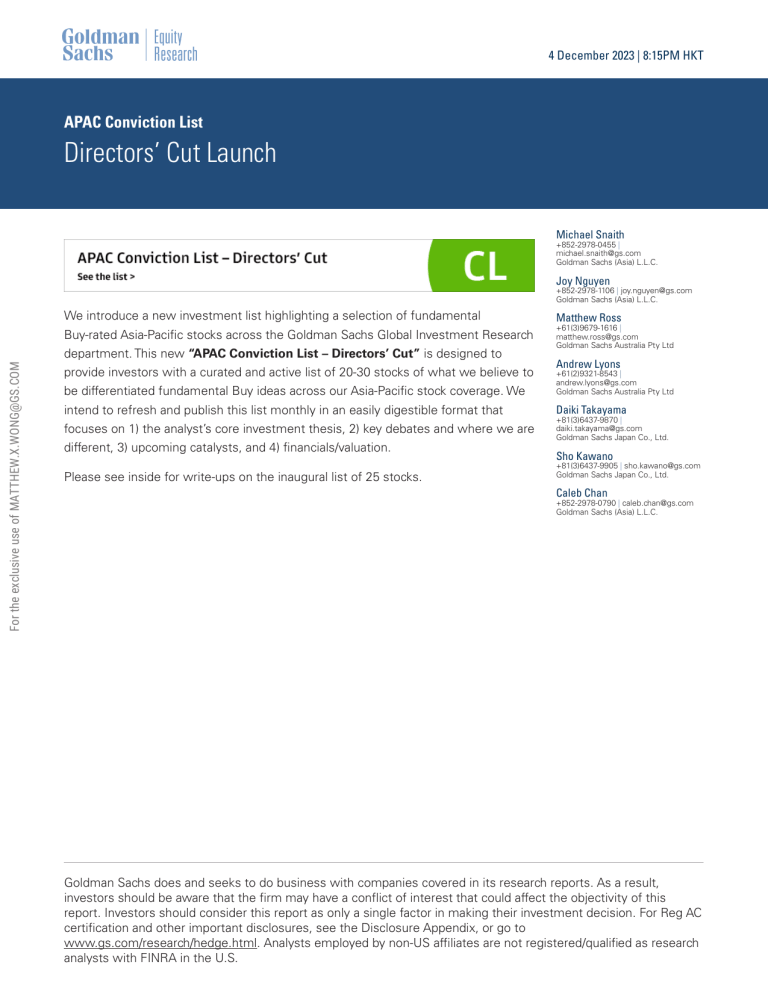

4 December 2023 | 8:15PM HKT APAC Conviction List Directors’ Cut Launch Michael Snaith +852-2978-0455 | michael.snaith@gs.com Goldman Sachs (Asia) L.L.C. Joy Nguyen We introduce a new investment list highlighting a selection of fundamental Buy-rated Asia-Pacific stocks across the Goldman Sachs Global Investment Research department. This new “APAC Conviction List – Directors’ Cut” is designed to provide investors with a curated and active list of 20-30 stocks of what we believe to be differentiated fundamental Buy ideas across our Asia-Pacific stock coverage. We intend to refresh and publish this list monthly in an easily digestible format that focuses on 1) the analyst’s core investment thesis, 2) key debates and where we are different, 3) upcoming catalysts, and 4) financials/valuation. Please see inside for write-ups on the inaugural list of 25 stocks. Matthew Ross +61(3)9679-1616 | matthew.ross@gs.com Goldman Sachs Australia Pty Ltd Andrew Lyons +61(2)9321-8543 | andrew.lyons@gs.com Goldman Sachs Australia Pty Ltd Daiki Takayama +81(3)6437-9870 | daiki.takayama@gs.com Goldman Sachs Japan Co., Ltd. Sho Kawano +81(3)6437-9905 | sho.kawano@gs.com Goldman Sachs Japan Co., Ltd. Caleb Chan +852-2978-0790 | caleb.chan@gs.com Goldman Sachs (Asia) L.L.C. 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM +852-2978-1106 | joy.nguyen@gs.com Goldman Sachs (Asia) L.L.C. Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S. Goldman Sachs APAC Conviction List How is this list constructed? 5 Regional Macro Challenges, Thematic Tailwinds 6 Anatomy of the List 8 Our 25 Differentiated Buy Recommendations 10 Asics - Brand strength driving channel and mix improvement 11 GCPL - Turnaround accelerating, top-tier domestic growth 14 Shenzhou International - The coming restocking cycle 17 Woolworths Group - Omni-channel leader extending share gains 20 AIA Group - Margin expectations too bearish 23 HDFC Bank - Synergies to drive substantial market share gains 26 MUFG - Rates and reform driven upside 29 Oversea-Chinese Banking Corp - Shareholder returns inflection 32 China Medical System - A new product cycle ahead 35 CSL - Compelling entry point while ROIC & earnings growth inflect 38 Shionogi - Emergence of sustainable earnings drivers 41 Sanhua Intelligent Controls - Global leader in HVAC/EV thermal components, further upside in Humanoid Robots 44 SMC - Cycle improvement to drive above-consensus earnings 47 Kuaishou Technology - Growth and monetization opportunity as a competitive SFV platform 50 PDD Holdings - Temu taking shape 53 Sony Group - Pivot towards software and content to drive higher growth 56 Suzuki Motor - Pipeline, price, and payout to drive valuation gap closure 59 Baoshan Iron & Steel - Consolidator, mix upgrade and margin upside 62 Lynas Rare Earths - Attractive positioning, expansion projects and valuation 65 Foxconn Industrial Internet - Margin expansion driven upside 68 Hitachi - Geared for next phase of growth 71 Renesas - High quality, cycle bottom, undervalued 74 SK Hynix - Sustaining lead into next generation memory 77 4 December 2023 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Table of Contents 2 Goldman Sachs APAC Conviction List 80 H World Group - Multiple ways to win 83 Appendix 1: Relevant research for themes 86 Price Target, Risks and Methodology 88 Disclosure Appendix 90 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM TSMC - Structural trends support long-term growth opportunity 4 December 2023 3 Goldman Sachs APAC Conviction List Exhibit 1: APAC Conviction List - Directors’ Cut All price targets are on a 12-month basis; all prices are in LCY as of close on Dec 1, 2023 Company Name Consumer 7936.T Asics Corp. GOCP.BO Godrej Consumer Products Ltd. 2313.HK Shenzhou International Group WOW.AX Woolworths Group Financials 1299.HK AIA Group HDBK.BO HDFC Bank 8306.T MUFG OCBC.SI Oversea-Chinese Banking Corp. Healthcare 0867.HK China Medical System Holdings CSL.AX CSL Ltd. 4507.T Shionogi & Co. Industrials 002050.SZ Sanhua Intelligent Controls 6273.T SMC Internet 1024.HK Kuaishou Technology PDD PDD Holdings 6758.T Sony Group Autos 7269.T Suzuki Motor Natural Resources & Clean Tech 600019.SS Baoshan Iron & Steel LYC.AX Lynas Rare Earths Ltd. Technology 601138.SS Foxconn Industrial Internet 6501.T Hitachi 6723.T Renesas Electronics 000660.KS SK Hynix Inc. 2330.TW TSMC Travel & Leisure H World Group HTHT Market cap ($, mn) Last Close Target price 12m Total Return Upside to Fwd Div Potential 12m PT Yield (12m) GS vs. Cons* Analyst Market / Exchange 6,488 12,586 15,205 27,840 5,238 1025.60 79.05 34.56 6,200 1,185 98 42.40 18% 16% 24% 23% 1% 2% 3% 3% 20% 17% 27% 26% -1% 4% -1% 1% Sho Kawano Arnab Mitra Michelle Cheng Lisa Deng Japan India China H Australia 98,808 141,585 103,680 42,686 66.85 1555.50 1,273 12.64 97 2,002 1,520 15.50 45% 29% 19% 23% 3% 2% 3% 7% 48% 30% 23% 30% 3% 3% -3% 3% Thomas Wang Rahul Jain Makoto Kuroda Melissa Kuang, CFA Hong Kong India Japan ASEAN 4,744 84,142 14,032 15 262.86 7,040 18.88 309 8,750 26% 18% 24% 4% 2% 2% 30% 19% 26% 2% 2% 22% Ziyi Chen Chris Cooper, CFA Akinori Ueda, Ph.D. China H Australia Japan 14,300 32,329 28.49 74,010 38 103,000 33% 39% 1% 1% 35% 41% 5% 11% Jacqueline Du Yuichiro Isayama China A Japan 31,553 200,918 105,646 57.20 145.27 12,720 88 176 16,000 54% 21% 26% 0% 1% 54% 21% 27% 4% 16% 4% Lincoln Kong, CFA Ronald Keung, CFA Minami Munakata China H China ADR Japan 22,862 6,058 7,900 30% 3% 33% 5% Kota Yuzawa Japan 19,487 3,935 6.25 6.35 8.20 7.50 31% 18% 6% 0% 37% 18% 15% 2% Trina Chen Paul Young China A Australia 42,075 68,413 32,027 71,695 477,125 15.15 10,455 2562.50 132,600 579 31.61 12,300 3,300 170,000 725 109% 18% 29% 28% 25% 6% 2% 2% 1% 3% 115% 19% 30% 30% 28% 22% 3% 10% 7% 7% Verena Jeng Ryo Harada Daiki Takayama Giuni Lee Bruce Lu China A Japan Japan South Korea Taiwan 11,506 36.10 52.70 46% 2% 48% 12% Simon Cheung, CFA China ADR FY2 EPS: GOCP.BO, WOW.AX, HDBK.BO, OCBC.SI, 4507.T, 002050.SZ, 1024.HK, 600019.SS, 601138.SS, 6501.T, 6723.T, 2330.TW, HTHT FY2 OP: 1299.HK, 6273.T, 6758.T, 7269.T, 000660.KS ; FY2 Sales: 7936.T, 2313.HK, 8306.T, CSL.AX, LYC.AX ; FY3 EPS: 0867.HK, PDD Notes: TSMC ADR price target is US$115 (Dec 1 close: US$98.55); H World Group China-H price target is HK$41.60 (Dec 1 close: HK$28) Source: Goldman Sachs Global Investment Research, Bloomberg 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Ticker 4 December 2023 4 Goldman Sachs APAC Conviction List How is this list constructed? A subcommittee designated by the Asia-Pacific Investment Review Committee will select stocks for the “APAC Conviction List – Directors’ Cut” from the Buy recommendations of Asia-Pacific stocks. The subcommittee will collaborate with each sector analyst to identify top ideas that offer a combination of conviction, a differentiated view and high risk-adjusted returns. The subcommittee will then choose what they view as the top 20-30 ideas across the department for the list. For the exclusive use of MATTHEW.X.WONG@GS.COM We intend to refresh and publish the list monthly. Any new names added to the APAC Conviction List – Directors’ Cut will include a concise description detailing the key drivers of the analyst’s Buy thesis, with a focus on where these views are different and relevant market debates, as well as links to their recent reports. All additions to the list will be captured in this monthly note. Removals (discussed below) may occur intra-month should a material event occur that requires an adjustment to the list. Reasons for removal can include (but are not limited to) analysts no longer having conviction in their idea (e.g. a downgrade), price realisation, the passage of catalysts or the subcommittee believing there are better opportunities elsewhere. In short, names will be removed if this committee determines a name is no longer a top investment idea across our coverage. Additional information. This list should not be seen as a portfolio, as we will not attempt to weight the included stocks or ensure diversification across our stock coverage. Inclusion on this list is not a stock rating and addition to, or removal from, this list does not necessarily represent a change in the analyst’s investment rating for such stock. 2e83ab6fea424dc8a1b6a8a7e94c6547 Visit the Conviction List portal page here: Regional Conviction Lists. 4 December 2023 5 Goldman Sachs APAC Conviction List Regional Macro Challenges, Thematic Tailwinds In his 2024 Asia Strategy Outlook (link), Chief Asia Strategist Timothy Moe argues for the challenging macro backdrop to extend into next year, characterized by slower growth, elevated interest rates, a strong dollar, political and geopolitical uncertainty and China’s growth headwinds. Given his expectation of modest index level returns, we would highlight a collection of themes that cut across our Asia-Pacific stock coverage, creating investment opportunities and longer-term tailwinds. See Appendix 1 for relevant research on the below themes. China in Transition For the exclusive use of MATTHEW.X.WONG@GS.COM China’s complex macro challenges put downward pressure on the aggregate growth outlook, placing it at the crossroads of supply chain restructuring trends, and driving unprecedented changes to the outlook for many sectors. The overarching aim of the government is to shift the composition of growth to more sustainable drivers, to raise productivity, and to enhance technological competitiveness. Our analysts favor sectors with global import reliance where self-sufficiency remains the goal, and those that remain resilient exporters. In the meantime, focus is on the opportunities coming from new capex, infrastructure and the supply chain beneficiaries. Our analysts believe China will have to develop its internal production capability on foundational technologies, specialized equipment, machine tools, and components, and select industrial and manufacturing sectors if it is to achieve the government’s strategic objectives and priorities. Impacted CL stocks: Sanhua Intelligent Controls, Baoshan Iron & Steel, SMC, Lynas Rare Earths, Shenzhou International 2e83ab6fea424dc8a1b6a8a7e94c6547 China Consumption With China’s economy transitioning, and the risk of a deeper/longer property price decline cycle, our analysts believe Chinese consumers will ratoinalize their spending going into 2024, implying a sustainable shift to value-focus. Compared to pre-pandemic times, our analysts forecast consumption growth to decelerate from +10% in 2016-19 and +8.8% in 2023E, supported by a reopening boost, to +7% next year in nominal terms. Within that, services consumption growth is expected to be more resilient and outpace at +9.2% in 2024E (vs. total key goods growth of +6%). In terms of key fundamental and share price drivers in 2024, our Greater China Consumer, Asia Travel & Leisure, and China Internet teams concurrently highlight two key themes – value focus and growing global presence. Impacted CL stocks: PDD Holdings, Kuaishou Technology, Shenzhou International, H World Group, Asics 4 December 2023 6 Goldman Sachs APAC Conviction List Japan Value in Action The Tokyo Stock Exchange (TSE) corporate governance reform initiatives, which look to promote substantive and sustained ROE improvement that would lead to higher P/Bs for the whole market, have been a game-changer for Japanese equities since January 2023. Our Chief Japan Strategist Bruce Kirk expects continued TSE pressure on corporates to respond to its requests will lead to further acceleration in corporate governance-related activity amongst listed Japanese companies in 2024. With the TSE having announced plans to publish a list of companies that have responded to its requests starting from January 2024, both our strategists and equity analysts believe there would be significant near-term pressure on the management teams who have yet to respond to do so. Impacted CL stocks: Hitachi, MUFG, Suzuki Motor, Renesas CHIPS Act & Generative AI For the exclusive use of MATTHEW.X.WONG@GS.COM Our analysts believe the rebuilding of semiconductor supply chains driven by the US CHIPS Act will drive opportunities for Japan, Korea and Taiwan semiconductor companies as the supply chain relocates. Meanwhile, with TSMC guiding for a 50% AI revenue CAGR from 2022 to 2027, our analysts believe AI is at the early stage of rapid market expansion and remain positive on the related value chains as the next big thing for Asia technology. They classify companies as either Enablers (that make generative AI possible) or Empowered Entities (that leverage generative AI to grow stronger), and subdivide the former into Public cloud hyperscalers, AI servers, Telecom operators, Networking equipment, Models (LLM developers), Semi/Semi-related, and Other (other hardware), and the latter into Content generation, Gaming, Automation, and Corporate productivity. 2e83ab6fea424dc8a1b6a8a7e94c6547 Impacted CL stocks: SK Hynix, TSMC, Foxconn Industrial Internet Make in India Global geopolitics and supply-chain disruptions have brought two critical issues to the fore for India’s policymakers: (1) Energy security, and (2) over-reliance on imports. The government’s US$33bn Production-Linked-Incentive (PLI) schemes aim to boost India’s energy transition, reduce imports, and eventually help India become a global manufacturing hub. PLI schemes have committed to capex investments of US$58bn over the next five years (and US$34bn ex-Semiconductor PLI), with over 660 entities (both Indian and global) having received approvals for participation. Our analysts highlight the themes of ‘Energy Transition’, ‘Import Substitution’ and ‘Enablers’, and given the implications to the broader region, are focused on the opportunities for Greater China Technology companies and footwear OEMs’ supply chain migration into India. Impacted CL stocks: HDFC Bank, Foxconn Industrial Internet 4 December 2023 7 Goldman Sachs APAC Conviction List Anatomy of the List Source: Goldman Sachs Global Investment Research Exhibit 3: APAC Conviction List - Valuation Table Ticker Company Name YTD Perf vs. MXAP GROWTH Sales EBITDA EPS FCF FY2 Growth Growth Growth Growth Year FY2 FY2 FY2 FY2 PE FY2 VALUATION EV/ FCF P/B EBITDA yield FY1 FY2 FY2 PROFITABILITY EBITDA EBITDA ROE Margin Margin CY24 FY1 FY2 LEVERAGE Net debt/ Net debt/ EBITDA EBITDA FY1 FY2 Consumer 7936.T GOCP.BO 2313.HK WOW.AX Asics Corp. Godrej Consumer Products Ltd. Shenzhou International Group Woolworths Group 76% 13% -14% -1% 24 25 24 25 6% 11% 17% 4% 10% 17% 33% 4% 18% 24% 24% 10% 341% 11% -67% 17% 28.2x 41.4x 19.7x 21.2x 4.6x 7.0x 3.0x 5.4x 12.2x 30.2x 13.3x 6.9x 3% 2% 2% 4% 12.5% 20.8% 21.1% 9.0% 13.0% 21.8% 24.0% 9.0% 17% 17% 16% 27% 0.3x 0.7x -2.1x 2.4x 0.1x 0.4x -1.5x 2.2x AIA Group HDFC Bank MUFG Oversea-Chinese Banking Corp. -27% -8% 39% 0% 24 25 25 24 8% 24% 1% 2% - 45% 32% 4% 3% - 14.3x 14.9x 11.0x 7.7x 2.3x 2.4x 0.8x 1.0x - - - - 17% 17% 7% 14% - - China Medical System Holdings CSL Ltd. Shionogi & Co. 18% -13% 3% 24 25 25 6% 9% -7% 3% 11% -1% 6% 15% 0% -1% 11% 4% 9.8x 1.8x 27.5x 4.4x 11.4x 1.6x 7.4x 16.8x 6.6x 8% 4% 10% 42.2% 32.8% 42.2% 40.8% 33.5% 44.7% 20% 17% 15% -1.1x 1.9x -3.3x -1.4x 1.4x -4.2x Sanhua Intelligent Controls SMC 30% 29% 24 25 24% 18% 25% 21% 34% 8% 519% -53% 25.4x 5.7x 22.0x 2.5x 18.5x 12.5x 1% 2% 16.8% 33.1% 16.9% 34.0% 24% 12% 0.2x -2.6x 0.1x -2.0x Kuaishou Technology PDD Holdings Sony Group -23% 74% 23% 24 24 25 16% 43% 7% 47% 38% 11% 68% 28% 18% 83% 17% 4% 15.4x 3.7x 20.8x 6.2x 14.9x 1.8x 6.8x 14.2x 6.6x 7% 7% 9% 15.7% 24.8% 17.7% 19.9% 24.0% 18.4% 20% 30% 12% -1.0x -3.4x 0.6x -1.3x -3.6x 0.0x Suzuki Motor 38% 25 4% 9% 11% 103% 9.2x 1.4x 3.8x 7% 12.6% 13.2% 16% -1.8x -1.7x Baoshan Iron & Steel Lynas Rare Earths Ltd. 8% -23% 24 25 0% 120% 24% 171% 58% 178% 174% 119% 8.9x 0.7x 13.1x 2.1x 3.4x 8.5x 11% 2% 10.0% 39.8% 12.4% 49.0% 8% 13% 0.6x -1.4x 0.1x -0.6x Foxconn Industrial Internet Hitachi Renesas Electronics SK Hynix Inc. TSMC 61% 52% 113% 73% 25% 24 25 24 24 24 14% -3% 5% 55% 25% 43% 10% 9% 312% 32% 42% 13% 4% 181% 26% 61% -32% -11% 280% 481% 8.6x 15.7x 10.0x 14.0x 14.4x 1.9x 2.1x 1.7x 1.4x 3.6x 5.2x 7.8x 4.9x 4.5x 7.2x 18% 9% 8% 10% 7% 6.4% 13.8% 39.8% 17.3% 67.5% 8.0% 15.6% 41.3% 45.9% 71.1% 24% 14% 23% 11% 27% -1.0x 0.4x -0.3x 4.1x -0.3x -1.5x 0.4x -0.7x 0.5x -0.6x -19% 24 10% 7% 7% 34% 18.5x 5.4x 10.2x 7% 32.4% 31.5% 32% -0.3x -0.8x Financials 1299.HK HDBK.BO 8306.T OCBC.SI 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Exhibit 2: Anatomy of the List Healthcare 0867.HK CSL.AX 4507.T Industrials 002050.SZ 6273.T Internet 1024.HK PDD 6758.T Mobility 7269.T Natural Resources & Clean Tech 600019.SS LYC.AX Technology 601138.SS 6501.T 6723.T 000660.KS 2330.TW Travel & Leisure HTHT H World Group Source: Bloomberg, Goldman Sachs Global Investment Research 4 December 2023 8 Goldman Sachs APAC Conviction List Exhibit 4: Regional exposure of the APAC Conviction List Exhibit 5: Sector exposure of the APAC Conviction List Companies by domicile (%) Companies by GICS Level 1 Sector (%) Singapore, 4% Communication Services, 4% South Korea, 4% Materials, 8% Consumer Staples, 8% India, 8% Mainland China, 32% Consumer Discretionary, 24% Australia, 12% Greater China, 40% Industrials, 12% Information Technology, 16% Health Care, 12% Japan, 32% Hong Kong, 4% Financials, 16% Source: Bloomberg, Goldman Sachs Global Investment Research Source: Bloomberg, Goldman Sachs Global Investment Research Exhibit 6: Upcoming Earnings Catalysts Ticker HDBK.BO 2330.TW 4507.T GOCP.BO 6501.T 000660.KS 8306.T 7269.T 7936.T 6723.T CSL.AX 6273.T 6758.T WOW.AX OCBC.SI LYC.AX 1299.HK 601138.SS 0867.HK PDD HTHT 2313.HK 1024.HK 002050.SZ 600019.SS Company Name HDFC Bank TSMC Shionogi & Co. Godrej Consumer Products Ltd. Hitachi SK Hynix Inc. MUFG Suzuki Motor Asics Corp. Renesas Electronics CSL Ltd. SMC Sony Group Woolworths Group Oversea-Chinese Banking Corp. Lynas Rare Earths Ltd. AIA Group Foxconn Industrial Internet China Medical System Holdings PDD Holdings H World Group Shenzhou International Group Kuaishou Technology Sanhua Intelligent Controls Baoshan Iron & Steel Date 1/12/2024 1/12/2024 1/30/2024 1/31/2024 2/1/2024 2/1/2024 2/2/2024 2/7/2024 2/9/2024 2/9/2024 2/14/2024 2/14/2024 2/14/2024 2/21/2024 2/23/2024 2/27/2024 3/11/2024 3/14/2024 3/18/2024 3/20/2024 3/27/2024 3/28/2024 4/2/2024 4/29/2024 4/29/2024 Event 2024 Q3 HDFC Bank Earnings Release 2023 Y TSMC Earnings Release 2024 Q3 Shionogi & Co. Earnings Release 2024 Q3 Godrej Consumer Products Ltd. Earnings Release 2024 Q3 Hitachi Earnings Release 2023 Y SK Hynix Inc. Earnings Release 2024 Q3 MUFG Earnings Release 2024 Q3 Suzuki Motor Earnings Release 2023 Y Asics Corp. Earnings Release 2023 Y Renesas Electronics Earnings Release 2024 S1 CSL Ltd. Earnings Release 2024 Q3 SMC Earnings Release 2024 Q3 Sony Group Earnings Release 2024 S1 Woolworths Group Earnings Release 2023 Y Oversea-Chinese Banking Corp. Earnings Release 2024 S1 Lynas Rare Earths Ltd. Earnings Release 2023 Y AIA Group Earnings Release 2023 Y Foxconn Industrial Internet Earnings Release 2023 Y China Medical System Holdings Earnings Release 2023 Q4 PDD Holdings Earnings Release 2023 Q4 H World Group Earnings Release 2023 Y Shenzhou International Group Earnings Release 2023 Y Kuaishou Technology Earnings Release 2023 Y Sanhua Intelligent Controls Earnings Release 2023 Y Baoshan Iron & Steel Earnings Release Date Dec-23 Mid-Jan 2024 Feb-24 3/3/2024 Apr-Jun 2024 May-24 Jul-24 Event Stage gate conversation with Terumo (instructive for the pace of further rollout) Analyst Meeting Final dividend announcement The 31st Conference on Retroviruses and Opportunistic Infections Phase 2 study results for S-309309 Mid Term Plan Announcement 2024 Paris Summer Olympics 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Taiwan, 4% Source: Bloomberg, Goldman Sachs Global Investment Research Exhibit 7: Upcoming Non-Earnings Catalysts Ticker CSL.AX 2330.TW OCBC.SI 4507.T 4507.T 8306.T 2313.HK Company Name CSL Ltd. TSMC Oversea-Chinese Banking Corp. Shionogi & Co. Shionogi & Co. MUFG Shenzhou International Group Source: Company data, Goldman Sachs Global Investment Research 4 December 2023 9 Goldman Sachs APAC Conviction List Our 25 Differentiated Buy Recommendations The company specific discussion in the sections below reflect the views of the covering analyst. Exhibit 8: APAC Conviction List - Directors’ Cut Company Name Summary Brand strength driving channel and mix improvement Turnaround accelerating, top tier domestic growth The coming restocking cycle Omni-channel leader extending share gains Margin expectations too bearish Synergies to drive substantial market share gains Rates and reform driven upside Shareholder returns inflection A new product cycle ahead Compelling entry point while ROIC & earnings growth inflect Emergence of sustainable earnings driver Global leader in HVAC/EV thermal components, further upside Humanoid Robots Cycle improvement to drive above-consensus earnings Growth and monetization opportunity as a competitive SFV platform Temu taking shape Pivot towards software and content to drive higher growth Pipeline, price and payout to drive valuation gap closure Consolidator, mix upgrade and margin upside Attractive positioning, expansion projects and valuation Margin expansion driven upside Geared for next phase of growth High quality, cycle bottom, undervalued Sustaining lead into next generation memory Structural trends support long-term growth opportunity Multiple ways to win Source: Goldman Sachs Global Investment Research 4 December 2023 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Ticker Consumer 7936.T Asics Corp. GOCP.BO GCPL 2313.HK Shenzhou International Group WOW.AX Woolworths Group Financials 1299.HK AIA Group HDBK.BO HDFC Bank 8306.T MUFG OCBC.SI OCBC Healthcare 0867.HK China Medical System CSL.AX CSL Ltd. 4507.T Shionogi & Co. Industrials 002050.SZ Sanhua Intelligent Controls 6273.T SMC Internet 1024.HK Kuaishou Technology PDD PDD Holdings 6758.T Sony Group Mobility 7269.T Suzuki Motor Natural Resources &Clean Tech 600019.SS Baoshan Iron & Steel LYC.AX Lynas Rare Earths Ltd. Technology 601138.SS Foxconn Industrial Internet 6501.T Hitachi 6723.T Renesas Electronics 000660.KS SK Hynix Inc. 2330.TW / TSM TSMC Travel & Leisure HTHT / 1179.HK H World Group 10 Goldman Sachs APAC Conviction List Asics - Brand strength driving channel and mix improvement Covered by Sho Kawano (sho.kawano@gs.com, +81 3 6437-9905) 7936.T Buy 12m Price Target: ¥6200 Upside: 18.4% GS Forecast 12/22 12/23E 12/24E 12/25E Market cap: ¥958.0bn / $6.5bn Revenue (¥ bn) 484.6 573.0 607.5 657.0 Enterprise value: ¥978.2bn / $6.6bn Op. profit (¥ bn) 34.0 53.5 60.0 70.0 34.0 52.0 -- -- Japan EPS (¥) 108.6 157.2 185.6 218.9 Japan Retail/Restaurants P/E (X) 22.6 33.3 28.2 23.9 P/B (X) 3.0 5.1 4.6 4.1 1.6 1.1 1.3 1.5 3m ADTV :¥7.3bn/ $48.8mn Op. profit CoE (¥ bn) M&A Rank: 3 Dividend yield (%) Leases incl. in net debt & EV?: Yes N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Price: ¥5238 EPS (¥) 0.2 0.3 0.1 (0.1) 11.3 11.8 11.6 12.0 6/23 9/23 12/23E -- 46.3 84.5 (62.7) -- Core thesis: Sho believes brand strength is improving in many regions and categories on the back of its focus on performance running. The company’s ability to manage costs has increased with the introduction of category-focused management. He believes it can deliver sustained margin improvement in step with top-line growth, forecasting 2-year CAGRs of 7%/14% in Sales/OP. Focus is on three growth drivers: (1) the shift to high-value-added products, (2) improvement in the regional/channel mix, and (3) Asics’ plans to keep annual production volume increases in check and curtail sales of low-margin products. Investor concerns are around the risk of weak wholesale sales if the inventory adjustment in the European footwear market persists through 1H12/24, and potential for guidance to be cautious given the firm’s tendency to set conservative targets. However, recent stock price trends suggest these concerns have been largely priced in. Asics trades on EV/NOPAT of 19X FY25E, vs. 24X for the five global sports brands despite its operating profit CAGR (FY22-FY25E) of +27% vs +18% for peers. Key debates: n Inventory cycle: There is a glut of inventory across sports shoes markets in the US/Europe, and orders from wholesalers, which account for 63% of the company’s overall sales, could remain weak. Given the strength of its products, Sho thinks any weakness will be offset by solid online/retail sales and favorable sales in Asia. n Multi category strength: Sho believes the likelihood of medium-term growth has increased given the spillover effect to other categories from market share gains by Performance Running (P.Run), scope for a better sales channel and region mix, and room for reducing operating expenses. Where we are different: Sho forecasts 3-year operating profit CAGR (FY22-FY25E) of +27% for Asics, which compares with an average of +18% CAGR for the five GS-covered global sports brands. Asics’ EV/NOPAT is 19X on FY25E, vs. 24X for the five 4 December 2023 11 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List global sports brands (median), and considering its high growth rate Sho sees considerable scope for Asics’ valuations to rise. He forecasts operating profit in FY12/25E to be ¥70bn, which is marginally above Bloomberg consensus. Catalysts: Look for changes in sales mix to support higher margin drivers of growth: n Rising contributions from a broader range of categories, including CPS and SPS, as these categories gain a knock-on effect from Asics’ stronger brand profile. n Earnings growth in Southeast Asia, China, and Japan. In China, local designs (25% of 2023 sales) are priced more affordably than rivals and are being well-received by consumers. n Improving profitability of low-margin entry models via intentional sales restraint. Exhibit 9: Sho expects earnings contributions from SE Asia/South Asia, China and Japan to increase Exhibit 10: Sales growth for the CPS and SPS categories is outstripping that for the core P.Run category Asics: Operating profits and operating margin by market Asics: Sales growth for 1Q-3Q12/23 (yoy, excluding forex impact) FY23 FY24 FY25 (GS E) (GS E) (GS E) Operating profit (JPY mn) Japan North America EMEA Greater China Oceania South-East Asia/ South Asia Others Elimination Consolidated Operating profit margin Japan North America EMEA Greater China Oceania South-East Asia/ South Asia Others Consolidated Sales growth (YoY, excluding forex impact) 45% 42% 40% 12,100 1,000 13,900 15,000 6,000 5,400 5,100 -5,000 53,500 13,100 1,800 13,900 17,400 6,400 6,900 5,500 -5,000 60,000 14,200 3,700 15,100 20,700 6,800 8,500 6,000 -5,000 70,000 11.5% 0.9% 9.5% 18.5% 16.0% 18.9% 10.2% 9.3% 11.4% 1.6% 9.4% 18.5% 16.0% 19.7% 10.7% 9.9% 11.5% 3.0% 9.7% 18.8% 15.8% 20.2% 11.3% 10.7% Source: Company data, Goldman Sachs Global Investment Research 36% 36% 35% 30% 25% 20% 15% 10% 7% 5% 0% 0% P.Run (53%) SPS (9%) CPS (11%) OT (9%) APEQ (7%) 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Valuation: 12m TP of ¥6,200, based on FY24E EV/NOPAT of 26X, the median multiple for five global sports brands. Notes: (1) OT = Onitsuka Tiger, APEQ = apparel and equipment. (2) Percentages in brackets for each category show sales weightings for FY12/22. Source: Company data Relevant Research: n Asics Corp. (7936.T): Conference call takeaways: Taking scalpel to low earnings structure and pursuing offensive strategy; raise GSe n 4 December 2023 Asics Corp. (7936.T): Earnings Review: Above expectations; guidance hike; solid growth in earnings; not concerned about US/Europe orders; Buy 12 Goldman Sachs Income Statement (¥ bn) __________________________________ Asics Corp. (7936.T) Rating since Aug 6, 2019 CL Ratios & Valuation _______________________________________ 12/22 22.6 3.0 (6.2) 9.8 12/23E 33.3 5.1 0.6 13.5 12/24E 28.2 4.6 2.8 12.3 12/25E 23.9 4.1 2.9 10.9 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 9.2 11.3 13.7 8.2 8.2 19.7 81.2 13.6 11.8 17.0 9.6 9.6 20.1 92.9 12.2 11.6 17.0 2.2 2.2 85.7 97.0 10.7 12.0 18.0 (3.1) (3.1) 100.0 97.3 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 45.5 56.2 13.0 1.1 2.8 470.7 143.3 48.2 62.7 15.1 1.1 2.6 545.8 187.1 49.5 65.5 16.0 1.1 2.6 581.8 212.8 48.2 64.8 16.9 1.1 2.5 626.0 223.5 BVPS (¥) 824.9 1,030.2 1,147.8 1,286.7 For the exclusive use of MATTHEW.X.WONG@GS.COM P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 19.9 39.7 111.4 66.7 7.0 10.4 18.2 42.4 44.8 50.0 9.3 12.5 6.0 9.9 18.1 13.3 9.9 13.0 8.1 13.3 17.9 17.6 10.7 13.6 4.1 5.0 5.6 6.1 Price Performance _______________________________________ 7936.T (¥) TOPIX 7,000 2,800 6,000 2,600 5,000 2,400 4,000 2,200 3,000 2,000 2,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m (0.0)% (1.4)% 42.1% 28.2% 72.6% 43.9% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 484.6 (243.9) (206.7) 0.0 12/23E 573.0 (278.5) (241.0) 0.0 12/24E 607.5 (289.8) (257.7) 0.0 12/25E 657.0 (308.8) (278.2) 0.0 Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -50.5 (16.5) 34.0 (1.1) -28.7 -71.9 (18.4) 53.5 (1.3) -49.5 -79.0 (19.0) 60.0 (0.1) -57.5 -89.5 (19.5) 70.0 (0.1) -67.5 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) (8.7) (0.1) -19.9 -19.9 108.6 108.6 108.6 108.6 (20.4) (0.3) -28.8 -28.8 157.2 157.2 157.2 157.2 (23.2) (0.3) -34.0 -34.0 185.6 185.6 185.6 185.6 (27.1) (0.3) -40.1 -40.1 218.9 218.9 218.9 218.9 40.0 36.8 60.0 38.2 68.0 36.6 80.0 36.5 Total revenue Cost of goods sold SG&A R&D DPS (¥) Div. payout ratio (%) Balance Sheet (¥ bn) _____________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 67.4 70.7 135.6 12/23E 64.7 80.7 155.9 12/24E 78.4 84.0 167.0 12/25E 90.3 89.5 183.2 Other current assets Total current assets Net PP&E Net intangibles 22.5 296.1 25.2 70.2 23.5 324.8 32.5 76.9 24.5 353.8 40.3 80.1 25.5 388.5 48.1 83.5 Total investments Other long-term assets Total assets Accounts payable 57.9 (24.4) 425.1 44.7 66.6 -500.8 51.0 70.2 -544.4 53.1 74.9 -595.0 56.6 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 22.0 -83.9 150.6 22.0 -63.5 136.5 22.0 -62.6 137.7 22.0 -60.7 139.3 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 57.9 -43.8 101.7 61.0 -112.8 173.8 61.0 -133.7 194.7 61.0 -157.2 218.2 Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted 252.3 -151.1 1.8 425.1 12.5 310.3 -188.7 1.8 500.8 18.4 332.4 -210.3 1.8 544.4 4.7 357.4 -235.7 1.8 595.0 (7.3) Cash Flow (¥ bn) _________________________________________ 12/22 12/23E 12/24E 12/25E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others 19.9 16.5 0.1 (61.9) 8.1 (17.3) (10.6) --(3.9) 28.8 18.4 0.3 (24.1) (1.8) 21.7 (15.5) --(1.0) 34.0 19.0 0.3 (12.3) (1.9) 39.1 (12.0) --(1.0) 40.1 19.5 0.3 (18.2) (1.9) 39.8 (12.2) --(1.0) Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (14.5) -(7.3) 2.2 7.4 2.3 (29.5) (27.9) (16.5) -(11.0) 3.1 0.0 (7.9) (2.7) 6.2 (13.0) -(12.5) -0.0 (12.5) 13.7 27.1 (13.2) -(14.7) -0.0 (14.7) 12.0 27.6 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 13 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List GCPL - Turnaround accelerating, top-tier domestic growth Covered by Arnab Mitra (arnab.mitra@gs.com, +91 22 6616-9345) GOCP.BO Buy 12m Price Target: Rs1185 Price: Rs1025.6 GS Forecast 3/23 3/24E 3/25E 3/26E 133,159.7 144,903.2 161,433.8 180,347.5 24,304.6 30,156.0 35,210.6 39,696.5 16.66 20.01 24.77 28.65 India P/E (X) 51.7 51.3 41.4 35.8 India Consumer P/B (X) 6.4 7.4 7.0 6.5 0.0 1.6 1.7 1.7 Market cap: Rs1.0tr / $12.6bn Revenue (Rs mn) Enterprise value: Rs1.1tr / $12.8bn EBITDA (Rs mn) 3m ADTV: NA EPS (Rs) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: Yes CROCI (%) FCF yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 15.5% EPS (Rs) (0.1) 0.7 0.4 0.1 17.7 16.3 16.3 17.5 2.2 2.0 2.2 2.5 3/23 6/23E 9/23E 12/23E 4.42 3.12 4.23 6.42 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Key debates: n Will new product initiatives deliver higher growth in India? Product strategy in its home insecticides business should drive a structural upgrade from low end formats to premium formats like electrics (where GCPL has high market shares). Air care and liquid detergents make up only ~10-15% of GCPL’s India revenue, but Arnab expects them to grow at 20-25% over FY23-26. Both these categories have low penetration and have strong tailwinds for growth. 4 December 2023 n Will GCPL be able to radically simplify its international business? The company will move its dry hair business in East Africa from own operations to a franchisee royalty model, reducing capital employed and improving ROCE. This model can potentially be replicated for other low margin international businesses of GCPL (c.25% of GCPL’s revenue is from Africa, out of which dry hair segment is low-margin). n Will the acquired FMCG business deliver on its margin promise? GCPL acquired the FMCG business of Raymond in May 2023, making up ~10% of GCPL’s India revenue in FY25E, after the synergies play out. With GCPL’s direct distribution reach 14 2e83ab6fea424dc8a1b6a8a7e94c6547 Core thesis: Godrej Consumer (GCPL) is a leader in home and personal care products in India with sizable revenues in Indonesia and Africa. Arnab forecasts 20% EPS CAGR over FY24-26E as the company’s turnaround accelerates. This is driven by a combination of 1) high single digit volume growth in the India business, 2) cost synergies from the recent RCCL acquisition, and 3) simplification in Africa operations delivering better profitability. GCPL trades at 40x FY25E P/E, which is at the lower end of the range for Arnab’s India FMCG coverage ex-ITC (average FY25E P/E of 46x). Arnab forecasts GCPL to deliver 18% FY23E-26E earnings CAGR, compared to an average earnings CAGR of ~13% for his FMCG coverage. Goldman Sachs APAC Conviction List and marketing initiatives, Arnab expects EBITDA margins will expand from 5% pre-acquisition to over 20% in FY25E, contributing to ~5% of consolidated EPS for FY25E. Where we are different: Greater conviction on India growth accelerating, driven by its strong product innovation and marketing efforts in segments where penetration is still low, driving above market growth and higher ASP. Arnab also sees higher growth/lower volatility in GCPL’s international business ahead on greater management execution and focus, lowering market concerns on a business which has been a drag historically. As a result, Arnab’s FY25E/26E EPS for GCPL are 4% above BBG consensus estimates. Catalysts: 1) Revenue and cost synergies from the Raymond business beginning 2HFY24; 2) Successful implementation of the Africa business restructuring leading to higher profitability (4Q FY24); 3) Acceleration of HI growth with the launch of higher efficacy products (1H FY25). Exhibit 11: GCPL’s 4 quarter rolling average growth in home care has been accelerating Exhibit 12: Arnab expects margin of the recently acquired Raymond business to improve significantly, driven by synergies Raymond brands Home care growth (GCPL) 16% 9,000 14% 8,000 12% 7,000 10% 6,000 8% 6% 5,000 4% 4,000 2% 3,000 0% 2,000 -2% 1,000 -4% -6% 0 1QFY23 2QFY23 3QFY23 4QFY23 Home care (trailing 4 quarters, YoY) 1QFY24 2QFY24 FY23 Home care (YoY) Source: Company data FY24E Revenue (Rs mn) FY25E FY26E EBITDA (Rs mn) Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Godrej Consumer Products Ltd. (GOCP.BO): A clear strategy to aggressively grow in India and simplify international business n 4 December 2023 Godrej Consumer Products Ltd. (GOCP.BO): Addressing investor questions on the Raymond Group acquisition 15 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Valuation: 12m TP of Rs1,185, based on a P/E multiple of 44x applied to Q5E-Q8E EPS. Goldman Sachs Income Statement (Rs mn) _________________________________ Godrej Consumer Products Ltd. (GOCP.BO) Rating since Aug 10, 2022 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 3/23 51.7 6.4 2.2 36.2 3/24E 51.3 7.4 2.0 35.5 3/25E 41.4 7.0 2.2 30.2 3/26E 35.8 6.5 2.5 26.5 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 36.1 17.7 13.9 (1.2) (1.5) 12.5 50.3 35.5 16.3 14.6 15.2 14.9 11.1 37.4 30.2 16.3 17.3 9.8 9.5 24.2 34.0 26.5 17.5 18.8 2.2 2.0 55.3 33.6 32.4 108.5 12.7 0.8 1.3 138,208.7 122,108.0 32.8 98.6 14.4 0.7 1.4 168,111.6 149,591.6 32.4 92.1 16.9 0.8 1.4 171,785.5 163,742.8 32.3 90.5 18.1 0.8 1.3 175,486.4 164,658.8 134.95 138.96 146.73 158.38 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rs) Average capital employed (Rs) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rs) Growth & Margins (%) ____________________________________ 3/23 3/24E 3/25E 3/26E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 8.5 1.5 (4.5) NM 16.5 18.3 8.8 24.1 20.1 NM 19.0 20.8 11.4 16.8 23.8 6.3 20.1 21.8 11.7 12.7 15.7 0.0 20.4 22.0 Net income margin 13.2 14.1 15.7 16.2 Price Performance _______________________________________ GOCP.BO (Rs) India BSE30 Sensex 1,300 80,000 1,200 75,000 1,100 70,000 1,000 65,000 900 60,000 800 55,000 Jan-23 Absolute Rel. to the India BSE30 Sensex Apr-23 Jul-23 Oct-23 3m 6m 12m 2.0% (1.2)% (2.6)% (9.9)% 17.0% 9.7% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D 3/23 133,159.7 (67,027.9) (19,201.9) -- 3/24E 144,903.2 (66,547.3) (22,488.1) -- 3/25E 161,433.8 (72,847.6) (24,730.7) -- 3/26E 180,347.5 (81,021.8) (27,628.1) -- Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit (11,510.5) 24,304.6 (2,362.9) 21,941.7 (1,757.4) -21,868.4 (12,525.6) 30,156.0 (2,571.3) 27,584.7 (2,494.3) -27,448.2 (13,954.6) 35,210.6 (2,703.2) 32,507.4 (1,341.8) -33,759.1 (15,589.5) 39,696.5 (2,839.5) 36,857.0 (666.8) -39,043.0 (4,302.7) --17,565.7 (541.1) 17,024.6 17.18 17.18 16.66 16.66 (6,999.3) --20,448.9 -20,448.9 20.01 20.01 20.01 20.01 (8,439.8) --25,319.3 -25,319.3 24.77 24.77 24.77 24.77 (9,760.8) --29,282.3 -29,282.3 28.65 28.65 28.65 28.65 0.00 0.0 16.00 80.0 17.00 68.6 17.00 59.3 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rs) EPS (diluted, pre-except) (Rs) EPS (basic, post-except) (Rs) EPS (diluted, post-except) (Rs) DPS (Rs) Div. payout ratio (%) Balance Sheet (Rs mn) ____________________________________ Cash & cash equivalents Accounts receivable Inventory 3/23 3,907.7 12,452.8 15,371.5 3/24E 4,670.4 13,551.0 14,349.7 3/25E 3,642.2 15,096.9 15,708.2 3/26E 5,686.4 16,865.7 17,470.8 Other current assets Total current assets Net PP&E Net intangibles 4,431.2 36,163.2 15,340.5 84,034.0 4,832.0 37,403.1 15,667.3 111,534.0 5,272.9 39,720.3 16,192.8 111,534.0 5,757.9 45,780.8 16,960.2 111,534.0 30,289.8 9,160.1 174,987.6 18,231.7 30,289.8 9,160.1 204,054.3 17,736.3 30,289.8 9,160.1 206,896.9 19,016.3 30,289.8 9,160.1 213,724.9 21,150.1 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities -380.1 14,301.3 32,913.1 -380.1 15,769.0 33,885.4 -380.1 17,389.1 36,785.6 -380.1 19,177.7 40,708.0 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 1,891.2 -2,241.1 4,132.3 25,891.2 -2,241.1 28,132.3 17,891.2 -2,241.1 20,132.3 8,891.2 -2,241.1 11,132.3 37,045.4 -137,942.3 -174,987.7 (2,016.5) 62,017.7 -142,036.6 -204,054.4 21,220.8 56,917.9 -149,979.2 -206,897.0 14,249.0 51,840.3 -161,884.7 -213,725.0 3,204.8 Total investments Other long-term assets Total assets Accounts payable Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rs mn) _______________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 3/23 3/24E 3/25E 3/26E 21,327.3 2,362.9 -933.4 (3,117.1) 21,506.5 27,448.2 2,571.3 -495.1 (6,862.7) 23,651.9 33,759.1 2,703.2 -(445.2) (9,691.4) 26,325.6 39,043.0 2,839.5 -(93.9) (11,946.8) 29,841.9 (2,197.4) (16,747.1) -(1,789.4) (20,733.9) (2,898.1) (27,500.0) -2,357.7 (28,040.3) (3,228.7) --2,593.5 (635.2) (3,607.0) --2,852.9 (754.1) -0.0 (6,343.6) (1,599.5) (7,943.1) (7,170.5) 19,309.1 -(16,354.6) 24,000.0 (2,494.3) 5,151.1 762.7 20,753.8 -(17,376.7) (8,000.0) (1,341.8) (26,718.6) (1,028.1) 23,096.9 -(17,376.7) (9,000.0) (666.8) (27,043.6) 2,044.2 26,234.9 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 16 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Shenzhou International - The coming restocking cycle Covered by Michelle Cheng (michelle.cheng@gs.com, +852 2978-6631) 2313.HK Buy 12m Price Target: HK$98 Price: HK$79.05 GS Forecast 12/22 12/23E 12/24E 12/25E 27,781.4 26,078.5 30,409.5 34,340.3 5,293.4 5,501.4 7,304.9 8,346.2 3.04 2.96 3.66 4.25 China P/E (X) 26.5 24.4 19.7 17.0 Greater China Retail P/B (X) 3.9 3.3 3.0 2.8 2.1 2.3 2.8 3.2 (1.5) (2.1) (1.6) (1.7) 18.8 16.0 18.3 19.2 2.5 5.2 1.7 5.3 12/22 6/23 12/23E -- 1.46 1.41 1.55 -- Market cap: HK$118.8bn / $15.2bn Revenue (Rmb mn) Enterprise value: HK$106.2bn / $13.6bn EBITDA (Rmb mn) 3m ADTV :HK$284.1mn/ $36.3mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: Yes CROCI (%) FCF yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 24% EPS (Rmb) Core thesis: Michelle’s positive view of Shenzhou is based on: 1) An improving earnings outlook into 2024 on the back of a global restocking cycle. With brands’ active inventory control from 2H22, Michelle believes the destocking cycle is approaching the end. Given the easier sales base starting from 4Q23, Shenzhou’s sales growth should turn positive yoy; into 1Q24, contrary to the majority of Michelle’s China consumer coverage that have high bases, near-term sales growth could serve as a share price catalyst. The stock offers the best 2-year recurring NI growth at 23% among larger cap consumer names. 2) Global presence. Shenzhou has ~75% sales exposure to the non-China market (as of 2022), which fits with the current broad-based investor preference for more balanced geographical exposure. 3) Undemanding valuation. Shenzhou currently trades at a P/E discount compared to its apparel OEM peers vs a premium during 2018-22 and its own 25x 5-year average (excluding 2021 outlier). Key debates: n Extent of restocking demand: Global economic outlook translates into the magnitude of the restocking cycle, although inventory level is improving. n GPM outlook: Discussions are centered around Shenzhou’s production base expansion plan in new countries and the effectiveness in ramp-up, scope for improving utilization rate and margins in China given concerns on shrinking exports to global markets. n Valuation: Shenzhou is trading at par or higher than sportswear brands listed in Hong Kong but at a discount to OEM peers listed in Taiwan. Where we are different: Michelle is more constructive on brands’ restocking upcycle into 2024, on the back of a more positive global market macro backdrop and brands’ efforts on inventory optimization in the past few quarters. She is positive on Shenzhou’s margin recovery supported by its enhanced order book, rising China utilization rate, and 4 December 2023 17 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List wallet share gain upside, though she still factors in a lower than historical level GPM in 2024-25E. Catalysts: 1) Nov-Dec 2023: Initial order book outlook for 2024; 2) 2024 Paris Summer Olympics; and 3) Easier sales base until 4Q24. Valuation: 12m TP of HK$98 is based on a 25x 2024E P/E. Exhibit 13: Signs of restocking as global sportswear brands and fashion/casual brands’ sales growth outpaced inventory growth in 3Q23, which benefits apparel/footwear OEMs Exhibit 14: OEMs vs brands: growth and valuation Gap between Sales yoy growth and Inventory yoy growth Sub-sector Sports retailers 1Q21 Apparel/footwear OEM 24 NI yoy growth vs 24PE 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 30.0 118% 16% 1% -20% -42% -58% -29% -23% -19% -6% Eclat 25.0 Retailers 8% -15% -5% -17% -33% -24% -11% -1% 7% 6% 2% 36% 82% 26% Sportswear 29% 87% 17% -2% -14% -32% -51% -41% -20% -12% 12% 3% Current 24PE Shenzhou Anta Makalot Huali Li Ning 15.0 10.0 Stella 5.0 Xtep 24 NP yoy growth 0.0 0% 5% 10% 15% 20% 25% 30% Red font denotes GS covered Greater China OEM stocks Excl. outlier Yue Yuen Source: Company data Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Asia Pacific Textile, Apparel & Footwear: Restocking prompts 4Q23 inflection point; upgrade YY to Buy, downgrade FT to Sell 4 December 2023 n Asia Pacific Textile, Apparel & Footwear: Marketing feedback our Huali/Feng Tay initiations n Asia Pacific Textile, Apparel & Footwear: Emerging from the downcycle; Initiate on Huali and Feng Tay 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 20.0 Fashion/ Casual 6% -10% -33% -38% -35% -21% -7% Feng Tay Nike -1% 18 Goldman Sachs Income Statement (Rmb mn) _______________________________ Shenzhou International Group (2313.HK) Rating since Aug 29, 2016 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 26.5 3.9 2.5 21.2 12/23E 24.4 3.3 5.2 17.5 12/24E 19.7 3.0 1.7 13.3 12/25E 17.0 2.8 5.3 11.3 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 21.3 18.8 15.6 (26.3) (26.6) 132.2 84.7 17.6 16.0 14.0 (35.4) (35.7) 137.4 86.9 13.3 18.3 16.1 (31.5) (31.9) 197.0 79.3 11.3 19.2 17.1 (36.5) (36.8) 229.9 79.6 55.9 19.5 14.8 0.6 1.4 33,328.5 21,759.0 62.4 21.3 13.6 0.6 1.4 33,055.3 21,795.4 60.0 24.3 15.4 0.6 1.4 37,703.0 22,695.6 59.7 24.2 16.3 0.7 1.3 39,390.8 24,542.7 20.46 21.75 23.79 26.02 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) Growth & Margins (%) ____________________________________ 12/22 12/23E 12/24E 12/25E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 16.5 13.4 35.3 23.6 14.3 19.1 (6.1) 3.9 (2.4) (2.2) 15.8 21.1 16.6 32.8 23.7 23.7 19.4 24.0 12.9 14.3 16.0 16.0 20.1 24.3 Net income margin 16.4 17.1 18.1 18.6 Price Performance _______________________________________ 2313.HK (HK$) Hang Seng China Ent. 140 8,000 120 7,500 100 7,000 80 6,500 60 6,000 40 5,500 Jan-23 Apr-23 Absolute Rel. to the Hang Seng China Ent. Jul-23 Oct-23 3m 6m 12m (1.8)% 7.9% 27.6% 36.2% 6.0% 17.5% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) DPS (Rmb) Div. payout ratio (%) 12/22 27,781.4 (21,655.6) (2,158.7) 0.0 12/23E 26,078.5 (19,849.4) (2,108.5) 0.0 12/24E 30,409.5 (22,071.6) (2,428.3) 0.0 12/25E 34,340.3 (24,708.4) (2,733.6) 0.0 -5,293.4 (1,326.3) 3,967.1 49.8 (21.4) 5,262.1 -5,501.4 (1,380.8) 4,120.6 327.8 (21.4) 5,003.2 -7,304.9 (1,395.3) 5,909.6 292.4 (21.4) 6,380.0 -8,346.2 (1,447.9) 6,898.3 285.0 (21.4) 7,381.2 (698.9) (0.4) -4,562.8 -4,562.8 3.04 3.04 3.04 3.04 (550.4) (0.4) -4,452.5 -4,452.5 2.96 2.96 2.96 2.96 (874.1) (0.4) -5,505.5 -5,505.5 3.66 3.66 3.66 3.66 (996.5) (0.4) -6,384.3 -6,384.3 4.25 4.25 4.25 4.25 1.67 54.9 1.63 55.0 2.01 55.0 2.34 55.0 Balance Sheet (Rmb mn) __________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 17,391.5 5,005.2 6,260.8 12/23E 20,892.3 3,911.8 6,153.3 12/24E 20,596.0 6,081.9 7,062.9 12/25E 23,611.8 5,151.0 7,906.7 Other current assets Total current assets Net PP&E Net intangibles 1,173.9 26,164.5 11,593.7 125.0 1,173.9 28,464.4 11,717.2 107.1 1,173.9 31,247.8 12,164.3 89.3 1,173.9 34,176.5 12,794.7 71.4 Total investments Other long-term assets Total assets Accounts payable 574.0 5,035.7 43,492.9 931.6 574.0 5,035.7 45,898.4 1,389.5 574.0 5,035.7 49,111.1 1,545.0 574.0 5,035.7 52,652.3 1,729.6 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 7,197.7 29.5 2,100.6 10,259.4 7,197.7 29.5 2,100.6 10,717.3 7,197.7 29.5 2,100.6 10,872.9 7,197.7 29.5 2,100.6 11,057.4 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 2,000.0 87.1 380.6 2,467.6 2,000.0 87.1 380.6 2,467.6 2,000.0 87.1 380.6 2,467.6 2,000.0 87.1 380.6 2,467.6 12,727.1 -30,752.9 12.9 43,492.9 (8,193.9) 13,184.9 -32,700.2 13.2 45,898.4 (11,694.6) 13,340.5 -35,756.9 13.6 49,111.1 (11,398.3) 13,525.1 -39,113.2 14.0 52,652.3 (14,414.1) Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations 4,562.8 1,326.3 0.4 (1,583.7) 322.4 4,628.1 4,452.5 1,380.8 0.4 1,658.7 (327.8) 7,164.6 5,505.5 1,395.3 0.4 (2,924.2) (292.4) 3,684.7 6,384.3 1,447.9 0.4 271.6 (285.0) 7,819.3 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (1,567.1) --1,195.7 (371.3) (1,486.5) --327.8 (1,158.7) (1,824.6) --292.4 (1,532.2) (2,060.4) --285.0 (1,775.5) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow -(2,063.2) (1,391.0) (836.6) (4,290.9) (34.1) 3,061.1 -(2,505.1) -0.0 (2,505.1) 3,500.8 5,678.2 -(2,448.9) -0.0 (2,448.9) (296.3) 1,860.2 -(3,028.0) -0.0 (3,028.0) 3,015.8 5,758.9 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 19 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Woolworths Group - Omni-channel leader extending share gains Covered by Lisa Deng (lisa.deng@gs.com, +61 2 9320-1084) WOW.AX Buy 12m Price Target: A$42.4 Price: A$34.56 GS Forecast Market cap: A$42.0bn / $27.8bn Revenue (A$ mn) Enterprise value: A$56.3bn / $37.4bn EBITDA (A$ mn) 6/23 6/24E 6/25E 6/26E 64,294.0 66,710.3 69,474.6 71,564.5 5,694.0 6,010.6 6,261.8 6,534.1 1.41 1.49 1.63 1.78 25.8 23.3 21.2 19.4 3m ADTV :A$64.8mn/ $41.7mn EPS (A$) Australia P/E (X) ANZ Consumer P/B (X) Dividend yield (%) M&A Rank: 3 Net debt/EBITDA (X) Leases incl. in net debt & EV?: Yes Frank/Imput (%) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 22.7% EPS (A$) 6.9 6.0 5.4 4.9 2.9 3.2 3.6 3.9 2.6 2.4 2.2 2.0 100.0 100.0 100.0 100.0 11.8 12.1 11.7 11.4 6/23 12/23E 6/24E 12/24E 0.69 0.72 0.77 0.72 Core thesis: Lisa’s Buy thesis is based on 1) robust supermarkets growth of ~4% in FY23-26E driven by strong population growth and a rational, oligopoly environment; 2) omni-channel leader further extending share gains: Lisa expects market share to increase 2pp to 37% by 2030E due to its early mover advantage in digitalization and omni-channel execution. By 2030E, she expects WOW to be the dominant leader in online with 50% share in a space that is expected to go from 5% to 10% of the total grocery market; 3) loyalty/retail media further margin opportunities: Woolworth’s strong digital and omni-channel advantage is further reinforced through a virtuous cycle of Loyalty and retail media (Cartology). Lisa expects ~A$1B retail media revenue at ~45% EBIT margin by 2030E, with further upside risk. Net net, she forecasts that WOW will deliver FY23-26E 3-yr group sales CAGR of 3.6% and NPAT CAGR of 8.2% vs key competitor Coles ~4.4% sales CAGR and -1.0% NPAT CAGR. Key debates: 4 December 2023 n Will Woolworth’s margin be eroded as cost of doing business (wage growth) outweighs sales? Lisa expects that Woolworths will continue to gain market share due to superior omni-channel execution while delivering margin expansion opportunities via 1) cost productivity in supply chain automation, promotional efficiency and workforce optimization; and 2) building further revenue levers with retail media, loyalty and general merchandise/market place. She expects Woolworths’ group EBIT margin to expand from 4.8% in FY23 to 5.3% by FY26E. n Do digital investments actually result in profitable growth and how long will it take for Coles to catch-up? Woolworths above market growth at ~5.1% sales CAGR and EBIT margin +1.3% to 6.0% from FY18-23 provides evidence that digital investments are driving positive returns. Additionally, in the last 5-years Woolworths has spent >A$1B in growth capex on ecom/digital. Lisa’s industry checks suggest 20 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List that this will drive a multi-year advantage from a scale of spend and time of learning perspective vs key industry peers. Where we are different: Lisa has higher conviction around Woolworths’ multi-year digital advantage vs Coles which will result in 1) omni-channel execution advantage with continued online leadership despite COL’s partnership with Ocado. Woolworths increased scale in online will lead to sustainable profit in this higher growth channel; 2) margin expansion opportunity from precision execution including mix improvement, promotional efficiency, employee productivity; and 3) opportunity around ancillary services including loyalty and retail media will drive further revenue/margin upside. Valuation: 12m TP of A$42.40 (50/50 SOTP and 10-yr DCF) implies a 12m forward P/E of ~28x vs company’s current trading P/E of ~22x and the stock’s 5-yr historical average of 26x. Exhibit 15: Lisa expects WOW to continue to gain share despite already being market leader Exhibit 16: WOW is trading at only ~1x P/E point premium to COL vs LT average of ~4x GSe AU Supermarket market share trend, FY23-30E change WOW P/E point premium to COL 40% 10 WOW: 36.6% +158bps 35% 9 8 30% COL: 27.8% +104bps 25% 7 6 20% 5 15% Aldi: 9.8%, +42bps 10% 4 3 2 1 0% 11/23 06/23 02/23 09/22 05/22 12/21 07/21 03/21 10/20 06/20 01/20 08/19 Source: Company data, Goldman Sachs Global Investment Research 0 04/19 Aldi 11/18 FY30e Metcash FY29e FY28e FY27e Coles FY26e FY25e FY24e FY23 FY22 FY21 FY20 FY19 Woolworths Source: Company data, Goldman Sachs Global Investment Research, FactSet Relevant Research: n Australia Retail: Race for the New Digital Consumer; Initiate on F&B and Home Retailers n 4 December 2023 Australia Retail: Supply Chain: Futureproof but Not Game Change; Buy WOW, Sell COL 21 2e83ab6fea424dc8a1b6a8a7e94c6547 MTS: 9.1%, 209bps 5% FY18 For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: 1) December 4 Metcash’s 1H24 result, which Lisa expects will confirm independents’ market share loss. 2) Woolworths’ 1H24 results in Feb 2024 which she expects will show similar sales growth but superior margin expansion relative to key competitor COL. Goldman Sachs Income Statement (A$ mn) _________________________________ Woolworths Group (WOW.AX) CL Rating since Mar 27, 2022 Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 6/23 25.8 6.9 2.6 10.3 6/24E 23.3 6.0 3.1 9.4 6/25E 21.2 5.4 4.0 8.9 6/26E 19.4 4.9 4.0 8.4 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 9.1 11.8 27.7 222.4 39.9 19.1 20.7 8.1 12.1 27.0 198.2 30.2 16.2 20.7 7.6 11.7 26.8 169.9 17.3 20.4 20.8 7.2 11.4 26.5 146.9 8.0 25.7 21.2 5.8 56.6 26.2 1.9 5.1 40,735.0 9,274.5 5.7 57.5 25.3 2.0 4.7 43,731.5 9,268.7 5.7 56.9 25.1 2.0 4.4 46,513.7 9,330.1 5.7 57.2 24.8 2.0 4.1 49,511.9 9,384.4 5.29 5.80 6.42 7.10 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (A$) Average capital employed (A$) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (A$) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 6/23 6/24E 6/25E 6/26E 5.7 12.7 14.3 11.9 4.8 8.9 3.8 5.6 5.6 7.9 4.9 9.0 4.1 4.2 9.5 9.5 5.1 9.0 3.0 4.3 9.4 9.4 5.3 9.1 2.7 2.7 2.9 3.0 Price Performance _______________________________________ WOW.AX (A$) S&P/ASX 200 42 7,600 40 7,400 38 7,200 36 7,000 34 6,800 32 6,600 Jan-23 Absolute Rel. to the S&P/ASX 200 Apr-23 Jul-23 Oct-23 3m 6m 12m (9.3)% (6.7)% (9.3)% (8.8)% (0.1)% 3.9% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (A$) EPS (diluted, pre-except) (A$) EPS (basic, post-except) (A$) EPS (diluted, post-except) (A$) DPS (A$) Div. payout ratio (%) 6/23 64,294.0 (47,118.0) (11,482.0) 0.0 6/24E 66,710.3 (48,773.3) (11,926.5) 0.0 6/25E 69,474.6 (50,670.3) (12,542.5) 0.0 6/26E 71,564.5 (52,091.4) (12,939.1) 0.0 -5,694.0 (2,578.0) 3,116.0 (677.0) -2,439.0 -6,010.6 (2,719.5) 3,291.0 (731.8) -2,559.2 -6,261.8 (2,748.2) 3,513.6 (710.4) -2,803.2 -6,534.1 (2,774.8) 3,759.2 (692.7) -3,066.5 (707.0) (11.0) -1,721.0 (103.0) 1,618.0 1.42 1.41 1.33 1.32 (741.8) 0.0 -1,817.4 -1,817.4 1.50 1.49 1.50 1.49 (812.6) 0.0 -1,990.6 -1,990.6 1.64 1.63 1.64 1.63 (888.9) 0.0 -2,177.6 -2,177.6 1.79 1.78 1.79 1.78 1.04 73.4 1.12 75.0 1.23 75.0 1.34 75.0 Balance Sheet (A$ mn) ___________________________________ 6/23 1,135.0 1,016.0 3,698.0 6/24E 1,084.8 1,059.1 3,875.1 6/25E 1,385.1 1,108.5 4,025.9 6/26E 2,058.2 1,145.8 4,281.5 Other current assets Total current assets Net PP&E Net intangibles 526.0 6,375.0 18,348.0 5,693.0 526.0 6,545.1 18,669.4 5,617.1 526.0 7,045.5 18,940.7 5,551.8 526.0 8,011.5 19,204.4 5,497.6 Total investments Other long-term assets Total assets Accounts payable 0.0 3,232.0 33,648.0 7,623.0 0.0 3,241.7 34,073.3 7,750.3 0.0 3,252.3 34,790.3 8,051.7 0.0 3,264.1 35,977.7 8,277.5 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 466.0 1,637.0 2,160.0 11,886.0 268.5 1,648.9 2,221.6 11,889.3 227.2 1,656.0 2,292.1 12,227.1 227.2 1,663.5 2,345.5 12,513.7 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 3,289.0 10,343.0 1,565.0 15,197.0 2,986.5 10,418.1 1,597.2 15,001.9 2,527.8 10,463.3 1,634.1 14,625.1 2,527.8 10,510.2 1,661.9 14,699.9 Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted 27,083.0 -6,425.0 140.0 33,648.0 2,620.0 26,891.1 -7,042.1 140.0 34,073.3 2,170.2 26,852.2 -7,798.0 140.0 34,790.3 1,369.9 27,213.6 -8,624.1 140.0 35,977.7 696.8 Cash & cash equivalents Accounts receivable Inventory Cash Flow (A$ mn) _______________________________________ 6/23 6/24E 6/25E 6/26E 1,721.0 2,578.0 (11.0) 544.0 (78.0) 4,754.0 1,817.4 2,719.5 0.0 (93.0) 45.5 4,489.4 1,990.6 2,748.2 0.0 101.4 54.1 4,894.3 2,177.6 2,774.8 0.0 (67.1) 22.1 4,907.4 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (2,519.0) (373.0) 1,020.0 28.0 (1,844.0) (2,138.1) -300.0 38.7 (1,799.4) (2,154.2) -300.0 42.6 (1,811.7) (2,176.6) -300.0 47.2 (1,829.4) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (1,067.0) (1,031.0) (601.0) (110.0) (2,809.0) 103.0 2,235.0 (1,040.0) (1,200.2) (500.0) 0.0 (2,740.2) (50.2) 2,351.3 (1,047.6) (1,234.7) (500.0) 0.0 (2,782.3) 300.3 2,740.1 (1,053.4) (1,351.6) -0.0 (2,405.0) 673.1 2,730.8 Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Source: Company data, Goldman Sachs Research estimates. 4 December 2023 22 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List AIA Group - Margin expectations too bearish Covered by Thomas Wang (thomas.wang@gs.com, +852 2978-1697) 1299.HK Buy 12m Price Target: HK$97 Price: HK$66.85 GS Forecast Market cap: HK$772.2bn / $98.8bn Net inc. ($ mn) 12/22 12/23E 12/24E 12/25E 3,331.0 4,760.1 6,679.6 7,374.5 3m ADTV :HK$1.8bn/ $232.4mn EPS ($) Hong Kong EPS growth (%) Greater China Insurance P/E (X) DPS ($) M&A Rank: 3 Dividend yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 45.1% 0.28 0.41 0.60 0.67 (54.6) 48.1 44.8 12.4 35.6 20.7 14.3 12.7 0.20 0.21 0.23 0.26 3.0 2.0 2.5 2.7 P/B (X) 2.6 2.5 2.3 2.1 ROE (%) 6.6 11.3 16.6 17.4 P/EV (X) 1.7 1.4 1.3 1.2 6/23 12/23E 6/24E 12/24E EPS ($) 0.19 0.22 0.30 0.30 Core thesis: As Covid disruptions and macro risks unwind, Thomas expects AIA to deliver strong VONB growth (18% CAGR in FY22-26), driven by: 1) the recovery and growth in sales to mainland Chinese visitors in HK, and 2) strong VONB growth in mainland China on the back of footprint-expansion, enlarged customer base following the build-out of its bancassurance distribution, and resilient consumer demand. AIA’s strong balance sheet, evident in its US$10bn share buyback program (2022-2024) and progressive dividend policy, in addition to rising bond yield, supports Thomas’s expectation of improvements in operating ROE (from 15% in FY23 to 18% by FY26). AIA now trades at 1.3X FY24E P/EV, near historical lows in 2016/2022 when the market had concerns about tightening in capital control (2016) and Covid lockdown (2022). Key debates: n Demand for high margin protection products: A larger-than-expected decline in 1H23 margin in mainland China raised investors’ concern that AIA’s affluent target consumers are reducing purchases for protection products. Thomas believes the margin decline was due to a mix of: 1) industry-wide push for savings products, and 2) AIA’s build-out of its bancassurance distribution. Underlying demand for high-margin protection product was resilient, as demonstrated by the strong double-digit growth in 3Q23. n 4 December 2023 Pace of footprint expansion in China: Despite receiving new licenses in Sichuan, Hubei, Henan, Tianjin, and Hebei since 2020, VONB contribution from these new branch offices has remained low, at 4% in 1H23. Thomas believes this was mainly the result of Covid-related disruptions, which significantly restricted AIA’s ability to recruit and develop new agents over the last 3 years. He sees a more aggressive pace of expansion in the coming 2-3 years, leading to greater contribution from the new branch offices. 23 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List n Yield gap supports HK MCV growth momentum: Thomas believes the sequential decline in sales to mainland Chinese visitors (MCV) in 3Q23 was more of a reflection of the initial pent-up demand, rather than a decline in appetite from onshore consumers. Elevated US bond yield and cuts in deposit rates by onshore banks means that yield gap between HK insurance products and onshore savings products have widened since early 2023. This should enhance the attractiveness of HK insurance products for onshore consumers. Thomas expects VONB growth in HK to remain at 20% or higher in FY24-26E. Catalysts: 1) Growth in the number of mainland Chinese visitors to HK in Dec and around the Chinese new year holiday in Feb 2024 could lead to improved confidence on HK MCV sales; 2) 4Q results to confirm VONB growth momentum; and 3) May 2024 disclosure of FY23 product mix in mainland China and 1Q24 MCV sales product mix. Valuation: 12m TP of HK$97 based on 14X forward new business multiple, implying 1.9X FY24E P/EV. Exhibit 17: Resilient demand from affluent consumers is reflected in AIA China’s higher margin vs. Chinese peers Exhibit 18: AIA is trading near historical lows, despite strong VONB growth outlook in next 3 years Agency channel VONB / APE (%) AIA 1-year rolling forward P/EV As of Nov-23, 2023 70% 60% AIA 1-year rolling forward P/EV 2.3 2.4 59% 2.2 2.2 50% 40% 2.1 34% 24% 25% 1.6 1.7 1.5 1.4 20% 1.0 0% AIA China Ping An China Life CPIC China Taiping NCI 1.5 1.4 1.4 1.2 10% 1.9 1.7 1.8 33% 30% 2.1 2.0 2.0 43% 1.3 1.3 1.4 1.3 1.2 1.2 1.0 0.8 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Source: Company data, Goldman Sachs Global Investment Research Source: Thomson Reuters Eikon, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n AIA Group (1299.HK): Addressing key investor questions on 1H23 results; Buy n AIA Group (1299.HK): First Take: VONB beats on broad-based growth momentum, China margin improves; Buy 24 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Where we are different: Thomas is more positive on demand from the affluent consumers in mainland China, reflected in his expectation of continued VONB growth momentum in both mainland China and in HK (i.e. sales to MCV, mainland Chinese visitors). He believes margin has likely bottomed out and should improve sequentially in 2H23 and 2024, driven by both growth in protection products and higher margin for savings products. Goldman Sachs Buy APAC Conviction List Balance Sheet ($ mn) _____________________________________ AIA Group (1299.HK) Rating since Dec 2, 2010 CL Ratios & Valuation _______________________________________ ROE (%) ROTE (%) ROA (%) ROEV (%) Div. payout ratio (%) P/E (X) Dividend yield (%) P/B (X) P/NTA per share (X) EVPS ($) P/Embedded value (X) 12/22 6.6 6.3 1.1 (1.8) 12/23E 11.3 11.2 1.8 7.9 12/24E 16.6 16.4 2.4 13.2 12/25E 17.4 17.3 2.4 13.8 70.6 35.6 2.0 2.6 4.18 5.82 1.7 50.7 20.7 2.5 2.5 3.97 5.98 1.4 38.4 14.3 2.7 2.3 3.87 6.59 1.3 38.4 12.7 3.0 2.1 3.66 7.29 1.2 Growth & Margins (%) ____________________________________ 12/23E 12/24E 12/25E 57.0 ---- 51.0 ---- 52.5 ---- 53.6 ---- Price Performance _______________________________________ 1299.HK (HK$) Hang Seng Index 110 26,000 100 24,000 90 22,000 80 20,000 70 18,000 60 12/22 8,020.0 237,941.0 63,363.7 163,872.3 12/23E 8,421.0 244,584.0 63,628.7 170,014.4 12/24E 8,842.1 262,985.4 68,347.6 183,028.1 12/25E 9,284.2 283,827.0 73,745.7 197,819.1 Investments (excl. fixed income) Net customer loans & advances Net intangibles Net PP&E Other assets Total assets 10,705.0 -3,277.0 2,844.0 10,589.0 270,471.0 10,941.0 -3,440.9 2,986.2 6,751.6 274,373.6 11,609.7 -3,612.9 3,135.5 7,067.3 294,242.6 12,262.2 -3,793.5 3,292.3 7,402.7 316,629.1 Insurance reserves Customer deposits Total debt Other liabilities Total liabilities --11,206.0 22,790.0 225,323.0 --11,423.1 17,623.7 234,342.2 --11,652.7 18,247.5 252,741.6 --11,886.9 18,905.9 272,579.1 44,672.0 -476.0 45,148.0 39,546.0 -485.5 40,031.5 41,002.8 -498.2 41,501.0 43,537.8 -512.2 44,050.1 270,471.0 274,373.6 294,242.6 316,629.1 0.26 15.8 0.35 7.4 0.42 4.7 0.49 2.6 Total common equity Other comprehensive income Minorities / others Total shareholders' equity Total liabilities & equity NBVPS ($) New business multiple (X) Source: Company data, Goldman Sachs Research estimates. 16,000 Jan-23 Apr-23 Absolute Rel. to the Hang Seng Index Jul-23 Oct-23 3m (6.1)% 6m (11.1)% 12m (16.8)% 2.5% (3.8)% (7.4)% Source: FactSet. Price as of 1 Dec 2023 close. Income Statement ($ mn) __________________________________ 12/22 -- 12/23E -- 12/24E -- 12/25E -- -0.0 -- -0.0 -- -0.0 -- -0.0 -- 3,331.0 4,760.1 6,679.6 7,374.5 Investment income (pretax) P&C other income Non-life pre-tax result P&C net profit ---- ---- ---- ---- ---- ---- ---- ---- Other pre-tax profit Other net profit -- -- -- -- -- -- -- -- 4,415.0 (28,593.0) 28,593.0 4,415.0 5,960.1 11,810.8 (11,810.8) 5,960.1 7,956.0 13,968.9 (13,968.9) 7,956.0 8,781.5 15,027.6 (15,027.6) 8,781.5 (1,050.0) (34.0) 3,331.0 -3,331.0 (1,190.1) (9.9) 4,760.1 -4,760.1 (1,263.3) (13.1) 6,679.6 -6,679.6 (1,392.6) (14.4) 7,374.5 -7,374.5 0.28 0.20 0.41 0.21 0.60 0.23 0.67 0.26 Life insurance income Net invs income (life) Life other income Life pre-tax op. results Life net profit P&C gross written premium (GWP) Non-life u.writing income Total insurance income Total investment income Total other income Pre-tax profit Provision for taxes Minorities / other Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) ($) DPS ($) 4 December 2023 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Life new bus. margin (% of APE) Life new bus. margin (% of PVP) P&C combined ratio Bank net interest margin 12/22 Cash & cash equivalents Total investments Equity investments Debt investments 25 Goldman Sachs APAC Conviction List HDFC Bank - Synergies to drive substantial market share gains Covered by Rahul Jain (rahul.m.jain@gs.com, +91 22 6616-9161) HDBK.BO Buy 12m Price Target: Rs2002 Price: Rs1555.5 GS Forecast 3/23 3/24E 3/25E 3/26E 441,085.8 599,471.3 792,049.3 959,699.3 79.05 79.07 104.47 126.58 18.6 0.0 32.1 21.2 India Financials P/E (X) 18.9 19.7 14.9 12.3 P/B (X) 3.0 2.7 2.4 2.1 M&A Rank: 3 ROA (%) 1.9 1.9 2.0 2.1 ROE (%) 17.0 16.7 16.9 18.0 Price/PPOP (X) 16.8 13.2 10.3 8.3 1.3 1.4 1.7 2.0 6/23 9/23 12/23E 3/24E 21.38 21.20 20.65 22.90 Market cap: Rs11.8tr / $141.6bn Net inc. (Rs mn) 3m ADTV: NA EPS (Rs) India EPS growth (%) Dividend yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 28.7% EPS (Rs) Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: HDFC Bank has potential to gain substantial market share in both lending and deposits over the next few years, driven by expanding distribution network and increasing cross-selling opportunities to existing customers. Rahul estimates it will deliver top quartile earnings growth of c.22%+ in FY24E-26E driven by an 18% CAGR in its loan book and improving return ratios (avg. ROA/ROE at c.2.0% and 16.6% over FY24-26E). The stock trades 1 std dev below its LT mean-valuation, after adjusting SOTP value for its group businesses, which Rahul sees as compelling. n Liabilities growth versus asset growth: HDFC Bank reported a loan deposit ratio of 107% as of 2QFY24 after it merged with HDFC Ltd raising investor concerns on both liquidity and cost of funds. However, Rahul expects HDFC Bank to grow its deposit base at 21% CAGR over FY23-26E, a 400bps market share gain, driven by both expanding distribution network and productivity gains. n Margin trajectory: Rahul forecasts NIMs to expand from 3.5% in FY24E on a consolidated basis to c.3.8% by FY31E, driven by 1) changing loan book mix in favor of retail loans, 2) cost efficiencies driven by cross-sell synergies, and, 3) realization of benefits from distribution network expansion carried out in the last 5 years. n Return profile to improve: Rahul continues to model superior return ratios for HDFC Bank including avg ROA of c.2.0% over FY24-FY26E. On ROE, he forecasts an expansion back to c.18% by FY26E driven by improvement in NIMs, operating leverage and balance sheet leverage, with long-term normalization at c.20%. Where we are different: 1) Superior deposit growth key to story: The combination of an expanding and maturing branch network (c.60% of existing branches <10 yrs old), mortgage lending post merger with HDFC Ltd, and strong retail lending business should help grow deposits at a CAGR of +21% over FY23-26E, stronger vs the system. 2) 4 December 2023 26 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List Operating leverage to improve; HDFC Bank to have best-in-class cost-to-income ratios: Rahul estimates cost-to-income ratio will fall from c.41% in FY24E to c.37% by FY26E and c.32% by FY31E, with shorter breakeven period for new branches with increased product offerings (mortgage loans) and operating leverage. HDFC Bank will be one of the best operating efficiency stories in the India Bank sector with the cost-to-income gap to its closest peer ICICI Bank rising from 130bps to 820bps by FY26E. 3) PPOP growth to be stronger than peer-banks: Rahul expects HDFC Bank to deliver 23% CAGR PPOP growth in FY24E-26E vs. 11%/15% FY24E-FY26E at ICICI Bank/Axis Bank, with FY25E operating profit ahead of VA consensus by +5%. better than expected growth would allow the bank to have better control over its margins as well as drive operating leverage. Valuation: 12m SOTP-based TP of Rs2,002, c.2.8X FY24-FY25E standalone BVPS for the banking business (c.90% of the value), HDFC Life contributes 5%, followed by HDB Financial Services (NBFC), and rest from other subsidiaries. Exhibit 19: HDFC Bank has managed to get higher incremental market share gains across states in 1Q19-3Q23 vs FY15-1Q19 period Exhibit 20: Rahul expects HDFC Bank’s investments in increasing its distribution footprint should start bearing fruit from FY24E onwards, widening the cost to income ratio differential vs ICICI Bank to c820bps in FY26 Source: RBI, Govt. Website Source: Company data, Goldman Sachs Global Investment Research 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: 1) Consistency in deposit share and quality of deposits (CASA): A better than forecast acceleration in deposit share gain could drive better than expected NIMs, as well as alleviate cost of funds concerns. 2) NIM improvement: Better-than-expected or sooner-than-expected improvement in NIMs could act as a catalyst for the company Rahul expects margins to improve from FY25E onwards. 3) Loan growth acceleration: Rahul models loan growth to remain healthy at 18% CAGR over FY23-FY26E; however, Relevant Research: 4 December 2023 n HDFC Bank: The Rise of a Giant; Returns/Growth Outlook Positive; Reinstate at Buy n HDFC Bank: Head-to-Head Comparison: HDFC vs ICICI; HDFC at inflection point 27 Goldman Sachs Income Statement (Rs mn) _________________________________ HDFC Bank (HDBK.BO) Rating since Jun 21, 2023 CL Ratios & Valuation _______________________________________ P/E (X) Price/PPOP (X) P/B (X) P/NTA per share (X) 3/23 18.9 16.8 3.0 2.98 3/24E 19.7 13.2 2.7 2.69 3/25E 14.9 10.3 2.4 2.37 3/26E 12.3 8.3 2.1 2.07 Dividend yield (%) Div. payout ratio (%) 1.3 24.0 1.4 27.7 1.7 25.0 2.0 25.0 Growth & Margins (%) ____________________________________ BVPS growth Total revenue growth Op. profit growth Net inc growth EPS growth 3/23 16.0 16.3 9.9 19.3 18.6 3/24E 15.0 28.2 27.0 35.9 0.0 3/25E 13.7 23.9 28.1 32.1 32.1 3/26E 14.6 19.9 23.8 21.2 21.2 DPS growth 22.6 15.2 19.4 21.2 For the exclusive use of MATTHEW.X.WONG@GS.COM Asset Quality ___________________________________________ Provision charge/total loans (%) Gr impaired assets/total loans (%) NPL ratio (%) Total provisions/total loans (%) 3/23 0.7 1.1 1.1 0.8 3/24E 0.4 1.4 1.4 1.1 3/25E 0.4 1.3 1.3 1.1 3/26E 0.5 1.3 1.3 1.0 Specific prov/gr impair assets (%) Loan loss reserve/NPLs (%) 75.8 75.8 80.1 80.1 79.6 79.6 74.7 74.7 Capital Item ____________________________________________ 3/23 0.0 17.1 Basel 3 CET1 ratio (%) Tier 1 capital ratio (%) 3/24E 17.3 18.8 3/25E 17.0 18.6 3/26E 16.8 18.4 Price Performance _______________________________________ HDBK.BO (Rs) India BSE30 Sensex 1,900 80,000 1,800 75,000 1,700 70,000 1,600 65,000 1,500 60,000 1,400 55,000 Jan-23 Absolute Rel. to the India BSE30 Sensex Apr-23 Jul-23 Oct-23 3m (1.2)% (4.3)% 6m (3.0)% (10.3)% 12m (3.9)% (9.9)% Source: FactSet. Price as of 1 Dec 2023 close. 3/23 868,422.4 238,440.0 (13,411.0) 87,118.0 3/24E 1,084,819.6 286,723.9 30,930.0 111,553.5 3/25E 1,356,950.1 352,000.8 30,930.0 126,973.0 3/26E 1,638,179.4 418,880.9 30,930.0 151,064.1 Total revenue Compensation & benefits exp. Non-employee costs Pre-provision op. profit Provision for loans Total provision expense Income/(loss) from associates 1,180,569.4 (155,123.6) (334,257.4) 704,048.5 (119,196.7) (119,196.7) -- 1,514,027.0 (211,312.4) (425,262.2) 893,974.2 (107,874.4) (107,874.4) -- 1,875,853.8 (262,444.4) (487,919.8) 1,145,020.1 (121,909.4) (121,909.4) -- 2,249,404.4 (304,072.9) (550,556.7) 1,417,106.6 (162,597.7) (162,597.7) -- Pre-tax profit Provision for taxes Minority interest Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rs) EPS (diluted, pre-except) (Rs) EPS (basic, post-except) (Rs) EPS (diluted, post-except) (Rs) 584,851.8 (143,766.0) 0.0 441,085.8 -441,085.8 79.05 --79.05 786,099.9 (186,628.6) 0.0 599,471.3 -599,471.3 79.07 --79.07 1,023,110.7 (231,061.4) 0.0 792,049.3 -792,049.3 104.47 --104.47 1,254,508.9 (294,809.6) 0.0 959,699.3 -959,699.3 126.58 --126.58 Wtd avg shares out. (diluted) (mn) Avg. yield on loans (%) Gr yld. on int. earning assets (%) Cost of fund (%) Net interest margin (%) 5,579.7 8.6 7.5 3.9 3.8 7,581.8 9.3 8.9 5.7 3.5 7,581.8 9.3 8.4 5.3 3.6 7,581.8 9.1 8.3 5.0 3.7 Net interest income Net fees Treasury income Other operating income Balance Sheet (Rs mn) ____________________________________ 3/24E 7,639,850.1 5,302,481.6 3/25E 9,358,816.4 6,250,329.2 3/26E 11,230,579.6 7,440,033.4 Domestic commercial lending Total overseas lending, gross Gross loans to customers Total NPLs, gross 9,738,892.7 12,882,167.6 0.0 0.0 16,142,365.0 26,074,621.0 180,190.3 366,043.5 14,868,196.6 0.0 30,801,157.0 406,794.8 17,462,200.0 0.0 36,497,277.3 487,766.5 Total loan loss reserve Net customer loans & advances Other interest earning assets Interest earning assets 136,506.0 293,337.4 16,005,859.0 25,824,499.3 181,501.4 587,627.6 23,111,496.6 35,019,901.8 323,814.8 30,477,342.2 587,627.6 40,624,357.1 364,464.2 36,132,813.1 587,627.6 47,472,745.4 Other non-int. earning assets Total assets Risk weighted assets CASA deposits 1,549,318.2 2,139,061.5 24,660,814.9 37,158,963.3 16,105,553.5 23,026,101.9 2,734,960.0 3,197,403.3 2,331,104.1 42,955,461.2 26,582,263.2 3,773,484.7 2,541,182.6 50,013,928.0 30,914,561.3 4,559,737.1 Non-CASA deposits Customer deposits Other paying liabilities Other liabilities 16,098,986.5 21,194,327.3 18,833,946.5 24,391,730.6 117,907.6 333,988.0 839,314.9 933,163.1 25,577,384.3 29,350,869.0 317,288.6 979,821.2 31,241,339.3 35,801,076.4 301,424.2 1,028,812.3 Total liabilities Total shareholders' equity Total liabilities & equity BVPS (Rs) 21,858,824.7 32,780,419.1 2,801,990.2 4,378,544.2 24,660,814.9 37,158,963.3 502.18 577.51 37,978,930.7 4,976,530.5 42,955,461.2 656.38 44,309,352.9 5,704,575.2 50,013,928.0 752.40 61.9 61.8 Domestic mortgages Domestic non-mortgages RWA/assets (%) 3/23 1,020,670.0 5,246,296.3 65.3 62.0 Profit Drivers ___________________________________________ 3/23 3/24E 3/25E 3/26E Net customer loan growth (%) Net interest margin (%) Fee income ratio (%) Cost/income (ex. goodwill) (%) Tax rate (%) CASA ratio (%) 16.9 3.8 26.1 40.4 24.6 14.5 61.3 3.5 28.9 41.0 23.7 13.1 18.0 3.6 28.1 39.0 22.6 12.9 18.6 3.7 27.6 37.0 23.5 12.7 Net cust. loans/deposits (%) 85.0 105.9 103.8 100.9 Profitability _____________________________________________ Op. revenue/avg. assets (%) Op. expenses/avg. assets (%) Pre-provision ROA (%) Loan loss prov./avg. assets (%) Pre-tax profit/avg. assets (%) Prov. for inc. tax/avg. assets (%) 3/23 5.2 2.1 3.1 0.5 2.6 0.6 3/24E 4.9 2.0 2.9 0.3 2.5 0.6 3/25E 4.7 1.8 2.9 0.3 2.6 0.6 3/26E 4.8 1.8 3.0 0.3 2.7 0.6 ROA (%) Leverage (X) ROE (%) ROE (pre-except.) (%) 1.9 8.8 17.0 17.0 1.9 8.5 16.7 16.7 2.0 8.6 16.9 16.9 2.1 8.8 18.0 18.0 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 28 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List MUFG - Rates and reform driven upside Covered by Makoto Kuroda (makoto.kuroda@gs.com, +81 3 6437-9920) 8306.T Buy 12m Price Target: ¥1520 Price: ¥1273 GS Forecast Market cap: ¥15.3tr / $103.7bn Net inc. (¥ bn) 3/23 3/24E 3/25E 3/26E 1,116.5 1,321.1 1,359.9 1,381.3 90.7 111.3 116.2 118.0 2.6 22.7 4.3 1.6 8.6 11.4 11.0 10.8 3m ADTV :¥100.4bn/ $673.6mn EPS (¥) Japan EPS growth (%) Japan Financials P/E (X) P/B (X) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 19.4% 0.5 0.8 0.8 0.7 M&A Rank: 3 ROA (%) 0.3 0.3 0.3 0.3 ROE (%) 6.5 7.4 7.3 7.1 Price/PPOP (X) 9.6 9.2 9.1 9.0 Dividend yield (%) 4.1 3.2 3.3 3.3 9/23 12/23E 3/24E 6/24E 30.7 29.9 3.4 25.1 EPS (¥) Core thesis: Makoto sees MUFG’s profit momentum as strong, due in part to improved overseas interest spreads, but also growth in loan-related fees and treasury earnings. Domestically, whilst potential BOJ policy action will be on investors’ minds into 2024, ROE is already rising from self-help initiatives including improving loan book NIMs, adjustments to business risk and reduction in cross-shareholdings. The improvement in total shareholder returns through buybacks and dividends should continue, with above-target CET1, relatively clean balance sheet (1.1% NPL ratio), and tailwinds from TSE corporate governance reform. MUFG’s new midterm plan for FY3/27, due to be announced in May 2024, should offer further details on this next stage of ROE improvement. Apart from interest rate upside, Makoto also expects continued strength in domestic/overseas corporate business & treasury/ALM, as well as recovery in Asia subsidiaries and capital markets to drive FY3/25E earnings. Key debates: n Next mid-term plan: This is a key focus event, with the market awaiting details on ROE targets/profit levels for the next three years. While equity method profit contribution from MS may slow down next FY, Makoto sees offsetting rise from cross-shareholding unwinds, loan NIM improvement, improved fee income, recovery at its ASEAN subsidiaries. n 4 December 2023 Interest rate rises: BOJ interest rate outlook, potential yield curve shape and impact on bank’s P/L and B/S are key discussions into potential BOJ interest rate normalization post-shunto wage hikes. Notably, MUFG has short-dated JGBs that can be repriced faster and a sophisticated treasury book; MUFG has raised term deposit rates but 84% of deposits are ordinary deposits that Makoto believes are unlikely to reprice given their low beta going into NIRP suggests low beta on the way up. 29 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List Where we are different: Makoto’s detailed sensitivity analysis of banks’ profits on various yield curve scenarios suggest that the market may be underappreciating MUFG’s sensitivity to a potential rise in yen rates, and the benefit from higher recurring income as its shorter-duration JGBs and loans repricing more than deposits. Catalysts: Macro - BOJ monetary policy meetings, BOJ operations (reduction in JGB purchase amount), wage & inflation data. Fundamentals - new mid-term plan announcement in May, which Makoto believes may include details on growth investment, and an ROE target higher than 7.5% on a self-help basis before factoring in higher yen rates; a path toward 9-10% long-term ROE. Valuation: 12m TP of ¥1,520 is based on a target P/B of 0.93X and end-FY3/25E BPS estimate of ¥1,635. Exhibit 21: Large corporate loan spreads improving SMFG Mizuho CAB reinvest in JGBs ST yield rise to 0.1% LT yield rises to 1.3% ROE path without rate rise 12.0% 10.0% 0.7% 8.0% 0.6% 0.4% 0.6% 1.3% 6.0% 4.0% 0.5% 8.0% 2.0% 0.4% 0.0% 0.3% 0.2% Source: Company data, Goldman Sachs Global Investment Research Midte… MUFG FY3/12 FY3/13 FY3/14 FY3/15 FY3/16 FY3/17 FY3/18 FY3/19 FY3/20 FY3/21 FY3/22 FY3/23 FY3/… FY3/… FY3/… Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n Japan Banks: Implications of YCC adjustment n MUFG (8306.T): Earnings Review: 2Q above expectations; FY23 guidance unchanged, but announces Y400bn share buyback; Buy 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 0.8% Exhibit 22: Megabanks’ ROEs on the rise 30 Goldman Sachs Income Statement (¥ bn) __________________________________ MUFG (8306.T) CL Rating since Dec 15, 2022 Ratios & Valuation _______________________________________ P/E (X) Price/PPOP (X) P/B (X) P/NTA per share (X) 3/23 8.6 9.6 0.5 -- 3/24E 11.4 9.2 0.8 -- 3/25E 11.0 9.1 0.8 -- 3/26E 10.8 9.0 0.7 -- Dividend yield (%) Div. payout ratio (%) 4.1 35.3 3.2 36.8 3.3 36.2 3.3 35.6 Growth & Margins (%) ____________________________________ BVPS growth Total revenue growth Op. profit growth Net inc. growth EPS growth 3/23 6.2 13.6 31.0 (1.3) 2.6 3/24E 8.9 (1.1) 4.9 18.3 22.7 3/25E 4.8 1.1 0.4 2.9 4.3 3/26E 4.6 4.3 1.6 1.6 1.6 DPS growth 14.3 28.1 2.4 0.0 For the exclusive use of MATTHEW.X.WONG@GS.COM Asset Quality ___________________________________________ Provision charge/total loans (%) Gr impaired assets/total loans (%) NPL ratio (%) Total provisions/total loans (%) 3/23 0.6 -NM -- 3/24E 0.4 -NM -- 3/25E 0.3 -NM -- 3/26E 0.3 -NM -- Specific prov/gr impair assets (%) Loan loss reserve/NPLs (%) -NM -NM -NM -NM Capital Item ____________________________________________ 3/23 --- Basel 3 CET1 ratio (%) Tier 1 capital ratio (%) 3/24E --- 3/25E --- 3/26E --- Price Performance _______________________________________ 8306.T (¥) TOPIX 1,600 2,800 1,400 2,600 1,200 2,400 1,000 2,200 800 2,000 600 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 7.6% 6.1% 6m 32.1% 19.1% 12m 70.2% 41.9% Source: FactSet. Price as of 1 Dec 2023 close. Net interest income Net fees Treasury income Other operating income Total revenue Compensation & benefits exp. Non-employee costs Pre-provision op. profit Provision for loans Total provision expense Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) Wtd avg shares out. (diluted) (mn) Avg. yield on loans (%) Gr yld. on int. earning assets (%) Cost of fund (%) Net interest margin (%) 3/23 2,907.5 1,695.4 372.1 (472.0) 3/24E 2,434.8 1,731.5 266.2 20.0 3/25E 2,524.4 1,729.9 224.0 24.5 3/26E 2,717.1 1,733.0 224.0 24.5 4,503.0 -(2,908.7) 1,594.3 (674.8) (674.8) 425.8 4,452.5 -(2,780.7) 1,671.8 (414.0) (414.0) 385.3 4,502.8 -(2,824.9) 1,677.9 (307.4) (307.4) 350.0 4,698.6 -(2,993.9) 1,704.8 (309.2) (309.2) 350.0 1,569.9 (369.6) -1,116.5 -1,116.5 90.7 90.7 90.7 90.7 1,815.5 (419.5) -1,321.1 -1,321.1 111.3 111.3 111.3 111.3 1,919.9 (480.0) -1,359.9 -1,359.9 116.2 116.2 116.2 116.2 1,948.4 (487.1) -1,381.3 -1,381.3 118.0 118.0 118.0 118.0 12,305.7 ----- 11,864.9 ----- 11,706.2 ----- 11,706.2 ----- Balance Sheet (¥ bn) _____________________________________ 3/23 --- 3/24E --- 3/25E --- 3/26E --- ----- ----- ----- ----- Total loan loss reserve Net customer loans & advances Other interest earning assets Interest earning assets -109,146.3 86,746.9 309,523.3 -111,993.3 90,449.9 311,068.6 -114,173.0 94,325.7 317,124.1 -115,614.0 94,325.7 318,565.1 Other non-int. earning assets Total assets Risk weighted assets CASA deposits 77,276.1 386,799.5 --- 90,389.0 401,457.6 --- 91,675.5 408,799.6 --- 92,525.9 411,091.1 --- Non-CASA deposits Customer deposits Other paying liabilities Other liabilities -213,609.5 13,632.6 125,575.8 -216,751.3 16,274.2 132,682.4 -219,970.0 16,515.9 135,695.7 -222,424.0 16,700.2 134,459.2 Total liabilities Total shareholders' equity Total liabilities & equity BVPS (¥) 368,526.6 18,272.9 386,799.5 1,433.1 382,087.8 19,369.8 401,457.6 1,561.1 388,561.6 20,238.1 408,799.6 1,635.3 389,963.4 21,127.7 411,091.1 1,711.3 -- -- -- -- Domestic mortgages Domestic non-mortgages Domestic commercial lending Total overseas lending, gross Gross loans to customers Total NPLs, gross RWA/assets (%) Profit Drivers ___________________________________________ 3/23 3/24E 3/25E 3/26E Net customer loan growth (%) Net interest margin (%) Fee income ratio (%) Cost/income (ex. goodwill) (%) Tax rate (%) CASA ratio (%) (1.2) -NM 64.6 23.5 -- 2.6 -NM 62.5 23.1 -- 1.9 -NM 62.7 25.0 -- 1.3 -NM 63.7 25.0 -- Net cust. loans/deposits (%) 51.1 51.7 51.9 52.0 Profitability _____________________________________________ Op. revenue/avg. assets (%) Op. expenses/avg. assets (%) Pre-provision ROA (%) Loan loss prov./avg. assets (%) Pre-tax profit/avg. assets (%) Prov. for inc. tax/avg. assets (%) 3/23 1.2 0.8 0.4 0.2 0.4 0.1 3/24E 1.1 0.7 0.4 0.1 0.5 0.1 3/25E 1.1 0.7 0.4 0.1 0.5 0.1 3/26E 1.1 0.7 0.4 0.1 0.5 0.1 ROA (%) Leverage (X) ROE (%) ROE (pre-except.) (%) 0.3 21.2 6.5 6.2 0.3 20.7 7.4 7.0 0.3 20.2 7.3 6.9 0.3 19.5 7.1 6.7 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 31 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Oversea-Chinese Banking Corp - Shareholder returns inflection Covered by Melissa Kuang (melissa.kuang@gs.com, +65 6889-2869) OCBC.SI Buy 12m Price Target: S$15.5 Price: S$12.64 GS Forecast Market cap: S$57.1bn / $42.7bn Net inc. (S$ mn) 12/22 12/23E 12/24E 12/25E 5,748.0 7,233.3 7,447.9 7,344.5 3m ADTV :S$54.9mn/ $40.4mn EPS (S$) 1.27 1.60 1.65 1.63 18.3 25.8 3.0 (1.4) Asean Financials P/E (X) 9.5 7.9 7.7 7.8 P/B (X) 1.1 1.1 1.0 1.0 M&A Rank: 3 ROA (%) 1.0 1.3 1.2 1.2 ROE (%) 12.8 Singapore EPS growth (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 22.6% 11.2 13.9 13.7 Price/PPOP (X) 8.6 6.9 6.9 7.0 Dividend yield (%) 5.6 6.7 7.2 7.4 9/23 12/23E 3/24E 6/24E 0.40 0.41 0.43 0.42 EPS (S$) Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: OCBC is a self-help story. The company has started to show its willingness to return capital to shareholders (new dividend policy of a minimum 50% payout), optimise its capital structure and reduce the drag on ROEs. According to Melissa, this should drive a narrowing of the valuation gap with peers with OCBC currently trading at 1-year forward P/B discount to peers of -12%. In a blue sky scenario, where OCBC fully pares its excess capital of S$5bn (8.7% of OCBC’s market cap and 87% of 2023E net income), Melissa sees Group ROEs rising to 15.1% in 2024E from her current forecast of 13.7%. n Willingness to pay: Underpinned by her deep dive analysis into OCBC, Melissa argues this change around capital management is underestimated by the market. The next-step is for OCBC to increase its core payout to reduce the build up in excess capital at both OCBC and GEH. She forecasts dividend payout ratios to rise to 58% by 2025E from 53% in 2022. n OCBC Bank capability to pay: Melissa sees OCBC Bank as able to further lift dividends closer to 70% to maintain a more stable CET1 ratio. OCBC Bank is capital generative given its decent profitability, muted loan growth as well as its low dividend payout ratio. Melissa’s analysis shows over the next three years, a move towards 70% dividend payout ratio for the bank entity assuming 2.5% CAGR in loan growth in 2023-2025E would see it better able to cap the rise in CET1 to prevent further drag on its ROEs. Where we are different: GEH to support OCBC dividend policy, given robust capital levels. GEH has been a drag on OCBC’s dividend payout given its lower dividend payout of 28-39% over the last five years while accounting for 11-22% of total group net income. Melissa forecasts the dividend payout to rise to 60% by 2025 as: (1) profitability 4 December 2023 32 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List improves with ROEs rising supported by higher investment returns given the higher interest rate environment, (2) solvency/CET1 ratios remain robust at its local entities, and (3) importantly, its increased willingness to pay as evident from the raising of its interim dividend to S$0.35, a 38% payout ratio, from S$0.10 in 1H22, a 21% payout. GEH changed the dividend policy at 1H23 to one that will be progressive and in line with profit trends vs a steady dividend policy based on sustainable profit levels in the past. Furthermore, there is S$2.4bn of surplus capital held at the Hold Co level sitting on GEH’s balance sheet, weighing on its ROEs. Valuation: 12m TP of S$15.50 is based on 2-staged DDM model. Exhibit 23: Excess capital of S$5.0bn, 8.7% of market cap, could lead to 1.4ppt uplift in 2024 ROE if pared back ROE GEH excess Excess capital as% of market cap % 18 DBS: 4.7% ROE uplift with excess liquiditiy paid out GEH deduction on CET1 12 16.3 10 20 13 10 12 - 11 (10) 10 (20) 9 UOB: 1.4% 0.6 0.6 0.8 14 Asset to equity (x) 14 ROA (%) 30 OCBC: 5.1% GEH: 3.6% 1.1 16 Exhibit 24: While group asset to equity ratio has fallen to a low, OCBC bank standalone has closed the ROA gap to DBS since 2022 0.2 17.4% 15.1% 13.7 13.7 14.0% 8 (30) 8 2013 6 DBS OCBC UOB For DBS, Melissa reversed the -$2.5bn hit to equity from cash flow hedges 2014 2015 2016 2017 Asset to equity (OCBC, RHS) 2018 2019 2020 2021 2022 9M23 ROA gap (OCBC ex GEH - UOB) 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: 1) Any further clarity on the pace of capital repatriation from OCBC or Great Eastern. 2) Announcement of OCBC’s final dividend in Feb 2024 - Melissa views a 2023 final dividend payout at similar levels to 2022 levels of 53% or higher will be positive and demonstrate OCBC’s willingness to return to shareholders. 3) Announcement of GEH final dividend in Feb 2024. Melissa views a higher payout of min 50% earnings inline with OCBC’s new dividend policy from its historical 28-39% would lift the ability for OCBC to raise its dividend payout. ROA gap (OCBC ex GEH - DBS) Source: Company data, Goldman Sachs Global Investment Research Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n OCBC: Higher dividends to close the valuation gap; reiterate Buy n OCBC: 3Q23 Earnings Review: Running on track, still potential for higher capital payout n OCBC: Potential for more capital returns still there; PTBC deal small 33 Goldman Sachs Income Statement (S$ mn) _________________________________ Oversea-Chinese Banking Corp. (OCBC.SI) Rating since May 2, 2023 CL Ratios & Valuation _______________________________________ P/E (X) Price/PPOP (X) P/B (X) P/NTA per share (X) Dividend yield (%) Div. payout ratio (%) 12/22 9.5 8.6 1.1 -- 12/23E 7.9 6.9 1.1 -- 12/24E 7.7 6.9 1.0 -- 12/25E 7.8 7.0 1.0 -- 5.6 53.4 6.7 53.1 7.2 55.2 7.4 57.8 Growth & Margins (%) ____________________________________ BVPS growth Total revenue growth Op. profit growth Net inc growth EPS growth DPS growth 12/22 (0.1) 10.2 14.0 18.3 18.3 12/23E 2.2 16.4 24.6 25.8 25.8 12/24E 6.4 2.2 0.5 3.0 3.0 12/25E 5.8 0.4 (2.1) (1.4) (1.4) 28.3 25.0 7.1 3.3 For the exclusive use of MATTHEW.X.WONG@GS.COM Asset Quality ___________________________________________ Provision charge/total loans (%) Gr impaired assets/total loans (%) NPL ratio (%) Total provisions/total loans (%) 12/22 0.2 1.1 1.1 1.2 12/23E 0.2 1.0 1.0 1.1 12/24E 0.2 1.1 1.1 1.1 12/25E 0.2 1.1 1.1 1.1 Specific prov/gr impair assets (%) Loan loss reserve/NPLs (%) 38.7 103.8 24.6 112.8 12.7 104.0 4.6 94.6 Capital Item ____________________________________________ 12/22 -15.9 Basel 3 CET1 ratio (%) Tier 1 capital ratio (%) 12/23E -15.7 12/24E -16.2 12/25E -16.5 Price Performance _______________________________________ OCBC.SI (S$) FTSE Straits Times Index 14.0 3,500 13.5 3,400 13.0 3,300 12.5 3,200 12.0 3,100 11.5 3,000 Jan-23 Apr-23 Absolute Rel. to the FTSE Straits Times Index Jul-23 3m 0.7% 5.4% Oct-23 6m 3.4% 5.9% 12m 2.3% 9.1% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 7,688.0 1,851.0 (206.0) 1,028.0 12/23E 9,581.2 1,749.2 0.0 1,147.0 12/24E 9,488.1 1,924.1 0.0 1,201.8 12/25E 9,103.1 2,193.5 0.0 1,225.9 Total revenue Compensation & benefits exp. Non-employee costs Pre-provision op. profit Provision for loans Total provision expense Income/(loss) from associates 11,675.0 (3,233.0) (1,793.0) 6,649.0 (505.0) (584.0) 978.0 13,589.8 -(5,302.4) 8,287.4 (643.1) (656.1) 1,022.0 13,892.8 -(5,567.6) 8,325.3 (723.4) (723.4) 1,114.0 13,942.7 -(5,790.3) 8,152.4 (746.9) (746.9) 1,192.0 Pre-tax profit Provision for taxes Minority interest Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (S$) EPS (diluted, pre-except) (S$) EPS (basic, post-except) (S$) EPS (diluted, post-except) (S$) 6,939.0 (1,057.0) -5,748.0 -5,748.0 1.27 --1.27 8,549.3 (1,147.3) -7,233.3 -7,233.3 1.60 --1.60 8,611.8 (990.4) -7,447.9 -7,447.9 1.65 --1.65 8,493.5 (976.8) -7,344.5 -7,344.5 1.63 --1.63 Wtd avg shares out. (diluted) (mn) Avg. yield on loans (%) Gr yld. on int. earning assets (%) Cost of fund (%) Net interest margin (%) 4,515.0 3.0 2.8 1.0 1.8 4,515.0 4.9 4.7 2.8 2.2 4,515.0 4.9 4.7 2.9 2.1 4,515.0 4.6 4.3 2.7 1.9 Net interest income Net fees Treasury income Other operating income Balance Sheet (S$ mn) ____________________________________ 12/22 62,015.0 34,752.0 12/23E 63,185.2 33,222.8 12/24E 64,740.8 34,040.7 12/25E 67,341.0 35,407.9 Domestic commercial lending Total overseas lending, gross Gross loans to customers Total NPLs, gross 179,157.0 -294,980.0 3,383.0 182,717.2 -297,757.3 3,027.8 187,215.9 -305,088.3 3,254.9 194,735.1 -317,341.6 3,544.3 Total loan loss reserve Net customer loans & advances Other interest earning assets Interest earning assets 3,513.0 291,467.0 53,794.0 427,567.0 3,415.2 294,513.1 61,620.2 445,992.1 3,385.1 301,874.2 61,590.1 459,506.4 3,353.9 314,158.7 61,558.9 474,407.8 Other non-int. earning assets Total assets Risk weighted assets CASA deposits 132,389.0 559,956.0 231,648.0 181,281.0 140,118.5 586,110.6 246,669.4 169,972.1 148,368.0 607,874.4 255,828.8 175,071.2 157,196.9 631,604.7 265,815.9 185,575.5 Non-CASA deposits Customer deposits Other paying liabilities Other liabilities 168,800.0 350,081.0 212.0 28,065.0 199,839.3 369,811.4 292.0 29,944.1 205,834.5 380,905.7 292.0 29,944.1 208,043.1 393,618.6 292.0 29,944.1 Total liabilities Total shareholders' equity Total liabilities & equity BVPS (S$) 505,288.0 54,668.0 559,956.0 11.38 530,925.6 55,185.0 586,110.6 11.63 549,131.4 58,742.9 607,874.4 12.38 569,453.6 62,151.0 631,604.7 13.10 41.4 42.1 42.1 42.1 Domestic mortgages Domestic non-mortgages RWA/assets (%) Profit Drivers ___________________________________________ 12/22 12/23E 12/24E 12/25E Net customer loan growth (%) Net interest margin (%) Fee income ratio (%) Cost/income (ex. goodwill) (%) Tax rate (%) CASA ratio (%) 1.8 1.8 NM 42.2 15.2 51.8 1.0 2.2 NM 38.3 13.4 46.0 2.5 2.1 NM 39.3 11.5 46.0 4.1 1.9 NM 40.8 11.5 47.1 Net cust. loans/deposits (%) 83.3 79.6 79.3 79.8 Profitability _____________________________________________ Op. revenue/avg. assets (%) Op. expenses/avg. assets (%) Pre-provision ROA (%) Loan loss prov./avg. assets (%) Pre-tax profit/avg. assets (%) Prov. for inc. tax/avg. assets (%) ROA (%) Leverage (X) ROE (%) ROE (pre-except.) (%) 12/22 2.1 0.9 1.2 0.1 1.3 0.2 12/23E 2.4 0.9 1.4 0.1 1.5 0.2 12/24E 2.3 0.9 1.4 0.1 1.4 0.2 12/25E 2.2 0.9 1.3 0.1 1.4 0.2 1.0 10.2 11.2 10.5 1.3 10.6 13.9 13.2 1.2 10.3 13.7 13.1 1.2 10.2 12.8 12.2 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 34 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List China Medical System - A new product cycle ahead Covered by Ziyi Chen (ziyi.chen@gs.com, +852 2978-0526) 0867.HK Buy 12m Price Target: HK$18.88 Price: HK$15 GS Forecast 12/22 12/23E 12/24E 12/25E 9,150.3 8,837.1 9,383.0 11,087.8 3,887.0 3,726.5 3,827.9 4,480.9 1.33 1.33 1.40 1.64 China P/E (X) 7.5 10.3 9.8 8.4 China Pharma, Biotech & Medtech P/B (X) 1.7 2.0 1.8 1.6 Market cap: HK$37.1bn / $4.7bn Revenue (Rmb mn) Enterprise value: HK$32.8bn / $4.2bn EBITDA (Rmb mn) 3m ADTV :HK$40.1mn/ $5.1mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: No CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 25.9% 5.2 3.8 4.0 4.7 (0.7) (1.1) (1.4) (1.6) 29.1 25.0 24.5 26.4 FCF yield (%) 12.2 8.1 8.0 8.6 6/23 12/23E 6/24E 12/24E EPS (Rmb) 0.78 0.54 0.72 0.68 Core thesis: Ziyi expects CMS’ revenue/earnings growth to accelerate from flattish in 2023 to 15-20% in 2025 and beyond, driven by: 1) a new product cycle built on a license-in focused pipeline - three new products approved in ‘23, likely four more in ‘24/’25; and 2) overhang removal for its three core products (Deanxit/Plendil/Ursofalk, collectively accounting for 50% of the revenue in 2022) exposed to drug volume-based procurement (VBP), which leads to notable product sales decline. Ziyi expects their dermatology/aesthetics portfolio to become a new driver, growing at a 3-year CAGR of 45%+ along with new product launches. With ROE staying at 20%+, consistent dividend payout at 40% and earnings near inflection, valuation (trading at 9x 2024 PE vs. average HK-listed pharma peers 15x) is attractive. Key debates: 4 December 2023 n Will earnings bottom in 2H23/1H24? Three key legacy products’ post-VBP sales performance is critical to earnings in 2023/24 as they collectively contributed c.50% of revenue/profit in 2022. While there are investor concerns on the company’s capacity to meet the guidance of retaining 50% of pre-VBP sales for the three core drugs, Ziyi sees higher probability given: 1) the smooth execution demonstrated for Deanxit, with 65% of pre-VBP volume/60% of sales retained after VBP result became effective in late November 2022; and 2) Plendil/Ursofalk see higher chances of achieving the target given their similarities to Deanxit’s brand profile (25+ years of marketing in China)/channel mix (30-40% of sales from retail channel). n Can some of the pipeline value be unlocked? After five years of pipeline build-up, 2023 marks the year for CMS to start a new product cycle. However, there are market concerns over the company’s ability to deliver commercial success given the lack of meaningful new launches in recent years. Ziyi is more confident, with the company’s expanding commercial franchise (8 marketed products, 600+ sales reps, 35 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List a network of 20+ dermatologists/10k+ institutions) for dermatology/aesthetics under a new brand ‘CMS Aesthetics’ paving the way for solid commercial execution. Where we are different: 1) Pipeline value – Ziyi uses DCF valuation for newly-launched products and near-commercial candidates, including Ilumetri and Opzelura with peak sales of Rmb1.5bn/2bn, respectively, and upside option from an earlier stage pipeline once the regulatory pathway is more visible; 2) Expectations on sales outlook for core drugs post VBP - Ziyi’s analysis indicates a higher probability than what the market expects on CMS’ management guidance of retaining 50%+ of pre-VBP sales, given the company’s consistent VBP strategy since 2019, execution track record on Deanxit and branded drug’s post VBP performance in the past (link). Valuation: 12m TP of HK$18.88 is derived from: 1) valuation of Rmb39.1bn for legacy products based on a 5-year exit P/E of 9.6x (average FY24E P/E of global generic peers) and 2) DCF-based value of Rmb4.2bn for the innovative drug pipeline. Exhibit 25: Ziyi expects revenue / earnings growth to bottom out in 2023 Exhibit 26: Derma/Aesthetics to contribute 47% of 3-year incremental revenue Revenue / earnings growth of CMS (2018-2025E) Dissection of 2022-2025E revenue growth by therapeutic category Three core VBP products Non-VBP assets New Therapeutics Consumer Health Revenue yoy OP yoy 12 10 25% Others Ophthalmology 20% 15% 8 CCV GI Derma + Aesthetics 10% 6 Derma / Aesthetics contribute 47% of the incremental revenue generated between 2022 and 2025E (GS estimates) 5% 4 0% 2 -5% - -10% Revenue (2022) 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: 1) 2023 NRDL negotiation results for newly approved products, particularly Ilumetri; 2) sales/earnings performance in 2H23 post implementation of 8th batch VBP and amid industry-wide anti-corruption measures; 3) meaningful regulatory progress of ruxolitinib cream in China. Revenue (2025E) 2018A 2019A 2020A 2021A 2022A 2023E 2024E 2025E Source: Company data, Goldman Sachs Global Investment Research Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n China Medical System Holdings (0867.HK): A new product cycle ahead to drive 3-year earnings acceleration; upgrade to Buy 4 December 2023 n China Medical System Holdings (0867.HK): APAC Healthcare Corporate Day 2023 — Key Takeaways: In-line post VBP performance; Guidance maintained n China Medical System Holdings (0867.HK): Earnings Review: Deanxit delivered guided post-VBP sales in 1H; full year guidance maintained 36 Goldman Sachs Income Statement (Rmb mn) _______________________________ China Medical System Holdings (0867.HK) Rating since Oct 5, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 7.5 1.7 12.2 5.7 12/23E 10.3 2.0 8.1 8.0 12/24E 9.8 1.8 8.0 7.4 12/25E 8.4 1.6 8.6 6.0 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 5.7 29.1 23.8 (17.6) (17.6) 74.9 18.9 8.0 25.0 20.9 (24.2) (24.2) 69.6 19.4 7.4 24.5 19.5 (29.1) (29.1) 71.1 18.9 6.0 26.4 20.2 (33.2) (33.2) 83.6 18.3 84.7 102.9 22.1 0.5 1.2 12,141.7 11,641.4 83.0 98.7 19.5 0.4 1.2 12,876.5 12,408.1 79.2 92.9 18.3 0.4 1.2 13,762.0 13,000.5 75.3 89.3 18.9 0.4 1.2 14,891.3 13,766.4 5.95 6.75 7.60 8.60 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) Growth & Margins (%) ____________________________________ 12/22 12/23E 12/24E 12/25E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 9.8 12.0 8.6 11.1 40.2 42.5 (3.4) (4.1) (0.1) (0.1) 39.8 42.2 6.2 2.7 5.5 5.5 38.4 40.8 18.2 17.1 16.8 16.8 38.1 40.4 Net income margin 35.6 36.9 36.6 36.2 Price Performance _______________________________________ 0867.HK (HK$) Hang Seng China Ent. 20 8,000 18 7,500 16 7,000 14 6,500 12 6,000 10 5,500 Jan-23 Apr-23 Absolute Rel. to the Hang Seng China Ent. Jul-23 Oct-23 3m 6m 12m 32.5% 45.6% 33.5% 42.4% 32.3% 46.6% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 9,150.3 (2,114.5) (3,357.9) 0.0 12/23E 8,837.1 (2,052.9) (3,264.4) 0.0 12/24E 9,383.0 (2,252.1) (3,531.7) 0.0 12/25E 11,087.8 (2,687.6) (4,173.4) 0.0 Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -3,887.0 (209.1) 3,677.9 56.4 65.1 3,762.9 -3,726.5 (206.8) 3,519.8 81.1 290.4 3,823.8 -3,827.9 (228.8) 3,599.2 118.3 299.7 3,927.7 -4,480.9 (254.1) 4,226.7 156.9 352.1 4,591.8 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) (486.7) (17.2) -3,259.0 -3,259.0 1.33 1.33 1.33 1.33 (565.3) (1.6) -3,256.8 -3,256.8 1.33 1.33 1.33 1.33 (489.8) (1.7) -3,436.2 -3,436.2 1.40 1.40 1.40 1.40 (576.6) (2.0) -4,013.2 -4,013.2 1.64 1.64 1.64 1.64 0.52 39.2 0.52 39.2 0.55 39.2 0.64 39.2 Total revenue Cost of goods sold SG&A R&D DPS (Rmb) Div. payout ratio (%) Balance Sheet (Rmb mn) __________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 4,376.4 2,043.9 477.2 12/23E 5,831.4 1,974.0 463.3 12/24E 7,266.9 2,095.9 508.3 12/25E 8,835.5 2,476.7 606.6 Other current assets Total current assets Net PP&E Net intangibles 1,931.9 8,829.4 425.5 3,732.4 1,931.9 10,200.6 891.1 3,566.9 1,931.9 11,803.0 1,366.1 3,401.5 1,931.9 13,850.6 1,913.5 3,236.0 3,044.8 1,721.4 17,753.5 563.2 3,339.3 1,721.4 19,719.4 546.8 3,643.0 1,721.4 21,934.9 599.8 3,999.0 1,721.4 24,720.6 715.8 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 1,783.3 -530.6 2,877.1 1,783.3 -529.7 2,859.8 1,783.3 -599.9 2,983.1 1,783.3 -825.9 3,325.1 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 0.0 -139.4 139.4 0.0 -139.4 139.4 0.0 -139.4 139.4 --139.4 139.4 3,016.5 -14,589.1 148.0 17,753.5 (2,593.0) 2,999.2 -16,570.5 149.6 19,719.4 (4,048.1) 3,122.5 -18,661.1 151.4 21,934.9 (5,483.6) 3,464.5 -21,102.8 153.4 24,720.6 (7,052.1) Total investments Other long-term assets Total assets Accounts payable Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E 3,259.0 209.1 17.2 90.1 (22.1) 3,553.2 3,256.8 206.8 1.6 67.5 (294.4) 3,238.2 3,436.2 228.8 1.7 (113.8) (303.7) 3,249.1 4,013.2 254.1 2.0 (363.1) (356.1) 3,550.2 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (524.9) (353.0) -(300.3) (1,178.2) (507.0) ---(507.0) (538.3) ---(538.3) (636.1) ---(636.1) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow -(1,276.2) -(123.7) (1,399.9) 975.1 3,028.3 -(1,276.2) -0.0 (1,276.2) 1,455.1 2,731.3 -(1,275.3) -0.0 (1,275.3) 1,435.5 2,710.9 -(1,345.6) -0.0 (1,345.6) 1,568.5 2,914.1 Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Source: Company data, Goldman Sachs Research estimates. 4 December 2023 37 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List CSL - Compelling entry point while ROIC & earnings growth inflect Covered by Chris Cooper (chris.cooper@gs.com, +61 2 9320-1489) CSL.AX Buy 12m Price Target: A$309 Price: A$262.86 GS Forecast Market cap: A$126.8bn / $84.1bn Revenue ($ mn) Enterprise value: A$143.9bn / $95.5bn EBITDA ($ mn) 6/23 6/24E 6/25E 6/26E 13,310.0 14,988.6 16,273.4 17,365.5 6,117.6 3,900.0 4,919.9 5,452.3 3m ADTV :A$199.7mn/ $128.2mn EPS ($) 4.55 5.54 6.35 7.43 Australia P/E (X) 43.3 31.5 27.5 23.5 ANZ Healthcare P/B (X) 6.0 4.9 4.4 4.0 1.1 1.5 1.8 2.1 2.7 1.9 1.4 0.9 -- -- -- -- CROCI (%) 15.1 12.5 13.3 14.3 6/23 12/23E 6/24E 12/24E EPS ($) 3.11 4.75 2.44 5.22 Dividend yield (%) M&A Rank: 3 Net debt/EBITDA (X) Leases incl. in net debt & EV?: No Frank/Imput (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 17.6% Core thesis: CSL is now entering a period of more capital-efficient growth, driving a sharp improvement in ROIC, coinciding with a period of historically-high earnings growth (+14% CAGR FY23-27E vs. +9% pre-Covid i.e. FY15-19) driven by core plasma franchise (Behring) margin recovery. Although valuation has historically correlated closely with Chris’s measure of forward returns, this relationship broke down through FY22-23 as NTM P/E de-rated more quickly than expected (from c.46x in Jun-21 to c.23x in Oct-23) given greater margin pressures, debates around competitive threats to core plasma franchise and underwhelming performance on its recent Vifor acquisition. However, the forward profile is now materially stronger, and Chris expects reported improvements in margins/returns through the upcoming periods to once again drive a re-rating. Key debates: 4 December 2023 n Are the historical advantages of plasma over pharma narrowing? Potentially, yes...and the sector will still offer a more attractive investment profile than pharma for many years to come. Concerns around competition and long-term industry headwinds are now overpriced, according to Chris. n If/when the Behring gross margin returns to pre-Covid levels? What needs to happen to exceed this? Behring is CSL’s core plasma franchise where FY23 GM of 49% was -790bps below pre-Covid levels given ongoing cost per litre challenges. Despite this, FY23 looks near-certain to see Behring’s GM trajectory trough and expectations have now been appropriately re-calibrated offering a more favourable risk/reward profile than anytime in the last two years. Chris’ base case assumes a recovery to pre-Covid GMs of 57% by FY28E. n Are Vifor’s NT challenges actually LT in nature? This is the segment which Chris has the least confidence and the NT trajectory for Vifor appears less favourable than management had hoped for at acquisition. The dialysis sector could recover NT but 38 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List appears pressured LT and now faces additional uncertainty from the GLP-1 class. This segment remains the primary cause for concern in driving the Group’s inflection in momentum but at 15% of sales and 7% of post-NCI NPAT, relative earnings headwinds are more than offset by improving fundamentals in Behring. Catalysts: Dec-23: A significant stage gate conversation occurring with Terumo (manufacturer of new plasmapheresis system Rika) in December will be instructive for the pace of further rollout (in c.15 out of 300+ centres currently). Feb-24: CSL will report 1H24 results. Investor focus will likely be centered around: (i) Behring margin recovery; (ii) update on new product launches; (iii) updates around Vifor, and headwinds currently faced. 1Q24: CSL will provide top-line data for CSL112 in early CY24. Across CSL’s pipeline, CSL112 represents the most material opportunity in Chris’s view, and remains the primary focus amongst the investor base. Valuation: 12m TP of A$309 is based on 20.5x NTM EV/EBITDA. Exhibit 27: Compelling entry point given ROIC inflection compounded by elevated earnings growth Exhibit 28: Behring (core plasma franchise) GM recovery now offers favourable risk/reward profile CSL: 12m forward P/E vs. GSe forward returns profile Behring gross margin forecasts 30 25 20 30x 23x 0.5 31x 30x - 27x 20x 24x 21x (0.5) 15 10 (1.0) 2e83ab6fea424dc8a1b6a8a7e94c6547 36x 35 60.0% 1.0 42x Behring gross margin (%) 41x 40 3yr forward returns profile^ 45 12m Forward P/E For the exclusive use of MATTHEW.X.WONG@GS.COM Where we are different: Chris recently focused on five key investor debates and his analysis suggests more upside risk to consensus than any time since the start of the pandemic given: i) competitive analysis of FcRn inhibitors in CIDP (his base case assumes a (3)-(4)% impact to Group EBIT FY27-30E); ii) modeling of key near-term launch opportunities (Hemgenix and garadacimab to re-inject growth into two key high-margin franchises); iii) Behring margin accretion analysis (he models +330bps from manufacturing yield alone); iv) updated thoughts on Vifor (challenges remain but are now more broadly understood); v) ROIC vs. CROCI analysis (ROIC to improve from 12% to 18% by FY30E). 58.0% 56.0% 54.0% 52.0% 50.0% 48.0% 5 0 (1.5) Cons - current GM ^ ROIC * 3yr forward change in ROIC * 3yr EPS CAGR Source: Company data, Goldman Sachs Global Investment Research GS - current GM Cons - pre downgrade GM Source: Company data, Visible Alpha Consensus Data, Goldman Sachs Global Investment Research Relevant Research: n CSL: ROIC inflection compounded by period of high earnings growth; Compelling entry point after multiple de-rate; Upgrade to Buy n 4 December 2023 CSL: Near-term margin risk skewed to upside; new launches key to long-term ROIC 39 Goldman Sachs Income Statement ($ mn) __________________________________ CSL Ltd. (CSL.AX) Rating since Nov 14, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 6/23 43.3 6.0 0.9 27.6 6/24E 31.5 4.9 3.3 19.4 6/25E 27.5 4.4 3.6 17.3 6/26E 23.5 4.0 4.4 15.1 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 27.6 15.1 14.5 59.9 59.9 6.9 134.4 19.4 12.5 16.1 47.1 47.1 7.8 133.5 17.3 13.3 16.9 35.5 35.5 8.7 127.1 15.1 14.3 17.9 23.2 23.2 9.9 124.3 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) ($) Average capital employed ($) 53.0 148.1 12.3 0.4 2.0 34,462.0 21,152.0 56.6 163.2 13.7 0.4 2.0 35,663.5 28,583.5 56.6 161.2 14.3 0.4 1.9 37,042.1 28,788.4 56.1 163.9 15.2 0.4 1.8 38,303.2 28,948.7 32.73 35.86 39.39 43.55 For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS ($) Growth & Margins (%) ____________________________________ 6/23 6/24E 6/25E 6/26E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 26.0 5.1 (5.4) 0.0 23.1 29.3 12.6 26.2 21.7 21.6 25.9 32.8 8.6 10.8 14.7 14.7 26.6 33.5 6.7 12.2 17.0 17.0 28.4 35.2 Net income margin 16.5 17.8 18.8 20.6 Price Performance _______________________________________ CSL.AX (A$) S&P/ASX 200 320 7,600 300 7,400 280 7,200 260 7,000 240 6,800 220 6,600 Jan-23 Absolute Rel. to the S&P/ASX 200 Apr-23 Jul-23 Oct-23 3m 6m 12m (2.3)% 0.5% (15.3)% (14.8)% (12.0)% (8.5)% Source: FactSet. Price as of 1 Dec 2023 close. 6/23 13,310.0 (6,466.0) (2,540.0) (1,235.0) 6/24E 14,988.6 (6,721.3) (3,031.2) (1,360.8) 6/25E 16,273.4 (7,161.4) (3,340.4) (1,444.9) 6/26E 17,365.5 (7,376.4) (3,523.1) (1,541.8) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -3,900.0 (831.0) 3,069.0 (406.0) 0.0 2,663.0 -4,919.9 (1,044.6) 3,875.3 (438.6) 0.0 3,436.7 -5,452.3 (1,125.6) 4,326.7 (399.8) 0.0 3,926.9 -6,117.6 (1,193.5) 4,924.1 (353.4) -4,570.7 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) ($) EPS (diluted, pre-except) ($) EPS (basic, post-except) ($) EPS (diluted, post-except) ($) (419.0) (50.0) -2,194.0 247.0 2,441.0 4.55 4.53 5.06 5.04 (618.6) (147.2) -2,670.9 -2,670.9 5.54 5.52 5.54 5.52 (706.8) (157.2) -3,062.8 -3,062.8 6.35 6.33 6.35 6.33 (822.7) (165.0) -3,583.0 -3,583.0 7.43 7.40 7.43 7.40 2.22 48.8 2.70 48.7 3.09 48.7 3.62 48.7 Total revenue Cost of goods sold SG&A R&D DPS ($) Div. payout ratio (%) Balance Sheet ($ mn) _____________________________________ 6/23 1,548.0 2,205.0 5,466.0 6/24E 3,050.7 2,442.0 5,497.6 6/25E 4,657.7 2,606.8 5,838.0 6/26E 6,763.4 2,734.1 5,993.1 Other current assets Total current assets Net PP&E Net intangibles 40.0 9,259.0 9,352.0 16,446.0 40.0 11,030.4 9,624.6 16,178.0 40.0 13,142.5 9,888.0 15,863.1 40.0 15,530.6 10,134.3 15,499.9 Total investments Other long-term assets Total assets Accounts payable 0.0 9,256.0 36,234.0 2,947.0 0.0 9,256.0 38,010.0 3,063.3 0.0 9,256.0 40,070.6 3,263.9 0.0 9,256.0 42,341.8 3,361.9 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 1,055.0 -606.0 4,608.0 1,055.0 -606.0 4,724.3 1,055.0 -606.0 4,924.9 1,055.0 -606.0 5,022.9 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 11,172.0 -2,628.0 13,800.0 11,172.0 -2,628.0 13,800.0 11,172.0 -2,628.0 13,800.0 11,172.0 -2,628.0 13,800.0 Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted 18,408.0 -15,786.0 2,040.0 36,234.0 10,679.0 18,524.3 -17,298.5 2,187.2 38,010.0 9,176.3 18,724.9 -19,001.2 2,344.4 40,070.6 7,569.3 18,822.9 -21,009.5 2,509.4 42,341.8 5,463.6 Cash & cash equivalents Accounts receivable Inventory Cash Flow ($ mn) ________________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 6/23 6/24E 6/25E 6/26E 2,194.0 596.0 -(1,035.0) 561.0 2,601.0 2,670.9 744.6 -(152.3) 147.2 3,857.6 3,062.8 814.7 -(304.5) 157.2 4,198.4 3,583.0 874.8 -(184.4) 165.0 4,922.0 (1,692.0) (10,534.0) 111.0 272.0 (11,843.0) (1,049.2) ---(1,049.2) (1,074.0) ---(1,074.0) (1,076.7) ---(1,076.7) -(1,239.0) 1,741.0 (46.0) 456.0 (8,888.0) 909.0 -(1,339.6) -34.0 (1,305.6) 1,502.7 2,808.4 -(1,551.4) -34.0 (1,517.4) 1,607.0 3,124.4 -(1,773.7) -34.0 (1,739.7) 2,105.7 3,845.3 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 40 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Shionogi - Emergence of sustainable earnings drivers Covered by Akinori Ueda (akinori.ueda@gs.com, +81 3 6437-9910) 4507.T Buy 12m Price Target: ¥8750 Upside: 24.3% GS Forecast 3/23 3/24E 3/25E Market cap: ¥2.1tr / $14.0bn Revenue (¥ bn) 426.7 446.7 415.6 435.0 Enterprise value: ¥1.5tr / $9.9bn Op. profit (¥ bn) 149.0 171.1 169.7 184.1 3m ADTV :¥8.7bn/ $58.1mn Op. profit CoE (¥ bn) 3/26E -- 150.0 -- -- Japan EPS (¥) 621.3 613.7 616.6 664.5 Japan Pharmaceuticals and Medical P/E (X) Equipment 10.8 11.5 11.4 10.6 1.8 1.7 1.6 1.4 2.0 2.1 2.2 2.4 (3.4) (3.3) (4.2) (4.6) 8.0 10.6 9.7 9.5 6/23 9/23 12/23E 3/24E 144.6 164.0 145.2 159.9 P/B (X) M&A Rank: 3 Dividend yield (%) Leases incl. in net debt & EV?: Yes N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Price: ¥7040 EPS (¥) Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: Shionogi is a branded drug maker with a strong presence in infectious diseases. According to Akinori, concerns over the impending patent cliff for mainstay anti-HIV drug dolutegravir (DTG) appear discounted in the share price already based on his DCF analysis. The share price could rise as three catalysts in particular are recognized: (1) the possibility of long-acting drugs blunting the decline in Shionogi’s HIV franchise; (2) potential for obesity treatment S-309309 to become a blockbluster; and (3) prospects for the COVID-19 therapeutic Xocova also attaining blockbuster status and launching in global markets. n Will royalty income decline sharply after DTG patent expiry?: Akinori expects the decline in royalty income due to DTG patent expiry to be offset by around half by market penetration of the long-acting injectable cabotegravir (CAB) for HIV treatment and prevention. n Could S-309309 be a blockbuster?: While it is too early to discuss the potential for the drug to become a blockbuster at this time (when late stage clinical trials results have not been released), Akinori thinks it could be widely used for additional weight loss when combined with GLP-1 receptor agonists, given its convenience as well as cheap and stable supply. n What are the prospects for COVID-19 therapeutic Xocova to attain blockbuster status and launch in global markets?: This drug has the potential to reduce the risk of long COVID-19 as it is effective in patients with mild symptoms with no risk of severe illness. Akinori thinks it could become a blockbuster through global market launch as well as usage in Japan (received emergency regulatory approval) as a best-in-class oral COVID-19 treatment. Where we are different: According to Akinori, the share price doesn’t adequately reflect 4 December 2023 41 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List Catalysts: At the time of quarterly results announcements, focus will be on market penetration by Cabenuva and Apretude, and sales of Xocova. In terms of products in development, of particular interest will be: (1) Data on CAB 400 to be presented at CROI 2024; (2) Phase 2 study results for S-309309 and potential licensing agreements for this drug; and (3) Potential for global rollout of Xocova, with data from the global Phase 3 SCORPIO-HR study also due out in Apr-Jun 2024. Valuation: 12m TP of ¥8,750 is based on a 12-year DCF model assuming a WACC of 6% and terminal growth of 0%. Exhibit 29: The company wide earnings trends is maintained at a relatively high level even after the patent cliff of DTG Exhibit 30: Main driver to offset patent cliff of DTG is cabotegravir with Akinori positive on its growth and opportunity Sales (lhs) and operating profits (rhs) (¥ mn) ViiV: Sales outlook for anti-HIV drugs (£ mn) 500,000 250,000 8,000 7,000 450,000 400,000 200,000 350,000 6,000 150,000 250,000 200,000 2e83ab6fea424dc8a1b6a8a7e94c6547 5,000 300,000 4,000 100,000 3,000 50,000 1,000 2,000 Other sales Other HIV products Operating profit Source: Company data, Goldman Sachs Global Investment Research Dovate + Juluca FY3/31e FY3/30e FY3/29e FY3/28e FY3/27e FY3/31e FY3/30e FY3/29e FY3/28e FY3/27e FY3/26e FY3/25e FY3/24e HIV royalty 0 FY3/26e 0 0 FY3/25e 50,000 FY3/24e 100,000 FY3/23 150,000 FY3/23 For the exclusive use of MATTHEW.X.WONG@GS.COM sustained earnings contributions its HIV franchise and potential for obesity treatment S-309309 and COVID-19 treatment Xocova to become blockbusters. In HIV treatments, Shionogi’s long-acting products offered by its licensing partner ViiV Healthcare have an edge in terms of proven track record and development timing over those offered by rival company Gilead Sciences. Akinori thinks it is possible that S-309309 remains underrated, considering its potential for producing an additional weight loss effect when combined with GLP-1 receptor agonists. He also believes Xocova has what it takes to become best-in-class as an oral COVID-19 therapeutic, as (1) it can also be used by patients with low risk of developing serious illness; (2) it is highly convenient; and (3) expectations it will also aid in reducing the risk of developing “long COVID” symptoms. He thinks Shionogi is under-recognized due to the complex treatment regimen and development trends for anti-HIV drugs, the lack of clinical trial data disclosures for S-309309, and the peak-out of investor interest in the COVID-19 theme. Cabotegravir Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Shionogi & Co. (4507.T): Pipeline in Focus: FAQ on S-309309; an anti-obesity drug that can coexist with GLP-1 receptor agonists 4 December 2023 n Shionogi & Co. (4507.T): Increasingly attractive infectious disease specialist, Reiterate Buy n Shionogi & Co. (4507.T) Buy: An infectious idea; initiate Buy 42 Goldman Sachs Income Statement (¥ bn) __________________________________ Shionogi & Co. (4507.T) Rating since Jun 8, 2017 CL For the exclusive use of MATTHEW.X.WONG@GS.COM Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 3/23 10.8 1.8 2.8 8.8 3/24E 11.5 1.7 9.1 7.4 3/25E 11.4 1.6 9.5 6.7 3/26E 10.6 1.4 9.3 5.5 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 8.8 8.0 17.8 (50.2) (50.2) 33.1 44.4 7.4 10.6 15.4 (53.5) (53.5) 38.0 42.3 6.7 9.7 14.3 (59.5) (59.5) 37.7 38.1 5.5 9.5 13.9 (63.4) (63.4) 40.9 35.3 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 99.5 89.1 16.5 0.3 1.2 1,414.8 543.3 91.8 93.1 14.8 0.3 1.2 1,490.0 553.0 97.4 86.1 13.4 0.3 1.1 1,632.3 538.6 91.8 80.0 13.0 0.3 1.1 1,788.5 530.1 BVPS (¥) 3,737.8 4,077.0 4,538.4 5,030.9 Growth & Margins (%) ____________________________________ 3/23 3/24E 3/25E 3/26E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 27.3 31.2 64.0 17.4 34.9 38.9 4.7 13.3 (1.2) 11.1 38.3 42.2 (7.0) (1.3) 0.5 3.3 40.8 44.7 4.7 7.2 7.8 11.0 42.3 45.8 Net income margin 43.3 39.0 42.1 43.3 Price Performance _______________________________________ 4507.T (¥) TOPIX 8,000 2,800 7,500 2,600 7,000 2,400 6,500 2,200 6,000 2,000 5,500 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 9.5% 7.9% 13.7% 2.6% 1.3% (15.5)% Source: FactSet. Price as of 1 Dec 2023 close. 3/23 426.7 (62.2) (113.0) (102.4) 3/24E 446.7 (49.0) (114.9) (111.7) 3/25E 415.6 (44.3) (97.7) (103.9) 3/26E 435.0 (46.1) (100.4) (104.4) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -166.2 (17.2) 149.0 71.3 -220.3 -188.3 (17.2) 171.1 47.5 -218.6 -185.9 (16.2) 169.7 49.3 -219.0 -199.3 (15.2) 184.1 52.4 -236.5 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) (35.8) 0.5 -185.0 -185.0 621.3 621.1 621.3 621.1 (45.0) 0.5 -174.1 -174.1 613.7 613.5 613.7 613.5 (44.6) 0.5 -174.9 -174.9 616.6 616.4 616.6 616.4 (48.5) 0.5 -188.5 -188.5 664.5 664.3 664.5 664.3 DPS (¥) Div. payout ratio (%) 135.0 21.7 150.0 24.4 155.0 25.1 172.0 25.9 Total revenue Cost of goods sold SG&A R&D Balance Sheet (¥ bn) _____________________________________ Cash & cash equivalents Accounts receivable Inventory 3/23 563.4 109.8 57.9 3/24E 630.4 114.9 45.6 3/25E 778.4 106.9 41.2 3/26E 917.1 111.9 42.9 Other current assets Total current assets Net PP&E Net intangibles 53.1 784.2 112.1 112.6 54.6 845.5 105.8 112.6 49.8 976.3 100.0 112.6 51.1 1,123.0 94.7 112.6 247.7 55.2 1,311.8 14.0 247.7 54.5 1,366.1 11.0 247.7 56.5 1,493.1 9.9 247.7 56.1 1,634.1 10.3 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities --144.5 158.6 --144.5 155.5 --144.5 154.4 --144.5 154.8 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 0.0 -31.4 31.4 --32.8 32.8 --30.5 30.5 --31.9 31.9 189.9 -1,100.0 21.8 1,311.8 (563.4) 188.3 -1,156.5 21.3 1,366.1 (630.4) 184.9 -1,287.4 20.8 1,493.1 (778.4) 186.7 -1,427.1 20.3 1,634.1 (917.1) Total investments Other long-term assets Total assets Accounts payable Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (¥ bn) _________________________________________ 3/23 3/24E 3/25E 3/26E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others 185.0 17.2 (0.5) 10.0 (33.8) 177.9 (120.5) --72.2 174.1 17.2 (0.5) 4.2 0.5 195.5 (10.9) ---- 174.9 16.2 (0.5) 11.3 0.5 202.4 (10.4) ---- 188.5 15.2 (0.5) (6.3) 0.5 197.4 (9.9) ---- Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (48.3) -(36.1) -(38.6) (74.8) 54.8 57.3 (10.9) -(42.6) -(75.0) (117.6) 67.0 184.6 (10.4) -(44.0) -0.0 (44.0) 148.0 192.0 (9.9) -(48.8) -0.0 (48.8) 138.7 187.5 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 43 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Sanhua Intelligent Controls - Global leader in HVAC/EV thermal components, further upside in Humanoid Robots Covered by Jacqueline Du (jacqueline.du@goldmansachs.cn, +86 21 2401-8948) 002050.SZ Buy 12m Price Target: Rmb38 Price: Rmb28.49 GS Forecast 12/22 12/23E 12/24E 12/25E 21,347.5 26,489.1 32,871.0 40,393.3 3,071.6 4,437.1 5,546.3 6,866.9 0.72 0.84 1.12 1.40 China P/E (X) 31.3 34.0 25.4 20.3 China Industrial Tech & Machinery P/B (X) 6.2 6.8 5.7 4.8 0.9 0.9 1.2 1.5 Market cap: Rmb102.1bn / $14.3bn Revenue (Rmb mn) Enterprise value: Rmb103.1bn / $14.4bn EBITDA (Rmb mn) 3m ADTV :Rmb608.0mn/ $83.6mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) 1.4 0.2 0.1 (0.0) 19.5 21.3 25.1 25.9 FCF yield (%) (0.5) 0.2 1.0 1.9 6/23 9/23 12/23E -- EPS (Rmb) 0.22 0.21 0.23 -- Leases incl. in net debt & EV?: No CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 33.4% Core thesis: Sanhua is a global leader in HVAC control & EV thermal management components. Jacqueline forecasts the company to deliver 23%/30% revenue/EPS CAGRs in 2023E-25E, driven by its growth potential in auto/EV thermal management, and on HVAC, continued Electronic Expansion Valve (EEV) penetration, and new growth opportunities from ESS and overseas residential heat pumps (especially in Europe). The humanoid robot component business is gradually kicking in as a new revenue stream, where Sanhua has the potential to become a Tier-1 supplier with the highest visibility among supply chain peers. Key upside could be whether the company can potentially produce planetary roller screw, a key component for the humanoid robot other than the likely actuator assembly business. Key debates: n EV industry growth: Despite the fact that Tesla’s share in revenue is declining (c.40% of segment revenue as of 1-3Q23), Sanhua has a wide customer base and is growing its share within BYD, aiming to supply not only components but also the thermal management modules and is collaborating with new EV entrants (AITO under Seres, Luxeed under Chery Auto and Xiaomi). Jacqueline expects the new-comers’ sales growth to make up for Tesla’s contribution drop. n 4 December 2023 Humanoid robot outlook: Investors’ key debates have focused on commercial feasibility, volume outlook, content value, etc. Jacqueline holds a positive view on the industry outlook heading into 2024-2025E supported by accelerating progress on various aspects: advancement in AI, better hardware configuration, widened & deepened manufacturing supply chain especially in China, significant cost reduction from likely $100-250k per unit last year to $30-150k now (much faster than GS assumption of -15% p.a.) through optimization in design and manufacturing 44 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List technique, as well as improving visibility on several initial application settings (special operations, manufacturing and commercial use). Where we are different: Jacqueline is 1%/4% above Wind consensus for 2024E/25E net profit, where she is more confident in the company’s margin improvement trend, driven by volume leverage and favorable product mix. Jacqueline is also more positive on the company’s ability to capture the opportunity from future technology innovations and believes humanoid robots have the potential to become the next widely adopted terminal device (after smartphones/cars) in a blue-sky scenario. Catalysts: 1) Continued order wins in EV segment (content value increase or new customers); 2) acceleration in ESS revenue recognition; 3) humanoid robot indication of interest kick in around mid-24E and volume production to start from 4Q24E. Exhibit 31: Clear content value improves, driven by increasing importance of thermal management systems ensures EV segment structural growth Exhibit 32: Jacqueine believes humanoid robots have the potential to become the next widely adopted terminal device (after smartphones/cars) in a blue-sky scenario. GS global humanoid robot shipment forecast (2022-2035E) vs. global EV shipment (2010-2021) and global smartphone shipment (2003-2016) Global EV shipment since 2010 Global smartphone shipment since 2003 Bluesky Scenario Bull Case Global humanoid robot shipment base case Bear Case 10000 7500 2025-35E sales CAGR 94% 5000 59% 2500 40% 0 ICE Among which: Sanhua value EV EV+ Total thermal management content value Source: Company data, Goldman Sachs Global Investment Research 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Valuation: 12m TP of Rmb38, based on a 30X 2025E P/E discounted back to 2024E. Source: IDC, IEA, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n China humanoid robot field trip: Seeing upside risks into 2024-2025E; Buy Sanhua n Global Automation: The investment case for humanoid robots n Sanhua Intelligent Controls (002050.SZ): Accelerating into green cooling and heating; reiterate Buy 45 Goldman Sachs Income Statement (Rmb mn) _______________________________ Sanhua Intelligent Controls (002050.SZ) Rating since Nov 2, 2022 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) 12/22 31.3 6.2 (0.5) 27.7 12/23E 34.0 6.8 0.2 23.2 12/24E 25.4 5.7 1.0 18.6 12/25E 20.3 4.8 1.9 14.9 27.7 19.5 21.4 33.5 33.5 10.7 68.2 23.2 21.3 21.5 5.2 5.2 38.4 62.4 18.6 25.1 24.5 3.4 3.4 73.5 58.7 14.9 25.9 25.6 (0.7) (0.7) 91.8 59.0 74.8 82.1 19.6 0.8 2.1 19,610.7 16,013.6 81.0 82.1 19.7 0.9 1.8 18,606.9 16,781.7 81.3 81.2 22.2 1.0 1.8 22,409.5 17,401.9 81.6 81.6 23.1 1.1 1.7 26,484.2 20,147.4 3.61 4.20 4.98 5.96 Growth & Margins (%) ____________________________________ 12/22 12/23E 12/24E 12/25E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 33.2 34.1 53.1 34.1 11.7 14.4 24.1 44.5 16.7 25.7 13.9 16.8 24.1 25.0 34.0 34.0 14.0 16.9 22.9 23.8 24.7 24.7 14.3 17.0 Net income margin 12.1 11.3 12.2 12.4 Price Performance _______________________________________ 002050.SZ (Rmb) Shanghai - Shenzhen 300 32.5 4,400 30.0 4,200 27.5 4,000 25.0 3,800 22.5 3,600 20.0 3,400 Jan-23 Apr-23 Absolute Rel. to the Shanghai - Shenzhen 300 Jul-23 Oct-23 3m 6m 12m (4.3)% 4.1% 13.4% 24.0% 27.2% 42.2% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 21,347.5 (15,781.1) (2,768.5) -- 12/23E 26,489.1 (19,129.5) (3,417.1) -- 12/24E 32,871.0 (23,752.9) (4,174.6) -- 12/25E 40,393.3 (29,175.2) (5,049.2) -- Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit (301.4) 3,071.6 (575.1) 2,496.5 (45.1) (84.7) 3,051.3 (264.9) 4,437.1 (759.4) 3,677.7 (44.6) (101.8) 3,567.9 (328.7) 5,546.3 (931.5) 4,614.8 (4.1) -4,762.2 (403.9) 6,866.9 (1,101.8) 5,765.1 0.1 -5,931.8 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) (443.2) (34.7) -2,573.3 -2,573.3 0.72 0.72 0.72 0.72 (524.5) (39.9) -3,003.5 -3,003.5 0.84 0.84 0.84 0.84 (690.5) (45.9) -4,025.8 -4,025.8 1.12 1.12 1.12 1.12 (860.1) (52.8) -5,018.9 -5,018.9 1.40 1.40 1.40 1.40 0.20 27.9 0.25 30.0 0.34 30.0 0.42 30.0 Total revenue Cost of goods sold SG&A R&D DPS (Rmb) Div. payout ratio (%) Balance Sheet (Rmb mn) __________________________________ 12/22 2,050.3 5,228.1 4,334.9 12/23E 2,348.4 6,531.6 4,716.9 12/24E 2,516.1 8,105.2 5,856.9 12/25E 3,287.3 9,960.0 7,193.9 Other current assets Total current assets Net PP&E Net intangibles 7,142.4 18,755.7 6,374.9 791.0 3,000.0 16,596.8 8,227.5 750.3 3,000.0 19,478.2 9,874.2 707.8 3,000.0 23,441.2 11,334.7 663.3 Total investments Other long-term assets Total assets Accounts payable 32.4 2,007.2 27,961.2 3,884.6 (69.4) 2,435.8 27,941.1 4,716.9 (69.4) 2,400.2 32,391.0 5,856.9 (69.4) 2,382.3 37,752.2 7,193.9 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 1,862.2 -3,709.1 9,455.9 2,562.2 -3,893.2 11,172.3 2,562.2 -4,199.9 12,619.0 2,562.2 -4,497.8 14,253.9 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 4,578.3 -807.7 5,386.0 578.3 -928.8 1,507.1 578.3 -1,068.1 1,646.5 578.3 -1,228.3 1,806.7 14,841.9 -12,941.3 178.0 27,961.2 4,390.2 12,679.4 -15,043.8 217.9 27,941.1 792.2 14,265.4 -17,861.8 263.8 32,391.0 624.4 16,060.6 -21,375.0 316.6 37,752.2 (146.8) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E 2,573.3 575.1 34.7 (925.5) 252.0 2,509.7 3,003.5 759.4 39.9 (853.2) 222.9 3,172.6 4,025.8 931.5 45.9 (1,573.6) 139.3 3,568.8 5,018.9 1,101.8 52.8 (1,854.8) 160.2 4,478.9 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (2,941.8) (5.9) 84.6 191.8 (2,671.3) (3,000.0) --4,142.4 1,142.4 (2,500.0) ---(2,500.0) (2,500.0) ---(2,500.0) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow -(1,021.6) 331.0 212.6 (478.0) (639.7) (432.1) -(717.0) (3,300.0) 0.0 (4,017.0) 298.0 172.6 -(901.0) -0.0 (901.0) 167.8 1,068.8 -(1,207.7) -0.0 (1,207.7) 771.2 1,978.9 Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Source: Company data, Goldman Sachs Research estimates. 4 December 2023 46 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List SMC - Cycle improvement to drive above-consensus earnings Covered by Yuichiro Isayama (yuichiro.isayama@gs.com, +81 3 6437-9806) 6273.T Buy 12m Price Target: ¥103000 Price: ¥74010 GS Forecast 3/23 3/24E 3/25E 3/26E Market cap: ¥4.8tr / $32.3bn Revenue (¥ bn) 824.8 803.0 944.0 1,044.0 Enterprise value: ¥4.1tr / $27.6bn Op. profit (¥ bn) 258.2 235.0 285.0 330.0 248.5 233.0 -- -- Japan EPS (¥) 3,482.3 3,114.6 3,367.2 3,942.0 Japan Machinery P/E (X) 18.4 23.8 22.0 18.8 P/B (X) 2.4 2.6 2.5 2.3 1.4 1.2 1.5 1.6 (2.2) (2.6) (2.0) (1.8) 18.3 19.4 19.4 20.1 6/23 9/23 12/23E 3/24E 808.5 660.3 0.0 0.0 3m ADTV :¥17.8bn/ $119.6mn Op. profit CoE (¥ bn) M&A Rank: 3 Dividend yield (%) Leases incl. in net debt & EV?: No N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 39.2% EPS (¥) Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: SMC is the No. 1 global maker of pneumatic equipment. Yuichiro expects the company to sustain its strong top-line performance driven by market share gains and improvement in regional sales mix. Although valuations are rising, the stock still looks undervalued versus other global FA makers and an improvement in the company’s fundamentals, coupled with aggressive shareholder return policies, should underpin the share price from here. SMC is trading on 22X FY3/25E P/E and 14.9X EV/EBITDA, versus the average of large-cap FA at 26.5X and 17.0X, respectively. n Order cycle bottoming-out: Yuichiro believes that the new order cycle has bottomed out and a positive earnings revision cycle will start sooner for SMC vs other FA peers. n Semiconductor capex cycle: SMC has one of the highest revenue exposure to semiconductor industry amongst GS global automation coverage with over 20% this fiscal year, and over 30% at the previous peak cycle. Capex outlook for the semiconductor supply chain should resume/recover earlier vs other major applications and Yuichiro expects its higher exposure should fuel a rerating of SMC in to 2024. Where we are different: Following his vertical/horizontal industry cross-check on Asian/global FA industry, Yuichiro sits ~11% above on EBIT for SMC vs Bloomberg consensus for FY3/25-26E. 2QFY3/24 results revealed underlying EBIT power was indeed above consensus by 15%. Additionally, confirmation of bottoming order momentum and its strong earnings power in the semiconductor industry provide upside risk, setting up well for the coming upcycle in FY3/25E(CY24) and beyond. Catalysts: Solid earnings power to drive consensus revisions; as the company is 4 December 2023 47 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List bottoming out from the trough, more earnings revisions should follow from each quarter. Also, as confirmed from the recent results, Yuichiro continues to expect the company to deploy 50%+ payout to investors, which should further trigger the rerating of the company as one of the best companies to execute on fundamentals and to pay back investors. Valuation: 12m TP of ¥103,000 is based on FY3/28E EV/EBITDA, applying the sector-average multiple of 9X, then applying the stock’s historical average premium of 60% and discounted back to FY3/25. Exhibit 33: Absolute level of orders has been bottoming in most major regions - Japan, China, AeCJ likely to drive the recovery, centered in semiconductor applications Exhibit 34: Yuichiro sees his Street high estimate as achievable in to FY3/25E and beyond, thanks to market share gain and favorable industry mix. Further expansion in EBITDA margin likely as well SMC: Trends in monthly order by region (indexed) SMC: Trends in revenue and EBITDA margin Japan (indexed) America Europe China (JPYmn) AeCJ 1,200,000 Japan North America Europe Asia Others/Elimination EBITDA margin (%, rhs) 40% 180 1,000,000 35% 160 800,000 30% 600,000 25% 400,000 20% 200,000 15% 0 10% 140 120 100 80 Source: Company data Jul-23 Oct-23 Apr-23 Jan-23 Jul-22 Oct-22 Apr-22 Jan-22 Jul-21 Oct-21 Apr-21 Jan-21 Jul-20 Oct-20 Apr-20 Jan-20 Jul-19 Oct-19 Apr-19 Jan-19 Jul-18 Oct-18 Apr-18 Jan-18 Jul-17 Oct-17 40 3/1999 3/2000 3/2001 3/2002 3/2003 3/2004 3/2005 3/2006 3/2007 3/2008 3/2009 3/2010 3/2011 3/2012 3/2013 3/2014 3/2015 3/2016 3/2017 3/2018 3/2019 3/2020 3/2021 3/2022 3/2023 3/2024E 3/2025E 3/2026E 60 Apr-17 Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Asia Pacific Machinery: Automation: Asia Opportunities Revisited; Closer look at competitive advantages and cyclical growth; upgrade CKD to Buy, downgrade Hiwin to Sell n 4 December 2023 Japan Machinery: Beyond the Cycle: 2H23 investment strategy: Focus on AI/semiconductors and US; Buy-rated Daikin/SMC 48 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 200 Goldman Sachs Income Statement (¥ bn) __________________________________ SMC (6273.T) Rating since Feb 21, 2019 CL Ratios & Valuation _______________________________________ 3/23 18.4 2.4 0.5 12.4 3/24E 23.8 2.6 4.2 15.1 3/25E 22.0 2.5 2.0 12.5 3/26E 18.8 2.3 3.4 10.6 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 12.4 18.3 13.8 (35.9) (35.9) 2,459.1 159.8 15.1 19.4 11.4 (39.1) (39.1) -178.8 12.5 19.4 11.6 (34.7) (34.7) -154.8 10.6 20.1 12.7 (33.2) (33.2) -159.3 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 97.5 61.4 13.2 0.4 1.1 1,222.8 982.4 102.2 63.8 11.1 0.4 1.1 1,255.5 1,089.6 92.9 56.7 11.3 0.4 1.1 1,410.7 1,156.1 95.6 60.8 12.3 0.5 1.1 1,538.0 1,275.9 26,331.7 27,997.9 29,730.9 31,954.1 P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (¥) Growth & Margins (%) ____________________________________ 3/23 3/24E 3/25E 3/26E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 13.4 14.3 17.9 28.6 31.3 34.4 (2.6) (6.3) (10.6) 0.0 29.3 33.1 17.6 20.7 8.1 22.2 30.2 34.0 10.6 15.6 17.1 9.1 31.6 35.5 Net income margin 27.2 24.7 22.4 23.4 Price Performance _______________________________________ 6273.T (¥) TOPIX 100,000 2,800 90,000 2,600 80,000 2,400 70,000 2,200 60,000 2,000 50,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 3.2% 1.7% (2.1)% (11.7)% 17.3% (2.2)% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) DPS (¥) Div. payout ratio (%) 3/23 824.8 (403.6) (163.0) (27.4) 3/24E 803.0 (402.0) (166.0) (30.0) 3/25E 944.0 (469.0) (190.0) (33.0) 3/26E 1,044.0 (497.0) (217.0) (36.0) -284.0 (25.8) 258.2 11.6 -308.8 -266.0 (31.0) 235.0 6.0 -271.5 -321.0 (36.0) 285.0 6.0 -291.0 -371.0 (41.0) 330.0 6.0 -336.0 (83.9) (0.3) -224.6 -224.6 3,482.3 3,482.3 3,482.3 3,482.3 (73.0) (0.1) -198.4 -198.4 3,114.6 3,114.6 3,114.6 3,114.6 (79.0) (0.2) -211.8 -211.8 3,367.2 3,367.2 3,367.2 3,367.2 (91.0) (0.2) -244.8 -244.8 3,942.0 3,942.0 3,942.0 3,942.0 900.0 25.8 900.0 28.9 1,100.0 32.7 1,200.0 30.4 Balance Sheet (¥ bn) _____________________________________ 3/23 623.5 228.8 418.6 3/24E 711.5 220.8 368.0 3/25E 662.6 259.6 432.7 3/26E 673.1 287.1 478.5 Other current assets Total current assets Net PP&E Net intangibles 52.9 1,323.8 327.0 16.6 52.9 1,353.2 396.0 16.6 52.9 1,407.8 440.0 16.6 52.9 1,491.6 479.0 16.6 Total investments Other long-term assets Total assets Accounts payable 82.4 178.1 1,927.9 73.6 82.4 178.1 2,006.4 66.9 82.4 178.1 2,104.9 78.7 82.4 178.1 2,227.8 87.0 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 7.1 -108.1 188.8 7.1 -108.1 182.1 7.1 -108.1 193.9 7.1 -108.1 202.2 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 5.0 -31.7 36.8 5.0 -31.7 36.8 5.0 -31.7 36.8 5.0 -31.7 36.8 225.6 -1,698.4 3.9 1,927.9 (611.3) 218.9 -1,783.5 4.0 2,006.4 (699.3) 230.6 -1,870.1 4.2 2,104.9 (650.4) 239.0 -1,984.4 4.4 2,227.8 (660.9) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (¥ bn) _________________________________________ 3/23 3/24E 3/25E 3/26E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others 224.6 25.8 0.3 (110.4) (38.7) 101.6 (81.6) --(5.5) 198.4 31.0 0.1 51.9 15.0 296.4 (100.0) ---- 211.8 36.0 0.2 (91.7) 15.0 171.4 (80.0) ---- 244.8 41.0 0.2 (65.0) 15.0 236.0 (80.0) ---- Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (87.1) -(58.1) 0.6 (55.9) (113.3) (81.3) 20.0 (100.0) -(57.3) -(51.1) (108.4) 88.0 196.4 (80.0) -(69.2) -(71.0) (140.2) (48.8) 91.4 (80.0) -(74.5) -(71.0) (145.5) 10.5 156.0 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 49 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Kuaishou Technology - Growth and monetization opportunity as a competitive SFV platform Covered by Lincoln Kong (lincoln.kong@gs.com, +852 2978-6603) 1024.HK Buy 12m Price Target: HK$88 Price: HK$57.2 GS Forecast 12/22 12/23E 12/24E 12/25E 94,182.5 113,505.2 131,722.7 153,431.5 1,464.8 17,828.9 26,242.2 35,737.8 (1.35) 2.02 3.40 5.11 Hong Kong P/E (X) NM 25.9 15.4 10.2 China Gaming & Entertainment P/B (X) 6.8 4.9 3.7 2.8 NM NM NM NM 15.5 (2.4) (2.3) (2.4) 1.8 53.1 66.0 79.2 FCF yield (%) (4.0) 3.9 7.0 10.4 9/23 12/23E 3/24E 6/24E EPS (Rmb) 0.74 0.64 0.51 0.83 Market cap: HK$246.6bn / $31.6bn Revenue (Rmb mn) Enterprise value: HK$227.4bn / $29.1bn EBITDA (Rmb mn) 3m ADTV :HK$1.1bn/ $135.6mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: Yes CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 53.8% Core thesis: Kuaishou is China’s 2nd-largest short-form video (SFV) player in terms of total timespent. Lincoln forecasts Kuaishou to deliver 16% yoy revenue growth in both 2024 & 2025, driven by a high 20% eCommerce GMV CAGR, monetization rate expansion and ads share gain. This is achieved through product category expansion, improving eCommerce recommendation feeds and store-wide ROI measures that drives better merchant ads conversion. He also expects Kuaishou to deliver group OP margin of 13%/17% by 2024E/2025E (vs. 8% in 2023) from better business mix (ads/commission high margin vs. livestreaming) and tight control of sales & marketing expenses as users/timespent reach peak level. Valuation (16x 2024GSe P/E) remains undemanding for 70%/52% 2024E/25E earnings growth. Key debates: n What underpins Kuaishou’s GMV/Ads market share gain, and the durability? While the market recognizes Kuaishou’s consistent share gain/above-industry revenue growth since listing, drivers and durability of its growth have been questioned. Lincoln takes a more positive view on 1) room for category expansion in Ecommerce, towards standard goods/E&A, furniture vertical (c.16% of Kuaishou’s GMV in 3Q23) as merchants seek new GMV growth channel. 2) growing paying users as Kuaishou current 110mn monthly Ecommerce paying users remain a small fraction of its total MAU base of 650mn – Lincoln sees upside to both user penetration and ARPU/purchase frequency, driven by better livestreaming Ecommerce content recommendation and broad shelf based Ecommerce expansion. 3) monetization efficiency driven by store-wide ROI products released to merchants which is expected to elevate Ecommerce ad take rate. n 4 December 2023 What is the profit margin outlook in the medium term? Post Kuaishou delivering 50 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List 10% group net profit margin in 2Q/3Q23, investors are questioning its margin level sustainability. Lincoln sees multiple margin accretive levers, including 1) positive mix shift driven by ecommerce take rate expansion, and lower contribution of less-profitable entertainment live streaming; and 2) across-the-board cost discipline, improving efficiency on user acquisition and retention, bandwidth optimization. n How is the competitive intensity of the short form video landscape on Where we are different: Market is still questioning Kuaishou’s ability to maintain such fast GMV/ads growth, and in the meantime expand domestic profit margin into 24/25E. Lincoln forecasts 20%+ GMV/ads CAGR, as Kuaishou have a differentiated user base skewed to lower tier cities, plenty of traffic that can be monetized (8% ad load vs. top player at mid teens), and merchants’ improving ROI on Ecommerce. Therefore, Lincoln’s forecasts are 4-5% above Visible Alpha consensus on 24/25 operating profit. Catalysts: 1. Solid print into 4Q23/year end, 2. Resilient ads growth and increase in take rate further from better Ad tech in 2H23 Valuation: 12m TP of HK$88, based on a discounted P/E valuation. Exhibit 35: China online advertising: ad spend and timespent share among top platforms; Kuaishou the only platform to see gradual increase in timespent share and ad spend share Exhibit 36: Lincoln sees room for Kuaishou to expand take rate and ARPU/purchase frequency China eCommerce: key metrics across platforms (as of 2023E) *bubble size indicative of ad revenue base 35% 2e83ab6fea424dc8a1b6a8a7e94c6547 Bytedance 202325 30% Ad revenue % share For the exclusive use of MATTHEW.X.WONG@GS.COM users/timespent and ads budget, especially given the fast ramp up of Tencent Video account? Lincoln notes that Kuaishou remains differentiated from Douyin Video Account in multiple aspects, providing diversified content to attract different user cohorts. The competition remains intense between the 3 players, though it’s more the 3 combined gaining timespent and ads share in the overall Internet space. 25% 20% 15% 10% Baidu - 2023-25 5% BILI - 2023-25 Kuaishou 2023-25 Tencent 2023-25 0% 0% 5% 10% 15% 20% 25% Timespent share % 30% Source: Company data, Goldman Sachs Global Investment Research 35% 40% Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Kuaishou Technology (1024.HK): 3Q23 review: Profit ahead, solid growth and ads share gain into year-end, margin uplift for 24-25E; Buy n 4 December 2023 Kuaishou Technology (1024.HK): Highly engaging short-form video community now at a profitability inflection point; initiate at Buy 51 Goldman Sachs Income Statement (Rmb mn) _______________________________ Kuaishou Technology (1024.HK) Rating since Sep 4, 2022 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 NM 6.8 (4.0) 167.6 12/23E 25.9 4.9 3.9 11.7 12/24E 15.4 3.7 7.0 7.4 12/25E 10.2 2.8 10.4 4.8 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales NM 1.8 (13.9) (23.5) (66.4) (11.5) -- 13.5 53.1 20.8 (38.0) (73.3) 17.4 -- 8.0 66.0 27.6 (54.9) (82.0) 31.7 -- 5.0 79.2 31.1 (68.9) (88.8) 48.4 -- 18.8 167.8 (15.3) 1.1 2.3 28,919.3 12,566.3 19.1 161.6 18.8 1.1 2.2 33,767.3 12,476.0 20.6 162.9 24.3 1.1 2.0 38,029.1 11,630.9 21.7 163.2 26.9 1.0 1.8 41,905.2 10,143.0 8.85 10.69 13.98 18.95 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 16.2 111.3 72.5 NM (6.7) 1.6 20.5 NM 249.1 NM 7.9 15.7 16.0 47.2 68.4 NM 12.6 19.9 16.5 36.2 50.4 NM 16.7 23.3 (6.1) 7.7 11.2 14.7 Price Performance _______________________________________ 1024.HK (HK$) Hang Seng Index 90 26,000 80 24,000 70 22,000 60 20,000 50 18,000 40 16,000 Jan-23 Absolute Rel. to the Hang Seng Index Apr-23 Jul-23 Oct-23 3m 6m 12m (10.9)% (2.7)% 6.8% 15.6% (0.9)% 10.4% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D 12/22 94,182.5 (51,261.9) (39,727.9) (9,638.6) 12/23E 113,505.2 (56,289.6) (39,745.2) (9,707.4) 12/24E 131,722.7 (62,136.8) (43,709.7) (10,585.6) 12/25E 153,431.5 (69,552.0) (48,320.9) (11,208.9) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit 137.0 1,464.8 (7,773.7) (6,308.8) 165.6 -(4,593.1) 1,221.2 17,828.9 (8,844.7) 8,984.2 534.3 -9,665.5 1,283.6 26,242.2 (9,668.0) 16,574.3 637.3 -17,211.5 1,228.6 35,737.8 (10,159.5) 25,578.4 872.6 -26,451.0 (1,158.3) --(5,751.4) (7,937.9) (13,689.4) (1.35) (1.35) (3.22) (3.22) (966.5) --8,698.9 (4,064.2) 4,634.8 2.02 2.02 1.07 1.07 (2,409.6) --14,801.9 (4,254.6) 10,547.3 3.40 3.40 2.42 2.42 (3,967.6) --22,483.3 (4,955.8) 17,527.5 5.11 5.11 3.98 3.98 -0.0 -0.0 -0.0 -0.0 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) DPS (Rmb) Div. payout ratio (%) Balance Sheet (Rmb mn) __________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 25,006.7 5,230.0 -- 12/23E 33,846.7 6,633.4 -- 12/24E 49,992.8 8,242.3 -- 12/25E 74,107.7 9,979.1 -- Other current assets Total current assets Net PP&E Net intangibles 16,478.1 46,714.8 25,595.4 1,090.0 17,259.3 57,739.4 26,806.6 988.2 17,995.9 76,231.0 27,491.2 870.1 18,873.6 102,960.4 28,354.8 1,020.7 Total investments Other long-term assets Total assets Accounts payable 0.0 13,008.6 87,819.9 23,614.5 0.0 13,208.2 100,153.6 26,223.8 0.0 13,424.9 119,428.4 29,225.2 0.0 13,659.3 147,406.4 32,980.7 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities -6,622.9 10,305.8 40,543.1 -6,382.7 11,384.9 43,991.3 -6,193.0 12,652.9 48,071.1 -6,113.7 14,246.9 53,341.3 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities -9,537.0 84.0 9,621.0 -9,928.6 84.0 10,012.6 -10,321.7 84.0 10,405.7 -10,546.1 84.0 10,630.2 50,164.2 -37,649.1 6.6 87,819.9 (25,006.7) 54,003.9 -46,143.1 6.6 100,153.6 (33,846.7) 58,476.8 -60,945.0 6.6 119,428.4 (49,992.8) 63,971.5 -83,428.3 6.6 147,406.4 (74,107.7) Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations (12,531.1) 7,773.7 -(1,116.1) 5,380.5 (493.0) 5,601.3 8,844.7 -1,503.8 2,693.0 18,642.7 12,956.9 9,668.0 -1,924.0 1,628.4 26,177.2 21,495.2 10,159.5 -2,735.0 753.8 35,143.4 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (9,672.3) ---(9,672.3) (9,954.1) ---(9,954.1) (10,234.5) ---(10,234.5) (11,173.7) ---(11,173.7) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow ---2,559.5 2,559.5 (7,605.8) (10,165.2) ---151.4 151.4 8,840.0 8,688.6 ---203.4 203.4 16,146.1 15,942.7 ---145.2 145.2 24,114.9 23,969.7 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 52 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List PDD Holdings - Temu taking shape Covered by Ronald Keung (ronald.keung@gs.com, +852 2978-0856) PDD Buy 12m Price Target: $176 Price: $145.27 GS Forecast 12/22 12/23E 12/24E 12/25E 130,557.6 236,551.9 338,667.7 422,904.2 40,344.5 58,715.6 81,185.9 129,963.5 27.51 38.97 49.81 79.29 China P/E (X) 13.9 26.6 20.8 13.1 China Ecommerce & Logistics P/B (X) 4.7 8.7 6.2 4.3 0.0 0.0 0.0 0.0 Market cap: $200.9bn Revenue (Rmb mn) Enterprise value: $172.6bn EBITDA (Rmb mn) 3m ADTV :$906.3mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: No CROCI (%) FCF yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 21.2% EPS (Rmb) (3.3) (3.4) (3.6) (3.2) 355.8 NM NM NM 9.9 6.3 7.2 8.9 6/23 9/23 12/23E -- 10.47 11.61 9.96 -- Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Key debates: n Can PDD sustain its value-focused proposition and profit margin amid intensified ecommerce price competition? Despite Alibaba, JD and Douyin’s increased shift towards value-for-money offerings, Ronald believes PDD has already built the strongest value-for-money mindshare amongst users, with high user retention and upside to shopping frequency/categories. He sees further room for PDD to expand average order value (AOV), driving GMV market share gains on consumers trading down. On margins, driven by PDD’s lean staff cost base and low S&M costs driven by its grocery-driven traffic advantage, Ronald expects PDD main platform margins to remain highest amongst peers (EBIT margin 55-60%), with improving Temu profitability. n 4 December 2023 Can PDD further lift take rate, as it is now higher than Taobao-Tmall? Still room for yoy take rate expansion on continued step-up in merchants adoption rate of the new standardized & site-wide marketing features given high certainty of ROI & easier functionalities, shifting merchants’ traditional click-based marketing to sales-based with improved focus on product price competitiveness and marketing 53 2e83ab6fea424dc8a1b6a8a7e94c6547 Core thesis: Ronald sees PDD as the region’s best positioned eCommerce company with a promising growth outlook (2024E: 43% rev. growth) driven by its Pinduoduo (China-based) and Temu (US-based, now in ~50 countries) platforms, leveraging its strong value-for-money user mindshare on the back of SKU focused algorithms, leading adtech capabilities combined with China’s most cost-competitive suppliers / merchants / supply chains. Ronald sees risk-reward as attractive, even after recent outperformance, given the market is still pricing the domestic platform at <15X 2024E P/E (vs. 20%+ domestic online marketing growth) with limited valuation ascribed to Temu, which is tapping into overseas TAM with strong traction and a clear profitability path. Goldman Sachs APAC Conviction List efficiency. China is one of the lowest take rate eCommerce markets vs. US / LatAm / ASEAN peers, with PDD’s GMV take rate at 4% vs. HSD/teens at global peers. n What is Temu’s long-term growth outlook & profit potential? Temu’s success Where we are different: 1) Temu’s profitability potential (Ronald expects Temu to turnaround as soon as in 2025E, three years earlier vs. V.A. consensus) based on a unit economics deep dive, with Temu delivering faster-than-expected expansion (GSe US$49bn GMV scale by 2025E) and product mark-up. 2) More positive view on the domestic platform’s potential vs. street for take rate expansion where Ronald sees the company’s consistent roll-out of ROI-based ‘blackbox’ advertisement solutions as driving further ad product adoption across merchants and improvement in take rates. Catalysts: 1) Domestic GMV run-rate into 4Q23/2024, DAU/MAU trends (per GS monthly eCommerce tracker); 2) Progress on merchants’ adoption of the new marketing tools and further take rate expansion; 3) Temu’s performance (DAU/GMV) over the next few months, on the back of post-Black Friday promotions incl. Christmas, further expansion in key markets, and continued GMV ramp up in 2024. Valuation: 12m TP of US$176, with domestic Pinduoduo platform at US$143/ADS (15X 24E NOPAT) and Temu at US$45/ADS (US$65bn), partly offset by SOTP discount. Exhibit 37: Ronald is above V.A. Consensus on PDD Earnings due to a more positive view on Temu profitability Exhibit 38: Temu to rapidly expand GMV scale while improving unit economics U.S. GMV (US$ bn) Non-U.S. GMV (US$ bn) GMV margin (%) 90.0 80.0 6% 1% 60.0 50.0 49 40.0 20.0 10.0 10% 78 71 70.0 30.0 9% -19% 18 6.1 11.9 45.8 0% -5% 33.5 -12% 34 12.9 25.5 21.5 23.9 27.8 30.3 32.1 2024E 2025E 2026E 2027E 2028E -10% -15% 0.0 -20% -25% 2023E Source: Goldman Sachs Global Investment Research, Visible Alpha Consensus Data 10% 5% 61 40.7 15% Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n PDD: 3Q23 review: Double beat: lifting Temu profit assumptions and valuation; Buy n PDD: Progress check on Temu: Lifting Temu GMV and near-term loss drag; refreshing scenarios; retain Buy 54 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM comes from: 1) its entrusted business model, focus on blockbuster SKUs and PDD’s flexible/cheapest supply chain to support the competitive prices; 2) unique low-price merchant ecosystem with high overlap with the Pinduoduo main platform & Duo Duo Grocery manufacturing merchants; 3) strong profitability of PDD’s domestic business, allowing PDD to invest into global. Ronald forecasts Temu 4Q23 GMV to exceed US$8bn and reach US$34bn/$49bn GMV by FY24E/25E, with an estimated US$4bn FY24E EBIT loss drag to PDD before turning around from 2025E with long-term positive high-single digit GMV profit margin potential. Goldman Sachs Income Statement (Rmb mn) _______________________________ PDD Holdings (PDD) Rating since Aug 30, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 13.9 4.7 9.9 8.7 12/23E 26.6 8.7 6.3 20.5 12/24E 20.8 6.2 7.2 14.1 12/25E 13.1 4.3 8.9 8.1 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 8.7 355.8 41.0 (113.8) (113.8) --- 20.5 (3,443.9) 39.1 (116.1) (116.1) --- 14.1 (232.5) 35.2 (116.6) (116.6) --- 8.1 (245.1) 39.1 (112.0) (112.0) --- 1.8 751.8 33.6 0.6 2.0 13,932.5 17,270.5 1.3 318.9 32.8 0.7 1.9 (16,915.4) 9,434.8 1.4 278.6 30.0 0.8 1.8 (43,891.3) (20,913.8) 1.5 274.4 32.7 0.7 1.5 (51,667.1) (40,014.8) 81.96 118.79 166.28 242.31 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 39.0 206.4 175.4 NM 29.2 30.9 81.2 45.5 41.7 NM 24.3 24.8 43.2 38.3 27.8 NM 23.5 24.0 24.9 60.1 59.2 NM 30.3 30.7 30.3 24.1 22.0 28.6 Price Performance _______________________________________ PDD ($) NASDAQ Composite 240 15,000 200 14,000 160 13,000 120 12,000 80 11,000 40 10,000 Jan-23 Apr-23 Absolute Rel. to the NASDAQ Composite Jul-23 Oct-23 3m 6m 12m 40.6% 38.0% 110.3% 92.6% 73.5% 39.2% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 130,557.6 (31,428.5) (53,145.7) (7,863.1) 12/23E 236,551.9 (84,016.2) (86,761.8) (8,281.7) 12/24E 338,667.7 (117,707.2) (128,144.9) (13,279.6) 12/25E 422,904.2 (134,691.1) (140,417.5) (19,632.5) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -40,344.5 (2,224.2) 38,120.3 3,945.4 -44,255.4 -58,715.6 (1,223.4) 57,492.2 7,452.3 -68,596.5 -81,185.9 (1,650.0) 79,535.9 6,453.6 -88,613.9 -129,963.5 (1,800.3) 128,163.2 6,310.4 -137,097.9 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) (4,725.7) --39,529.7 (7,718.4) 31,811.4 31.26 27.51 24.94 21.95 (11,482.8) --57,113.7 (8,907.4) 48,206.2 42.11 38.97 34.97 32.36 (14,163.1) --74,450.8 (11,532.7) 62,918.1 53.82 49.81 45.48 42.09 (16,208.8) --120,889.1 (12,986.7) 107,902.4 85.68 79.29 76.47 70.77 -0.0 -0.0 -0.0 -0.0 Total revenue Cost of goods sold SG&A R&D DPS (Rmb) Div. payout ratio (%) Balance Sheet (Rmb mn) __________________________________ 12/22 92,300.4 587.7 -- 12/23E 180,702.7 1,064.8 -- 12/24E 283,779.4 1,524.5 -- 12/25E 414,244.6 1,903.7 -- Other current assets Total current assets Net PP&E Net intangibles 123,729.8 216,617.9 1,044.8 134.0 127,636.5 309,404.0 1,223.4 73.1 128,798.5 414,102.4 1,819.0 18.4 130,043.1 546,191.4 2,760.1 12.9 Total investments Other long-term assets Total assets Accounts payable 0.0 19,323.2 237,120.0 64,993.1 0.0 19,323.2 330,023.8 81,836.5 0.0 19,323.2 435,263.0 97,867.0 0.0 19,323.2 568,287.5 104,679.0 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities --51,896.4 116,889.5 --71,625.9 153,462.4 --86,383.9 184,250.8 --91,707.3 196,386.3 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities --2,459.6 2,459.6 --2,459.6 2,459.6 --2,459.6 2,459.6 --2,459.6 2,459.6 119,349.0 -117,770.9 -237,120.0 (92,300.4) 155,921.9 -174,101.8 -330,023.8 (180,702.7) 186,710.4 -248,552.6 -435,263.0 (283,779.4) 198,845.8 -369,441.7 -568,287.5 (414,244.6) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 12/22 12/23E 12/24E 12/25E 31,811.4 2,224.2 -7,423.4 7,048.9 48,507.9 48,206.2 1,223.4 -32,189.0 8,124.7 89,743.4 62,918.1 1,650.0 -29,166.8 11,532.7 105,267.6 107,902.4 1,800.3 -10,511.7 12,986.7 133,201.1 (635.7) --(21,726.0) (22,361.7) (1,341.1) ---(1,341.1) (2,190.9) ---(2,190.9) (2,735.9) ---(2,735.9) ---110.2 110.2 26,256.4 47,872.2 ---0.0 0.0 88,402.3 88,402.3 ---0.0 0.0 103,076.7 103,076.7 ---0.0 0.0 130,465.2 130,465.2 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 55 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Sony Group - Pivot towards software and content to drive higher growth Covered by Minami Munakata (minami.munakata@gs.com, +81 3 6437-9830) 6758.T Buy 12m Price Target: ¥16000 Price: ¥12720 GS Forecast 3/23 3/24E 3/25E 3/26E Market cap: ¥15.6tr / $105.6bn Revenue (¥ bn) 11,539.8 12,059.1 12,850.8 13,582.4 Enterprise value: ¥17.0tr / $114.9bn Op. profit (¥ bn) 1,208.2 1,209.3 1,409.1 1,571.1 1,160.0 1,170.0 -- -- Japan EPS (¥) 758.4 725.3 855.1 954.7 Japan Games & Internet P/E (X) 14.7 17.5 14.9 13.3 P/B (X) 1.9 2.0 1.8 1.6 0.7 0.7 0.7 0.9 3m ADTV :¥38.9bn/ $260.7mn Op. profit CoE (¥ bn) M&A Rank: 3 Dividend yield (%) Leases incl. in net debt & EV?: No N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 25.8% EPS (¥) 1.1 0.6 0.0 (0.5) 4.8 8.1 8.9 9.6 6/23 9/23 12/23E 3/24E 176.1 161.9 261.1 121.7 Core thesis: Minami expects investors to shift focus from further hardware penetration to software and content growth on expansion of Sony’s entertainment contents portfolio. She sees earnings driven by (1) higher growth of anime industry than game or music, and (2) full-scale entry into live service games where life cycle revenues tend to be larger than games for one-time purchases and recurring revenue is foreseeable. For Crunchyroll, she forecasts 126% CAGR growth in operating profit for the next 5 years, accounting for 42% of pictures segment OP in FY3/28. She also forecasts first-party game content’s 5-year gross profit CAGR at 24%. Her SoTP-based target price is ¥16,000, whereas the current PER of 14.9X is still lower compared to its 5-year historical average of 15.3X. Key debates: 4 December 2023 n Outlook for PS5 shipments: As PS5’s life cycle approaches the middle innings, focus is on the pace and outlook for installed base expansion. Minami forecasts PS5 shipments of 22 mn units in both FY3/24 & FY3/25, although achieving company guidance (25 mn units in FY3/24) is a high hurdle given 1H progress. She expects consensus to be at around 20-22 mn units. n G&NS segment profit swing factors in FY3/25: Minami expects key profit growth drivers to be a partial contribution from PS Plus price hikes, growth in software and add-on content with the launch of live service games and expansion of the PS5 installed base. As the game segment’s profitability has decreased, the extent to which revenue recovers in FY3/25 has become a focal point. She is optimistic about a recovery in profitability due to (1) effectively leveraging PS5 installed base with the expanding sales of software and content, and (2) the high profitability PS Plus price increase emerges. n I&SS segment risk scenarios through FY3/25: Market focus has been on 56 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List production yield of new CMOS product in FY3/24 as well as overall smartphone / China market conditions. With yields for the new CMOS products improving, she expects FY3/24 profits to mark the bottom and improve going forward, while yen appreciation could be a risk due to high forex sensitivity. n Competition from other platforms in the G&NS business: She thinks the possible acquisition of larger game studios and IP could be more likely now, given the increasing importance of exclusive content with the PS5 platform. Catalysts: (1) Sell-through momentum for PS5 hardware (weekly updates for Japan region and irregular updates for global). (2) The announcement of first-party and third-party PS5 titles from FY3/25 (State of Play & PS Showcase typically air in February and/or May-June). (3) Updates on paid subscriber numbers for Crunchyroll and progress in collaboration with Amazon Prime Video (to be verified on FY3/24 Q3-Q4 earnings release and business segment in May 2024). (4) The announcement of the medium-term plan for FY3/25-FY3/27 expected in 2024, particularly given the M&A strategy for the content business and capital allocation priorities (planned for May 2024). Valuation: 12m TP of ¥16,000, based on a FY3/26 SOTP. Exhibit 39: Crunchyroll to drive profit growth in the pictures segment Exhibit 40: Minami forecasts strong growth in add-on content, especially first-party content Sony Group: Pictures segment profit outlook and breakdown G&NS segment: Gross gross profit breakdown 20 150 15 100 10 50 5 0 - 2022 2023E 2024E 2025E 2026E 2027E Television production (LHS) Motion pictures (LHS) Other media networks (LHS) Crunchyroll (LHS) Crunchyroll number of paying subscriber (RHS) Source: Company data, Goldman Sachs Global Investment Research 1,800 1,600 1,400 Network services Full games 3P Full games 1P Add on contents 3P Add on contents 1P 1,200 2022-2027E CAGR +13% 2e83ab6fea424dc8a1b6a8a7e94c6547 200 G&NS gross profit breakdown (JPY bn) 2,000 25 Number of paying subscriber (mn) 250 Pictures segment operating profit (¥bn) For the exclusive use of MATTHEW.X.WONG@GS.COM Where we are different: GSe FY3/25-FY3/27 operating profit estimates are 4-11% higher than the Bloomberg consensus given bullish assumptions for sales per user rather than PS5 shipment volume and a positive impact on earnings from Japanese anime content via Crunchryoll. -3% 1,000 800 600 400 200 0 +18% +15% +32% Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n Sony Group (6758.T): Rising to prominence as an anime/game content operator; up to Buy n Sony Group (6758.T): President meeting confirms confidence in live game pipeline; Buy 57 Goldman Sachs Income Statement (¥ bn) __________________________________ Sony Group (6758.T) Rating since Jul 13, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 3/23 14.7 1.9 (2.2) 7.3 3/24E 17.5 2.0 8.2 8.0 3/25E 14.9 1.8 8.6 6.7 3/26E 13.3 1.6 9.6 5.6 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 7.3 4.8 13.0 32.8 32.8 -37.0 8.0 8.1 11.7 16.3 16.3 30.2 45.4 6.7 8.9 12.5 0.8 0.8 35.2 45.0 5.6 9.6 12.5 (13.0) (13.0) 39.3 45.2 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 53.9 94.4 12.9 0.4 4.4 22,503.9 9,088.6 55.0 90.6 11.1 0.4 4.1 22,416.1 9,480.1 54.5 92.1 11.8 0.4 3.8 22,462.9 9,137.1 54.7 92.5 11.8 0.4 3.5 22,508.2 8,831.7 5,850.7 6,453.8 7,214.0 8,058.7 For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (¥) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 3/23 3/24E 3/25E 3/26E 16.3 8.6 6.5 15.4 10.5 19.2 4.5 (3.6) (4.4) 13.3 10.0 17.7 6.6 10.7 17.9 11.8 11.0 18.4 5.7 8.1 11.7 15.8 11.6 18.8 8.1 7.4 8.2 8.6 Price Performance _______________________________________ 6758.T (¥) TOPIX 18,000 2,800 16,000 2,600 14,000 2,400 12,000 2,200 10,000 2,000 8,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 1.5% 0.1% (5.1)% (14.4)% 12.3% (6.4)% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D 3/23 11,539.8 (7,174.7) (2,451.7) (705.2) 3/24E 12,059.1 (7,902.8) (2,221.8) (725.2) 3/25E 12,850.8 (8,408.6) (2,287.9) (745.2) 3/26E 13,582.4 (8,855.0) (2,371.2) (785.2) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -2,212.8 (1,004.6) 1,208.2 -24.4 1,180.3 -2,133.5 (924.2) 1,209.3 (20.0) 20.0 1,189.3 -2,361.9 (952.8) 1,409.1 (20.0) 20.0 1,389.1 -2,553.4 (982.3) 1,571.1 (20.0) 20.0 1,551.1 (236.7) (6.5) -937.1 -937.1 758.4 755.0 758.4 755.0 (293.4) (6.4) -889.5 -889.5 725.3 722.9 725.3 722.9 (333.5) (6.9) -1,048.7 -1,048.7 855.1 852.3 855.1 852.3 (373.1) (7.1) -1,170.9 -1,170.9 954.7 951.6 954.7 951.6 75.0 9.9 85.0 11.7 95.0 11.1 110.0 11.5 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) DPS (¥) Div. payout ratio (%) Balance Sheet (¥ bn) _____________________________________ Cash & cash equivalents Accounts receivable Inventory 3/23 1,480.9 1,777.9 1,468.0 3/24E 2,565.5 1,857.9 1,534.1 3/25E 3,794.6 1,979.9 1,634.8 3/26E 5,158.6 2,092.6 1,727.9 Other current assets Total current assets Net PP&E Net intangibles 1,049.6 5,776.5 1,344.9 3,400.8 1,049.6 7,007.2 1,418.7 2,954.4 1,049.6 8,458.9 1,464.0 2,508.0 1,049.6 10,028.8 1,479.7 2,061.6 18,770.9 2,748.1 32,041.2 1,866.0 18,790.9 2,748.1 32,919.3 2,055.4 18,810.9 2,748.1 33,990.0 2,186.9 18,830.9 2,748.1 35,149.1 2,303.0 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 2,102.9 -5,340.1 9,308.9 2,100.0 -5,340.1 9,495.4 2,100.0 -5,340.1 9,627.0 2,100.0 -5,340.1 9,743.1 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 1,767.7 -13,676.3 15,444.0 1,767.7 -13,676.3 15,444.0 1,767.7 -13,676.3 15,444.0 1,767.7 -13,676.3 15,444.0 Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted 24,752.9 -7,229.7 58.6 32,041.2 2,389.7 24,939.4 -7,914.9 65.0 32,919.3 1,302.2 25,070.9 -8,847.1 71.9 33,990.0 73.1 25,187.0 -9,883.1 79.0 35,149.1 (1,290.9) Total investments Other long-term assets Total assets Accounts payable Cash Flow (¥ bn) _________________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 3/23 3/24E 3/25E 3/26E 937.1 1,004.6 6.5 (740.2) (893.4) 314.7 (613.6) (282.2) (282.2) 125.3 889.5 924.2 6.4 43.3 (20.0) 1,843.4 (551.7) ---- 1,048.7 952.8 6.9 (91.2) (20.0) 1,897.2 (551.7) ---- 1,170.9 982.3 7.1 (89.7) (20.0) 2,050.6 (551.7) ---- (1,052.7) -(92.7) (99.8) 361.8 169.2 (568.7) (298.9) (551.7) -(104.2) (2.9) (100.0) (207.1) 1,084.6 1,291.7 (551.7) -(116.5) -0.0 (116.5) 1,229.1 1,345.6 (551.7) -(134.9) -0.0 (134.9) 1,364.0 1,498.9 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 58 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Suzuki Motor - Pipeline, price, and payout to drive valuation gap closure Covered by Kota Yuzawa (kota.yuzawa@gs.com, +81 3 6437-9863) 7269.T Buy 12m Price Target: ¥7900 Price: ¥6058 GS Forecast 3/23 3/24E 3/25E 3/26E Market cap: ¥3.4tr / $22.9bn Revenue (¥ bn) 4,641.6 5,147.0 5,352.0 5,584.0 Enterprise value: ¥2.7tr / $18.1bn Op. profit (¥ bn) 350.6 459.0 506.0 528.0 -- 430.0 -- -- Japan EPS (¥) 455.2 591.6 658.7 693.8 Japan Automobiles P/E (X) 9.9 10.2 9.2 8.7 P/B (X) 1.3 1.6 1.4 1.3 3m ADTV :¥10.6bn/ $70.9mn Op. profit CoE (¥ bn) M&A Rank: 2 Dividend yield (%) Leases incl. in net debt & EV?: No N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 30.4% EPS (¥) 2.2 2.6 3.3 3.5 (2.4) (1.8) (1.7) (1.6) 9.8 13.2 13.9 13.8 6/23 9/23 12/23E 3/24E 138.0 128.8 143.2 181.6 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: Suzuki Motor’s market cap implies a negative value for the parent company after deducting Maruti Suzuki’s market cap versus a premium pre-2021; a gap Kota expects to narrow, with a 2024 pipeline of new launches resulting in acceleration of volume growth both domestically and in India, and with a mix shift margin upgrade. Finally, he believes an improvement in capital efficiency at the parentco level should act as a potential upside valuation catalyst. n India capacity expansion: The India business is executing a growth plan to increase annual production capacity to over 4mn vehicles by 2030, from 2.25mn, enabling the company to grow market share from 40%+ now to 50%. Suzuki is also considering leveraging its competitive India manufacturing operations to divert 1mn vehicles for export, of the targeted 4mn capacity. n EV strategy: Investors are concerned that Suzuki has been slow to introduce EVs relative to rivals. However, Kota believes Suzuki can be competitive, even as a latecomer, given that: (1) India, its main market for consolidated sales, has set a target of net zero in 2070; (2) the Make in India policy is likely to limit EV imports from China (where there is concern about oversupply) and other countries. n Capital allocation: Management has a multi-pronged approach to capital management: progressive dividends, a target dividend payout ratio of 30% (for FY3/26) from 22% in 3/2022, and an increase in the total shareholder return rate through buybacks. Kota believes the company is conscious of enhancing shareholder returns even as it makes investments in growth and implements an electrification strategy. Where we are different: Kota’s FY3/24-FY3/25 operating profit estimates are 6.5%/7.4% above IFIS consensus, with a more positive outlook for Japan price hikes 4 December 2023 59 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List and India mix improvement. He also thinks management recognizes valuation is low, excluding the mkt cap of its Indian subsidiary Maruti Suzuki (58% equity interest) and plans to address this through better operational efficiency and capital allocation improvements. Catalysts: (1) India launches in 1H24. With Suzuki Maruti focused on regaining a 50% market share in India, Kota expects production capacity to ramp to over 4mn units by 2025 and with a roll out of its SUV pipeline. (2) Price hikes, Kota has modeled price hikes in Japan for 2024 which should give comfort to the market that they can comfortably offset the impact of inflation as it launches new models. (3) Kota believes the market will gain some comfort that the company can successfully transition over to EV product with the launch of the first model in 2024, and vertically integrate the product platform with the start-up of local battery production in India. Valuation: 12m TP of ¥7,900 based 85% on FY3/25E SOTP-based fundamental value of ¥7,800 (applying the historical 10-year average discount of 10%), and 15% M&A value of Exhibit 41: Doubling capacity in India Exhibit 42: Non-India operation improving India capacity outlook NAV and Japan segment OPM 12,000 6.0% 10,000 5.0% 8,000 4.0% 6,000 4,000 3.0% 2,000 2.0% 0 -4,000 2013 Source: Company data, Goldman Sachs Global Investment Research 2014 2015 2016 2017 Valuation gap 2018 2019 2020 2021 2022 Suzuki JPN ex.Royalty OPM 1.0% 0.0% 2023 2e83ab6fea424dc8a1b6a8a7e94c6547 -2,000 April September February July December May October March August January June November April September February July December May October March August January June November April September February For the exclusive use of MATTHEW.X.WONG@GS.COM ¥8,700 (SOTP-based, assuming a discount of 0%). Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Suzuki Motor (7269.T): Earnings Review: Guidance raise above expectations; we raise our TP and reiterate Buy n 4 December 2023 Japan Value in Action II: Reiterate Buy on five large-caps with potential for further change and highlight seven companies prompting FAQs 60 Goldman Sachs Income Statement (¥ bn) __________________________________ Suzuki Motor (7269.T) Rating since Jun 21, 2016 CL For the exclusive use of MATTHEW.X.WONG@GS.COM Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 3/23 9.9 1.3 0.6 2.6 3/24E 10.2 1.6 3.6 3.4 3/25E 9.2 1.4 7.5 3.0 3/26E 8.7 1.3 8.3 2.8 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 2.6 9.8 14.0 (11.6) (11.6) 52.0 33.6 3.4 13.2 16.4 (5.9) (5.9) 60.4 36.3 3.0 13.9 16.4 (5.3) (5.3) 64.1 37.4 2.8 13.8 15.5 (5.5) (5.5) 64.4 37.4 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 36.4 35.8 10.7 1.0 2.2 3,789.9 1,654.4 36.7 38.4 12.6 1.1 2.2 3,851.2 1,963.2 37.9 39.7 12.9 1.0 2.1 4,062.6 2,179.9 37.8 39.4 12.4 1.0 2.1 4,266.3 2,342.3 BVPS (¥) 3,376.0 3,772.6 4,201.9 4,662.9 Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 3/23 3/24E 3/25E 3/26E 30.1 49.5 37.9 9.9 7.6 11.4 10.9 23.0 30.0 60.0 8.9 12.6 4.0 9.1 11.4 25.0 9.5 13.2 4.3 4.4 5.3 5.0 9.5 13.2 4.8 5.5 5.7 5.7 Price Performance _______________________________________ 7269.T (¥) TOPIX 9,000 2,800 8,000 2,600 7,000 2,400 6,000 2,200 5,000 2,000 4,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 5.0% 3.5% 32.9% 19.9% 24.4% 3.8% Source: FactSet. Price as of 1 Dec 2023 close. 3/23 4,641.6 (3,491.7) (799.4) (205.6) 3/24E 5,147.0 (3,845.1) (842.9) (230.0) 3/25E 5,352.0 (3,986.3) (859.7) (240.0) 3/26E 5,584.0 (4,177.7) (878.3) (250.0) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -527.9 (177.3) 350.6 31.2 11.6 381.0 -649.0 (190.0) 459.0 30.3 15.2 501.0 -708.0 (202.0) 506.0 30.0 16.8 550.3 -739.0 (211.0) 528.0 29.7 17.5 572.7 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) (106.8) (53.2) -221.1 -221.1 455.2 445.7 455.2 445.7 (150.3) (69.1) -281.6 -281.6 591.6 579.0 591.6 579.0 (165.1) (77.9) -307.3 -307.3 658.7 644.6 658.7 644.6 (171.8) (83.7) -317.2 -317.2 693.8 678.8 693.8 678.8 100.0 22.0 160.0 27.0 200.0 30.4 210.0 30.3 Total revenue Cost of goods sold SG&A R&D DPS (¥) Div. payout ratio (%) Balance Sheet (¥ bn) _____________________________________ Cash & cash equivalents Accounts receivable Inventory 3/23 1,003.8 491.3 485.3 3/24E 894.3 544.8 538.2 3/25E 920.8 566.5 559.6 3/26E 965.2 591.0 583.8 Other current assets Total current assets Net PP&E Net intangibles 208.1 2,188.5 1,134.5 3.8 291.3 2,268.5 1,134.5 3.8 407.8 2,454.7 1,082.5 3.8 570.9 2,711.0 1,021.5 3.8 Total investments Other long-term assets Total assets Accounts payable 1,118.2 132.6 4,577.7 383.2 1,358.2 132.6 4,897.7 424.9 1,453.4 132.6 5,127.0 441.8 1,496.5 132.6 5,365.5 460.9 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 347.0 -757.2 1,487.4 347.0 -1,104.3 1,876.2 347.0 -1,104.3 1,893.1 347.0 -1,104.3 1,912.3 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 416.8 -164.9 581.7 416.8 -173.7 590.5 446.8 -183.4 630.2 476.8 -194.1 670.9 4,139.5 -1,639.8 430.6 4,577.7 (240.0) 4,693.1 -1,795.8 430.6 4,897.7 (130.4) 4,914.1 -1,960.2 430.6 5,127.0 (127.0) 5,145.4 -2,131.7 430.6 5,365.5 (141.4) Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (¥ bn) _________________________________________ 3/23 3/24E 3/25E 3/26E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others 221.1 177.3 53.2 (83.2) (81.8) 286.6 (269.9) --(32.8) 281.6 190.0 69.1 (64.6) (15.9) 460.2 (340.0) --(78.0) 307.3 202.0 77.9 (26.2) (17.5) 543.5 (300.0) --(78.0) 317.2 211.0 83.7 (29.7) (18.2) 564.0 (300.0) --(78.0) Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (302.7) -(46.6) 105.2 (27.0) 31.6 15.5 16.7 (418.0) -(76.2) -(75.6) (151.7) (109.6) 120.2 (378.0) -(93.3) 30.0 (75.6) (138.9) 26.6 243.5 (378.0) -(96.0) 30.0 (75.6) (141.6) 44.4 264.0 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 61 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Baoshan Iron & Steel - Consolidator, mix upgrade and margin upside Covered by Trina Chen (trina.chen@gs.com, +852 2978-2678) 600019.SS Buy 12m Price Target: Rmb8.2 Price: Rmb6.25 GS Forecast 12/22 12/23E 12/24E 12/25E 366,406.0 340,405.3 340,709.2 343,596.3 36,325.4 33,995.9 42,199.9 46,817.5 0.55 0.44 0.70 0.86 China P/E (X) 11.2 14.1 8.9 7.3 China Basic Materials P/B (X) 0.7 0.7 0.7 0.6 4.5 3.6 5.7 7.0 0.6 0.6 0.1 (0.2) Market cap: Rmb139.2bn / $19.5bn Revenue (Rmb mn) Enterprise value: Rmb181.5bn / $25.4bn EBITDA (Rmb mn) 3m ADTV :Rmb504.5mn/ $69.3mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: No CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 31.2% 5.9 6.3 7.4 7.8 FCF yield (%) 14.1 (15.4) 11.2 12.9 6/23 12/23E 6/24E 12/24E EPS (Rmb) 0.20 0.24 0.36 0.34 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Key debates: n Depressed industry steel margin in weak demand environment, absence of output control, and elevated raw material costs. n Despite strong 3Q23A results, there are questions on how much of the strong GP (Rmb315/t for 3Q23) comes from the lagged raw material cost. n Earnings and return impact from the potential capacity growth targets. Where we are different: (1) Trina forecasts a higher steel margin outlook for Baosteel in the next 6-12 months, driven by improvement in CRC margin, on the back of end of finished goods destocking in the manufacturing sector and the positive outlook for China auto production (9% growth for 2024E). While the steel cycle is expected to remain depressed in China in 2024E, she sees limited downside to industry margins from the current levels. This would allow the relative outperformance of CRC product to materialize. Baosteel’s unit gross profit should improve to an average of Rmb500/t in 2025E versus current 1H23A of Rmb150/t, with ROE expanding from 5.0% to 7.4-8.7% in 2024-25E. (2) The company’s medium and long-run business strategy, capacity expansion plans and continued product mix upgrades, could lead to further upside. 4 December 2023 62 2e83ab6fea424dc8a1b6a8a7e94c6547 Core thesis: With nearly 27% of product sales exposed to auto sheet, and more than 50% market share in the China auto sheet market, Baosteel is a unique beneficiary of the price premium recovery of flat steel CRC in China. The company’s medium-term plan for continued consolidation and product mix upgrades provide further upside. Already, the largest steel mill in China, it is spending 10% of annual capex on technical transformation, mostly on automation. Risk reward is attractive from both margin and valuation prospective. Baosteel currently is trading at 0.65x P/B, low end of its historical range of 0.5-2.0x, and an average of 1.0x P/B in global steel peers. Upside risks are underpinned with improving ROE, from 5% in 2023E to 8% in 2024E, and 10% in 2025. Goldman Sachs APAC Conviction List Specifically, Baosteel targets to reach total steel capacity of 80mnt by 2024E, and 100mnt by 2027E, from 51mnt in 2022, mostly through internal asset restructuring, acquisitions, and construction of new capacity overseas. Additionally, product mix upgrades could significantly improve the GP mix of the company. Catalysts: Quarterly realized margin in the coming months. Valuation: 12m TP of Rmb8.20, derived from a historical P/B vs. ROE correlation – or 2024E P/B of 0.95x on 2024E ROE of 7.4%. Exhibit 43: Unit gross profit - Baosteel Unit GP (Rmb/t) Baosteel 1,200 Unit GP by product - Baosteel (Rmb/t) 1,200 1,000 1,000 800 800 600 600 400 400 200 200 0 0 Source: Company data, Mysteel, Goldman Sachs Global Investment Research HR products Other steel products 1H25E 1H24E 1H23A 1H22A 1H21A 1H20A 1H19A 1H18A 1H17A 1H16A 1H15A 1H14A 1H13A 1H12A 1H11A 1H10A 1H09A 1H08A (200) (200) 1Q09A 3Q09A 1Q10A 3Q10A 1Q11A 3Q11A 1Q12A 3Q12A 1Q13A 3Q13A 1Q14A 3Q14A 1Q15A 3Q15A 1Q16A 3Q16A 1Q17A 3Q17A 1Q18A 3Q18A 1Q19A 3Q19A 1Q20A 3Q20A 1Q21A 3Q21A 1Q22A 3Q22A 1Q23A 3Q23A 2024E CR product Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n China commodities 2024 outlook: New and old, a year of deceleration: 4 preferred themes in copper, flat steel, value in cement, and the hog cycle n Baoshan Iron & Steel (600019.SS): Earnings Review: Strong 3Q23 on higher unit steel profit; Maintain Buy 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Exhibit 44: Unit gross profit by products - Baosteel 4 December 2023 63 Goldman Sachs Income Statement (Rmb mn) _______________________________ Baoshan Iron & Steel (600019.SS) Rating since Sep 4, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) 12/22 11.2 0.7 14.1 4.9 12/23E 14.1 0.7 (15.4) 5.3 12/24E 8.9 0.7 11.2 4.0 12/25E 7.3 0.6 12.9 3.4 4.9 5.9 6.3 9.5 9.5 9.2 47.6 5.3 6.3 5.0 8.8 8.8 13.5 49.1 4.0 7.4 7.6 2.6 2.6 18.0 48.0 3.4 7.8 8.9 (3.0) (3.0) 29.6 46.8 36.5 63.6 5.6 0.9 1.8 481,309.3 237,393.0 38.1 71.7 4.5 0.9 1.7 504,769.3 238,425.4 37.4 75.2 6.6 0.9 1.6 523,425.2 240,309.8 37.2 76.0 7.7 0.9 1.6 542,925.8 240,214.6 8.74 8.90 9.38 9.88 Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 1.0 (29.7) (48.9) (53.0) 4.5 9.9 (7.1) (6.4) (19.1) (19.1) 4.4 10.0 0.1 24.1 57.6 57.6 6.8 12.4 0.8 10.9 22.5 22.5 8.0 13.6 3.3 2.9 4.6 5.5 Price Performance _______________________________________ 600019.SS (Rmb) Shanghai - Shenzhen 300 7.5 4,400 7.0 4,200 6.5 4,000 6.0 3,800 5.5 3,600 5.0 3,400 Jan-23 Apr-23 Absolute Rel. to the Shanghai - Shenzhen 300 Jul-23 Oct-23 3m 6m 12m (1.7)% 7.0% 6.8% 16.8% 11.4% 24.6% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) DPS (Rmb) Div. payout ratio (%) 12/22 366,406.0 (346,292.8) (9,308.4) (3,168.2) 12/23E 340,405.3 (321,626.8) (9,387.3) (3,167.4) 12/24E 340,709.2 (312,309.7) (9,421.0) (3,166.1) 12/25E 343,596.3 (310,547.6) (9,452.7) (3,166.1) 431.4 36,325.4 (19,735.3) 16,590.1 (1,546.0) 2,548.3 15,044.0 1,183.6 33,995.9 (19,173.5) 14,822.3 (802.5) 2,548.3 14,019.9 -42,199.9 (19,173.5) 23,026.4 (924.6) 2,548.3 22,101.8 -46,817.5 (19,173.5) 27,644.0 (578.2) 2,548.3 27,065.8 (1,015.1) (1,842.1) -12,186.9 -12,186.9 0.55 0.55 0.55 0.55 (2,663.8) (1,491.1) -9,865.0 -9,865.0 0.44 0.44 0.44 0.44 (4,199.3) (2,350.7) -15,551.8 -15,551.8 0.70 0.70 0.70 0.70 (5,142.5) (2,878.6) -19,044.6 -19,044.6 0.86 0.86 0.86 0.86 0.28 50.9 0.23 50.9 0.36 50.9 0.44 50.9 Balance Sheet (Rmb mn) __________________________________ 12/22 24,149.7 36,297.0 46,010.0 12/23E 36,770.0 34,859.6 45,488.7 12/24E 36,802.8 34,890.7 44,171.0 12/25E 37,114.7 35,186.3 43,921.8 Other current assets Total current assets Net PP&E Net intangibles 68,432.0 174,888.8 148,258.7 12,079.7 36,432.0 153,550.2 156,808.2 12,079.7 36,432.0 152,296.4 157,634.7 12,079.7 36,432.0 152,654.7 158,461.2 12,079.7 Total investments Other long-term assets Total assets Accounts payable 0.0 63,021.7 398,248.9 62,046.3 0.0 63,021.7 385,459.8 64,350.6 0.0 63,021.7 385,032.5 64,408.0 0.0 63,021.7 386,217.3 64,953.8 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 17,482.5 -64,458.8 143,987.7 16,893.0 -32,458.8 113,702.4 12,883.4 -32,458.8 109,750.2 8,873.1 -32,458.8 106,285.8 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 27,073.0 -11,311.8 38,384.8 39,417.0 -11,311.8 50,728.8 30,061.2 -11,311.8 41,373.0 20,703.9 -11,311.8 32,015.7 182,372.5 -194,622.9 21,253.4 398,248.9 20,405.8 164,431.2 -198,284.1 22,744.6 385,459.8 19,539.9 151,123.2 -208,814.0 25,095.2 385,032.5 6,141.7 138,301.5 -219,941.9 27,973.9 386,217.3 (7,537.6) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E 12,186.9 19,735.3 1,842.1 18,338.4 (7,383.6) 44,719.0 9,865.0 19,173.5 1,491.1 (27,737.0) (0.0) 2,792.6 15,551.8 19,173.5 2,350.7 1,344.1 -38,420.1 19,044.6 19,173.5 2,878.6 499.3 -41,596.1 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (22,423.0) --(3,768.0) (26,191.0) (27,723.0) ---(27,723.0) (20,000.0) ---(20,000.0) (20,000.0) ---(20,000.0) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow -(13,092.2) (3,273.7) (25,610.3) (13,739.7) 4,103.7 22,296.0 -(6,203.8) 11,754.4 32,000.0 37,550.6 12,620.2 (24,930.3) -(5,021.9) (13,365.4) 0.0 (18,387.3) 32.8 18,420.1 -(7,916.8) (13,367.5) 0.0 (21,284.3) 311.9 21,596.1 Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Source: Company data, Goldman Sachs Research estimates. 4 December 2023 64 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Lynas Rare Earths - Attractive positioning, expansion projects and valuation Covered by Paul Young (paul.young1@gs.com, +61 2 9321-8302) LYC.AX Buy 12m Price Target: A$7.5 Upside: 18.1% GS Forecast 6/23 6/24E 6/25E 6/26E 739.3 600.3 1,321.3 1,761.0 377.7 238.8 647.5 858.8 0.34 0.17 0.48 0.66 Australia P/E (X) 23.5 36.5 13.1 9.6 ANZ Resources FCF yield (%) (2.3) (8.2) 1.9 7.9 0.0 0.0 0.0 0.0 (2.2) (1.4) (0.6) (0.9) Market cap: A$5.9bn / $3.9bn Revenue (A$ mn) Enterprise value: A$5.6bn / $3.7bn EBITDA (A$ mn) 3m ADTV :A$24.2mn/ $15.5mn EPS (A$) Dividend yield (%) M&A Rank: 3 Net debt/EBITDA (X) Leases incl. in net debt & EV?: Yes EV/EBITDA (X) For the exclusive use of MATTHEW.X.WONG@GS.COM Price: A$6.35 17.2 23.4 8.5 6.0 ROCE (%) 30.3 11.4 21.3 25.9 6/23 12/23E 6/24E 12/24E EPS (A$) 0.18 0.05 0.13 0.20 Core thesis: The largest western world producer of high-value rare earth (RE) elements used in the production of magnets for electric vehicles and wind turbines; neodymium (Nd), praseodymium (Pr). With the global NdPr market dominated by China (~70-80% of production), LYC is an important ex-China source of NdPr and has long-term offtakes with Japanese and Chinese magnet producers. With the commissioning of LYC’s Kalgoorlie facility underway and the recent 3-year extension to LYC’s operating licence in Malaysia, investors should look through FY24 considering it is a transitional year. LYC also has a strategic agreement with the US Department of Defence (DoD) which is fully funding the company’s US refinery. The stock is trading at ~0.85x NAV (A$7.92/sh) and pricing in just US$71/kg NdPr (spot at US$69/kg) vs. Paul’s long run US$80/kg (real $, from 2027) NdPr price forecast. LYC’s balance sheet is strong with net cash of ~A$700mn and US/Australia/Japan government support and funding. Key debates: n Competing against China’s dominant position in RE production: China releases a half-yearly RE quota with the most recently announced production quota in-line with Paul’s latest rare earths (NdPr) SD model. He continues to think that China Northern Rare Earths (CNRE), as the largest producer and therefore the primary liquidity provider into the Chinese NdPr price index and price setter, will continue to moderate production to even out margins through the RE value chain from mines to magnets over the medium term. n Ramp-up and capex of expansion projects: Kalgoorlie cracking and leaching facility, Mt Weld mine expansion and US refinery. Where we are different: Paul is constructive on the rare earth market over the medium to long run: Paul has developed a proprietary global Rare Earth Oxide (REO) NdPr 4 December 2023 65 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List supply/demand model built bottom-up and incorporating GS latest demand forecasts for EVs and Wind turbines along with mapping out all global mine supply and potential development projects. This drives his forecast of US$80/kg versus spot at US$69/kg. Catalysts: 1) Possibility that China announces a flat production quota in 2024; 2) Ramp-up of the key Kalgoorlie Facility; 3) Capex and timing update on Mt Weld expansion - resource and reserve upgrades/announcement of any future expansion plans. Valuation: 12m TP of A$7.50, based on 50:50 NAV:EV/EBITDA with a target multiple of 16x. Exhibit 45: Paul expects China’s supply to keep the market balanced over the medium term Exhibit 46: Lynas is growing NdPr production by >50% over the next ~4 years and adding a Heavy Rare Earth Product Stream (Tb, Dy) from their US refinery NdPr supply by source and total global demand (kt) Production Volumes (kt) 120 kt NdPr 60 80 38.9 40 60 28.4 40 20 16.0 16.8 20 10 10.1 10.6 5.9 6.1 4.8 2023 2024E 12.2 2030E 2029E 2028E 2027E 2026E 2025E 2024E 2023E 2022 2021 2020 2019 Australia China SE Asia North America Africa Rest-of-World Recycled Total demand Supply volumes are recovery adjusted 0 49.1 49.1 6.2 6.5 6.5 30.5 30.5 30.5 30.5 11.9 12.0 12.0 2028E 2029E 2030E 27.2 30 0 48.8 4.9 47.1 50 2018 2022 NdPr 18.3 7.4 8.9 10.5 11.7 2025E 2026E 2027E Other Light Rare Earths Heavy Rare Earths Source: Company data, Goldman Sachs Global Investment Research Source: Company data, Goldman Sachs Global Investment Research, Bloomberg, Wood Mackenzie Relevant Research: 4 December 2023 n Lynas Rare Earths Ltd. (LYC.AX): Malaysia extends Crack & Leach license to 2026, increasing our FY24 & FY25 NdPr production & PT to A$7.5; Buy n Lynas Rare Earths Ltd. (LYC.AX): World’s largest single producer of NdPr for EVs & Wind, doubling to 10.5ktpa & likely upsizing to >12ktpa, but fully valued; initiate Neutral 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 100 66 Goldman Sachs Income Statement (A$ mn) _________________________________ Lynas Rare Earths Ltd. (LYC.AX) Rating since Oct 10, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 6/23 23.5 3.4 (2.3) 17.0 6/24E 36.5 2.5 (8.2) 22.8 6/25E 13.1 2.1 1.9 8.4 6/26E 9.6 1.8 7.9 6.0 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 17.1 27.7 16.3 (37.9) (38.5) 78.4 47.7 23.4 9.8 7.2 (14.5) (15.0) 37.1 66.8 8.5 26.2 17.7 (15.1) (15.6) 126.2 47.0 6.0 30.0 20.5 (22.7) (23.1) 194.6 51.7 41.8 77.5 14.4 0.3 1.2 1,369.1 1,098.2 35.6 89.0 6.9 0.2 1.2 2,032.1 1,659.3 25.0 67.4 16.3 0.4 1.2 2,408.8 2,164.1 27.5 76.3 19.0 0.5 1.2 2,567.1 2,416.1 2.36 2.50 2.96 3.46 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (A$) Average capital employed (A$) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (A$) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 6/23 6/24E 6/25E 6/26E (19.6) (37.2) (43.2) NM 42.7 51.1 (18.8) (36.8) (48.9) NM 25.4 39.8 120.1 171.2 178.4 NM 39.5 49.0 33.3 32.6 36.0 NM 40.2 48.8 42.0 27.1 34.2 34.9 Price Performance _______________________________________ LYC.AX (A$) S&P/ASX 200 10 7,600 9 7,400 8 7,200 7 7,000 6 6,800 5 6,600 Jan-23 Absolute Rel. to the S&P/ASX 200 Apr-23 Jul-23 Oct-23 3m 6m 12m (12.3)% (9.7)% (14.8)% (14.3)% (27.8)% (25.0)% Source: FactSet. Price as of 1 Dec 2023 close. 6/23 739.3 (346.2) (45.8) -- 6/24E 600.3 (313.3) (48.3) -- 6/25E 1,321.3 (624.1) (49.7) -- 6/26E 1,761.0 (848.0) (54.2) -- Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit 30.4 377.7 (62.2) 315.5 32.3 -347.8 -238.8 (86.0) 152.8 38.5 -191.2 -647.5 (125.7) 521.8 10.6 -532.4 -858.8 (151.5) 707.4 16.4 -723.8 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (A$) EPS (diluted, pre-except) (A$) EPS (basic, post-except) (A$) EPS (diluted, post-except) (A$) (37.2) --310.7 -310.7 0.34 0.34 0.34 0.34 (28.7) --162.5 -162.5 0.17 0.17 0.17 0.17 (79.9) --452.5 -452.5 0.48 0.48 0.48 0.48 (108.6) --615.2 -615.2 0.66 0.66 0.66 0.66 -0.0 -0.0 -0.0 -0.0 Total revenue Cost of goods sold SG&A R&D DPS (A$) Div. payout ratio (%) Balance Sheet (A$ mn) ___________________________________ Cash & cash equivalents Accounts receivable Inventory 6/23 1,011.2 59.6 111.9 6/24E 522.3 57.5 108.0 6/25E 583.2 123.7 232.4 6/26E 879.8 142.1 266.9 Other current assets Total current assets Net PP&E Net intangibles 3.9 1,186.6 1,344.2 -- 3.9 691.7 1,992.0 -- 3.9 943.2 2,262.0 -- 3.9 1,292.7 2,402.4 -- Total investments Other long-term assets Total assets Accounts payable 0.0 107.9 2,638.7 82.0 0.0 107.9 2,791.6 70.8 0.0 107.9 3,313.1 159.7 0.0 107.9 3,803.0 194.7 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 10.0 4.5 68.5 165.0 10.0 4.5 58.5 143.8 10.0 4.5 53.5 227.7 10.0 4.5 53.5 262.7 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 167.4 8.5 134.5 310.3 160.4 8.5 138.1 306.9 140.4 8.5 164.5 313.3 120.4 8.5 169.0 297.8 475.3 -2,163.4 -2,638.7 (833.8) 450.6 -2,340.9 -2,791.6 (352.0) 541.0 -2,772.1 -3,313.1 (432.9) 560.6 -3,242.4 -3,803.0 (749.4) Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (A$ mn) _______________________________________ 6/23 6/24E 6/25E 6/26E 310.7 62.2 -46.0 (32.1) 386.8 162.5 86.0 -4.7 (54.9) 198.4 452.5 125.7 -(96.6) 5.8 487.4 615.2 151.5 -(17.9) (11.9) 736.9 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (595.5) --41.0 (554.5) (727.5) --42.6 (684.9) (389.4) --14.7 (374.7) (285.6) --20.0 (265.6) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (3.2) -(6.0) 208.1 199.0 45.6 (208.8) (6.3) 0.0 (7.0) 10.9 (2.4) (488.9) (529.0) (6.3) (121.4) (20.0) 95.9 (51.8) 60.9 98.0 (6.3) (354.8) (20.0) 206.4 (174.8) 296.6 451.3 Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Source: Company data, Goldman Sachs Research estimates. 4 December 2023 67 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Foxconn Industrial Internet - Margin expansion driven upside Covered by Verena Jeng (verena.jeng@gs.com, +852 2978-1681) 601138.SS Buy 12m Price Target: Rmb31.61 Price: Rmb15.15 GS Forecast 12/22 12/23E 12/24E 12/25E 511,849.6 487,620.7 558,033.8 645,179.4 23,431.7 31,421.9 44,777.7 54,120.8 1.01 1.24 1.76 2.01 China P/E (X) 9.6 12.2 8.6 7.5 Greater China Technology P/B (X) 1.5 2.1 1.9 1.7 Market cap: Rmb300.5bn / $42.1bn Revenue (Rmb mn) Enterprise value: Rmb269.9bn / $37.8bn EBITDA (Rmb mn) 3m ADTV :Rmb1.7bn/ $239.0mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: No CROCI (%) FCF yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 108.7% EPS (Rmb) 5.7 4.4 6.3 7.2 (0.4) (1.0) (1.5) (1.4) 23.2 18.8 23.5 23.3 3.8 11.3 18.2 9.6 9/23 12/23E 3/24E 6/24E 0.32 0.56 0.33 0.32 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: Foxconn Industrial Internet (FII) is a key contributor to Hon Hai and a leading EMS of telecom equipment, network equipment, cloud service equipment, precision tools and industrial robots. Given its broad exposure along the AI supply chain, from GPU modules, GPU baseboards, AI servers, and related infrastructure, Verena sees FII as well-placed to capture strong AI demand growth. She forecasts AI revenue contribution to grow from 2% in 2022 to 24% in 2025E. At the same time, the company is moving from OEM to ODM and towards cloud service providers (CSP) from enterprises, which Verena views as positive for mix and gross margins. n Legacy business in better shape: Investor concerns focus on the potential for the legacy businesses to be a growth drag, but Verena argues these to be in better shape in 2024 with new customers and upgrade of the business model from OEM to ODM. In networking, Verena sees the opportunity for market share gains with existing customers as well as new customer penetration. Additionally, she expects AI should lead to increasing demand for high-speed routers and switches and value-add opportunities for EMS/ODM given a more complex design/manufacturing process. In general servers, the company is transitioning from EMS business models to ODM, creating the potential for significant profitability improvement with 3~4% GM for EMS, vs. 7~9% GM for ODM. n 4 December 2023 AI server comprehensive offerings: FII’s comprehensive solutions from GPU modules to baseboards, from L6 server motherboard to L12 full rack server clusters, etc., set it apart from its competitors. Additionally, its diverse server manufacturing capacity in Taiwan, Mainland China, South East Asia and Mexico, means clients have the flexibly to choose where to manufacture and deliver their systems. As a result of this combination, Verena believes FII should gain market share in the AI server era. 68 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List Where we are different: GSe 2024E/2025E earnings are 22%/20% higher than Bloomberg consensus, driven by Verena’s more positive expectations around FII’s GM expansion. She believes the market is underestimating the profitability improvement from product upgrades across major business segments including networking (increasing contribution of high speed networking), server (ramp up of AI servers with general servers migrating to ODMs from OEMs), and smartphone components. Valuation: 12m TP of Rmb31.61 is based on 18x 2024E P/E, the higher-end of FII’s historical trading range, reflecting a positive view on its AI servers business. Exhibit 47: FII: Networking, AI servers, GPU module and server parts as the main drivers in 2022-25E (Rmb m) 57,000 16% FII water fall chart (2022-2025E) 52,000 47,000 6,183 42,000 32,000 30% CSP revenues: AI server + general servers + HPC AI server revenues: AI server + GPU modules 25% 12% 7,625 14,370 8% 10% 10% 10% 27,000 20% 9% 7% 15% 39,966 22,000 17,000 14% 2,492 1,792 3,714 37,000 Exhibit 48: AI and Cloud revenues support GM expansions 6% 4,102 20,010 20,073 10% 4% 12,000 5% 2% 0% 0% 2022 GM Source: Company data, Goldman Sachs Global Investment Research 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: (1) AI servers ramp up: Shipments started in 3Q23 and 2024 is the first full year with more chipset platforms. FII doubled server capacity in both Mexico and Vietnam to fulfill clients’ needs. (2) Customers (US cloud, large-scale enterprises) to announce 2024 capex in early 2024. Verena expects FII to have new customers, along with the GPU supply bottleneck easing in 2024. (3) General servers market recovery to start in 4Q23-1Q24, driven by Intel (Eaglestream) and AMD (Geona) new chipset platforms and healthier channel inventory. (4) 4Q23 results, to be announced in mid-March 2024, which Verena expects to show stronger revenues YoY and continuous GM expansion vs. 3Q23. 2023E CSP servers revenue % 2024E 2025E AI server revenues % Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n Foxconn Industrial Internet (601138.SS): AI infrastructure to be early beneficiary under Large Language Model trend; upgrade to Buy 4 December 2023 n Foxconn Industrial Internet (601138.SS): Chairman visit: AI server ramp up in 3Q/4Q23 reaffirmed, better product mix to drive GM ahead; Buy n Global Tech: PCs, smartphones, servers: Quantifying market opportunities 69 Goldman Sachs Income Statement (Rmb mn) _______________________________ Foxconn Industrial Internet (601138.SS) Rating since Apr 12, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (Rmb) Average capital employed (Rmb) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (Rmb) 12/22 9.6 1.5 3.8 7.8 12/23E 12.2 2.1 11.3 8.6 12/24E 8.6 1.9 18.2 5.2 12/25E 7.5 1.7 9.6 4.2 7.8 23.2 16.2 (7.9) (7.9) 13.6 53.2 8.6 18.8 18.3 (22.0) (22.0) 11.0 58.5 5.2 23.5 23.6 (42.6) (42.6) 16.1 52.3 4.2 23.3 24.2 (42.3) (42.3) 20.1 45.7 65.9 58.1 15.5 1.8 2.2 151,536.9 106,383.3 66.0 59.0 17.5 1.7 2.1 168,156.0 114,393.2 52.0 59.0 22.3 1.7 2.1 190,652.4 99,691.9 50.0 59.0 22.9 1.8 2.0 215,263.0 95,289.3 6.49 7.06 7.86 8.77 Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 16.4 3.9 0.4 10.2 3.9 4.6 (4.7) 34.1 22.5 22.5 5.3 6.4 14.4 42.5 41.8 41.8 6.8 8.0 15.6 20.9 14.6 14.6 7.4 8.4 3.9 5.0 6.3 6.2 Price Performance _______________________________________ 601138.SS (Rmb) Shanghai - Shenzhen 300 30 4,400 25 4,200 20 4,000 15 3,800 10 3,600 5 3,400 Jan-23 Apr-23 Absolute Rel. to the Shanghai - Shenzhen 300 Jul-23 Oct-23 3m 6m 12m (28.7)% (22.4)% (15.5)% (7.6)% 64.9% 84.3% Source: FactSet. Price as of 1 Dec 2023 close. 12/22 511,849.6 (474,677.8) (5,372.3) (11,588.0) 12/23E 487,620.7 (445,381.2) (5,548.5) (10,675.0) 12/24E 558,033.8 (502,744.3) (4,269.0) (12,834.8) 12/25E 645,179.4 (577,997.6) (4,613.0) (14,839.1) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -23,431.7 (3,220.2) 20,211.4 339.4 2.6 21,963.0 -31,421.9 (5,405.9) 26,016.0 (78.8) (1.0) 26,944.1 -44,777.7 (6,592.0) 38,185.7 (747.0) -38,338.7 -54,120.8 (6,391.2) 47,729.6 (1,110.5) -47,019.1 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) EPS (diluted, post-except) (Rmb) (1,879.1) (10.8) -20,073.1 -20,073.1 1.01 1.01 1.01 1.01 (2,346.9) (0.1) -24,597.1 -24,597.1 1.24 1.24 1.24 1.24 (3,450.5) 0.0 -34,888.2 -34,888.2 1.76 1.76 1.76 1.76 (7,052.9) 0.0 -39,966.3 -39,966.3 2.01 2.01 2.01 2.01 0.55 54.4 0.67 54.4 0.96 54.4 1.09 54.4 Total revenue Cost of goods sold SG&A R&D DPS (Rmb) Div. payout ratio (%) Balance Sheet (Rmb mn) __________________________________ 12/22 69,429.8 97,689.8 77,321.8 12/23E 90,162.1 78,655.2 78,866.7 12/24E 125,950.1 80,346.2 80,909.6 12/25E 133,091.2 96,415.3 80,613.1 Other current assets Total current assets Net PP&E Net intangibles 4,498.5 248,939.9 15,937.0 440.3 4,498.5 252,182.6 19,426.9 440.3 4,498.5 291,704.4 18,834.9 440.3 4,498.5 314,618.1 15,443.7 440.3 Total investments Other long-term assets Total assets Accounts payable 12,215.7 6,654.8 284,187.7 74,233.4 12,215.7 6,654.8 290,920.3 69,752.9 12,215.7 6,654.8 329,850.0 92,778.2 12,215.7 6,654.8 349,372.6 94,081.3 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 55,764.6 -19,177.6 149,175.6 55,764.6 -19,177.6 144,695.1 55,764.6 -19,177.6 167,720.4 55,764.6 -19,177.6 169,023.5 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 3,484.5 -2,194.1 5,678.6 3,484.5 -2,194.1 5,678.6 3,484.5 -2,194.1 5,678.6 3,484.5 -2,194.1 5,678.6 154,854.2 -128,975.2 358.3 284,187.7 (10,180.7) 150,373.6 -140,188.2 358.4 290,920.3 (30,913.0) 173,399.0 -156,092.7 358.4 329,850.0 (66,701.0) 174,702.1 -174,312.1 358.4 349,372.6 (73,842.1) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (Rmb mn) ______________________________________ 12/22 12/23E 12/24E 12/25E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations 20,073.1 3,220.2 10.8 (18,693.2) 10,754.7 15,365.6 24,597.1 5,405.9 0.1 13,009.1 6.9 43,019.0 34,888.2 6,592.0 0.0 19,291.6 -60,771.7 39,966.3 6,391.2 0.0 (14,469.5) -31,888.0 Capital expenditures Acquisitions Divestitures Others Cash flow from investing (8,093.3) (342.5) -(6,871.8) (15,307.5) (8,902.6) ---(8,902.6) (6,000.0) ---(6,000.0) (3,000.0) ---(3,000.0) Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow -(11,089.8) 2,246.1 (4,661.7) (13,505.3) (13,447.2) 7,272.3 -(13,384.0) -0.0 (13,384.0) 20,732.3 34,116.3 -(18,983.7) -0.0 (18,983.7) 35,788.0 54,771.7 -(21,746.9) -0.0 (21,746.9) 7,141.1 28,888.0 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 70 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Hitachi - Geared for next phase of growth Covered by Ryo Harada (ryo.harada@gs.com, +81 3 6437-9865) 6501.T Buy 12m Price Target: ¥12300 Price: ¥10455 GS Forecast 3/23 3/24E 3/25E 3/26E Market cap: ¥10.1tr / $68.4bn Revenue (¥ bn) 10,881.2 8,977.3 8,748.5 9,448.4 Enterprise value: ¥11.1tr / $75.0bn Op. profit (¥ bn) 748.1 735.1 853.9 983.6 -- 720.0 -- -- Japan EPS (¥) 671.3 590.8 667.0 777.4 Japan Industrial Electronics P/E (X) 10.0 17.7 15.7 13.4 P/B (X) 1.3 2.3 2.1 1.9 2.2 1.5 1.6 1.7 3m ADTV :¥23.6bn/ $158.7mn Op. profit CoE (¥ bn) M&A Rank: 3 Dividend yield (%) Leases incl. in net debt & EV?: No N debt/EBITDA (ex lease,X) CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 17.6% EPS (¥) 1.1 0.4 0.4 0.1 4.5 12.1 14.4 14.9 6/23 9/23 12/23E 3/24E 75.0 150.1 141.2 246.2 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: Whereas business portfolio reforms have been the focus of investors to-date, Hitachi has transformed itself and become globally competitive, shifting attention to the next phase of organic growth centered on its acquired businesses, GlobalLogic and Hitachi Energy (formerly ABB Power Grid). Ryo forecasts adjusted operating profit CAGR to accelerate to 17% over the next 3 years, from 8% in the last 3 years. Moreover, Ryo expects CROCI will rise to 14.9% in FY3/26E, from 6.7% in FY3/20, on business growth as well as the deconsolidation of businesses with low capital efficiency. n North American IT investment outlook and its impact on GlobalLogic: Whilst GlobalLogic will not be immune to any potential slowdown, Ryo believes GlobalLogic could be more insulated than competitors and able to leverage cross-selling opportunities from existing Hitachi customers, to win new orders at limited acquisition cost, in Japan and Asia primarily. n Group synergies: Hitachi is aiming to utilize embedded software from GlobalLogic to extract data from Hitachi Energy’s power grid business, and analyze it using Hitachi’s Lumada (AI) in order to control infrastructure more efficiently. Ryo believes that synergies between Hitachi Energy’s power grid unit and IT operations (GlobalLogic and Lumada) could be higher than what the market currently perceives. Ryo’s scenario analysis suggests that Hitachi Energy’s FY3/28 adjusted operating profit margin could reach up to 12% under a blue sky scenario. Where we are different: (1) Ryo argues that linking the key businesses of Hitachi Energy and GlobalLogic with Hitachi’s IoT platform has the potential to transform Hitachi Energy into a major earnings driver in the future. Specifically, he expects Hitachi to apply the digital technologies of GlobalLogic to infrastructure businesses like power grids and 4 December 2023 71 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List railways, expanding its future services business offering, leading to margin expansion. (2) Ryo’s scenario analysis suggests that per-share implied valuation could reach as high as ¥15,000 if the market were to price in Hitachi’s longer-term growth potential on progress integrating its hardware and software businesses (see Ryo’s deep dive report & IR Day site visit note on Hitachi Energy. Catalysts: 1) Capital management: Ryo expects another share buyback (Y200bn) to be announced at the end of FY3/24. 2) Business optimisation: Hitachi has already completed major business restructuring efforts, but does intend to reshape its business portfolio on an ongoing basis, such as the home appliances business. 3) Strategy update: New medium-term plan (to start from FY3/26), and management commentary prior to that could give an indication as to its direction. Exhibit 49: Profit growth CAGR will accelerate from 8% in the past 3 years to 17% for the next 3 years, fueled by Digital and Green. Exhibit 50: Software (grid automation) to contribute from the next medium-term plan Trend of adjusted operating profit Sales assumptions by scenario (JPYmn) 1,200,000 CAGR (3/23-3/26E) 17% 1,000,000 CAGR (3/20-3/26E) 8% 800,000 600,000 400,000 200,000 0 FY3/21 FY3/22 FY3/23 FY3/23 FY3/24E FY3/25E FY3/26E FY3/20 (ex. HCM, (ex. HM, Hitachi Astemo) Chemical) Total Digital Systems & Services Green Energy & Mobility Connective Industries FY3/20 ~ FY3/23 is adjusted with annualized HCM and HM. FY3/23 (ex. HCM, HM, Astemo) ~ FY3/26 is the sum excluding Others and Elimination. HCM is Hitachi Construction Metals, HM is Hitachi Metals. Source: Company data, Goldman Sachs Global Investment Research 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Valuation: 12m TP of ¥12,300, based on 9.5x FY3/25E EV/EBITDA. Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n Hitachi (6501.T) - Hitachi Energy IR Days: Reconfirmed top global competitiveness; upbeat on margin/CF growth, good prospects for digital cooperation; raise TP n Hitachi (6501.T) - Hitachi Energy: Potential to become a more powerful earnings driver combining power grid and IT n Hitachi (6501.T) - Beneficiary of global digital and green transformation trends; reinstate at Buy 72 Goldman Sachs Income Statement (¥ bn) __________________________________ Hitachi (6501.T) Rating since Mar 16, 2023 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 3/23 10.0 1.3 6.9 6.5 3/24E 17.7 2.3 13.8 8.9 3/25E 15.7 2.1 9.3 8.2 3/26E 13.4 1.9 9.6 7.2 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 6.5 4.5 14.0 25.9 25.9 14.6 61.9 8.9 12.1 12.2 11.1 11.1 18.8 63.2 8.2 14.4 13.9 10.7 10.7 25.1 65.5 7.2 14.9 14.5 2.7 2.7 28.9 67.4 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 98.2 73.6 12.2 0.9 2.3 11,739.8 7,114.4 108.2 81.5 11.8 0.8 2.4 10,165.1 6,029.4 101.2 82.8 11.8 0.7 2.2 10,446.1 5,665.5 96.7 81.5 12.2 0.7 2.1 10,794.1 6,097.8 5,111.8 4,540.2 5,035.7 5,621.5 For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (¥) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 3/23 3/24E 3/25E 3/26E 6.0 (0.3) 11.3 0.0 6.9 11.7 (17.5) (2.5) (12.0) 10.3 8.2 13.8 (2.5) 9.6 12.9 6.3 9.8 15.6 8.0 9.5 16.5 2.9 10.4 15.8 6.0 6.3 7.3 7.8 Price Performance _______________________________________ 6501.T (¥) TOPIX 11,000 2,800 10,000 2,600 9,000 2,400 8,000 2,200 7,000 2,000 6,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 5.4% 4.0% 30.1% 17.4% 42.8% 19.1% Source: FactSet. Price as of 1 Dec 2023 close. 3/23 10,881.2 (8,192.1) (1,624.7) (316.2) 3/24E 8,977.3 (6,650.1) (1,264.1) (328.0) 3/25E 8,748.5 (6,343.1) (1,223.5) (328.0) 3/26E 9,448.4 (6,789.2) (1,347.6) (328.0) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -1,274.3 (526.2) 748.1 (25.7) 52.8 820.0 -1,242.9 (507.8) 735.1 (15.0) 190.0 824.1 -1,361.7 (507.8) 853.9 (10.0) 200.0 1,027.9 -1,491.4 (507.8) 983.6 (10.0) 200.0 1,157.6 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) (116.1) (54.7) -649.1 -649.1 671.3 671.3 671.3 671.3 (206.0) (50.0) -568.1 -568.1 590.8 590.8 590.8 590.8 (257.0) (130.0) -640.9 -640.9 667.0 667.0 667.0 667.0 (289.0) (130.0) -738.6 -738.6 777.4 777.4 777.4 777.4 145.0 21.6 160.0 27.1 170.0 25.5 175.0 22.5 Total revenue Cost of goods sold SG&A R&D DPS (¥) Div. payout ratio (%) Balance Sheet (¥ bn) _____________________________________ Cash & cash equivalents Accounts receivable Inventory 3/23 833.3 2,875.0 1,646.2 3/24E 1,258.7 2,445.9 1,463.8 3/25E 1,206.6 2,405.8 1,676.8 3/26E 1,608.9 2,598.3 1,810.9 Other current assets Total current assets Net PP&E Net intangibles 574.1 5,928.5 1,700.5 3,410.0 574.1 5,742.5 1,238.0 3,482.8 574.1 5,863.3 1,248.0 3,482.8 574.1 6,592.3 1,258.0 3,482.8 975.5 486.9 12,501.4 1,548.5 975.5 (11.6) 11,427.2 1,421.4 975.5 486.9 12,056.5 1,458.1 975.5 486.9 12,795.4 1,574.7 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 919.5 -2,698.2 5,166.2 919.5 -2,698.2 5,039.1 919.5 -2,698.2 5,075.8 919.5 -2,698.2 5,192.4 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 1,293.8 -705.8 1,999.7 873.8 -705.8 1,579.7 863.8 -705.8 1,569.7 853.8 -705.8 1,559.7 7,165.8 -4,942.9 392.7 12,501.4 1,380.1 6,618.8 -4,365.8 442.7 11,427.2 534.7 6,645.4 -4,838.3 572.7 12,056.5 576.8 6,752.1 -5,340.6 702.7 12,795.4 164.4 Total investments Other long-term assets Total assets Accounts payable Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (¥ bn) _________________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 3/23 3/24E 3/25E 3/26E 649.1 526.2 54.7 293.3 (696.3) 827.0 (349.7) 0.8 (52.8) 552.8 568.1 507.8 50.0 484.3 190.0 1,800.2 (350.0) (72.8) (190.0) -- 640.9 507.8 130.0 (136.2) 200.0 1,342.5 (350.0) 0.0 (200.0) -- 738.6 507.8 130.0 (210.0) 200.0 1,366.4 (350.0) 0.0 (200.0) -- 151.1 -(129.0) (486.4) (498.2) (1,113.7) (135.5) 477.3 (612.8) -(153.9) (420.0) (188.2) (762.1) 425.4 1,450.2 (550.0) -(163.3) (10.0) (671.3) (844.6) (52.1) 992.5 (550.0) -(166.3) (10.0) (237.8) (414.1) 402.3 1,016.4 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 73 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Renesas - High quality, cycle bottom, undervalued Covered by Daiki Takayama (daiki.takayama@gs.com, +81 3 6437-9870) 6723.T Buy 12m Price Target: ¥3300 Price: ¥2562.5 GS Forecast 12/22 12/23E 12/24E 12/25E Market cap: ¥4.7tr / $32.0bn Revenue (¥ bn) 1,502.7 1,468.6 1,547.5 1,756.1 Enterprise value: ¥4.6tr / $30.9bn Op. profit (¥ bn) 559.4 505.2 538.7 643.7 541.7 -- -- -- Japan EPS (¥) 192.6 247.8 256.6 314.4 Japan Electronic P/E (X) Components/Semiconductors 6.9 10.3 10.0 8.2 1.6 2.3 1.7 1.2 3m ADTV :¥31.5bn/ $211.2mn Op. profit CoE (¥ bn) P/B (X) M&A Rank: 3 Dividend yield (%) 0.0 0.0 1.6 2.0 0.7 (0.3) (0.7) (1.1) CROCI (%) 19.0 12.8 14.1 16.1 6/23 9/23 12/23E -- EPS (¥) 66.3 60.4 56.1 -- Leases incl. in net debt & EV?: No N debt/EBITDA (ex lease,X) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 28.8% Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Core thesis: Daiki views Renesas as attractive in terms of both visibility on earnings bottoming out and underappreciated valuation multiples. He expects earnings to trough in 4Q12/23-1Q12/24 with the operating margin holding at 30% or more, followed by a strong recovery trend beginning 2Q12/24. At the same time, he believes the valuation discount is likely to be eliminated. With a 12m TP of ¥3,300, the stock is high-quality, undervalued, and a likely beneficiary of a cyclical recovery in the Asia technology hardware sector as a whole. n Early Signals: Are there early signs of earnings bottoming out in 1Q-2Q12/24, such as sustainability in automotive applications, a bottom-out for industrial and consumer product applications (IOT), and a recovery in DC applications? n Competition: What are the risks from local Chinese peer companies and current pricing conditions in the market? n Returns: Is there any risk of a decline in ROE and CROCI over the medium to long term due to upfront investment and M&A? As a result, are there any risks of lower capital allocation to shareholder returns? n Valuations: Overall, would valuations remain low? Where we are different: Daiki thinks the earnings structure is now already more resilient than in past cycles due to multiple changes, including management, product mix, inventory management, and industry positioning. The valuation discount is likely to be eliminated through improvement in earnings momentum from around 2Q12/24 and progress in enhancing shareholder returns (reinstatement of dividends), and following conclusion of the sale of Renesas’ shares held by major shareholder INCJ (Nov 2023). Catalysts: Daiki expect earnings to hit a major bottom with the operating margin holding 4 December 2023 74 2e83ab6fea424dc8a1b6a8a7e94c6547 Key debates: Goldman Sachs APAC Conviction List at 30% or more in 4Q12/23 (results for this quarter are typically announced in the first half of February) and then the company to start seeing a gradual increase in capacity utilization (front-end) coupled with profit margin improvement from 1Q-2Q12/24. Valuation: 12m TP of ¥3,300 (based on FY12/24-FY12/25E average EV/GCI vs. CROCI/WACC, applying an EV/DACF multiple of 10X). Exhibit 51: Renesas’ OPM is second highest after TI; Daiki sees 4Q23 as the margin trough in the current cycle Exhibit 52: While the gap is being closed with the 5-company average, Renesas still looks cheap with the lowest P/E OPM: Global peer comparison P/E: Global peer comparison Historical PER OPM 40.0 60% 35.0 50% 30.0 25.0 40% 20.0 30% 15.0 10.0 20% 5.0 0.0 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22 Nov-22 Jan-23 Mar-23 May-23 Jul-23 Sep-23 Nov-23 0% 1Q -10% 2Q 3Q 4Q 2018 Renesas 1Q 2Q 3Q 4Q 1Q 2019 Infineon 2Q 3Q 4Q 1Q 2Q 2020 3Q 4Q 1Q 2021 STMicro 2Q 3Q 2022 NXP 4Q 1Q 2Q 3Q 4QE 2023E 2024 2025 Texas Instruments Source: Data compiled by Goldman Sachs Global Investment Research Renesas Infineon STMicro NXP Texas Instruments 5 comp Avg Source: Data compiled by Goldman Sachs Global Investment Research Relevant Research: n Japan Technology: Hardware - Electronic Components: Raise TPs on Renesas Electronics, Rohm, reiterate Buy ratings as both names look more attractive n Renesas Electronics (6723.T): Earnings Review: Above expectations; looking for earnings to bottom out while high margins maintained 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 10% 4 December 2023 75 Goldman Sachs Income Statement (¥ bn) __________________________________ Renesas Electronics (6723.T) Rating since Oct 14, 2020 CL Ratios & Valuation _______________________________________ 12/22 6.9 1.6 10.6 4.5 12/23E 10.3 2.3 7.8 7.0 12/24E 10.0 1.7 8.2 4.9 12/25E 8.2 1.2 12.4 2.7 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 4.5 19.0 28.0 27.3 27.3 8.8 39.6 7.0 12.8 25.6 (9.3) (9.3) 63.1 46.2 4.9 14.1 22.0 (21.9) (21.9) 89.8 44.5 2.7 16.1 22.9 (33.6) (33.6) 107.3 42.9 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (¥) Average capital employed (¥) 36.8 120.2 24.5 0.5 1.8 3,110.8 1,855.4 40.0 126.4 23.3 0.5 1.6 3,177.8 1,828.1 38.5 123.5 20.6 0.5 1.5 3,259.0 1,677.3 37.2 127.8 21.4 0.5 1.4 3,349.3 1,637.0 822.8 1,124.0 1,501.3 2,196.7 P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (¥) Growth & Margins (%) ____________________________________ 12/22 12/23E 12/24E 12/25E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 51.1 70.3 60.0 NM 37.2 42.5 (2.3) (8.5) 28.6 NM 34.4 39.8 NM NM NM NM 34.8 41.3 13.5 18.8 22.5 25.0 36.7 43.2 Net income margin 25.1 29.6 28.3 29.7 Price Performance _______________________________________ 6723.T (¥) TOPIX 3,500 2,800 3,000 2,600 2,500 2,400 2,000 2,200 1,500 2,000 1,000 1,800 Jan-23 Absolute Rel. to the TOPIX Apr-23 Jul-23 Oct-23 3m 6m 12m 4.0% 2.5% 7.7% (2.9)% 88.1% 56.8% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (¥) EPS (diluted, pre-except) (¥) EPS (basic, post-except) (¥) EPS (diluted, post-except) (¥) DPS (¥) Div. payout ratio (%) 12/22 1,502.7 (648.7) (230.8) (196.0) 12/23E 1,468.6 (636.7) (235.3) (220.0) 12/24E 1,547.5 (661.1) (249.7) (230.0) 12/25E 1,756.1 (700.1) (294.4) (250.0) 132.3 639.2 (79.8) 559.4 (61.9) 0.0 483.0 128.5 585.2 (80.0) 505.2 26.0 -529.8 132.0 638.7 (100.0) 538.7 (2.0) -522.3 132.0 758.7 (115.0) 643.7 (2.0) -627.3 (105.5) (0.2) 0.0 377.3 0.0 377.3 202.4 202.4 202.4 202.4 (94.0) (0.5) -435.3 -435.3 261.9 261.9 261.9 261.9 (84.0) (0.5) -437.8 -437.8 310.4 310.4 310.4 310.4 (106.0) (0.5) -520.8 -520.8 469.9 469.9 469.9 469.9 -0.0 -0.0 40.0 12.9 50.0 10.6 Balance Sheet (¥ bn) _____________________________________ 12/22 336.1 162.6 188.0 12/23E 753.9 158.9 183.7 12/24E 946.1 167.5 193.6 12/25E 1,200.7 190.0 219.7 Other current assets Total current assets Net PP&E Net intangibles 28.5 715.1 208.0 1,539.8 34.7 1,131.2 205.6 1,442.2 34.7 1,341.8 253.2 1,344.6 34.7 1,645.1 295.8 1,247.0 Total investments Other long-term assets Total assets Accounts payable 14.2 335.1 2,812.3 222.9 14.2 122.0 2,915.3 217.9 14.2 122.0 3,075.9 229.6 14.2 122.0 3,324.2 260.5 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 120.0 -182.5 525.5 45.0 -124.3 387.2 45.0 -124.3 398.9 45.0 -124.3 429.8 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 635.7 -113.6 749.3 535.7 -120.3 656.0 435.7 -120.3 556.0 335.7 -120.3 456.0 1,274.8 0.0 1,533.8 3.7 2,812.3 419.7 1,043.2 -1,868.4 3.7 2,915.3 (173.2) 954.9 -2,117.3 3.7 3,075.9 (465.4) 885.8 -2,434.6 3.7 3,324.2 (820.0) Cash & cash equivalents Accounts receivable Inventory Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (¥ bn) _________________________________________ 12/22 12/23E 12/24E 12/25E Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others 377.3 79.8 0.2 (65.5) 87.5 479.3 (216.4) (6.7) -125.7 435.3 80.0 0.5 2.9 (94.5) 424.2 (90.0) --(97.6) 437.8 100.0 0.5 (6.7) (84.5) 447.1 (150.0) --(97.6) 520.8 115.0 0.5 (17.7) (106.5) 512.1 (160.0) --(97.6) Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (97.5) --(129.9) (137.8) (267.7) 114.1 262.9 (187.6) --(175.0) 356.2 181.2 417.8 334.2 (247.6) -68.3 (100.0) 24.4 (7.3) 192.2 297.1 (257.6) -82.8 (100.0) 17.3 0.1 254.6 352.1 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 76 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List SK Hynix - Sustaining lead into next generation memory Covered by Giuni Lee (giuni.lee@gs.com, +82 2 3788-1177) 000660.KS Buy 12m Price Target: W170000 Price: W132600 GS Forecast 12/22 12/23E 12/24E 12/25E 44,621.6 31,883.0 49,506.9 57,003.3 20,960.9 5,517.2 22,722.2 29,832.3 3,242 (11,609) 9,450 16,950 South Korea P/E (X) 31.5 NM 14.0 7.8 Korea Technology P/B (X) 1.1 1.6 1.4 1.2 1.2 0.9 1.5 1.6 0.8 4.0 0.5 0.1 12.4 1.9 10.7 14.5 (6.5) (6.0) 9.9 13.1 9/23 12/23E 3/24E 6/24E (3,174) (338) 971 1,884 Market cap: W93.6tr / $71.7bn Revenue (W bn) Enterprise value: W116.2tr / $89.0bn EBITDA (W bn) 3m ADTV :W415.1bn/ $311.9mn EPS (W) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: Yes CROCI (%) FCF yield (%) For the exclusive use of MATTHEW.X.WONG@GS.COM Upside: 28.2% EPS (W) Core thesis: Whilst Giuni expects memory industry production to recover next year, with both DRAM and NAND likely to grow at low-teens% yoy, this will be well below his shipment growth forecasts (+20-25% yoy), driven by a cyclical recovery in traditional demand drivers such as PCs and smartphones, and new growth areas such as rising AI demand (high-bandwidth memory). This will lead to meaningfully lower inventory levels and the pricing upcycle to continue for the next several quarters. Hynix is well on track in preparing for the next generation HBM3E, which should allow the company to continue to be the market leader in High-Bandwidth Memory (HBM) for the next couple of years. Hynix and Samsung Electronics (SEC) are both highly leveraged to the memory cycles and will benefit from the cycle upturn, but Giuni forecasts a relatively sharper recovery in operating margin and ROE for Hynix through the upcycle. Key debates: n 1Q24 DRAM/NAND ASP: Investor discussions are centered around the magnitude of potential ASP increase in 1Q24. Similar to market expectations, Giuni forecasts a deceleration in NAND ASP increases from the likely high base in 4Q23E; for DRAM, he expects ASP growth to accelerate in 1Q24E due to the pronounced impact from SEC’s larger-than-expected production cuts in September 2023, and the continued mix shift toward HBM/DDR5 (a significant ASP premium over DDR4 DRAM). 4 December 2023 n HBM competition: With Hynix currently leading the HBM3 market for Nvidia, investors question how long this can be maintained, particularly through the transition to next generation HBM3E. Hynix has a head start in the sampling process for HBM3E and this should help it sustain its lead through 2024/25. n Timing of memory production recovery: Companies will likely have to see a normalized (or at least reasonable) level of inventory and margin before considering bringing a meaningful level of production back up. Giuni estimates this to be 77 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List mid-2024 for DRAM and late-2024 for NAND. Where we are different: GSe Hynix 2024 OP estimate is 7% above Bloomberg consensus (NAND estimates are lower but DRAM estimates are higher for 2024E). Giuni forecasts ROE to improve from -13.5% in 2023 to 17% in 2024E. Catalysts: 1) Acceleration of memory pricing growth in 1Q24, 2) Confirmation of memory inventory normalization trend during 1H24, 3) Rising HBM/DDR5 penetration rate in 2024, 4) Timing of memory production recovery, 5) Higher on-device AI penetration rate, and 6) server/smartphone/PC demand recovery in 2024. Valuation: 12m TP of W170,000, based on 1.8X 2024E P/B Exhibit 53: While HBM revenue accounted for only 5% of Hynix’s DRAM revenue in 2022, we expect the weighting will rise to 21% by 2025E Exhibit 54: Hynix shares are trading at 1.4X 12m FWD P/B with 2024E ROE of 11% Hynix 12m FWD P/B Hynix HBM revenue as % of total DRAM 10 25% 8 20% 6 15% 40% 1.5X 30% 20% 1.0X 4 10% 2 5% 10% 0% 0.5X -10% 0% 0 2021 2022 2023E Hynix HBM revenue 2024E 2025E Hynix HBM revenue % of DRAM Source: Company data, Goldman Sachs Global Investment Research 0.0X Jan 13Jan 14Jan 15Jan 16Jan 17Jan 18Jan 19Jan 20Jan 21Jan 22Jan 23Jan 24 12m FWD P/B 15yr avg. -1 STDEV ROE (RHS) -20% +1 STDEV Source: Company data, Goldman Sachs Global Investment Research, Bloomberg Relevant Research: 4 December 2023 n South Korea Technology: Semiconductors - Memory: DRAM/NAND industry bit shipment to continue to outpace production in 2024 n Samsung Electronics (005930.KS): HBM deep-dive; AI memory a new US$2bn profit opportunity by 2025, raise TP and reiterate Buy 78 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM 50% 2.0X (W tn) Goldman Sachs Income Statement (W bn) _________________________________ SK Hynix Inc. (000660.KS) Rating since Jan 10, 2022 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 31.5 1.1 (6.5) 4.2 12/23E NM 1.6 (6.0) 20.6 12/24E 14.0 1.4 9.9 4.6 12/25E 7.8 1.2 13.1 3.2 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 4.2 12.4 3.6 29.2 26.4 13.7 100.7 21.8 1.9 (13.5) 40.8 37.5 (6.0) 165.0 4.5 10.7 11.0 19.1 16.4 7.7 82.3 3.2 14.5 17.1 6.5 4.0 17.4 57.9 55.0 22.3 3.5 0.4 1.6 154,652.3 75,597.5 70.3 23.7 (14.4) 0.3 1.8 161,897.6 78,039.7 57.2 23.1 10.3 0.5 1.7 171,046.5 74,938.3 55.0 22.9 16.0 0.5 1.6 187,209.2 74,889.3 92,004 80,390 92,088 106,090 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (W) Average capital employed (W) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (W) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 3.8 (9.1) (76.8) (22.1) 15.3 47.0 (28.5) (73.7) (458.1) 0.0 (26.0) 17.3 55.3 311.8 181.4 66.7 18.0 45.9 15.1 31.3 79.4 5.0 27.2 52.3 5.0 (25.1) 13.1 20.5 Price Performance _______________________________________ 000660.KS (W) KOSPI 160,000 3,000 140,000 2,800 120,000 2,600 100,000 2,400 80,000 2,200 60,000 2,000 Jan-23 Absolute Rel. to the KOSPI Apr-23 Jul-23 Oct-23 3m 6m 12m 10.5% 13.1% 20.2% 23.3% 56.6% 55.0% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D 12/22 44,621.6 (28,993.7) (4,343.9) (4,474.6) 12/23E 31,883.0 (32,873.6) (3,675.2) (3,622.5) 12/24E 49,506.9 (32,508.2) (4,374.1) (3,734.5) 12/25E 57,003.3 (32,060.6) (5,536.4) (3,886.1) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -20,960.9 (14,151.5) 6,809.4 (443.6) 131.2 4,002.8 -5,517.2 (13,805.5) (8,288.3) (1,249.0) 44.8 (10,095.8) -22,722.2 (13,832.0) 8,890.2 (930.7) 104.0 8,863.5 -29,832.3 (14,312.0) 15,520.3 (619.4) 144.0 15,884.9 (1,761.1) (12.1) -2,229.6 -2,229.6 3,242 3,242 3,242 3,242 2,107.8 (0.2) -(7,988.2) -(7,988.2) (11,609) (11,609) (11,609) (11,609) (2,348.8) (12.0) -6,502.6 -6,502.6 9,450 9,450 9,450 9,450 (4,209.5) (12.0) -11,663.4 -11,663.4 16,950 16,950 16,950 16,950 1,200 37.0 1,200 (10.3) 2,000 21.2 2,100 12.4 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (W) EPS (diluted, pre-except) (W) EPS (basic, post-except) (W) EPS (diluted, post-except) (W) DPS (W) Div. payout ratio (%) Balance Sheet (W bn) ____________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 6,409.0 5,186.1 15,664.7 12/23E 10,746.0 7,087.5 13,154.8 12/24E 18,137.0 8,428.5 9,163.2 12/25E 25,551.2 8,744.3 8,930.3 Other current assets Total current assets Net PP&E Net intangibles 1,473.6 28,733.3 60,228.5 3,512.1 1,542.1 32,530.4 52,788.9 3,510.0 2,257.8 37,986.5 50,084.5 3,337.5 2,257.8 45,483.6 51,825.7 3,158.0 1,749.2 9,648.3 103,871.5 2,186.2 1,864.6 11,666.7 102,360.5 2,077.1 1,968.6 14,181.0 107,558.1 2,036.3 2,112.6 14,756.8 117,336.6 1,984.5 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 7,423.2 280.9 9,953.3 19,843.7 11,221.3 316.7 8,756.3 22,371.4 10,221.3 300.4 8,772.5 21,330.6 10,221.3 310.9 8,762.1 21,278.8 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 15,671.4 1,516.2 3,549.7 20,737.3 20,285.2 1,530.1 2,831.3 24,646.5 18,285.2 1,451.7 3,086.7 22,823.6 18,285.2 1,502.2 3,220.6 23,007.9 40,581.0 -63,266.4 24.2 103,871.5 16,685.6 47,017.9 -55,315.9 26.7 102,360.5 20,760.5 44,154.2 -63,365.2 38.7 107,558.1 10,369.5 44,286.7 -72,999.2 50.7 117,336.6 2,955.3 Total investments Other long-term assets Total assets Accounts payable Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted Cash Flow (W bn) ________________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 12/22 12/23E 12/24E 12/25E 2,229.6 14,151.5 12.1 (2,806.6) 1,194.0 14,780.5 (7,988.2) 13,805.5 0.2 499.3 (3,789.9) 2,526.9 6,502.6 13,832.0 12.0 2,609.8 (3,156.9) 19,799.6 11,663.4 14,312.0 12.0 (134.6) (535.5) 25,317.2 (19,010.3) (1,027.7) -2,154.2 (17,883.7) (7,705.9) --(616.0) (8,321.9) (10,500.0) --(1,082.9) (11,582.9) (13,000.0) (2,400.0) -(1,126.8) (16,526.8) (301.9) (1,677.8) 5,394.4 (2,575.0) 839.7 (2,263.6) (4,229.7) (326.4) (825.7) 8,411.9 2,872.3 10,132.0 4,337.0 (5,179.1) (306.4) (825.7) (3,000.0) 3,306.4 (825.7) 7,391.0 9,299.6 (314.1) (1,376.2) -314.1 (1,376.2) 7,414.2 12,317.2 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 79 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List TSMC - Structural trends support long-term growth opportunity Covered by Bruce Lu (bruce.lu@gs.com, +886 2 2730-4185) 2330.TW 12m Price Target: NT$725 Price: NT$579 Upside: 25.2% TSM 12m Price Target: $115 Price: $98.55 Upside: 16.7% Buy GS Forecast 12/22 12/23E 12/24E 12/25E 2,263,891 2,152,730 2,699,202 3,266,925 1,558,533 1,454,077 1,919,532 2,398,014 39.20 31.85 40.27 50.64 Taiwan P/E (X) 13.2 18.2 14.4 11.4 Taiwan Semiconductor P/B (X) 4.5 4.3 3.6 3.0 2.1 2.0 2.9 3.7 (0.3) (0.3) (0.6) (0.8) 26.4 18.6 21.9 24.5 3.9 1.2 6.7 7.8 9/23 12/23E 3/24E 6/24E 8.13 8.72 8.53 9.80 Market cap: NT$15.0tr / $477.1bn Revenue (NT$ mn) Enterprise value: NT$14.6tr / $464.9bn EBITDA (NT$ mn) 3m ADTV :NT$13.4bn/ $417.8mn EPS (NT$) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: Yes CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM FCF yield (%) EPS (NT$) Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Key debates: n Pricing outlook: Some investors are concerned with TSMC’s pricing outlook in 2024 and the competition from mainland China for mature nodes. However, Bruce believes TSMC’s pricing should be relatively firm especially for advanced nodes thanks to its technology leadership. As for the competition for legacy nodes, he believes the impact would be minimal given its focus on specialty technology and single source. n Technology dominance: There are market concerns on the sustainability of TSMC’s technology lead into N2 with GAA (Gate-All-Around) structure given the potential come back of Intel, as well as the competition from Samsung. Nevertheless, TSMC remains confident in maintaining its advantage for N2 when it is introduced in 2025. Where we are different: Bruce’s 2024/2025E earning estimates are 7-11% higher than consensus, as he is more optimistic on TSMC’s revenue growth outlook driven by: 1) Re-stocking demand from PCs/smartphones/servers, and incremental AI contribution. He believes the end demand recovery from these segments alongside the AI demand support its utilization rate (UTR) outlook especially for N5/N7; 2) 4 December 2023 80 2e83ab6fea424dc8a1b6a8a7e94c6547 Core thesis: Despite a choppy near-term outlook, Bruce believes TSMC will achieve its 15-20% revenue CAGR target for the next several years, driven primarily by mid-to-high single digit % silicon content growth and HPC demand, with GM to remain at 53%+. He favors TSMC’s leadership position, with long-term growth opportunity underpinned by structural industry trends (5G/AI/HPC/EV) and the key AI enabler among our Taiwan semis coverage thanks to its leadership stance in leading edge nodes and advanced packaging technology. Goldman Sachs APAC Conviction List Incremental contribution from 3nm. He also estimates that 3nm will account for 15% of its total wafer revenue in 2024E (vs 6% in 2023E); and 3) Intel outsourcing expansion. Bruce’s analysis shows that Intel is likely to account for c.7%/10% of TSMC’s revenue in 2024/2025E. Net net, Bruce is looking for a 24%/21% of revenue (in USD term) growth in 2024/2025E. He also sees upside potential on its quarterly dividend payout on improving free cash flow. Catalysts: 1) The potentially stronger than expected monthly revenue (November & December), partially driven by better FX and rush orders, and 2) its next analyst meeting in mid-January 2024, which Bruce believes the company will provide a strong guidance on its 2024/1Q24 revenue growth outlook. Valuation: 12m TP of NT$725, which is derived by applying a target P/E multiple of 18x (0.5stdv above its 5-year trading average) to 2024E EPS. Bruce is also Buy rated on the ADR (TSM) with a 12m TP of US$115, based on a USD/TWD rate of 31.5. Exhibit 56: Bruce sees potential upside on cash dividend payout 120,000 40% 35 32 35% 100,000 30% 25% 80,000 20% 15% 60,000 30 27 25 20 10% 5% 40,000 0% -5% 20,000 -10% Total revenue (USDmn) YoY (%, RHS) Source: Company data, Goldman Sachs Global Investment Research 2025E 2024E 2022 2023E 2021 2020 2019 2018 2017 2016 2015 2014 2013 -15% 2012 0 2011 15 22 10 5 17 10 10 11 2019 2020 2021 11 12 2022 2023E Cash dividend (NT$/share) 2024E 2025E Cash div. based on 70% of FCF per share Source: Company data, Goldman Sachs Global Investment Research Relevant Research: 4 December 2023 n TSMC (2330.TW): Embracing a new growth chapter in 2024; reiterate Buy n TSMC (2330.TW): Assessing TAM from Intel outsourcing for TSMC; reiterate Buy 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Exhibit 55: TSMC’s revenue growth outlook (in USD terms) 81 Goldman Sachs Income Statement (NT$ mn) _______________________________ TSMC (2330.TW) Rating since May 7, 2019 CL Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 13.2 4.5 3.9 8.3 12/23E 18.2 4.3 1.2 10.1 12/24E 14.4 3.6 6.7 7.3 12/25E 11.4 3.0 7.8 5.5 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 8.3 26.4 39.8 (17.0) (17.0) 79.2 33.4 10.1 18.6 25.7 (11.9) (11.9) 51.8 46.8 7.3 21.9 27.2 (26.7) (26.7) 82.6 47.8 5.5 24.5 28.4 (36.6) (36.6) 179.2 49.1 34.6 181.0 34.3 0.5 1.7 6,390,285.9 2,145,407.7 39.6 182.2 23.5 0.4 1.6 7,571,949.7 2,776,987.0 38.9 180.0 24.5 0.4 1.5 8,331,824.9 3,110,850.9 44.5 231.4 25.6 0.5 1.4 9,354,829.8 3,188,286.6 113.60 134.32 162.09 194.23 Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Gross cash invested (ex cash) (NT$) Average capital employed (NT$) For the exclusive use of MATTHEW.X.WONG@GS.COM BVPS (NT$) Growth & Margins (%) ____________________________________ 12/22 12/23E 12/24E 12/25E Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin 42.6 45.3 70.4 (0.0) 49.5 68.8 (4.9) (6.7) (18.8) 6.8 42.6 67.5 25.4 32.0 26.4 44.7 44.0 71.1 21.0 24.9 25.8 26.5 46.0 73.4 Net income margin 44.9 38.4 38.7 40.2 Price Performance _______________________________________ 2330.TW (NT$) Taiwan SE Weighted Index 650 18,000 600 17,000 550 16,000 500 15,000 450 14,000 400 13,000 Jan-23 Apr-23 Absolute Rel. to the Taiwan SE Weighted Index Jul-23 Oct-23 3m 6m 12m 5.7% 0.8% 5.1% (0.5)% 16.1% (0.0)% Source: FactSet. Price as of 1 Dec 2023 close. Total revenue Cost of goods sold SG&A R&D 12/22 2,263,891.3 (915,536.5) (63,813.7) (163,262.2) 12/23E 2,152,730.0 (979,272.7) (69,323.7) (187,098.3) 12/24E 2,699,202.0 (1,226,412.5) (76,284.0) (209,552.0) 12/25E 3,266,924.8 (1,433,904.4) (88,884.0) (241,552.0) Other operating inc./(exp.) EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates Pre-tax profit -1,558,533.1 (437,254.3) 1,121,278.9 8,272.4 7,798.4 1,144,190.7 -1,454,077.3 (537,042.1) 917,035.3 34,673.2 5,473.0 966,382.8 -1,919,532.4 (732,578.9) 1,186,953.5 37,312.4 6,395.9 1,230,661.9 -2,398,014.2 (895,429.8) 1,502,584.4 43,155.3 6,196.0 1,551,935.7 Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (NT$) EPS (diluted, pre-except) (NT$) EPS (basic, post-except) (NT$) EPS (diluted, post-except) (NT$) (127,290.2) (370.3) -1,016,530.2 -1,016,530.2 39.20 39.20 39.20 39.20 (141,023.7) 529.5 -825,888.6 -825,888.6 31.85 31.85 31.85 31.85 (187,312.7) 820.0 -1,044,169.2 -1,044,169.2 40.27 40.27 40.27 40.27 (239,589.7) 820.0 -1,313,166.0 -1,313,166.0 50.64 50.64 50.64 50.64 11.00 28.1 11.75 36.9 17.00 42.2 21.50 42.5 DPS (NT$) Div. payout ratio (%) Balance Sheet (NT$ mn) __________________________________ Cash & cash equivalents Accounts receivable Inventory 12/22 1,342,814.1 231,408.8 221,149.1 12/23E 1,325,012.8 236,056.7 331,111.7 12/24E 1,747,608.7 339,142.5 375,932.2 12/25E 2,183,322.5 458,190.5 503,223.3 Other current assets Total current assets Net PP&E Net intangibles 257,524.7 2,052,896.7 2,693,837.0 25,999.2 255,359.1 2,147,540.3 3,087,359.8 20,009.1 255,359.1 2,718,042.4 3,244,462.6 12,327.4 255,359.1 3,400,095.4 3,459,214.4 4,645.8 Total investments Other long-term assets Total assets Accounts payable 68,927.9 123,118.1 4,964,778.9 510,823.1 97,910.1 123,807.4 5,476,626.7 466,618.2 104,306.0 123,807.4 6,202,945.9 743,045.2 110,502.0 123,807.4 7,098,265.1 1,075,075.5 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 0.0 -433,403.7 944,226.8 0.0 -361,946.6 828,564.8 0.0 -361,946.6 1,104,991.8 0.0 -361,946.6 1,437,022.1 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 839,096.5 -220,966.7 1,060,063.2 907,321.4 -225,846.4 1,133,167.8 607,321.4 -225,846.4 833,167.8 307,321.4 -225,846.4 533,167.8 Total liabilities Preferred shares Total common equity Minority interest Total liabilities & equity Net debt, adjusted 2,004,290.0 -2,945,653.2 14,835.7 4,964,778.9 (503,717.6) 1,961,732.6 -3,483,243.2 31,650.8 5,476,626.7 (417,691.3) 1,938,159.6 -4,203,269.3 61,517.0 6,202,945.9 (1,140,287.2) 1,970,190.0 -5,036,692.0 91,383.1 7,098,265.1 (1,876,001.0) Cash Flow (NT$ mn) ______________________________________ Net income D&A add-back Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow 12/22 12/23E 12/24E 12/25E 1,016,530.2 437,254.3 370.3 52,321.6 104,122.8 1,610,599.2 825,888.6 537,042.1 (529.5) (158,815.4) (36,471.7) 1,167,114.0 1,044,169.2 732,578.9 (820.0) 128,520.8 (6,395.9) 1,898,052.9 1,313,166.0 895,429.8 (820.0) 85,691.1 (6,196.0) 2,287,271.0 (1,082,672.1) --(108,256.1) (1,190,928.2) (992,098.1) --21,475.0 (970,623.2) (882,000.0) (1,102,500.0) ------(882,000.0) (1,102,500.0) -(285,234.2) 84,022.6 59,364.5 (141,847.1) 277,823.9 527,927.1 -(285,227.4) 49,601.0 21,334.2 (214,292.1) (17,801.3) 175,015.9 -(324,143.2) (300,000.0) 30,686.2 (593,457.0) 422,595.9 1,016,052.9 -(479,743.3) (300,000.0) 30,686.2 (749,057.2) 435,713.8 1,184,771.0 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 82 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List H World Group - Multiple ways to win Covered by Simon Cheung (simon.cheung@gs.com, +852 2978-6102) HTHT 12m Price Target: $52.7 Price: $36.1 Upside: 46% 1179.HK 12m Price Target: HK$41.6 Price: HK$28 Upside: 48.6% Buy GS Forecast 12/22 12/23E 12/24E 12/25E 13,862.0 21,583.8 23,750.4 25,789.4 1,120.0 6,351.4 7,421.8 8,543.4 (2.64) 13.09 13.94 17.04 China P/E (X) NM 19.7 18.5 15.1 Asia Leisure P/B (X) 8.5 6.4 5.4 4.5 0.0 2.5 2.4 3.0 Market cap: $11.5bn Revenue (Rmb mn) Enterprise value: $11.3bn EBITDA (Rmb mn) 3m ADTV :$45.5mn EPS (Rmb) Dividend yield (%) M&A Rank: 3 N debt/EBITDA (ex lease,X) Leases incl. in net debt & EV?: No CROCI (%) For the exclusive use of MATTHEW.X.WONG@GS.COM FCF yield (%) EPS (Rmb) 7.9 (0.3) (0.8) (1.2) 12.2 21.5 22.0 23.3 0.7 5.4 7.2 8.6 6/23 9/23 12/23E -- 3.34 4.80 2.45 -- Core thesis: H World is one of the leading multi-brand chain hotel operators in China with 9k hotels in operations and another 129 in Europe under its subsidiary, Deutsche Hospitality. The company is well-positioned to benefit from a number of themes highlighted in Simon’s recent services consumption deep-dive report (Link): (1) Tradedown for its focus in the economy/midscale segments and further expansion into lower-tiered cities - the latter representing 55% of its pipeline; (2) Industry consolidation in a highly fragmented market structure amid rising chain penetration HTHT only captures 3% of hotel room share in China and targets to double its hotel count to ~20k by 2030; (3) Pricing power for its quality product offerings, as people pay more attention to hygiene in the post-pandemic era. Key debates: n Where we are in the cycle: Sustainability of H World’s RevPar cyclical improvement heading into next year and how fast it would grow in longer run given various factors in play (i.e., dilution from penetration into lower-tiered cities, expansion in upscale segment, intensity of competition). n Long-term penetration level: At what level China’s chain hotel penetration would settle at? Getting close to the US level (72%) would suggest more upside, but reaching only to ~40% in Europe would imply less. n Overseas business: Its ability to drive better profitability for Deutsche Hospitality by replicating its success in China to Europe, i.e., revamp its membership programs, hotel adds by franchise/asset light model. Where we are different: Simon believes cyclical leisure/travel demand recovery has further to run with its share of China’s personnel consumption expenditure only half way 4 December 2023 83 2e83ab6fea424dc8a1b6a8a7e94c6547 Source: Company data, Goldman Sachs Research estimates, FactSet. Price as of 01 Dec 2023 close. Goldman Sachs APAC Conviction List back to pre-pandemic level at 11% (vs. 14% in FY19 and 8% in FY22). He forecasts RevPar to continue growing though modestly at +3% yoy, contrary to market concerns that it would fall next year. He models +10% EBITDA growth for China hotels to Rmb7bn in FY24E, implying 38% EBITDA margin (vs. Rmb6.3bn or 37% in FY23E). While long-term industry RevPar is subject to debate, he believes quality offerings would warrant continued 3-4% CAGR for H World in the medium term and sees potential upside in hotel additions and capital returns to help support stock performance ahead. Valuation: 12m TPs of US$52.70/HK$41.60. Valuation is attractive at 11.5x/10.4x FY23E/24E EV/EBITDA, well below its historical average of 16-17x and at a discount to its global peers (14-15x for Marriott and Hilton). In Simon’s stress test where he assumes -14% RevPar next year, the stock would still be trading below mid-cycle at 13.7x. Net add Gross add 545 450 14% 13% 12% 9% 9% 9% 8% 7% 7% 5% 350 6% 6% 6% 6% 6% 5% 5% 3% 3% 3% 74 244 250 1% 1% 0% 150 109 163 135 50 84 95 7 15 209 111 - 53 116 180 89 18 67 22 337 313 216 210 192 22 316 120 262 258 195 309 139 390 374 383 406 256 94 270 158 136 - 67 27 130 53 197 81 77 - Source: Goldman Sachs Global Investment Research 1Q23 Jinjiang H World BTG 2Q23 GHG Jinjiang H World Jinjiang BTG GHG 4Q22 H World Note: Green denotes services category, Blue denotes goods category, Red denotes total consumption. Jinjiang (50) 3Q23 Source: Company data, Goldman Sachs Global Investment Research Relevant Research: n China consumption services 2024 outlook: A more resilient backdrop: 5 key themes, deep-dive into structural drivers. Stress tests n 4 December 2023 H World Group (HTHT): 3Q23 call takeaway: Cautiously optimistic on 4Q23 outlook. Both recurring and special dividend; Buy 84 2e83ab6fea424dc8a1b6a8a7e94c6547 18%18% 10% Gross closure BTG 15% Domestic hotels GHG 20% 650 550 BTG 2024E YoY growth (Base case) 25% 23% Exhibit 58: Quarterly hotel openings vs. peers GHG Exhibit 57: 2024 consumption growth breakdown by category (base case) H World For the exclusive use of MATTHEW.X.WONG@GS.COM Catalysts: 1) After retreating to ~85% of 2019 levels (from ~110% during the Golden Week holidays), Simon expects industry RevPar to bounce back in coming weeks. 2) Accelerating hotel sign-ups and addition as the industry attracts more capital from property sector given better payback and visibility. (3) M&A or improving capital return for its strong FCF. Goldman Sachs Income Statement (Rmb mn) _______________________________ H World Group (HTHT) CL Rating since Mar 29, 2020 Ratios & Valuation _______________________________________ P/E (X) P/B (X) FCF yield (%) EV/EBITDAR (X) 12/22 NM 8.5 0.7 23.3 12/23E 19.7 6.4 5.4 9.8 12/24E 18.5 5.4 7.2 9.0 12/25E 15.1 4.5 8.6 7.9 EV/EBITDA (excl. leases) (X) CROCI (%) ROE (%) Net debt/equity (%) Net debt/equity (excl. leases) (%) Interest cover (X) Days inventory outst, sales 130.3 12.2 (18.5) 54.9 54.9 (0.7) 2.1 11.5 21.5 38.0 (14.4) (14.4) 12.5 1.8 10.2 22.0 31.6 (37.5) (37.5) 12.4 2.2 8.4 23.3 32.4 (56.6) (56.6) 17.2 2.1 30.5 147.2 (20.7) 0.2 7.0 14,670.0 28.06 31.5 145.0 31.6 0.3 5.0 12,379.9 40.33 37.2 152.6 28.7 0.3 4.4 10,399.1 48.00 37.5 167.1 29.3 0.4 3.9 8,864.6 57.37 For the exclusive use of MATTHEW.X.WONG@GS.COM Receivable days Days payable outstanding DuPont ROE (%) Turnover (X) Leverage (X) Average capital employed (Rmb) BVPS (Rmb) Growth & Margins (%) ____________________________________ Total revenue growth EBITDA growth EPS growth DPS growth EBIT margin EBITDA margin Net income margin 12/22 12/23E 12/24E 12/25E 8.4 (29.0) (1,509.4) (100.0) (2.1) 8.1 55.7 467.1 596.6 NM 23.2 29.4 10.0 16.9 6.5 (4.4) 25.3 31.2 8.6 15.1 22.2 22.2 27.5 33.1 (13.1) 19.0 18.7 21.1 Price Performance _______________________________________ HTHT ($) NASDAQ Composite 55 15,000 50 14,000 45 13,000 40 12,000 35 11,000 30 10,000 Jan-23 Apr-23 Absolute Rel. to the NASDAQ Composite Jul-23 3m (13.3)% (15.0)% 12/22 13,862.0 (10,846.0) (2,288.0) -- 12/23E 21,583.8 (12,514.5) (3,023.9) -- 12/24E 23,750.4 (13,397.6) (3,237.0) -- 12/25E 25,789.4 (14,071.0) (3,481.1) -- Other operating inc./(exp.) ESO expense EBITDA Depreciation & amortization EBIT Net interest inc./(exp.) Income/(loss) from associates 392.0 -610.0 (1,414.0) (294.0) (322.0) (36.0) 306.1 -6,996.5 (1,348.3) 5,003.1 (172.7) 3.0 306.1 -7,481.6 (1,403.9) 6,017.9 (11.8) -- 306.1 -8,607.0 (1,458.8) 7,084.6 239.1 -- Pre-tax profit Provision for taxes Minority interest Preferred dividends Net inc. (pre-exceptionals) Post-tax exceptionals Net inc. (post-exceptionals) EPS (basic, pre-except) (Rmb) EPS (diluted, pre-except) (Rmb) EPS (basic, post-except) (Rmb) (1,641.0) (207.0) 28.0 -(1,820.0) 1,000.0 (820.0) (5.85) (5.85) (2.64) 5,339.4 (1,174.0) (60.0) -4,105.4 64.0 4,169.4 12.89 12.88 13.09 6,006.1 (1,501.5) (60.0) -4,444.6 -4,444.6 13.94 13.94 13.94 7,323.6 (1,830.9) (60.0) -5,432.7 -5,432.7 17.04 17.04 17.04 (2.64) -0.00 13.08 -6.57 13.94 -6.28 17.04 -7.67 Total revenue Cost of goods sold SG&A R&D EPS (diluted, post-except) (Rmb) EPS (diluted, excl. ESO) (Rmb) DPS (Rmb) Balance Sheet (Rmb mn) __________________________________ 12/22 12/23E 12/24E 12/25E Cash & cash equivalents Accounts receivable Inventory 5,086.0 1,425.0 70.0 10,538.7 2,306.2 137.1 14,484.7 2,537.7 146.8 19,160.2 2,755.6 154.2 Other current assets Total current assets Net PP&E Net intangibles 2,597.0 9,178.0 6,784.0 5,278.0 359.0 13,341.0 6,298.8 5,199.5 359.0 17,528.2 5,701.7 5,121.0 359.0 22,429.0 5,085.6 5,042.4 Total investments Other long-term assets Total assets Accounts payable 1,945.0 38,322.0 61,507.0 4,736.0 1,948.0 38,322.0 65,109.3 5,209.6 1,948.0 38,322.0 68,620.9 5,991.0 1,948.0 38,322.0 72,827.0 6,889.7 Short-term debt Short-term lease liabilities Other current liabilities Total current liabilities 3,288.0 -5,122.0 13,146.0 922.0 -5,318.2 11,449.8 --5,543.8 11,534.9 --5,803.3 12,693.0 Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities 6,635.0 -32,923.0 39,558.0 7,748.7 -32,923.0 40,671.7 8,670.7 -32,923.0 41,593.7 8,670.7 -32,923.0 41,593.7 Total liabilities Preferred shares Total common equity Minority interest 52,704.0 -8,729.0 74.0 52,121.5 -12,853.8 134.0 53,128.6 -15,298.3 194.0 54,286.7 -18,286.3 254.0 Total liabilities & equity Net debt, adjusted RNAV 61,507.0 4,837.0 -- 65,109.3 (1,868.0) -- 68,620.9 (5,813.9) -- 72,827.0 (10,489.4) -- Oct-23 6m (3.7)% (11.8)% 12m (4.1)% (23.0)% Source: FactSet. Price as of 1 Dec 2023 close. Cash Flow (Rmb mn) ______________________________________ Net income D&A add-back 12/22 (1,820.0) 1,414.0 12/23E 4,105.4 1,348.3 12/24E 4,444.6 1,403.9 12/25E 5,432.7 1,458.8 Minority interest add-back Net (inc)/dec working capital Other operating cash flow Cash flow from operations Capital expenditures Acquisitions Divestitures Others (28.0) 205.0 1,793.0 1,564.0 (1,053.0) (57.0) -588.0 60.0 (474.8) 193.2 5,232.1 (784.6) -2,238.0 0.0 60.0 540.3 225.6 6,674.4 (728.4) ---- 60.0 673.4 259.5 7,884.4 (764.2) ---- Cash flow from investing Repayment of lease liabilities Dividends paid (common & pref) Inc/(dec) in debt Other financing cash flows Cash flow from financing Total cash flow Free cash flow (522.0) -0.0 (644.0) (453.0) (1,097.0) (55.0) 511.0 1,453.4 -(2,092.5) (1,252.3) 2,111.9 (1,232.8) 5,452.7 4,447.5 (728.4) -(2,000.1) 0.0 0.0 (2,000.1) 3,946.0 5,946.1 (764.2) -(2,444.7) -0.0 (2,444.7) 4,675.5 7,120.2 Source: Company data, Goldman Sachs Research estimates. 4 December 2023 85 2e83ab6fea424dc8a1b6a8a7e94c6547 Buy APAC Conviction List Goldman Sachs APAC Conviction List Appendix 1: Relevant research for themes China in Transition China in Transition: At the crossroads of the supply chain China commodities 2024 outlook: New and old, a year of deceleration: 4 preferred themes in copper, flat steel, value in cement, and the hog cycle China Real Estate: Focus shifting to the secondary market and “Stage II easing” Global Automation: The investment case for humanoid robots For the exclusive use of MATTHEW.X.WONG@GS.COM Asia Economics Analyst: Sizing the “New Three” in the Chinese Economy China Strategy: Equity lessons learned for China from Japan’s lost decades and investment implications China Consumption China Consumer: Deceleration in consumption growth on China economy transitioning 2e83ab6fea424dc8a1b6a8a7e94c6547 China Consumer: 2024 outlook: 5 key themes and a sustainable shift to value-focus and growing global presence China Consumption Services 2024 Outlook. A more resilient backdrop: 5 key themes, deep-dive into structural drivers. Stress tests China eCommerce 2024 Outlook: One of our top preferred sub-sectors: 6 key themes across value-for-money, adtech & going global Japan Value in Action Japan Value in Action II: Reiterate Buy on five large-caps with potential for further change and highlight seven companies prompting FAQs Japan Portfolio Strategy: 2024 Outlook: TSE corporate governance reform and net inflows to drive continued TOPIX upside Japan Value in Action: Five large-cap Buys to size up the opportunity 4 December 2023 86 Goldman Sachs APAC Conviction List CHIPS Act & Generative AI The Asia AI Ecosystem Rebuilding the semiconductor supply chains: Opportunities for Japan/KoreaSemiconductors: ‘Taiwan plus one’ Global Technology: Semiconductors: Is CHIPS Act enough to re-shape global supply chain? - Assessing cost differences between Taiwan and US Generative AI in China: A roadmap for internet giants; opportunity set and risk factors For the exclusive use of MATTHEW.X.WONG@GS.COM GC Tech: AI vs. general servers: debates on profitability and supply chain beneficiaries Make in India Make in India: Kick-starting the Growth Engines Make in India: Exploring Greater China Tech’s opportunity 2e83ab6fea424dc8a1b6a8a7e94c6547 Make in India: The path of Greater China footwear OEMs’ migration 4 December 2023 87 Goldman Sachs APAC Conviction List Price Target, Risks and Methodology Ticker Company Name 1299.HK AIA Group 7936.T Asics Corp. PTMR We are Buy rated on AIA. Our 12-month discounted model-based target price is HK$97, based on 14X forward new business multiple. This implies 1.9X FY24E P/EV. Downside risks: Slowdown in mainland China growth, especially for high-margin protection products; delays in regulatory approval for new provinces in mainland China; significant tightening in capital control from mainland China, negatively affecting sales and policy renewal in HK; and broad economic growth weakness in Asia. Our 12-month price target of ¥6,200 is based on FY24E EV/NOPAT of 26X, the median multiple for five global sports brands. Key risks include the relaxation of efforts to achieve a robust cost structure and an unexpected slowdown in the performance running category. 600019.SS Baoshan Iron & Steel We are Buy rated on Baosteel with a 12-month target price of Rmb8.2/share, derived from a historical P/B vs. ROE correlation – or 2024E P/B of 0.95x on 2024E ROE of 7.4%. Downside risks to our view: 1) lower-than-expected steel prices and margin which are determined by the industry supply-demand balance 2) lower CRC margin due to the weaker auto market demand in which Baosteel has higher exposure than peers, 3)higher raw material cost which included iron ore, coking coal. 0867.HK China Medical System Holdings Our 12m TP of HK$18.88 is derived from: 1) valuation of Rmb39.1bn for legacy products based on a 5-year exit P/E of 9.6x (average FY24E P/E of global generic peers) and 5-year earnings CAGR of 8%, for which we expect the generics portfolio to resume single-digit growth for VBPed drugs and steady growth for non-VBP drugs; and 2) DCF-based value of Rmb4.2bn for the innovative drug pipeline with a discount rate of 8.5% (same as the discount rate for the whole company) and terminal growth rate of 2% (for other early-stage assets, in-line with other biotech/pharma under our coverage), implying PS of 0.7x for sales in 2033E. Downside risks: 1) penetration of targeted therapies in psoriasis/vitiligo may come below expectations; 2) market share gain may come below expectations amid competition; 3) post-VBP performance of generics portfolio may be worse than expected. CSL.AX CSL Ltd. Key downside risks: Competitive product launches, continued operating challenges could mitigate margin recovery, negative results form pipeline/commercialisation activities. 601138.SS Foxconn Industrial Internet Our 12m target price is Rmb31.61 based on 18.0x 2024E P/E, set in line with peers' regression of P/E and forward year earnings growth and is consistent with its peer average for 2024E P/E. We are positive on FII given its growing exposure to AI servers, where its ODM business carries higher GM, and its comprehensive client base to better benefit from the AI servers trend. Key downside risks: (1) Worse-than-expected demand and profit from the AI server business; (2) Worse-than-expected iPhone component business expansion due to fierce competition; (3) Slower-than-expected capacity ramp-up in the new factory; (4) Lower-than-expected iPhone shipment given FII provides components for iPhone. GOCP.BO We are Buy rated on GCPL with a 12-month target price of Rs1,185. We value GCPL at 44x on our Q5 to Q8 EPS. Key risks include adverse weather impacting seasonal demand for products, increased supply of non-compliant incense sticks, macro conditions impacting commodity prices, increases in commodity costs. HTHT / 1179.HK Godrej Consumer Products Ltd. Methodology: We are Buy rated on H World Group with 12-month target prices of US$52.7/HK$41.6. Our TPs are SOTP-based, with 15x FY24E EV/EBITDA on its core hotel operations business and other investments at reported book value. We view this as warranted given we expect H World to also be a key beneficiary of 1) valuefocused consumption trend; 2) industry consolidation amid rising chain penetration; 3) Pricing power on quality product offerings. H World Group Key Risks: (1) weaker-than-expected macro leading to slower-than-expected RevPAR growth; (2) weaker-than-expected funding channels in China leading to fewerthan-expected franchisee additions; (3) slower-than-expected recovery of consumer/travel demand in China post Covid; (4) dilutive M&A; and (5) weaker-thanexpected operating performance and cash drag from Deutsche Hospitality. We value HDFC Bank on a sum-of-the-parts basis which comprises the value of the bank and its subsidiaries including its life and non-life insurance businesses, asset management businesses, a non-banking finance company, and a stockbroking company. Our 12m SOTP-based target price of Rs 2,002 is based on: We value the banking business (contributing 90% of total target valuation) at c.19X FY24-FY25E EPS (c.2.9X FY24-FY25E standalone BVPS) given its superior RORWA at 3.3% (FY24-FY26 avg.). These valuations are close to 1STDEV higher than the historical mean as we believe the bank will be able to achieve strong EPS growth as well as improving ROEs consistently over the next few years, without the need to raise any capital in our estimates. HDFC Ergo valued similar to ICICI Lombard's trailing P/E valuations at 35X FY23E PAT. HDBK.BO HDFC Bank 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Our 12-month target price of A$309 is based on 20.5x NTM EV/EBITDA. HDB Financial Services valued at level similar to HDFC Bank given the lending nature of the business and similar business practices catering to different business segments. HDFC Securities valued similar to other retail brokers such as Angel One/ICICI Securities based on trailing P/E valuations at 15X FY23E PAT. CREDILA Financial Services valuation is based on the proposed investment agreement between HDFC Ltd. and BPEA EQT Group and Chrys Capital group as of Jun 19, 2023. Key risks include: 1) Execution strategy in terms of cross-selling; 2) Aggressive competition in retail loans and deposits; 3) Lack of traction in digital properties; and 4) Macro slowdown. Our 12-month target price of ¥12,300 for Hitachi is based on EV/EBITDA of 9.5X (FY3/25E). Hitachi's deconsolidation of Hitachi Construction Machinery and Hitachi Metals (PROTERIAL) in FY3/23 and Astemo in FY3/24 removed from its consolidated accounts two businesses with relatively large capex and low capital efficiency when compared with IT and other businesses. Following the deconsolidation of these businesses, we look for investors to price in prospects for future CROCI improvement. 6501.T Hitachi 1024.HK Kuaishou Technology Risks: Digital systems & services: delays and losses generated on large projects, weaker IT capex sentiment at customers accompanying a macroeconomic downturn, reemergence of supply disruptions for servers and other products, slower standalone growth at GlobalLogic, slower-than-expected realization of synergies between it and GlobalLogic; Green energy & mobility (Hitachi Energy): delays on power transmission/distribution projects, a sharp rise in input costs; Connective industries: weaker new construction demand in China, losing out on new repair/maintenance orders to competitors in Japan, semiconductor production equipment (SPE) prices not improving over the long term a risk for Hitachi High-Tech; companywide: Forex swings (¥1 appreciation vs. USD likely has a negative impact of ¥1 bn on sales and ¥0.1 bn on adjusted EBITA) and an increase in purchase price allocation (PPA) amortization due to forex swings. Our 12m target price for Kuaishou is HK$88, which is based on a discounted P/E valuation (target P/E multiple of 18x 2025E EPS). Key downside risks: 1) Slower than expected ad budget recovery; 2) Weaker-than-expected monetization; 3) Slower than expected growth of its aggregate user engagement base (DAU x time spent per DAU); 4) Lower-than-expected profitability. Note: Company specific views in the exhibit are those of the covering analyst. Source: Goldman Sachs Global Investment Research 4 December 2023 88 Goldman Sachs APAC Conviction List Ticker Company Name PTMR LYC.AX Lynas Rare Earths Ltd. Our 12m PT is A$7.5, based on 50:50 NAV:EV/EBITDA with a target multiple of 16x. Downside risks: (1) Macro risks and lower-than-expected RE magnet demand on lower EM & DM demand growth for wind turbines and electric vehicles, (2) lower NdPr prices, (3) Project execution & capex risks on key projects Kalgoorlie C&L facility, Mt Weld, LAMP and construction of the US Heavy & Light rare earth refinery. Our 12-month target price of ¥1,520 is based on a target P/B of 0.93X and our end-FY3/25E BPS estimate of ¥1,635. We derive our target P/B multiple from our normalized ROE estimate of 7.71% (FY3/26 ROE forecast adjusted by normalized credit cost of -12 bp) and a cost of equity of 8.3%. We are Buy rated. 8306.T MUFG Key downside risks: (1) long-term yield decline due to global economic downturn; (2) credit cycle worsening due to global economy hard-landing scenario; and (3) capital markets remaining weak for a long time. OCBC.SI Oversea-Chinese Banking Corp. PDD PDD Holdings 6723.T Renesas Electronics We are Buy rated on OCBC with a 12-m target price of S$15.50 (Based on 2-stage DDM). Key risks include: (-) Sudden or sharper than expected FED cut cycle; (-) Changes in strategy to return capital; (-) Unexpected dilutive M&A activity. Key risks: (1) Domestic GMV/online marketing revenue moderation in growth, (2) Engagement weakness on lower engagement at its Duo Duo Grocery business and following its app version update in Mar 2023, (3) Lack of disclosures of Temu thus far and rising Temu losses where equity markets may not price in the long-term value today, (4) Any further rise in cross-border eCommerce competition in the US. We are Buy rated on Renesas. Our 12-month target price of ¥3,300 is based on the average of FY12/24E-FY12/25E EV/GCI vs. CROCI/WACC, applying an EV/DACF multiple of 10X (25% premium to the sector average, implying a target P/E of 13X). Key risks include a slowdown or delayed recovery in consumer electronics-related demand, stagnant automobile production, protracted reduction in semiconductor inventories, delayed recovery for industrial equipment applications, and yen appreciation. 002050.SZ Sanhua Intelligent Controls Our 12-month target price for Sanhua Intelligent Controls is Rmb38, based on a 30X 2025EP/E discounted back to 2023E on a COE of 10.5%. Key downside risks: 1) More intensified competition in the EV thermal management segment; 2) Worse-than-expected Tesla EV sales; 3) Increasing home appliance demand/home appliance cycle downturn. 2313.HK Shenzhou International Group We are Buy rated on Shenzhou with a 12-month TP of HK$98, based on a 25x 2024E P/E. Key risks: 1) Slower-than-expected demand recovery; 2) weaker-thanexpected cost control, which could lead to earnings risks; 3) a slower ramp-up in production in Vietnam/Cambodia; and 4) FX volatility. 4507.T Shionogi & Co. Our 12-month target price of ¥8,750 is based on a 12-year DCF model assuming WACC of 6% and terminal growth of 0%. Key risks include downside in key drug sales versus our expectations, development suspensions or delays, and changes in product evaluation, lower sales of Xofluza due to a decline in the number of influenza patients, and changes in insurance reimbursement systems for infectious disease treatments globally. 000660.KS SK Hynix Inc. We are Buy-rated on SK Hynix with a 12-month target price of W170,000 derived using a target P/B applied to 2024E BVPS. Our target P/B multiple is 1.8X, applying a premium to the average of the peak P/B multiples during the past 4 upcycles (1.7X) given the company's stronger positioning in the premium segment as well as better visibility for an improving pricing trend. Key risks: A major deterioration in memory supply/demand and delays in technology migration. 6273.T SMC Our 12-month target price of ¥103,000 is based on FY3/28E EV/EBITDA, applying the sector-average multiple of 9X. We then apply the stock’s historical average premium of 60% and discount this back to FY3/25. Risks include a downturn in capex sentiment in the auto and tech industries, key client industries. 6758.T Sony Group Our 12-month target price is ¥16,000. We use an SOTP methodology to calculate our target price for Sony, with FY3/26E as our base year. Key risks to our thesis are weaker-than-expected (1) growth in sales per user in the G&NS business, (2) performance of Crunchyroll, and (3) CMOS earnings. 7269.T Suzuki Motor Our 12-month target price of ¥7,900 is based 85% on a FY3/25E SOTP-based fundamental value of ¥7,800 (applying the stock’s historical 10-year average discount of 10%), and 15% on M&A value of ¥8,700 (SOTP-based theoretical value, assuming a discount of 0%). Key risks include protracted semiconductor shortages, yen appreciation, and a stalling Indian economy due to inflation. We are Buy rated on TSMC, with a 12m TP of NT$725, which is derived by applying a target P/E multiple of 18x (0.5stdv above its 5-year trading average) to 2024E EPS. We are Buy rated on the ADR (TSM) with a 12m TP of US$115, based on a USD/TWD rate of 31.5. 2330.TW / TSM TSMC WOW.AX Woolworths Group 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM We are Buy rated on Pinduoduo. Our 12-month DCF-based target price is US$176, with a WACC of 14% and terminal growth rate of 3%, cross-checked with SOTP. Key downside risks to our views: (1) further deterioration in end-demand recovery impacting capacity utilization; (2) slower customer node migrations; (3) further delays in 5G penetration resulting in slower long-term semiconductor content growth; (4) poor yields/execution resulting in worse-than-expected profitability; (5) stronger competition resulting in ASP/profitability erosion; and (6) unfavorable FX trend or higher-than-expected cost increase weighing on margin outlook. Our 12m TP for WOW is A$42.4, based on 50/50 SOTP and 10-yr DCF to reflect short-term management capabilities and longer-term strategic growth. Downside risks: Worse than expected price competition driving deflation, better than expected take-up of COL Ocado expansive range driving WOW online share loss, inability to drive positive returns from supply chain automation and workforce optimization programs, expectations of retail media sales/margin opportunity not materializing. Note: Company specific views in the exhibit are those of the covering analyst. Source: Goldman Sachs Global Investment Research 4 December 2023 89 Goldman Sachs APAC Conviction List Disclosure Appendix Reg AC We, Michael Snaith, Joy Nguyen, Matthew Ross, Andrew Lyons, Daiki Takayama, Sho Kawano and Caleb Chan, hereby certify that all of the views expressed in this report accurately reflect our personal views about the subject company or companies and its or their securities. We also certify that no part of our compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs’ Global Investment Research division. GS Factor Profile The Goldman Sachs Factor Profile provides investment context for a stock by comparing key attributes to the market (i.e. our coverage universe) and its sector peers. The four key attributes depicted are: Growth, Financial Returns, Multiple (e.g. valuation) and Integrated (a composite of Growth, Financial Returns and Multiple). Growth, Financial Returns and Multiple are calculated by using normalized ranks for specific metrics for each stock. The normalized ranks for the metrics are then averaged and converted into percentiles for the relevant attribute. The precise calculation of each metric may vary depending on the fiscal year, industry and region, but the standard approach is as follows: Growth is based on a stock’s forward-looking sales growth, EBITDA growth and EPS growth (for financial stocks, only EPS and sales growth), with a higher percentile indicating a higher growth company. Financial Returns is based on a stock’s forward-looking ROE, ROCE and CROCI (for financial stocks, only ROE), with a higher percentile indicating a company with higher financial returns. Multiple is based on a stock’s forward-looking P/E, P/B, price/dividend (P/D), EV/EBITDA, EV/FCF and EV/Debt Adjusted Cash Flow (DACF) (for financial stocks, only P/E, P/B and P/D), with a higher percentile indicating a stock trading at a higher multiple. The Integrated percentile is calculated as the average of the Growth percentile, Financial Returns percentile and (100% - Multiple percentile). For a more detailed description of how we calculate the GS Factor Profile, please contact your GS representative. M&A Rank Across our global coverage, we examine stocks using an M&A framework, considering both qualitative factors and quantitative factors (which may vary across sectors and regions) to incorporate the potential that certain companies could be acquired. We then assign a M&A rank as a means of scoring companies under our rated coverage from 1 to 3, with 1 representing high (30%-50%) probability of the company becoming an acquisition target, 2 representing medium (15%-30%) probability and 3 representing low (0%-15%) probability. For companies ranked 1 or 2, in line with our standard departmental guidelines we incorporate an M&A component into our target price. M&A rank of 3 is considered immaterial and therefore does not factor into our price target, and may or may not be discussed in research. Quantum Quantum is Goldman Sachs’ proprietary database providing access to detailed financial statement histories, forecasts and ratios. It can be used for in-depth analysis of a single company, or to make comparisons between companies in different sectors and markets. Disclosures Financial advisory disclosure Goldman Sachs and/or one of its affiliates is acting as a financial advisor in connection with an announced strategic matter involving the following company or one of its affiliates: Sony Group Corporation Logos disclosure Third party brands used in this presentation are the property of their respective owners, and are used here for informational purposes only. The use of such brands should not be viewed as an endorsement, affiliation or sponsorship by or for Goldman Sachs or any of its products/services. The rating(s) for Renesas Electronics is/are relative to the other companies in its/their coverage universe: Alps Alpine, Hirose Electric, IRISO Electronics, Ibiden, Japan Aviation Electronics Industry, Japan Display Inc., Kyocera, Mabuchi Motor, Maxell Ltd., MinebeaMitsumi Inc., Murata Mfg., NGK Insulators, Nichicon, Nidec, Nippon Ceramic, Niterra, Nitto Denko, Pacific Industrial, Renesas Electronics, Rohm, Shinko Electric Industries, TDK, Taiyo Yuden The rating(s) for China Medical System Holdings is/are relative to the other companies in its/their coverage universe: 3SBio Inc., Angelalign Technology, Autobio, BeiGene Ltd. (A), BeiGene Ltd. (ADR), Betta Pharma, BioKangtai, CSPC Pharma, China Medical System Holdings, Dian Diagnostics, Eyebright, Fosun Pharma (A), Fosun Pharma (H), Hansoh Pharma, Hengrui Medicine, Huadong Medicine Co., Hualan Biological Engineering, InnoCare Pharma (A), InnoCare Pharma (H), Innovent Biologics, Jiangsu Nhwa Pharmaceutical Co., Kelun Biotech, Kingmed, Legend Biotech Corp., Lepu, Livzon Pharmaceutical Group (A), Livzon Pharmaceutical Group (H), Mindray, Pien Tze Huang, Shandong Weigao Group, Sichuan Kelun Pharmaceutical Co., Sino Biopharmaceutical, Tong Ren Tang Ltd., Tonghua Dongbao, United Imaging, Walvax, Zai Lab (ADR), Zai Lab (H), Zhejiang Huahai Pharmaceutical, Zhifei The rating(s) for PDD Holdings is/are relative to the other companies in its/their coverage universe: Alibaba Group (ADR), Alibaba Group (H), Dada Nexus Ltd., Full Truck Alliance Co., JD Logistics, JD.com Inc. (ADR), JD.com Inc. (H), Kerry Logistics Network Ltd., Meituan, PDD Holdings, STO Express, Sinotrans Ltd. (A), Sinotrans Ltd. (H), Tencent Holdings, Vipshop Holdings, YTO Express Group, Yunda Holding, ZTO Express (Cayman) Inc. (ADR), ZTO Express (Cayman) Inc. (H) The rating(s) for SK Hynix Inc. is/are relative to the other companies in its/their coverage universe: Hansol Chemical, LG Display, LG Electronics, LG Innotek Co., SK Hynix Inc., Samsung Electro-Mechanics, Samsung Electronics, Samsung Electronics (Pref), Samsung SDS Co. The rating(s) for Lynas Rare Earths Ltd. is/are relative to the other companies in its/their coverage universe: Allkem Ltd., Alumina, BHP Group Ltd., BlueScope Steel, Capricorn Metals Ltd., Champion Iron Ltd., Core Lithium Ltd., Coronado Global Resources Inc., De Grey Mining Ltd., Deterra Royalties Ltd., Evolution Mining Ltd., Fortescue Metals Group, Gold Road Resources Ltd., IGO Ltd., Iluka Resources, Liontown Resources Ltd., Lynas Rare Earths Ltd., Mineral Resources, New Hope Corp., Northern Star Resources Ltd., Pilbara Minerals Ltd., Regis Resources, Rio Tinto Ltd., Sandfire Resources, Sims Metal Management Ltd., South32 Ltd., Whitehaven Coal Ltd. The rating(s) for Suzuki Motor is/are relative to the other companies in its/their coverage universe: Aisin, Bridgestone, Denso, Hino Motors, 4 December 2023 90 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Financial Returns and Multiple use the Goldman Sachs analyst forecasts at the fiscal year-end at least three quarters in the future. Growth uses inputs for the fiscal year at least seven quarters in the future compared with the year at least three quarters in the future (on a per-share basis for all metrics). Goldman Sachs APAC Conviction List Honda Motor, Isuzu Motors, Mazda Motor, Mitsubishi Motors, Mitsui High-tec Inc., Nifco Inc., Nissan Motor, Subaru Corp., Sumitomo Metal Mining, Sumitomo Rubber Industries, Suzuki Motor, TOYO TIRE, Toyota Boshoku, Toyota Industries, Toyota Motor, Unipres Corp., Yamaha Motor The rating(s) for TSMC and TSMC (ADR) is/are relative to the other companies in its/their coverage universe: ASE Technology Holding, ASE Technology Holding (ADR), Chipbond Technology Corp., Delta Electronics, GlobalWafers Co., King Yuan Electronics Co., Lotes, MediaTek, Novatek Microelectronics, Parade Technologies Ltd., Realtek Semiconductor Corp., Silergy Corp., TSMC, TSMC (ADR), United Microelectronics Corp., United Microelectronics Corp. (ADR), Vanguard International Corp., Win Semiconductors Corp., uPI The rating(s) for MUFG is/are relative to the other companies in its/their coverage universe: Aeon Financial Service Co., GMO FG, GMO PG, Japan Exchange Group, Japan Post Bank, Japan Post Insurance, MUFG, Mizuho FG, Net Protections Holdings, Rakuten Bank Ltd., SBI Sumishin Net Bank Ltd., SMFG, SMTH The rating(s) for Sanhua Intelligent Controls is/are relative to the other companies in its/their coverage universe: AVIC Jonhon, Anhui Ronds, CRRC Corp. (A), CRRC Corp. (H), Centre Testing Intl Group, China Railway Signal & Comm (A), China Railway Signal & Comm (H), Cubic Sensor & Instrument, Estun Automation Co., Faratronic, HCFA, Haitian International Holdings, Han’s Laser Technology, HangKe Technology, Hongfa Technology, Hymson, Kehua Data Co., Lead Intelligent, Leader Harmonious Drive Systems Co., Luster LightTech Co., Nantong Jianghai Capacitor Co., OPT Machine Vision Tech Co., Pony Testing, Raytron Technology, Sanhua Intelligent Controls, Shanghai Baosight Software, Shanghai Friendess Electronic Tech, Shenzhen Envicool Technology, Shenzhen Inovance Technology Co., Shenzhen Kstar Science & Tech, Shuanghuan Driveline, Techtronic Industries, United Winners, Wuhan Raycus Fiber Laser Tech, Yiheda Automation, Zhejiang Supcon Technology Co., Zhuzhou CRRC Times Electric Co. (A), Zhuzhou CRRC Times Electric Co. (H) The rating(s) for H World Group (ADR) and H World Group (H) is/are relative to the other companies in its/their coverage universe: Air China (A), Air China (H), BTG Hotels Group, Bloomberry Resorts Corp., China Eastern Airlines (A), China Eastern Airlines (H), China Southern Airlines (A), China Southern Airlines (H), China Tourism Group Duty Free (A), China Tourism Group Duty Free (H), Fosun Tourism Group, Galaxy Entertainment Group, Genting Berhad, Genting Malaysia Bhd, Genting Singapore Ltd., GreenTree Hospitality Group, Guangzhou Baiyun Intl Airport Co., H World Group (ADR), H World Group (H), Hainan Meilan Intl Airport, Kangwon Land, MGM China, Melco International Development, Melco Resorts & Entertainment Ltd., Nagacorp Ltd., Paradise Co., SJM Holdings, Sands China, Shanghai Intl Airport, Shanghai Jinjiang Int’l Hotels, Shangri-La Asia, Shiji, Songcheng Performance, Spring Airlines Co., Tongcheng Travel Holdings, Trip.com Group (ADR), Trip.com Group (H), Wynn Macau The rating(s) for Godrej Consumer Products Ltd. is/are relative to the other companies in its/their coverage universe: Asian Paints (India), Avenue Supermarts Ltd., Britannia Industries Ltd., Colgate Palmolive (India), Dabur India, Devyani International Ltd., Emami Ltd., Godrej Consumer Products Ltd., Hindustan Unilever, ITC, Jubilant Foodworks, Marico, Nestle India, Pidilite Industries, Sapphire Foods India Ltd., Tata Consumer Products Ltd., Titan Co., Westlife Foodworld Ltd. The rating(s) for Oversea-Chinese Banking Corp. is/are relative to the other companies in its/their coverage universe: BDO Unibank, Bangkok Bank, Bank Central Asia, Bank Mandiri, Bank Negara Indonesia, Bank Rakyat Indonesia, Bank of Philippine Islands, DBS Group, Kasikornbank, Krung Thai Bank, Metropolitan Bank and Trust Co, Oversea-Chinese Banking Corp., SCB X PCL, TMBThanachart Bank PCL, United Overseas Bank The rating(s) for Baoshan Iron & Steel is/are relative to the other companies in its/their coverage universe: Aluminum Corp. of China (A), Aluminum Corp. of China (H), Angang Steel (A), Angang Steel (H), Anhui Conch Cement (A), Anhui Conch Cement (H), BBMG Corp. (A), BBMG Corp. (H), Baoshan Iron & Steel, CMOC Group (A), CMOC Group (H), Chenming Paper (A), Chenming Paper (H), China Coal Energy (A), China Coal Energy (H), China Hongqiao Group, China National Building Material, China Resources Cement Holdings, China Shenhua Energy (A), China Shenhua Energy (H), GEM Co., Ganfeng Lithium (A), Ganfeng Lithium (H), Huayou Cobalt, Jiangxi Copper (A), Jiangxi Copper (H), Lee & Man Paper Manufacturing Ltd., MMG Ltd, Maanshan Iron & Steel (A), Maanshan Iron & Steel (H), Nine Dragons Paper Holdings, Qinghai Salt Lake Industry, Shanying Int Holdings, Sichuan Yahua Industrial Group, Sun Paper, Tianqi Lithium (A), Tianqi Lithium (H), West China Cement, Yankuang Energy (A), Yankuang Energy (H), YongXing Special Materials, Zhaojin Mining Industry, Zijin Mining (A), Zijin Mining (H) The rating(s) for CSL Ltd. is/are relative to the other companies in its/their coverage universe: CSL Ltd., Capitol Health Ltd., Cochlear Ltd., Fisher & Paykel Healthcare Corp., Integral Diagnostics Ltd., Nanosonics Ltd., Opthea Ltd., Pro Medicus Ltd., Ramsay Health Care Ltd., ResMed Inc., Sonic Healthcare Ltd. The rating(s) for Kuaishou Technology is/are relative to the other companies in its/their coverage universe: 37 Interactive Entertainment, Baidu.com Inc. (ADR), Baidu.com Inc. (H), Bilibili Inc. (ADR), Bilibili Inc. (H), Focus Media Information Tech, G-Bits, Kuaishou Technology, Mango Excellent Media, NetEase Inc. (ADR), NetEase Inc. (H), Perfect World, Tencent Music Entertainment Group (ADR), Tencent Music Entertainment Group (H), XD Inc., Zhihu Inc. (ADR), Zhihu Inc. (H), iQIYI Inc. The rating(s) for Hitachi is/are relative to the other companies in its/their coverage universe: Daihen, Fuji Electric Co., Fujikura, Furukawa Electric, Hitachi, Meidensha, Mitsubishi Electric, Panasonic Holdings, Sumitomo Electric Industries The rating(s) for AIA Group is/are relative to the other companies in its/their coverage universe: AIA Group, China Life Insurance Co. (A), China Life Insurance Co. (H), China Pacific Insurance (A), China Pacific Insurance (H), China Taiping Insurance Holdings, Lufax Holding Ltd. (ADR), Lufax Holding Ltd. (H), New China Life Insurance (A), New China Life Insurance (H), PICC Group (A), PICC Group (H), PICC Property and Casualty Co., Ping An Insurance Group (A), Ping An Insurance Group (H), Prudential Plc, Prudential Plc (H), Waterdrop Inc. The rating(s) for Shenzhou International Group is/are relative to the other companies in its/their coverage universe: Angel Yeast, Anta Sports Products, Bosideng International Holdings, China Pet Foods, Chow Tai Fook Jewellery Group, Eclat Textile Co., Feng Tay Enterprises, Fu Jian Anjoy Foods Co., Gourmet Master Co., Haidilao International Holding, Helens, Henan Shuanghui Ltd., Huali Industrial Group, Jiumaojiu, Juewei Food, Li Ning Co., Ligao Foods, Luk Fook Holdings, Makalot Industrial Co, Miniso (ADR), Miniso (H), Nayuki, Petpal Pet Nutrition Technology, Pop Mart, Pou Sheng International Holdings, President Chain Store, Qianweiyangchu, Sanquan Foods, Shanghai M&G, Shenzhou International Group, Stella International Holdings, Toly Bread, Topsports Intl Holdings, Uni-President Enterprises, WH Group, Weizhixiang, Xiabuxiabu Catering Management, Xtep International Holdings, Yue Yuen Industrial, Yum China Holdings, Yum China Holdings (H), Zhou Hei Ya Intl The rating(s) for Foxconn Industrial Internet is/are relative to the other companies in its/their coverage universe: 3PEAK, AAC, ACM Research, AMEC, ASMPT, ASR Micro, AccoTest, Actions Technology, Amlogic, Anji Micro, Anlogic, Arcsoft, Asus, Awinic, BOE, Bestechnic, Bomin, CCore, CFME, CR Micro, Cambricon, Cellwise, China Mobile (HK), China Telecom, China Tower Corp., China Unicom, China United Network Comm, Chinasoft Intl, Chipown, Comba, Compal, Dahua, Desay SV, EHang, Empyrean, Eoptolink, Espressif, Etek, Everbright Photonics, FIT Hon Teng, Fiberhome, Foxconn Industrial Internet, GalaxyCore, Gigabyte, Gigadevice, Glodon Co., Goodix, HG Tech, HTC Corp., Hengtong, Hikvision, Hirain, Hon Hai, Hua Hong, Huatian, ISoftStone, Innolight, Inventec, JCET, Jingce, KFMI, Kingdee, Kingsemi, Kingsoft Office, Largan, Lenovo, Lianchuang, Longsys, Luxshare, Maxscend, Montage, NAURA, NSIG, NavInfo Co., Novosense, O-film, Pegatron, Primarius, Quanta, Rockchip, Ruijie, SG Micro, SICC, SMIC (A), SMIC (H), Sanan, Sangfor, Shennan Circuits, Silan, SinoWealth, StarPower, Sunny Optical, TFC Optical, Thundersoft, Thunisoft, Tongfu, Transsion, USI, Vanchip, 4 December 2023 91 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM The rating(s) for Woolworths Group is/are relative to the other companies in its/their coverage universe: A2 Milk Co., Breville Group, Coles Group, Corporate Travel Management Ltd., Domino’s Pizza Enterprises, Endeavour Group, Flight Centre Travel Group, Harvey Norman Holdings, JB Hi-Fi Ltd., Metcash Ltd., Premier Investments Ltd., Super Retail Group, Treasury Wine Estates Ltd., Webjet Ltd., Wesfarmers Ltd., Woolworths Group Goldman Sachs APAC Conviction List Venustech, VeriSilicon, Will Semi, Wingtech, Wistron, Wiwynn, YJ Semitech, YJK, YOFC (A), YOFC (H), Yonyou, ZTE (A), ZTE (H), ZWSOFT, iFlytek The rating(s) for HDFC Bank is/are relative to the other companies in its/their coverage universe: Aavas Financiers Ltd., Axis Bank, Bajaj Finance, Bandhan Bank Ltd., HDFC Bank, ICICI Bank, IDFC First Bank Ltd., IndusInd Bank, Kotak Mahindra Bank, L&T Finance Holdings, LIC Housing Finance, Mahindra & Mahindra Financial Svcs, PNB Housing Finance Ltd., SBI Cards & Payment Services Ltd., Shriram Finance Ltd., State Bank of India, Yes Bank The rating(s) for Shionogi & Co. is/are relative to the other companies in its/their coverage universe: Astellas Pharma, CUC Inc., CareNet Inc., Chugai Pharmaceutical, Daiichi Sankyo, Eisai, JMDC Inc., M3, Olympus, Ono Pharmaceutical, Otsuka Holdings, PHC Holdings, PeptiDream Inc., Santen Pharmaceutical, Sawai Group, Shionogi & Co., Sysmex, Takeda Pharmaceutical, Terumo The rating(s) for Asics Corp. is/are relative to the other companies in its/their coverage universe: ABC-Mart, Adastria, Aeon, Asics Corp., Askul, Cosmos Pharmaceutical, Fast Retailing, Isetan Mitsukoshi Holdings, J. Front Retailing Co., Lawson, Marui Group, MonotaRO, Nitori, Pan Pacific International Holdings, Rakuten Group, Ryohin Keikaku, Saizeriya, Seven & i Holdings, Shimamura, Shimano, Skylark Co., Sugi Holdings Co., Tsuruha Holdings, Welcia Holdings, Workman Co., ZOZO The rating(s) for Sony Group is/are relative to the other companies in its/their coverage universe: Bandai Namco Holdings, Capcom, CyberAgent, Konami Group, LY Corp., Nexon, Nintendo, Oriental Land, Recruit Holdings, Sony Group, Square Enix Holdings The rating(s) for SMC is/are relative to the other companies in its/their coverage universe: CKD Corp., Daifuku Co., Daikin Industries, FUJI, Fanuc, Fujitsu General, Harmonic Drive Systems Inc., Hitachi Construction Machinery, Hoshizaki Corp., Keyence, Komatsu, Kubota, Kurita Water Industries, Makita, Misumi Group, NSK, NTN, Okuma Corp., Omron Corp., Organo Corp., Renova Inc., SMC, THK, Takeuchi MFG, West Holdings, Yaskawa Electric Company-specific regulatory disclosures Distribution of ratings/investment banking relationships Goldman Sachs Investment Research global Equity coverage universe Rating Distribution Global Investment Banking Relationships Buy Hold Sell Buy Hold Sell 48% 36% 16% 62% 56% 44% As of October 1, 2023, Goldman Sachs Global Investment Research had investment ratings on 2,960 equity securities. Goldman Sachs assigns stocks as Buys and Sells on various regional Investment Lists; stocks not so assigned are deemed Neutral. Such assignments equate to Buy, Hold and Sell for the purposes of the above disclosure required by the FINRA Rules. See ‘Ratings, Coverage universe and related definitions’ below. The Investment Banking Relationships chart reflects the percentage of subject companies within each rating category for whom Goldman Sachs has provided investment banking services within the previous twelve months. Price target and rating history chart(s) Compendium report: please see disclosures at https://www.gs.com/research/hedge.html. Disclosures applicable to the companies included in this compendium can be found in the latest relevant published research Target price history table(s) SK Hynix Inc. (000660.KS) Date of report Target price (W) 26-Oct-23 170,000 20-Sep-23 160,000 21-Jun-23 155,000 15-Mar-23 118,000 01-Feb-23 120,000 12-Jan-23 110,000 26-Oct-22 115,000 25-Sep-22 120,000 27-Jul-22 135,000 21-Jun-22 155,000 19-Apr-22 181,000 10-Mar-22 182,000 30-Jan-22 173,000 10-Jan-22 170,000 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Compendium report: please see disclosures at https://www.gs.com/research/hedge.html. Disclosures applicable to the companies included in this compendium can be found in the latest relevant published research Regulatory disclosures Disclosures required by United States laws and regulations See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager or co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-managed public offerings in prior periods; directorships; for equity securities, market making and/or specialist role. Goldman Sachs trades or may trade as a principal in debt securities (or in related derivatives) of issuers discussed in this report. The following are additional required disclosures: Ownership and material conflicts of interest: Goldman Sachs policy prohibits its analysts, professionals reporting to analysts and members of their households from owning securities of any company in the analyst’s area of coverage. 4 December 2023 92 Goldman Sachs APAC Conviction List Analyst compensation: Analysts are paid in part based on the profitability of Goldman Sachs, which includes investment banking revenues. Analyst as officer or director: Goldman Sachs policy generally prohibits its analysts, persons reporting to analysts or members of their households from serving as an officer, director or advisor of any company in the analyst’s area of coverage. Non-U.S. Analysts: Non-U.S. analysts may not be associated persons of Goldman Sachs & Co. LLC and therefore may not be subject to FINRA Rule 2241 or FINRA Rule 2242 restrictions on communications with subject company, public appearances and trading securities held by the analysts. Distribution of ratings: See the distribution of ratings disclosure above. Price chart: See the price chart, with changes of ratings and price targets in prior periods, above, or, if electronic format or if with respect to multiple companies which are the subject of this report, on the Goldman Sachs website at https://www.gs.com/research/hedge.html. The following disclosures are those required by the jurisdiction indicated, except to the extent already made above pursuant to United States laws and regulations. Australia: Goldman Sachs Australia Pty Ltd and its affiliates are not authorised deposit-taking institutions (as that term is defined in the Banking Act 1959 (Cth)) in Australia and do not provide banking services, nor carry on a banking business, in Australia. This research, and any access to it, is intended only for “wholesale clients” within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other entities which are the subject of its research reports. In some instances the costs of such site visits or meetings may be met in part or in whole by the issuers concerned if Goldman Sachs Australia considers it is appropriate and reasonable in the specific circumstances relating to the site visit or meeting. To the extent that the contents of this document contains any financial product advice, it is general advice only and has been prepared by Goldman Sachs without taking into account a client’s objectives, financial situation or needs. A client should, before acting on any such advice, consider the appropriateness of the advice having regard to the client’s own objectives, financial situation and needs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests and a copy of Goldman Sachs’ Australian Sell-Side Research Independence Policy Statement are available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html. Brazil: Disclosure information in relation to CVM Resolution n. 20 is available at https://www.gs.com/worldwide/brazil/area/gir/index.html. Where applicable, the Brazil-registered analyst primarily responsible for the content of this research report, as defined in Article 20 of CVM Resolution n. 20, is the first author named at the beginning of this report, unless indicated otherwise at the end of the text. Canada: This information is being provided to you for information purposes only and is not, and under no circumstances should be construed as, an advertisement, offering or solicitation by Goldman Sachs & Co. LLC for purchasers of securities in Canada to trade in any Canadian security. Goldman Sachs & Co. LLC is not registered as a dealer in any jurisdiction in Canada under applicable Canadian securities laws and generally is not permitted to trade in Canadian securities and may be prohibited from selling certain securities and products in certain jurisdictions in Canada. If you wish to trade in any Canadian securities or other products in Canada please contact Goldman Sachs Canada Inc., an affiliate of The Goldman Sachs Group Inc., or another registered Canadian dealer. Hong Kong: Further information on the securities of covered companies referred to in this research may be obtained on request from Goldman Sachs (Asia) L.L.C. India: Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (India) Securities Private Limited, Research Analyst - SEBI Registration Number INH000001493, 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025, India, Corporate Identity Number U74140MH2006FTC160634, Phone +91 22 6616 9000, Fax +91 22 6616 9001. Goldman Sachs may beneficially own 1% or more of the securities (as such term is defined in clause 2 (h) the Indian Securities Contracts (Regulation) Act, 1956) of the subject company or companies referred to in this research report. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Goldman Sachs (India) Securities Private Limited Investor Grievance E-mail: india-client-support@gs.com. Compliance Officer: Anil Rajput |Tel: + 91 22 6616 9000 | Email: anil.m.rajput@gs.com. Japan: See below. Korea: This research, and any access to it, is intended only for “professional investors” within the meaning of the Financial Services and Capital Markets Act, unless otherwise agreed by Goldman Sachs. Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (Asia) L.L.C., Seoul Branch. New Zealand: Goldman Sachs New Zealand Limited and its affiliates are neither “registered banks” nor “deposit takers” (as defined in the Reserve Bank of New Zealand Act 1989) in New Zealand. This research, and any access to it, is intended for “wholesale clients” (as defined in the Financial Advisers Act 2008) unless otherwise agreed by Goldman Sachs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests is available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html. Russia: Research reports distributed in the Russian Federation are not advertising as defined in the Russian legislation, but are information and analysis not having product promotion as their main purpose and do not provide appraisal within the meaning of the Russian legislation on appraisal activity. Research reports do not constitute a personalized investment recommendation as defined in Russian laws and regulations, are not addressed to a specific client, and are prepared without analyzing the financial circumstances, investment profiles or risk profiles of clients. Goldman Sachs assumes no responsibility for any investment decisions that may be taken by a client or any other person based on this research report. Singapore: Goldman Sachs (Singapore) Pte. (Company Number: 198602165W), which is regulated by the Monetary Authority of Singapore, accepts legal responsibility for this research, and should be contacted with respect to any matters arising from, or in connection with, this research. Taiwan: This material is for reference only and must not be reprinted without permission. Investors should carefully consider their own investment risk. Investment results are the responsibility of the individual investor. United Kingdom: Persons who would be categorized as retail clients in the United Kingdom, as such term is defined in the rules of the Financial Conduct Authority, should read this research in conjunction with prior Goldman Sachs research on the covered companies referred to herein and should refer to the risk warnings that have been sent to them by Goldman Sachs International. A copy of these risks warnings, and a glossary of certain financial terms used in this report, are available from Goldman Sachs International on request. European Union and United Kingdom: Disclosure information in relation to Article 6 (2) of the European Commission Delegated Regulation (EU) (2016/958) supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council (including as that Delegated Regulation is implemented into United Kingdom domestic law and regulation following the United Kingdom’s departure from the European Union and the European Economic Area) with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest is available at https://www.gs.com/disclosures/europeanpolicy.html which states the European Policy for Managing Conflicts of Interest in Connection with Investment Research. Japan: Goldman Sachs Japan Co., Ltd. is a Financial Instrument Dealer registered with the Kanto Financial Bureau under registration number Kinsho 69, and a member of Japan Securities Dealers Association, Financial Futures Association of Japan Type II Financial Instruments Firms Association, The Investment Trusts Association, Japan, and Japan Investment Advisers Association. Sales and purchase of equities are subject to commission pre-determined with clients plus consumption tax. See company-specific disclosures as to any applicable disclosures required by Japanese stock exchanges, the Japanese Securities Dealers Association or the Japanese Securities Finance Company. Ratings, coverage universe and related definitions Buy (B), Neutral (N), Sell (S) Analysts recommend stocks as Buys or Sells for inclusion on various regional Investment Lists. Being assigned a Buy or Sell on an Investment List is determined by a stock’s total return potential relative to its coverage universe. Any stock not assigned as a Buy or a Sell on an Investment List with an active rating (i.e., a stock that is not Rating Suspended, Not Rated, Coverage Suspended or Not Covered), is deemed Neutral. Each region manages Regional Conviction lists, which are selected from Buy rated stocks on the respective region’s Investment lists and represent investment recommendations focused on the size of the total return potential and/or the likelihood of the realization of the return across their respective areas of coverage. The addition or removal of stocks from such Conviction lists are managed by the Investment Review Committee or other 4 December 2023 93 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Additional disclosures required under the laws and regulations of jurisdictions other than the United States Goldman Sachs APAC Conviction List designated committee in each respective region and do not represent a change in the analysts’ investment rating for such stocks. Total return potential represents the upside or downside differential between the current share price and the price target, including all paid or anticipated dividends, expected during the time horizon associated with the price target. Price targets are required for all covered stocks. The total return potential, price target and associated time horizon are stated in each report adding or reiterating an Investment List membership. Coverage Universe: A list of all stocks in each coverage universe is available by primary analyst, stock and coverage universe at https://www.gs.com/research/hedge.html. Not Rated (NR). The investment rating, target price and earnings estimates (where relevant) are not provided or have been suspended pursuant to Goldman Sachs policy when Goldman Sachs is acting in an advisory capacity in a merger or in a strategic transaction involving this company, when there are legal, regulatory or policy constraints due to Goldman Sachs’ involvement in a transaction, when the company is an early-stage biotechnology company, and in certain other circumstances. Rating Suspended (RS). Goldman Sachs Research has suspended the investment rating and price target for this stock, because there is not a sufficient fundamental basis for determining an investment rating or target price. The previous investment rating and target price, if any, are no longer in effect for this stock and should not be relied upon. Coverage Suspended (CS). Goldman Sachs has suspended coverage of this company. Not Covered (NC). Goldman Sachs does not cover this company. Not Available or Not Applicable (NA). The information is not available for display or is not applicable. Not Meaningful (NM). The information is not meaningful and is therefore excluded. Goldman Sachs Global Investment Research produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the world produce research on industries and companies, and research on macroeconomics, currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd (ABN 21 006 797 897); in Brazil by Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; Public Communication Channel Goldman Sachs Brazil: 0800 727 5764 and / or contatogoldmanbrasil@gs.com. Available Weekdays (except holidays), from 9am to 6pm. Canal de Comunicação com o Público Goldman Sachs Brasil: 0800 727 5764 e/ou contatogoldmanbrasil@gs.com. Horário de funcionamento: segunda-feira à sexta-feira (exceto feriados), das 9h às 18h; in Canada by Goldman Sachs & Co. LLC; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in India by Goldman Sachs (India) Securities Private Ltd.; in Japan by Goldman Sachs Japan Co., Ltd.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs New Zealand Limited; in Russia by OOO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in the United States of America by Goldman Sachs & Co. LLC. Goldman Sachs International has approved this research in connection with its distribution in the United Kingdom. Goldman Sachs International (“GSI”), authorised by the Prudential Regulation Authority (“PRA”) and regulated by the Financial Conduct Authority (“FCA”) and the PRA, has approved this research in connection with its distribution in the United Kingdom. European Economic Area: GSI, authorised by the PRA and regulated by the FCA and the PRA, disseminates research in the following jurisdictions within the European Economic Area: the Grand Duchy of Luxembourg, Italy, the Kingdom of Belgium, the Kingdom of Denmark, the Kingdom of Norway, the Republic of Finland and the Republic of Ireland; GSI - Succursale de Paris (Paris branch) which is authorised by the French Autorité de contrôle prudentiel et de resolution (“ACPR”) and regulated by the Autorité de contrôle prudentiel et de resolution and the Autorité des marches financiers (“AMF”) disseminates research in France; GSI - Sucursal en España (Madrid branch) authorized in Spain by the Comisión Nacional del Mercado de Valores disseminates research in the Kingdom of Spain; GSI - Sweden Bankfilial (Stockholm branch) is authorized by the SFSA as a “third country branch” in accordance with Chapter 4, Section 4 of the Swedish Securities and Market Act (Sw. lag (2007:528) om värdepappersmarknaden) disseminates research in the Kingdom of Sweden; Goldman Sachs Bank Europe SE (“GSBE”) is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and Deutsche Bundesbank and disseminates research in the Federal Republic of Germany and those jurisdictions within the European Economic Area where GSI is not authorised to disseminate research and additionally, GSBE, Copenhagen Branch filial af GSBE, Tyskland, supervised by the Danish Financial Authority disseminates research in the Kingdom of Denmark; GSBE - Sucursal en España (Madrid branch) subject (to a limited extent) to local supervision by the Bank of Spain disseminates research in the Kingdom of Spain; GSBE - Succursale Italia (Milan branch) to the relevant applicable extent, subject to local supervision by the Bank of Italy (Banca d’Italia) and the Italian Companies and Exchange Commission (Commissione Nazionale per le Società e la Borsa “Consob”) disseminates research in Italy; GSBE - Succursale de Paris (Paris branch), supervised by the AMF and by the ACPR disseminates research in France; and GSBE - Sweden Bankfilial (Stockholm branch), to a limited extent, subject to local supervision by the Swedish Financial Supervisory Authority (Finansinpektionen) disseminates research in the Kingdom of Sweden. General disclosures This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large majority of reports are published at irregular intervals as appropriate in the analyst’s judgment. Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have investment banking and other business relationships with a substantial percentage of the companies covered by Global Investment Research. Goldman Sachs & Co. LLC, the United States broker dealer, is a member of SIPC (https://www.sipc.org). Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research. The analysts named in this report may have from time to time discussed with our clients, including Goldman Sachs salespersons and traders, or may discuss in this report, trading strategies that reference catalysts or events that may have a near-term impact on the market price of the equity securities discussed in this report, which impact may be directionally counter to the analyst’s published price target expectations for such stocks. Any such trading strategies are distinct from and do not affect the analyst’s fundamental equity rating for such stocks, which rating reflects a stock’s return potential relative to its coverage universe as described herein. We and our affiliates, officers, directors, and employees will from time to time have long or short positions in, act as principal in, and buy or sell, the securities or derivatives, if any, referred to in this research, unless otherwise prohibited by regulation or Goldman Sachs policy. The views attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do not necessarily reflect those of Global Investment Research and are not an official view of Goldman Sachs. Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in the products mentioned that are inconsistent with the views expressed by analysts named in this report. 4 December 2023 94 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM Global product; distributing entities Goldman Sachs APAC Conviction List This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of investments referred to in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Investors should review current options and futures disclosure documents which are available from Goldman Sachs sales representatives or at https://www.theocc.com/about/publications/character-risks.jsp and https://www.fiadocumentation.org/fia/regulatory-disclosures_1/fia-uniform-futures-and-options-on-futures-risk-disclosures-booklet-pdf-version-2018. Transaction costs may be significant in option strategies calling for multiple purchase and sales of options such as spreads. Supporting documentation will be supplied upon request. Differing Levels of Service provided by Global Investment Research: The level and types of services provided to you by Goldman Sachs Global Investment Research may vary as compared to that provided to internal and other external clients of GS, depending on various factors including your individual preferences as to the frequency and manner of receiving communication, your risk profile and investment focus and perspective (e.g., marketwide, sector specific, long term, short term), the size and scope of your overall client relationship with GS, and legal and regulatory constraints. As an example, certain clients may request to receive notifications when research on specific securities is published, and certain clients may request that specific data underlying analysts’ fundamental analysis available on our internal client websites be delivered to them electronically through data feeds or otherwise. No change to an analyst’s fundamental research views (e.g., ratings, price targets, or material changes to earnings estimates for equity securities), will be communicated to any client prior to inclusion of such information in a research report broadly disseminated through electronic publication to our internal client websites or through other means, as necessary, to all clients who are entitled to receive such reports. Disclosure information is also available at https://www.gs.com/research/hedge.html or from Research Compliance, 200 West Street, New York, NY 10282. © 2023 Goldman Sachs. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of The Goldman Sachs Group, Inc. 2e83ab6fea424dc8a1b6a8a7e94c6547 For the exclusive use of MATTHEW.X.WONG@GS.COM All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client websites. Not all research content is redistributed to our clients or available to third-party aggregators, nor is Goldman Sachs responsible for the redistribution of our research by third party aggregators. For research, models or other data related to one or more securities, markets or asset classes (including related services) that may be available to you, please contact your GS representative or go to https://research.gs.com. 4 December 2023 95