Budgeting Exam Review: Sales, Production, & Cost Variances

advertisement

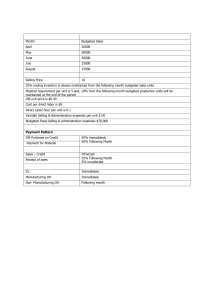

Review for Exam II Problem 1: Quarterly budget preparation • Milo Company manufactures beach umbrellas. The company is preparing detailed budgets for the third quarter and has assembled the following information to assist in the budget preparation: • The Marketing Department has estimated sales as follows for the remainder of the year (in units): July 30,000 August 70,000 September 50,000 October 20,000 November 10,000 December 10,000 • The budgeted selling price of the beach umbrella is $12 per unit. Company aims to maintain finished goods inventory of 15% of the following month’s sales. • Each umbrella requires 4 feet of Gilden and the company’s policy is to maintain 50% of the following month’s production needs (Sometimes it is hard to get this material and hence the hefty amount of inventory). Budgeted purchase price for Gilden is $0.80 per foot. • While the company has a stated inventory policy, because of the uncertainty, the actual inventory can differ. The actual inventory on July 1 for the finished goods and Gilden are 5,000 units and 60,000 feet respectively. • Derive the sales budget, production budget and the purchase budget for Gilden for the 3rd quarter, month by month as well as for the total 3rd quarter. 1 Solution: Sequence matters: Sales budget Production Budget RM budget Sales budget: Units budgeted to be sold Budgeted sales dollars July 30,000 August 70,000 September 50,000 $360,000 $840,000 $600,000 3rd Quarter Production budget: • Use the inventory equation: # of units to be produced = # of units to be sold + Budgeted change in the inventory of finished goods. • # of units to be sold + (15% of next month’s sales - 15% of current sales) • For July # of units of production = 30,000 + (15% of 70,000 – 15% of 30,000) July Budgeted sales units Add: Desired ending inventory Less: Desired beg. inventory Budgeted production units 3rd Quarter 150,000 30,000 August 70,000 September 50,000 10,500 7,500 3,000 3,000 4,500 10,500 7,500 4,500 36,000 67,000 45,500 148,500 RM Budget (output = 1 umbrella; input = 4 feet of gilden) Input output relationship: 1 unit of output requires 4 gilden For July, budgeted consumption of gilden = 36,000 x 4 feet per unit = 144,000 Inventory policy for RM: Ending inventory = 50% of next month’s quantity of gilden to be consumed Budgeted beg inventory of gilden for July = 0.5 x 144,000 = 72,000 Actual inventory of gilden = 60,000 (given data) Budgeted consumption of gilden for August = 67,000 x 4 = 268,000 Budgeted End. Inventory of gilden for July = 0.5 x 268,000 = 134,000 2 Budgeted purchase qty of gilden for July = Budgeted consumption of gilden + budgeted changed of gilden during July Raw materials Budget: Budgeted production units (umbrellas) Budgeted consumption of gilden Add: Desired end. Inventory of gilden Less: Desired beg. Inventory of gilden Budgeted purchase of gilden (in feet) Purchase budget (in $) for gildent July 36,000 August 67,000 September 45,500 3rd Quarter 148,000 144,000 268,000 182,000 592,000 134,000 91,000 37,000 37,000 60,000 134,000 91,000 60,000 218,000 225,000 128,000 569,000 $174,400 $180,000 $102,400 $455,200 3 Problem 2: The FeelGood company manufactures vitamins. Each bottle contains 100 tablets, and each tablet contains 500 mg. of Vitamin C. FeelGood has prepared the following budget for producing one bottle of Vitamin C. Direct Materials 52,500 mg @ $0.0001 per mg Direct Labor 6 minutes @ $12.00 per hour • For the most recent month, FeelGood produced 2,500 bottles of Vitamin C and reported the following variance data: DM price variance $3,000 Favorable DM Qty. variance $1,875 Unfavorable DL price variance $188 Unfavorable DL Qty. variance $180 Favorable • Find the actual quantity of DM used, actual price paid for DM, actual DL hours consumed, actual wage rate for DL. • Also find the total DM, total DL variances. Solution: Step 1: Find the flexible budget for the month Flexible budget should be based on actual output for the month = 2,500 Flexible budget quantity of DM = (2,500 * 52.5gm = 131,250g) Flexible budget cost = (131,250g *$0.1 = $13,125) • Let SQ, AQ, SP, AP represent budgeted and actual quantity and budgeted and actual price of DM respectively. • DM quantity variance = $1,875 U What is the relationship between AQ and SQ? • (AQ- 131,250) X $0.1 = 1,875 AQ = (13,125 + 1,875)/0.1 = 150,000 gms. 150,000,000 gms. • DM price variance = $3,000 F What is the relationship between AP and SP? • ($0.1 – AP) 150,000 = 3,000 AP = $0.08 per gm = $0.00008 per mg. • • Total DM variance = $1,875 U + $3,000 F = $1,125 F This should be the difference between FB DM cost (=$13,125) and actual DM cost (=$12,000) 4 DL cost variances: • Flexible budget for the month based on the actual output for the month: Flexible budget qty 2,500 X 0.1 = 250 hours Flexible budget cost 250 X $12.00 = $3,000 • • • • • Let SH, AH, SR, AR represent budgeted and actual DL hours and wage rate respectively. DL quantity variance = $180 F SH must be greater than AH • (250 - AH) X $12 = 180 AH = 250 – (180/12) = 235 hours DL Rate variance = $188 U AR must be greater than SR • (AR – $12) 235 = 188 AR = $12.80 per DLH. Total DL variance = $180 F + $188 U = $8 U This should be the difference between actual DL cost (=$3,008) and FB DL cost (=$3,000). 5 Problem 3 • Bradshaw Industries makes two varieties – Standard and Deluxe – of one of its products. The following information is available: # of units Standard Deluxe 250,000 50,000 DL hrs. / unit 2 4 Price per unit $14 $18 Var. costs per unit $8 $9 UCM per unit $6 $9 • • The fixed costs for Bradshaw is $1,400,000. Bradshaw is considering a proposal to change the product mix between standard and Deluxe to 1:1 but keep the total units of production at the same level. Required: A) Allocate fixed costs using # of units. Calculate the expected profit under the new product mix. B) Allocate the fixed costs using # of DLH. Calculate the expected profit under the new product mix. C) Which of the two estimates above seem reasonable? Why? Solution First calculate the current operating income Current income = 250,000($6) + 50,000($9) = $1,950,000 - $1,400,000 = $550,000 Compute the fixed cost allocation rate using @ of units as cost allocation driver. • • Fixed cost per unit = $1,400,000/300,000 units = $4.666667 per unit. Notice that since the total # of units don’t change after the product mix change, the total fixed cost (projected based on the above cost allocation rate) will remain the same. Since the new product mix has more units of Deluxe, operating profit will go up. • Profit before product mix change: Profit from Standard = 250,000 ($14-$8) – 250,000($4.666667) = $333,333 Profit from Deluxe = 50,000($18-$9) – 50,000 ($4.666667) = $216,667 Total profit = $550,000 • Operating income with the new product mix = 150,000($6) + 150,000($9) – (300,000) $4.66667 = $850,000 6 Now compute the allocation rate using DL hours. $1,400,000 • Cost allocation rate = • Suppose the fixed costs change when product mix changes. What would be the new level of fixed costs? DL hours after product mix was changed = 150,000 (2) + 150,000(4) = 900,000 hours. In other words, DL hours increase by 28.6% If we believe in a robust relationship between DL hours and fixed costs, then the operating income after product mix has changed can be obtained as: Contribution margin = 150,000 ($6) + 150,000($9) = $2,250,000 Predicted fixed costs = 900,000 X $2 = $1,800,000 Predicted operating income after product mix change = $450,000 • • • 700,000 = $2 per DL hour. Problem 4: Precision Manufacturing Inc. makes two types of hydraulic valves: EX300 and TX500. Relevant data about production and cost are provided below: # of units produced Direct materials cost Direct Labor cost EX200 60,000 $366,325 $120,000 TX500 12,500 $162,500 $42,500 • The company currently allocates overhead cost using direct labor dollars. Implementation of ABC is under consideration. Activity measure Activity Cost Pool (and activity Mfg. OH EX300 TX500 measure) Machining (machine-hours) $198,250 90,000 62,500 Machine hours Setup (setup hours) 150,000 75 300 Setups Product level (# of batches) 100,250 1 1 # of products General factory (Direct Labor 60,125 $120,000 $42,500 dollars) Total mfg. Oh cost $508,625 • • • Use the current allocation method and compute the cost of the products. Use ABC to compute the cost of products. Calculate the extent of over/undercosting under conventional costing system. 7 Solution: Step 1: Calculate product cost under existing system Mfg. OH cost allocation rate under current system = $508,625 $162,500 = $3.13 per DL $ EX300 TX500 Direct Materials $366,325 $162,550 Direct Labor 120,000 42,500 Mfg. OH applied @$3.13 per DL $ 375,600 133,025 $861,925 $338,075 Divide by # of units produced 60,000 12,500 Cost per unit $14.37 $27.05 Step 2: Calculate product cost under proposed system Activity cost pool Machining Setup Product level General factory Cost in the pool $198,250 150,000 100,250 60,125 Direct materials Direct labor Machining Setups Product sustaining General factory Cost per unit Total Activity 152,500 M/c hrs. 375 setup hours 2 products 162,500 DL $ EX300 $366,325 120,000 117,000 30,000 50,125 44,400 $727,850 $12.13 Activity Rate $1.30 per M/c hr. $400 per setup hr. $50,125 per product $0.37 per DL$ TX500 $162,550 42,500 81,250 120,000 50,125 15,725 $472,150 $37.77 8 Problem 5 • Provident Company (PC) has several divisions. Mining division refines toldine which is used as an input by the metal division in the production of an alloy. Metal division sells this alloy to customers @ a price of $150 per unit. Mining division is required to transfer its entire output of 400,000 units of toldine to the metals division @ a transfer price of full manufacturing cost plus 10% markup. Unlimited quantities of toldine can be purchased and sold in the open market at $90 per unit. If the mining division opts to sell toldine in the outside market, it would incur a variable selling cost of $5 per unit. The cost structure for both divisions are provided below: Mining division Metals division Direct material $12 $6 Direct labor 16 20 Variable manufacturing 8 12 overhead Fixed manufacturing 24 13 overhead • The direct material cost for the metals division (given in the table above) excludes the transfer price paid by the metals division to the mining division for todline. A. Compute the transfer price that is used by PC. B. Use the ideal transfer price rule to find the appropriate transfer price that should be used by PC assuming the Mining division can sell a maximum of 760,000 units of todline in external market. i. Assume that the capacity of Mining division is 400,000 units. ii. Assume that the capacity of Mining division is 1,000,000 units. C. Assume that PC follows the full cost plus 10% transfer price and Mining division’s capacity is 2,000,000 units. A customer is approaching the metal division with a special order for a quantity of 100,000 units @ a special order price of $100 per unit. Assume that Metals division has enough capacity to execute this special order and has the authority to make a decision for the special order. Will his decision result in goal congruence? Why or Why not? D. Assume everything as in (C) but transfer price is as per ideal TP rule. Is there goal congruence? 9 Solution: • Characterize the cost details for both divisions: • Variable cost for internal transfer = Variable manufacturing cost for Mining = $12 + $16 +$8 = $36 • Variable cost for Mining for external sales = • Variable cost for Metals (excluding the transfer price) = $6 +$ 20 + $12 = $38 A. Find the transfer price in vogue today: • Full manufacturing cost of todline for the Mining division (for internal transfer) = Variable cost of manufacturing + Fixed manufacturing overhead cost • Transfer price = $60 + 10% of $60 = $66 B. Ideal transfer price = incremental cost of transfer plus opportunity cost of transfer B(i): In part B(i), as per the data in the problem, Mining is operating @ capacity. For every unit of transfer, Mining loses an opportunity to sell todline @ $90 per unit in external market. Incremental cost of transfer = Variable mfg. cost = Opportunity cost of transfer = Ideal transfer price = 10 B. (ii) Incremental cost of transfer is the same as in B(i) = What is the opportunity cost of transfer now? Metals has a capacity of 1,000,000 units and can sell in external market only 760,000. It can transfer up to 240,000 without losing any external sales. If Metals has to transfer 400,000 units internally, then it loses the opportunity of selling 160,000 units in the external market. Opportunity cost of transfer = Average opportunity cost of transfer = Ideal TP = C. Metal division has capacity of 2,000,000 units. After selling 750,000 in external market, it can transfer 400,000 units to Mining without any opportunity cost. In addition, it can transfer 100,000 units required by the special order without any opportunity cost. Let us first evaluate the special order from the perspective of the Metal division manager who has the authority to make this decision. Variable cost of executing the special order = $38 + $66 = $104. What would the Metal division manager decide? Now evaluate the special order from the perspective of Provident Corporation. Variable cost of executing the special order = $36 + $38 = $74 Contribution from the special order = $100 – 74 = $26 per unit incremental profit from the special order = 100,000 ($26) = $2,600,000 Corporation would want the Metals division manager to accept the special order. Is there goal congruence ? 11 D. Ideal TP rule would suggest the following transfer price: TP = outlay cost + opportunity cost = $36 + 0 = $36 Now, the perspective of the Metals division manager would change. The relevant cost of executing the special order = Transfer price for todline + $38 = $74 Notice that the relevant cost of executing the special order from the perspective of the divisional manager converges with the relevant cost of executing the special order from the perspective of the Corporation. Since the special-order price exceeds the relevant cost of special order, Metals division manager would ACCEPT the special order. Goal Congruence WILL OCCUR. 12