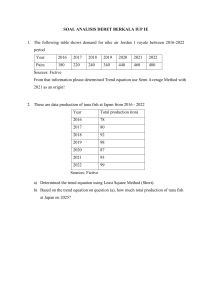

1.0 ACKNOWLEDGEMENT We would like to express our sincere gratitude to Dr. Muhamad Sukor Bin Jaafar for his invaluable guidance, support, and encouragement throughout the completion of this report. His expertise and insightful feedback have been instrumental in shaping the content and improving the overall quality of this assignment. We would also like to extend our thanks to our classmates who provided valuable input and shared their perspectives, contributing to a richer and more comprehensive study. Finally, we are deeply thankful to our family and friends for their unwavering support and understanding during the challenging moments of this academic endeavor. This report would not have been possible without the collective support and guidance from these individuals, and for that, we are truly grateful. 1 2.0 INTRODUCTION Financial ratio analysis serves as a critical tool for evaluating the financial health and performance of companies. Financial ratios serve as key indicators of a company's financial well-being, allowing for a systematic evaluation of its strengths, weaknesses, opportunities, and threats. These ratios facilitate benchmarking against industry standards and competitors, aiding in the identification of areas for improvement and potential risks. This report explores the financial ratios of CelcomDigi Bhd (CELC) and Redtone, two prominent players in the telecommunications sector. CelcomDigi stands out as a key player in the telecommunications industry. By examining various financial metrics, ratios provide insights into different aspects of a company's operations, liquidity, activity, leverage and profitability. These ratios offer valuable insights into CelcomDigi's profitability and market valuation. Meanwhile, REDtone Digital Berhad is a key player in the telecommunications industry, making significant strides in the competitive market. This Malaysian company has garnered attention for its financial performance and strategic positioning. A detailed financial analysis provides a comprehensive understanding of the company's financial dynamics. Conducting a comprehensive financial ratio analysis empowers stakeholders to make informed decisions regarding investments, partnerships, and strategic initiatives. By comparing the financial ratios of CelcomDigi and Redtone, stakeholders can identify industry leaders and pinpoint areas for improvement. In conclusion, financial ratio analysis plays a pivotal role in understanding the strengths and weaknesses of telecommunications companies. Through the evaluation of key financial metrics, stakeholders can navigate the competitive landscape, fostering strategic decisionmaking for sustained success in the dynamic telecommunications sector. 2 3.0 COMPANY BACKGROUND 3.1 CELCOMDIGI CelcomDigi Berhad, a communications conglomerate and mobile service provider in Malaysia, is the result of a merger between Digi.Com Berhad and Celcom in 2022. With equal ownership from Axiata and Telenor at 33.1% each, CelcomDigi stands as the largest wireless carrier in the country, boasting over 20.3 million subscribers as of the end of Q4 2022. Digi Telecommunications Sdn Bhd, CelcomDigi's predecessor, was established in 1990 and quickly gained recognition as a major player in the Malaysian telecommunications market. Digi's cellular network launch in 2000 marked the beginning of its expansion and innovation, cementing its position as a leading telecommunications provider throughout the 2000s. The merger with Celcom in 2022 aimed to create a powerhouse in the Malaysian telecommunications industry, combining the strengths of both companies to form a stronger and more competitive entity. With a combined customer base of over 20 million subscribers, CelcomDigi is poised to deliver enhanced services and innovation to its customers. CelcomDigi envisions itself as the leading digital enabler in Malaysia, connecting people, communities, and businesses to a world of possibilities. Committed to providing innovative and reliable telecommunications services, the company leverages innovative technologies like 5G, AI, and IoT to empower Malaysians to thrive in the digital age. Throughout its history, CelcomDigi has made significant contributions to the Malaysian telecommunications landscape, including providing widespread access to mobile and broadband services, driving innovation in the industry, connecting Malaysians to a world of possibilities, and contributing to Malaysia's economic growth and digital transformation. As CelcomDigi continues to invest in network expansion, digital innovation, and customer service excellence, it remains committed to empowering Malaysians and playing a leading role in the country's digital transformation journey. 3 3.2 REDTONE REDtone's journey began in 1996 when it was established as VMS Technology Sdn Bhd. The company quickly gained recognition as a leading provider of discounted call services, catering to the needs of over 600 corporate customers. This early success laid the foundation for REDtone's future growth and expansion into a broader range of telecommunications and digital infrastructure services. In 2002, REDtone was officially incorporated as REDtone Digital Berhad. This marked a significant milestone for the company as it became a pioneer Multimedia Super Corridor (MSC) status company. The MSC, established in 1996, was a visionary initiative aimed at transforming Malaysia into a global hub for information and communications technology (ICT). REDtone's MSC status recognition solidified its position as a leading innovator and provider of advanced telecommunications solutions. REDtone's growth trajectory continued with its listing on the Malaysian Stock Exchange's MESDAQ market (now known as the ACE Market) in January 2004. This public listing provided the company with access to capital and enhanced its visibility within the Malaysian business landscape. In 2015, REDtone's success attracted the attention of Berjaya Corporation Berhad, a prominent Malaysian conglomerate. REDtone became a subsidiary of Berjaya Corporation Berhad, further solidifying its position within the Malaysian telecommunications industry. REDtone's service portfolio has evolved over the years, reflecting the company's commitment to staying ahead of the curve in the ever-changing ICT landscape. From its initial focus on discounted call services, REDtone has expanded its offerings to include broadband and corporate internet, cloud and IoT, and managed services. Today, REDtone stands as a leading provider of integrated telecommunications and digital infrastructure services for organizations in Malaysia. With its strong record of innovation, customer-centric approach, and commitment to social responsibility, REDtone is poised to continue its growth trajectory and play a pivotal role in shaping the future of Malaysia's telecommunications and digital landscape. 4 4.0 FINANCIAL RATIO ANALYSIS 4.1 TREND ANALYSIS (CELCOMDIGI) PROFITABILITY RATIOS i. CELCOMDIGI PROFIT MARGIN RETURN ON ASSETS RETURN ON EQUITY (%) (%) (%) 2018 23.60 25 229 2019 22.75 18 217 2020 19.84 15 201 2021 18.34 15 184 2022 11.26 6 13 30 250 25 200 (%) 20 150 15 (%) PROFITABILITY RATIOS 100 10 5 50 0 0 2018 2019 PROFIT MARGIN 2020 YEARS 2021 RETURN ON ASSETS 2022 RETURN ON EQUITY The depicted financial performance of CelcomDigi reveals a concerning downward trajectory in key profitability ratios over the past five years, signaling potential challenges and prompting a thorough examination of the company's financial health. Beginning with the profit margin, CelcomDigi has experienced a consistent decline from 23.60% in 2018 to 11.26% in 2022. This sustained reduction in profit margin is a cause for alarm, indicating a worrisome trend where the company's earnings relative to revenue have been steadily diminishing. The drop from 18.34% in 2021 to 11.26% in 2022 represents a substantial decrease, raising questions about the firm's ability to maintain profitability in a competitive market. 5 Similarly, the Return on Assets (ROA) for CelcomDigi has witnessed a decline from 25% in 2018 to 6% in 2022. This indicates a diminishing capacity to generate profits from its assets. The steady reduction in ROA over the years suggests a potential inefficiency in asset utilization or changing market dynamics that are impacting the company's ability to extract value from its asset base. Furthermore, the Return on Equity (ROE) trend is equally troubling, with a decline from 229% in 2018 to 13% in 2022. The ROE trajectory, reflecting the company's ability to generate returns for its shareholders, showcases a significant and consistent drop over the years. The decline from 184% in 2021 to 13% in 2022 accentuates the urgency for CelcomDigi to address underlying issues impacting its profitability and shareholder value. In conclusion, CelcomDigi is confronted with a critical need to reassess its strategic approach, operational efficiency, and overall business model to reverse the alarming decline in profitability. Swift and decisive actions, such as cost management, operational optimizations, and strategic repositioning, will be crucial for CelcomDigi to stabilize its financial health and restore confidence among stakeholders. Rigorous financial planning and a proactive response to market dynamics will be essential for the company to regain its footing and secure a more favorable trajectory for its future prospects. 6 ACTIVITY RATIOS ii. CELCOMDIGI Account Average Inventory Fixed Asset Total Receivable Collection Turnover Turnover Asset Turnover Period (ITO) (TIMES) Turnover (TIMES) (DAYS) (TIMES) 2018 4.39 81 107 2.26 1.05 2019 4.81 74 69.19 1.15 0.76 2020 5.63 63 44.91 1.04 0.68 2021 5.74 62 54.13 1.11 0.72 2022 2.53 141 41 0.49 0.17 (TIMES) 140 160 120 140 100 120 100 80 80 60 60 40 40 20 20 0 DAYS TIMES ACTIVITY RATIOS 0 2018 2019 2020 Years 2021 2022 Average Collection Period (Days) Account Receivable Turnover Inventory Turnover (ITO) Fixed Asset Turnover Total Asset Turnover CelcomDigi's activity ratios, vital indicators of the company's efficiency in managing its assets, have exhibited a concerning downward trend over the past five years. This decline in efficiency raises alarms as it may potentially lead to lower profitability in the future. A detailed breakdown of individual ratios offers insights into the challenges faced by CelcomDigi and suggests areas for improvement to ensure sustainable business performance. Starting with the Account Receivable Turnover, which gauges the efficiency of debt collection, CelcomDigi showed improvement from 4.39 times in 2018 to 5.73 times in 2021. However, the significant dip to 2.53 times in 2022 raises questions about potential challenges in the current economic climate or alterations in credit policies. The need to closely monitor 7 and address this decline is crucial to sustaining healthy cash flow and ensuring financial stability. Examining the Average Collection Period, which signifies the time taken to collect receivables, a decrease from 81 days in 2018 to 141 days in 2022 initially suggests faster debt collection. However, the observed increase in 2022 mirrors the trend in the Account Receivable Turnover ratio, indicating a potential need for CelcomDigi to reassess and optimize its credit and collection procedures. The Inventory Turnover Ratio, reflecting efficiency in managing inventory, exhibited significant fluctuations over the years. While it peaked at 107 times in 2018, it dropped considerably to 41 times in 2022, signaling a potential need for improvement in inventory management strategies. Addressing this decline is vital to preventing excess inventory holding costs and ensuring optimal resource allocation. The Fixed Asset Turnover Ratio, indicating revenue generation per dollar of fixed assets, declined from 2.26 times in 2018 to 0.49 times in 2022. This suggests underutilization of fixed assets, necessitating a thorough review of asset utilization strategies to enhance operational efficiency and maximize returns. The Total Asset Turnover, reflecting overall efficiency in utilizing all assets, witnessed a substantial decrease from 1.05 times in 2018 to 0.17 times in 2022. This underscores the urgency for CelcomDigi to take proactive measures to maximize returns on investments and enhance overall operational efficiency. In conclusion, CelcomDigi's activity ratios highlight concerns about declining efficiency in asset management. To maintain long-term profitability and competitiveness, the company needs to address these challenges promptly. 8 iii. LEVERAGE RATIOS CELCOMDIGI DEBT RATIOS TIMES INTEREST FIXED CHARGE (%) EARNED COVERAGE (TIMES) (TIMES) 2018 89.15 17.12 0.05 2019 91.95 8.54 0.81 2020 93.29 7.62 1.67 2021 92.77 8.32 1.38 2022 57.40 5.82 1.04 18 100 90 80 70 60 50 40 30 20 10 0 16 14 TIMES 12 10 8 6 4 2 0 2018 2019 2020 TIMES INTEREST EARNED 2021 (%) LEVERAGE RATIOS 2022 FIXED CHARGE COVERAGE DEBT RATIOS (%) CelcomDigi's leverage ratios offer a nuanced view of their financial health, presenting a mixed picture that underscores both potential risks and positive developments. Examining these ratios provides valuable insights into the company's reliance on debt, its ability to meet financial obligations, and recent shifts in its financial structure. Starting with the Debt Ratios, which consistently exceeded 89% for most years, there is a clear indication of CelcomDigi's high dependence on debt financing. This heightened debt burden raises concerns about the company's vulnerability to adverse economic conditions. However, a noteworthy and positive development emerged in 2022, where the debt ratio significantly decreased to 57.40%. This reduction suggests a recent improvement in CelcomDigi's financial structure, potentially signaling a strategic move towards a more balanced mix of debt and equity. 9 Moving on to the Times Interest Earned Ratio, which gauges the company's ability to meet interest payments, there was a decline from 17.12 in 2018 to 5.82 in 2022. While this downward trend raises eyebrows, it is essential to note that the ratio remains comfortably above the minimum threshold of 1. This implies that CelcomDigi continues to maintain sufficient coverage of interest expenses, mitigating immediate concerns about its ability to meet interest obligations. Considering the Fixed Charge Coverage Ratio, which assesses the company's capacity to manage all fixed financial obligations, including interest and debt, the ratio dipped below 1 in 2022. However, it consistently stayed above 0.05 throughout the preceding years, indicating a generally acceptable ability to handle fixed financial charges. This suggests that, despite the temporary dip, CelcomDigi has historically demonstrated a reasonable capacity to manage its fixed financial commitments. In summary, CelcomDigi's leverage ratios highlight a high reliance on debt, posing potential challenges during economic downturns. However, the company's ability to cover interest expenses and manage fixed charges has generally remained within an acceptable range. The significant decrease in debt ratios in 2022 is a positive signal, indicating a potential shift towards a more balanced and sustainable financial structure. 10 iv. LIQUIDITY RATIOS CELCOMDIGI CURRENT RATIOS (TIMES) QUICK RATIOS (TIMES) 2018 0.78 0.75 2019 0.67 0.64 2020 0.61 0.12 2021 0.49 0.07 2022 0.49 0.15 TIMES LIQUIDITY RATIOS 0,9 0,8 0,7 0,6 0,5 0,4 0,3 0,2 0,1 0 2018 2019 2020 YEARS CURRENT RATIOS 2021 2022 QUICK RATIOS Beginning in 2018, CelcomDigi's current ratio stood at 0.78%, indicating that its current assets were sufficient to cover 78% of its current liabilities. However, this ratio steadily decreased over the subsequent years, reaching 0.67% in 2019, 0.61% in 2020, and remaining at 0.49% in both 2021 and 2022. A current ratio below 1 implies that the company may face challenges in meeting its short-term obligations, as its current assets are insufficient to cover the entirety of its current liabilities. CelcomDigi's quick ratio, which measures the company's ability to meet its immediate liabilities without relying on the sale of inventory. In 2018, the quick ratio was 0.75 times, signalling a relatively healthier position. However, this ratio declined to 0.64 times in 2019, further dropping to 0.12 times in 2020, 0.07 times in 2021, and marginally recovering to 0.15 times in 2022. A quick ratio below 0.5 is generally considered a worrisome indication of potential financial distress, highlighting the company's limited ability to cover its short-term liabilities without relying on inventory sales. 11 The persistent decline in both the current and quick ratios suggests that CelcomDigi may be grappling with diminishing liquidity. In conclusion, the consistent decline in CelcomDigi's liquidity ratios raises significant concerns about the company's ability to meet its short-term obligations. Addressing these challenges promptly and implementing effective liquidity management strategies will be crucial for CelcomDigi to restore confidence among stakeholders and ensure its financial stability in the ever-evolving telecommunications industry. 12 4.2 TREND ANALYSIS (REDTONE) i. PROFITABILITY RATIOS REDTONE PROFIT RETURN ON RETURN ON MARGIN (%) ASSETS (%) EQUITY (%) 2018 5.2 2.28 7.39 2019 10 2.85 14.46 2020 10.6 3.44 4.1 2021 3.8 16.41 11.60 2022 24.6 13.58 19.90 PROFITABILITY RATIOS 30 25 (%) 20 15 10 5 0 2018 2019 2020 YEARS PROFIT MARGIN 2021 2022 RETURN ON ASSETS RETURN ON EQUITY Starting with the Profit Margin, Redtone has experienced a noteworthy surge from 5.2% in 2018 to 10% in 2019. This positive momentum continued in 2020, reaching 10.6%, demonstrating the company's ability to generate more profit relative to its revenue. Although there was a dip in 2021 to 3.8%, Redtone rebounded impressively in 2022, achieving a remarkable profit margin of 24.6%. This overall positive trend indicates an increasing efficiency in cost management and revenue generation, solidifying Redtone's position as a profitable player in the telecommunications sector. Examining the Return on Assets (ROA), Redtone's performance showcases a consistent upward trajectory. Starting at 2.28% in 2018, the ROA increased to 2.85% in 2019, reflecting the company's improved ability to generate profit from its assets. The positive trend continued, with a substantial surge in 2021 to 16.41%. While there was a slight decrease to 13 13.58% in 2022, the overall trend signifies Redtone's effective utilization of assets to generate profits, underscoring operational efficiency and strategic asset management. Similarly, Redtone's Return on Equity (ROE) demonstrates a compelling story of improvement. Beginning at 7.39% in 2018, the ROE surged to 14.46% in 2019, indicating the company's ability to generate more earnings for its stockholders. Although there was a temporary decline to 4.1% in 2020, Redtone rebounded significantly in 2021 to 11.60% and achieved an even higher ROE of 19.90% in 2022. This highlights Redtone's commitment to maximizing shareholder value and the company's effectiveness in utilizing equity to generate returns. In summary, Redtone's profitability ratios paint a positive picture of the company's financial performance over the last five years. The upward trajectory in profit margin, coupled with the consistent improvement in ROA and ROE, reflects a strategic and efficient management approach. While there was a temporary dip in some ratios in 2021, the subsequent rebound in 2022 suggests resilience and adaptability in navigating market dynamics. These positive trends bode well for Redtone's future prospects, positioning the company as a promising player in the telecommunications industry. Continued vigilance and strategic planning will be essential to sustain and build upon these achievements in the evolving business landscape. 14 ii. ACTIVITY RATIOS REDTONE ACCOUNT AVERAGE INVENTORY FIXED ASSET TOTAL RECEIVABLE COLLECTION TURNOVER TURNOVER ASSET TURNOVER PERIOD (TIMES) (TIMES) TURNOVER (TIMES) (DAYS) 2018 1.76 204 270 5.92 0.56 2019 5.17 69 51.91 12.64 0.78 2020 1.58 228 324.83 7.55 0.70 2021 1.31 273 305.37 9.73 0.63 2022 1.47 243 332.02 19.52 0.53 (TIMES) ACTIVITY RATIOS 300 300 200 200 100 100 0 DAYS TIMES 400 0 2018 2019 2020 YEARS 2021 2022 Fixed Asset Turnover Average Collection Period Account Receivable Turnover Inventory Turnover (ITO) Total Asset Turnover Redtone's activity ratios provide valuable insights into the efficiency of its operational and asset management strategies. Analyzing these ratios over the past five years reveals a mixed picture, showcasing areas of notable improvement alongside opportunities for enhancement. Starting with the Account Receivable Turnover, the ratio indicates Redtone's efficiency in collecting receivables. In 2018, the ratio was relatively low at 1.76 times, signaling a slower collection process. However, Redtone made significant strides, reaching an impressive 5.17 times in 2019. Unfortunately, a subsequent decline occurred, with the ratio dropping to 1.47 times in 2022. This suggests a recent decline in efficiency, indicating that Redtone may be facing challenges in collecting receivables promptly. 15 The Average Collection Period, measuring the time it takes for Redtone to collect receivables, exhibited a dramatic improvement from 204 days in 2018 to 69 days in 2019. However, this positive trend reversed, with the average collection period increasing to 243 days in 2022. The correlation with the decline in Account Receivable Turnover reinforces the notion that Redtone is taking longer to collect its receivables, necessitating a closer examination of credit and collection processes. Turning to Inventory Turnover, the ratio was exceptionally high in 2020 (324.83 times) and 2021 (305.37 times), indicating efficient inventory management. Although there was a slight decrease to 332.02 times in 2022, Redtone continues to manage its inventory effectively. This is a positive sign for operational efficiency and cost control. The Fixed Asset Turnover Ratio, reflecting how efficiently Redtone utilizes fixed assets, was notably high in 2022 at 19.52 times. This suggests that Redtone is generating substantial revenue per dollar of fixed assets, showcasing effective utilization and operational efficiency. Examining the Total Asset Turnover, the ratio has remained relatively stable over the past five years, ranging from 0.53 times to 0.78 times. This indicates consistent efficiency in using all assets, but there may be opportunities for further improvement. Evaluating ways to optimize asset utilization could contribute to overall operational efficiency. In conclusion, Redtone's activity ratios showcase a mixed performance. While the company has made significant improvements in inventory management and fixed asset utilization, challenges in account receivable collection and the overall efficiency of asset utilization are evident. 16 iii. LEVERAGE RATIOS REDTONE DEBT RATIOS TIMES INTEREST FIXED CHARGE (%) EARNED (TIMES) AVERAGE (TIMES) 2018 31.57 27.50 4.09 2019 30.67 32.60 2.43 2020 37.90 30.12 3.29 2021 34.25 41.50 2.99 2022 25.02 47.62 3.35 45 40 35 30 25 20 15 10 5 0 40 35 30 25 20 15 10 5 0 2018 2019 2020 YEARS 2021 (%) TIMES LEVERAGE RATIOS 2022 TIMES INTEREST EARNED (TIMES) FIXED CHARGE AVERAGE (TIMES) DEBT RATIOS Redtone's leverage ratios offer a compelling insight into the robust financial health and prudent financial management practices of the company. Examining these ratios over the past five years reveals a consistently positive trajectory, underscoring Redtone's sound approach to capital structure and financial stability. Starting with the Debt Ratios, which indicate the proportion of Redtone's total capital financed by debt, the fluctuations observed over the past five years have been within a relatively low range of 25.02% to 37.90%. This consistent moderation suggests that Redtone has maintained a healthy balance between debt and equity financing, effectively managing financial risk. The conservative approach to debt financing contributes to the company's overall financial stability and resilience. Moving to the Times Interest Earned ratio, which measures Redtone's ability to cover its interest expenses, a remarkable improvement is evident. The ratio increased substantially 17 from 27.50 times in 2018 to an impressive 47.62 times in 2022. This upward trend signifies that Redtone is generating significantly more income than required to meet its interest obligations, reinforcing the company's strong financial standing and ability to navigate potential economic challenges. Similarly, the Fixed Charge Coverage ratio, assessing Redtone's capacity to meet all fixed financial obligations, including interest and debt, mirrors the positive trend observed in the Times Interest Earned ratio. Experiencing a substantial upward trajectory, the Fixed Charge Coverage ratio reached 3.35 times in 2022. This signifies that Redtone can comfortably cover its fixed charges, further solidifying its financial health and demonstrating a robust capability to manage various financial obligations. In summary, Redtone's leverage ratios collectively paint a positive and encouraging picture of the company's financial health. The low debt ratios reflect a conservative and prudent approach to debt financing, while the substantial increases in both Times Interest Earned and Fixed Charge Coverage ratios underscore Redtone's strong capacity to manage financial obligations. This positioning suggests that Redtone is well-prepared for future growth and investment opportunities, instilling confidence among stakeholders and paving the way for sustained success in the dynamic telecommunications industry. 18 iv. LIQUIDITY RATIOS REDTONE CURRENT RATIOS QUICK RATIOS (TIMES) (TIMES) 2018 2.29 2.28 2019 2.67 2.66 2020 2.56 2.56 2021 2.63 3.62 2022 3.28 3.27 LIQUIDITY RATIOS 4 TIMES 3 2 1 0 2018 2019 2020 YEARS CURRENT RATIOS 2021 2022 QUICK RATIOS The presented graph illuminates Redtone's liquidity ratios, encompassing both the current ratio and quick ratio, pivotal metrics that gauge the company's ability to meet shortterm obligations with its assets. These liquidity indicators are crucial in assessing Redtone's financial flexibility and its capacity to honor immediate financial commitments. The current ratio, a metric reflecting the ratio of current assets to current liabilities, witnessed an upward trajectory for Redtone from 2.29 times in 2018 to 2.67 times in 2019, indicative of an initially strengthening ability to settle short-term obligations. However, there was a slight dip in 2020, with the current ratio decreasing to 2.56 times, signaling a potential challenge in covering immediate liabilities. Encouragingly, Redtone rebounded in 2021, registering a current ratio of 2.63 times, and experienced a significant boost in 2022, reaching 3.28 times. This positive shift suggests an improvement in the company's ability to fulfill shortterm obligations, showcasing resilience and adaptability. Simultaneously, the quick ratio, a measure of the company's capability to settle shortterm obligations with its most liquid assets, demonstrated a consistent increase from 2018 to 2019. The quick ratio surged from 2.28 times in 2018 to 2.66 times in 2019, indicating a robust 19 ability to cover immediate liabilities with highly liquid assets. However, there was a marginal decline in 2020, with the quick ratio decreasing to 2.56 times, signaling a potential constraint in using the most liquid assets to meet short-term obligations. In 2021, Redtone displayed a modest improvement, with the quick ratio rising slightly to 3.62 times, suggesting a potential reversal in the earlier downward trend. Nonetheless, there was a subsequent decrease in 2022 to 3.27 times, highlighting the importance of ongoing vigilance regarding liquidity management. The fluctuation in both the current and quick ratios underscores the dynamic nature of Redtone's liquidity position. While the company showcased resilience and adaptability, evidenced by the rebound in 2021 and a notable surge in 2022, continuous monitoring and strategic liquidity management will be essential to navigate potential challenges in the everevolving business landscape. In conclusion, the presented liquidity ratios depict Redtone's ongoing efforts to enhance its financial flexibility and meet short-term obligations effectively. The positive trends observed in both ratios, especially the notable increase in 2022, suggest a promising trajectory. However, careful consideration and strategic planning will be imperative to sustain and fortify Redtone's liquidity position amidst the uncertainties inherent in the telecommunications industry. 20 5.0 COMPARATIVE ANALYSIS (CELCOMDIGI, REDTONE) 5.1 PROFITABILITY RATIOS (CELCOMDIGI, REDTONE) i. PROFIT MARGIN CELCOMDIGI YEARS REDTONE PROFIT MARGIN (%) 2018 23.60 5.2 2019 22.75 10 2020 19.84 10.6 2021 18.34 3.8 2022 11.26 24.6 PROFIT MARGIN 30 25 (%) 20 15 10 5 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE A comparative analysis of the profitability ratios of Celcomdigi and Redtone reveals a consistent trend favoring Celcomdigi over the past five years, with higher profit margins across the board. This financial disparity can be attributed to a combination of factors that underscore Celcomdigi's dominance and resilience in the telecommunications sector. Examining the profit margins for the years 2018 to 2022, Celcomdigi consistently outperformed Redtone. In 2018, Celcomdigi boasted a profit margin of 23.60%, significantly surpassing Redtone's 5.20%. The trend continued in 2019, with Celcomdigi at 22.75% compared to Redtone's 10.00%. Even in 2020, as the global landscape faced economic challenges, Celcomdigi maintained a profit margin of 19.84%, while Redtone recorded 10.60%. The year 2021 witnessed Celcomdigi's profit margin at 18.34% against Redtone's 3.80%. However, a surprising shift occurred in 2022 when Redtone experienced a surge in profitability, boasting a profit margin of 24.60%, while Celcomdigi's margin dipped to 11.26%. 21 Celcomdigi's sustained lead can be attributed to various strategic advantages. The company commands a larger market share, positioning itself as the leading mobile operator in Malaysia with a customer base exceeding 11 million. This substantial market presence affords Celcomdigi economies of scale, enhancing its bargaining power with suppliers and contributing to more efficient operations. Furthermore, Celcomdigi's success can be attributed to its diversified product and service offerings. By providing a broad range of telecommunications solutions, Celcomdigi caters to diverse consumer needs, thereby securing multiple revenue streams. This diversification not only insulates the company from market fluctuations but also enhances its competitiveness. In contrast, Redtone, with around 3 million customers, faces inherent challenges in competing with Celcomdigi. The smaller customer base limits Redtone's ability to leverage economies of scale, resulting in a less competitive position in terms of pricing and service offerings. Additionally, Redtone's focus on the fixed broadband market, while valuable in providing specialized services, inherently presents a less profitable landscape compared to the dynamic and lucrative mobile market. While Celcomdigi's consistent profitability signifies its industry leadership and strategic prowess, the surprising surge in Redtone's profitability in 2022 warrants further investigation. This unexpected shift may be attributed to specific market dynamics, strategic initiatives, or external factors influencing Redtone's performance during that period. In conclusion, Celcomdigi's superior profitability ratios over the years underscore its strategic advantages, market dominance, and adept management. 22 ii. RETURN ON ASSETS RETURN ON ASSETS 30% 25% 20% 15% 10% 5% 0% 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The 5-year comparative analysis of Return on Assets (ROA) between CelcomDigi and Redtone reveals a notable and evolving trend in their respective abilities to generate profits from their assets. This analysis provides valuable insights into the changing dynamics of efficiency and profitability within the two telecommunications companies. In 2018, CelcomDigi exhibited a robust ROA of 25%, surpassing Redtone's ROA of 2.28%. This suggested that CelcomDigi was more efficient in converting its assets into profits compared to Redtone. However, over the subsequent years, a clear shift in this comparative performance emerged. By 2019, CelcomDigi's ROA experienced a decline to 18%, while Redtone demonstrated improvement, reaching an ROA of 2.85%. This narrowing gap indicated a convergence in their efficiency in utilizing assets for profit generation. In 2020, CelcomDigi's ROA further decreased to 15%, while Redtone's increased to 3.44%. 23 The divergence in ROA trends became more pronounced in 2021, as CelcomDigi's ROA declined to 15.00%, while Redtone's ROA surged significantly to 16.41%. Both companies experienced an increase, but Redtone's substantial improvement showcased a more pronounced upward trajectory. In 2022, CelcomDigi's ROA declined sharply to 6.00%, reflecting a significant drop in its ability to generate profits from its assets. Conversely, Redtone's ROA experienced a more modest decline to 13.58%, maintaining its lead over CelcomDigi. In conclusion, this comparative analysis underscores the evolving landscape of asset efficiency and profitability in the telecommunications sector. For CelcomDigi, addressing the sharp decline in ROA is imperative for sustained competitiveness and financial health. Meanwhile, Redtone's consistent improvement positions the company favorably within the industry. 24 iii. RETURN ON EQUITY CELCOMDIGI YEARS REDTONE RETURN ON EQUITY (%) 2018 229 7.39 2019 217 14.46 2020 201 4.1 2021 184 11.60 2022 13.00 19.90 RETURN ON EQUITY 250 (%) 200 150 100 50 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The comprehensive 5-year comparative analysis of Return on Equity (ROE) between CelcomDigi and Redtone reveals a noteworthy divergence in their respective abilities to generate profits from equity. This analysis sheds light on the evolving dynamics of efficiency and profitability within the two telecommunications companies. In 2018, CelcomDigi exhibited an impressive ROE of 229%, far surpassing Redtone's ROE of 7.39%. This stark contrast indicated CelcomDigi's superior efficiency in transforming equity into profits compared to Redtone. However, a significant shift in this comparative performance became evident in the subsequent years. By 2019, CelcomDigi's ROE declined to 217%, while Redtone demonstrated improvement, reaching an ROE of 14.46%. This narrowing gap indicated a convergence in their efficiency in utilizing equity for profit generation. In 2020, both companies experienced a decline in ROE, with CelcomDigi's dropping further to 201%, while Redtone's declined more sharply to 4.10%. Despite the decline, CelcomDigi maintained a higher ROE than Redtone in 2020. 25 In 2021, CelcomDigi's ROE declined to 184%, while Redtone's ROE recovered slightly to 11.60%. Both companies exhibited a slight recovery, but CelcomDigi's ROE remained higher than Redtone's. The notable change occurred in 2022 when CelcomDigi's ROE sharply declined to 13.00%, while Redtone's ROE increased significantly to 19.90%. This marked the first time Redtone surpassed CelcomDigi's ROE, showcasing a remarkable improvement in Redtone's ability to generate profits from equity. The overarching 5-year comparative analysis highlights Redtone's substantial increase in ROE, contrasting with CelcomDigi's significant decline. Redtone's consistent improvement positions the company as more adept at leveraging its equity for profitability, while CelcomDigi faces challenges in maintaining the efficiency it demonstrated in 2018. As a result, Redtone's ROE has now surpassed CelcomDigi's by a notable margin in 2022. In conclusion, this comparative analysis underscores the shifting landscape of equity efficiency and profitability in the telecommunications sector. For CelcomDigi, addressing the sharp decline in ROE is imperative for sustained competitiveness and financial health. Meanwhile, Redtone's consistent improvement positions the company favorably within the industry. 26 5.2 ACTIVITY RATIOS (CELCOMDIGI, REDTONE) i. ACCOUNT RECEIVABLE TURNOVER CELCOMDIGI YEARS REDTONE ACCOUNT RECEIVABLE TURNOVER (TIMES) 2018 4.39 1.76 2019 4.81 5.17 2020 5.63 1.58 2021 5.74 1.31 2022 2.53 1.47 TIMES ACCOUNT RECEIVABLE TURNOVER 7 6 5 4 3 2 1 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The Account Receivable Turnover is a financial ratio that measures how efficiently a company manages its receivables. A higher Account Receivable Turnover generally indicates that a company is collecting its receivables more quickly, which is a positive sign of efficient management. A lower turnover may suggest that the company is taking more time to collect payments. In examining the Account Receivable Turnover (ART) for CelcomDigi, the year 2018 provides a baseline with an ART of 4.39 times, and no percentage change is available as there is no previous year for comparison. Moving to 2019, the ART increased to 4.81 times, representing a percentage increase of approximately 9.56%. This uptick indicates that CelcomDigi enhanced its efficiency in collecting receivables compared to the preceding year. The positive trend continued into 2020, where the ART rose to 5.63 times, reflecting a percentage increase of around 17.05%. This suggests a continued improvement in receivables management. In 2021, the ART reached 5.74 times, with a modest percentage increase of approximately 1.96%, indicating relatively stable performance. However, in 2022, 27 there was a significant decrease to 2.53 times, resulting in a percentage decrease of approximately -55.97%. This substantial drop suggests a potential issue in CelcomDigi's receivables management, possibly indicating prolonged payment collection or challenges in credit control. Shifting focus to Redtone, the period from 2018 to 2019 witnessed a remarkable improvement in ART, surging from 1.76 to 5.17, representing a substantial percentage increase of approximately 193.18%. This substantial improvement in efficiency suggests effective management of receivables during that period. However, from 2019 to 2020, there was a significant decline as the ART dropped from 5.17 to 1.58, resulting in a considerable percentage decrease of approximately -69.47%. The subsequent years, 2020 to 2021, witnessed a further decrease in ART from 1.58 to 1.31, with a percentage decrease of approximately -17.09%, indicating a slight decline in receivables management efficiency. However, in 2021 to 2022, there was a small improvement as the ART increased from 1.31 to 1.47, reflecting a percentage increase of approximately 12.21%. These fluctuations in ART for Redtone underscore the dynamic nature of its receivables management, suggesting varying degrees of efficiency and potential challenges in different years. To conclude, CelcomDigi, there was an overall increasing trend from 2018 to 2021, but a significant decrease in 2022. For Redtone, there was a substantial increase from 2018 to 2019, followed by fluctuations in subsequent years. 28 ii. AVERAGE COLLECTION PERIOD CELCOMDIGI YEARS REDTONE AVERAGE COLLECTION PERIOD (DAYS) 2018 81 204 2019 74 69 2020 63 228 2021 62 273 2022 141 243 AVERAGE COLLECTION PERIOD 300 DAYS 250 200 150 100 50 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The Average Collection Period is a financial metric that represents the average number of days it takes for a company to collect payment from its customers after a sale is made. A lower Average Collection Period is generally considered better as it indicates that the company is collecting payments more quickly. A higher collection period may suggest that the company takes longer to collect payments. Over the observed years, CelcomDigi's Average Collection Period (ACP) demonstrated a consistent improvement in payment collection efficiency. From 2018 to 2019, the ACP decreased by approximately 8.64%, signaling enhanced effectiveness in receivables management. This positive trend continued in 2019 to 2020, with a further reduction of about 14.86%, indicating sustained efficiency. The ACP remained relatively stable from 2020 to 2021, decreasing by approximately 1.59%, showcasing consistent performance. However, in 2021 to 2022, there was a significant increase of approximately 127.42%, suggesting potential challenges in CelcomDigi's receivables management, resulting in a longer average time to collect payments. 29 Conversely, Redtone experienced significant fluctuations in its ACP. The period from 2018 to 2019 saw a remarkable improvement, with the ACP decreasing by approximately 66.18%, indicating effective receivables management strategies. However, from 2019 to 2020, there was an unexpected increase of about 230.43%, reflecting challenges or changes in payment collection processes. This trend persisted in 2020 to 2021, with the ACP increasing by approximately 19.74%, indicating ongoing challenges in Redtone's receivables management. Although there was a slight decrease in 2021 to 2022, with a percentage decrease of approximately 10.99%, the ACP remained considerably higher than in earlier years, suggesting continued challenges in payment collection. These variations in ACP for both CelcomDigi and Redtone provide valuable insights into the effectiveness of their respective receivables management strategies and highlight areas for potential improvement or attention. To conclude, for CelcomDigi, there was an overall decreasing trend from 2018 to 2021, but a significant increase in 2022. For Redtone, there was a substantial decrease in 2019, followed by an increase in the subsequent years. 30 iii. INVENTORY TURNOVER CELCOMDIGI YEARS REDTONE INVENTORY TURNOVER (TIMES) 2018 107 270 2019 69.19 51.91 2020 44.91 324.83 2021 54.13 305.37 2022 41 332.02 TIMES INVENTORY TURNOVER 350 300 250 200 150 100 50 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE Inventory Turnover is a financial ratio that measures how many times a company's inventory is sold and replaced over a specific period. A higher inventory turnover generally indicates more efficient inventory management A higher Inventory Turnover generally indicates that a company is selling and restocking its inventory more frequently, which can be a sign of effective inventory management. A lower turnover may suggest slower inventory sales and potentially excess inventory. In examining the Inventory Turnover for CelcomDigi and Redtone over the specified years, notable trends in inventory management efficiency emerge. For CelcomDigi, from 2018 to 2019, there was a substantial decrease in Inventory Turnover from 107 times to 69.19 times, indicating a 35.99% reduction. This decline suggests a slower pace in inventory turnover, possibly influenced by changes in sales dynamics or inventory management practices. The trend persisted from 2019 to 2020, with the turnover decreasing to 44.91 times, representing a further 35.08% decrease. However, in 2020 to 2021, there was an increase to 54.13 times, signifying a 20.55% improvement, potentially reflecting enhanced sales performance or improved inventory management. Nonetheless, in 2021 to 2022, the turnover decreased to 41 31 times, indicating a 24.29% reduction, which may signify adjustments in market demand or inventory strategies. In contrast, Redtone experienced substantial fluctuations in Inventory Turnover. From 2018 to 2019, there was a significant decrease from 270 times to 51.91 times, reflecting an 80.75% decline and suggesting a major shift in the speed of inventory turnover. The subsequent year, 2019 to 2020, saw a remarkable increase to 324.83 times, marking a substantial 525.26% rise and indicating a significant improvement in inventory turnover, potentially driven by increased sales or more efficient inventory management. In 2020 to 2021, there was a slight decrease to 305.37 times (a 5.99% decrease), despite the turnover remaining high, suggesting continued efficiency in inventory management. Finally, in 2021 to 2022, there was a further increase to 332.02 times, representing an 8.72% improvement and implying sustained sales growth or enhanced inventory management practices. These fluctuations in Inventory Turnover for both companies provide valuable insights into their ability to optimize inventory levels and meet customer demand effectively, with changes influenced by factors such as market dynamics, sales performance, and evolving inventory management strategies. To conclude, for CelcomDigi, there was a decrease in inventory turnover from 2018 to 2020, followed by an increase in 2021 and a decrease again in 2022. For Redtone, there were fluctuations in inventory turnover, with a substantial decrease in 2019 and 2020, followed by an increase in 2021 and a slight increase in 2022. 32 iv. FIXED ASSET TURNOVER CELCOMDIGI YEARS REDTONE FIXED ASSET TURNOVER (TIMES) 2018 2.26 5.92 2019 1.15 12.64 2020 1.04 7.55 2021 1.11 9.73 2022 0.49 19.52 FIXED ASSETS TURNOVER 25 TIMES 20 15 10 5 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE Fixed Asset Turnover is a financial ratio that measures a company's ability to generate revenue from its fixed assets. It's calculated by dividing the total revenue by the average fixed assets. A higher fixed asset turnover generally indicates better utilization of fixed assets. A higher Fixed Asset Turnover generally indicates that a company is generating more revenue for each dollar invested in fixed assets, which is a positive sign of asset efficiency. A lower turnover may suggest that the company is not efficiently utilizing its fixed assets to generate revenue. Examining the Fixed Asset Turnover for CelcomDigi and Redtone across the specified years reveals distinctive trends in the efficiency of utilizing fixed assets to generate sales. For CelcomDigi, from 2018 to 2019, there was a notable decrease in Fixed Asset Turnover from 2.26 times to 1.15 times, indicating a 49.56% reduction in efficiency. This decline may suggest challenges in optimizing asset utilization or shifts in operational strategies. The trend continued in 2019 to 2020, with a further decrease to 1.04 times, marking a 9.57% decrease, potentially indicating ongoing challenges in maximizing fixed asset efficiency. However, in 2020 to 2021, there was a slight increase to 1.11 times, reflecting a 6.73% improvement, suggesting potential 33 adjustments in operational processes or enhanced sales efficiency. Nonetheless, in 2021 to 2022, the Fixed Asset Turnover sharply decreased to 0.49 times, representing a significant 55.86% reduction. This substantial drop may signify challenges in effectively utilizing fixed assets, potentially influenced by changes in business operations or a decline in sales. Conversely, Redtone's Fixed Asset Turnover demonstrated distinct fluctuations. From 2018 to 2019, there was a remarkable increase from 5.92 times to 12.64 times, marking a substantial 113.51% rise, suggesting significant improvements in asset utilization efficiency. However, in 2019 to 2020, there was a decrease to 7.55 times, resulting in a 40.17% reduction, indicating challenges in maintaining the previous year's level of efficiency. The trend reversed in 2020 to 2021, with an increase to 9.73 times, reflecting a 28.81% improvement, potentially indicating enhanced operational processes or increased sales efficiency. Notably, in 2021 to 2022, the Fixed Asset Turnover sharply increased to 19.52 times, representing a significant 100.82% rise, implying exceptional improvement in utilizing fixed assets effectively. These variations underscore the importance of assessing the efficiency of fixed asset utilization for both companies, considering factors such as operational strategies, sales dynamics, and changes in business processes. To conclude, for CelcomDigi, there were fluctuations in fixed asset turnover, with a decrease from 2018 to 2019, a slight decrease in 2020, an increase in 2021, and a significant decrease in 2022. For Redtone, there were significant fluctuations, with a substantial increase in 2019, followed by decreases in 2020 and 2021, and a significant increase again in 2022. 34 v. TOTAL ASSET TURNOVER CELCOMDIGI YEARS REDTONE TOTAL ASSET TURNOVER (TIMES) 2018 1.05 0.56 2019 0.76 0.78 2020 0.68 0.70 2021 0.72 0.63 2022 0.17 0.53 Times TOTAL ASSETS TURNOVER 1,2 1 0,8 0,6 0,4 0,2 0 2018 2019 2020 Years CELCOMDIGI 2021 2022 REDTONE Total Asset Turnover is a financial ratio that measures a company's ability to generate revenue from its total assets. It's calculated by dividing the total revenue by the average total assets. A higher total asset turnover generally indicates better utilization of assets. A higher Total Asset Turnover generally indicates that a company is generating more revenue for each dollar invested in total assets, which is a positive sign of asset efficiency. A lower turnover may suggest that the company is not efficiently utilizing its total assets to generate revenue. The Total Asset Turnover for CelcomDigi and Redtone over the specified years reveals distinctive trends in the efficiency of utilizing total assets to generate sales. For CelcomDigi, from 2018 to 2019, there was a notable decrease from 1.05 times to 0.76 times, indicating a 27.62% reduction in efficiency. This decline may suggest challenges in optimizing asset utilization or shifts in operational strategies. The trend continued in 2019 to 2020, with a further decrease to 0.68 times, marking a 10.53% decrease, potentially indicating ongoing challenges in maximizing total asset efficiency. However, in 2020 to 2021, there was a slight increase to 0.72 times, reflecting a 5.88% improvement and suggesting potential adjustments in operational processes or enhanced sales efficiency. Nonetheless, in 2021 to 2022, the Total 35 Asset Turnover sharply decreased to 0.17 times, representing a significant 76.39% reduction. This substantial drop may signify challenges in effectively utilizing total assets, potentially influenced by changes in business operations or a decline in sales. Similarly, Redtone's Total Asset Turnover demonstrated distinct fluctuations. From 2018 to 2019, there was a remarkable increase from 0.56 times to 0.78 times, marking a significant 39.29% rise and suggesting improvements in asset utilization efficiency. However, in 2019 to 2020, there was a decrease to 0.70 times, resulting in a 10.26% reduction, indicating challenges in maintaining the previous year's level of efficiency in total asset utilization. The trend reversed in 2020 to 2021, with a decrease from 0.70 times to 0.63 times, reflecting a 10% decrease and suggesting ongoing challenges in optimizing asset utilization or shifts in business strategies. Notably, in 2021 to 2022, the Total Asset Turnover decreased from 0.63 times to 0.53 times, representing a 15.87% decrease, indicating potential challenges in effectively utilizing total assets, potentially influenced by changes in business operations or a decline in sales. These variations underscore the importance of assessing the efficiency of total asset utilization for both companies, considering factors such as operational strategies, sales dynamics, and changes in business processes. To conclude, for both CelcomDigi and Redtone, there were fluctuations in total asset turnover over the years. CelcomDigi had a decrease from 2018 to 2019, a further decrease in 2020, an increase in 2021, and a significant decrease in 2022. Redtone had an increase from 2018 to 2019, a slight decrease in 2020, a further decrease in 2021, and another decrease in 2022. 36 5.3 LEVERAGE RATIOS (CELCOMDIGI, REDTONE) i. DEBT RATIOS CELCOMDIGI YEARS REDTONE DEBT RATIOS (%) 2018 89.15 31.57 2019 91.95 30.67 2020 93.29 37.90 2021 92.77 34.25 2022 57.40 25.02 DEBT RATIOS 100 (%) 80 60 40 20 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE A comparative analysis of the debt ratios of CelcomDigi and Redtone reveals an ongoing downward trend favoring Celcomdigi over the past five years, with higher debt expenses across the board. A lot of factors that highlight Celcomdigi's strength and dominance in the telecom industry can be blamed for this financial gap. By looking at the Debt Ratio from 2018 to 2022, Redtone exhibited a consistent superiority over CelcomDigi. In 2018, CelcomDigi boasted a debt ratio of 89.15%, significantly surpassing Redtone's 31.57%. The trend suddenly increased in 2019, with CelcomDigi at 91.95% compared to Redtone's 30.67%. Even in 2020, as the global landscape faced economic challenges, CelcomDigi maintained an increase of 93.29%, while Redtone also recorded an increase of 37.90%. The year 2021 observed that CelcomDigi debt ratio decreased a little bit from 2020 at 92.77% against Redtone's 34.25%. However, a surprising shift occurred in 2022 when Redtone experienced a decrease in expenses, boasting a debt ratio of 25.02%, while CelcomDigi ratio dipped to 57.40%. 37 Furthermore, CelcomDigi is a big company. It has a big size and life cycle stage of a company that can influence its debt ratio. CelomDigi is generally larger and more established companies that have greater access to debt markets and may use debt for strategic purposes. But compared to Redtone, it also has great access to debt markets because the smaller and newer company may have lower debt ratios as they focus on building equity. Redtone’s showed a greater decrease in debt ratios in 2022 because of lower financial risk. It is because a lower debt ratio indicates that the company has less financial leverage, which reduces its overall financial risk. It is important that the optimal debt ratio varies by industry and company characteristics. 38 ii. TIMES INTEREST EARNED (CELCOMDIGI, REDTONE) CELCOMDIGI YEARS REDTONE TIMES INTEREST EARNED 2018 17.12 27.50 2019 8.54 32.60 2020 7.62 30.12 2021 8.32 41.50 2022 5.82 47.62 TIMES INTEREST EARNED 60 TIMES 50 40 30 20 10 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE A financial indicator of a company's capacity to pay interest on outstanding debt is revealed by comparing CelcomDigi and Redtone over a five-year period using times interest earned (TIE). This analysis offers insightful information about how the two telecom companies' earnings and effectiveness are changing. In 2018, CelcomDigi exhibited a strong TIE of 17.12 times, surpassing Redtone's TIE of 27.50 times. This year indicates that Redtone’s has a greater ability to cover interest costs compared to CelcomDigi because a higher earnings before interest and tax reflects stronger operating profitability. But in the years that followed, there was a noticeable change in this relative performance. By 2019, CelcomDigi's TIE experienced a degradation to 8.54 times, while Redtone demonstrated growth, reaching a TIE of 32.60 times. This closing difference suggested an increase in their ability to generate profits from the use of assets. In 2020, CelcomDigi's TIE further decreased to 7.62, while Redtone's also reduced to 30.12 times. 39 The variations in TIE trends showed more improvement in 2021, as CelcomDigi's TIE increased to 8.32 times, while Redtone's TIE raised significantly to 41.50 times. Both companies experienced growth, but Redtone's significant progress demonstrated a more marked upward trend. In 2022, CelcomDigi's TIE declined sharply until 5.82 times, showing a sharp decline in its capacity to turn a profit from its assets. On the other hand, Redtone's TIE experienced a more increase to 47.62 times, maintaining its lead over CelcomDigi. In conclusion, this comparative analysis by highlighting how a company’s ability to service its debt between these two companies, CelcomDigi and Redtone. It is important to consider these factors in the company’s specific case when interpreting the TIE ratio. By that, Redtone has a higher TIE compared to CelcomDigi because a company having a great times interest earned (TIE) ratio is considered a robust operating performance, characterized by healthy profit margins and efficient cost management. 40 iii. FIXED CHARGE AVERAGE CELCOMDIGI YEARS REDTONE FIXED CHARGE AVERAGE 0.05 0.05 4.09 0.81 0.81 2.43 1.67 1.67 3.29 1.38 1.38 2.99 1.04 1.04 3.35 FIXED CHARGE COVERAGE 5 TIMES 4 3 2 1 0 0,05 0,81 1,67 YEARS CELCOMDIGI 1,38 1,04 REDTONE A higher Fixed Charge Coverage ratio indicates a company’s ability to satisfy fixed financial obligations. A Fixed Charge Coverage Ratio above 1.0 times implies that the company is making enough money to cover its fixed charges, which is good. A thorough 5-year analysis of CelcomDigi and Redtone Fixed Charge Coverage shows significant differences in the two companies’ capacity to make equity profits. The two telecom companies’ changing efficiency and profitability dynamics are clarified by this analysis. In 2018, CelcomDigi exhibited Fixed Charge Average of 0.05 times, far surpassing Redtone's Fixed Charge Average of 4.09 times. This establishing difference demonstrates how much more effectively Redtone converted assesses a company’s ability to cover its fixed charges into earnings than CelcomDigi. But in the following years, a notable change in this comparative performance was obvious. By 2019, CelcomDigi's Fixed Charge Average improved to 0.81 times, while Redtone demonstrated decreased, reaching the Fixed Charge Average of 2.43 times. This closing difference suggested that they were becoming better at using interest expense and lease 41 payments to generate profits. In 2020, both companies experienced an increase in Fixed Charge Average with CelcomDigi's raising further to 1.67 times, while Redtone's also grew more sharply to 3.29 times. According to research, Redtone will continue to have a higher Fixed Charge Average than CelcomDigi in 2020. In 2021, CelcomDigi's ROE declined 1.38 times, while Redtone's Fixed Charge Average partially recovered to 2.99 times. While both businesses showed signs of decreased, Redtone continued to be higher than CelcomDigi. The notable change occurred in 2022 when CelcomDigi's Fixed Charge Average sharply reduced to 1.04 times, while Redtone's Fixed Charge Average increased significantly to 3.35 times. This time Redtone’s Fixed Charge Average exceeded that of CelcomDigi because of higher earnings before interest and tax that provides more room to cover fixed charges due to that the profitability and operational runs efficiency directly impact the EBIT. For Redtone’s, the trend showed higher compared to CelcomDigi, which means the trends in the fixed charge coverage ratio sign of financial stability. It suggests that the company is generating sufficient earnings to comfortably cover its fixed charges that reduce the risk of default on debt obligations over time because it can provide insights into a company’s financial stability and management’s ability to navigate economic challenges. This comparative analysis concludes by highlighting the changing fixed average efficiency and profitability landscape in the telecommunications industry. It is important for investors and analysts to consider the ratio of a company’s growth stage and specific business. By that, Redtone has a higher Fixed Charge Coverage compared to CelcomDigi. The company showed more consistency but is not suitable for continuous improvement because of the company's operating efficiency that generates strong earnings from their core in business, indicating effective cost management and profitability. 42 5.4 LIQUIDITY RATIOS (CELCOMDIGI, REDTONE) i. CURRENT RATIOS CELCOMDIGI YEARS REDTONE CURRENT RATIOS (times) 2018 0.78 2.29 2019 0.67 2.67 2020 0.61 2.56 2021 0.49 2.63 2022 0.49 3.28 CURRENT RATIOS 3,28 3,5 3 2,67 TIMES 2,56 2,29 2,5 2,63 2 1,5 1 0,78 0,67 0,61 0,49 0,5 0,49 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The comparative analysis of CelcomDigi and Redtone's current ratios over the past five years provides valuable insights into their respective financial positions. Examining these ratios reveals notable trends in liquidity and financial health, emphasizing the differences in their ability to meet short-term obligations. In 2018, CelcomDigi's current ratio stood at 0.78, indicating that its current assets could cover 78% of its current liabilities. In contrast, Redtone boasted a higher current ratio of 2.29, signaling a stronger financial position with 2.29 times more current assets than current liabilities. This initial comparison suggested that Redtone held a superior financial standing compared to CelcomDigi. As the years progressed, CelcomDigi experienced a decline in its current ratio, dropping to 0.67 in 2019 and further decreasing to 0.61 in 2020. These declines signaled a weakening financial position for CelcomDigi, as its current assets became less sufficient to 43 meet current liabilities. In contrast, Redtone's current ratio remained relatively stable at 2.67 in 2019 and 2.56 in 2020, indicating sustained financial strength during this period. The divergence continued in 2021, with CelcomDigi's current ratio plummeting to 0.49, reflecting a more pronounced deterioration in its financial status. Meanwhile, Redtone's current ratio improved slightly to 2.63, highlighting the company's ability to strengthen its financial position. In 2022, CelcomDigi's current ratio remained at 0.49, indicating a persistently challenging financial situation. In contrast, Redtone's current ratio climbed significantly to 3.28, emphasizing an improvement in its financial standing. The overarching narrative from this comparative analysis underscores the divergent financial trajectories of CelcomDigi and Redtone. CelcomDigi faced a consistent decline in its current ratio, signaling increased challenges in meeting short-term obligations and potentially managing liquidity. Redtone, on the other hand, not only maintained a strong financial position but also demonstrated an upward trend in its current ratio, showcasing improved liquidity and financial health. In conclusion, the comparative analysis of current ratios emphasizes the importance of liquidity in assessing the financial stability of companies. CelcomDigi's declining current ratio signals potential challenges, while Redtone's consistently higher and improving current ratio positions the company as financially resilient. Stakeholders and investors can use these insights to make informed decisions about the financial health and sustainability of CelcomDigi and Redtone in the dynamic telecommunications industry. 44 ii. QUICK RATIOS CELCOMDIGI YEARS REDTONE QUICK RATIOS (TIMES) 2018 0.75 2.28 2019 0.64 2.66 2020 0.12 2.56 2021 0.07 3.62 2022 0.15 3.27 TMES QUICK RATIOS 4 3,5 3 2,5 2 1,5 1 0,5 0 2018 2019 2020 YEARS CELCOMDIGI 2021 2022 REDTONE The comparative analysis of CelcomDigi and Redtone's quick ratios over the past five years provides a nuanced perspective on their respective liquidity positions and short-term solvency. Examining these ratios reveals consistent disparities in their ability to meet immediate financial obligations. In 2018, CelcomDigi's quick ratio was 0.75 times, indicating that 75% of its assets were liquid and readily available to cover short-term liabilities. In contrast, Redtone boasted a substantially higher quick ratio of 2.28 times, signifying a remarkable 228% liquidity in its assets. This initial comparison suggested that Redtone held a superior position in terms of short-term solvency. As the years unfolded, CelcomDigi's quick ratio faced a decline, dropping to 0.64 times in 2019 and further plummeting to a concerning 0.12 times in 2020. These declines indicated a significant tightening of CelcomDigi's liquidity, posing potential challenges in meeting immediate financial obligations. In stark contrast, Redtone's quick ratio remained relatively 45 stable at 2.66 times in 2019 and 2.56 times in 2020, showcasing sustained liquidity strength during this period. The disparity in liquidity positions continued to widen in 2021, with CelcomDigi's quick ratio falling further to 0.07 times, signaling a situation of very tight liquidity. In contrast, Redtone's quick ratio surged significantly to an impressive 3.62 times, indicating extraordinarily strong liquidity. In 2022, CelcomDigi's quick ratio saw a slight recovery to 0.15 times, suggesting a modest improvement in liquidity. Meanwhile, Redtone's quick ratio declined slightly to 3.27 times, still maintaining an exceptionally strong liquidity position. The overarching narrative from this comparative analysis underscores the consistent advantage Redtone has maintained in terms of liquidity over the past five years. Redtone's quick ratio consistently outpaced CelcomDigi's, reflecting a more robust ability to cover shortterm obligations and maintain financial flexibility. In conclusion, the comparative analysis of quick ratios emphasizes the importance of liquidity in assessing the short-term solvency of companies. CelcomDigi's declining quick ratio signals tightening liquidity, while Redtone's has a better and consistently higher and stable quick ratio positions the company as more resilient in meeting immediate financial obligations. 46 6.0 CONCLUSIONS Based on both financial ratios of both companies, CelcomDigi has a better financial position than REDtone in almost every way. CelcomDigi has a lower debt-to-equity ratio, which means that it is less reliant on debt to finance its operations. This makes CelcomDigi less risky and more likely to be able to weather a financial downturn. CelcomDigi also has a higher times interest earned ratio, which means that it is better able to meet its interest obligations. This is important because it shows that CelcomDigi is generating enough cash flow to cover its debt payments. Finally, CelcomDigi has higher profit margins than REDtone, which means that it is keeping a larger percentage of its revenue as profit. This suggests that CelcomDigi is more efficient than REDtone and is better at managing its costs. Overall, CelcomDigi is the clear winner in terms of financial ratios. It is less risky, more profitable, and more efficient than REDtone. This suggests that CelcomDigi is a better longterm investment than REDtone. 47 7.0 APPENDIXES 7.1 INCOME STATEMENT CELCOMDIGI 48 7.2 INCOME STATEMENT 49 REDTONE 7.3 BALANCE SHEET CELCOMDIGI 50 7.4 BALANCE SHEET REDTONE 51 7.5 ANNUAL REPPORT CELCOM 2018-2022 2018 52 53 2019 54 55 2020 56 57 2021 58 59 2022 60 61 7.6 ANNUAL REPORT REDTONE 2018-2022 2018 62 63 64 65 2019 66 67 68 69 2020 70 71 72 2021 73 74 75 2022 76 77 78 7.7 OTHER REFERENCES FROM WEBSITE (CELCOMDIGI) 79 80 81 82 83 84 7.8 OTHER REFERENCES FROM 85 WEBSITE (REDTONE) 86 87 88 8.0 REFERENCES Wikipedia. (n.d.). CelcomDigi. https://en.wikipedia.org/wiki/CelcomDigi Celcom. (n.d.). Celcom-Digi Merger. https://www.celcom.com.my/celcom-digi-merger REDtone. (n.d.). About REDtone. https://www.redtone.com/corporate/about-redtone/ REDtone. (2019). Annual Report 2018. https://www.redtone.com/wpcontent/uploads/2019/04/REDtone_Annual_Report_201 8.pdf REDtone. (2019). Annual Report 2019. https://www.redtone.com/wp-content/uploads/2019/10/REDtone-Annual-Report2019.pdf REDtone. (2020). Annual Report 2020. https://www.redtone.com/wp-content/uploads/2020/10/REDtone-AR2020.pdf REDtone. (2021). Annual Report 2021. https://www.redtone.com/wp-content/uploads/2021/10/REDtone-Annual-Report2021-1.pdf REDtone. (2022). Annual Report 2022. https://www.redtone.com/wp-content/uploads/2022/10/Annual-Report-2022.pdf CelcomDigi. (2018). Annual Report 2018. https://celcomdigi.listedcompany.com/misc/FlippingBook_PDF_Publisher/Publication s/HTML/DIGI_2018-new/89/ CelcomDigi. (2019). Annual Report 2019. https://celcomdigi.listedcompany.com/misc/FlippingBook_PDF_Publisher/Publication s/HTML/DIGI_2019-new/167/ CelcomDigi. (2020). Annual Report 2020. https://celcomdigi.listedcompany.com/misc/ar/ar2020.pdf CelcomDigi. (2021). Annual Report 2021. https://celcomdigi.listedcompany.com/misc/ar/ar2021.pdf CelcomDigi. (2022). Annual Report 2022. https://celcomdigi.listedcompany.com/misc/FlippingBook_PDF_Publisher/Publication s/HTML/CelcomDigi_2022/index.html Wall Street Journal. (n.d.). CelcomDigi Financials. https://www.wsj.com/market-data/quotes/MY/XKLS/6947/financials/annual/incomestatement Wall Street Journal. (n.d.). REDtone Financials. https://www.wsj.com/market-data/quotes/MY/XKLS/0032/financials/annual/incomestatement 89