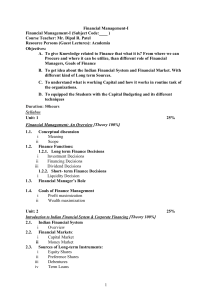

Unit 1- Introduction Meaning - scope and functions of Finance - Financial management – Nature, Characteristic, Functions, Scope & Process - Objectives of financial management – profit maximization - wealth maximization - Time value of money - present value of money – concepts-simple practical problems. What is Finance? Finance is derived from the Latin word ‘Fin’ meaning money or cash. Finance is concerned with decisions about money, or more appropriately, cash/fund flows. Classification of finance Private Finance can be classified into two categories: personal finance and business finance. Personal finance deals with the process of optimizing finances by individuals such as people, families and single consumers. A great example is an individual financing his/her own car by mortgage. Personal finance involves financial planning at the lowest individual level. It includes savings accounts, insurance policies, consumer loans, stock market investments, retirement plans and credit cards. Business Finance involves the process of optimizing finances by business organizations. It involves asset acquisition and proper allocation of funds in a way that maximizes the achievement of set goals. Businesses can require finances on either of the three levels; short, medium or long term. Public finance is the finance sector that deals with the allocation of resources to meet the set budgets for government entities. This branch of economics is responsible for the scrutiny of the meaning and effects of financial policies implemented by the government. This sector examines the effects and results of the application of taxation and the expenditures of all economic agents and the overall economy. Richard Musgrave, a renowned Economics professor, terms Public Finance as a complex of problems that are centered around the income and expenditure processes of the government. Public finance has several branches; public revenue, public expenditure, public debt, budget policy and the fiscal policy. Functions of finance: Forecasting cash inflows and outflows; Raising funds; Allocation of funds; Effective use of funds; and. Financial control (budgetary and non-budgetary). Finance Functions (Scope of Financial Management) The finance function encompasses the activities of raising funds, investing them in assets and distributing returns earned from assets to shareholders. While doing these activities, a firm attempts to balance cash inflow and outflow. It is evident that the finance function involves the four decisions viz., financing decision, investment decision, dividend decision and liquidity decision. Thus the finance function includes: 1. Investment decision 2. Financing decision 3. Dividend decision 4. Liquidity decision 1. Investment Decision: The investment decision, also known as capital budgeting, is concerned with the selection of an investment proposal/ proposals and the investment of funds in the selected proposal. A capital budgeting decision involves the decision of allocation of funds to long-term assets that would yield cash flows in the future. Two important aspects of investment decisions are: i. The evaluation of the prospective profitability of new investments, and ii. The measurement of a cut-off rate against the prospective return of new investments could be compared. Future benefits of investments are difficult to measure and cannot be predicted with certainty. Risk in investment arises because of the uncertain returns. Investment proposals should, therefore, be evaluated in terms of both expected return and risk. Besides the decision to commit funds in new investment proposals, capital budgeting also involves a replacement decision, that is decision of recommitting funds when an asset becomes less productive or non-profitable. The computation of the risk-adjusted return and the required rate of return, selection of the project on these bases, forms the subject-matter of the investment decision. Long-term investment decisions may be both internal and external. In the former, the finance manager has to determine which capital expenditure projects have to be undertaken, the amount of funds to be committed and the ways in which the funds are to be allocated among different investment outlets. In the latter case, the finance manager is concerned with the investment of funds outside the business for merger with, or acquisition of, another firm. 2. Financing Decision: Financing decision is the second important function to be performed by the financial manager. Broadly, he or she must decide when, from where and how to acquire funds to meet the firm’s investment needs. The central issue before him or her is to determine the appropriate proportion of equity and debt. The mix of debt and equity is known as the firm’s capital structure. The financial manager must strive to obtain the best financing mix or the optimum capital structure for his or her firm. The firm’s capital structure is considered optimum when the market value of shares is maximized. 3. Dividend Decision: Dividend decision is the third major financial decision. The financial manager must decide whether the firm should distribute all profits, or retain them, or distribute a portion and return the balance. The proportion of profits distributed as dividends is called the dividend-payout ratio and the retained portion of profits is known as the retention ratio. Like the debt policy, the dividend policy should be determined in terms of its impact on the shareholders’ value. The optimum dividend policy is one that maximizes the market value of the firm’s shares. Thus, if shareholders are not indifferent to the firm’s dividend policy, the financial manager must determine the optimum dividendpayout ratio. Dividends are generally paid in cash. But a firm may issue bonus shares. Bonus shares are shares issued to the existing shareholders without any charge. The financial manager should consider the questions of dividend stability, bonus shares and cash dividends in practice. 4. Liquidity Decision :( also known as working capital) Investment in current assets affects the firm’s profitability and liquidity. Current assets should be managed efficiently for safeguarding the firm against the risk of illiquidity. Lack of liquidity in extreme situations can lead to the firm’s insolvency. A conflict exists between profitability and liquidity while managing current assets. If the firm does not invest sufficient funds in current assets, it may become illiquid and therefore, risky. But if the firm invests heavily in the current assets, then it would lose interest as idle current assets would not earn anything. Thus, a proper trade-off must be achieved between profitability and liquidity. The Profitability-liquidity trade-off requires that the financial manager should develop sound techniques of managing current assets and make sure that funds would be made available when needed. Concept of working capital There are two concepts or senses used for working capital. These are: 1. Gross Working Capital 2. Net working Capital 1. Gross Working Capital: The concept of gross working capital refers to the total value of current assets. In other words, gross working capital is the total amount available for financing of current assets. However, it does not reveal the true financial position of an enterprise. How? A borrowing will increase current assets and, thus, will increase gross working capital but, at the same time, it will increase current liabilities also. As a result, the net working capital will remain the same. This concept is usually supported by the business community as it raises their assets (current) and is in their advantage to borrow the funds from external sources such as banks and the financial institutions. In this sense, the working capital is a financial concept. As per this concept: Gross Working Capital = Total Current Assets 2. Net Working Capital: The net working capital is an accounting concept which represents the excess of current assets over current liabilities. Current assets consist of items such as cash, bank balance, stock, debtors, bills receivables, etc. and current liabilities include items such as bills payables, creditors, etc. Excess of current assets over current liabilities, thus, indicates the liquid position of an enterprise. The ratio of 2:1 between current assets and current liabilities is considered as optimum or sound. What this ratio implies is that the firm/ enterprise has sufficient liquidity to meet operating expenses and current liabilities. It is important to mention that net working capital will not increase with every increase in gross working capital. Importantly, net working capital will increase only when there is an increase in current assets without corresponding increase in current liabilities. Thus, in the form of a simple formula: Net Working Capital = Current Assets-Current Liabilities After subtracting current liabilities from current assets what is left over is net working capital. Financial Procedures and Systems For effective finance function some routine functions have to be performed. Some of these are: · Supervising receipts and payments and safeguarding of cash balances · Custody and safeguarding of securities, insurance policies and other valuable papers · Taking care of the mechanical details of new outside financing · Record keeping and reporting The main functions of a Financial Manager: 1. Raising of Funds In order to meet the obligation of the business it is important to have enough cash and liquidity. A firm can raise funds by the way of equity and debt. It is the responsibility of a financial manager to decide the ratio between debt and equity. It is important to maintain a good balance between equity and debt. 2. Allocation of Funds Once the funds are raised through different channels the next important function is to allocate the funds. The funds should be allocated in such a manner that they are optimally used. In order to allocate funds in the best possible manner the following point must be considered § The size of the firm and its growth capability § Status of assets whether they are long-term or short-term § Mode by which the funds are raised These financial decisions directly and indirectly influence other managerial activities. Hence formation of a good asset mix and proper allocation of funds is one of the most important activity 3. Profit Planning Profit earning is one of the prime functions of any business organization. Profit earning is important for survival and sustenance of any organization. Profit planning refers to proper usage of the profit generated by the firm. Profit arises due to many factors such as pricing, industry competition, state of the economy, mechanism of demand and supply, cost and output. A healthy mix of variable and fixed factors of production can lead to an increase in the profitability of the firm. Fixed costs are incurred by the use of fixed factors of production such as land and machinery. In order to maintain a tandem it is important to continuously value the depreciation cost of fixed cost of production. An opportunity cost must be calculated in order to replace those factors of production which have gone through wear and tear. If this is not noted then these fixed costs can cause huge fluctuations in profit. 4. Understanding Capital Markets Shares of a company are traded on stock exchange and there is a continuous sale and purchase of securities. Hence a clear understanding of the capital market is an important function of a financial manager. When securities are traded on the stock market there involves a huge amount of risk involved. Therefore a financial manager understands and calculates the risk involved in this trading of shares and debentures. It’s on the discretion of a financial manager as to how to distribute the profits. Many investors do not like the firm to distribute the profits amongst shareholders as dividend could be instead invested in the business itself to enhance growth. The practices of a financial manager directly impact the operation in the capital market. Financial Goals and Firm’s Mission and Objectives · Firms’ primary objective is maximizing the welfare of owners but, in operational terms, they focus on the satisfaction of its customers through the production of goods and services needed by them. · Firms state their vision, mission and values in broad terms. · Wealth maximization is more appropriately a decision criterion, rather than an · Goals or objectives are missions or basic purposes of a firm’s existence. · The shareholders’ wealth maximization is the second-level criterion ensuring that the objective or a goal. decision meets the minimum standard of the economic performance. · In the final decision-making, the judgment of management plays the crucial role. · The wealth maximization criterion would simply indicate whether an action is economically viable or not. Organization Chart of the Financial Management The chief finance executive works directly under the president or the managing director of the company. Besides routine networks, the person in charge keeps the Board of Directors informed about all the phases of business activity, including economics, social and political developments affecting the business behavior. He also furnishes information about the financial status of the company by reviewing it from time to time. The chief finance executive may have many officers under him to carry out his function. Broadly his functions are divided into two types: 1. Treasury function 2. Control functions An illustrative organization chart of finance function of management in a big organization is shown below: Organization of the Financial Management Function Role of Treasurer The main role of Treasurer is that he refers to the financial officer and then looks at the task of financing and its related activities. The Treasury always deals with liquid assets and so the main role of the treasurer is to look at the cash and its other liquid assets. Some important tasks of Treasurer are as follows: · He formulated the whole capital structure of the organization in accordance with goals of the organization and then to implement it to the organization. · He also manages the amount of liquid assets and all types of cash. · He basically acts as a cashier. · He plays the role of an authority signatory on payment cheques including the authority to approve such cheques. · Reconciliation in bank accounts. · He manages the overall credit function of the firm. · He also has the authority to utilize the surplus cash of the company whenever there is any type of short term beneficial investments. · He also makes the companies policies according to decisions on trade discounts and vendor payment. · He also maintains relationships with bankers and vendors. All of the above-mentioned functions of treasurer are implemented with the help of cash manger, finance manager and credit manager. Role of controller As we have already seen that the treasurer deals with liquid assets, the controller of the organization has to record the transactions of these liquid assets. It is the combined and effective working of both the departments that give rise to an effective system of internal controls. Controller is a financial officer responsible for accounting and control. He does the following functions: · Records all the transactions in the general ledger, the accounts receivables and the accounts payables, sub-ledger, transaction with respect to fixed assets such as depreciation, inventory control, etc. · He looks into the aspects of taxes and insurance. · He also keeps track of the company's short term investments by recording and reconciling the transaction with those of the brokerage firms. · He carefully looks into the regulatory aspects and implementation of the company’s policy on trade discounts and receivables aging. · He always acts as the planning director. · He keeps a record of the attendance of the employees, their movement timings so as to facilitate in preparing the payroll. · He reports information to the management. The office bearer who assists the controller in accomplishing the above tasks is: tax manager, data processing manager, cost accounting manager and accounting manager. Thus the functions of financial accounting, internal audit, taxation, management accountings and control, budget-planning and control are accomplished in this manner. Financial management is management principles and practices applied to finance. General management functions include planning, execution and control. Financial decision making includes decisions as to size of investment, sources of capital, extent of use of different sources of capital and extent of retention of profit or dividend payout ratio. Financial management, is therefore, planning, procure, evaluate and control of investment of money resources, raising of such resources and retention of profit/payment of dividend. Howard and Upton define financial management as "that administrative area or set of administrative functions in an organization which have to do with the management of the flow of cash so that the organization will have the means to carry out its objectives as satisfactorily as possible and at the same time meets its obligations as they become due. Bonneville and Dewey interpret that financing consists in the raising, providing and managing all the money, capital or funds of any kind to be used in connection with the business. Osborn defines financial management as the "process of acquiring and utilizing funds by a business”. Considering all these views, financial management may be defined as that part of management which is concerned mainly with raising funds in the most economic and suitable manner, using these funds as profitably as possible. Nature or Features or Characteristics of Financial Management Nature of financial management is concerned with its functions, its goals, trade-off with conflicting goals, its indispensability, its systems, its relation with other subsystems in the firm, its environment, its relationship with other disciplines, the procedural aspects and its equation with other divisions within the organization. 1. Financial Management is an integral part of overall management. Financial considerations are involved in all business decisions. So financial management is pervasive throughout the organization. 2. The central focus of financial management is valuation of the firm. That is financial decisions are directed at increasing/maximization/ optimizing the value of the firm. 3. Financial management essentially involves risk-return trade-off. Decisions on investment involve choosing of types of assets which generate returns accompanied by risks. Generally higher the risk, returns might be higher and vice versa. So, the financial manager has to decide the level of risk the firm can assume and satisfy with the accompanying return. 4. Financial management affects the survival, growth and vitality of the firm. Finance is said to be the life blood of business. It is to business, what blood is to us. The amount, type, sources, conditions and cost of finance squarely influence the functioning of the unit. 5. Finance functions, i.e., investment, rising of capital, distribution of profit, are performed in all firms - business or non-business, big or small, proprietary or corporate undertakings. Yes, financial management is a concern of every concern. 6. Financial management is a sub-system of the business system which has other subsystems like production, marketing, etc. In systems arrangement financial sub-system is to be well-coordinated with others and other sub-systems well matched with the financial subsystem. Objectives of Financial Management The financial management is generally concerned with procurement, allocation and control of financial resources of a concern. The objectives can be1. To ensure regular and adequate supply of funds to the concern. 2. To ensure adequate returns to the shareholders which will depend upon the earning capacity, market price of the share, expectations of the shareholders. 3. To ensure optimum funds utilization. Once the funds are procured, they should be utilized in maximum possible way at least cost. 4. To ensure safety on investment, i.e, funds should be invested in safe ventures so that adequate rate of return can be achieved. 5. To plan a sound capital structure-There should be sound and fair composition of capital so that a balance is maintained between debt and equity capital. Functions of Financial Management 1. Estimation of capital requirements: A finance manager has to make estimation with regards to capital requirements of the company. This will depend upon expected costs and profits and future programs and policies of a concern. Estimations have to be made in an adequate manner which increases earning capacity of enterprise. 2. Determination of capital composition: Once the estimation have been made, the capital structure have to be decided. This involves short- term and long- term debt equity analysis. This will depend upon the proportion of equity capital a company is possessing and additional funds which have to be raised from outside parties. 3. Choice of sources of funds: For additional funds to be procured, a company has many choices likea) Issue of shares and debentures b) Loans to be taken from banks and financial institutions c) Public deposits to be drawn like in form of bonds. Choice of factor will depend on relative merits and demerits of each source and period of financing. 4. Investment of funds: The finance manager has to decide to allocate funds into profitable ventures so that there is safety on investment and regular returns is possible. 5. Disposal of surplus: The net profits decision have to be made by the finance manager. This can be done in two ways: a. Dividend declaration - It includes identifying the rate of dividends and other benefits like bonus. b. Retained profits - The volume has to be decided which will depend upon expansion, innovational, diversification plans of the company. 6. Management of cash: Finance manager has to make decisions with regards to cash management. Cash is required for many purposes like payment of wages and salaries, payment of electricity and water bills, payment to creditors, meeting current liabilities, maintenance of enough stock, purchase of raw materials, etc. 7. Financial controls: The finance manager has not only to plan, procure and utilize the funds but he also has to exercise control over finances. This can be done through many techniques like ratio analysis, financial forecasting, cost and profit control, etc. Process of FM: • Assess Current Financial Position • Define and Prioritizing Goals • Financial and Investment Plan • Implementation of the Plan • Monitor, Evaluate and Adjust Performance Profit maximization Profit maximization is the capability of a business or company to earn the maximum profit with low cost which is considered as the chief target of any business and also one of the objectives of financial management. According to financial management, profit maximization is the approach or process which increases the profit or Earnings per Share (EPS) of the business. More specifically, profit maximization to optimum levels is the focal point of investment or financing decisions. “Profit maximization may be the ‘end’ but the means to achieve this end, is what matters, and that distinguishes a company in the corporate world and the market.” – Henrietta Newton Martin Benefits of Profit Maximization: · Economic Existence: The foundation of the profit maximization theory is profit and profit is a must for the economic existence of any company or business. · Performance Standard: Profit determines the standard of performance of any business or company. When a business is unable to make profits, it fails to fulfill its chief target and causes a risk to its existence. · Economic and Social Well-being: Profit maximization theory indirectly plays a role in economic and social well-being. When a business makes a profit, it utilizes and allocates resources properly which in turn results in the payments for capital, fixed assets, labor and organization. In this way, economic and social welfare is performed. Drawbacks of Profit Maximization: · The Vagueness of the Profit Concept: The concept of profit is indefinite because different people may have a different idea about profit, such as profit can be EPS, gross profit, net profit, profit before interest and tax, profit ratio, etc. Particularly, no definite profit-maximizing rule or method exists in reality. · Does Not Consider Time Value of Money: The profit maximization theory only states that higher the profit better the performance of the business. The theory only considers profit without considering the time value of money. The concept of the time value of money tells that a certain unit of money today will not be equal to the same unit of money a year later. · Does Not Consider the Risk: Any business decision only considering profit maximization model ignores the involved risk factor which may be harmful to the existence of the business in the long-run. Because if the business is incapable of handling the higher risk, it’s survival will be in question. · Does Not Consider the Quality: Intangible benefits e.g. image, technological advancements, quality, etc. are not considered in the profit maximization approach which is considered as one of the biggest drawbacks. These intangible assets have a mentionable role in creating value for the business which cannot be ignored. Profit maximization theory is based on a traditional viewpoint but the modern business and financial concept value wealth maximization much more than profit maximization. How to Achieve Profit Maximization: The following two steps can be applied to achieve profit maximization. 1. Increasing Sales-revenue: Sales-revenue can be increased in the following profitmaximizing ways. · Increasing sales quality by applying better marketing strategies, quality improvement, a thorough market study to assess that from which segment more money is coming to the business and concentrate in making more sales from those products or services. You can also borrow the best marketing strategy from your competitors, or similar businesses. · Insisting existing customers to buy extra services or products. · Diversification by selling a wider variety of products or services. · Revising pricing of products or services to achieve increased sales-revenue. You can charge a higher price for your product or service if its better in quality. Temporarily you can lose a few clients but according to researchers, people prefer a quality product or services even by paying a little high. · Motivating employees can also increase sales-revenue because satisfied employees will perform better and help to produce better products and services which will help the company to earn a profit. Better performance appraisal techniques such as announcing employee of the month, promotion, increment, etc. or going out for picnic, lunch, arranging cultural programs, etc. can motivate employees. · Educating all customers both existing and potential for your product or service by tv or radio or newspaper advertisements, digital marketing or email-marketing or socialmedia marketing, publishing and distributing leaflets, posters, banners, etc. Cost-cutting: Cost-cutting can be done in the following profit-maximizing 2. manners. · Analysis of the full expenditure of money to different sectors. · Negotiate with suppliers for cheaper prices especially when buying in large quantities. · Manufacturing process should be more efficient to reduce wastage. Technologies which saves time and expands production should be applied. · Looking for a new cost-effective energy supplier because a large amount of money is spent on the energy sector. · Outsourcing: A business cannot do all the tasks by itself or a small business cannot hire a talented people on a full-time basis at a higher Outsourcing can save a lot of money here. Full-time employees will be engaged in revenue-generating projects and simple tasks can be done by outsourcing or through freelancers. Business people can maximize profit by following the above steps keeping time value of money, the risk and quality factor in consideration. Wealth Maximization Wealth maximization is a modern approach to financial management. Maximization of profit used to be the main aim of a business and financial management till the concept of wealth maximization came into being. It is a superior goal compared to profit maximization as it takes a broader arena into consideration. Wealth or Value of a business is defined as the market price of the capital invested by shareholders. The Concept of Wealth Maximization Defined as Follows It simply means maximization of shareholder’s wealth. It is a combination of two words viz. wealth and maximization. A wealth of a shareholder maximizes when the net worth of a company maximizes. To be even more meticulous, a shareholder holds share in the company/business and his wealth will improve if the share price in the market increases which in turn is a function of net worth. This is because wealth maximization is also known as net worth maximization. Finance managers are the agents of shareholders and their job is to look after the interest of the shareholders. The objective of any shareholder or investor would be a good return on their capital and safety of their capital. Both these objectives are well served by wealth maximization as a decision criterion for business. How to Calculate Wealth? Wealth is said to be generated by any financial decision if the present value of future cash flows relevant to that decision is greater than the costs incurred to undertake that activity. Increase in wealth is equal to the present value of all future cash flows less the cost/investment. In essence, it is the net present value (NPV) of a financial decision. Increase in Wealth = Present Value of cash inflows – Cost. Where, Present Value of Cash Inflows = CF1 + CF1 +……….+ CFn ——— ——— ——— (1 + K)1 (1 + K)2 (1 + K)n Advantages of Wealth Maximization Model Wealth maximization model is a superior model because it obviates all the drawbacks of profit maximization as a goal of a financial decision. ● Firstly, the wealth maximization is based on cash flows and not on profits. Unlike the profits, cash flows are exact and definite and therefore avoid any ambiguity associated with accounting profits. Profit can easily be manipulative, if there is a change in accounting assumption/policy, there is a change in profit. There is a change in method of depreciation, there is a change in profit. It is not the case in case of Cashflows. ● Secondly, profit maximization presents a shorter term view as compared to wealth maximization. Short-term profit maximization can be achieved by the managers at the cost of long-term sustainability of the business. ● Thirdly, wealth maximization considers the time value of money. It is important as we all know that a dollar today and a dollar one-year latter do not have the same value. In wealth maximization, the future cash flows are discounted at an appropriate discounted rate to represent their present value. Suppose there are two projects A and B, project A is more profitable however it is going to generate profit over a long period of time, while project B is less profitable however it is able to generate return in a shorter period. In a situation of an uncertainty, project B may be preferable. So, timing of returns is ignored by profit maximization, it is considered in wealth maximization. ● Fourthly, the wealth-maximization criterion considers the risk and uncertainty factor while considering the discounting rate. The discounting rate reflects both time and risk. Higher the uncertainty, the discounting rate is higher and vice-versa. Economic Value Added In the light of modern and improved approach to wealth maximization, a new initiative called “Economic Value Added (EVA)” is implemented and presented in the annual reports of the companies. Positive and higher EVA would increase the wealth of the shareholders and thereby create value. Time value of money The time value of money (TVM) is the concept that money you have now is worth more than the identical sum in the future due to its potential earning capacity. This core principle of finance holds that provided money can earn interest, any amount of money is worth more the sooner it is received. TVM is also sometimes referred to as present discounted value. The time value of money draws from the idea that rational investors prefer to receive money today rather than the same amount of money in the future because of money's potential to grow in value over a given period of time. For example, money deposited into a savings account earns a certain interest rate and is therefore said to be compounding in value. Present Value of money (discounting) Present value is the concept that states an amount of money today is worth more than that same amount in the future PV = FVn/ (1 + i)n PV = Present Value FV = Future value (compounding) I = Interest rate N = No of years PV = 1127.63/(1 + 0.05)5 = 127.63/(1.05)5 =127.63/1.2762 = Rs. 100 UNIT 2 - Financing Decision Sources of financing - capital structure - Factors determining capital structure - liquidity and capital structure - profitability and capital structure - Calculation of E.P.S - Concepts of leverages - operating leverages - financial leverages - combined leverages. SOURCES OF FINANCING. 1. Personal Investment: When starting a business, your first investor should be yourself—either with your own cash or with collateral on your assets. This proves to investors and bankers that you have a long-term commitment to your project and that you are ready to take risks. 2. Venture capital: Venture capital is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks and any other financial institutions. 3. Business incubators: Business incubators (or "accelerators") generally focus on the high-tech sector by providing support for new businesses in various stages of development. However, there are also local economic development incubators, which are focused on areas such as job creation, revitalization and hosting and sharing services. Commonly, incubators will invite future businesses and other fledgling companies to share their premises, as well as their administrative, logistical and technical resources. For example, an incubator might share the use of its laboratories so that a new business can develop and test its products more cheaply before beginning production. 4. Government grants and subsidies: Government agencies provide financing such as grants and subsidies that may be available to your business. The Canada Business Network website provides a comprehensive listing of various government programs at the federal and provincial level. 5. Bank Loans: Bank loans are the most commonly used source of funding for small and medium-sized businesses. Consider the fact that all banks offer different advantages, whether it's personalized service or customized repayment. It's a good idea to shop around and find the bank that meets your specific needs. Capital Structure The capital structure is the particular combination of debt and equity used by a company to finance its overall operations and growth. Equity capital arises from ownership shares in a company and claims to its future cash flows and profits. Debt comes in the form of bond issues or loans, while equity may come in the form of common stock, preferred stock, or retained earnings. Short-term debt is also considered to be part of the capital structure. Both debt and equity can be found on the balance sheet. Company assets, also listed on the balance sheet, are purchased with this debt and equity. Capital structure can be a mixture of a company's long-term debt, short-term debt, common stock, and preferred stock. A company's proportion of short-term debt versus long-term debt is considered when analyzing its capital structure. Factors Determining Capital Structure Trading on Equity- The word “equity” denotes the ownership of the company. Trading on equity means taking advantage of equity share capital to borrowed funds on reasonable basis. It refers to additional profits that equity shareholders earn because of issuance of debentures and preference shares. It is based on the thought that if the rate of dividend on preference capital and the rate of interest on borrowed capital is lower than the general rate of company’s earnings, equity shareholders are at advantage which means a company should go for a judicious blend of preference shares, equity shares as well as debentures. Trading on equity becomes more important when expectations of shareholders are high. Degree of control- In a company, it is the directors who are so called elected representatives of equity shareholders. These members have got maximum voting rights in a concern as compared to the preference shareholders and debenture holders. Preference shareholders have reasonably less voting rights while debenture holders have no voting rights. If the company’s management policies are such that they want to retain their voting rights in their hands, the capital structure consists of debenture holders and loans rather than equity shares. (equity -vote, debt-risk) Flexibility of financial plan- In an enterprise, the capital structure should be such that there is both contractions as well as relaxation in plans. Debentures and loans can be refunded back as the time requires. While equity capital cannot be refunded at any point which provides rigidity to plans. Therefore, in order to make the capital structure possible, the company should go for issue of debentures and other loans. Choice of investorsThe company’s policy generally is to have different categories of investors for securities. Therefore, a capital structure should give enough choice to all kind of investors to invest. Bold and adventurous investors generally go for equity shares and loans and debentures are generally raised keeping into mind conscious investors. Capital market conditionIn the lifetime of the company, the market price of the shares has got an important influence. During the depression period, the company’s capital structure generally consists of debentures and loans. While in periods of boons and inflation, the company’s capital should consist of share capital, generally equity shares. Period of financingWhen a company wants to raise finance for a short period, it goes for loans from banks and other institutions; while for a long period it goes for issues of shares and debentures. Cost of financingIn a capital structure, the company has to look to the factor of cost when securities are raised. It is seen that debentures at the time of profit earning of a company prove to be a cheaper source of finance as compared to equity shares where equity shareholders demand an extra share in profits. Stability of salesAn established business which has a growing market and high sales turnover, the company is in position to meet fixed commitments. Interest on debentures has to be paid regardless of profit. Therefore, when sales are high, thereby the profits are high and the company is in a better position to meet such fixed commitments like interest on debentures and dividends on preference shares. If a company is having unstable sales, then the company is not in a position to meet fixed obligations. So, equity capital proves to be safe in such cases. Sizes of a companySmall size business firms capital structure generally consists of loans from banks and retained profits. While on the other hand, big companies having goodwill, stability and an established profit can easily go for issuance of shares and debentures as well as loans and borrowings from financial institutions. The bigger the size, the wider is total capitalization. Some of the factors influencing the capital structure are as follows − Cash insolvency − Failure to pay fixed interest liabilities causes risk of cash insolvency. Failure of payment leads to liquidation of a company. (how much cash is required) Variations of earnings − Higher the debt in capital structure, higher the risk in variation of earnings. If the interest rate is more than return on investment profits decreases, shareholders will get less returns or sometimes no return. Cost of capital − Finance manager should carefully design the cost for each source, because that design will define firm finances and its future growth. Government policies − Monetary and fiscal policies will also affect capital structure. Lending policies of financial institutions, SEBI rules and regulations can change the financial pattern of a firm. Size of the company − Smaller companies will find to raise debt capital; they have to depend more on equity shares. On the other hand, bigger companies have various securities to raise funds. Nature of business − To have a stable earnings, companies prefer debentures or preference shares and those companies which don’t have or have less earnings will prefer internal resources. (based on business) Period of finance − Long term funds are raised by issuing debentures or preference shares. For permanent funds raised by issuing equity shares. Taxation − Dividend payable on equity and preference share capital are not deductible for tax purposes. Interest paid on debt is taxable which effects firms’ tax liability. Liquidity and capital structure We examine the relation between equity market liquidity and capital structure. We find that firms with more liquid equity have lower leverage and prefer equity financing when raising capital. For example, after sorting firms into size quintiles and then into liquidity quintiles, the average debt-to-asset ratio of the most liquid quintiles is about 38% while the average for the least liquid quintiles is 55%. Similar results are observed in panel analyses with clustered errors and using instrumental variables. Our results are consistent with equity market liquidity lowering the cost of equity and, therefore, inducing a greater reliance on equity financing. We explore the relationship between liquidity of a firm’s equity and its capital structure. Firms with more liquid stocks benefit from lower costs of equity issuance. Therefore, it is hypothesized that such firms are likely to have a preference for equity in their capital structure. This article empirically investigates the relationship between liquidity and capital structure decisions on a sample of Indian firms. Contrary to the existing literature, we find no empirical evidence for an inverse relationship between liquidity and leverage among Indian firms. The results are indicative of the fact that due to distinctive features of emerging markets, namely, less sophisticated capital markets, higher information asymmetry, concentrated ownership, constrained access to debt and prevalence of family owned businesses, there are other more significant determinants of capital structure that subsume the explanatory power of liquidity variables. Profitability and capital structure The capitalization structure of a business is its foundation. From its first sale to the projects it invests in down the road, everything begins with the way it finances its operations. The capitalization structure can have a huge impact on a company's profitability. Capitalization structure (more commonly called capital structure) simply refers to the money a company uses to fund operations and where that money comes from. Capital can be raised either through the acquisition of debt or through equity. Equity financing comes from the sale of stock to shareholders. Debt can come from many sources, such as bank loans, personal loans and credit card debt, but it must always be repaid at a later date, usually with interest. Business ownership is shared, so the proverbial pie of profits must be divided into a greater number of pieces. A company funded fully by debt may have hefty interest payments each month, but when all is said and done, the profits belong entirely to the business owners. Without shareholder dividends to pay, the profits can be reinvested in the business through the purchase of new equipment or by opening a new location, generating even greater profits down the road. Another indirect effect of capital structure on profitability is its impact on the potential availability of additional capital if it is needed in the future. A company with a particularly high debt to equity ratio may be seen as unnecessarily risky by both lenders and potential shareholders, making it difficult to raise additional funds. Limited access to capital funding, in turn, limits the business's growth potential, keeping profit margins stagnant. A company with a particularly debt-heavy capital structure makes larger interest payments each year, thereby reducing net profit. Calculation of E.P.S Earnings per share = Net Income – Preferred dividend Number of common shares outstanding EPS shows how much of the company’s earnings are attributable to each common share. Net income available to shareholders for EPS purposes refers to net income less dividends on preferred shares. Dividends payable to preferred shareholders are not available to common shareholders and must be deducted to calculate EPS. E.g., Assume that on January 1, 2017, XYZ Company reported the following: Preferred shares: 1,000,000 authorized, 400,000 issued and outstanding, $4 per share per year dividend, cumulative, convertible at the rate of 1 preferred to 5 common shares. Common shares: 5,000,000 authorized, 800,000 issued and outstanding, no par value, and no fixed dividend. Calculate Basic EPS if net income was $2,234,000. Step 1: Calculate net income available to common shareholders Net income 22,34,000 Less: Cumulative preferred dividends Net income available to common shareholders (16,00,000) 6,34,000 Step 2: Weighted Average Number of Shares Outstanding In our example, there are no instances of common share issuance or repurchase. Therefore, the weighted average is equal to the number of shares outstanding: 800,000 Step 3: Apply the Basic EPS formula (6,34,000)/(8,00,000) = 0.79 Example 2 Refer to this for more problems. https://drive.google.com/drive/folders/11LZQEPoPMhrYawrtxNhlZGzhBKU_oFtA? usp=sharing Concepts of leverages - operating leverages - financial leverages - combined leverages. ● Leverages - Leverage refers to the use of debt (borrowed funds) to amplify returns from an investment or project. ● Investors use leverage to multiply their buying power in the market. ● Companies use leverage to finance their assets—instead of issuing stock to raise capital, companies can use debt to invest in business operations in an attempt to increase shareholder value. Operating leverage measures a company’s fixed costs as a percentage of its total costs. It is used to evaluate the breakeven point of a business, as well as the likely profit levels on individual sales. The following two scenarios describe an organization having high operating leverage and low operating leverage. 1. High operating leverage. A large proportion of the company’s costs are fixed costs. In this case, the firm earns a large profit on each incremental sale, but must attain sufficient sales volume to cover its substantial fixed costs. If it can do so, then the entity will earn a major profit on all sales after it has paid for its fixed costs. However, earnings will be more sensitive to changes in sales volume. 2. Low operating leverage. A large proportion of the company’s sales are variable costs, so it only incurs these costs when there is a sale. In this case, the firm earns a smaller profit on each incremental sale but does not have to generate much sales volume in order to cover its lower fixed costs. It is easier for this type of company to earn a profit at low sales levels, but it does not earn outsized profits if it can generate additional sales. Financial leverage is the use of borrowed money (debt) to finance the purchase of assets with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing. In most cases, the provider of the debt will put a limit on how much risk it is ready to take and indicate a limit on the extent of the leverage it will allow. In the case of asset-backed lending, the financial provider uses the assets as collateral until the borrower repays the loan. In the case of a cash flow loan, the general creditworthiness of the company is used to back the loan. (Lower is preferred) Combined Leverage - A degree of combined leverage (DCL) is a leverage ratio that summarizes the combined effect that the degree of operating leverage (DOL) and the degree of financial leverage has on earnings per share (EPS), given a particular change in sales. This ratio can be used to determine the most optimal level of financial and operating leverage to use in any firm. Unit 3 - Capital Budgeting. Long-term and short-term Investment decisions A long-term investment usually represents investments which are intended to meet expenses towards a major life event such as buying a second home, children’s education and marriage or retirement. It offers a greater probability of maximizing returns over a period of 10 years or more. Long term investments are usually illiquid but offer a high rate of return. An investment which has a time span of not more than 3 years is called short term investment. The most common examples of short-term investments are Bank Fixed Deposits, Mutual Funds, short-term bonds, money market funds etc. What is Capital Budgeting? Capital budgeting is the process that a business uses to determine which proposed fixed asset purchases it should accept, and which should be declined. This process is used to create a quantitative view of each proposed fixed asset investment, thereby giving a rational basis for making a judgment. Capital Budgeting Techniques To assist the organization in selecting the best investment there are various techniques available based on the comparison of cash inflows and outflows. These techniques are: 1. Payback period method In this technique, the entity calculates the time period required to earn the initial investment of the project or investment. The project or investment with the shortest duration is opted for. 2. Net Present value (Present value of future returns) The net present value is calculated by taking the difference between the present value of cash inflows and the present value of cash outflows over a period of time. The investment with a positive NPV will be considered. In case there are multiple projects, the project with a higher NPV is more likely to be selected. 3. Accounting Rate of Return In this technique, the total net income of the investment is divided by the initial or average investment to derive at the most profitable investment. 4. Internal Rate of Return (IRR) For NPV computation a discount rate is used. IRR is the rate at which the NPV becomes zero. The project with higher IRR is usually selected. 5. Profitability Index Profitability Index is the ratio of the present value of future cash flows of the project to the initial investment required for the project. Each technique comes with inherent advantages and disadvantages. An organization needs to use the best-suited technique to assist it in bud SHORT TERM INVESTMENT DECISIONS Short term investment decisions are also known as working capital management. It relates to the allocation of funds as among cash and equivalents, receivables and inventories. Such a decision is influenced by tradeoff between liquidity and profitability. The reason is that the more liquid the asset, the less it is likely to yield and the more the profitable the asset, the more illiquid it is. A sound short-term investment policy ensures higher profitability, proper liquidity and sound structural health of the organisation. LONG TERM INVESTMENT DECISION This is also known as capital budgeting. These are expenditures, the benefits of which are expected to be received over a long period of time exceeding a year. The finance manager has to assess the profitability of various projects before committing the funds. The investment proposals should be evaluated in terms of expected profitability, costs involved and the risk associated with the projects. Such decisions can be made for ● the setting up of new units, ● expansion of present units, ● replacement of permanent assets, ● R&D project costs and allocation of resources. Features of Capital Budgeting Large Investments Capital Budgeting is related to taking decisions requiring large funds. It is a process used for selecting the high-value capital projects by the management. Managers use capital budgeting for properly analysing different investment opportunities and take decisions with proper care. Irreversible Decision The decisions taken through the capital budgeting process are irreversible in nature. This process requires making choices for large fund investment in different capital projects available. A decision once taken becomes difficult to be amended as it involves the allocation of large funds and affects company growth. High-value assets once purchased can’t be sold at the same prices and at the same time. High Risk There is a high degree of risk involved in the capital budgeting process. Decisions taken in this process are concerned with future return and the future is uncertain. Future unforeseen like change in fashion and taste, technological and research advancement may lead to higher risk. It, therefore, involves critical analysis before taking any decision as there are a large amount of funds allocated by business through this process. Long Term Effect On Profitability Capital Budgeting decisions have long term effects on the profit-earning capacity of the business. It involves decisions regarding large investments providing return to business. Decisions taken through capital budgeting affect both current and future earning potential of the company. Any unwise decision may affect business growth adversely and may be fatal. Therefore capital budget is termed our utmost function for every business which has great influence over its profitability. Impacts Cost Structure The decisions taken through the capital budgeting process have a direct impact on the cost structure of the business. Through decisions taken in this process, businesses commit themselves to costs like interest, insurance, rent, supervision etc. If the investment taken does not generate the anticipated income for the business, then it would increase the cost expenses and lead business to losses. Difficult Decisions Decisions taken through the capital budgeting process are difficult in nature. Decisions taken here are regarding the future which is uncertain and may have many unforeseen. It, therefore, becomes difficult for managers to choose the most profitable investment providing better return in future. Affects Competitive Strengths Capital budgeting process directly influences the future competitive strength of the business. Decisions taken in this process are regarding the profit generating investments and affects the company growth. A right decision taken can lead the company to great heights whereas a wrong decision may become fatal for the business. Therefore capital budgeting directly influences the strengths and weaknesses of a business. Advantages of CB Evaluates Investment Plans Capital budgeting is a key tool used by management for the evaluation of investment projects. It assists in taking decisions regarding long term investments by properly analyzing investment opportunities. Using the capital budgeting techniques-risk, return and investment amount of each project is examined. Identify Risk It enables in identifying the risk associated with investment plans. Capital budgeting examines the project from different aspects to find out all possible losses and risks. It studies how these risks affect the return and growth of the business which are helpful in making an appropriate decision. Chooses Investment Wisely Capital budgeting plays an effective role in selecting a profitable investment project for the business. It is the one that decides whether a particular project is beneficial to take or not. This technique considers cash flows of investment proposal during its entire life for finding out its profitability. Companies are able to choose investment wisely by analyzing different factors in a competitive market using capital budgeting techniques. Avoid Over And Under Investment Managers use capital budgeting techniques to determine the appropriate investment amount for the business. The right amount of investment is a must for every business for earning better returns and avoiding losses. Capital budgeting analyses the firm capability and objectives for determining the right investment accordingly. Maximize Shareholder’s Wealth Capital budgeting assists in maximizing the overall value of shareholders. It is a tool that enables companies to deploy their funds in the most effective way possible thereby earning huge profits. Companies are able to select investments with higher returns and lower costs which eventually raises the shareholder’s wealth. Control Project Expenditure Capital budgeting focuses on minimizing the expenditure of investment projects. While examining the investment proposals, it ensures that the project has an adequate amount of inflows for meeting out its expenses and provide an anticipated return. The selection of effective investment projects helps companies in controlling their expenditure and earning better profits. Disadvantages of CB Irreversible Decisions The major limitation with capital budgeting is that the decisions taken through this process are long-term and irreversible in nature. Decisions have an impact on the long term durability of the company and require the utmost care while taking them. Any wrong capital budgeting decision would have an adverse effect on profitability and continuity of business. Rely On Assumptions And Estimations Capital budgeting techniques rely on different assumptions and estimations for analyzing investment projects. Annual cash flow and life of project estimated is not always true and may increase or decrease than the anticipated values. Decisions taken on the basis of these untrue estimations may lead businesses to losses. Higher Risk Capital budgeting decisions are riskier in nature as it involves a large amount of capital expenditure. These decisions require the utmost care as it affects the success or failure of every business. Any wrong decisions regarding allotment of funds may lead the business to substantial losses or eventually cause a complete shutdown. Uncertainty This process is dependent upon futuristic data which is uncertain for analyzing the investment proposals. Capital budgeting anticipates the future cash inflows and outflows of the project for determining its profitability. The future is always uncertain and data may prove untrue which leads to wrong decisions. Ignores Non-Financial Aspect Capital budgeting technique considers only financial aspects and ignores all non-financial aspects while analyzing the investment plans. Non-financial factors have an efficient role in the success and profitability of the project. The real profitability of the project cannot be determined by ignoring these factors. Factors affecting Capital Budgeting Cash flows of the project: When a corporation takes an investment decision involving a vast amount it expects to create some cash flows over a period. These cash flows are in the form of a series of cash receipts and payments over the life of an investment. The rate of return: The most significant standard is the rate of return of the project. These calculations are based on the expected returns from each proposal and the appraisal of risk involved. Suppose, there are two projects A and B (with the same risk involved) with a rate of return of 10 per cent and 12 per cent, respectively, then under normal circumstances, project B will be selected. (The investment criteria involved: The decision to invest in an exacting venture involves a number of calculations regarding the amount of investment, interest rate, cash flows and rate of return. There are dissimilar techniques to appraise investment proposals which are known as capital budgeting techniques. Capital Structure: The company’s capital structure, i.e., the composition of shareholder’s funds and borrowed funds, determines its capital budgeting decisions. Working Capital: The availability of capital required by the company to carry out day to day business operations influences its long-term decisions. Capital Return: The management estimates the expected return from the prospective capital investment while planning the company’s capital budget. Availability of Funds: The company’s potential for capital budgeting is dependent on its dividend policy, availability of funds and the ability to acquire funds from the other sources. Earnings: If the company has a stable earning, it may plan for massive investment projects on leveraged funds, but the same is not suitable in case of irregular earnings. Capital Budgeting Process 1. Identifying investment opportunities An organization needs to first identify an investment opportunity. An investment opportunity can be anything from a new business line to product expansion to purchasing a new asset. For example, a company finds two new products that they can add to their product line. 2. Evaluating investment proposals Once an investment opportunity has been recognized an organization needs to evaluate its options for investment. That is to say, once it is decided that new product/products should be added to the product line, the next step would be deciding on how to acquire these products. There might be multiple ways of acquiring them. Some of these products could be: ● Manufactured In-house ● Manufactured by Outsourcing manufacturing the process, or ● Purchased from the market 3. Choosing a profitable investment Once the investment opportunities are identified and all proposals are evaluated an organization needs to decide the most profitable investment and select it. While selecting a particular project an organization may have to use the technique of capital rationing to rank the projects as per returns and select the best option available. In our example, the company here has to decide what is more profitable for them. Manufacturing or purchasing one or both of the products or scrapping the idea of acquiring both. 4. Capital Budgeting and Apportionment After the project is selected an organization needs to fund this project. To fund the project it needs to identify the sources of funds and allocate it accordingly. The sources of these funds could be reserves, investments, loans or any other available channel. 5. Performance Review The last step in the process of capital budgeting is reviewing the investment. Initially, the organization had selected a particular investment for a predicted return. So now, they will compare the investments expected performance to the actual performance. In our example, when the screening for the most profitable investment happened, an expected return would have been worked out. Once the investment is made, the products are released in the market, the profits earned from its sales should be compared to the set expected returns. This will help in the performance review. *For better understanding: Step # (i) Project Generation Generating the proposals for investment is the first process of capital budgeting. For an ongoing business concern, investment proposals of various types may originate at different levels within a firm. The investment proposal may fall into one of the following categories: (a) Proposals to add new product to the product-line, and Proposals to expand production capacity in existing product-lines. (b) Proposals to reduce the costs of the output of the existing products without altering the scale of operation. Generation of investment proposals may originate within the firm or outside the firm. Within the firm, it may come either from top, middle or bottom management. Sometimes, ordinary workers can also be considered as the source for generating such ideas. Sales campaigning, trade fairs, people in the industry, R/D institutes, conferences and seminars will also offer a wide variety of innovations on capital assets that could be taken up for the investment. It may be for a plant or machinery or new product, or new production techniques. The healthy firm must always keep a watch as these developments and must exploit such opportunities for the welfare of the business firm. Step # (ii) Project Evaluation: Project evaluation involves two steps: (a) Estimation of benefits and costs (b) Selection of an appropriate criterion to judge the desirability of the project. The benefits and costs of the project is measured in terms of cash flows. The estimation of the cash inflows and cash outflows mainly depends on future uncertainties. The risk associated with each project must be carefully analysed and sufficient provision must be made for covering the different types of risks. The role of the financial manager is very crucial here because he has to consult and seek the opinion of the executives (production marketing and purchase) before making a final decision. Proper coordination must be established in evaluating such proposals. Many at times the suggestions made by the production department may not be suitable to finance and purchase managers. Similarly, proposals made by finance and purchase managers may not be relevant or suitable to production managers. Therefore, each proposal must be scrutinized on the basis of its merits. If needed, it is advisable to seek expert advice on the matter. As far as possible, the criterion selected must be consistent with the firm’s objective of maximising its market value. The technique of time value of money may come as a handy tool in evaluation of such proposals. Step # (iii) Project Selection: No standard administrative procedure can be laid down for approving the investment proposal. The screening and selection procedures are different from firm-to-firm. In a real life situation all capital budgeting decisions are made by top management. However, the projects can scientifically be screened by middle level management in consulting with the head of the finance department. Step # (iv) Project Execution: Once the proposal for capital expenditure or investment is finalised, it is the duty of the finance manager to explore the different alternatives available for acquiring the funds. He has to prepare a capital budget. He has to take sufficient care to reduce the weighted average cost of funds. The funds so mobilised must be carefully spent or deployed on capital assets or on the projects. For effective control over the flow of funds, he has to prepare periodical reports and must seek prior permission from the top management. Systematic procedures should be developed to review the performance of projects during their lifetime and after completion. The follow-up, comparison of actual performance with original estimates not only ensures better forecasting but also helps in sharpening the techniques for improving future forecasts. Payback method What is the meaning of payback period? Payback period is the time required to recover the initial cost of an investment. It is the number of years it would take to get back the initial investment made for a project. Therefore, as a technique of capital budgeting, the payback period will be used to compare projects and derive the number of years it takes to get back the initial investment. The project with the least number of years usually is selected. Salient features of Payback period method ● Payback period is a simple calculation of time for the initial investment to return. ● It ignores the time value of money. All other techniques of capital budgeting consider the concept of time value of money. Time value of money means that a rupee today is more valuable than a rupee tomorrow. So other techniques discount the future inflows and arrive at discounted flows. ● It is used in combination with other techniques of capital budgeting. Owing to its simplicity the payback period cannot be the only technique used for deciding the project to be selected. Accounting Rate of Return (ARR) It is the percentage rate of return that is expected from an investment or asset compared to the initial cost of investment. 3. Net Present value (Present value of future returns) The net present value is calculated by taking the difference between the present value of cash inflows and the present value of cash outflows over a period of time. The investment with a positive NPV will be considered. In case there are multiple projects, the project with a higher NPV is more likely to be selected. 4. Internal Rate of Return (IRR) For NPV computation a discount rate is used. IRR is the rate at which the NPV becomes zero. The project with higher IRR is usually selected. 5. Profitability Index Profitability Index is the ratio of the present value of future cash flows of the project to the initial investment required for the project.