Financing Payouts

Joan Farre-Mensa, University of Illinois at Chicago

Roni Michaely, University of Geneva

Martin Schmalz, University of Oxford

Motivation: An untested assumption

Ross, Westerfield, and Jaffe (2013):

•

“A firm should begin making distributions when it generates

sufficient internal cash flow to fund its investment needs now and

into the foreseeable future.”

•

Set level of payouts “low enough to avoid expensive future

external financing.”

Conventional wisdom in payout lit.: payouts funded w/ free cash flow

•

Grullon et al. (2002), DeAngelo et al. (2006): lifecycle view of the firm

–

Young firms raise capital to invest, mature firms pay out excess FCF

•

dividends when cash flow is permanent, share repurchases when it is temporary

Same firm should not raise and pay out capital at the same time

RQ1: Do managers follow the textbook advice?

As it turns out, they do not: Financed payouts are prevalent

43% of payout payers initiate net debt or equity issues in the same year

they pay a dividend or repurchase shares (= “finance” their payouts)

41% of payout payers do not generate enough profits to maintain their

investment and payout levels without the proceeds of these issues

The economic magnitude of financed payouts is important

31% of aggregate payouts are financed with a security issue initiated by

the same firm in the same year; debt is by far the largest financing source

Conversely, 37% of aggregate proceeds of security issues are paid out

by the same firm in the same year, both via repurchases & dividends

Financed payouts are persistent

65% of firms that finance their payouts do it at least once every two years

The gap between payouts and free cash flow persists—in fact, widens—

over five-year intervals

RQ2: Why do firms finance their payouts?

A policy of financing payouts is obviously costly—so why do it?

•

Firms face non-trivial fixed and marginal costs of raising external capital (e.g.,

Hennessy and Whited 2007)

One key reason is firms’ desire to jointly manage their capital

structure and cash holdings (increase leverage w/o depleting cash)

Tax considerations—both the tax deductibility of interest payments

and the avoidance of repatriation taxes—are a key motivating factor

Other reasons—which we do not directly study—likely also important:

Agency considerations (Easterbrook 1984, Jensen 1986), cross-market

arbitrage (Ma 2019), monetary policy (Acharya and Plantin 2020,

Elgouacem and Zago 2019)

RQ3: What are the consequences of debtfinanced payouts?

•

Debt-financed payouts appear to increase firms’ exposure to negative

shocks, particularly for firms w/o an investment-grade credit rating

–

•

Just 26% of firms that debt-finance their payouts have an investment-grade rating

Debt-financed payouts are associated with:

–

lower investment levels during industry downturns

–

a deeper stock price decline during the COVID-19 crisis

•

Of course, the decision to debt-finance payouts is endogenous, so we

stop short from claiming causality

•

That said, our findings suggest that not all payouts are the same when

thinking about the consequences of payouts on financial fragility

Contributions

1. First systematic analysis of how firms fund their payouts

–

Earlier evidence that some firms occasionally finance payouts

o

E.g., Denis and Denis (1993) investigate 39 leveraged recaps. Similarly, Danis,

Rettl, and Whited (2014) study large debt-financed payouts, which are “not frequent”

o

Fama French (2005) & Grullon et al. (2011): some firms simultaneously raise equity

& pay out

Turns out much of it is driven by equity issues initiated by employees via stockoption exercises, which we conservatively exclude

The pervasiveness, magnitude, and persistence of financed payouts that

we document indicates that over 40% of firms do not follow the textbook

advice of funding payouts internally

Contributions

2. Enhance our understanding of motives behind payout policies

─

Firms’ reliance on financed payouts to actively manage capital structure is

consistent w/ trade-off theories of capital structure

─

Evidence does not support Myers’ (1984) pecking-order prediction that “an

unusually profitable firm will end up w/ unusually low debt ratio, and it won’t do

much of anything about it. It won’t go out of its way to issue debt and retire

equity to achieve a more normal debt ratio”

3. The COVID-19 crisis has renewed calls from policy makers and public

commentators to impose restrictions on corporate payouts, in particular

share repurchases (see, e.g., CARES Act, Schumer and Sanders 2019).

Our paper suggests that not all payouts are created equal when it comes

to their impact on financial fragility—the source of payout financing

matters

Sample and data

•

•

Sample: Public firms incorporated and located in the U.S., 1989-2019

•

exclude financial firms and utilities

•

exclude firms in year of their IPO

Main variables from the statement of cash flows in Compustat

–

Free cash flow: operating CF + investment CF

•

investment CF = – capex – acquis + sale PPE

–

Net debt issues: max {debt issues – debt repurchases, 0}

–

Equity issues; follow McKeon (2015) and break down in

•

firm-initiated issues (SEOs and private placements)

•

employee-initiated issues (employee stock option exercises,

warrant exercises)

Focus only on “actively financed payouts”: payouts financed

with simultaneous net debt or firm-initiated equity issues

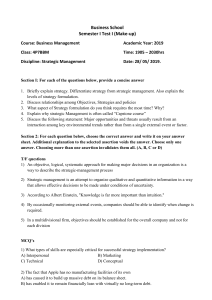

Payouts and security issues

Dollar magnitudes (billions of 2012 $)

1,200

1,000

800

600

400

200

0

1989

1991

1993

1995

Total payout

1997

1999

2001

2003

2005

2007

Repurchases & special dividends

2009

2011

2013

2015

2017

2019

Regular dividends

•

We aggregate repurchases and special dividends as they are both part of the discretionary

component of payouts (they can be cut w/ little consequence)

• Repurchases account for over 97% of repurchases + special dividends

• For brevity, sometimes we write “repurchases” to refer to repurch. + spec. dividends

•

By contrast, cutting (or even failing to increase) regular dividends tends to be perceived as

costly (e.g., Brav et al. 2005)

Payouts and security issues

Dollar magnitudes (billions of 2012 $)

1,200

1,000

800

600

400

200

0

1989

1991

1993

1995

1997

Total payout

1999

2001

2003

2005

2007

Repurchases & special dividends

2009

2011

2013

2015

2017

2019

2009 2011 2013 2015 2017

Employee-initiated equity issues

2019

Regular dividends

Dollar magnitudes (billions of 2012 $)

700

600

500

400

300

200

100

0

1989

1991 1993 1995

Net debt issues

1997

1999 2001 2003 2005

Firm-initiated equity issues

2007

To what extent do the same firms

simultaneously (in the same year) raise and

pay out capital?

Amount of payout that is financed (FP it) =

min { Payout it, Firm-initiated issuance proceeds it }

•

Firm counts

•

Dollar magnitudes

Simultaneous payouts and issues (counts)

60%

% of all payout payers that simultaneously

raise capital (avg. = 43%)

40%

20%

% of all public firms that simultaneously

raise and pay out capital (avg. = 22%)

0%

1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

Simultaneous payouts and issues ($)

Dollar magnitudes (billions of 2012 $)

350

300

250

200

150

100

50

0

1989

1991

1993

1995

1997

1999

2001

Total payouts financed by net debt issues

Reg. dividends financed by net debt issues

2003

2005

2007

2009

2011

2013

2015

2017

2019

Repurchases & spec. div. financed by net debt issues

Total payouts financed by firm-initiated equity issues

• On average, 31% of aggregate payouts are simultaneously raised in capital markets

• Financed reps are more common than financed divs, particularly in recent years

• Debt is by far the most common source of payout financing

Simultaneous payouts and security issues are

-

prevalent (43% of all payout payers)

-

economically large (31% of aggregate payouts)

-

strongly procyclical (at least until 2015)

55% are share repurchases & special dividends,

45% are regular dividends

They are financed mostly with debt

Not surprising: SEOs and private placements are small

relative to net debt issues

Still, 17% of firm-initiated equity issues are

simultaneously paid out vs. 41% of net debt issues

o

81% of employee-initiated equity issues are paid out

Do firms that finance their payouts need to raise

external capital to be able to pay out as much as they

do, given their profit and investment levels?

– Alternatively, it may be that firms are simply raising capital (while

generating enough FCF to fund their payouts) to boost their cash reserves

Payout gap (PG it) =

min { max {TP it – “internal funds” it , 0}, TP it }

where “internal funds” =

free cash flow + cash reduction + proceeds of employeeinitiated equity issues

Dollar magnitudes (billions of 2012 $)

350

300

250

200

150

100

50

0

1989

1991

1993

1995

1997

1999

2001

2003

Simultaneous payouts and security issues

2005

2007

2009

2011

2013

2015

2017

2019

Aggregate sum of total payout gaps

80% of firms that simultaneously raise and pay out capital have a payout

gap, i.e., they could not have funded their payouts using their internal

funds

•

Payout gaps are largely repurchase gaps—firms that repurchase more

than they can fund with their internal funds, after paying their dividends

Dollar magnitudes (billions of 2012 $)

140

120

100

80

60

40

20

0

1989

1991

1993

1995

1997

1999

2001

2003

Repurchase & special dividend gap

2005

2007

2009

2011

2013

Regular dividend gap

2015

2017

2019

Payout gaps are not the result of timing mismatches

between payouts and free cash flow (e.g., due to

payout smoothing)

Prevalence and magnitude of payout gaps increases if

we measure gaps over 5-year intervals payouts

gaps are persistent!

Why do firms set payout levels above their internal funds,

which they need to finance by simultaneously raising

costly external capital?

– The costs of doing so can be substantial. Hennessy and Whited

(2007): “for large (small) firms, estimated marginal equity

flotation costs start at 5.0% (10.7%) and [deadweight]

bankruptcy costs equal to 8.4% (15.1%) of capital.”

Just 26% of firms that debt-finance payouts have investment-grade rating

Thus, there must be some offsetting benefit

• We begin by examining the characteristics of firms that finance

their payouts

Focus on firms that finance their repurchases with debt

Decision cannot be explained by reluctance to cut dividends,

debt is by far the largest source of payout financing

Estimate probit model, show marginal effects

Firms with high

leverage and high

cash are less likely to

finance their payouts

with debt

Combining payouts

with debt issues

allows firms to

increase their (net)

leverage without

depleting their cash

reserves (or incurring

repatriation taxes)

Note: If the firm is investing and

growing, leverage will not

explode!

Regressions include industry and year FE

Evolution of median target leverage deviation with and

without debt-financed discretionary payouts

2%

0%

-1

0

1

2

3

4

-2%

-4%

-6%

-8%

Actual target leverage deviation for firms that debt-finance their repurchases

Counterfactual target leverage deviation if debt-financed repurchases were set to zero

In counterfactual exercise, for debt-financed repurchases, we set

– net debt issues (ND) = ND – min{Rep, ND}

– repurchases (Rep) = Rep – min{Rep, ND}

5

Evolution of mean target leverage deviation with and

without debt-financed discretionary payouts

6%

4%

2%

0%

-1

0

1

2

3

4

-2%

-4%

-6%

Actual target leverage deviation for firms that debt-finance their repurchases

Counterfactual target leverage deviation if debt-financed repurchases were set to zero

In counterfactual exercise, for debt-financed repurchases, we set

– net debt issues (ND) = ND – min{Rep, ND}

– repurchases (Rep) = Rep – min{Rep, ND}

5

What if firms tried to achieve same leverage increase by

simply increasing their repurchases, without

simultaneously raising debt?

10%

0%

-1

0

1

2

3

4

5

-10%

-20%

-30%

-40%

-50%

Actual cash over actual assets for firms that debt-finance their repurchases

Counterfactual cash over actual assets if firms tried to attain the same leverage increases by only

repurchasing more without raising any net debt

–

Plot shows the median; mean is even starker

81% of firms do not have enough cash to achieve the same leverage

increase exclusively through payout increases!

What motivates firms’ attempts to jointly manage their

capital structure and their cash holdings?

Corporate income taxes

Repatriation taxes

State-level tax increases as exogenous shocks to the

demand for leverage

•

Following Heider and Ljungqvist (2015), we exploit staggered changes in

state corporate income taxes as plausibly exogenous shocks to the value

of interest tax deductions using a diff-in-diff approach

─

Issuing debt allows firms to minimize their tax bill because interest is tax

deductible

─

Paying out the debt ensures that tax savings are not offset by the new taxable

interest income that would be generated if firms retained the proceeds as cash

•

Tax increases play a significant role in explaining debt-financed payouts,

but (as expected) only for firms w/ profits to shield from tax

Did the 2017 TCJA decrease firms’ incentives to use debtfinanced payouts to avoid paying repatriation taxes?

•

The Tax Cuts and Jobs Act of 2017 (TCJA) eliminated US multinational

firms’ incentives to hoard cash overseas to avoid repatriation taxes

–

Before the TCJA, US corporations were taxed on worldwide income. However,

a US corporation could defer foreign income by retaining earnings through a

foreign subsidiary

–

The US corporation would pay US tax on the foreign earnings only when they

were repatriated. Upon repatriation, the earnings would be subject to US

taxation at a rate up to 35%, with a credit for foreign taxes paid

•

The repatriation typically resulted in a net US tax obligation because the US tax rate

was usually higher than the foreign tax rate

–

Debt-financed payouts allowed firms to ensure that their net leverage would

not fall despite the cash held overseas. Firms could then wait for a repatriation

tax holiday (like the one in 2004) to bring back foreign cash and repay debt

–

Pursuant to the TCJA, the US now exempts from taxation the earnings of a

US firm from active foreign subsidiaries, even if the earnings are repatriated

•

After the TCJA came into effect in 2018, the tax cost of repatriating foreign

earnings is no longer associated w/ a higher likelihood to debt-finance payouts

•

Dynamic results are consistent w/ the parallel trends assumption

What are the consequences of debt-financed payouts?

Investment reaction to industry downturns

Stock price reaction to COVID-19 crisis

If anything,

repurchasing firms

tend to invest more,

even during periods of

industry distress

Regressions include firm and year FE

If anything,

repurchasing firms

tend to invest more,

even during periods of

industry distress

The same is not true

for firms whose

repurchases are debtfinanced

Regressions include firm and year FE

If anything,

repurchasing firms

tend to invest more,

even during periods of

industry distress

The same is not true

for firms whose

repurchases are debtfinanced

Debt-financed

repurchases lead to

−0.6 p.p. less

investment following

periods of industry

distress

Regressions include firm and year FE

If anything,

repurchasing firms

tend to invest more,

even during periods of

industry distress

The same is not true

for firms whose

repurchases are debtfinanced

Debt-financed

repurchases lead to

−0.6 p.p. less

investment following

periods of industry

distress

No significant effect for

firms w/ an

investment-grade

rating

Debt-financed

repurchases are

associated w/ a

deeper stock price

decline during the

COVID-19 crisis

This finding is

exclusive to debtfinanced repurchases.

Cash-flow financed

repurchases are not

associated w/ deeper

stock declines. This

likely explains the

insignificant findings

found by Fahlenbrach,

Rageth, and Stulz

(2020)

Debt-financed

repurchases are

associated w/ a

deeper stock price

decline during the

COVID-19 crisis

This finding is

exclusive to debtfinanced repurchases.

Cash-flow financed

repurchases are not

associated w/ deeper

stock declines. This

likely explains the

insignificant findings

found by Fahlenbrach,

Rageth, and Stulz

(2020)

Again, no significant

effect for firms w/ an

investment-grade

rating

Conclusions

•

The commonly held view in the payout literature that payouts are first and

foremost a vehicle to returns free cash flow to investors

payouts should be set “low enough to avoid expensive future external financing”

(Ross et al. 2013)

is incomplete

•

•

Payouts that are financed with simultaneous debt or equity issues are

–

prevalent: 43% of payout payers do so

–

large in magnitude: 31% of aggregate payouts are financed

–

persistent

–

take the form of both repurchases (55%) and dividends (45%)

Payout financing is an important use of the capital firms raise:

–

41% of aggregate proceeds of net debt issues

–

17% of aggregate proceeds of firm-initiated equity issues

are simultaneously paid out

Conclusions

•

We show that firms use debt-financed payouts to jointly manage their

capital structure and cash holdings, motivated, in particular, by tax

considerations

•

We show that not all payouts are created equal when it comes to their

impact on financial fragility—the source of payout financing matters

Our findings highlight that firms’ liquidity, capital structure, and payout

policies are closely related

Important to study them jointly!