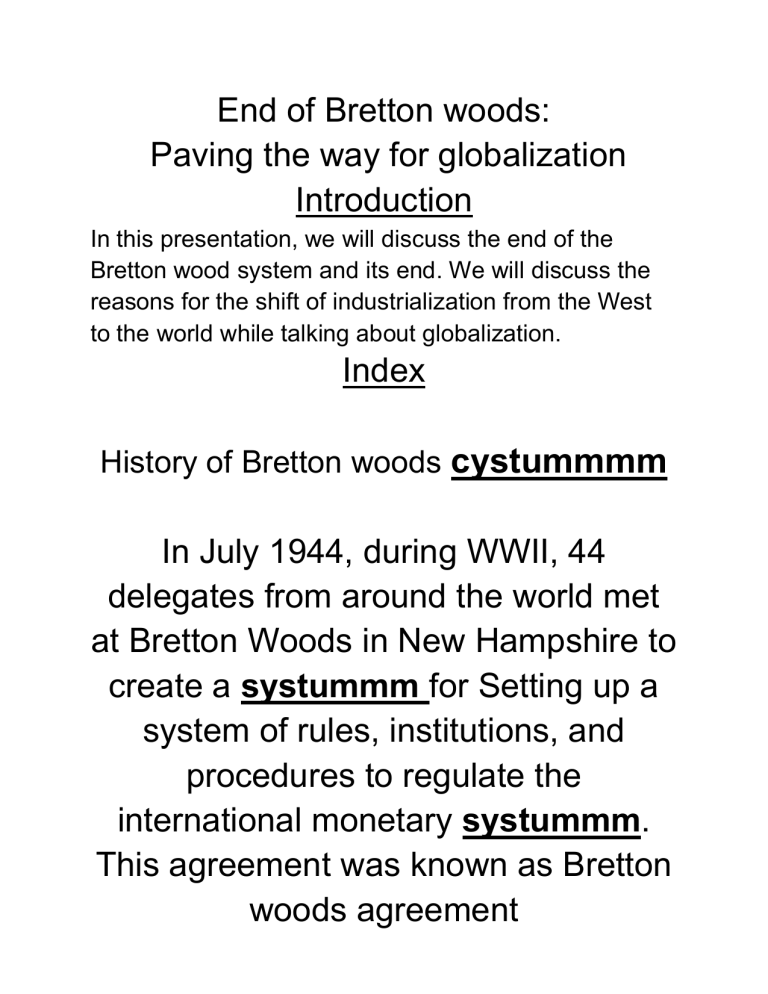

End of Bretton woods: Paving the way for globalization Introduction In this presentation, we will discuss the end of the Bretton wood system and its end. We will discuss the reasons for the shift of industrialization from the West to the world while talking about globalization. Index History of Bretton woods cystummmm In July 1944, during WWII, 44 delegates from around the world met at Bretton Woods in New Hampshire to create a systummm for Setting up a system of rules, institutions, and procedures to regulate the international monetary systummm. This agreement was known as Bretton woods agreement Bretton woods agreement The Bretton Woods conference established the International Monetary Fund (IMF) to deal with external surpluses and deficits of its member nations. The International Bank for Reconstruction and Development (popularly known as the World Bank) was set up to finance post war reconstruction. The IMF and the World Bank are referred to as the Bretton Woods institutions or sometimes the Bretton Woods twins. The post-war international economic system is also often described as the Bretton Woods systummm End of bretton wood system End of Bretton Woods system The system dissolved between 1968 and 1973. In August 1971, U.S. President Richard Nixon announced the "temporary" suspension of the dollar's convertibility into gold. While the dollar had struggled throughout most of the 1960s within the parity established at Bretton Woods, this crisis marked the breakdown of the system. An attempt to revive the fixed exchange rates failed, and by March 1973 the major currencies began to float against each other. Since the collapse of the Bretton Woods system, IMF members have been free to choose any form of exchange arrangement they wish (except pegging their currency to gold): allowing the currency to float freely, pegging it to another currency or a basket of currencies, adopting the currency of another country, participating in a currency bloc, or forming part of a monetary union Oil shocks Many feared that the collapse of the Bretton Woods system would bring the period of rapid growth to an end. In fact, the transition to floating exchange rates was relatively smooth, and it was certainly timely: flexible exchange rates made it easier for economies to adjust to more expensive oil, when the price suddenly started going up in October 1973. Floating rates have facilitated adjustments to external shocks ever since. The IMF responded to the challenges created by the oil price shocks of the 1970s by adapting its lending instruments. To help oil importers deal with anticipated current account deficits and inflation in the face of higher oil prices, it set up the first of two oil facilities. Nixon Shock The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold Although Nixon's actions did not formally abolish the existing Bretton Woods system of international financial exchange, the suspension of one of its key components effectively rendered the Bretton Woods system inoperative. While Nixon publicly stated his intention to resume direct convertibility of the dollar after reforms to the Bretton Woods system had been implemented, all attempts at reform proved unsuccessful. By 1973, the current regime based on freely floating fiat currencies de facto replaced the Bretton Woods system for other global currencies. Helping poor countries From the mid-1970s, the IMF sought to respond to the balance of payments difficulties confronting many of the world's poorest countries by providing concessional financing through what was known as the Trust Fund. In March 1986, the IMF created a new concessional loan program called the Structural Adjustment Facility. The SAF was succeeded by the Enhanced Structural Adjustment Facility in December 1987.