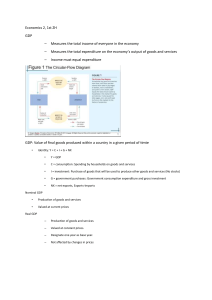

Circular Flow of Income Model We start with a simple and closed economy -no foreign trade. In such an economy there are only 2 sectors: Households and Firms Households give the factors of production to firms and the firms use these factors to produce. Then in turn, Firms give the output to households and households spend the money. In this very simple model there is no government. Further assumptions: No foreign trade and finally…. Households don’t save. They spend all their income Now let us make it more complicated. Households do not spend all the income -they also save When Households spend money, some is spent on foreign goods. Also government takes some of the income in the form of taxes. These are leakages… But then there are also injections. In other words the additional complications can be summed up as follows In such a system, we need to compare leakages to injections. MEASURING ECONOMIC ACTIVITY We use GDP as our chief measure Gross Domestic Product… and we have 3 methods to calculate GDP. …. Remember national Income = National Output…. because they measure the same thing actually. The 3rd method below is the classical method most often used in economic reports. Again, all methods should produce the same result. But in theory there are measurement errors and the 3 results will differ to some extent GDP vs GNI GDP is location based. As long as the economic activity occurs within the borders of a country, it is counted. We do not consider who owns the factors of production. GNI focuses on nationality…. GNI is the total income earned by a country’s factors of production regardless of where they are located. We include COCA COLA Turkey in USA’s GNI. When comparing numbers over time we have to take into account real vs nominal. To convert nominal GDP into Real GDP we use something called the PRICE DEFLATOR. And of course the really important figure is the PER CAPITA number Do not write PER CAPITAL - that is wrong…. What is the purpose of these measurements? BUT…. There are some shortcomings THE BUSINESS CYCLE Remember -the busimess cycle refers to the short term fluctuations The through in the graph above is the recovery phase Next comes the BOOM Now lets turn our attention to the long term trend. The long term trend is all about the Production Possibilities Curve… I.e. here what matters is the LRAS Do not confuse a fall in GDP growth rate with a fall in GDP