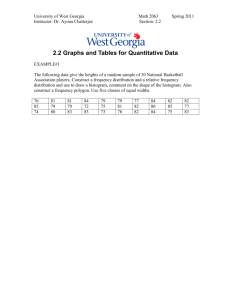

Decision Science December 2023 Examination Solution Q. 1 Title: Investment Recommendation for Mr. Saproo Using Expected Monetary Values (EMVs) Introduction: Mr. Rajinder Saproo, a 10 lakh INR investor, sought the advice of MukulbhaiGadhecha, a Mumbai-based financial expert. Mukulbhai was entrusted with advising Mr. Saproo on the best investment strategy given certain economic development scenarios. Mr. Saproo's outlook for the next year is divided into three categories: 10% positive about 'genuine economic growth,' 50% confident about'moderate economic growth,' and 40% hopeful about 'reduced financial growth.' Mukulbhai Gadhecha thoroughly examined possible payoffs for various investment options under these conditions. Maruti Suzuki shares, Tata Motor stocks, and D Mart stocks were the investment options under consideration, with each providing unique returns based on the financial position. Choice Tree Diagram: In order to give Mr. Saproo with clear and educated advise, we created a choice tree diagram that graphically depicts the investment possibilities and the associated risks of each economic scenario. The decision tree allows for the demonstration of capability outcomes and expected returns in the context of unique situations. The Tree Diagram below is an example. Investment Decision (10, 00,000 INR) / | \ / | \ Good Economic / Moderate Economic \ Lower Economic Growth / Growth \ Growth 10% (0.10) / 50% (0.50) \ / \ / / \ / 40% (0.40) / \ / / \ / Mauti Suzuki Shares TATA Motor Shares D Mart shares 3, 00,000 (0.10) 4, 00,000 (0.10) | | 1, 20,000 (0.50) | 50,000 (0.40) | 1,00,000 (0.50) | 4,50,000 (0.10) 2,30,000 (0.50) | 10,000 (0.40) 30,000 (0.40) The decision tree displays Mr. Saproo's choices, which are entirely based on his available money of 10,000 INR and the probability assigned to each economic development scenario. The three investment possibilities are set out on the tree's last degree, each with its own return for 'genuine financial increase,''moderate financial growth,' and 'decreased financial rise.' EMVs (Expected Monetary Values): We estimated the anticipated economic Values (EMVs) for each financing choice for each economic scenario to arrive at a good funding decision for Mr. Saproo. EMV is an important decision-making tool since it takes into account both capacity returns and their related possibilities. EMV is computed as the product and probability of each conceivable end outcome. Here are the EMVs calculated for each investment option: Mauti Suzuki Shares: EMV = (0.10 * 3, 00,000) + (0.50 * 1, 20,000) + (0.40 * 50,000) = 30,000 + 60,000 + 20,000 = 110,000 INR TATA Motor shares: EMV = (0.10 * 4, 00,000) + (0.50 * 1, 00,000) + (0.40 * 10,000) = 40,000 + 50,000 + 4,000 = 94,000 INR D Mart shares: EMV = (0.10 * 4, 50,000) + (0.50 * 2,30,000) + (0.40 * 30,000) = 45,000 + 1,15,000 + 12,000 = 172,000 INR Recommendations: D-Mart stock is Mr. Saproo's favorite investment, as is his EMV calculation for most of all investment options. This feature gives you the highest estimated return on most investments, with an EMV of approximately INR 172,000. Of partners D Mart aims to maximize efficiency while evaluating relevant opportunities. The recommendations are based on a comprehensive analysis of recovery plans under different financial development scenarios identified in the EMV. result: To summarize, Mr. Tapulo proposed to invest Rs 1 million and select D-Mart shares. Support this desire by carefully considering the possibilities and potential returns of each financial option. By specializing in D-Mart stock, Mr. Saplow is able to maximize profits depending on his optimistic view of the financial future, as shown by the probabilities he assigns to different economic growth scenarios. However, Sapro said it is important to keep in mind that all investments involve a certain level of risk, and that market conditions should be disclosed in order to make informed decisions as circumstances change. You should continue to do so and regularly review your investment portfolio. This recommendation is primarily based on the information available at the time of the decision and an understanding of the economic scenario. SOLUTION - 2 The Quest for the Optimal Alpha: Within the field of forecasting, we set out on a journey to discover the alpha value, which holds the secret to greater predictive abilities. Our path leads us through the thick forest of mean Absolute Deviation (MAD) and the perilous terrain of suggest-squared errors (MSE). These measurements will be our compass on our journey. The Participants: Our worthy adversaries are alpha values 0.1, 0.2, 0.5, 0.7, and 0.9. Each Alpha strives to establish its value in the realm of predicting, but only one will triumph. Alpha = 0.1 (1) (2) (3) r s (α=0.1) 2 1127 0.1⋅977+0.9⋅977=977 3 694 4 1357 0.1⋅694+0.9⋅992=962.2 5 1020 0.1⋅1357+0.9⋅962.2=1001.68 6 1187 0.1⋅1020+0.9⋅1001.68=1003.512 7 866 yea Sale Exponential Smoothing 1 8 977 1459 977 0.1⋅1127+0.9⋅977=992 0.1⋅1187+0.9⋅1003.512=1021.8608 0.1⋅866+0.9⋅1021.8608=1006.2747 9 1163 0.1⋅1459+0.9⋅1006.2747=1051.5472 10 991 11 1411 0.1⋅991+0.9⋅1062.6925=1055.5233 12 1323 0.1⋅1411+0.9⋅1055.5233=1091.0709 13 995 14 1764 0.1⋅995+0.9⋅1114.2638=1102.3375 15 1552 0.1⋅1764+0.9⋅1102.3375=1168.5037 16 1465 0.1⋅1552+0.9⋅1168.5037=1206.8533 17 1398 0.1⋅1465+0.9⋅1206.8533=1232.668 18 1893 0.1⋅1398+0.9⋅1232.668=1249.2012 19 1422 0.1⋅1893+0.9⋅1249.2012=1313.5811 20 2063 0.1⋅1422+0.9⋅1313.5811=1324.423 21 1703 0.1⋅2063+0.9⋅1324.423=1398.2807 22 1758 0.1⋅1703+0.9⋅1398.2807=1428.7526 23 0.1⋅1758+0.9⋅1428.7526=1461.6774 (1) (2) yea Sal r 1 2 es 0.1⋅1163+0.9⋅1051.5472=1062.6925 0.1⋅1323+0.9⋅1091.0709=1114.2638 (3) Exponential Smoothing (4) Error (5) |Error| (6) Error2 977 977 112 7 977 1127-977=150 150 22500 (7) |%Erro r| 13.31% 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 694 992 135 7 102 0 118 7 694-992=-298 298 88804 42.94% 962.2 1357-962.2=394.8 394.8 155867.04 29.09% 1001.68 1020-1001.68=18.32 18.32 335.6224 1.8% 1003.512 866 1021.8608 145 9 116 3 1006.2747 1051.5472 991 1062.6925 141 1 132 3 1055.5233 1091.0709 995 1114.2638 176 4 155 2 146 5 1102.3375 1168.5037 1206.8533 139 1232.668 1187- 1003.512=183.488 183.488 33667.8461 15.46% 866-1021.8608=- 155.860 1459- 452.725 204960.179 155.8608 1006.2747=452.7253 1163- 1051.5472=111.4528 991-1062.6925=71.6925 8 3 111.452 8 24292.589 2 71.6925 5139.8179 355.476 126363.704 1323- 231.929 1091.0709=231.9291 995-1114.2638=119.2638 1764- 1102.3375=661.6625 1552- 1168.5037=383.4963 1465- 1206.8533=258.1467 1398- 7 1 119.263 8 9 25.19% 14223.8658 11.99% 5 9 3 3 383.496 147069.398 7 7.23% 53791.0871 17.53% 661.662 437797.310 258.146 31.03% 12421.7159 9.58% 1411- 1055.5233=355.4767 18% 37.51% 24.71% 66639.6949 17.62% 165.332 27334.6664 11.83% 8 18 19 20 21 22 189 3 142 2 206 3 170 3 175 8 23 1232.668=165.332 1249.2012 1313.5811 1324.423 1398.2807 1428.7526 1461.6774 1893- 643.798 414476.881 1422- 108.418 1249.2012=643.7988 1313.5811=108.4189 2063- 1324.423=738.577 8 9 738.577 4 11754.6602 7.62% 545496.013 8 1703- 304.719 1758- 329.247 108403.841 1398.2807=304.7193 1428.7526=329.2474 Total Forecasting errors 3 (1) (2) (3) r s (α=0.2) 2 1127 0.2⋅977+0.8⋅977=977 yea Sale Exponential Smoothing 1 977 977 35.8% 92853.8625 17.89% 4 1 79 78 18.73% 6136.40 2594193.79 428.88 1. Mean absolute error (MAE), also called mean absolute deviation (MAD) 2. Mean squared error (MSE) 34.01% % 0.2⋅1127+0.8⋅977=1007 3 694 4 1357 0.2⋅694+0.8⋅1007=944.4 5 1020 0.2⋅1357+0.8⋅944.4=1026.92 6 1187 0.2⋅1020+0.8⋅1026.92=1025.536 7 866 8 1459 0.2⋅866+0.8⋅1057.8288=1019.463 9 1163 0.2⋅1459+0.8⋅1019.463=1107.3704 10 991 11 1411 0.2⋅991+0.8⋅1118.4963=1092.9971 12 1323 0.2⋅1411+0.8⋅1092.9971=1156.5977 13 995 14 1764 0.2⋅995+0.8⋅1189.8781=1150.9025 15 1552 0.2⋅1764+0.8⋅1150.9025=1273.522 16 1465 0.2⋅1552+0.8⋅1273.522=1329.2176 17 1398 0.2⋅1465+0.8⋅1329.2176=1356.3741 18 1893 0.2⋅1398+0.8⋅1356.3741=1364.6993 19 1422 0.2⋅1893+0.8⋅1364.6993=1470.3594 20 2063 0.2⋅1422+0.8⋅1470.3594=1460.6875 21 1703 0.2⋅2063+0.8⋅1460.6875=1581.15 22 1758 0.2⋅1703+0.8⋅1581.15=1605.52 23 0.2⋅1187+0.8⋅1025.536=1057.8288 0.2⋅1163+0.8⋅1107.3704=1118.4963 0.2⋅1323+0.8⋅1156.5977=1189.8781 0.2⋅1758+0.8⋅1605.52=1636.016 (1) (2) yea Sal r 1 2 3 4 5 6 7 8 9 10 11 12 13 es (3) Exponential Smoothing (4) Error (5) |Error| (6) Error2 977 977 112 7 977 7 102 0 118 7 9 116 3 22500 13.31% 694-1007=-313 313 97969 45.1% 944.4 1357-944.4=412.6 412.6 170238.76 30.41% 1026.92 1020-1026.92=-6.92 6.92 47.8864 0.68% 1025.536 1019.463 1107.3704 991 1118.4963 141 1 132 3 r| 150 866 1057.8288 145 |%Erro 1127-977=150 694 1007 135 (7) 1092.9971 1156.5977 995 1189.8781 1187- 1025.536=161.464 866-1057.8288=191.8288 1459- 1019.463=439.537 1163- 1107.3704=55.6296 161.464 26070.6233 13.6% 191.828 8 439.537 36798.2885 22.15% 193192.739 2 55.6296 3094.6488 991-1118.4963=- 127.496 1411- 318.002 101125.859 127.4963 1092.9971=318.0029 1323- 1156.5977=166.4023 995-1189.8781=194.8781 3 9 166.402 3 194.878 1 30.13% 4.78% 16255.3181 12.87% 4 22.54% 27689.7384 12.58% 37977.4851 19.59% 14 15 16 17 18 19 20 21 22 23 176 4 155 2 146 5 139 8 189 3 142 2 206 3 170 3 175 8 1150.9025 1273.522 1329.2176 1356.3741 1364.6993 1470.3594 1764- 1150.9025=613.0975 1552- 1273.522=278.478 1465- 1329.2176=135.7824 1398- 1356.3741=41.6259 1893- 1364.6993=528.3007 1422-1470.3594=48.3594 613.097 375888.540 5 6 34.76% 278.478 77549.9951 17.94% 135.782 4 18436.8596 9.27% 41.6259 1732.7171 528.300 279101.666 7 3 48.3594 2338.6328 2.98% 27.91% 3.4% 2063- 602.312 362780.311 5 8 1581.15 1703-1581.15=121.85 121.85 14847.4167 7.16% 1605.52 1758-1605.52=152.48 152.48 23250.1446 8.67% 1636.016 Total 1460.6875 1460.6875=602.3125 5060.04 1888886.63 54 17 Forecasting errors 1. Mean absolute error (MAE), also called mean absolute deviation (MAD) 2. Mean squared error (MSE) 29.2% 369% Alpha = 0.5 (1) (2) (3) r s (α=0.5) 2 1127 0.5⋅977+0.5⋅977=977 3 694 4 1357 0.5⋅694+0.5⋅1052=873 5 1020 0.5⋅1357+0.5⋅873=1115 6 1187 0.5⋅1020+0.5⋅1115=1067.5 7 866 8 1459 0.5⋅866+0.5⋅1127.25=996.625 9 1163 0.5⋅1459+0.5⋅996.625=1227.8125 10 991 11 1411 0.5⋅991+0.5⋅1195.4062=1093.2031 12 1323 0.5⋅1411+0.5⋅1093.2031=1252.1016 13 995 14 1764 0.5⋅995+0.5⋅1287.5508=1141.2754 15 1552 0.5⋅1764+0.5⋅1141.2754=1452.6377 16 1465 0.5⋅1552+0.5⋅1452.6377=1502.3188 17 1398 0.5⋅1465+0.5⋅1502.3188=1483.6594 18 1893 0.5⋅1398+0.5⋅1483.6594=1440.8297 yea Sale Exponential Smoothing 1 977 977 0.5⋅1127+0.5⋅977=1052 0.5⋅1187+0.5⋅1067.5=1127.25 0.5⋅1163+0.5⋅1227.8125=1195.4062 0.5⋅1323+0.5⋅1252.1016=1287.5508 19 1422 0.5⋅1893+0.5⋅1440.8297=1666.9149 20 2063 0.5⋅1422+0.5⋅1666.9149=1544.4574 21 1703 0.5⋅2063+0.5⋅1544.4574=1803.7287 22 1758 0.5⋅1703+0.5⋅1803.7287=1753.3644 23 0.5⋅1758+0.5⋅1753.3644=1755.6822 (1) (2) yea Sal r 1 2 3 4 5 6 7 8 9 10 es (3) Exponential Smoothing (4) Error (5) |Error| (6) Error2 977 977 112 7 977 7 102 0 118 7 9 116 3 r| 150 22500 13.31% 694-1052=-358 358 128164 51.59% 873 1357-873=484 484 234256 35.67% 1115 1020-1115=-95 95 9025 9.31% 1067.5 1187-1067.5=119.5 119.5 14280.25 10.07% 866-1127.25=-261.25 261.25 68251.5625 30.17% 866 1127.25 145 |%Erro 1127-977=150 694 1052 135 (7) 996.625 1227.8125 991 1195.4062 1459-996.625=462.375 462.375 1163-1227.8125=64.8125 991-1195.4062=- 213790.640 6 64.8125 4200.6602 204.406 41781.915 31.69% 5.57% 20.63% 11 12 13 14 15 16 17 18 19 20 21 22 23 141 1 132 3 1093.2031 1252.1016 995 1287.5508 176 4 155 2 146 5 139 8 189 3 142 2 206 3 170 3 175 8 1141.2754 1452.6377 1502.3188 1483.6594 1440.8297 1666.9149 1544.4574 1803.7287 1753.3644 1755.6822 204.4062 2 1093.2031=317.7969 9 14111323- 1252.1016=70.8984 317.796 100994.853 8 70.8984 5026.5884 995-1287.5508=- 292.550 1764- 622.724 387785.939 292.5508 1141.2754=622.7246 1552- 1452.6377=99.3623 1465-1502.3188=37.3188 1398-1483.6594=85.6594 8 6 1 6.4% 37.3188 1392.6964 2.55% 85.6594 7337.5369 6.13% 1422-1666.9149=- 244.914 2063- 1544.4574=518.5426 1703-1803.7287=100.7287 1758- 1753.3644=4.6356 Total 35.3% 99.3623 9872.8676 452.170 204457.969 244.9149 5.36% 85585.9596 29.4% 1893- 1440.8297=452.1703 22.52% 3 9 518.542 6 100.728 7 4.6356 4 23.89% 59983.2867 17.22% 268886.399 25.14% 10146.2738 5.91% 21.4892 0.26% 5046.64 1877741.88 388.09 71 82 % Forecasting errors 1. Mean absolute error (MAE), also called mean absolute deviation (MAD) MAD =5046.6471 / 21=240.3165 2. Mean squared error (MSE) MSE=1877741.8882 / 21=89416.2804 ALPHA = 0.7 (1) (2) (3) r s (α=0.7) 2 1127 0.7⋅977+0.3⋅977=977 3 694 4 1357 0.7⋅694+0.3⋅1082=810.4 5 1020 0.7⋅1357+0.3⋅810.4=1193.02 6 1187 0.7⋅1020+0.3⋅1193.02=1071.906 7 866 8 1459 0.7⋅866+0.3⋅1152.4718=951.9415 9 1163 0.7⋅1459+0.3⋅951.9415=1306.8825 10 991 11 1411 0.7⋅991+0.3⋅1206.1647=1055.5494 yea Sale Exponential Smoothing 1 977 977 0.7⋅1127+0.3⋅977=1082 0.7⋅1187+0.3⋅1071.906=1152.4718 0.7⋅1163+0.3⋅1306.8825=1206.1647 12 1323 0.7⋅1411+0.3⋅1055.5494=1304.3648 13 995 14 1764 0.7⋅995+0.3⋅1317.4094=1091.7228 15 1552 0.7⋅1764+0.3⋅1091.7228=1562.3169 16 1465 0.7⋅1552+0.3⋅1562.3169=1555.0951 17 1398 0.7⋅1465+0.3⋅1555.0951=1492.0285 18 1893 0.7⋅1398+0.3⋅1492.0285=1426.2086 19 1422 0.7⋅1893+0.3⋅1426.2086=1752.9626 20 2063 0.7⋅1422+0.3⋅1752.9626=1521.2888 21 1703 0.7⋅2063+0.3⋅1521.2888=1900.4866 22 1758 0.7⋅1703+0.3⋅1900.4866=1762.246 23 0.7⋅1758+0.3⋅1762.246=1759.2738 (1) (2) yea Sal r 1 2 3 4 5 es 0.7⋅1323+0.3⋅1304.3648=1317.4094 (3) Exponential Smoothing (4) Error (5) |Error| (6) Error2 977 977 112 7 977 7 102 0 |%Erro r| 1127-977=150 150 22500 13.31% 694-1082=-388 388 150544 55.91% 810.4 1357-810.4=546.6 546.6 298771.56 40.28% 1193.02 1020-1193.02=-173.02 173.02 29935.9204 16.96% 694 1082 135 (7) 6 7 8 9 10 11 12 13 14 15 16 17 18 19 118 7 1071.906 866 1152.4718 145 9 116 3 951.9415 1306.8825 991 1206.1647 141 1 132 3 1055.5494 1304.3648 995 1317.4094 176 4 155 2 146 5 139 8 189 3 142 2 1091.7228 1562.3169 1555.0951 1492.0285 1426.2086 1752.9626 1187- 1071.906=115.094 115.094 13246.6288 9.7% 866-1152.4718=- 286.471 1459- 507.058 257108.281 286.4718 951.9415=507.0585 1163-1306.8825=143.8825 991-1206.1647=215.1647 1411- 1055.5494=355.4506 1323- 1304.3648=18.6352 8 5 143.882 5 215.164 7 82066.0922 33.08% 9 20702.1629 12.37% 46295.8647 21.71% 355.450 126345.113 6 7 18.6352 347.2697 995-1317.4094=- 322.409 103947.852 1764- 672.277 451956.587 322.4094 1091.7228=672.2772 1552-1562.3169=10.3169 1465-1555.0951=90.0951 1398-1492.0285=94.0285 4 1 2 4 1.41% 32.4% 38.11% 0.66% 90.0951 8117.119 6.15% 94.0285 8841.3619 6.73% 466.791 217894.253 1422-1752.9626=- 330.962 109536.220 330.9626 25.19% 10.3169 106.4374 1893- 1426.2086=466.7914 34.75% 4 2 6 4 24.66% 23.27% 20 21 22 206 3 170 3 175 8 23 1521.2888 1900.4866 2063- 541.711 293451.056 1703-1900.4866=- 197.486 1521.2888=541.7112 197.4866 1762.246 1758-1762.246=-4.246 1759.2738 Total 2 6 4.246 8 39000.9694 11.6% 18.0284 21 03 1. Mean absolute error (MAE), also called mean absolute deviation (MAD) 2. Mean squared error (MSE) MSE=2280732.7803 / 21=108606.3229 ALPHA = 0.9 (1) (2) (3) r s (α=0.9) 2 1127 0.9⋅977+0.1⋅977=977 3 694 4 1357 0.9⋅694+0.1⋅1112=735.8 5 1020 0.9⋅1357+0.1⋅735.8=1294.88 6 1187 0.9⋅1020+0.1⋅1294.88=1047.488 yea Sale Exponential Smoothing 1 977 977 0.9⋅1127+0.1⋅977=1112 0.24% 5629.70 2280732.78 434.76 Forecasting errors MAD=5629.7021 / 21=268.0811 26.26% % 0.9⋅1187+0.1⋅1047.488=1173.0488 7 866 8 1459 0.9⋅866+0.1⋅1173.0488=896.7049 9 1163 0.9⋅1459+0.1⋅896.7049=1402.7705 10 991 11 1411 0.9⋅991+0.1⋅1186.977=1010.5977 12 1323 0.9⋅1411+0.1⋅1010.5977=1370.9598 13 995 14 1764 0.9⋅995+0.1⋅1327.796=1028.2796 15 1552 0.9⋅1764+0.1⋅1028.2796=1690.428 16 1465 0.9⋅1552+0.1⋅1690.428=1565.8428 17 1398 0.9⋅1465+0.1⋅1565.8428=1475.0843 18 1893 0.9⋅1398+0.1⋅1475.0843=1405.7084 19 1422 0.9⋅1893+0.1⋅1405.7084=1844.2708 20 2063 0.9⋅1422+0.1⋅1844.2708=1464.2271 21 1703 0.9⋅2063+0.1⋅1464.2271=2003.1227 22 1758 0.9⋅1703+0.1⋅2003.1227=1733.0123 23 0.9⋅1758+0.1⋅1733.0123=1755.5012 (1) (2) yea Sal r 1 es 0.9⋅1163+0.1⋅1402.7705=1186.977 0.9⋅1323+0.1⋅1370.9598=1327.796 (3) Exponential Smoothing 977 977 (4) Error (5) |Error| (6) Error2 (7) |%Erro r| 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 112 7 977 1127-977=150 150 22500 13.31% 694-1112=-418 418 174724 60.23% 735.8 1357-735.8=621.2 621.2 385889.44 45.78% 1294.88 1020-1294.88=-274.88 274.88 75559.0144 26.95% 694 1112 135 7 102 0 118 7 1047.488 866 1173.0488 145 9 116 3 896.7049 1402.7705 991 1186.977 141 1 132 3 1010.5977 1370.9598 995 1327.796 176 4 155 2 1028.2796 1690.428 146 1565.8428 1187- 1047.488=139.512 139.512 19463.5981 11.75% 866-1173.0488=- 307.048 1459- 562.295 307.0488 896.7049=562.2951 1163-1402.7705=239.7705 991-1186.977=195.977 1411- 1010.5977=400.4023 1323-1370.9598=47.9598 995-1327.796=332.796 1764- 1028.2796=735.7204 1552-1690.428=138.428 1465-1565.8428=- 8 1 239.770 5 94278.9656 35.46% 316175.802 38.54% 57489.8869 20.62% 195.977 38407.0037 19.78% 400.402 160321.997 3 9 47.9598 2300.1396 332.796 110753.162 3 735.720 541284.510 4 4 138.428 19162.3 28.38% 3.63% 33.45% 41.71% 8.92% 100.842 10169.2695 6.88% 5 17 18 19 20 21 22 23 139 8 189 3 142 2 206 3 170 3 175 8 100.8428 1475.0843 1405.7084 1844.2708 1464.2271 2003.1227 1733.0123 1755.5012 1398-1475.0843=77.0843 8 77.0843 5941.9862 1893- 487.291 237453.076 1422-1844.2708=- 422.270 178312.664 1405.7084=487.2916 422.2708 2063- 1464.2271=598.7729 1703-2003.1227=300.1227 1758- 1733.0123=24.9877 Total 6 2 8 7 9 6 598.772 358529.004 300.122 7 5.51% 25.74% 29.7% 29.02% 90073.6401 17.62% 24.9877 624.3866 1.42% 6575.36 2899413.84 504.39 27 88 % Errors in forecasting 1. Mean absolute error (MAE), also known as mean absolute deviation (MAD), is defined as MAD=6575.3627/21=313.1125 MSE (mean squared error) MSE=2899413.8488/21=138067.3261 Let's now make a chart in MS Excel to show the MAD and MSE values for each alpha. Based on these criteria, we will next examine which alpha is substantially better for the projection. When we study the results, two alpha values jump out as strong contenders: 0.2 and 0.5. They have the lowest MAD and MSE values, indicating their predicting accuracy. These alphas have shown to be dependable friends in our pursuit of accuracy. The Final Thought: Alpha values of 0.2 and 0.5 have emerged as winners in the big forecasting arena, where precision is important. Their ability to limit mistakes, both absolute and squared, makes them the preferred choice for those seeking the most dependable forecasts. In the long term, the choice of alpha is obvious: Allow 0.2 and 0.5 to lead the way in our forecasting efforts, as they have shown to be the keys to unlocking. SOLUTION 3-A We dug into world data and regular distribution to determine the odds of the Mirchi set from the product surviving 100 days. With a mean lifespan (mean) of 90 days and a standard deviation of 10 days, we start calculating the difference using Z-scores for the fascinating world of the ancient traditional line distribution table. Step 1: Find the Z-score< br>Z-score is the knight in shining armor number, it is our guide to help us understand how close the value is to the average. In this study, we investigated the Z score of the 100-day durability of the Mirchi lamp. The Z-score is expressed by the following expression: Z = (X-μ) / σ where: X is the interest amount, 100 days. µ, noble environment (life expectancy), stable at 90 days. σ is the confidence level of the standard deviation, the 10-day confidence level After calling this model, the Z score emerges: Z=(100 -90)/ 2= 1< br> 2. Step: Uncovering the Possibility With Z-scores, we plan to reveal hidden opportunities in the history of the common table. These words correspond to ancient writings about Z-scores that reveal the secrets of probability. Our task is to show the probability that the Z score is not less than 1 but also equal to or less than 1 ( P ( Z≤1 ) ). Normal distribution process, our estimate is uncertain and the famous P (Z ≤ 1) is about 0.8413. So the result is correct: there is an attractive probability of 0.8413 or 84.13%. Here's the chance for the Mirchi sets selected from the batch to bravely last 100 days. In conclusion, a journey into the mysterious world of statistics reveals a chance of 84.13%. It is estimated that the Mirchi lighting selection from the manufacturer can withstand 100 days of reviews and clicks, which is taken from the average and deals with different aspects of life and is considered a normal distribution. SOLUTION 3-B Stacked Bar 14000 12000 10000 8000 6000 4000 2000 0 ALMORA BAGESHWAR CHAMOLI CHAMPAWAT DEHRADUN HARIDWAR Micro NAINITAL Small PAURI GARHWAL PITHORAGARH RUDRA PRAYAG TEHRI GARHWAL UDHAM SINGH NAGAR UTTARKASHI Medium Reasons for Choosing Stacked Bar Chart: Comparative Clarity: The main objective is to have a clear and visible assessment of the contribution of micro, small and medium enterprises to all MSMEs in every district of Uttarakhand. Stacked bar charts do a good job of showing the contributions within each section. This similarity is important to understand the distribution of MSME groups across states. Part-to-whole visualization: Stacked bar charts essentially show part-to-whole relationships. Each bar in the chart represents all small, medium and micro businesses in a region. The segments in this row represent 3 MSME categories: micro, small and medium. The department facilitates all types of assistance to all MSMEs in a district. It's good to take things apart. Smart Information About the Region: Uttarakhand is a state where many economic changes are taking place in its various regions. Stacked bar charts help compare the composition of MSMEs across regions. By analyzing the share of micro, small and medium businesses in each segment, stakeholders will benefit from understanding the type of business in the near future. Based on this assessment, policy makers and experts can develop strategies for different regions. Clarity and Accessibility: Stacked bar charts are known for their clarity and ease of interpretation. They are intuitive and require little explanation. Each area is represented by a bar, and sections of the bar are often shaded to increase clarity. This design ensures that the image is usable and understandable by a variety of business targets, regardless of whether they are familiar with data visualization techniques. Visual differentiation through color coding significantly improves readability, allowing viewers to easily differentiate between MSME groups. Conclusion: Stacked bar chart has been chosen as the required visualization method to show the contribution of small and medium enterprises in Uttarakhand to small and medium enterprises at several important points as follows: applicable. It provides a clear basis for comparison, ensures a good communication of the space as a whole, compares between regions, makes it understandable and accessible. This decision ensures that the truth is presented in the lesson and understood by a wide audience; this makes it an excellent tool to demonstrate understanding of the fragmentation of the MSME group in the state.