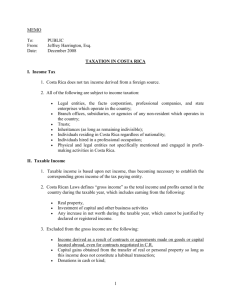

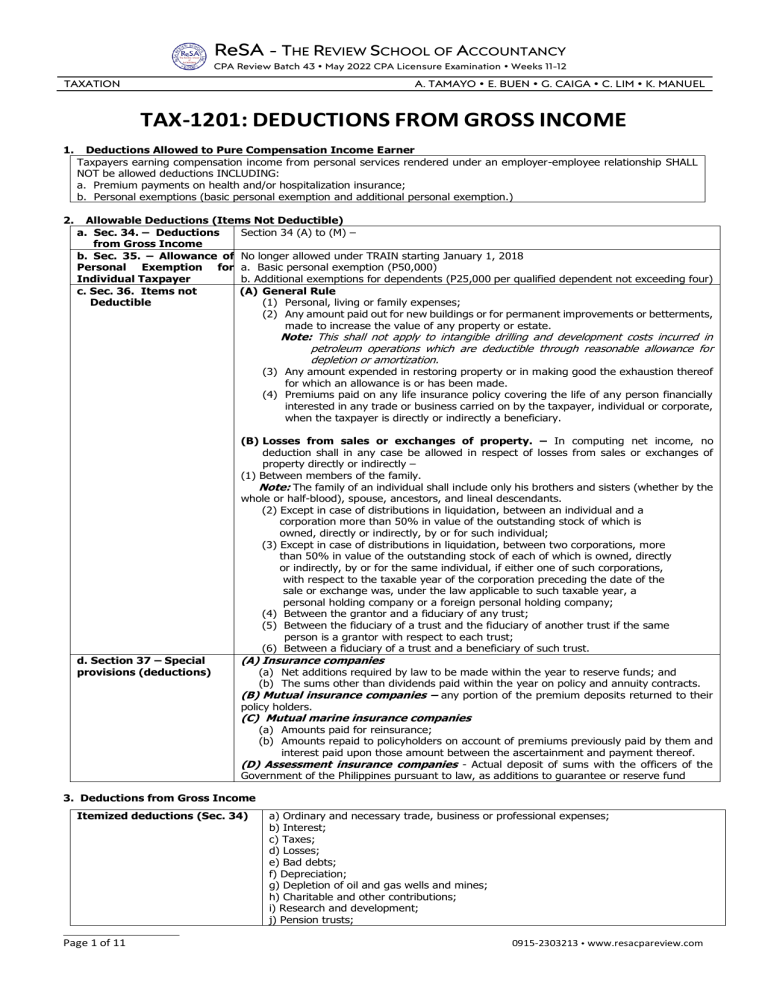

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY CPA Review Batch 43 May 2022 CPA Licensure Examination Weeks 11-12 TAXATION A. TAMAYO E. BUEN G. CAIGA C. LIM K. MANUEL TAX-1201: DEDUCTIONS FROM GROSS INCOME 1. Deductions Allowed to Pure Compensation Income Earner Taxpayers earning compensation income from personal services rendered under an employer-employee relationship SHALL NOT be allowed deductions INCLUDING: a. Premium payments on health and/or hospitalization insurance; b. Personal exemptions (basic personal exemption and additional personal exemption.) 2. Allowable Deductions (Items Not Deductible) a. Sec. 34. – Deductions Section 34 (A) to (M) – from Gross Income b. Sec. 35. – Allowance of No longer allowed under TRAIN starting January 1, 2018 Personal Exemption for a. Basic personal exemption (P50,000) Individual Taxpayer b. Additional exemptions for dependents (P25,000 per qualified dependent not exceeding four) c. Sec. 36. Items not (A) General Rule Deductible (1) Personal, living or family expenses; (2) Any amount paid out for new buildings or for permanent improvements or betterments, made to increase the value of any property or estate. Note: This shall not apply to intangible drilling and development costs incurred in petroleum operations which are deductible through reasonable allowance for depletion or amortization. (3) Any amount expended in restoring property or in making good the exhaustion thereof for which an allowance is or has been made. (4) Premiums paid on any life insurance policy covering the life of any person financially interested in any trade or business carried on by the taxpayer, individual or corporate, when the taxpayer is directly or indirectly a beneficiary. (B) Losses from sales or exchanges of property. – In computing net income, no deduction shall in any case be allowed in respect of losses from sales or exchanges of property directly or indirectly – (1) Between members of the family. Note: The family of an individual shall include only his brothers and sisters (whether by the whole or half-blood), spouse, ancestors, and lineal descendants. (2) Except in case of distributions in liquidation, between an individual and a corporation more than 50% in value of the outstanding stock of which is owned, directly or indirectly, by or for such individual; (3) Except in case of distributions in liquidation, between two corporations, more than 50% in value of the outstanding stock of each of which is owned, directly or indirectly, by or for the same individual, if either one of such corporations, with respect to the taxable year of the corporation preceding the date of the sale or exchange was, under the law applicable to such taxable year, a personal holding company or a foreign personal holding company; (4) Between the grantor and a fiduciary of any trust; (5) Between the fiduciary of a trust and the fiduciary of another trust if the same person is a grantor with respect to each trust; (6) Between a fiduciary of a trust and a beneficiary of such trust. d. Section 37 – Special provisions (deductions) (A) Insurance companies (a) Net additions required by law to be made within the year to reserve funds; and (b) The sums other than dividends paid within the year on policy and annuity contracts. (B) Mutual insurance companies – any portion of the premium deposits returned to their policy holders. (C) Mutual marine insurance companies (a) Amounts paid for reinsurance; (b) Amounts repaid to policyholders on account of premiums previously paid by them and interest paid upon those amount between the ascertainment and payment thereof. (D) Assessment insurance companies - Actual deposit of sums with the officers of the Government of the Philippines pursuant to law, as additions to guarantee or reserve fund 3. Deductions from Gross Income Itemized deductions (Sec. 34) Page 1 of 11 a) Ordinary and necessary trade, business or professional expenses; b) Interest; c) Taxes; d) Losses; e) Bad debts; f) Depreciation; g) Depletion of oil and gas wells and mines; h) Charitable and other contributions; i) Research and development; j) Pension trusts; 0915-2303213 www.resacpareview.com ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME k) Additional requirements for deductibility of certain payments l) Optional standard deduction m) Premium payments on health and/or hospitalization insurance of an individual taxpayer (no longer allowed under TRAIN). Notes: (1) The above deductible items shall be allowed as deduction only if it is shown that the tax required to be deducted and withheld therefrom has been paid to the BIR [(Sec. 34 (K)]. (2) No deduction will also be allowed notwithstanding payments of withholding tax at the time of the audit investigation or reinvestigation/reconsideration in cases where no withholding of tax was made in accordance with Secs. 57 and 58 of the Tax Code. (R.R. No. 12-2013) (Revoked under R.R. 6-2018) 4. Itemized Deductions Amplified a. Expenses in General 1) Requisites for deductibility of expenses, in general 2) Requisites for deductibility of salaries, wages, and other forms of compensation including the grossed-up monetary value of fringe benefits 3) Requisites for deductibility of travel expenses, here and abroad 4) Requisites for deductibility of rentals and/or other payments required as a condition for the continued use or possession 5) Requisites for deductibility of entertainment, amusement and recreation expenses 6) Ceiling on deductible entertainment, amusement and recreation expenses Exercise in Ceiling on deductible entertainment, amusement and recreation expenses 7) Additional deductions from taxable income 8) Other examples of ordinary itemized deductions (expenses) Page 2 of 11 a) Ordinary and necessary; b) Paid or incurred during the taxable year; c) Directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of profession; d) Substantiated with sufficient evidence, such as official receipts or other adequate records. a) Reasonable; b) Personal services actually rendered; c) Withholding tax imposed has been paid. a) Reasonable; b) Incurred or paid while away from home; c) Incurred or paid in the pursuit of trade, business or profession. a) Reasonable; b) For purposes of trade, business or profession; c) Taxpayer has not taken or is not taking title or in which he has no equity other than that of a lessee, user or possessor. a) Reasonable b) Must be paid or incurred during the taxable year; c) Must be directly connected to the development, management and operation or to conduct of trade, business or profession or directly related to or in furtherance of the conduct of his or its trade, business or exercise of profession; d) Must not be contrary to law, morals, public policy or public order; e) Must not have been paid, directly or indirectly, to an official or employee of the national government, or any local government unit, or of any government-owned or controlled corporation (GOCC), or of a foreign government, or to a private individual, or corporation, or general professional partnership, or a similar entity if it constitutes a bribe, kickback or other similar payments; f) Must be duly substantiated by adequate proof. The official receipts or invoices or bills or statements of accounts must be in the name of taxpayer claiming the deduction; g) The appropriate amount of withholding tax, if applicable, should have been withheld therefrom and paid to the BIR. a) Sales of goods or properties – One-half percent (0.50%) of net sales (gross sales less sales returns/allowances and sales discount) b) Sale of services, including exercise of profession and use or lease of property – One percent (1%) of net revenue (gross revenue less discounts) ERA Corporation is engaged in the sale of goods and services with net sales/net revenue of P200,000 and P100,000 respectively. The actual entertainment, amusement and recreation expense for the taxable quarter totaled to P3,000. How much is the amount of the deductible entertainment, amusement and recreation expense? a) One-half (1/2) of the value of labor training expenses incurred for skills development of enterprise-based trainees enrolled in public senior high schools, public higher education institutions, or public technical and vocational institutions and duly covered by an apprenticeship agreement; b) For the additional deduction for enterprise-based training of students from public educational institutions, the enterprise shall secure proper certification from the DepEd, TESDA, or CHED; c) Such deduction shall not exceed ten percent (10%) of direct labor wage. a) Advertising and promotions l) Professional fees b) Commissions m) Repairs and maintenance c) Communication, light and water n) Royalties ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME d) Director’s fee e) Fuel and oil f) Insurance g) Janitorial and messengerial services h) Management and consultancy fee i) Miscellaneous j) Office supplies k) Other services o) Security services p) SSS, GSIS, Philhealth and other contributions q) Tolling fees r) Training and seminars Exercises: 1) LAB Corporation, a domestic manufacturing corporation, had a gross sales of P100,000,000.00 for fiscal year ending June 30, 2021. It incurred cost of sales of P60,000,000.00 which includes Direct Labor Wage of P20,000,000.00 and operating expenses of P17,500,000.00 which include training expenses amounting to P3,000,000.00. The corporation complied with all the prescribed requirements (e.g., Apprenticeship Agreement, Certification from DepED or TESDA or CHED, whichever is applicable). How much is the corporation’s net taxable income for the taxable year? 2) Using the same data in number 1) except that the Cost of sales of P60,000,000.00 includes Direct Labor Wage of P10,000,000.00, how much is the corporation’s net taxable income for the taxable year? b. Interest Expense 1) Requisites for deductibility of interest expense 2) Reduction of deductible interest expense a) The indebtedness must be that of the taxpayer; b) The interest must have been stipulated in writing; c) The interest must be legally due; d) The interest payment must not be between related taxpayers; e) The interest must not be incurred to finance petroleum operation; and f) The interest was not treated as capital expenditure, if such interest was incurred in acquiring property used in trade, business, or exercise of profession. The taxpayer’s otherwise allowable deduction for interest expense shall be reduced by an amount equivalent to 20% of interest subjected to final tax. If the final withholding tax rate on interest income of 20% will be adjusted in the future, the interest expense reduction rate shall be adjusted accordingly. 3) Reduction rate of corporations Before CREATE, the interest expense reduction rates are as follows: Beginning January 1, 2000 – 38% Beginning November 1, 2005 to December 31 2008 – 42% Beginning January 1, 2009 – 33% In the case of corporations, since the income tax rates changed effective July 1, 2020, it follows that the deduction from interest expense of 20% shall be effective also on the said date. For domestic corporations with net taxable income not exceeding P5,000,000.00 and total assets not exceeding P100,000,000.00, excluding the land on which the particular business entity’s office, plant and equipment are situated, the deduction is 0% since there is no difference in the fnal tax tax rate on taxable income (20%) with the tax rate applied on the interest income subjected to final tax (20%). 4) Reduction rate of In the case of individuals engaged in business or practice of profession, such deduction shall individuals take effect upon the effectivity of CREATE. 3) Interest incurred or paid Interest incurred or paid by the taxpayer on all unpaid business-related taxes shall be fully on all unpaid businessdeductible from the gross income and shall not be subject to reduction by an amount equal related taxes to certain percentage of the interest income subject to final tax. 4) Prepaid interest of an Deductible not in the year that the interest was paid in advance but in the year that the individual under cash basis indebtedness was paid. 5) Exercises a) In 2018, an individual taxpayer, using cash basis of accounting, obtained a P500,000 loan from a bank for business use. The bank deducted in advance an interest of P50,000. In 2019, the P500,000 loan was paid in full by the taxpayer. How much was the deductible interest in 2018 and 2019? b) Using the same information in letter a. except that payments were made as follows: 2019, P300,000; 2020, P200,000. How much was the deductible interest expense in 2018, 2019 and 2020? c) For fiscal ending June 30, 2021, Xaris Hope Corporation, aside from the expenses of P17,500,000.00, incurred interest expense of P400,000.00 which satisfied the prescribed requirements for deductibility. It also earned interest income of P100,000.00, net of final tax of 20%. The corporation’s total assets amount to P150,000,000.00 which include P20,000,000.00 worth of land. How much is the deductible interest expense? Page 3 of 11 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME d) For the taxable year 2021, Faith Corporation incurred interest expense of P500,000.00 on its bank loan. For the year, its gross income assets amount to P50,000,000.00, exclusive of the cost of land of P7,100,000.00. It registed gross income of P10,000,000.00 and incurred operating expenses of P6,000,000.00, inclusive of the interest expense. It earned interest for the same year amounting to P150,000. How much is allowable interest? e) CPL Corporation secured in 2018 a bank loan for its business expansion, and incurred interest expense of P2,000,000.00 in calendar year 2020 on the said bank loan. In the same year, it likewise earned interest income of P300,000.00 subjected to final tax of 20%. For calendar year 2020, its gross inclme amounted to P20,000,000.00. Its gross assets, excluding the value of the land where its building and plant are situated, is P100,000,000.00. Its operating expenses amounted to P10,000,000.00, inclusive of the interest expense of P2,000,000.00. How much is the allowable interest expense? f) CTE Corporation incurred interest expense of P500,000.00 in calendar year 2020 on its bank loan. The said loan was secured in 2019 to finance the construction of its warehouse. In calendar year 2020, its gross assets amounted to P50,000,000.00, excluding the land with a cost of P5,500,000.00. It recorded a gross income of P10,000,000.00 and incurred operating expenses of P6,000,000.00, inclusive of interest expense. It had an interest income earned for the same year amounting to P150,000.00. How much is the allowable interest expense? g) AJD Corporation used accrual basis yearly since it was organized. On May 1, 2021 it purchased an equipment for P1,120,000, VAT inclusive. The equipment was estimated to have a life of 5 years. The equipment was financed through a one-year loan with Banco de Plata with interest at the rate of 18% per annum beginning January 16, 2021, which was discounted in full. During the same year, the corporation also paid interest on business-related taxes amounting to P50,000. In 2021, AJD had interest income from its bank deposit in the amount of P100,000. AJD decided to expense outright the interest incurred to acquire the equipment. Question 1 - How much was the deductible interest? 2 -Assuming AJD Corporation decided to capitalize the interest incurred to acquire the equipment, how much would be the total cost of the equipment? h) COU Corporation paid the following during the year 2020: Interest for late payment of income tax for 2019 Surcharge and compromise penalty for late payment of income tax for 2019 Interest on bonds issued by COU Corporation Interest on money borrowed by the Corporation from Conrad Uberita, 60% owner of COU Corporation Interest on preferred stock which in reality is a dividend P 5,000 7,250 100,000 50,000 20,000 How much is the deductible interest? c. Taxes 1) Requisites for deductibility 2) Meaning of the term “taxes” 3) Interest on delinquent taxes 4) Non-deductible taxes 5) Examples of local taxes Page 4 of 11 a. Paid or incurred within the taxable year; b. Connected with the taxpayer’s profession, trade or business. a. The term “taxes” includes national and local taxes, and means tax proper only. b. No deduction shall be claimed for any surcharge or penalty on delinquent taxes. Deductible as interest expense, not as taxes. a. Philippine income; d. Foreign income tax claimed as tax credit; b. Estate and donor’s taxes; e. Stock transaction tax c. Special assessment; f. Value-added tax a. Local taxes that may be imposed by provinces: 1) Tax on Transfer of Real Property Ownership 2) Tax on Business of Printing and Publication 3) Franchise Tax 4) Tax on Sand, Gravel and Other Quarry Resources 5) Professional Tax 6) Amusement Tax 7) Annual Fixed Tax for Every Delivery Truck or Van of Manufacturers or Producers, Wholesalers of, Dealers, or Retailers in, Certain Products a. Local taxes that may be imposed by municipalities 1) Tax on Business 2) Fees for Sealing and Licensing of Weights and Measures 3) Fishery Rentals, Fees and Charges ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME 6) Credit against tax for taxes in foreign countries 7) Year in which tax credit is taken c. Local taxes imposed by barangays 1) Taxes on stores or retailers with fixed business establishments 2) Service Fees or Charges 3) Barangay Clearance 4) Other Fees and Charges a) On commercial breeding of fighting cocks, cockfighting an cockpits; b) On places of recreation which charge admission fees; and c) On billboards, signboards, neon signs, and outdoor advertisements Allowable income tax credit – Lower between: a. Actual foreign income tax paid; and b. Statutory limitation. a. At the option of the taxpayer and irrespective of the method of accounting used, tax credit shall be taken in the year in which the taxes of the foreign country were incurred; b. Once the option to credit the foreign taxes in the year incurred is made, the credits for all subsequent years shall be taken upon the same basis; c. No portion of any such foreign taxes shall be allowed as deduction in the same or any succeeding year. 8) Exercise: Mr. Jose San Jose, resident citizen, married, derived income from sources within and without the Philippines. The following were the data on his taxable income and foreign taxes for the year 2020: Net income, Philippines P150,000 Net income, Country A (before P50,000 income tax) 200,000 Net income, Country B (after P30,000 income tax) 70,000 Net income, Country C (before P32,000 income tax) 150,000 Net loss, Country D (150,000 ) Net income, Country E (no income tax paid) 50,000 The taxes paid by Mr. San Jose when he filed the quarterly declarations for the first three (3) quarters in 2020 were P10,000. How much was the tax payable in the Philippines when the taxpayer filed his annual return, assuming he opted to claim foreign income taxes as: 1) tax credit? 2) deduction? d. Losses 1) Requisites for deductibility of losses 2) Net operating loss Exercise in NOLCO Page 5 of 11 a) Actually, sustained during the taxable year; b) Not compensated for by insurance or other forms of indemnity; c) Incurred in trade, profession or business; d) Property is connected with trade, business or profession; e) Arising from fires, storms, shipwreck, or other casualties, or from robbery, theft or embezzlement; f) Declaration of loss is submitted within 45 days from the date of discovery of the casualty or robbery, theft or embezzlement giving rise to the loss; g) Not claimed as deduction for estate tax purposes in the estate tax return. a) Meaning of net operating loss - Excess of allowable deduction over gross income of the business in a taxable year. b) Net operating loss carry over - Pertains to net operating loss of the business or enterprise for any taxable year immediately preceding the current taxable year. c) Requisites for deductibility of NOLCO (1) The operating loss had not been previously offset as deduction from gross income; (2) There has been no substantial change in the ownership of the business or enterprise in that: (a) not less than 75% in nominal value of outstanding issued shares, if the business is in the name of a corporation, is held by or on behalf of the same persons; (b) not less than 75% of the paid-up capital of the corporation, if the business is in the name of a corporation, is held by or on behalf of the same persons. d) Carry over period - The net operating loss shall be carried over as a deduction from gross income for the next 3 succeeding taxable years immediately following the year of such loss. e) Net operating loss for mines other than oil and gas wells (1) For mines other than oil and gas wells, a net operating loss incurred in any of the first 10 years of operation may be carried over as a deduction from the taxable income for the next 5 years immediately following the year of such loss. (2) The entire amount of the loss shall be carried over to the first 5 taxable years following the loss, and any portion of such loss which exceeds the taxable income of such first year shall be deducted in like manner from the taxable income of the next remaining 4 years. f) Domestic and resident foreign corporations cannot enjoy the benefit of NOLCO for as long as it is subject to MCIT in any taxable year (MCIT is greater than NCIT) g) The running of the three-year period for the expiry of NOLCO is not interrupted by the fact that such corporation is subject to MCIT in any taxable year during such three-year period. How much is the taxable net income if a domestic corporation has the following data on gross income and expenses? 2015 2016 2017 2018 2019 Gross income P700,000 P900,000 P600,000 P700,000 P800,000 Business expenses 900,000 800,000 550,000 680,000 600,000 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME 3) Capital loss 4) Loss on wash sales Exercises in wash sales 5) Wagering losses 6) Abandonment losses 7) Casualty loss Exercises in casualty loss Deductible from capital gain only a. Losses from wash sales are not deductible b. Gains from wash sales are taxable A taxpayer under calendar year has the following selected transactions: Sept. 9, 2016 – Purchased 100 shares of Kaye Co. common for P5,000. Dec. 21, 2018 – Purchased 50 shares of Kaye Co. common for P2,750. Dec. 26, 2018 – Sold the 100 shares purchased on Sept. 9, 2014 for P4,000. Jan. 2, 2019 - Purchased 25 shares of Kaye Co. common for P1,125. Compute the following: 1) Shares sold at a loss without covering acquisition 2) Loss on wash sale and the capital loss 3) The adjusted cost of the shares bought on December 21, 2016 and January 2, 2017 Deductible to the extent of the gains from wagering transactions a. If contract area where petroleum operations are undertaken is partially or wholly abandoned, all accumulated exploration and development expenditures pertaining to contract area shall be allowed as a deduction. b. If producing well is subsequently abandoned, the unamortized costs, as well as the undepreciated costs of equipment directly used, shall be allowed as deduction in the year such well, equipment or facility is abandoned. a. If the loss is sustained due to partial destruction the deductible amount is the lower between the book value and the cost to restore. b. If the cost to restore is greater than the book value, the excess of cost to restore is capitalized. c. If the loss is sustained due to total or complete destruction, the deductible amount is the book value of the property destroyed. d. In both cases (partial or total destruction), salvage value and insurance recovery are offset against the deductible loss. a. A taxpayer has a business property having an adjusted basis of P100,000. It is completely destroyed by fire in 2019. The only claim for reimbursement consists of an insurance claim for P80,000 is settled in 2020. Question 1 – In what year can the taxpayer deduct the casualty loss? 2 – How much is the deductible loss? b. J. Ireneo acquired machinery for use in his business. After a strong typhoon, the machinery suffered partial damage. The following data were made available in connection with the determination of the deductible loss: Cost P500,000 Accumulated depreciation 300,000 Restoration cost 250,000 Estimated remaining useful life 5 years Question 1 – How much was the deductible loss? 2 – How much would be the new basis for depreciation? 8) Loss due to voluntary removal of building incident to renewal 9) Real estate bought upon which is located a building 10) Loss of useful life 11) Shrinkage in the value of stock 12) Corporate reorganization Deductible Not deductible expense on account of cost of removal, the value of the real estate, exclusive of the old improvements, being presumably equal to the purchase price of the land and building plus the cost of removal Actual loss is deductible Not deductible. But if a stock of a corporation becomes worthless, the cost or other basis may be deducted in the taxable year the stock became worthless. a. No gain or loss shall be recognized on a corporation or in its stock or securities: 1) if such corporation is a party to reorganization and exchanges property in pursuance of a plan of reorganization 2) solely for stock or securities in another corporation that is party to the reorganization. b. A reorganization is defined as: 1) A corporation, which is a party to a merger or consolidation, exchanges property solely for stock in a corporation, which is a party to the merger or consolidation. 2) The acquisition by one corporation, - in exchange solely for all or a part of its voting stock, or - in exchange solely for all or part of the voting stock of a corporation which is in control of the acquiring corporation, of stock of another corporation - if immediately after the acquisition, the acquiring corporation has control of such other corporation whether or not such acquiring corporation had control immediately before the acquisition. 3) The acquisition by one corporation, - in exchange solely for all or a part of its voting stock, or Page 6 of 11 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME - in exchange solely for all or part of the voting stock of a corporation which is in control of the acquiring corporation, of substantially all of the properties of another corporation. Exercises in corporate readjustment Note: In determining whether the exchange is soley for stock, the assumption by the acquiring corporation of a liability of the others shall be disregarded. 4) A recapitalization, which shall mean an arrangement whereby the stock and bonds of a corporation are readjusted as to amount, income, or priority or an agreement of all stockholders and creditors to change and increase or decrease the capitalization or debts of the corporation or both 5) A reincorporation, which shall mean the formation of the same corporate business with the same assets and the same stockholders surviving under a new charter. c. In all the above instances of exchanges of property, prior BIR confirmation or tax ruling shall not be required for purposes of availing the tax exemption. d. Gain may be recognized if the taxpayer received cash and property a. Anton Corporation was merged with Conrad Corporation. A stockholder of Anton Corporation, which ceased to exist, surrendered his Anton Corporation shares valued at P8,000 in exchange for Conrad Corporation shares valued at P10,000. How much is the gain to be recognized? b. A stockholder of a corporation that was merged with another corporation had the following data: FMV of shares received P10,000 Cash received 3,000 FMV of property received 500 Cost of the shares surrendered 9,000 13) Transfer of property for stock that led to control of corporation Exercise in transfer of property for stock e. Bad Debts 1) Requisites for deductibility 2) Measure of bad debts Page 7 of 11 Compute the following: 1) The amount of gain recognized 2) Adjusted basis of the shares received. a. Loss is not recognized b. Gain may be recognized if the taxpayer received cash and property in addition to the shares received c. The term control means ownership of stocks in the corporation after the transfer of property possessing at least 51% of the total voting power of all classes of stocks entitled to vote. d. The collective and not the individual ownership of the all classes of stocks entitled to vote of the transferor alone or together with others, not exceeding four (4) shall be used in determining the presence of control. e. Stocks issued for services shall not be considered as issued in return for property. (Phil. CPA) Mr. Juan de la Cruz transferred his commercial land with a cost of P500,000 but with a fair market value of P750,000 to JDC Corporation in exchange of the stocks of the corporation with a par value of P1,000,000. As a result of the transfer, he became the majority stockholder of the corporation. How much is the gain (loss) to be recognized a) There must be an existing indebtedness due to the taxpayer which must be valid and legally demandable; b) Connected with taxpayer’s profession, trade or business; c) Not sustained in a transaction entered into between related parties; d) Actually, charged off the books of accounts of the taxpayer as of the end of the taxable year; e) Actually, ascertained to be worthless and uncollectible as of the end of the taxable year. a. If a corporation computes the income upon the basis of valuing its notes or accounts receivable at their fair market value, the amount deductible for bad debts in any case is limited to such original valuation. b. A purchaser of accounts receivable which cannot be collected and are consequently charged off the books as bad debts is entitled to deduct them; the amount of deduction being based upon the price paid for them and not upon their face value. c. Only the difference between the amount received in distribution of the assets of a bankrupt company and the amount of the claim may be deducted as bad debt. d. The difference between the amount received by a creditor of a decedent in the distribution of the assets of the decedent’s estate and the amount of the claim may be considered a worthless debt. ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME f. Depreciation 1) Requisites for deductibility 2) Methods of depreciation 3) Depreciation of properties used in petroleum operations 4) Depreciation of properties used in mining operations other than petroleum operations 5) Rules on Deductibility of Depreciation on Vehicles, Others Expenses Incurred and Input Tax on Disallowed Expenses (RR No. 12-2012, Oct. 12, 2012) a. Reasonable; b. Property is used in the trade or business; c. Property must have a limited useful life; d. Allowance must be charged off during the year. a. Straight line method; b. Declining balance method; c. Sum-of-the-years-digit method; d. Other methods which may be prescribed by the Secretary of Finance upon recommendation of the Commissioner. a. Depreciation of properties directly related to production of petroleum initially placed in service in a taxable year shall be allowed under straight-line method or declining balance method on the basis of an estimated life of 10 years or such shorter life as may be permitted by the Commissioner. b. Properties not used directly in the production of petroleum shall depreciated under the straight-line method on the basis of an estimated life of 5 years. a. At the normal rate of depreciation if the expected life is 10 years or less; b. Depreciated over any number of years between 5 years and the expected life if the latter is more than 10 years. The following guidelines shall be observed in determining whether depreciation expense can be claimed or not on account of vehicles capitalized by the taxpayer, or in claiming other expenses and input taxes on account of said vehicles: a. No deduction from gross income for depreciation shall be allowed unless the taxpayer substantiates the purchase with sufficient evidence, such as official receipts and other adequate records which contain the following, among others: 1) Specific Motor Vehicle Identification Number, Chassis Number, or other registrable numbers of the vehicle; 2) Total price of the specific vehicle subject to depreciation, and 3) The direct connection or relation of the vehicle to the development, management, operation and/or conduct of the trade of business or profession of the taxpayer. b. Only one vehicle for land transport is allowed for the use of an official or employee, the value of which should not exceed P2,400,000. c. No depreciation shall be allowed for yachts, helicopters, airplanes and/or aircrafts, and land vehicles which exceed the above threshold amount (P2,400,000), unless the taxpayer’s main line of business is transport operations or lease of transportation equipment and the vehicles purchased are used in said operations; d. All maintenance expenses on account of non-depreciable vehicles for taxation purposes are disallowed in its entirety; e. The input taxes on the purchase of non-depreciable vehicles and all input taxes on maintenance expenses incurred thereon are likewise disallowed for taxation purposes. g. Depletion of Oil and Gas Wells and Mines 1) Method of depletion Cost-depletion method 2) Limitation of depletion It cannot exceed the capital invested in the mine. 3) Intangible exploration a. Deductible in the year incurred if such expenditures are incurred for non-producing wells and development drilling and/or mines; costs b. Deductible in full or may be capitalized and amortized if such expenditures incurred are for producing wells and/or mines in the same contract area. 4) Total amount deductible for exploration and development expenditures (if the taxpayer elects to deduct exploration and development expenditures) a. Not to exceed 25% of the net income from mining operations computed without the benefit of any tax incentives under existing laws. b. Actual exploration and development expenditures minus 25% of the net income from mining shall be carried forward to the succeeding years until fully deducted. h. Charitable and Other Contributions 1) Requisites for a. Actually paid or made within the taxable year; deductibility b. Made to the Philippine Government or any political subdivisions or to any non-profit organizations or institutions specified in the Tax Code; c. Must be evidenced by adequate records or receipts. Page 8 of 11 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1201 Weeks 11-12: DEDUCTIONS from GROSS INCOME 2) Contributions deductible with limit 3) Contributions deductible in full a. Those made for the use of the Government of the Philippines or any of its agencies or any political subdivision exclusively for public purpose; b. Those made to accredited domestic corporation or associations organized and operated exclusively for: 1) religious; 2) charitable; 3) scientific; 4) youth and sports development; 5) cultural or educational purposes; or 6) rehabilitation of veterans. c. Those made to social welfare organizations; d. Those made to non-government organizations. a. Donations to Government of the Philippines or to any of its agencies or political subdivisions, including fully owned government corporations, exclusively to finance, to provide for, or to be used in undertaking priority activities in education, health, youth and sports development, human settlements, science and culture, and economic development. b. Donations to certain foreign institutions or international organizations; c. Donations to accredited non-government organizations (nonprofit domestic corporations): 1) Organized and operated exclusively for scientific, research, educational, character building and youth and sports development, health, social welfare, cultural and charitable purposes, or a combination of these; 2) Which not later than the 15th day of the 3rd month after the close of the taxable year in which the contributions are received, makes utilization of the contributions directly for the purpose or function for which the organization is organized and operated; 3) The administrative expense shall, on annual basis, not exceed 30% of the total expenses; 4) The assets of which, in the event of dissolution, would be distributed to another nonprofit domestic corporation organized for similar purpose or purposes, or to the state for public purpose, or would be distributed by a court to another organization to be used in such manner as in the judgment of said court shall best accomplish the general purpose for which the dissolved organization was organized. 4) Limitation on the a. Individual – 10% of taxable income derived from trade, business or profession before deductible amount charitable and other contributions. b. Corporation – 5% of taxable income derived from trade, business or profession before charitable and other contributions. 5) Valuation The amount of any charitable contribution of property other than money shall be based on the acquisition cost of said property. 6) Contributions deductible a. In determining its net income, the general professional partnership can deduct by a general professional contributions deductible in full; partnership b. Contributions subject to limit shall be claimed and deducted by the partners in proportion to their respective interest in the partnership. 7) Exercise: Compute the taxable income An individual taxpayer, married, and with two (2) qualified dependent children, has the following data for the year 2020: Gross business income P500,000 Long term capital gain 20,000 Short term capital loss 5,000 Deductions (excluding charitable and other contributions) 124,200 Contributions to a non-profit foreign charitable organization 15,000 Contributions given directly to fire victims 20,000 Contributions to University of the Philippines 10,000 Contributions to a non-profit religious domestic corporation 25,000 Contribution of office equipment to a non-profit organization for the rehabilitation of veterans (Acquisition cost, P20,000; FMV, P15,000) i. Research and Development 1) Requisites for deductibility 2) Amortization period of deferred research and development 3) Limitations on deduction of research and development Page 9 of 11 a. Paid or incurred by the taxpayer in connection with his trade, business or profession; b. Not treated as ordinary and necessary expenses; c. Chargeable to capital account but not chargeable to property of a character which is subject to depreciation or depletion. Ratably distributed over a period of not less than sixty (60) months as may be elected by the taxpayer (beginning with the month in which the taxpayer first realizes benefits from such expenditures). a. Any expenditure for the acquisition or improvement of land, or for the improvement of property to be used in connection with research and development of a character which is subject to depreciation and depletion; and b. Any expenditure paid or incurred for the purpose of ascertaining the existence, location, extent, or quality of any deposit or ore or other mineral, including oil or gas. TAX-1201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Weeks 11-12: DEDUCTIONS from GROSS INCOME j. Pension Trusts 1) Requisites for deductibility a. Reasonable; b. Established and maintained by employer; c. For the payment of pensions to employees. 2) Amount deductible a. Contribution for current pension – In full (considered ordinary and necessary expense); b. Contribution for past pension – Apportioned in equal parts over a period of 10 years. 3) Exercise: An employer maintains pension trust for its employees. The following contributions are made: 2015 2016 2017 Current service costs P 100,000 P 100,000 P 100,000 Past service costs 80,000 60,000 Total contributions P 180,000 P 160,000 P 100,000 How much is the deductible pension contributions for the year 2015, 2016 and 2017? k. Optional Standard Deductions (OSD) (RR No. 16-2008 as amended by RR No. 2-2010) 1) Persons covered The following may be allowed to claim OSD in lieu of the itemized deductions (i.e., items of ordinary and necessary expenses allowed under Section 34 (A) to (J) and (M), Section 37, other special laws, if applicable): a) Individuals (1) Resident citizen (2) Non-resident citizen (3) Resident alien b) Taxable estates and trusts c) Corporations (1) Domestic corporation (2) Resident foreign corporation 2) Determination of the amount of OSD for individuals a) Maximum allowed The OSD allowed to individual taxpayers shall be a maximum of forty percent (40%) of gross sales (if on accrual basis) or gross receipts (if on cash basis) during the taxable year. b) Treatment of cost of sales and cost of services c) Determination of gross sales or gross receipts for other individuals The “cost of sales” in case of individual seller of goods, or the “cost of services” in the case of individual seller of services, are not allowed to be deducted for purposes of determining the basis of the OSD. For other individual taxpayers allowed by law to report their income and deductions under a different method of accounting (e.g., percentage of completion basis, etc.) other than cash and accrual method of accounting, the “gross sales” or “gross receipts” shall be determined in accordance with said acceptable method. 3) Determination of the amount of OSD for corporations a) OSD for corporations In the case of corporate taxpayers, the OSD allowed shall be in an amount not exceeding forty percent (40%) of their gross income. b) Gross income defined In the case of seller of goods, gross income” shall mean the gross sales less sales returns, discounts and allowances and cost of goods sold. In the case of sellers of services, the term “gross income” means “gross receipts” less sales returns, allowances, discounts and cost of services. The items of gross income under Section 32 (A) of the Tax Code, as amended, which are required to be declared in the income tax return of the taxpayer for the taxable year are part of the gross income against which the OSD may be deducted in arriving at taxable income. Passive income which have been subjected to a final tax at source shall not form part of the gross income for purposes of computing the forty percent (40%) optional standard deduction. c) Included in gross sales Gross sales” shall include only sales contributory to income taxable under Section 27(A) of the Tax Code. d) Included in cost of goods sold Cost of goods sold” shall include the purchase price or cost to produce the merchandise and all expenses directly incurred in bringing them to their present location and use. e) Cost of services defined “Cost of services” means all direct costs and expenses necessarily incurred to provide the services required by the customers and clients such as: (1) Salaries and employee benefits of personnel, consultants and specialists directly rendering the services, and (2) Cost of facilities directly utilized in providing the service such as depreciation or rental of equipment used and cost of supplies. “Cost of services” shall not include interest expense except in the case of banks and other financial institutions. Page 10 of 11 TAX-1201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Weeks 11-12: DEDUCTIONS from GROSS INCOME f) Gross receipts defined Gross receipts” means amounts actually or constructively received during the taxable year. For taxpayers engaged as sellers of services but employing the accrual basis of accounting for their income, the term “gross receipts” shall mean amounts earned as gross revenue during the taxable year. 4) Determination of the OSD for general professional partnerships (GPP) and partners of GPP A general professional partnership and the partners comprising such partnership may avail of the optional standard deduction only once, either by the general professional partnership or the partners comprising the partnership. 5) Summary of important points in OSD Corporation 1) Basis Gross income 2) Rate 40% 3) Cost of sales/Cost of Deducted services 4) Choice of OSD (irrevocable) To be signified in the return 5) Submission of financial statements Required 6) Keeping of records Required pertaining to gross income 7) Hybrid method (partly itemized deductions partly OSD) Not allowed 8) Computation of GS/GR xxx taxable net income Less: Ret and allow xxx using OSD Discounts xxx xxx Net sales xxx Less: COS xxx Gross income xxx Other income xxx Total xxx Less: OSD xxx Taxable net income xxx General Prof. Partnership Gross income 40% Individuals Gross sales/Gross receipts 40% Deducted Not deducted To be signified in the return To be signified in the return Required Required pertaining to gross income Not required Required pertaining to gross sales/receipts Not allowed GS/GR xxx Less: Ret and allow xxx Discounts xxx xxx Net sales xxx Less: COS xxx Gross income xxx Other income xxx Total xxx Less: OSD xxx Taxable net income xxx Not allowed GS/GR Less: Ret and allow xxx Discounts xxx Net sales Other income Total Less: OSD xxx BPE xxx AE xxx Taxable net income xxx xxx xxx xxx xxx xxx xxx 6) Exercises a. A retailer of goods, whose accounting method is under the accrual basis, has a gross sales of P1,000,000 with a cost of sales amounting to P800,000 for year 2018. The taxpayer is qualified to choose OSD as deductions. Question 1 – How much is the amount of OSD assuming the taxpayer is: a) an individual. b) a corporation. 2 – How much is the net taxable income assuming the taxpayer is: a) an individual, single with no qualified dependents. b) a corporation. THOT: “He who walks in another’s tracks leaves no footprints.” - = END = - Page 11 of 11