m

in 2002

Industries and Altice Participations contributed

and EBITDA is forecaster in the region of €17m.

undisclosed amounts for equity stakes of 23% and 34%

respectively.

Casema is the third largest cable operator in the Netherlands. It Providence Equity and Carlyle have each acquired 46%

Casema

is

the

third

largest

cable

operator

in

the

Netherlands.

It has

has been in operation for around 30 years and today has 1.3m

ownership

of Casema, with

GMTbeen

owninginthe remaining

subscribers.

It isfor

located

mainly30

in the

centraland

and south-western

operation

around

years

in 2002 has8%.

around 1.3m subscribers. It serves

parts of the Netherlands and serves cities such as The Hague,

mainly the central and south-western parts of the Netherlands. Casema services

Utrecht and Breda. Casema's list of services, available now or in

theinclude

near future,

include: internet

viacable,

the cable,

pay-per-view,

internet

via the

pay-per-view,

telephony, data communication and

alarm systems, home shopping, telephony, data communication

video

on

demand.

and video-on-demand.

Aster cable television network, created in 1994, is the biggest

A consortium of investment funds acquired the cable TV

Aster

cable

network,

in 1994,

is the ofbiggest

cable operator

the joint

operations

Elektrim Telekomunikacja,

thein

Polish

cable

operator

in thetelevision

lucrative Warsaw

region,created

reaching more

than 500,000 households. It also offers its customers Internet

venture between Elektrim SA and Vivendi Universal SA,

lucrative

Warsaw

region,

reaching

more

than

500,000

households.

It

also

offers

its

for a total consideration of €110m. € 29.33m will be

access.

retained in Elektrim Telekomunikacja, the remainder will

customers Internet access.

be spread between Elektrim as way of debt repayment

and Vivendi.

Source: MergerMarket, Factiva

6