THE CITY OF DAYTONA BEACH

SPECIAL MEETING - CITY COMMISSION

October 23, 2019

6:00 P.M.

AGENDA

City Hall

City Commission Chambers

Website Address – www.codb.us (City Clerk)

NOTICE - If any person decides to appeal any decision of the City Commission at this meeting, he

will need a record of the proceedings and, for that purpose, he may need to ensure that a verbatim

record of the proceedings is made, which record includes the testimony and evidence upon which the

appeal is to be based. The City does not prepare or provide such a record.

For special accommodations,

please notify the City Clerk’s

Office at least 72 hours in

advance. (386)671-8020

Help for the hearing

impaired is available through

the Assistive Listening

System. Receivers can be

obtained from the City

Clerk’s Office.

In accordance with the Americans with Disabilities Act (ADA), persons needing a special

accommodation to participate in the Commission proceedings should contact the City Clerk's Office

not later than three days prior to the proceedings.

1.

Call to order.

2.

Roll Call.

3.

Development Loan – Affordable Housing Midtown Manor

RESOLUTION APPROVING THE CITY'S COMMITMENT, SUBJECT TO CERTAIN

CONDITIONS, TO GRANT A CONTINGENT LOAN FROM THE CITY OF DAYTONA

BEACH TO MIDTOWN MANOR LIMITED PARTNERSHIP. MIDTOWN MANOR IS AN

ENTITY CREATED BY BENEFICIAL COMMUNITY PARTNERS TO SUPPORT THE

AWARD OF FLORIDA HOUSING AND FINANCE CORPORATION (FHFC) CREDITS TO

BENEFICIAL COMMUNITY PARTNERS FOR THE CONSTRUCTION OF A 4 STORY, 82

UNIT AFFORDABLE HOUSING PROJECT TO BE KNOWN AS MIDTOWN MANOR.

SUBJECT TO COMMISSION APPROVAL THE CITY MANAGER HAS SIGNED THE LOAN

COMMITMENT LETTER. A COPY OF THE LETTER WAS AGREED TO LAST WEEK BY

MIDTOWN MANOR LIMITED PARTNERSHIP. ADDITIONALLY THE CITY WILL ISSUE

DOCUMENTS NEEDED BY MIDTOWN MANOR LIMITED PARTNERSHIP TO PERFECT

THEIR TAX CREDIT APPLICATION TO FHFC.

Recommendation: Adoption of the Resolution.

Action: Motion to adopt the Resolution.

4.

Adjournment.

AGENDA SUMMARY

The City of Daytona Beach

Meeting Date:

10-23-19

First Agenda Action:

10-23-19

DEPARTMENT/DIVISION:

Development and Administrative Services

STAFF CONTACT:

Second Agenda Action:

James S. Morris, Deputy City Manager

ITEM TITLE:

Development Loan - Affordable Housing Midtown Manor

ACTION (check one): Presentation O Discussion Q Resolution [X] Ordinance [~l

Resolution - PUBLIC HEARING Q Ordinance on first reading - PUBLIC HEARING •

IS ITEM BUDGETED: YES |~1 NO 1X1 BUDGETS

TOTAL COST $ 0

VISION PLAN/STRATEGIC PLANNING INITIATIVE: N/A

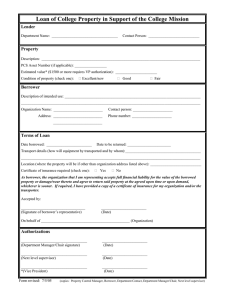

BACKGROUND: The documents attached for City Commission approval addresses the City's commitment,

subject to conditions outlined in the attached documents, to grant a contingent loan from the City of Daytona

Beach to Midtown Manor Limited Partnership. Midtown Manor is an entity created by Beneficial Community

Partners to support the award of Florida Housing and Finance Corporation (FHFC) credits to Beneficial

Community Partners for the construction of a 4 story. 82 unit affordable housing proiect to be known as

Midtown Manor. Subject to Commission approval the City Manager has signed the loan commitment letter. A

copy of the letter was agreed to last week by Midtown Manor Limited Partnership. Additionally the City will

issue documents needed by Midtown Manor Limited Partnership to perfect their tax credit application to FHFC.

STAFF/BOARD RECOMMENDATION: Deputy City Manager reccommends approval.

REVIEWED BY AS REQUIRED:

DEPT./DIVISION HEAD

PURCHASING

LEGAL

DATE:

DATE:

DATE: )Cy3//^

CITY MANAGER

Updated 01/11

The CITY OF DAYTONA BEACH

"THE WORLD'S MOST FAMOUS BEACH"

MEMORANDUM

DATE:

October 21, 2019

TO:

James V. Chisholm, City Mana

FROM:

James S. Morris, Deputy City

SUBJECT:

Development Loan - AffordalHt^Housing Midtown Manor Limited

Partnership

The attached document is a loan commitment letter from the City of Daytona Beach to Midtown

Manor Limited Partnership. Midtown Manor Limited Partnership is an entity created by the

principal of Beneficial Community Partnership to construct the Midtown Manor Apartments.

For reference the proposed project is a 4 story, 82 unit building with amenities. The use was first

allowed by the Midtown Lofts PD. The PD was approved in 2017. At the October 16, 2019

Commission meeting the Commission extended the deadline provisions of the Midtown Lofts

PD (which will govern construction of the Midtown Manor building) to October 15, 2020.

The principal conditions or contingencies set out in the commitment letter are as follows:

In the event Midtown Manor Limited Partnership is awarded tax credits from FHFC, the City

loan in the amount of $425,625.00, which is for the limited period of six (6) months, will not

be funded until:

1. A final certificate of occupancy (CO.) is issued for the 82 unit building and

related accessory structure

2. A second mortgage from Midtown Manor Limited Partnership to the City is

executed for use at the loan's closing and to be recorded in the Public Records of

Volusia County.

3. A portion of the Developer's Fee to be recovered by the Developer in the sum of

$425,625.00 will be assigned to the City as additional collateral for the loan. The

assignment is in lieu of meeting staffs previous request that Beneficial or its

successor entity assign FHFC tax credits to the City as additional collateral for the

$425,625.00 loan. Upon loan repayment to the City, the City will:

a. Satisfy the second mortgage held in its favor,

b. Release the Developer from the pledge of the Developer's Fee

c. Authorize release of the escrowed Developer's Fee held as additional

security.

Planning Department • P.O. Box 2451. Daytona Beach. Florida 321 15-245 1

www.codb.us

380 671-802D

./•

The intent of the documents and promises contained therein is to allow a proper sequence

of events to occur before the City's funds may be committed or released with assurance

they will be repaid. First the tax credit must be awarded, next the building should be

finished to allow a final CO.

Finally, when the loan is repaid the City will issue documents (satisfaction of mortgage)

and release of developer's fee assignment to reflect the repayment of the City and release

of liens etc... in favor of the City.

Planning Department • P.O. Box 2451. Daytona Beach, Florida 321 15-245

www.cixlb.Lis

3No 671-8020

The CITY OF DAYTONA BEACH

"THE WORLD'S MOST FAMOUS BEACH"

October 21. 2019

Mr. Ken Bowron

Beneficial Community Partners

1990 Main Street, Ste. 750

Sarasota, FL 34236

Re:

Midtown Manor Redevelopment - Revised Loan Commitment

Dear Mr. Bowron:

The purpose of this revised letter is to set forth the agreed-upon terms pursuant to which the

City of Daytona Beach ("City") will agree to loan Beneficial Community Partners

("Borrower") the sum of $425,625 (the "Loan Principal" or "Principal"), for Borrower's use

in defraying or financing Borrower's costs to develop an 82 unit affordable apartment housing

complex (the "Development"), on approximately 2.7 acres of real property (the "'Property"), at

223 Martin Luther King Boulevard, Daytona Beach Florida. The Property is generally

described on Exhibit A; provided, however, that at Closing the description of the Property

may be revised as needed to include any other parcels or lots that comprise the Development.

This letter supersedes and replaces the previous letter dated October 17, 2019.

The terms and conditions are as follows:

1. Term of Loan: The Loan Term shall commence at the Time of Closing provided below, and

end 180 days thereafter. The end of the Loan Term is referred as the "Loan Payoff Date."

2. Interest. Interest will accrue on the unpaid portion of the Principal from the Time of Closing

until paid, at the rate of 3% per annum.

3. Repayment. On the Loan Payoff Date and without need for prior invoice by the City, the

Borrower shall repay the City the Principal, plus accrued interest. No partial repayments will

be due prior to that date.

James Morris, l)eput\ ( il\ Manager Development & .VdminUiraitve Services

momsjames a codkus

o Hojc2451 • Davtuna Beach. Fl

32!!--245 I • Phone 3Xf>-^"?l-X|21 • lax 3X6-67i-NI30«

4. Verification of Loan. Upon Borrower's request. The City shall agree to execute a

verification of loan required by Florida Housing Finance Corporation ("FHFC") in order for

the Borrower to receive an FHFC Tax Credit Allocation, if consistent with the terms and

conditions herein.

5. Security and Related Obligations.

a. The City shall have a security interest on the Property in the form of a mortgage, which

Borrower shall sign at Closing, and which shall recorded in the public records of Volusia

County at Borrower's cost The form of the mortgage shall be provided by or acceptable to

the City. City acknowledges that Borrower intends to secure a primary loan ("Primary Loan")

from a commercial lending institution ("Primary Lender") to finance the cost of the

Development. The City will subordinate its mortgage to the mortgage interest to the Primary

Loan, provided, that the terms and conditions of the Primary Loan are reasonably acceptable

to the City; and, provided, further, thatunless waived by the City, the combined loan-to-value

("LTV") of the Primary Loan andthe loan provided for herein, will not exceed 80% of the fair

market value ofthe Property upon completion of the Development.

b. In addition, repayment of the loan provided for herein shall be a personal obligation of the

Borrower. Borrower shall execute a promissory note in a form acceptable to the City.

c. In addition, Borrower shall providethe City a personal guarantee of repayment("Guarantee")

from a member, officer, or partner of Borrower, or other organization or individual

(ctGuarantor"). The proposed Guarantor selected by Borrower is subject to the City's prior

approval based on the proposed Guarantor's ability to meetthe obligations ofthe Guarantee.

d. In addition, Borrower, by and through its managing member or officer, shall pledge and

secure $425,625 of the Developer Fee that Borrower is entitled to retain/receive in association

withthe Development pursuant to Borrower's partnership documents, as a source of funds for

repaying the loan. Borrower shall place such portions of the Developer's Fee as they are

received by or paid to Borrower in accordance with Borrower's partnership documents, in

escrow by an attorney or title company mutually agreed to by the City and the Borrower, in an

amount sufficient to secure repayment of the loan.

6. Pre-Closing Obligations. Prior to Closing, Borrower will complete each of the following

Pre-Closing Obligations:

a. During the 2019 calendar year, Borrower will apply to the FHFC for affordable housing tax

credits for the Development.

b. Borrower will promptly notify the City upon Borrower's receipt of notice from the FHFC that

FHFC has awarded tax credits of approximately $15.2 Million associated with the

Development. This loan commitment will terminate automatically if Borrower fails to receive

a Tax Credit Allocation from FHFC on or before June 30,2020.

c. Borrower will take title to the Property in fee simple, free of defects, encumbrances, rights of

purchasers, exceptions, restrictions, or easements, except as approved by the City. Borrower

will provide proof of such title to the City, such as via a property information report.

d. Borrower will complete the Development and receive a Certificate of Occupancy ("CO").

Partial or Temporary CO's shall not be sufficient for disbursement of funds from the City. In

addition, Borrower shall provide the following to the City after the CO is issued:

(i)

A certified ALTA survey of the boundaries of the Property, showing the location of all

improvements comprising the Development.

Page 2 of6

(ii)

Written proof that the value of the total development cost equals or exceeds

$15,000,000. Acceptable forms of proof include a letter from the project architect, certifying

the construction value of the improvements; a letter from an MAI certified appraiser, or any

other form of proof reasonably acceptable to the City Manager for the City,

e. Borrower, and Borrower's guarantors) as referenced below, shall provide the City with

current financial statements. The financial statements shall be prepared in accordance with

generally accepted accounting principles and shall be in a form acceptable to City and

certified by the affidavit of the person or entity which is the subject of each financial

statement. The City shall have the right to terminate any the loan commitment if the financial

statements do not comply with these requirements or if the financial statements provide the

City a reasonable basis for concern that Borrower or Borrower's guarantor(s) will not be able

to meet their respective guarantee obligations.

7. Closing:

a. Time of Closing. The Time of Closing will be scheduled within a reasonable time after the

Certificate of Occupancy (CO.) has been issued for the Development, provided that Borrower

has completed all other Pre-Closing Obligations referenced above.

b. Closing Requirements. At Closing, Borrower will be required to execute the mortgage and

promissory note, and provide the Guarantee referenced above. The City may also require

Borrower to execute additional documents, such as an escrow agreement and affidavits, to

ensure that the other conditions referenced herein (such as Pre-Closing Obligations) are met

8. Correctness/Accuracy: The City's loan is subject to and conditioned upon the continued

correctness of the information contained in the financial statements, applications,

presentations to City, and all other documents submitted to City, and upon which the loan and

the required FHFC Verification of Contribution are predicated. The loan is further

conditioned upon there being no concealmentof material facts which would cause the City to

refuse the loan, or make a loan on substantially different terms.

9. Assignability:

Neither the FHFC Verification of Contribution nor the loan shall be

assignable, nor shall Borrower have any right to designate a payee of the loan proceeds,

without the City's actual, intended prior approval. Any attempt at assignment without such

prior approval shall be void.

10. Organizational Documents: The loan is conditioned upon Borrower supplying City with

true and correct copies of the partnership agreement of Beneficial Community Partners and

the City's approval of the terms and conditions thereof. In the event that the partners of the

partnership are corporate entities, this commitment is further conditioned upon Borrower

supplying the City with true and correct copies of the partner's articles, bylaws, minutes of

meetings and such other documents and agreements necessary to evidence the partner's good

standing and authority to enter into the loan.

11. Personal Guarantees: An officer/partner of Borrower shall execute a personal loan

guarantee in favor of City upon terms and conditions satisfactory to City. The person

designated by Borrower must be reasonable satisfactory to the City.

Page 3 of6

12. Funding: Disbursement of funds to Borrower shall occur after issuance of the Certificate of

Occupancy to Borrower.

13. Additional Funding: The loan is conditioned upon Borrower obtaining from the Primary

Lender a title commitment for the loan upon terms and conditions satisfactory to City.

Borrower shall provide City with satisfactory evidence that the loan fees and other costs for

such title commitment have been paid and that such commitment is in full force and effect and

will remain in full force and effect until completion ofthe Development.

14. Documentation: The loan is conditioned upon due execution, acknowledgment and delivery

to the City of all documents referred to herein in form and substance acceptable to the City

and such other instruments or documents as the City may require to fully evidence and

document the loan, perfect the City's security interest thereunder, and provide for the required

guarantee. Such documents and instruments shall be legal, valid and enforceable against the

parties to be bound thereby, be in a form approved by the City and its counsel and shall

contain such additional terms, conditions and provisions as the City may require.

15. Occupancy Restrictions: The Development shall be used to accommodate households

meeting the standards of the FHFC for affordable housing for a period of at least 50 years

from the date of completion.

16. Rent Restrictions: Charges for rent and all other terms shall conform to the affordable

housing standards required by FHFC/HUD for a period of at least 50 years from the date of

completion.

17. Borrower Expenses: Borrower shall pay all fees associated with the loan closing. Such fees

shall include, but not be limited to, mortgagee title insurance policy naming the City as

insured, recording fees, appraisal fees (at City's sole discretion), survey fees, City's attorney

fees, closing fees charged by closing agent

18. Insurance: Borrower shall provide proof of insurance to City, with coverage types and

amounts sufficient to protect the City's mortgage interest.

19. Termination of Existing Tax Incentive Agreement/Waiver: The loan and issuance of the

FHFC Verification of Contribution is contingent on the execution of an agreement, to be

hereafter provided by the City, between the City/CRA and the existing property owner, Heron

Development, Inc., or its successors and assigns (collectively referred to herein as "Heron"),

terminating the Tax Incentive Agreement approved by City Resolution Number 16-250.

As a further inducement to the City to make the loan, Borrower represents and warrants that

neither Borrower nor Borrower's partners, members, officers, affiliates, or subsidiaries has

entered into any arrangement with Heron for the assignment of Heron's rights under the Tax

Incentive Agreement; and Borrower hereby waives any such rights.

20. Performance Bonds: The loan is conditioned upon performance bonds in the fiill amount of

the construction contract issued by a surety upon terms and conditions satisfactory to City and

upon the surety under such bonds naming the City as additional obligee thereunder.

Page 4 of6

21. Prior Negotiations: All prior negotiations, commitments, agreements, representations and

warranties, if any, made by the City are deemed superseded hereby and are of no force and

effect unless specifically set forth herein.

22. City's Right to Terminate: City reserves the right to cancel this Memorandum of

Understanding and terminate any obligations hereunder, upon the occurrence of any of the

following events:

a. Borrower is unable to complete all Pre-Closing Obligations within the time required, or

refuses to execute one or more documents required at Closing.

b. Borrower's failure or inability to comply with any of the terms of this Memorandum of

Understanding.

c. The filing by or against Borrower or any Guarantor of a petition in bankruptcy or insolvency

or for recognition or the appointment of a receiver or trustee, or the making by Borrower or

any Guarantor of an assignment for the benefit of creditors, or the filing of a petition for

arrangement by Borrower or Guarantor.

d. A default by Borrower regarding any other mortgage and/or construction loan encumbering

the secured property described above.

e. The failure of Borrower to disclose to the City all information material to the loan or the

Development and the improvements, or the misrepresentation by Borrower of any material

fact relating to the loan, the Development, the improvements or the financial condition of

Borrower or any Guarantor.

f. Any financing encumbering the Security property described above other than the anticipated

Primary Loan referenced above.

23. Limitations on Source of Funds. The loan provided for herein shall not be considered a debt

obligation of the city within the meaning of any constitutional or statutory provision or

limitation. The City's obligation to fund the loan provided for herein is a limited obligation of

the City, and neither the full faith and credit nor the taxing power of the City is pledged as

security for this obligation. The City's funding of the loan is subject to budgeting in the fiscal

year in which the loan must be paid.

24. No Third Party Beneficiaries. There are no third party beneficiaries, and no party shall have

any rights with regard to or arising out of this commitment except for the City and Borrower.

25. Police Powers. Nothing herein shall be construed as a waiver of, or contract, with respect to

the regulatory and permitting authority of the City under applicable laws, rules, and

regulations. Further, nothing herein contained shall be construed as a waiver by the City of its

sovereign immunity under the constitution and laws of the State of Florida.

26. General Provisions: This commitment cannot be amended or otherwise changed unless in an

instrument in writing signed by all parties. This commitment and all documents, instruments

and performance hereunder shall be construed under the laws of the State of Florida.

Paragraph headings have been included solely for convenience and shall not be deemed a part

of this commitment for any purposes relating to interpretation or construction of its terms. In

the event of any litigation between the parties with respect to this commitment or the

transaction contemplated hereunder, including but not limited to an action to interpret or

Page 5 of6

enforce the terms of this commitment, all parties agree that the exclusive jurisdiction and

venue shall be in Volusia County. Florida. By accepting this commitment you irrevocably

consent to submit to the jurisdiction of Volusia County. When requested to do so. Borrower

will execute and deliver any requested further documents as may be deemed necessary in

order to carry out the intent of this commitment.

The Development must comply with all applicable City codes, standards and current zoning

requirements. The Development must also comply with affordability requirements as defined

in grant from FHFC.

Borrower is expected to be adequately represented by its own legal counsel. Conditions stated

herein may be changed only by the prior written consent of both of the parties to this letter.

If these terms and conditions are acceptable to you. please sign below where indicated.

Regards.

w*<[vL

James V. Chisholm,

.ity Manager

On behalf of Beneficial Community Partners. I have reviewed the terms and conditions of this

loan commitment and they are acceptable.

Date signed:

Printed Name: <ffejf\ 2<fi(snm Tfs-

Title:

t^a&tC

Pane 6 of 6

/£>/rJ //9

State ofFlorida

Department ofState

I certify from the records of this office that MIDTOWN MANOR LIMITED

PARTNERSHIP is a limited partnership organized under the laws of the State of

Florida, filed on September 30, 2019.

The document number of this limited partnership is A19000000426.

I further certify that said limited partnership has paid all fees due this office

through December 31, 2019 and that its status is active.

I further certify that said limited partnership has not filed a Certificate of

Withdrawal.

Given under my hand and the

Great Seal ofthe State ofFlorida

at Tallahassee, the Capital, this

the Sixteenth day of October, 2019

Secretary ofState

Tracking Number: 6360120439CU

To authenticate this certificate,visit the following site,enter this number, and then

follow the instructions displayed.

https://services.sunbiz.org/Filings/CertificateOfStatus/CertificateAuthentication

9/30/2019

4:10:35

PM

PAGE

2/004

Fax

Server

Electronic Filing Cover Sheet

Note: Please print this page and use it as a cover sheet. Type the fax uutlil

number (shown below) on the top and bottom ol'all pages of (lie document.

>«.'•

(((HI 900029 1388 3)))

i—>

. —

»~0

IIIIMIIIIIIIIIIIDlMlllllllllllllllllllllllllllll

oo

m

ItII*,"'>'

m

f(190 0029-13880ADC8

CD

-Jy. 'J.

tirr.

—o

CO

o

-

Note: DO NOT hit the UliFRKSH/RlSLOAD button on your browser from cHlsii

page. Doing so will generate another cover sheet,

^* ~ ;

__

en

cj_

Division ot Corpora*;ions

Kax

C-

Mumbor

:

(850)617-6393

t'i o~i:

CO

r\.

t.i :

Account

Narp.o

NELSON

Account

Number

120I60C0OO01

Phone

ea*j

Fa x

Nuir.bG r

MULL INS

RII.F'.Y

SCARBOROUGH

!.J,P

(4n7) 329-4277

(407)839-42<J<

'Entice the ema i 1 nddiT.sa nor this business entity lo bo used for future

annua I reporz m.ill.tnns. Krvtor only one email adiiiess please.*"

Eniail

\CucU^\&Detnd(c\gIcoirvi. CQhq

Addcass:

FLORIDA/FOREIGN U7IXLP

Midtown Manor Limited Partnership

Certificate of Status

i

Certified Copy

1

|Pagc Count

|]istimated Charge

1

02

|| 51,061.25

|

^k#K. vik <*

YSCOTT

-ww-i zoo

Electronic Filing Menu

Corporate Tiling Menu

hltps://elile.sunbi7..org/scripts/cfi Icovi'.CXC

Help

9/30/2019

Broad

and

Cassel

9/30/2019

4:10:35

PM

PAGE

3/004

Fax

Server

CBttTTFICATEOF LIMTIED PARTNKRSHIP

OF

MIDTOWN MANOR LIMITED PARTNERSHIP

Pursuant to ilic authority of Section 620.1201, Florida Statutes, the undersigned, constituting

the sole general partner of* MIDTOWN MANOR LIMITED PARTNERSHIP (the "Partnership"),

hereby submits the following in connection with (he fonimliou of the Partnership:

1. The name of the Partnership shall be Midtown Manor Limited Paitaorrthip (lht£

"Partnership").

2.

r- r-

ZB

The address of the initial office where records shall be kepi shall be 2 N.ilamiamib

Trail, Suite SOO, Sarasota, Florida 34236. The name and address of the initial regtstered^agent foco

service of process is Beneficial Communities, LLC, 2 N. Tttmiumi Trail, Sxiito SOO, jSarasota'p'

Florida 34236.

3.

n(,

-o

The names and initial business address of the General Partner is:

S^.

en

MIDTOWN MANOR CP LLC, a

on-,

—

Florida limited liability company

"

2 N. Tamiatni Trail, Suite 800

Sarasota, Florida 34236

4.

The initial mailing address of the limited pailnerslup is 2 N. Tmnmmi Trail, Suite

800, Sarasota. Florida 34236.

5.

The Partnership hereby eleets to not be a limited liability limited partnership.

This Certificate has been executed by the undersigned as ofthc30 day of•Apt MX', 2019.

GENERAL. PARTNER:

MIDTOWN MANORGP LLC, a Florida limited

liability company

Donald W. Paxton, Manager

Broad and Cassel

9/30/2019 4:10:35 PM

PAGE

4/004

Fax Server

ACKNOWLEDGEMENT OF REGISTERED AGENT

Having been designated as the Registered Agent for MIDTOWN MANOR LIMITED

I'ARTNJiRSl UP, the undesigned hereby uccepls the designation and agreesto act as {he Registered

Agent of said limited partnership and states that it is familiar with and accepts its statutory

obligations as such.

BENEFICIAL COMMUNITIES, LLC, a Florida

limited liability company

3>c-.

r~r-i

By:

/

p>^

Donald W. Paxton, Sole Member ^Cor"

co --.

«^=>

<£

'""O

co

o

jh

Dated the.^O day of ty^&ftbfY .2019.

o-

t7

2 in

en

On-.

—

5>