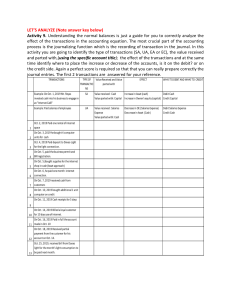

Accounting Information System - Principles of Accounting - Lecture Notes Study Objectives 1. Analyze the effect of business transactions on the basic accounting equation. 2. Explain what an account is and how it helps in the recording process. 3. Define debits and credits and explain how they are used to record business transactions. 4. Identify the basic steps in the recording process. 5. Explain what a journal is and how it helps in the recording process. 6. Explain what a ledger is and how it helps in the recording process. 7. Explain what posting is and how it helps in the recording process. 8. Explain the purposes of a trial balance. 9. Classify cash activities as operating, investing, or financing. Outline Study Objective 1 - Analyze the Effect of Business Transactions on the Basic Accounting Equation Accounting Information System collects and processes transactions. communicates financial information to decision makers. Factors that shape the Accounting Information System include: nature of the company’s business types of transactions company size the volume of data information demands of management and others. Most businesses use computerized accounting systems, sometimes referred to as electronic data processing (EDP) systems. Accounting Transactions economic events that require recording in the financial statements occur when assets, liabilities, or stockholders’ equity items change as a result of some economic event Transaction analysis - the process of identifying the specific effects of economic events on the accounting equation A Summary of Three Important Points about Transactions: 1. Each transaction is analyzed in terms of its effect on assets, liabilities, and stockholders’ equity. 2. The two sides of the equation must always be equal. 3. The cause of each change in stockholders’ equity must be indicated. Study Objective 2 - Explain What an Account is and How it Helps in the Recording Process Account - an individual accounting record of increases and decreases in a specific asset, liability, or stockholders' equity item. An account consists of three parts: (1) the title of the account, (2) a left or debit side, and (3) a right or a credit side. It is referred to as a T account because the alignment of the parts of the account resembles the letter T. Study Objective 3 - Define Debits and Credits and Explain How They are Used to Record Business Transactions The term debit means left, and credit means right. They DO NOT mean increase or decrease. Debit is abbreviated Dr. and credit is abbreviated Cr. The act of entering an amount of the left side of an account is called debiting. Making an entry on the right side is called crediting. When the totals of the two sides are compared, an account will have a debit balance if the left side (dr side) is greater. Conversely, the account will have a credit balance if the right side (cr side) is greater. Double-entry accounting For each transaction, the debits must equal the credits and the accounting equation must be kept in balance. This helps to ensure the accuracy of the recorded amounts and helps to detect errors. Debits increase assets, expenses and dividends. Debits decrease liabilities, common stock and revenues. Credits decrease assets, expenses and dividends. Credits increase liabilities, stockholders’ equity, and revenues. Study Objective 4 - Identify the Basic Steps in the Recording Process The basic steps in the accounting process are: Analyze each transaction in terms of its effect on the accounts. A source document, such as a sales slip, a check, a bill, or a cash register tape provides evidence of the transaction. Enter the transaction information in the journal. Transfer the journal information to the appropriate accounts in the ledger (book of accounts). Study Objective 5 - Explain What A Journal is and How it Helps in the Recording Process Transactions are entered in the journal in chronological order before being transferred to the accounts. The journal has a place to record the debit and credit effects on specific accounts for each transaction. Companies may use various types of journals, but every company has the most basic form of journal, a general journal. The journal makes three significant contributions to the recording process: 1. The journal discloses in one place the complete effect of a transaction. 2. The journal provides a chronological record of transactions. 3. The journal helps prevent or locate errors because the debit and credit amounts for each entry can be readily compared. Entering transaction data into the journal is known as journalizing. Study Objective 6 - Explain What a Ledger is and How it Helps in the Recording Process The entire group of accounts maintained by a company is referred to as the ledger. The general ledger contains all of the asset, liability and stockholders' equity accounts. Information in the ledger provides management with the balances in various accounts. Accounts in the general ledger are listed in the chart of accounts, in an order consistent with assets, liabilities, stockholders’ equity, revenues, and expenses. Study Objective 7 - Explain What Posting is and How it Helps in the Recording Process Posting is the process of transferring journal entries to the ledger accounts. Posting accumulates the effects of journal transactions in the individual ledger accounts. Study Objective 8 - Explain the Purposes of a Trial Balance A trial balance is a list of accounts and their balances on a specific date. The primary purpose of the trial balance is to prove the mathematical equality of debits and credits after posting. A trial balance uncovers errors in journalizing and posting. is useful in the preparation of financial statements. is limited in that it will balance but not uncover errors when: A transaction is not journalized. A correct journal entry is not posted. A journal entry is posted twice, Incorrect accounts are used in journalizing and posting, or Offsetting errors are made in recording the amount of a transaction. Study Objective 9 – Classify Cash Activities as Operating, Investing, or Financing. Operating activities are the types of activities the company performs to generate profits. These can include cash received or spent to directly support the company’s operations, like cash used to pay an accounts payable or cash spent to purchase inventories. Investing activities include the purchase or sale of long-lived assets used in operating the business, or the purchase or sale of investment securities (like stocks and bonds of other companies). Financing activities include borrowing money, issuing shares of stock and paying dividends. Review What is the basic accounting equation? How do business transactions effect the basic accounting equation? What is an account and how does it help in the recording process? Define debit and credit and explain how they are used to record business transactions. What are the basic steps in the recording process? What is a journal? How does it help in the recording process? What is a ledger? How does it help in the recording process? What is the purpose of posting and how does it help in the recording process? What is the purpose of a trial balance? If the debits equal the credits in the trial balance, will the financial statements be error-free? Why or why not? Define cash activities as operating, investing, or financing and give one example of each.