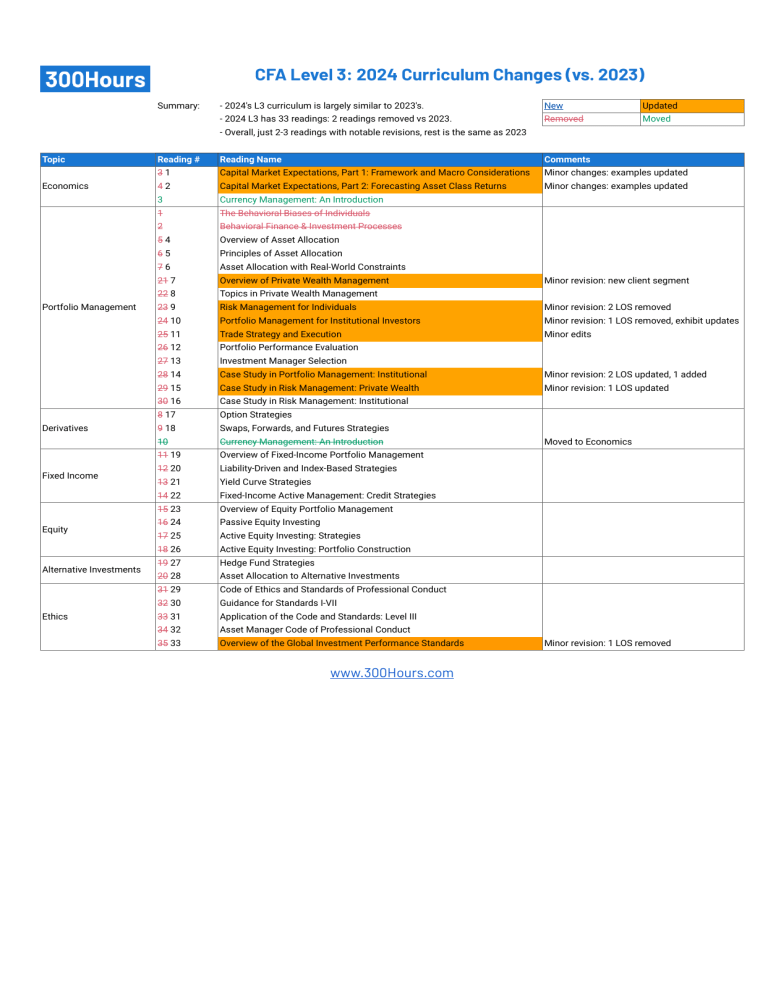

CFA Level 3: 2024 Curriculum Changes (vs. 2023) Summary: - 2024's L3 curriculum is largely similar to 2023's. New Updated - 2024 L3 has 33 readings: 2 readings removed vs 2023. Removed Moved - Overall, just 2-3 readings with notable revisions, rest is the same as 2023 Topic Economics Portfolio Management Derivatives Fixed Income Equity Alternative Investments Ethics Reading # Reading Name Comments 31 Capital Market Expectations, Part 1: Framework and Macro Considerations Minor changes: examples updated 42 Capital Market Expectations, Part 2: Forecasting Asset Class Returns Minor changes: examples updated 3 Currency Management: An Introduction 1 The Behavioral Biases of Individuals 2 Behavioral Finance & Investment Processes 54 Overview of Asset Allocation 65 Principles of Asset Allocation 76 Asset Allocation with Real-World Constraints 21 7 Overview of Private Wealth Management 22 8 Topics in Private Wealth Management 23 9 Risk Management for Individuals Minor revision: 2 LOS removed 24 10 Portfolio Management for Institutional Investors Minor revision: 1 LOS removed, exhibit updates 25 11 Trade Strategy and Execution Minor edits 26 12 Portfolio Performance Evaluation 27 13 Investment Manager Selection 28 14 Case Study in Portfolio Management: Institutional Minor revision: 2 LOS updated, 1 added 29 15 Case Study in Risk Management: Private Wealth Minor revision: 1 LOS updated 30 16 Case Study in Risk Management: Institutional 8 17 Option Strategies 9 18 Swaps, Forwards, and Futures Strategies 10 Currency Management: An Introduction 11 19 Overview of Fixed-Income Portfolio Management 12 20 Liability-Driven and Index-Based Strategies 13 21 Yield Curve Strategies 14 22 Fixed-Income Active Management: Credit Strategies 15 23 Overview of Equity Portfolio Management 16 24 Passive Equity Investing 17 25 Active Equity Investing: Strategies 18 26 Active Equity Investing: Portfolio Construction 19 27 Hedge Fund Strategies 20 28 Asset Allocation to Alternative Investments 31 29 Code of Ethics and Standards of Professional Conduct 32 30 Guidance for Standards I-VII 33 31 Application of the Code and Standards: Level III 34 32 Asset Manager Code of Professional Conduct 35 33 Overview of the Global Investment Performance Standards www.300Hours.com Minor revision: new client segment Moved to Economics Minor revision: 1 LOS removed