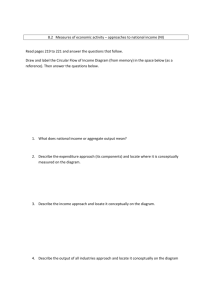

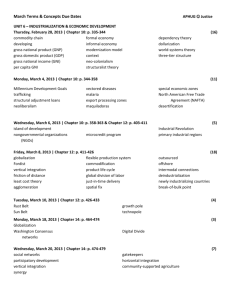

ECONOMIC INDICATORS Presented by: Yasmine Emerald Avila ECONOMIC INDICATORS People worry about the conditions of the economy. Most of the time, they ask the nation’s leaders about the state of the economy. How is the economy doing? They are expecting the political leaders to solve the economic problems of the country. To do this, measuring the economic performance of the country is necessary. It can gauge if the government and other sectors are performing well. In measuring the economic performance of the country, various economic indicators are used, such as Gross National Product or Gross National Income, Gross Domestic Product, Per Capita Income, Inflation rate, the money supply, and the stock market. Economic indicators are the instruments used to evaluate the development of the economy. The indicators describe the condition of the country’s economy Gross National Product (GNP)/Gross National Income (GNI) Gross National Product (GNP)/Gross National Income (GNI) is considered as the most important indicator for measuring the development of the economy. In GNP/ GNI, the overall production of the country is studied and examined. GNP/GNI is the accumulation of all the goods and services produced in the country. There are numerous products produced in the country with various units of measures like kilo, yard, meter, dozen, gallon, and liter. Similarly, to measure the overall production of the economy, a specific measuring unit is used. The price and the market value of the commodities are combined together to come up with the total amount of production in the country. This procedure means that any goods or services, which have no market value, are not included in the computation of GNP. The final goods or products, which is ready for consumption, are included in the computation Gross National Product (GNP)/Gross National Income (GNI) These are the products that do not undergo any process to become finished products. One good example is flour, which is considered as intermediate good and its value is not included in the computation of GNP to avoid double counting, because it has to be processed to become bread, which is the final good. In other words, GNP refers to the total market value of all the final goods and services produced in the country for a given period of time. Included in the GNP of the country is the production of Filipinos within and outside the country. For example, the income earned by Overseas Filipino Workers (OFWs) is included in the GNP, which is determined yearly. GNP is similar to Gross National Income (GNI) except that GNP does not deduct the Indirect Business Taxes.ons Different Types of GNP/GNI 02 01 Nominal and Real GNP/GNI Potential and Actual GNP/GNI WHOA! Nominal and Real GNP/GNI GNP/GNI is measured through the market value or the price of the goods and services in the market. It means that price is the main determinant of the levels of production. As we notice in Table No.1, GNP/ GNI is expressed in two ways. GNP/GNI at current prices is called nominal GNP/GNI. It refers to the total production of the country based on the prevailing price in the market. The second one is the GNP/GNI at constant prices which is known as real GNP/GNI. It is the value of the country’s production based on the price in a given base year. WHOA! Potential and Actual GNP/GNI Potential GNP/GNI is the estimated total production of the country based on the productivity and capacity of the factors mentioned earlier. It is the goal of the economy for a year. At the end of the year, the production of the country is measured, and it represents the actual GNP/GNI. Actual GNP/ GNI is the amount of produced goods and services attained in a country for one year. It serves as a barometer if the economy has been effective in maximizing the use of the natural resources, machineries, and workers in achieving the potential GNP/GNI. APPROACHES TO GNP MEASUREMENT Final expenditure approach Government Expenditures Personal Expenditure Business Expenditure Net Export Net Factor Income from Abroad (NFIA) Statistical Discrepancy You can enter a subtitle here if you need it It is also called the Value Added Approach where all the contribution of each sector like agriculture, industry, and services are computed. The value of the goods depends on the contribution of every sector in processing and production of goods and services. When the value of the goods is added together as contribution from each sector, then the Gross Domestic Product (GDP) is computed. Before the computation of the GNP/GNI, GDP should be determined first and then the Net Factor Income from Abroad (NFIA) is added. Industrial Origin Approach Each factor of production receives payment for its services and this serves as income. The various payments are rent for land, wages for workers, interest for capital, and profit for entrepreneurs. When the factor income are combined together, the result is the National Income (NI). It is important to measure the national income because it reflects the living conditions of the people. It is also the gauge on how much income should be divided among the people. National Income is the total income received by the sectors of the economy. The components of GNP/GNI must be identified to be able to compute the National Income. Factor Income Approach COMPONENTS OF NATIONAL INCOME Compensation of Employees (CE) Entrepreneurial Income (EI) Government Income (GI) Corporate Income (CI) Capital Consumption Allowance (CCA) It refers to the fund for depreciation intended for buying new machineries and facilities. Gradually, capital goods will reach the period of depreciation and become wornout. Indirect Business Taxes (IBT) Indirect tax imposed on the goods and services made after the subsidy has been deducted. There are other indicators that measure the economic performance of the economy. GNP/GNI is just one of them. Even if the government reported that the GNP/GNI achieved a five percent increase, people do not believe it because the reality speaks the truth, majority of the Filipinos do not feel the the underground economy, where millions of people venture and million others patronize. Some of them get higher income than those people who are legally employed and those who are engaged in legal businesses. Some of the activities in the underground economy include sari-sari stores, household businesses, sidewalk vendors, buy and sell activities without government permits and other illegal activities like illegal gambling, drug trafficking, and smuggling to name a few. These serve as limiting factors in computing the GNP/GNI, because there are no records of the transactions done by the underground economy. The GNP/GNI growth is the basis of the government for acquiring foreign loans. GNP/GNI analysis is necessary to understand the economic condition of the country. National Income Distribution According to Article XII, Section I of the 1987 Constitution, the goals of the national economy is more equitable distribution of opportunities, income, and wealth; a sustained increase in the amount of goods and services produced by the nation for the benefit of the people; and an expanding productivity as the key to raising the quality of life for all, especially the underprivileged. Source: www.gov.ph/constitutions/1987-constitution/ What is income? Income is the money received by an individual as payment for producing goods and services. The income received by the household before the taxes are deducted is called Personal Income (PI). But when taxes and security insurances are deducted from the income, the household receives Personal Disposable Income (PDI). This income is the actual amount of money the consumer can spend. Income Distribution Income distribution refers to how the national income is divided among all sectors of the economy. A study of the statistical report of NEDA shows that the target of the national economy is very far from being realized. The 10% of families received different percentage in the income. Lorenz Curve Income distribution in a country is illustrated by a curve called Lorenz Curve, which was formulated by Conrad Lorenz, an American statistician, in 1905, who made a diagram to show the relationship between the population and income received in the economy. Lorenz Curve consists of two axes: the horizontal which represents the percentage of population by income group and the vertical, which represents the percentage of income received. In constructing the Lorenz Curve, it is necessary to get the cumulative percentage of income and population. To get the cumulative percentage of income, add the first 10 percent to the next income decile or the 10 percent of the population that received the certain percentage of income. THANK YOU FOR LISTENING!