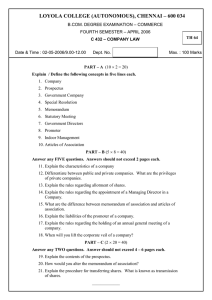

Date: 20/05/2012

Module-E: CORPORATE LAWS [Mr. Rizwan Manai]

ANALYSIS OF SECTIONS

100 Marks

1) COMPANIES

ORDINANCE, 1984 (70

MARKS)

2) SECRETARIAL PRACTICES –

Performance of a Company

Secretary (15 MARKS)

40 MARKS

30 MARKS

Companies

Ordinance, 1984

Rules issued under

Companies

Ordinance, 1984

+

2nd Schedule

+

Companies General

Provisions and

Forms Rules, 1984

+

SROs + Circulars

(Up to 31.12.2012)

3) OTHER LAWS

(15 MARKS)

(1) Banking

Companies

Ordinance,

1962

(2) Takeover

Ordinance,

2002

(3) Foreign

Exchange

Regulation

Act, 1947

(i) Buy-Back

Rules, 1999

(ii) Companies

Share Capital

(Variation of

Rights and

Privileges

Rules, 2000

(iii) NBFC Rules,

2003 + NBFC

Regular,

2008

NOTE: Read once from Companies Ordinance, 1984.

1

SROs vs. Circulars

SRO (Statutory Rules and Orders)

SRO

Circular

=

Extension of Law

=

To replace “as may be provided” in any section

=

Explanation of Law

=

e.g. Circular 1 / 2008

(Also called “General Orders”)

Reasoning over requirement of

publication of notice of meeting

in Urdu newspaper

ORDINANCE vs. ACT

President’s announcement

of enforced law

For example, Sales

Tax Act, 1990

Where parliament is not in session

Bill prepared (Draft law)

and approved by

parliament

(Senate + National Assembly +

Provincial Assembly)

Note: “Assent” means ‘after obtaining approval’.

2

Types of Enforcement of Law

(i) At once: The entire law will be effective on a single date.

(ii) Piecemeal: Ordinance or Act will come into force on such date(s) as may be prescribed.

Various sections will become applicable on various dates. [Section 1 (3)]. Companies

Ordinance, 1984, is a type of “PIECEMEAL ENFORCEMENT”.

Act 1984 to April 1997

Jurisdiction of Companies Ordinance [Section 1 (2)]

It extends to the whole of Pakistan. However, the following are not to be considered as part of

Pakistan for enforcing any law of Pakistan:

(i) FATA – Federally Administered Tribal Areas;

(ii) PATA – Provincially Administered Tribal Areas; and

(iii) AJK – Azad Jammu & Kashmir.

These voluntarily adopted

Companies Ordinance, 1984.

PREAMBLE

Companies Ordinance, 1984, is:

An Ordinance to:

- Consolidate and

- Amend the law, i.e. the Companies Act, 1913 (Repealed law).

It relates to:

(i) Companies [Section 2 (1) (7)]; and

(ii) Certain other associations [Section 14 + Section 503 + Section 452]

3

COMPANY [SECTION 2 (1) (7)]

Existing Company

Company financed and registered under

the Companies Ordinance, 1984

CERTAIN OTHER ASSOCIATIONS (IMPORTANT)

SECTION 14

SECTION 452

SECTION 503 (2)

Group of persons

exceeding 20

Foreign Companies

Corporations =

formed under

parliament –

special

enactment

+

Company

incorporated

outside Pakistan,

but having branches

in Pakistan [e.g.

Barclays Bank].

Carrying on

business

+

To earn profit

If security of

corporation is

listed on any

Stock Exchange.

+

Branch = subject to

Companies

Ordinance, 1984, as

Foreign Companies.

Not covered

under exclusion

of Section 14.

NEXT CLASS:

Day

Date

Time

Tuesday

22/05/2012

6:15 pm – 8:15 pm

4

Date: 22/05/2012

WAYS TO ACQUIRE CORPORATE STATUS IN PAKISTAN (Separate Personality)

Companies

Ordinance, 1984

Parliament Special

Enactment

Companies’ Ordinance applicability

S-503 (i)

It is similar to formation

law – the governing law

for these matters is

solely the Companies

Ordinance, 1984

Company is such

Other Company

where ‘other law’

No separate governing statute, like:

is applicable for

- Textile Mills

governing the company.

– Pharmaceutical

Securities

Listed

E.g. Pakistan

National Shipping

Corporation (PNSC)

Companies Ordinance, 1984

Securities not

listed (outside

the scope of

the

Companies

Ordinance)

E.g. State

Life

Insurance

(i) Insurance Company

= Insurance Ordinance, 2000

Companies Ordinance,

1984, for governing

matters, applicable to

extent, not contradicting

with separate governing

statute.

(governing law of Insurance Company),

e.g. EFU General Insurance Company, Limited

(ii) Banking Company

= Banking Companies Ordinance, 1962

To the extent of the

following sections of

the Companies

Ordinance:

- Section 156;

- Section 158;

- Section 230 to 247;

(governing law for Banking Companies in Pakistan),

- Section 254 to 274;

e.g. Soneri Bank Limited

- Section 277; and

- Section 278.

5

APPLICABILITY OF COMPANIES ORDINANCE, 1984, OF CERTAIN OTHER ASSOCIATIONS

(1) Foreign Companies [Section 452] - To the extent of:

a. Matters provided in between Sections 452 to 465; OR

b. Sections referred in between Sections 452 to 465.

(2) Group of more than 20 members [Section 14 and Section 444] – Applicability of Ordinance

to such extent as to enable the Court to order for compulsory winding up in registered

company.

STRATEGY TO DECIDE TO COME IN THE ORDINANCE

Compulsory

Opt In

Compulsory

Opt Out

[Section 4]

(i) Foreign Incorporated Company,

deciding to have a place of business

in Pakistan (Branches) – Section 452.

Foreign

Company

Certain

Other

Associations

(ii) Corporation with listed securities –

Section 503 (2).

(iii) Doing of certain businesses,

requiring to take the shape under

the Companies Ordinance, like:

(a) Insurance Company;

Other laws

(b) Banking Company;

(c) Modaraba Company; and

(d) Asset Management Company.

(iv) Group of more than 20 members –

Section 14 + Business + Profitmaking.

(i) University [e.g. Karachi

University and NED University

of Engineering & Technology.

(ii) Co-operative society.

(iii) Trading Corporation, owned

and controlled by a province

and carrying on business

within that province.

Note: The above are

“Provincial Subjects”, whereas

the Companies Ordinance,

1984, is a “Federal Subject”.

Voluntary Opt

In

Due to the following

benefits:

(i) Separate Entity of

Companies – Veil

of Incorporation

[Section 32].

(ii) Limited Liability of

members [Section

300 to 303].

(iii) Perpetual

Succession.

(Details of the above

are on the next page)

6

Voluntary Opt In (continued)

(1) VEIL OF INCORPORATION:

Incorporation certificate acts as a veil between directors and officers.

(a) Business management + Owners / Members

and

(b) Outsiders

Tax Authorities

Creditors

Customers

Thereby, faults and achievements of business managers will be considered [of the company, not the

managers?]

There are 13 places in the Companies Ordinance, 1984 that are defined as situations in case of “Lifting of Veil

of Incorporation”.

(2) LIMITED LIABILITY:

(i) All liabilities of the company will be paid out of the assets of the company.

(ii) Members (or owners) will not be required to contribute, except a specified amount

(depending upon the structure of the company) to enable the company to pay off its

liabilities.

(iii) Thereby, the risk to put a charge on personal assets of the members will be avoided.

(3) PERPETUAL SUCCESSION:

Incorporation certificates result in perpetual succession of corporatized business till winding up,

e.g. Bonanza, Tullo Ghee (both 3rd Generation).

NEXT CLASS:

Day

Date

Time

Sunday

27/05/2012

8:00 am – 9:45 am

7

DATE: 29/05/2012

SECTION 1:

1)

2)

3)

4)

OBJECTIVE OF COMPANIES ORDINANCE, 1984

Healthy growth of corporate enterprise.

Protection of investors and creditors.

Promotion of investment.

Development of economy.

Companies Ordinance, 1984, extends to all provinces and federally administered area (i.e.

Islamabad) of Pakistan. It does not extend to Azad Jammu and Kashmir (AJK), FATA (i.e.

Federally Administered Tribal Areas) and PATA (i.e. Provincially Administered Tribal Areas), as

the said areas are not the part of Pakistan according to the constitution of Pakistan.

Note: Section 2 and Section 3 relate to definitions of terms specified in the Companies

Ordinance, 1984. [Refer to the Companies Ordinance, 1984, for the definitions].

Target of SECP

There

would be no

self study.

Functioning of SECP under S-12 + SECP Act, 1997

Still, Companies Ordinance, 1984, applies to companies incorporated in Azad Jammu and

Kashmir (AJK).

Why = Voluntary adopted in 1989.

Non-Trading Corporation (Tourism, Service Provider) with Provincial Objective = Yes, as it is

not covered under Section 4.

Because of Provincial Object

Section 4

Section 4 – Ordinance not to apply to certain corporations: (1) Trading corporation owned or

controlled by province and carrying business within that province; (2) co-operative society; and

(3) university.

They are provincial object.

Peculiarity of Section 5 is applicable = Ordinary objective = Target of SECP.

So, target government of Province, or Provincial Government.

Power of Federal government instead of SECP

= Due to Reg. of Constitution

8

Section 5 – Application of Ordinance to non-trading companies with purely provincial objects:

Power of the Federal Government and the SECP = Powers of Provincial Government.

Directional Documents During the Life of a Company

(1)

(2)

(3)

(4)

(5)

Memorandum of Association (MOA) [Subordinate to Companies Ordinance, 1984].

Articles of Association (AOA) [Subordinate to MOA and Companies Ordinance, 1984].

Agent is Contract – Subordinate to AOA + MOA + Companies Ordinance, 1984.

Resolution – Subordinate to Agents + AOA + MOA + Companies Ordinance, 1984.

Prospectus (for Public Limited Company) – All the above.

Providing therein is not in line with Companies Ordinance.

1984

Law amended, but

document not amended.

Lack of care for

preparation of documents.

6 months or 9 months limit of AGM

4 months limit applicable

4 months limit of AGM

Direction documents can be applied

only to the extent, when their

applicability does not result in violation

of Companies Ordinance, 1984.

Directional document’s provision is not in line with the Companies Ordinance, 1984.

Status of Documents

But, contradicting provision

= Considered void

Document still

valid

9

Requirement to continuously update the documents with changed law

Section 6 provides automatic mechanism to update the documents with changed law without going

into any legal formality for the purpose.

However, companies may proceed to change and update the documents as a matter of Corporate

Responsibilities.

Section 6 – Ordinance to override memorandum, articles, etc.:

The provisions of this Ordinance shall have effect notwithstanding anything contained in the MOA,

AOA, contract, agreement or resolution.

Any provision in above which is repugnant to the aforesaid provisions of this Ordinance, shall

become or be void, as the case may be.

COURTS UNDER COMPANIES ORDINANCE, 1984 [SECTION 7 TO SECTION 10]

High Court

For certain

matters of the

Companies

Ordinance,

1984, which can

be taken only by

the Court.

Like to

challenge

the

directors’

election.

Petition for

winding up

of

companies.

For certain

matters, necessity

arises to take up,

but matter is such

as which is outside

the power of SECP.

Dispute

over title

of

shares.

Supreme Court

Certain decisions of

SECP under

Ordinance.

Like Completion of

Management of Adamjee

Insurance about hostile

takeover of the company

by Mansha Group.

10

are provided as Final:

S-30 = If certificate of

incorporation applied

but refusal by SECP –

Decision of SECP is

final, e.g. A petition on

1.1.2012 – Registered

office is in Sindh, which

has moved from

Punjab w.e.f 1.12.2011

Are not provided as

Final: Decision of SECP

over complaint about

delayed transfer of

shares – Section 78A.

Yes, it can be taken up

with High Court.

Appeal against

order of High

Court

Relevant Court =?

1) Establish

preceding 6

months of date of

filing of petition of

1.7.2011 to

31.12.2011.

2) Provinces of

Registered office

in above period,

i.e. 1.7.2011 30.11.2011 –

Punjab; 1.12.2011

-31.12.2011 –

Sindh.

Note:

Section 305: Grounds in which application can be made to request the Court to wind up the

company.

Punjab has longest been the province of Registered Office during the preceding 6 months of filing

date of petition = Punjab High Court

JURISDICTION OF COURTS [section 7 to 10] (Notes from Book)

Section 7 – Jurisdiction of Courts: High Court having jurisdiction in the place at which registered

office of the company is situated. However, civil court may be empowered by the Federal

Government.

For the purpose of jurisdiction to wind up companies, the expression “registered office” means the

place which has longest been the registered office during the 6 months immediately preceding the

presentation of the petition for winding up.

Section 8 – Constitution of Company Benches: One or more to be constituted by chief justice of the

High Court to exercise the jurisdiction vested in the High Court under section 7.

Section 9 – Procedure of the Courts: Notwithstanding anything contained in any other law, all

matters coming before the Court under this Ordinance shall be disposed of, and the judgment

pronounced as expeditiously as possible, but not later than 90 days from the date of presentation

of the petition / application, except in extraordinary circumstances and on grounds to be recorded,

the Court shall hear the case from day to day.

Adjournment (or Suspension): 14 days at any one time or 30 days in all, or for sufficient cause to be

recorded in writing – mentioned in court diary.

Section 10 – Appeal against Court Orders:

(1) Notwithstanding anything contained in any other law, an appeal against any order, decision or

judgment of the Court shall lie to the Supreme Court where the company ordered to be wound

up has a paid up share capital of not less than Rs. 1 million; and

Where the company ordered to be wound up has a paid up capital of less than Rs. 1 million, or

has no share capital, such appeal shall lie only if the Supreme Court grants leave to appeal.

(2) Save as provided in sub-section (1), an appeal from any order made, or decision given, by the

Court shall lie in the same manner in which and subject to the same conditions under which

appeals lie from any order or decision of the Court.

(3) An appeal preferred under sub-section (2) shall be finally disposed of by the Court hearing the

appeal within 90 days of the submission of the appeal.

11

COURTS UNDER COMPANIES ORDINANCE (SECTION 10)

High Court

(see previous

notes)

Supreme Court

(Court of Appeal

against order of

the Court)

Appeal can be

filed without

seeking any

prior

permission

If the paid up

capital of the

company is Rs. 1

million, or mote

than Rs. 1 million

* High Court’s

order in relation

to compulsory

winding up of a

company due to

circumstances

of Section 305

If the paid up

capital is less than

Rs. 1 million, or

there is no paid

up capital

* High Court’s

other order

Like order of

the Court for

resolving

dispute over

title of shares

On the basis

Correct procedure to submit

appeal will be established.

Initially, file an appeal with

the Supreme Court to seek

possibility of filing an appeal

Bifurcation as

such is the

requirement of

Section 10.

* = Note

* Besides, the point of prior permission of the Supreme Court.

Rest of the formalities for filing of appeal – same for each of the categories.

Formalities – as applicable for ANY CASE under other laws.

Section 14 – Sub-section (3): Exceptions to the Requirement

Exception 1: - Society, body or association other than a partnership, formed or incorporated under

any other Pakistan law.

12

Building Association = Not supposed to be registered on – although there are more than 20

members.

Not carrying on

business

Motive = Not to

earn profit

Example:

1) Alamgir Welfare Trust

= Having more than 20 trustees + Carrying on business + With the aim of making a profit

Although there are 3 conditions applicable, they are not required to be registered as they have

formed themselves under the law of the country.

2) XYZ & Co. – having 22 members (Partnership)

Registered under

Partnership Act

(1) Including 20 members.

(2) With the objective of

carrying on business.

(3) With the objective of making

a profit.

(4) Exception – Not Applicable

(as they have not taken

shape under any other law).

Not Registered under

Partnership Act

SAME

(4) Although they have taken

status under partnership law,

but the Partnership Law is not

valid to claim the exception.

Exception 2: - A joint family carrying on joint family business; OR

Exception 3: - A partnership of 2 or more joint families, where the total number of members of

such families, excluding the minor members, does not exceed 20.

13

Joint Family A

Joint Family B

Yarn Manufacturer

Fabric Manufacturer

24 members

22 members

[11 members]

[8 members]

Not subject to the Companies Ordinance, 1984

SAME

as it is a Joint Family business.

Entered into partnership arrangement = New registration requirements would be applicable.

The concept of Joint Family is no longer applicable as it has a number of members exceeding 20.

Exception 4: - Partnership of lawyers, accountants or any other profession where practice as a

limited liability company is not permitted under the relevant laws / regulations of such practice.

Notes from Handbook:

INCORPORATION OF COMPANIES & MATTERS INCIDENTAL THERETO

SECTION 14: Obligation to register certain associations, partnerships, etc., as companies:

Sub-section (1): This section is applicable to:

Partnership;

Association; and

Company

- Consisting of more than 20 persons

- With the Purpose of Carrying on any business

- With the Object of the Acquisition of gain.

Sub-section (2): Consequences of Non-Registration:

For every person who is a member:

Fine = Rs. 5,000;

Personally liable for all liabilities incurred in such business.

14

Sub-section (3): Exceptions to the Requirement:

Society, body, or association, other than a partnership, formed or incorporated under any

other Pakistan law; OR

A joint family carrying on joint family business; OR

A partnership of 2 or more joint families, where the total number of members of such

families, excluding the minor members, does not exceed 20; OR

Partnership of lawyers, accountants or any other profession where the practice as a limited

liability company is not permitted under relevant laws / regulations of such practice.

MEMORANDUM OF ASSOCIATION [SECTIONS 15-25]

Company – defined in Section 2 (1) (7)

Company:

(i) Formed under Section 15 of the Companies Ordinance; and

(ii) Registered under Sections 30 and 32.

Under Companies Ordinance, 1984 + Existing Company

Limited by

shares

Private Company = 1 or more members

If it has 1 member only – then it is termed

as a “Single Member Company” (SMC)

If it has more than 1 member – then it is

termed as “Other Private Company”

PREREQUISITES FOR FORMATION OF A COMPANY

(1) Minimum number of members (desired type).

(2) Lawful purpose (the objective of the company as provided in the form of activities under the

Object Clause of the Memorandum of Association (MOA) – is not repugnant to any applicable

law of the Court.

(3) Subscribing of the MOA by the minimum number of members as above, who have agreed to

form a company.

Section 19: - What is the meaning of “subscriber” in the Memorandum of Association” (MOA)?

(i) Writing down the name, address, Computerized National Identity Card (CNIC) / Passport No.

and other particulars;

(ii) Statement to form a company (and agree to fulfill all the responsibilities under the

Companies Ordinance, 1984);

15

(iii) If the company has Share Capital, each subscriber shall write the number of shares that they

are willing to take; at least 1 share shall be taken – Qualification share to become

subscriber.

(iv) If the company is a Guarantee Limited Company, the amount of guarantee to be undertaken

for the purpose of winding up has to be mentioned.

Whether a Company can be a Subscriber to the MOA of any Other Company

Yes, a company can be a subscriber to the MOA of any other company, according to Rule 2A of the

Companies Provisions & Forms Rules, 1985, by the following procedures:

(i) By appointing any “authorized representative” [who can be any person] – with the privilege to

act as such.

(ii) The authorized representative so appointed should add his particulars and will provide the

statement on behalf of persons to whom he is representing.

Voting Rights

Voting rights = Shares and other securities [Instrument to influence decision of a meeting].

Other rights [Notice of meetings, attendance at meetings and surplus in winding up]

= Shares or other securities

Debentures

[Section 2 (1) (12)

Share Capital

[Section 2 (1) (30A)

Section 114: Voting rights can be assigned for the purpose of members meeting, or for the

debenture holders … whose debentures are convertible into shares.

Procedure to Assign Voting Rights of Convertible Debenture Holders

The procedure is to obtain the maximum votes to the extent of votes that are available on shares of

equivalent face value.

16

MEMORANDUM OF ASSOCIATION [SECTIONS 15-25]

SECTION 15: Mode of Forming a Company:

Any of the following:

3 or more persons (i.e. a “Public company”);

1 or more persons (i.e. a “Private company”); or

1 person (i.e. a “Single Member Company” – SMC)

may form a company for lawful purpose by subscribing their names to a MOA and by complying

with the requirements of registration. The company formed may be:

Company limited by shares {Section 2 (1) (8)};

Company limited by guarantee {Section 2 (1) (9)}; and

Unlimited company

Explanatory Notes:

1. Definition of Memorandum of Association (MOA):

“Memorandum of Association” (MOA) is a document which sets out the constitution of a

company and, as such, it is the foundation on which the structure of the company is based. It

defines its relations with the outside world and the scope of its activities.

2. Requirement of MOA:

Company cannot be formed unless MOA is subscribed by the minimum number of members, as

laid out in Section 15(1).

3. Definition of Articles of Association (AOA):

“Articles of Association” (AOA) is a document which sets out the regulations for the company –

Section 26(1).

4. Requirement of AOA:

AOA duly signed by subscribers of MOA is required to be registered along with MOA in order to

form a company {Section 26(1)}.

Exception for registration requirement of AOA is in the case of “Company Limited by Shares”,

wherein if the AOA is not registered, then “Table A in the First Schedule” shall be deemed as

AOA {Section 26(5)}.

Section 26: Registration of Articles:

Since the AOA sets out the manner in which the company is to be governed, therefore no

mandatory contents are prescribed. However, under sub-section (2):

17

“Articles of Association” (AOA) may adopt all or any of the regulations of Table A”.

Under Sub-section (3), in case of company limited by guarantee and an unlimited company, AOA

shall state:

If the company has share capital = Amount of share capital – proposed to be registered.

If the company has no share capital = Number of members – proposed to be registered.

Under Sub-section (6):

“AOA shall be explicit and without ambiguity and shall list and enumerate the voting and other

rights attached to the different classes of shares and other securities, if any, issued or to be issued”.

Status of Table A {Section 26(5)}:

In case of a company limited by shares, if the AOA are:

Not registered, OR

Registered and do not exclude or modify the regulations in Table A,

those regulations shall, so far as applicable, be the regulations of the company in the same manner

and to the same extent as if they were contained in duly registered AOA.

Note:

Next class is on Tuesday, June 5th, 2012, from 6:15 pm to 8:15 pm.

18

DATE: 05/06/2012

Corporate Laws

STATUS OF TABLE A

= Limited by Shares

Deemed Articles of

Association (AOA) where

company has not

prepared its own AOA.

Where the company

has prepared its AOA

To the extent

applicable

Not Excluded

OR

Modified

By own Articles of Association

Article 46 – Table A:

If borrowings of the company exceed paid up capital, then the excess borrowing requires member

approval

Otherwise, Board of Directors (BOD) approval of borrowing is sufficient.

Example:

ABC Ltd. (Limited by Shares)

Table A will not

be applicable as it

has been

excluded through

own AOA.

AOA registered with the Registrar

(Say) Article 22 = Provides that:

Applicability

of Table A

on the

Registered

Company

Table A will not

be applied as it

has been

modified through

own AOA.

If borrowing level

exceeds twice of

paid up capital,

then excess

borrowing requires

member approval.

19

Article 46 of

OR A is not

Table

applicable to

us.

COMPANIES ORDINANCE, 1984

(Sections 1 to 14)

S. No.

1.

Situation

Solution

ABC Ltd. is a company formed and

registered under the Companies Act, 1913.

Mr. Kamal is holding 1,000 shares of Rs. 10

each, for which he has duly paid Rs. 5 per

share. Under the provisions of AOA,

management was allowed to call unpaid

amount on shares under any circumstances

which BOD, through their resolution,

decides as fit for the purpose. Accordingly,

BOD passed the resolution and asked Mr.

Kamal to pay Rs. 5,000, being unpaid

amount on the shares. Mr. Kamal

contended that the company is a separate

entity and therefore, shareholders can’t be

compelled to pay for needs of the company

except in winding up. Comment on the

contention of Mr. Kamal.

(1) Members may still be required to contribute specified

amounts (depending upon the structure of the

company – as required to be provided in MOA) in the

assets of the company, despite it being declared as a

separate entity under Section 32.

(2) The above requirement to contribute is due to the

applicability of concept of “Limited Liability”.

(3) The timings to contribute above specified amounts also

depends upon the “structure of the company”, keeping

in view the definition of:

(i) company limited by shares; and

(ii) company limited by guarantee.

(4) In case of company limited by shares (as given in

question), timing to call can be:

(i) In the course of winding up; and

(ii) Even in the situation of going concern.

Conclusion: On the basis of the above:

Mr. Kamal’s contention is tenable about the

company as a separate entity.

But, the contention over the matter of timing of

outstanding calls is not workable only in the case

of winding up.

S.

Situation Provision Provision Applicability

No.

/Matter

in AOA

in CO,

1984

i) AGM –

6 months 4 months * 4 months

Time

Limit

ii) Deadline 45 days

30 days

* 30 days

– for

dispatch

of

divided

warrants

* Application of AOA for above purpose would result in

violation of the Companies Ordinance, 1984.

* For such type of situation, Section 6 of the Companies

Ordinance, 1984, has provided supremacy of the Ordinance

for Corporate Law matters in such a way that the

Ordinance has overriding effect over inter alia AOA.

(1) With respect to Corporate Laws, the situation of

merger may result in the number of partners exceeding

20. Furthermore, it is always valid to assume that the

partnership is formed for:

i) Carrying on the business; and

ii) Above business intends to earn profits of members

(partners).

2.

AOA of Alpha Ltd., provides inter alia as

follows:

i) AGM will be held within 6 months of

close of accounting year, whereas the

Companies Ordinance, 1984, under

section 158 provides for 4 months for

the purpose.

ii) Dividend warrants shall be dispatched

within 45 days of declaration, whereas

the Companies Ordinance, 1984, under

section 248 provides for 30 days for

the purpose.

Comment over the appropriateness of the

above situation and the necessary course

of action that is required for the purpose.

3.

A & Co. and B & Co. are two partnership

firms, carrying on spare parts business

separately. Both the firms are considering a

proposal of merger of two firms whereby

each of the partners of existing firms will be

partner of new merged firm. Comment

over the suitability of the proposal.

20

4.

Company is a voluntary association of

persons for common objective, recognized

under the law as a separate person. Discuss

the exceptions of the said “voluntary

association of persons”.

5.

Every company must have registered office

under Section 142 of the Companies

Ordinance, 1984. Which purpose will be

served due to this requirement?

(2) Due to above, the status of partnership will not be

workable; rather, the business will require registration

under the Companies Ordinance, 1984, to become

corporatized entity.

(3) Generally, having the status under other laws results in

the escape (i.e. abolishment) of the requirement of

registration under the Companies Ordinance, 1984, but

the said other laws shall be other than partnership law.

(1) Compulsory opt in;

(2) Foreign company;

(3) Company with listed securities;

(4) Doing certain business required to take shape under

the Companies Ordinance, 1984; and

(5) Group of persons exceeding 20 members.

(1) Section 7: To establish the jurisdiction of relevant High

Court for Corporate Law matters for any company.

(2) Section 48: All correspondence with the company or

any officer of the company shall be addressed at the

Registered Office… otherwise, it will be considered

invalid.

21

DATE: 10/06/2012

Section 27: Printing, Signature, etc. of Articles of Association:

The Articles of Association need to be:

(1)

(2)

(3)

(4)

Printed;

In paragraphs numbered consecutively;

Signed by each subscriber with particulars; and

Dated.

PROMOTERS GUIDE

PERMISSION BE OBTAINED PRIOR TO INCORPORATION

1

Banking Company

2

Non-Banking Finance Institution (NBFC)

3

4

5

6

Security service providing Company

Corporate brokerage house

Money Exchange Company

Association not for profit u/s 42

7

Trade organization u/s 42

(i) Ministry of Finance; and

(ii) State Bank of Finance (SBP)

Securities & Exchange Commission of

Pakistan (SECP)

Interior division – i.e. Ministry of Interior

Stock Exchange (transfer of Card)

State Bank of Pakistan (SBP)

License from SECP: e.g.

(1) Chambers of Commerce;

(2) Institute of Corporate Governance;

and

(3) Hotel Association.

License from Ministry of Commerce

Not for Profit Organization

This is an organization that deals with certain specified industry matters. This is also known as a

“Trade Organization”.

(i) In the case of Insurance Association of Pakistan - Only insurance companies can become a

member.

(ii) In the case of Chambers of Commerce of Pakistan – It is not a trade organization as textiles,

insurance, Pharma, etc., so everyone can become a member.

22

PROMOTERS GUIDE - DOCUMENTS FOR REGISTRATION OF A LIMITED COMPANY

1. First step is to seek, from Registrar, the availability of name (Rule 5 of the Companies General Provisions

& Forms Rules, 1985).

Rule 5: Application of seeking availability of particular name with the Registrar + Prescribed fee:

Rule 5 specifies that the Registrar will confirm the availability of the particular name, chosen by the

company, within 2 days.

Note: The requirement to pay stamp duty through adhesive stamp is no longer applicable through

provincial law.

2. Copy of:

(i) National Identity Card (NIC); OR

(ii) Passport, in case of foreigner.

For each of the above, you have to do the following:

(1) Subscribe; and

(2) There have to be witness(es) to the Memorandum of Association (MOA) and the Articles of

Association (AOA).

3. Four printed copies of the MOA / AOA and one with adhesive stamps under stamp Act, 1899. Each

subscriber has to sign in the presence of one witness, i.e. Each copy of the MOA / AOA has to be signed

along with certain statements.

4. Form I – Prescribed Form for Seeking Certificate of Incorporation.

5. Registration / Filing Fee.

Certificate of

availability of name

Registrar, head of CRO

Certificate of

incorporation

[Company Registration Office]

Various other filings

under the Ordinance

Hierarchy of Company Registration Office (CRO)

SECP

Registered Headquarters Islamabad

CRO

CRO

As decided

by Federal

Government

CRO

6. Authorization of sponsor in favour of a person to make good the deficiencies, if any in MOA & AOA, as

may be pointed out by the Registrar concerned and to collect certificate of incorporation.

23

COMPANY REGISTRATION OFFICES (CROs)

[Section 466 & 467]

Constitution:

Federal Government may constitute CROs, at such places, as it thinks fit for (this is the discretionary

power of Federal Government for number of CROs):

o Registration of company; and

o Other work under this Ordinance

Application for seeking certificate of incorporation on F-1 can be filed with any CRO. Although

the company may be the one which has proposed to have registered office in the province of

Punjab as duly provided in “Place Clause” of AOA, but the application can be filed with the CRO,

Karachi.

Once the application for certificate of incorporation has been issued by a CRO, then the said CRO

will be called as concerned CRO for exercising the jurisdiction over the company for which it has

issued the certificate of incorporation.

It is not binding on the company to file 5 documents in the city of registered office. Documents can

be filed with any CRO, i.e. documents for registration of a limited company.

Hierarchy of CRO:

In each CRO, Federal Government may appoint, as it thinks necessary:

Registrar;

Additional Registrar;

Joint Registrar;

Deputy Registrar; and

Assistant Registrar.

And in the above, Registrar shall be the head of the organization which will ultimately report to the

Registrar Headquarters, Islamabad.

Use of Seal:

The CRO will use the seal for the following purposes:

Authentication of documents; and

For use on certificate of incorporation.

To assess the genuineness of the documents from the Register – Seal on document.

24

Documents with Registrar made Public:

Registrar maintains the following record in relation to every company:

Certificate of incorporation.

Certificate of commencement of business.

Various documents and forms filed with the Registrar by the companies.

Register of companies.

Register of mortgages and charges.

Any person may inspect the above documents and may require a certified copy on payment of the

fees specified in the Sixth Schedule. The certified true copy of the documents shall be considered as

equivalent to the original document, during the course of all legal proceedings.

Documents with Registrar made Public

Every document filed by any company with the Registrar has been declared as a public document

under section 466 (6), because it is binding on the Registrar to provide a certified copy of every

document upon request of any person on payment of the prescribed fee.

Doctrine of Constructive Notice under Corporate Laws

Everyone dealing with the company will be assumed to have prior knowledge about the powers and

affairs of the company (Memorandum of Association, Articles of Association and Accounts, etc. of

the company, because every document which is concerned with:

(i) powers; and

(ii) affairs of the company,

has been declared as a public document under the law, as per S-466 (6) of the Companies

Ordinance, 1984.

25

Sections 16-18: Section 16: Contents of a Memorandum of a Company Limited by Shares

+ Section 17: Contents of a Memorandum of a Company Limited by Guarantee

Section 19

+ Section 18: Contents of a Memorandum of an Unlimited Company:

Memorandum shall provide

(nothing less, nothing more

than provided under the law):

Company Limited by Shares (S16)

Company Limited by

Guarantee (S-17)

Unlimited Company

(S-18)

Public Limited Company =

Limited/Ltd.; and Private

Limited Company = (Pvt.) Ltd. –

as the last words of its name

√

(Guarantee) Limited

√

Only name

√

√

√

√

√

√

√

√ (See note later on)

√ (Only where the

company has share

capital)

√

×

√

(i) Name

(ii) Province of Registered

Office (Practically, name

of city and exact address is

also mentioned)

(iii) Objects (Activities of the

Company – in Pakistan

and abroad

(iv) Liability

(v) Share Capital

√

(vi) Association & Subscriber

Clause

√

×

√

only for those companies having share capital

Notes on the Above:

Sections 16-18: Section 16: Contents of a Memorandum of a Company Limited by Shares

+ Section 17: Contents of a Memorandum of a Company Limited by Guarantee

+ Section 18: Contents of a Memorandum of an Unlimited Company:

(1) Name: Every company shall have, as the last word of its name, as the following:

Section 16: Company Limited by Shares: “Limited” in the case of a Public Limited Company

(PLC); with parenthesis and the words “(Pvt) Ltd” in the case of a Private Limited Company.

Section 17: Company Limited by Guarantee: “(Guarantee) Limited.

Section 18: Unlimited Company: Only the name of the company.

Example: In the case of a company, ABC:

(1) Limited by Shares:

(i) ABC (SMC – Pvt) Ltd [as per SMC Rules, 2003];

(ii)Private (Pvt) – ABC (Pvt) Ltd; and

(iii) Public (PLC) – ABC Ltd

26

(2) Limited by Guarantee:

ABC (Guarantee) Ltd

(3) Unlimited Company:

ABC Company Ltd (i.e. no “Ltd”, or “Limited” as the last words of its name)

(2) Province of Registered Office: The province or the part of Pakistan not forming part of a

province, as the case may be, in which the registered office of the company is to be situated.

(3) Objects: Objects of the company and except in the case of a trading corporation, the territories

to which they extend.

1) Act, transaction, or business from

Section 496 - Importance of Object Clause:

the company’s point of view – Not

Act, Transaction, Business – outside the object clause

binding on the company

= ULTRA VIRES to the Company

OR

2) But, the third party is still

protected as the law has provided the

ULTRA VIRES the Memorandum of Association

concerned director, or officer, who

Note: Transaction of the company – it is binding for payment on the

concerned

director, oretc.,

officer

executed

the transaction,

to be=

“Lifting of Veil of Incorporation”.

personally responsible + Rs. 5,000

penalty.

(4) Share Capital: The amount of Share Capital with which the company proposes to be

registered and the amount divisible thereof into shares of fixed amounts (Note: this is not

applicable for a guarantee limited company without share capital and an unlimited

company).

Share Capital in Memorandum of Association (MOA) = Authorized Capital (the capital which

is yet to be ‘issued’)

Number of shares * Fixed Amount per share

Authorized Capital = 10,000 * 10 = 100,000

Par Value

Face Value

Nominal Value

(5) Liability:

(i) Company Limited by Shares: Liability of members is limited; and

27

(ii) Company Limited by Guarantee: Each member undertakes to contribute their asset(s) at

the time of winding up while he is a member, or within 1 year afterwards, for the payments

of debts and liabilities of the company contracted before he ceases to be a member and of

the costs, charges and expenses of winding up.

Note: In the case of a (Guarantee) Limited company, according to Section 298 (1) (iii) of the

Companies Ordinance, 1984:

The Criteria to Establish the Liability of Past Members:

a. Winding up must have been commenced 1 year on ceasing the membership.

b. Guaranteed amount is being enforced for payment of liabilities, or payment of cost of

winding up.

c. If guarantee is being enforced for the payment of liabilities, the liabilities must be those

which have been contracted at the time prior to cessation of membership.

d. Present members are not able to contribute.

e. This will be the case if the Court so orders.

(6) Association & Subscription Clause:

No subscriber shall take less than one share and shall write, opposite to his name, the

number of shares he takes.

DATE: 12/06/2012

Example:

Non Pak – Ltd.

Shares: In case of shares, irrespective of availability of voting rights

designated as a member.

He will always be

Non-Voting Preference Shares:

Take, for example, Mr. A. He acquires 5,000 shares in the capacity of allottee.

designated as a member.

So, he is

Acquisition of shares, whether voting or non-voting, through the process of:

(i) Subscribing the Memorandum of Association (MOA);

(ii) Allotment; and

(iii) ‘Transfer in’ for existing members.

It would also result in designating the acquirer as MEMBER Section 147 – Provided the fact must

have been provided in the “Register of Members”.

28

Debentures:

In relation to acquisition of security other than shares, e.g. debentures, the acquirer would be

designated as member only when the security is with the voting rights.

Besides being shares, voting rights (for members meeting) can be assigned, through providing in

the Articles of Association (AOA), in relation to convertible debentures, in the manner provided in

Section 114.

Case Study in relation to Ultra Vires to the Company

1) M/s. A, B and C has signed the MOA & AOA of ABC Ltd. (unlisted public limited company), in the

capacity of subscriber. They also become the directors of the company and took the entire

share capital of the company and the debentures. The share capital of the company comprises

of:

100,000 ordinary shares of Rs. 100 each.

100,000, 9% non-voting preference shares of Rs. 10 each.

Furthermore, the debentures are issued in the form of 1,000 TFCs of Rs. 5,000 each.

Required: Which of the following instrument can results in designating the holder as member?

(i) Ordinary shares

(ii) Non-voting preference shares

(iii) Debentures

Solution:

(i) Ordinary shares: Yes, ordinary shares can result in designating the holder as member.

In case of shares, irrespective of availability of voting rights

as a member.

He will always be designated

(ii) Non-voting preference shares: Yes, non-voting preference shares can result in designating the

holder as member. Acquisition of shares, whether voting or non-voting, through the process of:

(a) Subscribing the Memorandum of Association (MOA);

(b) Allotment; and

(c) ‘Transfer in’ for existing members, designates the holder as member.

It would also result in designating the acquirer as MEMBER Section 147 – Provided the fact must

have been provided in the “Register of Members”.

29

(iii) Debentures: No, debentures will not result in designating the holder as member, because in

relation to acquisition of security other than shares (i.e. debentures in this case), the acquirer

would be designated as member only when the security is with the voting rights.

In relation to acquisition of security other than shares, e.g. debentures, the acquirer would be

designated as member only when the security is with the voting rights.

Besides being shares, voting rights (for members meeting) can be assigned, through providing in

the Articles of Association (AOA), in relation to convertible debentures, in the manner provided in

Section 114.

2) The above company is formed with the object of construction and sale of housing schemes and

the ancillary activities in relation to the business of housing schemes.

Required:

(i) Which document is relevant in order to identify the objects of the company?

(ii) If the law has set out the purpose of the company as “Lawful Purpose” u/s 15 of the Ordinance,

then which purpose will be served through providing in object clause of MOA.

Solution:

(i) The Memorandum of Association (MOA) is the document that is relevant in order to identify the

objects of the company.

(ii) Object clause is designed with the purpose to provide the ACTIVITIES, which a company is

allowed to undertake during its life.

3) Due to attractive incentives announced by government for launch of schemes of commercial

projects, Mr. A announced the scheme of commercial projects, in the capacity of executive

director, where the rest of non-executive director was not aware over the situation. As a result

of the said announcement, Mr. A took the deposits of Rs. 1 million each for the launch of 100

projects. Subsequent to the launch of the scheme and taking up the deposits, the government

reverted back to the decision. Furthermore, rest of the directors did not agree with the

proposal for proceeding over the projects of commercial schemes and therefore, the situation

of refund to depositors arises who had also claimed the damages.

Required:

(i) The company refused to pay the principal and the damages thereon to the depositors. What is

that concept on the basis of which the said refusal will be forwarded to the depositors?

30

Solution:

The concept on the basis of which the said refusal is forwarded to the depositors:

1) From the data given, it appears that the launch of commercial project is outside the object

clause of MOA. An Act, Transaction, or Business, outside the object clause is in fact ULTRA VIRES

to the company within the meaning of S-496.

2) Above section [i.e. S-496] renders the act, transaction, or business, so done, as ‘VOID’.

Therefore, the company is legally entitled to refuse the repayment.

(ii) Course of action for depositors to recover the amount.

Solution:

Course of action for depositors to recover the amount:

In the situation of Ultra Vires to the company, the law has made the concerned director / officer (in

this case, Mr. A) responsible to refund the security deposit along with damages.

(iii) Remedy available to the depositors where MOA was not provided to the depositors by the

director in order to screen out the permissibility for the company to launch the commercial

projects scheme.

Solution:

S-466 has made all documents filed with the Registrar, including MOA and AOA as public

documents. Thereby, any person can have certified copies of the same upon payment of the

prescribed fee.

Because of the above declaration of public documents, it is assumed that every person dealing with

the company has knowledge about the company, including the knowledge in relation to the MOA

due to the applicability of the concept of “DOCTRINE OF CONSTRUCTIVE NOTICE”.

(iv) The concept on the basis of which depositors can still not be able to be held responsible, the

company where they have not gone through with object clause of MOA.

31

Solution:

Refer to answer to part (iii) of this question.

DEFINITION OF MEMBER (OF A COMPANY)

S. 2 (1) (21)

Means

Company having

Share Capital

Company not having

Share Capital

(a) Subscriber to the MOA.

(b) Every person to whom any of the following securities is allotted:

(i) Share;

(ii) Scrip or other security which gives him a voting right in the company.

(c) Every person who becomes the holder of:

(i) Share;

(ii) Scrip or other security which gives him a voting right in the company.

Any person who has

agreed to become a

member of the

company and whose

name is so entered in

the register of

members.

And whose name is entered in the register of members.

Instrument to become member:

(i) Share; or

(ii) Other securities with voting rights.

Ways to become member (company having share capital):

(i) Subscribing of MOA;

(ii) Allottee of:

(a) Share; or

(b) Other security with voting rights.

(iii) “Transfer in” of:

(a) Share; or

(b) Other security with voting rights. Subject to fulfillment of formalities for having entry in register of members.

Ways to become member (company not having share capital):

Agreement with the company to become member and therefore, the manner of which will be governed with reference to

AOA. In case of transfer of membership, formalities for entry in the register of members will be required to be fulfilled.

32

CASE STUDY IN RELATION TO COMPANY LIMITED BY GUARANTEE

1) M/s. A, B and C are intending to form a company, limited by guarantee, for a particular form of

business, in order to earn profit for maximization of shareholders wealth. It is further proposed

that the company will take the type of private limited company and will have a share capital.

Your advice is sought in relation to the following matters:

(i) Is there any possibility to skip the formality to prepare AOA and for what purpose could

reliance be placed on any model as provided under the Ordinance?

(ii) Situation in which the territories of operation for attainments of objects under the object

clause of MOA are required to be defined.

(iii) The procedure to define the type of the company and how the type so defined shall be

indicative during the life of the company.

Solution:

(i) Since it is limited by guarantee, the company has to prepare, inter alia, Articles of

Association, in order to form a company. The facility to proceed over formation of a

company is to do with the concept of “deemed power under Articles of Association” (AOA)

as Table A is available for a company limited by shares only.

(ii) Every company has to define the territories of operation for attainments of objects under

the object clause of MOA, except for a trading corporation.

(iii) The “type of company” in this case means that the company can either be a:

(a) Private Limited Company; or

(b) Public Limited Company.

If the company has the following 3 restrictions in its Articles of Association, then it is termed as a

“private company”:

i) Transferability of shares, if any

RESTRICTIVE;

ii) Number of members = 50

LIMIT; and

iii) Invitation of subscription from public to subscribe for shares

PROHIBITION.

In the absence of the above restrictions in the Articles of Association, the company is a PUBLIC

COMPANY.

2) Based on your advice, they proceeded and for the purpose of preparation of MOA, each

subscriber is contemplating to take 100,000 shares of Rs. 10 each, fully paid and further

undertook the guarantee amount of Rs. 1 million. One of their common friends indicated that

the guarantee amount can even be enforced where a particular member has ceased the

33

membership. The said indication created concern for them and therefore your further advice

sought for following matters:

(i) Conditions, the satisfaction of which is required to be established in order to enforce the

guarantee amount, even after ceasing the membership.

(ii) The document on the basis of which the liability of past member(s) will be claimed.

Solution:

(i) Conditions which are required to be satisfied in order to enforce the guarantee amount

even after ceasing the membership:

1) Winding up has to commence within 1 year of cessation of membership.

2) During the above winding up, there is the point of ‘required amount’ for payment of:

(a) Liabilities;

(b) Expenses; and

(c) Costs and Charges of Winding Up.

3) Present members will be unable (not allowed) to contribute.

4) If the Court so orders.

(ii) The document on the basis of which the liability of past member(s) will be claimed:

The liability of past member(s) will be claimed based on the “Liability Clause” of the

Memorandum of Association.

3) After a few years of incorporation, the company had gone (or went) into liquidation. The

winding up commenced on 1st January 2011 and on this date, liabilities were calculated, as

follows:

(a) Total liability: Rs. 10 million

(b) Liabilities contracted and accrued during the last 12 months: Rs. 8 million

(c) Liabilities contracted and accrued for the period prior to last 12 months: Rs. 2 million

During the going concern, the shares of M/s. A and C transferred to M/s. X and Y in accordance

with the procedure, as provided in AOA of the company and thus M/s. X and Y became the

member of the company and the said members along with Mr. B are continuing since then till

the date of commencement of winding up, i.e. 1st January 2011. The membership of Mr. A was

transferred to Mr. X during the last 12 months, whereas the membership of Mr. C was

transferred to Mr. Z during the period prior to the said last 12 months.

Required:

(i) Which of the past members can be held responsible for the debts of the company?

(ii) The amount of debt for which the above past member can be held responsible.

(iii) Procedure to be followed in order to be held responsible by the past member.

34

Solution:

(i) The past member who can be held responsible for the debts of the company:

Mr. C

He can’t be held responsible as past member on time lag between:

Ceasing membership and Commencement of winding up

> 12 months

Therefore, Mr. A, only, can be held responsible as PAST MEMBER.

(ii) The amount of debt for which the above past member can be held responsible:

AMOUNT = Rs. 2 million (i.e. Liabilities contracted and accrued for the period prior to the last 12

months) + so much of the amount out of the Rs. 8 million (i.e. Liabilities contracted and accrued

during the last 12 months) which was contracted before the ceasing of membership.

(iii) Procedure to be followed in order to be held responsible by the past member:

First, the amount should be claimed in the presence of a member, etc…

Section 19: Printing, Signature, etc., of Memorandum of Association (MOA):

(1)

(2)

(3)

(4)

Printed;

Divided into paragraphs numbered consecutively;

Signed by each subscriber with particulars; and

Dated.

Deemed Power under MOA & AOA {S-19(2)}

Notwithstanding anything contained in:

Ordinance;

Any other law; and

Memorandum of Association (MOA) and Articles of Association (AOA).

The MOA and AOA shall be deemed to include the power to enter into any arrangement for

obtaining:

Loans;

Advances; and

Credits

The lender is a bank, or a financial institution, as defined in the

Banking Companies Ordinance (BCO), 1962.

35

AND to issue other securities not based on interest [S-2 (1) (30A)] for raising resources from a

Scheduled Bank, or a Financial Institution.

Security not based on interest

Redeemable Capital

Clause 46, Table A: The outstanding amount of borrowing shall not at any time, without the

sanction of the company in general meeting, exceed the issued share capital of the company.

36

DATE: 19/06/2012

S-2 (1) (7)

Preparation of

Memorandum and

Articles

Minimum Number

of Subsidiaries

Company

Formed

+

Registered

S-30

Lawful Purpose

Under Companies Ordinance, 1984

+ Existing Company X

+

Filing of MOA

and AOA

Activities Required:

Normally, sign –

when promotion

outsourced

formation activity

Practicing Advocate

Declaration of

Compliance

with the

Requirement

of Formation

of a Company

[Form – I]

Duly signed by

Persons of Rule-4 of

the Companies

Rules, 1985

Practicing Chartered

Accountant or Cost and

Management

Accountant

37

Proposed

Director or

Officer named

in AOA

PROVISIONS WITH RESPECT TO REGISTRATION OF Memorandum of Association (MOA) / Articles

of Association (AOA)

Section 30: - Registration of Memorandum and Articles, etc.:

(1) MOA & AOA, if any, shall be filed with the Registrar.

(2) Declaration by such persons may be prescribed (Rule – 4) in this behalf, or by a person named in

the Articles as a director, or other officer of the company --- of compliance with all or any of

requirements of this Ordinance (Form – I) and the Registrar may accept such declaration as

sufficient evidence of such compliance.

(3) Registrar shall retain and register, if satisfied:

(i) The company should be formed and should work for a lawful purpose;

(ii) None of the objects stated in the MOA are / should be:

Inappropriate; or

Deceptive or insufficiently expressive.

(iii) All requirements of Ordinance and Rules are complied with.

Rule 4:

Following are the prescribed persons for filing of Form – I ---- Person engaged in the formation of

the company, who is:

(i) Advocate, who is entitled to appear before High Court or Supreme Court,

(ii) Member of ICAP / ICMAP, practicing in Pakistan, OR

(iii) Named in AOA as director / other officer.

The Registrar may require any of the following person to furnish information / clarification /

document.

Who makes declaration u/s 30 (2);

Promoter;

Director of proposed company; or

Witness to signature of subscribers to MOA.

REFUSAL {Section 30(4)}: If application for incorporation, refused by any of the Registrars or

subordinates (Deputy Registrar, Joint Registrar, Additional Registrar, or Assistant Registrar) supply

deficiency and remove defect OR appeal to the Registrar / SECP. Appeal may be filed within 30 days

of the order of refusal. Order of SECP shall be final and shall not be called in question before any

Court or other authority.

38

STRATEGY TO HANDLE WHERE FORM-I IS REFUSED

Supply

deficiency

Form I –

Refusal will

always be

accompanied

with reason.

Either Appeal

Order =

FINAL

Appeal

OR

(Provide missing

information in document)

Registration [Head of

Central Registration

Office – CRO]

AND / OR

Remove defect (Rectify

the information in

document already

submitted).

Where Refusal Order is from

Securities &

Exchange

Commission of

Pakistan (SECP)

Where Refusal Order is

from Registrar

Hierarchy within

any CRO

Assistant

Registrar

Deputy

Registrar

Joint

Registrar

Additional

Registrar

= Challenge the possibility of appeal order of Registrar or SECP.

Every member

Subsequent to subscription

of Memorandum of

Association (MOA) and

Articles of Association (AOA)

Subscriber to Memorandum

of Association (MOA) and

Articles of Association (AOA)

Provision of S-31

Subject to same -

S-19: Statement of Binding

o Privileges &

o Bindings

of MOA and AOA

39

Section 31: - Effect of Memorandum & Articles:

The Memorandum and Articles binds the company and its members to the same extent as if they

respectively had been signed by each member and contained a covenant on the part of each

member, his heirs and legal representative, to observe and be bound by all provisions of MOA &

AOA subject to Ordinance. {sub-section (1)}.

All money payable by any member under MOA or AOA shall be a debt due from him to the

company. {sub-section (2)}.

ABC (Guarantee) Limited

Mr. Ajmal took guarantee in MOA = Rs. 1,000,000.

Due to death = Membership transferred to Mr. Akram (the son of the deceased member).

Company has gone into liquidation. Mr. Akram refused to honour the demand of liquidation of

guaranteed amount – with the reason that he didn’t personally undertake the amount.

Bindings and covenants of MOA are applicable, inter alia, to the legal heirs of deceased members as

the legal heirs had personally undertaken the bindings.

×

Date of Receipt of Certificate of Incorporation (Irrelevant date for calculation of S-32)

= 23/04/2012

√

Date of Incorporation as mentioned in Certificate of Incorporation

= 13/04/2012

Effects?

1)

2)

3)

4)

Separate person;

Availability of corporate powers;

Permissibility to use common seal; and

Perpetual succession.

(No interruption over constitution till winding up).

40

COMMON SEAL

= Official Seal

Same as common seal

+ Territory name

where official seal is

allowed to be used

English or Urdu –

[Section 213]

Name of the Company +

Engraved Form

Section 32: Effect of Registration:

On the registration of MOA, the Registrar shall certify that the company is incorporated and in case

of a limited company, that the company is limited by shares or guarantee, as the case may be.

From the date of incorporation as mentioned in the Certificate of Incorporation, the subscribers

together with such other persons as may from time to time become members of the company shall

be:

A body corporate by the name contains in MOA;

Capable forthwith of exercising all the functions of an incorporated company; and

Having perpetual succession and a common seal.

But with such liability of members to contribute to the assets of the company in the event of its

being wound up as is mentioned in the Ordinance.

COMMON SEAL

One of the privileges of incorporation that is assigned under the Ordinance is to have a common seal from

the date of incorporation as mentioned in the certificate of incorporation.

The above seal is required to be prepared in accordance with the manner as provided in the Ordinance

whereby the name of the company, in legible English or Urdu characters must be engraved on its seal. [This

is the manner in which to prepare the common seal – i.e. in engraved form].

A company means an artificial and legal person and, therefore, will have no body similar to natural person

and as such, it cannot sign documents for itself. It acts through natural persons, called directors and officers.

Under the Ordinance, following are empowered to authenticate the documents and proceedings on behalf

of the company [as per Section 51 of the Companies Ordinance, 1984]:

41

Chief Executive;

A Director;

Company Secretary; or

Other authorized officer, e.g. CIA [Certified Internal Auditor] and CFO [Chief Financial Officer] – They

must be authorized persons.

It is further provided that authentication by any of the above will render the completion of the matter at all

in this regard and common seal is not required unless the use of common seal is specifically provided for any

particular matter, under any provision of the Ordinance.

Following are the specific matters for which the use of common seal is mandatory:

On share certificates as prima facie evidence of the title of the member [Section 89].

On the form of proxy where the appointer is a body corporate [Section 162].

On the power of attorney, in favour of any person, to act as attorney of the company to execute the

deeds on behalf of the company. [Section 2 (2)].

On the letter of authority in favour of any person to use official seal, in lieu of common seal outside

Pakistan (official seal shall be facsimile of the common seal). [Section 2 (3)].

Consequence of use of common seal which is not prepared in accordance with the law:

If any officer of a limited company, or any person on its behalf, uses or authorizes the use of the seal

wherein his name is not engraved in English or Urdu, then the following are the consequences:

Fine which may extend to Rs. 2,000.

Personal liability for the liability arising under the document on which the seal is used. However, the

said personal liability will be absolved if the company has agreed to accept the liability. Normally, the

Articles of Association provides members resolution to accept the liability for the company which

otherwise has become void due to the reason that seal has been used, on any document, which is

not prepared in accordance with the above manner–Lifting of Veil of Incorporation [Section 144 (2)]

42

DATE: 24/06/2012

CORPORATE LAWS

Memorandum of Association (MOA) and Articles of Association (AOA)

MOA & AOA = Directional documents of the company

Essential for incorporation

During operation, the need may arise to

alter MOA & AOA in order to maintain

compatibility of operations with the

provision of the said documents.

MOA alteration

- various provisions being governed

through S-20

AOA alteration – S-28

MOA alteration:

Only those clauses can be altered, the possibility of which is provided under any provision of the

Ordinance.

(i) Place: Rule – 3 and Rule – 21;

(ii) Objective: Rule – 3 and Rule – 21;

(iii) Name: Rule – 5 and Rule – 39;

(iv) Liability: Rule – 34 and Rule – 111 and Rule – 112; and

(v) Share Capital: Rule – 92.

Note: Association & Subsidiary Clause cannot be altered.

For above alteration, procedure followed shall be that which is prescribed.

procedure.

Prescribed

Above procedure shall be applied within the boundaries defined for alteration

alteration.

Extent of

43

Question:

Which business of AGM, being ordinary business in AGM, is permitted to discuss cases in EOGM?

Answer:

The only (‘ordinary’) business of AGM, that is permitted to discuss cases in EOGM, is “Election of

directors”.

e.g. “Resolved that an account be opened with NIB Bank, I.I. Chundrigar Road Branch.”

Question:

Who is entitled to receive notice of BOD meeting?

Answer:

This is generally provided in AOA. Generally, all directors are declared as entitled. But, for old

companies, it may appear that directors not in Pakistan will not be entitled.

Resolution by Circulation

Signed By

A

Situation 1

Not in Pakistan – not

entitled to receive

Situation 2

Agreed

B

C

D

E

Not agreed

Agreed

Agreed

Agreed

Agreed

Agreed

Agreed

Agreed

As 100% approval is

required, it is not

satisfied.

100% - satisfied

Situation 3

Not in Pakistan, but

entitled to receive –

Not agreed

Not agreed

Not agreed

Agreed

Agreed

100% - not

satisfied

Matters for Which Resolution by Circulation Can’t be Proceeded

Matters for which BOD meeting is essential – S-196, e.g. approval of accounts, bonus to employees

and legal suit.

44

Board Resolution

Rule of Majority of Resolution

Rule of 100% Approved – For Resolution

BOD Resolution (more than 50%)

Resolution by Circulation (entitled to receive notice)

Members Resolution

Rule of Majority of Resolution

Rule of Specific Majority

Ordinary Resolution

Special Resolution

Bifurcation between Ordinary Resolution

or Special Resolution

It is already determined under

the Ordinance – based on the

nature of business.

Like

Alteration of MOA

Approval of Accounts

about Place Clause

= Special Resolution

Ordinary Resolution – Section 234(say) 90% approved

Ordinary resolution as a % of approval is irrelevant to conclude the requirements of Ordinary /

Special Resolution.

45

In ordinary business, there would always be ordinary resolution.

In special business, it may be through:

(i) Ordinary Resolution (like: Issue of shares at discount); and

(ii) Special Resolution.

Note:

(1) Special Resolution will only be for special business;

(2) But, special business would not always be through Special Resolution.

Notes from Handout

AGENDA AND RESOLUTIONS

Agenda: Statement of business to be transacted at a meeting is called agenda of the meeting. This

is mentioned in the ‘notice of the meeting’.

Agenda, in fact, defines the purpose of convening the meeting and, therefore, presented in the notice of the

meeting.

Agenda item: Each business within the agenda is called an “agenda item”. For members meeting,

agenda items can be bifurcated between “Ordinary” and “Special” business. The decision of

designating ordinary or special business will be as follows:

S. No.

Type of Meeting

1.

Statutory Meeting

2.

Annual General Meeting (AGM)

3.

Extra Ordinary General Meeting (EOGM)

4.

Class Meeting

46

Ordinary or Special Business

Bifurcation not applicable

Ordinary Business

(i) Consideration of accounts and reports of

directors and auditors.

(ii) Declaration of dividend.

(iii) Appointment of auditors and fixing of the

remuneration.

(iv) Election of directors.

(i) – (iii) cannot be discussed except in AGM.

Special Business (other than “ordinary

business”)

Other than above.

All businesses are special business. [(iv) can be

discussed].

Class Resolution & special business [S-28]

The reason to distinguish ordinary or special business is due to the requirement of “Statement of

Material Facts” which is required to be accompanied with “Notice of Meeting”, in order to set out

all the material facts concerning such business, including, in particular, the nature and extent of the

interest, if any, therein of every director, whether directly or indirectly and where approval of any

documents is proposed in the meeting, time and place of inspection of the document, be also

specified in the statement. [Section 160 (1) (b) – “Statement of material facts” with special matters.

Statement of Material Facts with Prescribed Contents [Important]:

For the following matter, the content of the Statement of Material Facts is prescribed (for others on

discretion):

(i) Issue of Shares at Discount [S-84];

(ii) To introduce Employees Stock Option Scheme (ESOS);

(iii) Buy-Back of Shares by listed companies – Section 95A & Buy-Back Rules, 1999;

(iv) Disposal of Sizeable part or undertaking by listed company – SRO 1227 / 05; and

(v) Investment in Associated Undertaking – Investment in Associated Undertaking Regulations,

2012.

Resolution {Sections 165 to 167}:

An agenda item that has been debated and voted is called a “resolution”.

The validity of any resolution will be determined, whether the resolution has:

Duly been incorporated in the minutes; and

The minutes have duly been signed by the Chairman

of the same meeting, or the Chairman of the subsequent

meeting – “signed minutes in minutes book”.

47

It is not required to define, how

many votes are in favour of, or

against, the resolution.

TYPES OF RESOLUTIONS

Board of Directors

Resolution by

Circulation

BOD Resolution

Resolution

passed in BOD

meeting. Note:

Before

members’

resolution,

there is always

BOD

resolution.

Resolution in

writing.

Signed by all

the directors

for the time

being entitled

to receive

notice of a

meeting of

the Directors.

This

resolution

shall be valid

and effectual,

as if it had

been passed

at a meeting

of the

Directors duly

convened and

held, but can

be proceeded

only for those

matters which

are not

specially

provided,

under the

Ordinance, to

be passed in

BOD

meetings.

Members

Ordinary

Resolution

Passed by a

majority of

members,

entitled to

attend and

vote, as are

present in

person, or

proxy.

48

Special

Resolution

Passed by

3/4th majority

of members,

entitled to

attend and

vote, as are

present in

person, or

proxy.

Creditors

Class

Resolution

Passed by

3/4th of the

(total)

members,

present in