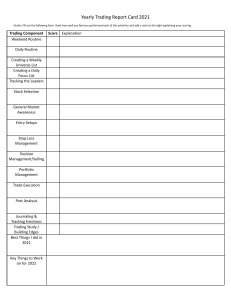

Fridays LIVE WEBINARS Fridays LIVE WEBINARS Institutional Trading Methods Mentorship KenneDyne spot▪ Institutional-trader The BEST way to Learn FOREX Market Psychology 2 Trading Strategy This is a systematic approach or plan that you use to engage the market. It outlines the rules and guidelines for entering and exiting trades based on your analysis and objectives. It helps you to stay disciplined, manage risk, and increase your chances of achieving consistent profitability. This is your collective mindset and emotions that drive your behavior and influence your trading. You MUST understand the psychological factors that impact market participants' decision-making processes. Risk Management 1 3 It involves the strategies and techniques you employ in the market to effectively manage and mitigate the potential risks associated with the assets you’re trading. KenneDyne spot▪ | Institutional-trader Day-Trading Plan D1 MARKET STRUCTURE BMS of MS (Body to body) BULLISH BEARISH BMS of D1 MS High/Resistant BMS of D1 MS Low/Support HTF CONFIRMATION - H4 Wait for D1 RTO on H4 or wait D1 Price to reject D1 Support H4 MUST BMS MS High Map H4 Bullish IMB LTF ENTRY SETUP - H1 Map Trading Range Spot SSL for Fakeout Map H1 setups inside H4 IMB HTF CONFIRMATION - H4 Wait for D1 RTO on H4 or wait D1 Price to reject D1 Resistant H4 MUST BMS MS Low Map H4 Bearish IMB ENTRY SnD + SnR + OB LTF ENTRY SETUP - H1 Map Trading Range Spot BSL for Fakeout Map H1 setups inside H4 IMB The BULLISH Structure sketch TP 2 The TOP-DOWN Analysis D1 BMS H1 MSB H4 BMS H1 QMC D1 - H4 - H1 KenneDyne spot▪ | Institutional-trader 1. MARKET STRUCTURE - D1 Institutional Support & Resistant R = Buy + Sell candle S = Sell + Buy candle Daily BMS MUST be BODY2BODY. Other Key zones you can consider include SnR, SnD, Old High/Low, FVG, Volume Imbalance & DM KenneDyne spot▪ | Institutional-trader When should you start waiting for Retracement? After D1 BMS of MS High, wait for MSB of MS Low on H1 to start short term sells against the trend. H1 MSB is an indicator that the market is willing to start mitigation. KenneDyne spot▪ | Institutional-trader 2. HTF CONFIRMATION - H4 Market Directional IMBALANCE ● ● ● ● Double Maru (DM) Engulfing (BE) Volume Imbalance Pin Bar/Doji H4 RTO can be a QM, SnRC1/2 or rejection at D1 SUPPORT. If you buy the H4 RTO, go to M15 & wait for BMS of MS High KenneDyne spot▪ | Institutional-trader 3. LTF ENTRY SETUPS - H1 ● ● ● Mark The MS on H1 (BMS, HH & HL) Draw TR from HL to HH Spot all possible H1 setups nested inside H4 Imbalances H1 Trading Range MUST give you a structure before considering your setup, & the setup must be nested inside H4 IMB. KenneDyne spot▪ | Institutional-trader Join our MVPs LIVE Trading Channels Its FREE | NO Subscription FEE Benefits of our MVP Traders - Analysis & signals (Entry, SL, TP) - SMC PDF & it's Videos - Live webinars & Recordings - Live Trading - 101 Mentorship - Cashback Rewards - Trading Competition Join here https://t.me/KenneDynespot My FINAL ADVICE KenneDyne spot▪ Institutional-trader Your primary objective, as a smart trader, is to wait for your best setups to show up. Money is made by stalking the big boys, not being active and forcing trades every time you see a sexy move. https://t.me/KenneDynespot