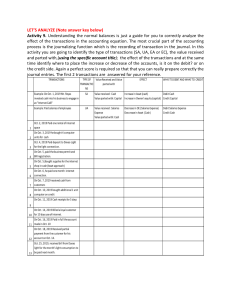

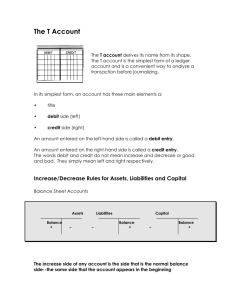

CHAPTER 3 Double-Entry Accounting and the Accounting Cycle (LO1): Explain how the double-entry accounting system works, including how it overcomes the limitations of the template approach. The double-entry accounting system is a fundamental framework used in accounting to record financial transactions. It addresses the limitations of the template method, especially when dealing with a large number of accounts and transactions. Key Points: 1. Basic Principle: - Each transaction is recorded in a way that affects at least two accounts. - The transaction amount is recorded twice, resulting in equal and offsetting effects. 2. Historical Context: - The double-entry system has been in use for over 700 years. - First documented in 1494 by Luca Pacioli in his book "Summa de Arithmetica, Geometria, Proportioni et Proportionalità." - Pacioli is known as the "Father of Accounting." 3. Overcoming Template Method Limitations: - The template method is adequate for small entities but becomes cumbersome with a large number of accounts. - The double-entry system allows for the use of hundreds or thousands of accounts, overcoming limitations in capturing detailed information. Computerized Accounting Systems: ➢ Most companies use computerized accounting systems. ➢ Integration with ERP systems allows for a broader analysis of data across various business processes. ➢ Regardless of the system type, the principles of the double-entry accounting system and the accounting cycle are followed. 3.2 Normal Balance This illustrates the normal balance concept. Basically, accountants say that accounts on the left side of the T (asset accounts) normally have a debit balance, while accounts on the right side of the T (liabilities and shareholders’ equity accounts) normally have a credit balance. KEY POINTS ➢ Asset accounts normally have a debit balance. ➢ Liabilities and shareholders’ equity accounts normally have a credit balance. Using the normal balance concept, we can determine whether an account normally has a debit or a credit balance. Once we know this, we will use the account’s normal balance to increase it and do the opposite to decrease it. 1. Cash Account (Asset): Normal Balance: Debit Increase in Cash: Record a debit. Decrease in Cash: Record a credit. End of Period Expectation: Net debit balance. 2. Accounts Payable (Liability): Normal Balance: Credit Increase in Accounts Payable: Record a credit. Decrease in Accounts Payable: Record a debit. End of Period Expectation: Net credit balance. 3. Abbreviations: DR and CR: Debit Abbreviation: DR (from "debitor" or "debtor"). Credit Abbreviation: CR (from "creditor"). Common Usage: Accountants use DR and CR to denote debits and credits, respectively. 6. Normal Balances of Special Accounts: Revenue Accounts: Credit balance (credited to increase). Expense Accounts: Debit balance (debited to increase). Dividends Declared: Debit balance (debited to decrease). 7. Calculating Retained Earnings: ➢ Formula: Retained Earnings = Opening Retained Earnings + Net Income - Dividends Declared. ➢ Impact on Retained Earnings: Revenues increase, expenses decrease, and dividends declared decrease Retained Earnings. 3.3 The accounting cycle The accounting cycle is a systematic process that allows businesses to measure, record, summarize, and communicate financial information. Here are the key steps in the accounting cycle: 1. Opening Balances: Objective: Begin with the balances from the previous accounting period. Process: Carry forward balances from the end of the previous period to the start new period. 2. Transaction Analysis: Objective: Analyze and understand the financial impact of transactions. Process: Examine business transactions to identify accounts affected and the nature of the impact (increase or decrease). 3. Recording Transactions in General Journal: Objective: Record transactions in chronological order. Process: Use a general journal to document transactions, indicating accounts affected, amounts, and nature of the transactions. 4. Journal Entries are Posted to the General Ledger: Objective: Transfer information from the general journal to individual accounts. Process: Post entries to the general ledger, updating specific accounts with transaction details. 5. Trial Balance is Prepared: Objective: Verify that debits equal credits. Process: Summarize all ledger account balances to ensure that total debits equal total credits. 6. Adjustments are Journalized and Posted: Objective: Make necessary adjustments for accruals, deferrals, and estimates. Process: Analyze and record adjusting entries to reflect the accurate financial position. 7. Adjusted Trial Balance is Prepared: Objective: Verify that debits still equal credits after adjustments. Process: Summarize adjusted balances to confirm the equality of debits and credits. 8. Financial Statements are Prepared: Objective: Summarize financial information for reporting. Process: Use adjusted trial balance to prepare financial statements, including the income statement, statement of retained earnings, and balance sheet. 9. Closing Entries are Journalized and Posted: Objective: Close temporary accounts and transfer balances to retained earnings. Process: Journalize and post closing entries to reset temporary accounts to zero balances and update retained earnings. 3.4 Understanding the Chart of Accounts The list of all of a company’s accounts is known as its chart of accounts. An example of a company’s chart of accounts Can Companies Change Their Chart of Accounts and What Are the Implications if They Do? Yes, companies can and do make changes to their chart of accounts. Companies can add new accounts when they enter new types of operations, open new locations, wish to capture information at a different level of detail, and so on. They can also delete accounts that are no longer required. Changes to permanent accounts (assets, liabilities, and shareholders’ equity accounts) within the chart of accounts can be made anytime. However, changes to temporary accounts (revenue and expense accounts) are generally made only at the beginning of an accounting period. This is because management normally wants to capture annual data related to the company’s revenues and expenses. Introducing new revenue and expense accounts during a cycle would require the company to go back and adjust the accounting for any such revenues or expenses already recorded in the period or else it would have incomplete information. 3.5 OPENING BALANCE Permanent VS Temporary Accounts – Permanent accounts: accounts whose balances carry over from one period to the next. All statement of financial position accounts are permanent accounts, i.e., assets, liabilities, and shareholders’ equity accounts are permanent accounts - Temporary Accounts: accounts used to keep track of information temporarily during each accounting period. The balances in these accounts are eventually transferred to a permanent account (retained earnings) at the end of the period by making closing entries. Revenue, expenses, and dividends declared accounts are temporary accounts. 3.6 Transaction Analysis and Recording ➢ Definition: Transaction analysis is a crucial step in the accounting cycle, involving the identification and evaluation of the effects of an event or transaction on the company's accounts. ➢ Source Documents: Evidence of a transaction is typically derived from source documents such as invoices, cheques, cash register tapes, bank deposit slips, time sheets, and shipping documents. The initial entries are usually made in the general journal. The journal is a chronological listing of all the events that are recorded in the accounting system. It is like the diary or travel journal that many people keep of their daily life or travels. A journal could be as simple as a book in which a chronological list of transactions is recorded, but most organizations’ journals are computerized. Each entry in the journal shows the effects of a transaction on the company’s accounts and is called a journal entry. 3 GOLDEN RULE 1. DEBIT THE RECEIVER CREDIT THE GIVER 2. DEBIT WHAT COMES IN CREDIT WHAT GOES OUT 3. DEBIT ALL EXPENSES AND LOSSES & CREDIT ALL INCOMES & GAINS JOURNAL ENTRIES Transaction 1: Issuing Shares for Cash - Description: SCL issued 10,000 common shares in exchange for $250,000 cash. - Effects: - Assets: Cash increased by $250,000. - Shareholders’ Equity: Common Shares increased by $250,000. - Journal Entry: - Jan. 1 - DR Cash $250,000 - CR Common Shares $250,000 Transaction 2: Taking Out a Bank Loan - Description: SCL borrowed $100,000 from its bank, payable in three years, with a 6% annual interest rate. - Effects: - Assets: Cash increased by $100,000. - Liabilities: Bank Loan Payable increased by $100,000. - Journal Entry: - Jan. 1 - DR Cash $100,000 - CR Bank Loan Payable $100,000 Transaction 3: Paying Rent for the Month - Description: SCL paid $1,100 in rent for January. - Effects: - Assets: Cash decreased by $1,100. - Expenses: Rent Expense increased by $1,100. - Journal Entry: - Jan. 1 - DR Rent Expense $1,100 - CR Cash $1,100 Transaction 4: Purchasing Equipment - Description: SCL paid $65,000 to purchase equipment. - Effects: - Assets: Equipment increased by $65,000. - Assets: Cash decreased by $65,000. - Journal Entry: - Jan. 1 - DR Equipment $65,000 - CR Cash $65,000 Transaction 5: Purchasing Insurance Coverage - Description: SCL paid $1,800 cash for a one-year insurance policy. - Effects: - Assets: Prepaid Insurance increased by $1,800. - Assets: Cash decreased by $1,800. - Journal Entry: - Jan. 1 - DR Prepaid Insurance $1,800 - CR Cash $1,800 Transaction 6: Purchasing Land - Description: SCL purchased land for $180,000. - Effects: - Assets: Land increased by $180,000. - Assets: Cash decreased by $180,000. - Journal Entry: - Jan. 6 - DR Land $180,000 - CR Cash $180,000 Transaction 7: Purchasing Inventory - Description: SCL bought $23,000 of inventory on account. - Effects: - Assets: Inventory increased by $23,000. - Liabilities: Accounts Payable increased by $23,000. - Journal Entry: - Jan. 10 - DR Inventory $23,000 - CR Accounts Payable $23,000 Transaction 8: Selling Products to Customers - Description: SCL sold products for $34,000; $21,000 received in cash, and the rest on account. - Effects: - Part 1: - Assets: Cash increased by $21,000. - Assets: Accounts Receivable increased by $13,000. - Revenues: Sales Revenue increased by $34,000. - Part 2: - Assets: Inventory decreased by $17,000. - Expenses: Cost of Goods Sold increased by $17,000. - Journal Entry: - Jan. 12 - Part 1: - DR Cash $21,000 - DR Accounts Receivable $13,000 - CR Sales Revenue $34,000 - Part 2: - DR Cost of Goods Sold $17,000 - CR Inventory $17,000 Transaction 9: Collecting Payments from Customers - Description: SCL received $11,000 from customers as payments on their accounts. - Effects: - Assets: Cash increased by $11,000. - Assets: Accounts Receivable decreased by $11,000. - Journal Entry: - Jan. 20 - DR Cash $11,000 - CR Accounts Receivable $11,000 Transaction 10: Paying Suppliers - Description: SCL made payments of $13,500 to suppliers. - Effects: - Assets: Cash decreased by $13,500. - Liabilities: Accounts Payable decreased by $13,500. - Journal Entry: - Jan. 22 - DR Accounts Payable $13,500 - CR Cash $13,500 Transaction 11: Paying Utility Costs - Description: SCL paid monthly utility costs of $1,900. - Effects: - Assets: Cash decreased by $1,900. - Expenses: Utilities Expense increased by $1,900. - Journal Entry: - Jan. 25 - DR Utilities Expense $1,900 - CR Cash $1,900 Transaction 12: Paying Advertising Costs - Description: SCL paid advertising costs for the month of $2,200. - Effects: - Assets: Cash decreased by $2,200. - Expenses: Advertising Expense increased by $2,200. - Journal Entry: - Jan. 26 - DR Advertising Expense $2,200 - CR Cash $2,200 Transaction 13: Paying Wages to Employees - Description: SCL paid $2,900 in wages for January. - Effects: - Assets: Cash decreased by $2,900. - Expenses: Wages Expense increased by $2,900. - Journal Entry: - Jan. 28 - DR Wages Expense $2,900 - CR Cash $2,900 Transaction 14: Declaring and Paying Dividends - Description: Dividends of $400 were declared and paid. - Effects: - Assets: Cash decreased by $400. - Shareholders’ Equity: Dividends Declared decreased by $400. - Journal Entry: - Jan. 31 - DR Dividends Declared $400 - CR Cash $400 The general journal contains detailed information on each transaction. The general ledger contains summary information for each account. Luca Pacioli referred to the ledger as the quaderno grande, which translates into the “big book.” The French term for the general ledger is grand livre, which also translates as “big book.” Thinking of the general ledger as the big box of cards or the big book is useful as we learn about smaller boxes of cards or smaller books as we move though subsequent chapters. These smaller boxes of cards or smaller books are known as subledgers. When posting has been completed, each transaction has been recorded twice, once in the general journal and again in the general ledger. TRIAL BALANCE The trial balance is a listing of all the account balances in the general ledger at a specific point in time. The final balances of each account are listed, with the accounts having final debit balances in one column and accounts having final credit balances in another. A check can then be done to ensure that the total of all accounts with debit balances equals the total of all accounts with credit balances. If these amounts are not equal, an error has been made in the journal entries or the posting process. It must be found and corrected before proceeding. The purpose of a trial balance is to assist in detecting errors that may have been made in the recording process. Something is wrong if the ledger does not balance; that is if the total of all the accounts with debit balances does not equal the total of all the accounts with credit balances. In such cases, there is no point in proceeding until the errors have been found and corrected. This makes the preparation of a trial balance a useful step in the accounting cycle. However, it is important to realize that the trial balance will not identify all types of errors. For example: ➢ The trial balance will still balance if the correct amount was debited or credited, but to the wrong account; for example, if a purchase of equipment was debited to the Inventory account, rather than to the Equipment account. ➢ The trial balance will still balance if an incorrect amount was recorded. An example is if a $450 transaction was recorded as a $540 transaction, for both the debit and credit portions of the entry. ➢ The trial balance will also not detect the complete omission of an entire journal entry. If neither the debit nor the credit portions of a journal entry were posted, the totals on the trial balance will still be equal. Adjusting Entries Purpose of Adjusting Entries Adjusting entries play a crucial role in the accounting cycle to ensure that a company's financial records accurately reflect its economic activities. The need for adjusting entries arises because not all transactions leave obvious indications, especially those related to the passage of time. Adjusting entries fall into two categories: accruals and deferrals. 1. Types of Adjusting Entries: - Accruals: Needed when recognizing revenue or expense before cash receipt or payment. - Deferrals: Required when recognizing revenue or expense after cash receipt or payment. Examples of Adjusting Entries: 1. Accruals: Accrued Revenue (Interest): - DR Interest Receivable - CR Interest Revenue - Impact on Financial Statements: - Revenues increase (Statement of Income) - Assets increase (Statement of Financial Position) - No effect on the Statement of Cash Flows Accrued Expenses (Wages): - DR Wages Expense - CR Wages Payable - Impact on Financial Statements: - Expenses increase (Statement of Income) - Liabilities increase (Statement of Financial Position) - No effect on the Statement of Cash Flows 2. Deferrals: Deferred Revenue (Customer Deposits): - DR Deferred Revenue - CR Tuition Revenue - Impact on Financial Statements: - Revenues increase (Statement of Income) - Liabilities decrease (Statement of Financial Position) - No effect on the Statement of Cash Flows Deferred Expenses (Insurance): - DR Insurance Expense - CR Prepaid Insurance - Impact on Financial Statements: - Expenses increase (Statement of Income) - Assets decrease (Statement of Financial Position) - No effect on the Statement of Cash Flows Special Case - Depreciation: Depreciation of Property, Plant, and Equipment: - DR Depreciation Expense - CR Accumulated Depreciation, Equipment - Impact on Financial Statements: - Expenses increase (Statement of Income) - Assets decrease (Statement of Financial Position) - No effect on the Statement of Cash Flows Key Observations about Adjusting Entries: 1. No Cash Involvement: - Adjusting entries never involve cash, as cash transactions are recorded at the time of occurrence. 2. Involvement of Financial Statements: - Adjusting entries always involve at least one statement of income account and one statement of financial position account. 3. Timing of Adjusting Entries: - Adjusting entries are made at the end of each accounting period (monthly, quarterly, or annually). Conceptual Framework and Comparability: The conceptual framework highlights that adjusting entries contributes to comparability in financial information. By accruing expenses like interest and wages, comparability is enhanced across different periods. Recording Adjusting Entries - Examples: Transaction 15: Recording Depreciation of Equipment - Analysis of Transaction: - Contra-assets (Accumulated Depreciation, Equipment) increased by $850. - Expenses (Depreciation Expense) increased by $850. - Journal Entry: - DR Depreciation Expense $850 - CR Accumulated Depreciation, Equipment $850 Transaction 16: Recording Insurance Expense - Analysis of Transaction: - Assets (Prepaid Insurance) decreased by $150. - Expenses (Insurance Expense) increased by $150. - Journal Entry: - DR Insurance Expense $150 - CR Prepaid Insurance $150 Transaction 17: Recording Interest Expense - Analysis of Transaction: - Liabilities (Interest Payable) increased by $500. - Expenses (Interest Expense) increased by $500. - Journal Entry: - DR Interest Expense $500 - CR Interest Payable $500 Helpful Hint: Adjusting entries involve both a statement of financial position account and a statement of income account. One-half of each adjusting entry is an asset or liability account, while the other half is a revenue or expense account. Ethics in Accounting: Adjusting entries often involve managerial judgment and estimation. Ethical considerations are crucial to ensure accurate financial reporting and prevent manipulation of earnings. Adjusted Trial Balance: After recording and posting adjusting entries, an adjusted trial balance is prepared. This ensures that total debits still equal total credits, correcting any imbalances before preparing financial statements. The adjusted trial balance is a critical step in the accounting cycle. 3.8 Preparing Financial Statements and Closing Entries Closing Entries: Completing the Accounting Cycle Purpose of Closing Entries Closing entries are crucial for finalizing the accounting cycle by transferring balances from temporary accounts (revenues, expenses, and Dividends Declared) to Retained Earnings. This ensures that temporary accounts start each year with zero balances, allowing for accurate measurement of revenues, expenses, and dividends for each period. Types of Closing Entries Closing entries can be prepared in various ways, such as using a two-entry, three-entry, or four-entry approach. The four-entry method is used here, as it closely aligns with the format in the statement of changes in equity. The four closing entries are: 1. Close all revenue accounts to the Income Summary account. 2. Close all expense accounts to the Income Summary account. 3. Close the Income Summary account to Retained Earnings. 4. Close the Dividends Declared account to Retained Earnings. Illustration of Closing Entries Closing Entry 1: Close Revenue Accounts - Example for SCL: - Year-end date - DR Sales Revenue $34,000 - CR Income Summary $34,000 Closing Entry 2: Close Expense Accounts - Example for SCL: - Year-end date - DR Income Summary $26,600 - CR Cost of Goods Sold $17,000 - CR Wages Expense $2,900 - CR Utilities Expense $1,900 - CR Rent Expense $1,100 - CR Advertising Expense $2,200 - CR Insurance Expense $150 - CR Depreciation Expense $850 - CR Interest Expense $500 Closing Entry 3: Close Income Summary to Retained Earnings - Example for SCL: - Year-end date - DR Income Summary $7,400 - CR Retained Earnings $7,400 Closing Entry 4: Close Dividends Declared to Retained Earnings - Example for SCL: - Year-end date - DR Retained Earnings $400 - CR Dividends Declared $400 Retained Earnings Opening Balance +7,400 (Net Income, Closing Entry 3) - 400 (Dividends Declared, Closing Entry 4) = 7,000 (Ending Balance)