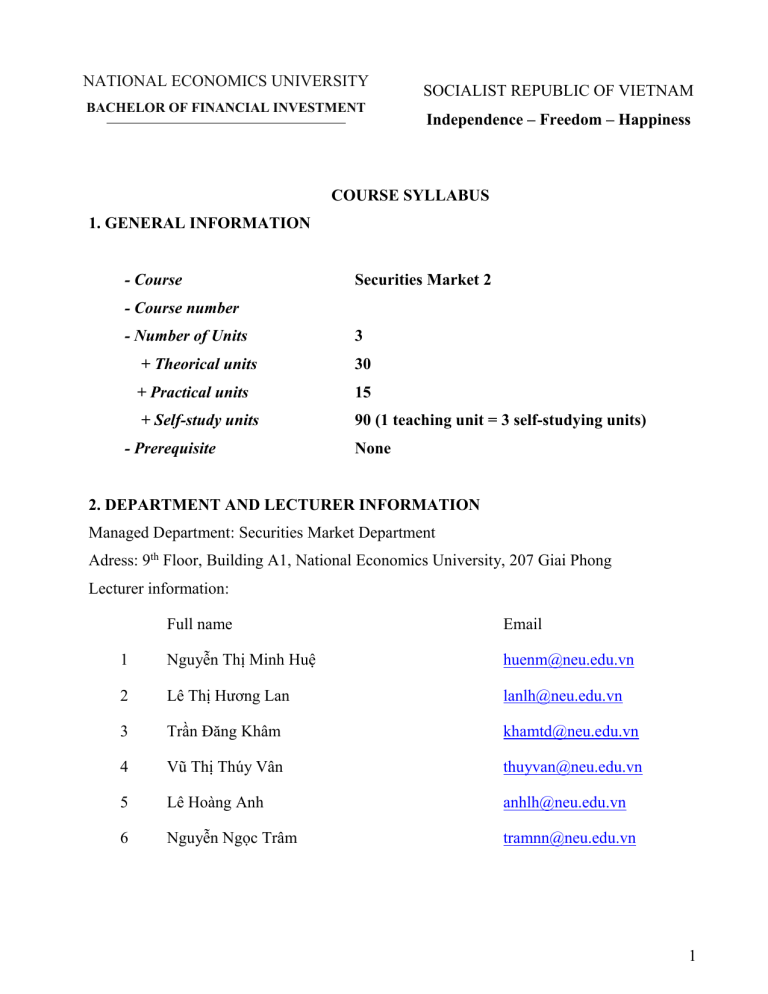

NATIONAL ECONOMICS UNIVERSITY BACHELOR OF FINANCIAL INVESTMENT SOCIALIST REPUBLIC OF VIETNAM Independence – Freedom – Happiness COURSE SYLLABUS 1. GENERAL INFORMATION - Course Securities Market 2 - Course number - Number of Units 3 + Theorical units 30 + Practical units 15 + Self-study units 90 (1 teaching unit = 3 self-studying units) - Prerequisite None 2. DEPARTMENT AND LECTURER INFORMATION Managed Department: Securities Market Department Adress: 9th Floor, Building A1, National Economics University, 207 Giai Phong Lecturer information: Full name Email 1 Nguyễn Thị Minh Huệ huenm@neu.edu.vn 2 Lê Thị Hương Lan lanlh@neu.edu.vn 3 Trần Đăng Khâm khamtd@neu.edu.vn 4 Vũ Thị Thúy Vân thuyvan@neu.edu.vn 5 Lê Hoàng Anh anhlh@neu.edu.vn 6 Nguyễn Ngọc Trâm tramnn@neu.edu.vn 1 3. COURSE DESCRIPTIONS Securities Market 2 is a compulsory module. This module provides specialization knowledge for students of Bachelor of Banking and Finance Program who major in Financial Investment. Securities Market 2 consists of four chapters with the advanced knowledge of securities and securities markets. The course covers issues such as: Monitoring and supervision by government agencies and self-regulatory organizations (SROs) of securities markets; organization and operation of securities companies and securities investment funds; supporting activities before, during, and after securities trading such as the securities depository, registration, clearing, and settlement processes. During this course, students will tackle exercises and analyze case studies that are mentioned at the end of each chapter. Students will learn how to apply theoretical knowledge to solve practical problems in the securities market of Vietnam. After finishing the course, students will be able to: - Understand how government agencies and SROs supervise and monitor securities markets; - Understand how securities trading is monitored and supervised; - Understand the organization and operation of securities companies; - Understand the roles of fund monitoring companies and their basic activities; - Understand the roles of investment funds and how they are operated; - Understand the securities depository, registration, clearing and settlement system and its roles to the securities trading. 4. LEARNING RESOURCES: COURSE BOOKS, REFERENCE BOOKS, AND SOFTWARES - Course book: 1. Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk, Fundamentals of Investing, 13th Edition, Pearson Series in Finance. 2. Alex Kane, Alan J. Marcus Zvi Bodie, Essentials of Investment, Nineth Edition, McGraw- Hill/Irwin - Reference books: 2 J. Cox, R. Hillman, D. Langevoort, A. Lipton, and W. Sjostrom, Securities Regulation: Cases and Materials, Ninth Edition, Wolters Kluwer. He Weiping, The Regulation of Securities Markets in China, Pelgrave Macmillan Alan R Palmiter, Securities Regulation, Seventh Edition, Wolters Kluwer. Niamh Moloney, EU Securities and Financial Markets Regulation, Third Edition, Oxford EU Law Library Bruce Zagaris, International White Collar Crime: Cases and Materials, Cambridge 5. COURSE GOALS Table 5.1. Course goals No. Course Goal Description [1] [2] Program Learning Outcome** [3] Level*** [4] Understand the process of monitoring and apply supervising in securities market G1 G2 PLO 1 PLO 3 Understand the activities and analyse PLO 1 performance of securities companies PLO 3 M M Understand the activities and practice G3 investment strategies of Investment Funds, Mutual Funds PLO 1 PLO 3 R Understand and judge the roles and G4 functions of securities depository and other PLO 1 logistics of securities trading (registration, PLO 3 R clearing, settlement) (I: Introduce; R: Reinforce; M: Master) 3 6. COURSE LEARNING OUTCOMES Table 6.1. Course Learning Outcome (CLO) Course Goals [1] CLOs CLOs Description* [2] [3] G1 Assessment Level** [4] Understand the securities market monitoring, the roles and CLO1.1 functions of Governement Agencies and Self-Regulatory 2 Organization CLO1.2 G2 Understand the securities market supervision: definition, framwork, content, methods 3 CLO2.1 Understand activities of securities companies 3 CLO2.2 Evaluate the business performance of securities companies 3 Understand and distinguish between fund management 3 G3 CLO3.1 company and investment funds; activities of fund management company CLO3.2 G4 CLO 4.1 Understand activities and investment strategies of 3 Understand about the role of the system supporting the 4 investment funds transaction process CLO 4.2 Understand activities include securities registration, 4 depository, clearing, and settlement 4 7. COURSE ASSESSMENT Table 7.1. Course Assessment Assessment methods Description [1] Class Time [2] [3] Class participation Week 1-15 CLOs [4] CLO2.1 Participation CLO2.2 CLO3.1 with the class rules CLO3.2 delineated below. Poor CLO4.1 class attendance, little [6] CLO1.1 Teacher Diary & Interation in class and compliance (%) [5] CLO1.2 on : (i) Class attendance, contribution tage indicators * Participation points will be based on general class Percen Assessment 10% (ii) Interation with teachers (iii) Answer quality CLO4.2 contribution in class or non-compliance with class rules will result in a poor class participation grade. Midterm CLO1.1 Midterm test Assessment at week 7 Midterm Exam and (20%) CLO1.2 Types questions : of short essay, CLO2.1 CLO2.2 Groupworks computation, multiple choice 40% CLO3.1 Group Presentation (20%) CLO3.2 Group presentation CLO4.1 and discussion CLO4.2 5 Final Exam Final exam of 90 minutes. Students have permission to take the final exam when they attend more than 80% of the total classes. Make-up exams will NOT be offered. CLO1.1 CLO1.2 CLO2.1 Types University schedule CLO2.2 questions : CLO4.1 essay, CLO4.2 of short 50% computation, multiple choice Students are allowed to use their textbooks, notes (hard copy). 8. LESSON PLAN Table 8.1. Lesson Plan Reading Week Topic* document* CLOs * [1] 1 2 [2] [3] Learning and teaching Assessment activities *** methods **** [5] [6] [4] CHAPTER 1 – SECURITIES MARKET: MONITORING AND SUPERVISION 1.1. Role of securities market monitoring and supervision 1.2. Securities market monitoring 1 (i) Class 2 Participation CHAPTER 1 – SECURITIES MARKET: MONITORING 1 Textbook, chapter 1 (ii) Interation Student read the required with teachers chapter before the lecture (iii) Answer CLO.1.2 Teacher deliver the quality lecture and handle the CLO.1.1 discusstion 2 CLO.1.1 Textbook, chapter 2 + 3 (i) Class Participation CLO.1.2 Student read the required CLO.2.1 chapter before the lecture (ii) Interation 6 AND SUPERVISION 1.3. Securities market supervision 1.4. Monitoring and Supervision securities market in several countries and in Vietnam 3 Teacher (iii) Answer discusstion quality 1 Textbook, Chapter 3 + 4 (i) Class 2 Student read the required Participation CLO2.1 Group discusstion CLO2.2 5 Group CLO2.1 Presentation CLO2.2 securities companies 2.2. Activities of securities companies chapter before the lecture (ii) Interation Teacher deliver the lecture and handle the discusstion with teachers Textbook, chapter 5 2 CHAPTER 2 – SECURITIES COMPANY 2.1. Overview of the with teachers lecture and handle the 1 4 deliver Teacher deliver the lecture and handle the discusstion Textbook, chapter 6 Student read the required CLO2.1 quality (i) Class Student read the required Participation chapter before the lecture (ii) Interation 1 2 (iii) Answer chapter before the lecture CLO2.2 Teacher deliver the lecture and handle the discusstion with teachers (iii) Answer quality (i) Class Participation (ii) Interation with teachers (iii) Answer quality 7 6 7 8 CHAPTER 2 – SECURITIES COMPANY 2.3. Evaluating the business performance of securities companies 1 (i) Class 2 CLO2.1 CLO2.2 Textbook, chapter 8 Participation Student read the required (ii) Interation chapter before the lecture with teachers Teacher deliver the lecture and handle the discusstion (iii) Answer quality 1 CLO2.1 2 Midterm Exam CLO2.2 Student read the required Participation CLO3.1 chapter before the lecture (ii) Interation Group Discussion CLO3.2 CHAPTER 3 – FUND MANAGEMENT COMPANY AND INVESTMENT FUND 3.1. Definition and activities of fund management company Textbook, chapter 7 Teacher deliver the CLO4.1 lecture and handle the CLO4.2 discusstion (i) Class with teachers (iii) Answer quality 1 (i) Class 2 Participation (ii) Interation CLO2.1 Textbook, chapter 10 with teachers Student read the required (iii) Answer chapter before the lecture quality CLO2.2 Teacher deliver the CLO3.2 lecture and handle the discusstion 3.2. Definition and activities of investment fund 3.3. Classification of investment fund 9 CHAPTER 3 – FUND MANAGEMENT COMPANY AND 1 2 (i) Class CLO2.1 CLO2.2 CLO3.2 Textbook, chapter 12 Participation Student read the required (ii) Interation chapter before the lecture with teachers 8 INVESTMENT FUND 3.4. Entities relating to the organization and operation of investment fund 3.5. Activities of investment funds Teacher deliver the lecture and handle the discusstion 1 Textbook, chapter 11 2 10 CLO2.1 Group Discussion CLO2.2 Textbook, chapter 12 2 11 CLO2.1 Group Presentation CLO2.2 12 quality (i) Class with teachers (iii) Answer quality (i) Class Student read the required Participation chapter before the lecture (ii) Interation CLO3.2 Teacher deliver the lecture and handle the discusstion CHAPTER 4 – SECURITIES DEPOSITORY, REGISTRATION , CLEARING, AND SETTLEMENT 4.1. Overview of securities depository, registration, clearing, and settlement Answer Student read the required Participation chapter before the lecture (ii) Interation CLO3.2 Teacher deliver the lecture and handle the discusstion 1 (iii) with teachers (iii) Answer quality 1 (i) Class 2 Participation Textbook, chapter 12 Student read the required CLO2.1 CLO2.2 chapter before the lecture Teacher deliver the CLO3.2 lecture and handle the discusstion (ii) Interation with teachers (iii) Answer quality 9 13 4.2. Securities depository CHAPTER 4 – SECURITIES DEPOSITORY, REGISTRATION , CLEARING, AND SETTLEMENT 4.3. Securities registration 4.4. Securities clearing and settlement Group Discussion 1 Textbook, chapter 13 2 Student read the required Participation chapter before the lecture CLO2.1 Teacher deliver (ii) Interation the with teachers CLO2.2 lecture and handle the (iii) CLO3.2 discusstion quality 1 CLO2.1 (i) Class 2 CLO2.2 Student read the required Participation 14 Group 1 Presentation 2 15 (i) Class Textbook, chapter 15 CLO3.1 chapter before the lecture CLO3.2 Teacher CLO4.1 lecture and handle the (iii) CLO4.1 discusstion quality Teacher CLO3.1 deliver deliver Answer (ii) Interation the with teachers Answer and (i) Class handle the discusstion Participation CLO3.2 (ii) Interation CLO4.1 with teachers CLO4.1 (iii) Answer quality 9. COURSE REQUIREMENTS AND EXPECTATION 9.1. Class Participation and Interaction Class participation points will be based on general class attendance, contribution in class and compliance with the class rules delineated below. Poor class attendance, little contribution in class or non-compliance with class rules will result in a poor class participation grade. Below are class rules: 10 1. Arrive on time and be seated and ready to begin when the class begins. If you do arrive late for more than 30 minutes, you will not be counted for that class. Note that this class is intended for registered students only. 2. Come prepared – read the readings assigned. 3. Turn off cell phones during classes. 4. Do not engage in individual discussions 5. No food in class time 6. Participate by contributing comments and questions during the discussions. The instructor will call on students during the class if participants do not volunteer. 7. Please use common courtesy and polite manners in class. 8. I have no tolerance for acts of academic dishonesty. 9.2. Student communication Studies show that students who engage in one-on-one discussions with the instructor about the course receive better grades. I, therefore, encourage your discussion with me. You can communicate during office hours, email or in class discussions. You also are welcome to make separate appointments. I will be available before and after class, but only for short questions. I also encourage feedback on the classes, lectures, teaching and reading material. We enhance the class every semester and your thoughts are valuable in the process. LECTURER 11