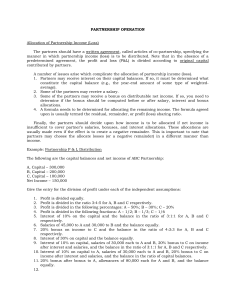

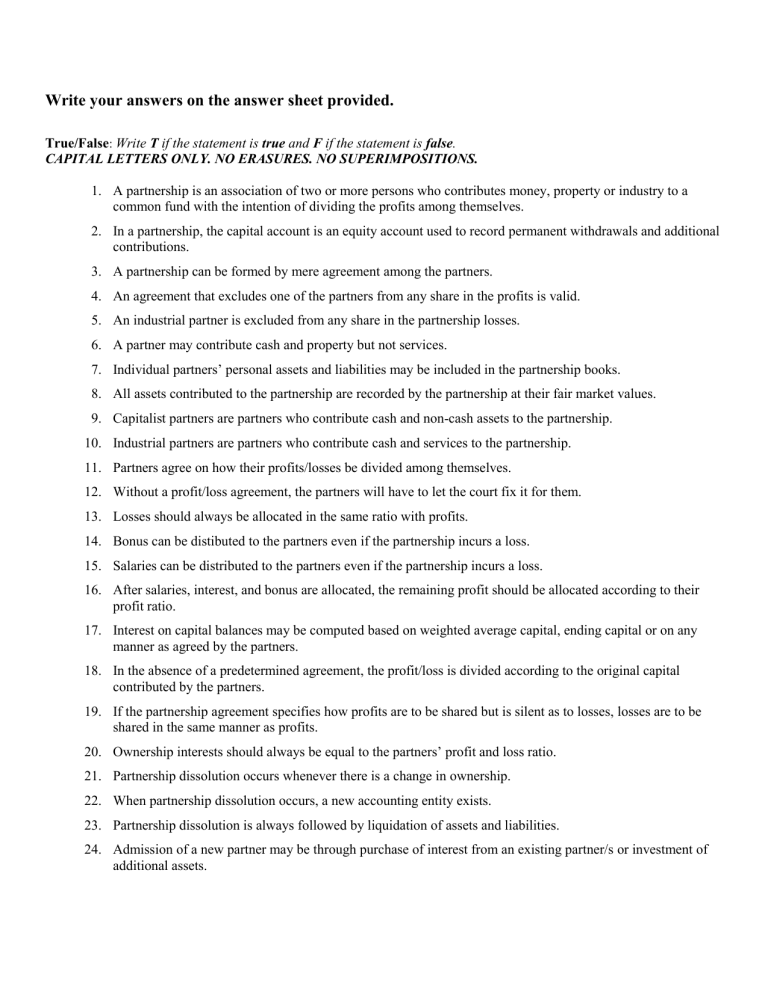

Write your answers on the answer sheet provided. True/False: Write T if the statement is true and F if the statement is false. CAPITAL LETTERS ONLY. NO ERASURES. NO SUPERIMPOSITIONS. 1. A partnership is an association of two or more persons who contributes money, property or industry to a common fund with the intention of dividing the profits among themselves. 2. In a partnership, the capital account is an equity account used to record permanent withdrawals and additional contributions. 3. A partnership can be formed by mere agreement among the partners. 4. An agreement that excludes one of the partners from any share in the profits is valid. 5. An industrial partner is excluded from any share in the partnership losses. 6. A partner may contribute cash and property but not services. 7. Individual partners’ personal assets and liabilities may be included in the partnership books. 8. All assets contributed to the partnership are recorded by the partnership at their fair market values. 9. Capitalist partners are partners who contribute cash and non-cash assets to the partnership. 10. Industrial partners are partners who contribute cash and services to the partnership. 11. Partners agree on how their profits/losses be divided among themselves. 12. Without a profit/loss agreement, the partners will have to let the court fix it for them. 13. Losses should always be allocated in the same ratio with profits. 14. Bonus can be distibuted to the partners even if the partnership incurs a loss. 15. Salaries can be distributed to the partners even if the partnership incurs a loss. 16. After salaries, interest, and bonus are allocated, the remaining profit should be allocated according to their profit ratio. 17. Interest on capital balances may be computed based on weighted average capital, ending capital or on any manner as agreed by the partners. 18. In the absence of a predetermined agreement, the profit/loss is divided according to the original capital contributed by the partners. 19. If the partnership agreement specifies how profits are to be shared but is silent as to losses, losses are to be shared in the same manner as profits. 20. Ownership interests should always be equal to the partners’ profit and loss ratio. 21. Partnership dissolution occurs whenever there is a change in ownership. 22. When partnership dissolution occurs, a new accounting entity exists. 23. Partnership dissolution is always followed by liquidation of assets and liabilities. 24. Admission of a new partner may be through purchase of interest from an existing partner/s or investment of additional assets. 25. When a new partner enters the partnership by purchasing the interest of an existing partner, the price paid for that interest is irrelevant to the partnership accounting records because it is a private or personal transaction among the partners. 26. When a new partner enters the partnership by purchasing the interest of an existing partner, a gain/loss must be recorded in the partnership books to account for the existing partner’s personal gain/loss. 27. Under the bonus method, when the capital account of a new partner is credited for an amount less than his contribution, a bonus is given to the existing partners. 28. Retirement, withdrawal, and death of a partner result to partnership dissolution. 29. When a retiring partner sells his interest to existing partner/s, a gain or loss from the transaction should be recorded in the partnership books. 30. When a retiring partner receives an amount less than his capital contribution, a bonus is allocated between the remaining partners in proportion to their capital accounts. Multiple Choice: Choose the letter of the best answer. CAPITAL LETTERS ONLY. NO ERASURES. NO SUPERIMPOSITIONS. 31. As of July 1, 2023, Faye and Gay decided to form a partnership. Their balance sheets on this date are: Faye Gay Cash P15,000 P37,500 Accounts Receivable 540,000 225,000 Merchandise Inventory 202,500 Machinery and Equipment 150,000 270,000 TOTAL P705,000 P735,000 Accounts Payable 135,000 240,000 Faye, Capital 570,000 Gay, Capital 490,000 TOTAL P705,000 P735,000 The partners agreed that the machinery and equipment of Faye is underdepreciated by P15,000 and that of Gay by P45,000. Allowance for doubtful accounts is to be set up amounting to P120,000 for Faye and P45,000 for Gay. The partnership agreement provides for a profit and loss ratio and capital interest of 60% to Faye and 40% to Gay. How much cash must Faye invest to bring the partners’ capital balances proportionate to their profit and loss ratio? a. P 142,500 c. P 172,500 b. P 52,500 d. P 102,500 32. On March 1, 2023, Patrick and Mike decided to combine their businesses and form a partnership. Their balance sheets on March 1, before adjustments, showed the following: Patrick Mike Cash P 9,000 P 3,750 Accounts receivable 18,500 13,500 Inventories 30,000 19,500 Furniture and fixtures (net) 30,000 9,000 Office equipment (net) 11,500 2,750 Prepaid expenses 6,375 3,000 TOTAL P 105,735 P 51,500 Accounts payable Capital TOTAL 33. 34. 35. 36. 37. P 45,750 59,625 P 105,375 P 18,000 33,500 P 51,500 They agreed to have the following items recorded in their books: 1. Provide 2% allowance for doubtful accounts. 2. Patrick’s furniture and fixtures should be P31,000 while Mike’s office equipment is underdepreciated by P250. 3. Rent expense incurred previously by Patrick was not yet recorded amounting to P1,000, while salary expense incurred by Mike was not also recorded amounting to P800. 4. The fair market value of inventory amounted to P29,500 for Patrick and P21,000 for Mike. Compute the net (debit) credit adjustment for Patrick and Mike. a. Patrick: P 2,870 c. Patrick: (P 870) Mike: P 2,820 Mike: P 180 b. Patrick: (P 2,870) d. Patrick: P 870 Mike: (P 2,820) Mike: (P 180) Using the same information, compute the total liabilities after formation: a. P 63,750 c. P 65,550 b. P 61,950 d. P 63,950 Compute the total assets after formation: a. P 156,875 c. P 160,765 b. P 157,985 d. P 152,985 On January 1, 2023, Rosabel, Jeryl, and Bernadette formed a partnership with profit or loss sharing agreement of 2:3:5. Rosabel contributed land with assessed value from the city assessor in the amount of P1,000,000. The appraised value of the land is P2,400,000. Jeryl contributed a building with a cost of P2,000,000 and accumulated depreciation of P1,500,000. The fair value of the building is P800,000. Bernadette contributed investment in traing securities with historical cost of P6,000,000. The trading securities have a quoted price in an active market of P3,000,000. The partners decided to bring their capital balances in accordance with their profit or loss sharing agreement. Furthermore, they have agreed that their total capital should be P10,000,000. Which of the following statements is correct? a. The agreed capital of Bernadette is P500,000. b. Rosabel should contribute additional capital in the amount of P1,800,000. c. Jeryl should contribute additional capital in the amount of P2,200,000. d. Bernadette is entitled to withdraw in the amount of P1,000,000. Leonard and Joker formed a partnership to operate a retail store of various merchandise. They agreed on the following distribution of profits and losses. Leonard Joker Salaries 400,000 350,000 Interest on capital ending balances before distribution of profit/loss 25% 30% Bonus on net income after salaries and interest but before bonuses 15% 12% Remainder 40% 60% Only 80% of the partners’ share in net income is distributed. The remaining 20% is retained as partners’ capital. Partnership’s net income amounted to P2,500,000 at the end of the year. Leonard and Joker’s ending capital balances prior to distribution of profit/loss amounted to P1,250,000 and P1,100,000, respectively. How much is Joker’s share in the partnership net income? a. P 1,018,985 b. P 950,000 c. P 1,297,985 d. P 997,985 How much is Joker’s ending capital after the distribution of the net income? 38. 39. 40. 41. 42. 43. 44. a. 1,359,597 b. 2,418,985 c. 1,600,000 d. 2,397,985 How much is Leonard’s share in the partnership net income? a. 1,481,015 b. 1,550,000 c. 1,202,015 d. 1,502,015 The partnership of Anaiah, Phoebe, Zhylote and Desiree reflected capital balances before the distribution of the net income amounting to P125,000; P100,000; P175,000; and P150,000, respectively. The partners are to divide profits and losses among themselves based on the following stipulations that they agreed on: 1. Salary of P30,000 each to Anaiah, Phoebe, and Desiree. 2. 10% interest on the capital balance before the distribution of income to the partners. 3. A 20% bonus after bonus, salaries, and interest is to be given to Zhylote. 4. The balance is to be divided on a 3:4:2:1 ratio. If Phoebe receives P70,000 from the partnership results of operations, what is the net income of the partnership? a. P300,000 c. P270,000 b. P235,000 d. P277,500 Kelly is trying to decide whether to accept a bonus of 25% of net income after salaries and bonus or a salary of P97,500 plus a bonus of 10% of net income after salaries and bonus as a means of allocating profit among partners. Salaries traceable to the other partners are estimated to be P450,000.What amount of income would be necessary so that Kelly would consider the choices equal? a. P 1,100,000 c. P 1,262,500 b. P 650,000 d. P 1,197,500 Partner A has a 25% participation in the profits of a partnership . During the year, A’s capital account had a net increase of P10,000. Partner A made contributions of P40,000 and capital withdrawals of P60,000 during the year. How much profit did the partnership earn during the year? a. 80,000 c. 120,000 b. 90,000 d. 100,000 A, B, and C are partners in an accounting firm. Their capital account balances at year-end were P90,000, P110,000, and P50,000, respectively. They share profits and losses on a 4:4:2 ratio, after the following special terms: 1. Partner C is to receive a bonus of 10% of net income after the bonus. 2. Interests of 10% shall be paid on that portion of a partner’s capital in excess of P100,000. 3. Salaries of P10,000 and P12,000 shall be paid to partners A and C respectively. Assuming a net income of P44,000 for the year, the total profit share of Partner C is: a. P7,800 c. P19,400 b. P16,800 d. P19,800 A, B, and C are partners with average capital balances during 2023 of P360,000, P180,000, and P120,000 respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P90,000 to A and P60,000 to C, the residual profit or loss is divided equally. In 2023, the partnership sustained a P99,000 loss before interest and salaries to partners. By what amount should A’s capital account change? a. P21,000 increase c. P105,000 decrease b. P33,000 decrease d. P126,000 increase Brejiet and Leah are partners with capital balances of P30,000 and P40,000 and sharing profits and losses 40% and 60%, respectively. If Donalyn is admitted as partner paying P20,000 in exchange for 50% of Brejiet’s equity. How much is the interest of Brejiet and Leah after admission of Donalyn? a. P15,000 and P40,000 c. P20,000 and P40,000 b. P15,000 and P20,000 d. P20,000 and P20,000 45. Mary, Gemma, and Myline are partners with capital balances of P224,000, P780,000 and P340,000, respectively, sharing profits and losses in the ratio of 3:2:1. Rhea is admitted as a new partner bringing in her expertise and is to invest cash for a 25% interest in the partnership which includes a credit of P210,000 bonus upon her admission. How much cash should Rhea contribute? a. P555,000 c. P168,000 b. P390,000 d. P450,000 46. Anselma, Analie and Christine were partners with capital balances on January 2, 2023 of P100,000, P150,000 and P200,000 respectively. Their profit/loss ratio is 5:3:2 while their capital interest ratio is 4:4:2. On July 1,2023, Russel was admitted into the partnership for 20% interest in capital and 25% in profits/losses by contributing P25,000 cash and the old partners agreed to bring their interest to their old P/L ratio. The partnership had net income of P60,000 before admission of Russel and the partners agree to revalue its overvalued equipment by P10,000. The capital balance of Anselma after the admission of Russel would be: a. P85,000 c. P168,000 b. P139,200 d. P134,400 47. Jocelyn and Therese are partners with capital balances of P60,000 and P20,000, respectively. Profits and losses are divided in the ratio of 60:40. Jocelyn and Therese decided to admit Jelie into the partnership. Jelie invested land valued at P15,000 for a 20% capital interest in the partnership.The cost of the land was P12,000. The partnership elected to use the bonus method to record admission of Jelie into the partnership. Jelie’s capital account should be credited for: a. P12,000 c. P16,000 b. P15,000 d. P19,000 48. A, B, and C are partners sharing profits in a 2:5:1 ratio, and with capital balances of P120,000, P155,000, and P115,000, respectively. The partners generated net loss of P140,000 during the year. Due to internal problems, B wants out of the partnership. Before retirement, the value of their inventory increased from 85,000 to 97,000. The partners decided to pay partner B P70,000 upon retirement. How much are the capital balances of partners A and C after the retirement of partner B? a. 84,667 and 97,333 c. 89,000 and 99,500 b. 91,333 and 100,667 d. 87,000 and 98,500 49. A, B, and C share profits in the ratio of 2:3:5. On January 20, C opted to retire from the partnership. The capital balances of the partners on this date were: A P25,000 B P40,000 C P35,000 CASE 1: How much will be the capital of B, assuming C sold his interest to B for P10,000? a. P75,000 c. P25,000 b. P50,000 d. P40,000 50. CASE 2: How much is debited from A assuming C is paid P39,000 in full settlement of his interest? a. P2,400 c. P3,000 b. P4,000 d. P1,600 Write your answers on the answer sheet provided. Answer Section TRUE/FALSE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. T T T F T F F T T F T F F F T T T T T F T T F T T F T T F F MULTIPLE CHOICE 31. C Adjusted first the accounts. Cash Accounts Receivable Merchandise Inventory Machinery and Equipment TOTAL Faye P15,000 420,000 135,000 P570,000 Gay P37,500 180,000 202,500 225,000 P645,000 32. 33. 34. 35. 36. 37. Accounts Payable 135,000 240,000 Faye, Capital 435,000 Gay, Capital 405,000 P570,000 P645,000 TOTAL Start with Gay’s capital account: 405,000/40% = 1,012,500 Compute how much should be Faye’s capital account: 1,012,500 x 60% = 607,500 Amount to be credited to Faye’s capital 607,500 Adjusted capital balance 435,000 Amount of cash Faye must invest 172,500 C Patrick Mike Allowance for Doubtful Account (370) (270) Furniture and Fixtures 1,000 Office equipment (250) Salaries/rent expense (1,000) (800) Inventory (500) 1,500 TOTAL (870) 180 C Patrick Mike Accounts Payable 45,750 18,000 Rent expense 1,000 Salary expense 800 46,750 18,800 TOTAL: 65,550 B Cash (9,000 + 3,750) 12,750 Accounts receivable (18,130 + 13,230) 31,360 Inventories (29,500 + 21,000) 50,500 Furniture and fixtures (net) (31,000 + 9,000) 40,000 Office equipment (net) (11,500 + 2,500) 14,000 Prepaid expenses (6,375 + 3,000) 9,375 TOTAL 157,985 C Partners Total conttibuted capital Total agreed capital Rosabel 2,400,000 2,000,000 Jeryl 800,000 3,000,000 Bernadette 3,000,000 5,000,000 TOTAL 6,200,000 10,000,000 C A Joker’s share in net income Multiply by: To be included in Joker’s capital Joker’s capital to invest (withdraw) (400,000) 2,200,000 2,000,000 3,800,000 1,297,985 20% 259,597 1,100,000 38. 39. 40. 41. Joker’s ending capital after the distribution of the net income 1,359,597 C Solution for 36 and 38 Leonard Joker Salaries 400,000 350,000 Interest: Leonard 1,250,000 x 25% 312,500 330,000 Joker 1,100,000 x 30% Bonus Leonard (2,500,000-750,000-642,500) x 15% 166,125 132,900 Joker (2,500,000-750,000-642,500) x 12% Remainder Leonard 808,475 x 40% 323,390 485,085 Joker 808,475 x 60% TOTAL 1,202,015 1,297,985 B Anaiah Phoebe Zhylote Desiree Salaries 30,000 30,000 30,000 Interest A-125,000 x 10% 12,500 P-100,000 x 10% 10,000 Z-175,000 x 10% 17,500 D-150,000 x 10% 15,000 Bonus 15,000** Remainder (3:4:2:1) 30,000 (squeeze) 70,000 *Net income after bonus, salaries and interest 75,000 **Zhylote’s bonus: 75,000 x 20% = 15,000 C Let x = net income after salaries and bonus Equation: 0.25x = 97,500 + 0.10x Simplify: 0.25x = 97,500 + 0.10x 0.15x = 97,500 0.15 0.15 x = 650,000 Option 1: Net income after salaries and bonus 650,000 Salaries 450,000 Bonus (650,000 x 25%) 162,500 Total net income 1,262,500 Option 2: Net income after salaries and bonus 650,000 Salaries (450,000 + 97,500) 547,500 Bonus (650,000 x 10%) 65,000 Total net income 1,262,500 C A, Capital Beginning bal. withdrawals 40,000 Total 750,000 642,500 299,025 808,475 2,500,000 Total 90,000 55,000 75,000* (30,000/40%) 235,000 60,000 Ending bal. 10,000 Contribution 30,000* Share in profit 70,000 70,000 *30,000/25% = 120,000 42. C Salaries Interest (110,000 - 100,000) x 10% Bonus = P P = 44,000-(44,000/1.10) 1+Br Remainder (4:4:2) Total 43. A Salaries Interest A-360,000 x 10% B-180,000 x 10% C-120,000 x 10% Loss Sharing (99,000 + 150,000 + 66,000)/3 A 10,000 B C 12,000 4,000 Total 22,000 1,000 4,000 3,400 19,400 17,000 44,000 1,000 6,800 16,800 6,800 7,800 A 90,000 B C 60,000 36,000 18,000 12,000 66,000 (105.000) (105.000) (105.000) (315.000) 21,000 (87,000) (33,000) (99,000) 44. A Partners Brejiet Leah Donalyn Total 45. C Original capital transfer balances within equity 30,000 (15,000) 40,000 15,000 70,000 Total 150,000 New capital balances 15,000 40,000 15,000 70,000 Total Contributed Bonus to (from) Total Agreed Capital partners Capital Mary 224,000 (105,000) 119,000 Gemma 780,000 (70,000) 710,000 Myline 340,000 (35,000) 305,000 Rhea 168,000** 210,000 378,000* Total 1,512,000 1,512,000 *(119,000+710,000+305,000)/75% x 25% = 378,000 **378,000 - 210,000 = 168,000 46. A Anselma Analie Christine Unadjusted capital balances 100,000 150,000 200,000 Net income 30,000 18,000 12,000 Revaluation loss-equipment (5,000) (3,000) (2,000) Adjusted capital balances 125,000 165,000 210,000 Total 450,000 60,000 (10,000) 500,000 Partners Total Contributed Capital Bonus to (from) partners Total Agreed Capital Anselma Analie Christine Russel 125,000 165,000 210,000 25,000 525,000 (40,000) (24,000) (16,000) 80,000 - 85,000 141,000 194,000 105,000 525,000 47. D Partners Total Contributed Capital Jocelyn 60,000 Therese 20,000 Jelie 15,000 Total 95,000 *95,000 x 20% = 19,000 48. B Unadjusted capital balances Net loss (2:5:1) Revaluation gain (2:5:1) Adjusted balances before retirement Payment to B Bonus to (from) partners Capital balances after retirement 49. A Capital balances before retirement Transfer of capital Capital balances after retirement 50. D Capital balances before retirement Full settlement of C’s interest Bonus to (from) partners (2:3) Capital balances after retirement Bonus to (from) partners Total Agreed Capital (2,400) (1,600) 4,000 - 57,600 18,400 19,000* 95,000 A 120,000 (35,000) 3,000 88,000 3.333 91,333 B 155,000 (87,500) 7,500 75,000 (70,000) (5,000) - A 25,000 25,000 B 40,000 35,000 75,000 C 35,000 (35,000) - A 25,000 B 40,000 (1,600) 23,400 (2,400) 37,600 C 35,000 (39,000) 4,000 - C 115,000 (17,500) 1,500 99,000 1.667 100,667 Total 390,000 (140,000) 12,000 262,000 (70,000) 192,000