allcott-et-al-2019-should-we-tax-sugar-sweetened-beverages-an-overview-of-theory-and-evidence

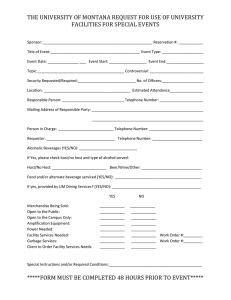

advertisement