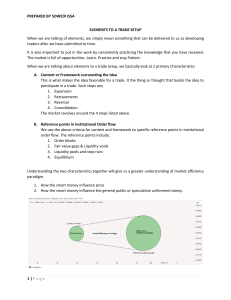

✏ ICT Mentorship | Month 1 Date @September 12, 2022 → September 18, 2022 Assign Status Completed Elements Of A Trade Setup There are two primary concerns: 1. Context or framework surrounding the idea: what makes the idea favourable for a trade a. Expansion b. Retracement c. Reversal d. Consolidation 2. Reference Points In Institutional Order Flow a. Order-blocks b. Fair Value Gaps & Liquidity Voids c. Liquidity Pools & Stop Runs d. Equilibrium ICT Mentorship | Month 1 1 This explains how the Smart Money interprets price and how it influences the Speculative and Uninformed Money via the Market Efficiency Paradigm. The Interbank Price Delivery Algorithm (Algo or Interbank Algo): It’s the actual artificial intelligence algorithm, it’s computer based (which is very efficient) and highly manipulated (which makes it easy to see the fingerprints of the Smart Money). All markets starts in a consolidation (holding pattern) and move into an expansion, that means there’s a impulse move. After that impulse it goes to a consolidation again or it ICT Mentorship | Month 1 2 goes into a retracement; when the retracement happens it goes back to another expansion or reversal. After the reversal, back to retracement, back to consolidation… This four conditions interchange throughout the ups and downs of the flow of the marketplace, you only get one of them at a time. So you only need to know where it is nor where is going to go next. All the moves of the market start from a consolidation because that’s where the markets are building orders (the market maker keeps market in a tight range until there is enough money to be absorbed to the “new” direction). What is expansion? Expansion is when price moves quickly from a level of equilibrium What is the importance? When price leaves a level quickly this indicates a willingness on the part of the Market Makers to reveal their intended repricing model. Which means that, if we are in a level of equilibrium and price moves up quickly → bullish order-block. What do we look for in price? The order-block the MM leave at or near the equilibrium. 💡 An order block is a market behavior that refers to an accumulation of orders (when bullish) and distribution of orders (when bearish) from financial institutions and banks. It basically points to an area that indicates where institutional traders would pile up their orders before entering the market. ICT Mentorship | Month 1 3 There’s a consolidation in the blue shaded area, it’s a clear high and low and the equilibrium price point is in the middle on that range (drawn with the Fibonacci Retracement Tool), this line of equilibrium will be touched a lot of times. What is Retracement? Retracement is when price moves back in the recently created price range. What is the importance? When price returns inside a recent price range, this indicates a willingness on the part of the market makers to reprice to levels not efficiently traded for fair value. What do we look for in price? The Fair Value Gaps and Liquidity Voids. ICT Mentorship | Month 1 4 When we see run-ups and run-downs very quick in price (real quick rallies), many times that range that is created will want to come back in and close that (fill it). A liquidity void is when the markets moves aggressively and a “pocket” is created , the price moved too quickly and skipped a part of the price. As traders we won’t chase price, we will wait and get a entry to fill that gap or we will wait until the price comes back to the original point (liquidity void filled) and continues it’s original direction. What is Reversal? Reversal is when price moves to the opposite direction that current direction has taken. What is the importance? When price reverses direction it indicates the MM have ran a level of stops and a significant move should unfold in the new direction. What do we look for in price? The Liquidity Pools just above an old price high and just below an old price low. ICT Mentorship | Month 1 5 Crosses are where the majority of stops (liquidity pools) are set. See how many times of OTE we can find in this chart. What is consolidation? When price moves inside a clear trading range and shows no willingness to move significantly higher or lower. What is the importance? When price consolidates it indicates MM are allowing orders to build on both sides of the market. Expert a new expansion near term. What do we look for in price? The Impulse Swing in price away from the equilibrium price level that is found exactly in the halfway point of the consolidation range. ICT Mentorship | Month 1 6 CONTEXT REFERENCE Expansion Order-blocks Retracement Fair Value Gaps & Liquidity Voids Reversal Liquidity Pools & Stop Runs Consolidation Equilibrium How Market Makers Condition The Market We as new traders are part of Uninformed Money, whether we acknowledge it or not, we have to understand that there is a Smart Money (banks) group of traders out there. It’s the small group of traders (Smart Money) who drive the price and move it around, we just try to follow and thinks it’s us moving the price, but we are not. You are not trading against a person anymore, it’s a computer program that delivers price and knows human behaviour. CONTEXT SESSION REFERENCE Expansion Judas Swing Order-blocks Retracement NY Session (3) Reversal London Swing (2) Consolidation Asian Range (1) Fair Value Gaps & Liquidity Voids Liquidity Pools & Stop Runs Equilibrium The Interbank Price Delivery Algorithm (…): ICT Mentorship | Month 1 7 Daily Range Structure 1. Price Equilibrium (Asian Range) 2. Manipulation (Judas Swing) - News Driver 3. Expansion (5am NY Time) 4. Reversal (London Open) 5. Expansion (5 AM NY to 8 AM) 6. Retracement (NY Pre-Session from 8 to 8:30 AM) 7. Reversal/Expansion Move (10-11 AM NY Time) 8. Reversal (London Close) 9. Consolidation (Rest Of The Day) 10. Price Equilibrium (Asian Range) If we are looking at price delivery, this is how it goes: Consolidation → expansion → retracement → expansion… Consolidation → expansion → reversal → exp. → cons… Consolidation → reversal Consolidation → retracement Trading Hours: NY TIME B.A TIME BCN TIME PRICE RANGE 17:00 18:00 23:00 Price Equilibrium Asian 23:00 00:00 05:00 Expansion Asian 01:00 02:00 07:00 Reversal London 6:00 to 9 7 to 10 12 to 15 Expansion London 9:00 - 9:30 10 to 10:30 15 to 15:30 Retracem. NY Open ICT Mentorship | Month 1 8 NY TIME B.A TIME BCN TIME PRICE RANGE 9 to 10 10 to 11 15 to 16 Expansion NY 10 to 17 11 to 18 17 to 23 Consolidat. NY 17:00 18:00 23:00 P.E Asian What To Focus On Right Now 1. Creating a daily price action logs with price charts a. Daily Chart - 12 months to no less than 9 months view b. 4 hour chart - 3 months view c. 60 minute chart- 3 weeks view d. 15 minute chart - 3 to 4 days view 2. Resist the urge to forecast price movements right now a. Where price shown a quick movement from a specific level b. Recent highs and recent lows that haven’t been retested c. Areas on the charts where price has left “clean” highs or lows (For example two lows at the same level → double bottom) d. What days weekly highs and lows are formed and what during which kill-zone are they formed in e. The daily high and daily low every trading day and in what kill-zone are they formed it 💡 What is a “Kill Zone”? Certain times of the day, where the market will form valid and high probability trade setups. These are the times you watch the markets and do your trading. You want to be finding set ups in these kill zones if you are using ICT trading: London Open (LO) → 7a.m. London Close (LC) → 4 p.m. NY Open (NYO) → 12 p.m. ICT Mentorship | Month 1 9 Equilibrium Vs. Discount ICT Mentorship | Month 1 10 Here we can see the market range that’s presently being traded in. If we look at this range, we have two very impulsive price moves at the beginning at the range → indication that there’s been displacement. 💡 Displacement is when someone with a lot of money has a strong conviction to move price. We want to see impulsive price swings: Swing High (followed by a retracement down) Swing Low (followed by a retracement up) Both in swing highs and swing lows we want to see the 3 candles that form the swing but also a 4th candle that is going to go lower (in a Swing High) and higher (in a Swing Low), when that happens we are going to see the price going back equilibrium, 50% level. 💡 Equilibrium is a midway point of a price move (line set up exactly at the middle or 50% of the range). When in a market range the price goes back to the equilibrium level, it is called Fair Value or Fair Market Value, it is a neutral condition but it can be used as an entry on the side of the previous direction on the market (bullish or bearish). ICT Mentorship | Month 1 11 We do NOTHING when price is ranging from the top of the range to equilibrium, only in equilibrium we can think about entering. 💡 Discount refers to everything going below equilibrium. When we have a bullish scenario for a market place, we look for impulsive price swings on the daily chart, we wait until it goes back to equilibrium or discount to get into the trade. When a market is at discount, discount prices don’t stay at the market very long. The market will rally from that place. The good entry is called OTE (Optimal Trade Entry) and it is located between the 0.62 and the 0.79 of the Fibonacci Retracement, the exact point would be 0.705 (Sweet Spot). ICT Mentorship | Month 1 12 When price goes to very suppressed levels and below equilibrium to a discount level, markets will not sustain discount prices very long if the underlying pinning of the marketplace is bullish. It gives context and a relative strength study. It should be sensitive, dynamic, moving away from equilibrium. If the market is going to go higher, it’s bullish, and it comes down below and old low, that’s going to be a stop-loss run (the market makers want to gather all of the orders that will be resting below those orders → old lows/highs). Fair Valuation Fair Valuations comes in the form of two perspectives: 1. Fair Value in regards to equal distance of a high or a low, what we also call equilibrium (50% level). 2. Fair Value for the perspective on valuation in regards to market makers. ICT Mentorship | Month 1 13 When the market returns back to an area of fair value, that is a fair value for the market maker to either sell or buy. 💡 A liquidity void is when price breaks down (or high) and quickly an away from the price where it was trading before, it’s a sudden movement, large ranges, very little wicks. The price spent very little time trading at these price levels and it was in a hurry to get down to this area when it starts to trade more efficiently, with then a retracement. When price is below the area of Liquidity Void, this is Fair Value which means the price is going to want to come back because it was very little trading there. What does this make it fair? They bought it at a deep discount and they’re liquidating at a premium. It’s fair for them to accumulate and then liquidate. When you are trading price action, keep in consideration: 1. Total Range you’re trading in. 2. Equilibrium Price Point relative to the most recent trading range high and low. ICT Mentorship | Month 1 14 Fair Value in Discount is FV for buy, for market maker buying. Fair Value in Premium is FV for sell, for market maker selling. Liquidity Runs 💡 Liquidity refers to the degree to which a market (asset or security) can be quickly bought or sold in the markets without affecting the asset’s price dramatically. Liquidity is where existing orders will reside. Liquidity is where above old highs and below old lows. They will target those same levels taking those orders out. ICT Mentorship | Month 1 15 Low Resistance Liquidity Run, there’s little resistance because we saw quick movement of the price (FVG), meanwhile it is filling that gap there’s not going to be resistance because there are not old lows and neither old highs it that area, is like a free way for price to come back to the old level. High Resistance Liquidity Run, when it gets back to that old high/low. Anything higher to that line becomes High Resistance. Impulse Price Swings & Market Protraction 💡 Market Protraction is time sensitive. Is an impulse price swing that is highly sensitive to a time of the day. There are 3 sensitive protractionary market moves every 24H: 0 a.m. GMT → Little movement up in the Asian session. 7 a.m. GMT → Impulse trading lower. 12 a.m. GMT → Retracement and then impulse lower. Market Protraction seeks liquidity. Every retracement is manipulation of the market to get liquidity. ICT Mentorship | Month 1 16 There is a time element applied to the small impulse swing: After Midnight GMT After 7 a.m GMT After 12 p.m GMT ICT Mentorship | Month 1 17