TAXATION FOR

ECONOMIC DEVELOPMENT

EDITORS:

MUHAMMAD AKARO MAINOMA

GODWIN EMMANUEL OYEDOKUN

SULEIMAN A. SALIHU ARUWA

TAIWO OLUFEMI ASAOLU

RAFIU OYESOLA SALAWU

TAXATION FOR ECONOMIC DEVELOPMENT

ISBN: 978-978-991-390-9

Copyright © 2022 – OGE Business School

All rights reserved. No part of this publication may be reproduced, stored in a retrieval

system, or transmitted in any form or by any means, electronic, mechanical, photocopying,

recording, or otherwise without the prior joint permission of the Author.

Published in Nigeria by:

OGE Business School

10, Abiodun Sobanjo Street, Off Bayo Ajayi Street,

Off Hakeem Balogun Street, Alausa

Agidingbi, Ikeja, Lagos. Nigeria

godwinoye@yahoo.com; info@ogecops.com

www.ogecops.com

+2348033737184; +2348055863944; +2348095419026

Printed in Nigeria by:

Diamond Prints & Design

No 8, Rufai Street, Off Sipeolu Street,

Shomolu, Lagos, Nigeria

peteromoyibo@gmail.com; 08037271767

NATIONAL LIBRARY OF NIGERIA CATALOGUING-IN PUBLICATION DATA

TAXATION for Economic development

1, Taxation—Nigeria –periodicals

2, Taxation—study and teaching—Nigeria

i, Mainoma, Akaro Mohammad

ii,Oyedokun, Godwin Emmanuel

iii, Aruwa, Suleiman, A, Salihu

iv, Asaolu, Taiwo Olufemi

v, Rafiu Oyesola Salawu

HJ 3081. TAX. 336.209669

ISBN 978-978-978-734-0. Pbk AACR 2

ii

TAXATION FOR ECONOMIC DEVELOPMENT

EDITORS

Professor Muhammad Akaro Mainoma

- Nasarawa State University, Keffi, Nigeria

Professor Godwin Emmanuel Oyedokun

- Lead City University, Ibadan, Nigeria

Professor Suleiman A. Salihu Aruwa

- Nasarawa State University, Keffi, Nigeria

Professor Taiwo Olufemi Asaolu

- Obafemi Awolowo University, Ile-Ife, Nigeria

Professor Rafiu Oyesola Salawu

- Obafemi Awolow University, Ile-Ife, Nigeria

iii

TAXATION FOR ECONOMIC DEVELOPMENT

For more information about the book, and order, please contact:

OGE Business School

10, Abiodun Sobanjo Street, Off Bayo Ajayi Street,

Off Hakeem Balogun Street, Alausa

Agidingbi, Ikeja, Lagos. Nigeria

godwinoye@yahoo.com; info@ogeprofessornal.com

www.ogeprofessional.com

+2348033737184, +2348055863944; +2348095419026

iv

DEDICATION

This book is dedicated to all Tutors, Teachers, Lecturers, Researchers, Professors and

Lovers of Tax Education.

v

PREFACE

Taxation for Economic Development is a compendium of interesting discourse with an

emphasis on various parts of tax management and tax compliance in Nigeria which has

been an issue in this era of the dwindling economy.

Over time, practitioners, administrators, academic, professionals in the field of tax have

been involved in rigorous searching of international journals, convention, international

regulation, departmental instructions, and guidelines to determine how best to tackle

management and compliance issue of tax, hence the diverse but collaborative contributions

from erudite scholars and practitioners in taxation to address issues through writing of this

book.

Taxation for Economic Development as an edited book has thirty (30) chapters with topics

ranging from tax compliance, management and challenges in Nigeria, relevance of culture

in tax compliance, multiplicity of tax, tax risk management, bridging tax gaps in Nigeria

through tax planning and systemic approach to sustaining Nigeria tax system amongst

others which are compiled and written and edited by thirty-eight (38) professionals and

academicians with the aim of enlightening and educating practitioners, researchers,

academicians and students of various higher institutions both in Nigeria and abroad on the

issues of tax management and tax compliance.

The book is written in plain language and devoid of professional jargons and it is a product

of careful studies, researches, and practices over time from well-meaning academic

professionals in taxation. It is, therefore, a must-read for all professionals, tax

administrators and students of various levels in Nigeria and abroad. However further

criticism is welcome for inclusion in the revised edition.

Prof. Muhammad A. Mainoma

Prof. Godwin E. Oyedokun

Lead Editors

vi

FOREWORD

Tax management and compliance involve the implementation of management decisions

based on principles, procedures, and actions to ensure the effectiveness of remittance by

taxpayers. The study of taxation, therefore, emphasizes the thorough evaluation of the

strength and weaknesses and ways of increasing the compliance level and how it can in turn

develop Nigerian Economy.

This book contains various topics related to tax management and tax compliance in Nigeria

and as it is no new that the country is currently facing various issues in terms of the

compliance level of taxpayers and also ensures adequate management to address main

economic issues facing the country.

This book has various contributions from academicians and practitioners who are deeply

rooted in tax practices as edited by Professor Muhammad Akaro Mainoma and Professor

Godwin Emmanuel Oyedokun as the lead editors among others has sufficiently covered

key areas of tax management, tax planning and tax compliance in the country with a

detailed exposure relevant to readers at levels of both academics and professionalism.

Having fully involved in the overall quality review and editing of this compendium of

writings, I, therefore, recommend this book on tax compliance and management to

students, researchers, and practitioners of taxation who wish to widen their research

knowledge/scope on tax management and compliance level in Nigeria.

Professor Taiwo Olufemi Asaolu, FCA

Professor of Management & Accounting

Obafemi Awolowo University, Ile-Ife, Nigeria

vii

ACKNOWLEDGMENTS

To God be the glory. We appreciate the time and contributions among other resources of all

contributors, reviewers and editors for their roles for the success of this book.

We noted the contribution of and the sleepless nights of Mr. Omoyibo Peter and his staff of

Diamond Prints and Design in ensuring this book is a success.

We also acknowledged the efforts of all technical staff at OGE Business School who all

worked day and night in supporting the production of this book.

Prof. Muhammad A. Mainoma

Prof. Godwin E. Oyedokun

Lead Editors

viii

ABOUT THE BOOK

This book titled Taxation for Economic Development is a follow up on the book on Tax

Management and Compliance in Nigeria, published in the year 2020, the current book have

twenty-five erudite scholars with vast knowledge in Taxation, Accounting, Law, Finance,

and Business among others. The Thirty (30) chapters therein critically evaluates

contemporary issues in taxation, tax management, tax compliance, tax reforms, Nigeria tax

system, tax law, regulatory framework, alternative tax policy, tax incentives, transfer

pricing, tax planning, tax assessment, tax risk, taxation for economic development and

reviewed cases in taxation and not without taking readers through their various effects of

the economy of the Nigerian state in the past, present with some pictures and suggestions

for the future.

Editors such as Professor Muhammad Akaro Mainoma, and Professor Godwin Emmanuel

Oyedokun, Professor Suleiman A. Salihu Aruwa, Professor Taiwo Olufemi Asaolu and

Professor Rafiu Oyesola Salawu, are the seasoned academics of repute that painstakingly

took time to review the chapters and edited this book and made it suitable use by tutors,

teachers, lecturers, researchers, Professors and all lovers of education.

This book will immensely benefit all Lovers of Tax Education, Taxpayers, Administrators,

Business owners, Professionals, Policymakers, Lecturers and Students of higher learning

(Universities, Polytechnics, Monotechnics, and Colleges of Education) across the country as

well as those writing various related professional examinations in taxation and accounting.

ix

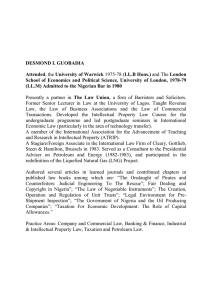

NOTES ON EDITORS

Professor Akaro Muhammad Mainoma is a Professor of Accounting & Finance in the

Department of Accounting, Faculty of Accounting, and the Immediate Past Vice Chancellor

Nasarawa State University, Keffi, Nigeria. He is a Governing Council Member and the

Immediate Past President of the Association of National Accountants of Nigeria (ANAN).

He is also a Governing Council Member and the Chairman of Education Committee of the

Chartered Institute of Taxation of Nigeria (CITN).

Professor Godwin Emmanuel Oyedokun is a Professor of Management & Accounting in

the Department of Management and Accounting, Faculty of Management and Social

Science, Lead City University, Ibadan and Principal Partner, Oyedokun Godwin Emmanuel

Co. (Chartered Accountants, Tax Practitioners & Forensic Accountants) of OGE

Professional Services. He is a Governing Council Member and the Chairman of Education

Committee of the Chartered Institute of Taxation of Nigeria (CITN).

Professor Suleiman A. Salihu Aruwa is Professor of Accounting & Finance in the

Department of Accounting, Faculty of Administration, Nasarawa State University, Keffi,

Nigeria. He is a Governing Council Member of the Association of National Accountants of

Nigeria (ANAN).

Professor Taiwo Olufemi Asaolu is a Professor of Accounting and Finance in the

Department of Management and Accounting, Obafemi Awolowo University, Ile-Ife,

Nigeria

Professor Rafiu Oyesola Salawu is a Professor of Management & Accounting, in the

Department of Management and Accounting, Faculty of Management and Social Sciences,

Obafemi Awolowo University, Ile-Ife, Nigeria.

x

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

NOTES ON CONTRIBUTORS

Adeagbo, Khadijat Ayobami is a lecturer in the Department of Accountancy, Faculty of

Financial Management Studies, The Polytechnic, Ibadan, Nigeria

Adebayo, Ganiyu Adebowale, PhD, is of the Department of Management and Accounting,

Faculty of Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Adegbenro, S. A., PhD, is of the Department of Management & Accounting, Lead City

University, Ibadan, Nigeria

Adejuwon, Oluwakemi Adefisayo is a lecturer in the Department of Management and

Accounting, Faculty of Management and Social Sciences, Lead City University, Ibadan,

Nigeria.

Adeolu-Akande, Modupeola Atoke, PhD is of Lead City University, Ibadan, Nigeria

Adewale, Olusesan Taiwo is a lecturer in the Department of Management and Accounting,

Faculty of Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Adewumi, Moyosore Akingbade is a lecturer in the Department of Management and

Accounting, Faculty of Management and Social Sciences, Lead City University, Ibadan,

Nigeria.

Aiwoho, Doris is of the Department of Accounting, Edo State Polytechnic, Usen, Nigeria.

Ajibola, Joseph Olusegun, PhD, is a Professor of Economics, Department of Economics,

Veronica Adeleke School of Social Sciences, Babcock University, Ilishan-Remo, Ogun State,

Nigeria and the Past President, Chartered Institute of Bankers of Nigeria

Akingbehin, K. O. is of the Department of Management & Accounting, Lead City University,

Ibadan, Nigeria

Amafa, Etupu Olufunmilayo is of the Department of Management and Accounting, Faculty of

Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Aruwa, Suleiman A. Salihu is Professor of Accounting & Finance in the Department of

Accounting, Faculty of Administration, Nasarawa State University, Keffi, Nigeria.

Asaolu, Taiwo Olufemi, PhD, is Professor of Management & Accounting, Obafemi Awolowo

University, Ile-Ife, Nigeria

Christopher, M. is of the Department of Management and Accounting, Faculty of

Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Dopemu, Olawale Samson, PhD, is a Manager at the Federal Inland Revenue Services, Lagos,

Nigeria.

Ekpe, Malthus Timothy is of Department of Accounting, Igbinedion University, Okada, Edo

State, Nigeria.

Friday, E. Akpan is a Director, Centre for Financial and Accounting Research (CEFAR)

Nigerian College of Accountancy, Jos.

Haruna, Roselyn Afor, PhD, is a Senior Lecturer in the Accounting Department, College of

Management and Social Sciences, Salem University, Lokoja, Nigeria Nigeria.

Igboyi, Linus Sunday, PhD, is a Lecturer at Nigerian College Of Accountancy, Kwall, Near Jos

and Managing Partner, Linigboi and Associates (Tax Practitioners).

Josiah, Mary, PhD, is the Head of the Department of Accounting, Igbinedion University,

Okada, Edo State, Nigeria.

xi

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

38.

39.

Kennedy, Iwundu, PhD, is of the Managing Partner, Accounting Tools Consulting, FCT, Abuja,

Nigeria and President, FCT Tax Practitioners Association.

Kupoluyi, Adewale K, PhD, is of the Department of Political Science and Public

Administration, Veronica Adeleke School of Social Sciences, Babcock University, IlishanRemo, Ogun State, Nigeria.

Lawal Babatunde Akeem, PhD is an Associate Professor and Head, Department of Accounting

& Finance, McPherson University, Seriki-Sotayo, Ajebo, Ogun State, Nigeria.

Lawal, Busayo Olawumi is a Lecturer in the Department of Accounting, Dominican

University, Ibadan, Nigeria

Mainoma, Akaro Muhammad, PhD is a Professor of Accounting & Finance in the Department

of Accounting, Faculty of Accounting, Nasarawa State University, Keffi, Nigeria.

Ogwuche, Emmanuel Ejeh is of Department of Accounting, College of Business and

Management Studies, Igbinedion University, Okada, Nigeria.

Oladejo, James Olusola, PhD, is a Lecturer in the Department of Management & Accounting,

Lead City University, Ibadan, Nigeria

Olanrewaju, Ademola is a Managing Partner, Ascension Consulting Services, Lagos Nigeria.

Olawale, Mathew Kunle is of the Department of Management and Accounting, Faculty of

Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Oloyede, Funmilayo Lizzy, PhD, is of the Department of Political Science and Public

Administration, Veronica Adeleke School of Social Sciences, Babcock University, IlishanRemo, Ogun State, Nigeria.

Oluyombo, Onafowokan O. is a Professor of Financial Accounting, and Head, Department of

Accounting, School of Management and Social Sciences, Pan Atlantic University, Lagos,

Nigeria.

Omoruyi, Bright Inuaghata is of the Department of Accounting, College of Business and

Management Studies, Igbinedion University, Okada, Edo State, Nigeria.

Oni, Olaosebikan Simeon, PhD, is a Barrister at Law and Lecturer in the Department of Law,

Faculty of Law, Lead City University Ibadan, Nigeria.

Orumwense, Kenny Esosa is of the Department of Accounting, Igbinedion University, Okada,

Edo State, Nigeria.

Oyedokun, Godwin Emmanuel, PhD is a Professor of Management & Accounting in the

Department of Management and Accounting, Faculty of Management and Social Science,

Lead City University, Ibadan and Principal Partner, Oyedokun Godwin Emmanuel Co.

(Chartered Accountants, Tax Practitioners & Forensic Accountants) of OGE Professional

Services.

Oyetunji, Oluwayomi Taiwo, PhD, is a Lecturer in the Department of Accounting & Finance,

McPherson University, Seriki-Sotayo, Nigeria

Sayo, Enoch is of the Department of Accounting & Finance, McPherson University, SerikiSotayo, Nigeria

Suleiman, Mustapha Aikins is of the Department of Management and Accounting, Faculty of

Management and Social Sciences, Lead City University, Ibadan, Nigeria.

Yaru, Mohammed Aminu, PhD, is a Lecturer in the Department of Economics, University of

Ilorin, Kwara State, Nigeria.

xii

TABLE OF CONTENTS

CONTENTS

PAGE

COPYRIGHT

ii

DEDICATION

v

PREFACE

vi

FOREWORD

vii

ACKNOWLEDGMENTS

viii

NOTES ON EDITORS

x

NOTES ON CONTRIBUTORS

xi

CONTENTS

xiv

TAXATION FOR ECONOMIC DEVELOPMENT

Oyedokun, Godwin Emmanuel

1

DETERMINANTS OF TAX MORALE AND TAX COMPLIANCE:

EVIDENCE FROM NIGERIA

Orumwense, Kenny Esosa; Josiah, Mary and Aiwoho, Doris

33

TAX REVENUE GENERATION IN THE FACE OF

COVID-19 PANDEMIC IN NIGERIA

Ogwuche, Emmanuel Ejeh; Josiah, Mary and Omoruyi, Bright Inuaghata

47

ENVIRONMENTAL TAXATION: ISSUES AND BENEFITS

Ekpe, Malthus Timothy and Josiah, Mary

60

DIGITAL ECONOMY AND COMMUNICATION TAX

Ademola, Olanrewaju and Adewumi, Moyosore Akingbade

74

TAX ADMINISTRATION AND TAXPAYERS' COMPLIANCE

IN NIGERIA

Kupoluyi, Adewale K.., Oloyede, Funmilayo Lizzy and

Oyedokun, Godwin Emmanuel

89

TAX AUDIT AND TAX INVESTIGATION

Igboyi, Linus Sunday

105

xiii

TAXATION AND THE EFFECT OF COVID-19 ON

NIGERIA BUSINESSES

Oyedokun, Godwin Emmanuel and Haruna, Roselyn Afor and

Adeolu-Akande, Modupeola Atoke

119

TAXATION OF SPECIALIZED BUSINESS IN NIGERIA

Friday, E. Akpan

139

TAX MANAGEMENT

Igboyi, Linus Sunday

157

TAX POLICY: IMPERATIVE FOR NIGERIAN REVENUE GENERATION

Oyedokun, Godwin Emmanuel and Christopher, Michael

168

ADDRESSING FISCAL CHALLENGES THROUGH BUDGET

TRANSPARENCY: THE CASE OF KWARA STATE

Yaru, Mohammed

193

PARENTS SOCIO-ECONOMIC STATUS AND CHILDREN

ACADEMIC PERFORMANCE

Oluyombo, Onafowokan O.

208

PROSPECT AND CHALLENGES OF DIGITAL SERVICES

TAX IN A 21ST CENTURY SOCIETY

Oyedokun, Godwin Emmanuel and Oni, Olaosebikan Simeon

232

TAX PLANNING AND MANAGEMENT: IMPERATIVES

OF TAXPAYERS' INCENTIVES

Iwundu, Kennedy and Aruwa, Suleiman A. Salihu

243

REVIEW OF CHAPTER: NEXUS BETWEEN TAXATION

AND SUSTAINABLE BUSINESS DEVELOPMENT

Suleiman, Mustapha Aikins

254

REVIEW OF CHAPTER: RELEVANCE OF CULTURE IN ENSURING

SUSTAINABLE TAX COMPLIANCE AMONG NIGERIANS

Amafa, Etupu Olufunmilayo

256

RECOVERY ENGAGEMENT: STAMP DUTY, EXCESS BANK

CHARGES AND GENERAL TAX AUDIT

Oyedokun, Godwin Emmanuel and Dopemu, Olawale Samson

260

REVIEW OF CHAPTER: IMPACT OF VALUE ADDED

ECONOMIC GROWTH IN NIGERIA

Olawale, Mathew Kunle

286

xiv

REVIEW OF CHAPTER: TAX COMPLIANCE AND ITS CHALLENGES

IN NIGERIA: THE PRACTICAL PERSPECTIVE

Adejuwon, Oluwakemi Adefisayo

290

FINANCE ACT 2020: FACTS AND POLICY IMPLICATION

Oyedokun, Godwin Emmanuel and Mainoma, Akaro Muhammad

293

FRAUD IDENTIFICATION IN FORENSIC TAX INVESTIGATION

AND RULE OF EVIDENCE

Oyedokun, Godwin Emmanuel and Asaolu, Taiwo Olufemi

298

EXAMINATION OF ETHICAL ISSUES FOR TAX PRACTITIONERS

IN NIGERIA

Kennedy, Iwundu and Adeolu-Akande, Modupeola Atoke

318

INTERNATIONAL FINANCIAL REPORTING STANDARDS' (IFRS)

ADOPTION AND TAXATION IN SOUTH WESTERN NIGERIA

Adegbenro, S. A., and Akingbehin, K. O.

328

TAXATION OF ENTERPRISES IN FREE TRADE ZONES IN NIGERIA

Oladejo, James Olusola

340

BUSINESS DISRUPTION AND CONTINUITY: REPOSITIONING

FOR TAX RESILIENCE

Ajibola, Joseph Olusegun

345

REVIEW OF CHAPTER: TAX COMPLIANCE AND ITS CHALLENGES

IN NIGERIA: THE PRACTICAL PERSPECTIVE

Adeagbo, Khadijat Ayobami

367

COMPANY INCOME TAX AND PROFITABILITY OF MULTINATIONAL

COMPANIES IN NIGERIA

Lawal, Babatunde Akeem; Oyetunji, Oluwayomi Taiwo;

Lawal, Busayo Olawumi, and Sayo, Enoch

371

BUILDING A SOCIAL CONTRACT: UNDERSTANDING TAX

MORALE IN NIGERIA

Adebayo, Ganiyu Adebowale

INCOME TAXES AND FINANCIAL PERFORMANCE OF SMALL

AND MEDIUM ENTERPRISES IN NIGERIA.

Adewale Olusesan Taiwo, Oyedokun Godwin Emmanuel

and Adewumi, Moyosore Akingbade

xv

394

404

CHAPTER ONE

TAXATION FOR ECONOMIC DEVELOPMENT

Oyedokun Godwin Emmanuel

Professor of Management & Accounting

Faculty of Management & Social Sciences

Lead City University, Ibadan, Nigeria.

godwinoye@yahoo.com; +2348033737184

ABSTRACT

Taxation refers to wealth from households or businesses to the government whose effects could

increase or reduce economic growth and economic welfare. On the other hand, a country's economic

development is usually indicated by an increase in citizens' quality of life. This chapter discussed the

concept, classes, purposes, history, effects, forms and principles of taxation, analyze the concept,

goals and policies of economic development, made a distinct difference between economic growth and

economic development. Reviewed the roles of taxation in financing economic development and why

tax is essential for development. It also presented taxation as a tool for economic management and

development, itemized the Schedule to Nigeria Taxes and Levies, objectives and guiding principles of

the National Tax Policy, and reviewed the revenue statistics in Africa 2020, focused on Nigeria as

well examine the tax-to-GDP ratio. It will also enable reader understood economic development

indicators and indices among many others.

Keywords: Economic development, Economic growth, Taxation.

INTRODUCTION

Revenue generated by an individual, organization or government determines the extent of

socio-economic infrastructural provision as well as the living standard of the people. From

ancient times, public finance is majorly funded through taxes often imposed on subjects by

the government in power. Revenues may be derived from tax and non-tax sources, oil and

non-oil, internally and externally generated, among other sources or classification.

Whatever the source or classification, taxation revenue is the most potent, reliable and

efficient source of revenue to both developed and developing economies (Konrad, 2014).

Taxation as a major source of government revenue is meant to foster growth and

development of individual nation if adequately collected and properly utilized. This

manual will be guided concepts of taxation, economic development and how taxation can

foster development.

1

Taxation For Economic Development

LITERATURE REVIEW

Concept of Taxation

While tax is a compulsory financial charge or some other type of levy imposed on a taxpayer

(an individual or legal entity) by a governmental organization in order to fund government

spending and various public expenditures. A failure to pay, along with evasion of or

resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may

be paid in money or as its labour equivalent. The first known taxation took place in Ancient

Egypt around 3000–2800 BC.

Taxation on the other hand is the imposition of compulsory levies on individuals or entities

by governments. Taxes are levied in almost every country of the world, primarily to raise

revenue for government expenditures, although they serve other purposes as well.

Oyedokun (2019) defined taxation as the concept and science of imposing tax on taxable

income of tax payers within a particular jurisdiction. Through taxes collected on these

taxable incomes, government ensures that resources are channeled towards important

projects in the society, while giving relief to the weak.

Abomaye (2017) is of the view that tax is a compulsory contributions made by animate and

inanimate beings to government being a higher authority either directly or indirectly to

fund its various activities and any refusal is meted with appropriate punishment. He went

on to say that Tax is an involuntary payment made by a resident of a state in obeisance to

levy imposed by a constituted authority of a sovereign state at a particular period of time;

and that Taxation is the process put in place by government (whichever tier) to exercise

authority on and over the imposition and collection of taxes based on enacted tax laws with

which projects are financed. Taxation is therefore seen as the transfer of resources as income

from the private sector to the public sector for its utilization to achieve some if not all the

nation's economic and social goals such as provision of basic amenities, social services,

educational facilities, public health, transportation, capital formation etc.

Most countries have a tax system in place to pay for public, common, or agreed national

needs and government functions. Some levy a flat percentage rate of taxation on personal

annual income, but most scale taxes based on annual income amounts. Most countries

charge a tax on an individual's income as well as on corporate income. Countries or

subunits often also impose wealth taxes, inheritance taxes, estate taxes, gift taxes, property

taxes, sales taxes, payroll taxes or tariffs.

In economic terms, taxation transfers wealth from households or businesses to the

government. This has effects which can both increase and reduce economic growth and

economic welfare. Consequently, taxation is a highly debated topic.

2

Taxation For Economic Development

In modern economies taxes are the most important source of governmental revenue. Taxes

differ from other sources of revenue in that they are compulsory levies and are unrequited

i.e., they are generally not paid in exchange for some specific thing, such as a particular

public service, the sale of public property, or the issuance of public debt. While taxes are

presumably collected for the welfare of taxpayers as a whole, the individual taxpayer's

liability is independent of any specific benefit received.

Purposes and Effects of Taxation

During the 19th century the prevalent idea was that taxes should serve mainly to finance the

government. In earlier times, and again today, governments have utilized taxation for other

than merely fiscal purposes. One useful way to view the purpose of taxation, attributable to

American economist Richard A. Musgrave, is to distinguish between objectives of resource

allocation, income redistribution, and economic stability. (Economic growth or

development and international competitiveness are sometimes listed as separate goals, but

they can generally be subsumed under the other three.) In the absence of a strong reason for

interference, such as the need to reduce pollution, the first objective, resource allocation, is

furthered if tax policy does not interfere with market-determined allocations. The second

objective, income redistribution, is meant to lessen inequalities in the distribution of income

and wealth. The objective of stabilization—implemented through tax policy, government

expenditure policy, monetary policy, and debt management—is that of maintaining high

employment and price stability.

There are likely to be conflicts among these three objectives. For example, resource

allocation might require changes in the level or composition (or both) of taxes, but those

changes might bear heavily on low-income families—thus upsetting redistributive goals.

As another example, taxes that are highly redistributive may conflict with the efficient

allocation of resources required to achieve the goal of economic neutrality.

The levying of taxes aims to raise revenue to fund governing or to alter prices in order to

affect demand. States and their functional equivalents throughout history have used

money provided by taxation to carry out many functions. Some of these include

expenditures on economic infrastructure (roads, public transportation, sanitation, legal

systems, public safety, education, health care systems), military, scientific research, culture

and the arts, public works, distribution, data collection and dissemination, public

insurance, and the operation of government itself. A government's ability to raise taxes is

called its fiscal capacity.

When expenditures exceed tax revenue, a government accumulates debt. A portion of taxes

may be used to service past debts. Governments also use taxes to fund welfare and public

3

Taxation For Economic Development

services. These services can include education systems, pensions for the elderly,

unemployment benefits, and public transportation. Energy, water and waste management

systems are also common public utilities.

According to the proponents of the Chartalist theory of money creation, taxes are not

needed for government revenue, as long as the government in question is able to issue fiat

money. According to this view, the purpose of taxation is to maintain the stability of the

currency, express public policy regarding the distribution of wealth, subsidizing certain

industries or population groups or isolating the costs of certain benefits, such as highways

or social security.

Effects can be divided in two fundamental categories:

i. Taxes cause an income effect because they reduce purchasing power to taxpayers.

ii. Taxes cause a substitution effect when taxation causes a substitution between taxed

goods and untaxed goods.

Classes of Taxes

In the literature of public finance, taxes have been classified in various ways according to

who pays for them, who bears the ultimate burden of them, the extent to which the burden

can be shifted, and various other criteria. Taxes are most commonly classified as either

direct or indirect, an example of the former type being the income tax and of the latter the

sales tax. There is much disagreement among economists as to the criteria for

distinguishing between direct and indirect taxes, and it is unclear into which category

certain taxes, such as corporate income tax or property tax, should fall. It is usually said that

a direct tax is one that cannot be shifted by the taxpayer to someone else, whereas an

indirect tax can be, they are:

i. Direct Taxes

Direct taxes are primarily taxes on natural persons (e.g., individuals), and they are typically

based on the taxpayer's ability to pay as measured by income, consumption, or net wealth.

What follows is a description of the main types of direct taxes.

Individual income taxes are commonly levied on total personal net income of the taxpayer

(which may be an individual, a couple, or a family) in excess of some stipulated minimum.

They are also commonly adjusted to take into account the circumstances influencing the

ability to pay, such as family status, number and age of children, and financial burdens

resulting from illness. The taxes are often levied at graduated rates, meaning that the rates

rise as income rises. Personal exemptions for the taxpayer and family can create a range of

income that is subject to a tax rate of zero.

4

Taxation For Economic Development

Taxes on net worth are levied on the total net worth of a person—that is, the value of his

assets minus his liabilities. As with the income tax, the personal circumstances of the

taxpayer can be taken into consideration. Personal or direct taxes on consumption (also

known as expenditure taxes or spending taxes) are essentially levied on all income that is

not channeled into savings. In contrast to indirect taxes on spending, such as the sales tax, a

direct consumption tax can be adjusted to an individual's ability to pay by allowing for

marital status, age, number of dependents, and so on. Although long attractive to theorists,

this form of tax has been used in only two countries, India and Sri Lanka; both instances

were brief and unsuccessful. Near the end of the 20th century, the “flat tax”—which

achieves economic effects similar to those of the direct consumption tax by exempting most

income from capital—came to be viewed favourably by tax experts. No country has

adopted a tax with the base of the flat tax, although many have income taxes with only one

rate.

Taxes at death take two forms: the inheritance tax, where the taxable object is the bequest

received by the person inheriting, and the estate tax, where the object is the total estate left

by the deceased. Inheritance taxes sometimes take into account the personal circumstances

of the taxpayer, such as the taxpayer's relationship to the donor and his net worth before

receiving the bequest. Estate taxes, however, are generally graduated according to the size

of the estate, and in some countries they provide tax-exempt transfers to the spouse and

make an allowance for the number of heirs involved. In order to prevent the death duties

from being circumvented through an exchange of property prior to death, tax systems may

include a tax on gifts above a certain threshold made between living persons (see gift tax).

Taxes on transfers do not ordinarily yield much revenue, if only because large tax payments

can be easily avoided through estate planning.

ii. Indirect Taxes

Indirect taxes are levied on the production or consumption of goods and services or on

transactions, including imports and exports. Examples include general and selective sales

taxes, value-added taxes (VAT), taxes on any aspect of manufacturing or production, taxes

on legal transactions, and customs or import duties.

General sales taxes are levies that are applied to a substantial portion of consumer

expenditures. The same tax rate can be applied to all taxed items, or different items (such as

food or clothing) can be subject to different rates. Single-stage taxes can be collected at the

retail level, as the U.S. states do, or they can be collected at a pre-retail (i.e., manufacturing

or wholesale) level, as occurs in some developing countries. Multistage taxes are applied at

each stage in the production-distribution process. The VAT, which increased in popularity

during the second half of the 20th century, is commonly collected by allowing the taxpayer

5

Taxation For Economic Development

to deduct a credit for tax paid on purchases from liability on sales. The VAT has largely

replaced the turnover tax; a tax on each stage of the production and distribution chain, with

no relief for tax paid at previous stages. The cumulative effect of the turnover tax,

commonly known as tax cascading, distorts economic decisions.

Although they are generally applied to a wide range of products, sales taxes sometimes

exempt necessities to reduce the tax burden of low-income households. By comparison,

excises are levied only on particular commodities or services. While some countries impose

excises and customs duties on almost everything from necessities such as bread, meat, and

salt, to nonessentials such as cigarettes, wine, liquor, coffee, and tea, to luxuries such as

jewels and furs, taxes on a limited group of products, alcoholic beverages, tobacco

products, and motor fuel yield the bulk of excise revenues for most countries. In earlier

centuries, taxes on consumer durables were applied to luxury commodities such as pianos,

saddle horses, carriages, and billiard tables. Today a main luxury tax object is the

automobile, largely because registration requirements facilitate administration of the tax.

Some countries tax gambling and state-run lotteries have effects similar to excises, with the

government's “take” being, in effect, a tax on gambling. Some countries impose taxes on

raw materials, intermediate goods (e.g., mineral oil, alcohol), and machinery.

Some excises and customs duties are specific i.e., they are levied on the basis of number,

weight, length, volume, or other specific characteristics of the good or service being taxed.

Other excises, like sales taxes, are ad valorem levied on the value of the goods as measured by

the price. Taxes on legal transactions are levied on the issue of shares, on the sale (or

transfer) of houses and land, and on stock exchange transactions. For administrative

reasons, they frequently take the form of stamp duties; that is, the legal or commercial

document is stamped to denote payment of the tax. Many tax analysts regard stamp taxes as

nuisance taxes; they are most often found in less-developed countries and frequently bog

down the transactions to which they are applied.

The Proportional, Progressive, and Regressive Taxes

Taxes can be distinguished by the effect they have on the distribution of income and wealth.

A proportional tax is one that imposes the same relative burden on all taxpayers i.e., where

tax liability and income grow in equal proportion. A progressive tax is characterized by a

more than proportional rise in the tax liability relative to the increase in income, and a

regressive tax is characterized by a less than proportional rise in the relative burden. Thus,

progressive taxes are seen as reducing inequalities in income distribution, whereas

regressive taxes can have the effect of increasing these inequalities.

6

Taxation For Economic Development

The taxes that are generally considered progressive include individual income taxes and

estate taxes. Income taxes that are nominally progressive, however, may become less so in

the upper-income categories especially if a taxpayer is allowed to reduce his tax base by

declaring deductions or by excluding certain income components from his taxable income.

Proportional tax rates that are applied to lower-income categories will also be more

progressive if personal exemptions are declared.

Income measured over the course of a given year does not necessarily provide the best

measure of taxpaying ability. For example, transitory increases in income may be saved,

and during temporary declines in income a taxpayer may choose to finance consumption

by reducing savings. Thus, if taxation is compared with “permanent income,” it will be less

regressive (or more progressive) than if it is compared with annual income.

Sales taxes and excises (except those on luxuries) tend to be regressive, because the share of

personal income consumed or spent on specific good declines as the level of personal

income rises. Poll taxes (also known as head taxes), levied as a fixed amount per capital

obviously regressive.

It is difficult to classify corporate income taxes and taxes on business as progressive,

regressive, or proportionate, because of uncertainty about the ability of businesses to shift

their tax expenses (see below Shifting and incidence). This difficulty of determining who

bears the tax burden depends crucially on whether a national or a sub-national (that is,

provincial or state) tax is being considered.

In considering the economic effects of taxation, it is important to distinguish between

several concepts of tax rates. The statutory rates are those specified in the law; commonly

these are marginal rates, but sometimes they are average rates. Marginal income tax rates

indicate the fraction of incremental income that is taken by taxation when income rises by

one dollar. Thus, if tax liability rises by 45 cents when income rises by one dollar, the

marginal tax rate is 45 percent. Income tax statutes commonly contain graduated marginal

rates i.e., rates that rise as income rises. Careful analysis of marginal tax rates must consider

provisions other than the formal statutory rate structure. If, for example, a particular tax

credit (reduction in tax) falls by 20 cents for each one-dollar rise in income, the marginal rate

is 20 percentage points higher than indicated by the statutory rates. Since marginal rates

indicate how after-tax income changes in response to changes in before-tax income, they are

the relevant ones for appraising incentive effects of taxation. It is even more difficult to

know the marginal effective tax rate applied to income from business and capital, since it

may depend on such considerations as the structure of depreciation allowances, the

deductibility of interest, and the provisions for inflation adjustment. A basic economic

7

Taxation For Economic Development

theorem holds that the marginal effective tax rate in income from capital is zero under a

consumption-based tax.

Average income tax rates indicate the fraction of total income that is paid in taxation. The

pattern of average rates is the one that is relevant for appraising the distributional equity of

taxation. Under a progressive income tax the average income tax rate rises with income.

Average income tax rates commonly rise with income, both because personal allowances

are provided for the taxpayer and dependents and because marginal tax rates are

graduated; on the other hand, preferential treatment of income received predominantly by

high-income households may swamp these effects, producing regressively, as indicated by

average tax rates that fall as income rises.

History of Taxation

The first known system of taxation was in Ancient Egypt around 3000–2800 BC in the First

Dynasty of Egypt of the Old Kingdom of Egypt. The earliest and most widespread form of

taxation was the corvée and tithe. The corvée was forced labour provided to the state by

peasants too poor to pay other forms of taxation (labour in ancient Egyptian is a synonym

for taxes). Records from the time document that the Pharaoh would conduct a biennial tour

of the kingdom, collecting tithes from the people. Other records are granary receipts on

limestone flakes and papyrus. Early taxation is also described in the Bible. In Genesis

(chapter 47, verse 24 of the New International Version), it states “But when the crop comes

in, give a fifth of it to Pharaoh. The other four-fifths you may keep as seed for the fields and

as food for yourselves and your households and your children”. Joseph was telling the

people of Egypt how to divide their crop, providing a portion to the Pharaoh. A share (20%)

of the crop was the tax (in this case, a special rather than an ordinary tax, as it was gathered

against an expected famine) The stock made by was returned and equally shared with the

people of Egypt and traded with the surrounding nations thus saving and elevating Egypt.

Samgharitr is the name mentioned for the Tax collector in the Vedic texts. In Hattusa, the

capital of the Hittite Empire, grains were collected as a tax from the surrounding lands, and

stored in silos as a display of the king's wealth.

In the Persian Empire, a regulated and sustainable tax system was introduced by Darius I

the Great in 500 BC; the Persian system of taxation was tailored to each Satrapy (the area

ruled by a Satrap or provincial governor). At differing times, there were between 20 and 30

Satrapies in the Empire and each was assessed according to its supposed productivity. It

was the responsibility of the Satrap to collect the due amount and to send it to the treasury,

after deducting his expenses (the expenses and the power of deciding precisely how and

from whom to raise the money in the province, offer maximum opportunity for rich

pickings). The quantities demanded from the various provinces gave a vivid picture of their

8

Taxation For Economic Development

economic potential. For instance, Babylon was assessed for the highest amount and for a

startling mixture of commodities; 1,000 silver talents and four months' supply of food for

the army. India, a province fabled for its gold, was to supply gold dust equal in value to the

very large amount of 4,680 silver talents. Egypt was known for the wealth of its crops; it was

to be the granary of the Persian Empire (and, later, of the Roman Empire) and was required

to provide 120,000 measures of grain in addition to 700 talents of silver. This tax was

exclusively levied on Satrapies based on their lands, productive capacity and tribute levels.

The Rosetta Stone, a tax concession issued by Ptolemy V in 196 BC and written in three

languages “led to the most famous decipherment in history—the cracking of

hieroglyphics”.

Islamic rulers imposed Zakat (a tax on Muslims) and Jizya (a poll tax on conquered nonMuslims). In India this practice began in the 11th century.

Policy, Legal and Institutional Reforms: A Historical Overview

Policy, legislative and administrative reforms of the Nigeria tax system predate

independence and can be traced back to early twentieth century when the then High

Commissioner of the [then] Northern Protectorate issued the Stamp Duties Proclamation in

1903, followed immediately thereafter in 1906 by the Native Revenue Proclamation. This

latter Proclamation systematized all the pre-colonial taxes by defining taxable rates; and

procedures for assessment and collection, as well as penalties for default thus eliminating

arbitrariness that had hitherto characterized the Nigerian tax system. It introduced the four

certainties essential in tax practice: what to pay, when to pay, where to pay and who to pay

to. The same Proclamation was re-issued as the Native Revenue Ordinance in 1917 to cover

the Southern territories and by 1927, was applicable in the whole country. The year 1943 was

a watershed period in the history of the Nigerian tax system as it witnessed the creation of

the Inland Revenue Department (renamed the Federal Board of Inland Revenue in 1958),

the precursor to the present day Federal Inland Revenue Service (FIRS). Following

independence in 1960, other legal and institutional reforms were effected in 1961 through

the establishment of the Federal Board of Inland Revenue (FBIR) and the Body of Appeal

Commissioners as the first point of call for tax dispute resolution. In the same year, the Joint

Tax Board (JTB) was created with the primary responsibility of ensuring uniformity of

standards and application of Personal Income Tax.

Other major reforms to the tax system were effected in 1982 with the establishment of the

Chartered Institute of Taxation of Nigeria and 1993 with a review of the composition of the

FBIR and establishment of the present day Federal Inland Revenue Service (FIRS) as the

operational arm of the FBIR; as well as a review of the functions of the JTB. Further changes

were effected in 2007 with the granting of financial and administrative autonomy to the

9

Taxation For Economic Development

FIRS following the recommendations of the 'Study and Working Group on Nigerian Tax

System' which had been set up in half a decade earlier. These and other reforms represented

the first major attempt at shifting focus away from oil to a more sustainable source of

revenue, that is, the non-oil sector. Since then, a raft of changes that cut across

organisational restructuring of the Federal and State authorities, the enactment of a

National Tax Policy, funding, legislation, taxpayer education, dispute resolution

mechanism, taxpayer registration, human capacity building, automation of key processes,

refund mechanism and several other areas have been effected.

Why so many reforms in our tax system? Given the low tax to GDP ratio, it is plausible to

assume that the need to address the problem of low tax returns motivated the Nigerian

Government to embark on these reforms. The scope of, and frequency with which tax

reforms have been implemented should however, be viewed within the broader context of

the structure of Nigeria's economy and the centrality of taxes to the attainment of national

development objectives. In specific terms, four main considerations seem to have informed

these frequent tax reforms: the need to diversify the revenue portfolio to safeguard against

the oil price volatility in the global market; the need for an accurate and reliable

determination of the optimal tax rate, since Nigeria operates on a cash budget system,

where expenditure proposals and overall fiscal management are anchored on revenue

projections; historical overreliance on petroleum and trade taxes while overlooking direct

and broad-based indirect taxes such as value added tax (VAT); and the ever-widening fiscal

deficit, an ever-present threat to macroeconomic stability.

According to the objectives of tax reforms in Nigeria include the need to bridge the gap

between the national development, needs and the funding of the needs; achieve improved

service delivery to the public; improve on the level of tax derivable from non-oil activities,

vis-à-vis revenue from oil activities; constantly review the tax laws to reduce/manage tax

evasion and avoidance; and improve the tax administration to make it more responsive,

reliable, skillful and taxpayers friendly, as well as achieve other fiscal objectives such as

managing inflation and improving balance-of-payment conditions. But the fiscal objectives

were only a means to an end. The end objectives of the tax policy reforms were to generate

revenue; promote growth and development; ensure effective protection for local industries

and encourage greater use of local raw materials; promote value addition and greater

geographical dispersion of domestic manufacturing capacities; and create jobs. And

although specific policy, legal and institutional measures have varied over time, these

objectives have remained relatively unchanged.

Schedule to Nigeria Taxes and Levies

Approved List for Collection of Taxes (ACT AMENDMENT) ORDER, 2015 (NBS, 2015).

10

Taxation For Economic Development

1. Taxes Collected by the Federal Government

Company income tax.

Withholding tax on companies, residents of the Federal Capital Territory,

Abuja and non-resident individuals.

Petroleum profits tax.

Education Tax.

Value Added Tax.

Capital gains tax on residents of the Federal Capital Territory, Abuja,

corporate and non-resident individuals.

National Information Technology Development Levy

Stamp duties on bodies corporate and residents of the Federal Capital

Territory, Abuja.

Personal income tax in respect of

a.

Members of the armed forces.

b.

Members of the Nigeria Police Force.

c.

Residents of the Federal Capital Territory, Abuja; and

d.

Staff of the Ministry of Foreign Affairs and non-resident individuals

2. Taxes and levies collected by the State Government.

Personal income tax in respect of:

a.

Pay-As-You-Earn (PAYE);

b.

Direct taxation (Self-assessment)

Withholding tax for Individuals

Capital gains tax for individuals

Stamp duties on instruments executed by individuals.

Pools betting, lotteries, gaming and casino taxes.

Road tax.

Business premises registration

Development levy for individuals

Naming of street registration fees in State Capitals.

Right of Occupancy fees on lands owned by the State Government.

Market taxes and levies where State finance is involved.

Hotel, Restaurant or Event Centre Consumption Tax, where applicable

Entertainment Tax, where applicable

Environmental (Ecological) Fee or Levy

Mining, Milling and Quarry Fees, where applicable

Animal Trade Tax, where applicable

Produce Sales Tax, where applicable

Slaughter or Abattoir Fees, where state finance is involved

Infrastructure Maintenance Charge or Levy, where applicable

Fire Service Charge

Economic Development Levy, where applicable

11

Taxation For Economic Development

-

Social Services Contribution Levy, where applicable

Signage and Mobile Advertisement, Jointly collected by States and Local

Governments

Property Tax

Land use charge, where applicable.

3. Taxes and Levies to be collected by Local Government

Shops and, kiosks rates

Tenement rates

On and off liquor license fees

Slaughter slab fees.

Marriage, birth and death registration fees.

Naming of street registration fee, excluding any street in the State Capital

Right of Occupancy fee on lands in rural areas, excluding those

collectable by the Federal and State Governments.

Market taxes and levies excluding any market where State Finance is

involved.

Motor Park levies.

Domestic animal license fees.

Bicycle, truck, canoe, wheelbarrow and cart fees, other than a

mechanically propelled truck.

Cattle tax payable by cattle farmers only.

Merriment and road closure levy.

Radio and television license fees (other than radio and television

transmitter).

Vehicle radio license fee (to be imposed by the local government of the

State in which the car is registered.

Wrong parking charges.

Public convenience, sewage and refuse disposal fees.

Customary burial ground permit fees.

Religious places establishment permit fees.

Signboard and advertisement permit fees

Wharf Landing Charge, where applicable

Forms of Taxation

In monetary economies prior to fiat banking, a critical form of taxation was seigniorage, the

tax on the creation of money.

Other obsolete forms of taxation include:

i. Scutage, which is paid in lieu of military service; strictly speaking, it is a

commutation of a non-tax obligation rather than a tax as such but functioning as a

tax in practice.

ii. Tallage, a tax on feudal dependents.

12

Taxation For Economic Development

iii. Tithe, a tax-like payment (one tenth of one's earnings or agricultural produce), paid

to the Church (and thus too specific to be a tax in strict technical terms). This should

not be confused with the modern practice of the same name which is normally

voluntary.

iv. (Feudal) aids, a type of tax or due that was paid by a vassal to his lord during feudal

times.

v. Danegeld, a medieval land tax originally raised to pay off raiding Danes and later

used to fund military expenditures.

vi. Carucage, a tax which replaced the danegeld in England.

vii. Tax farming, the principle of assigning the responsibility for tax revenue collection

to private citizens or groups.

viii. Socage/Burgage, a feudal tax system based on land rent.

Principles of Taxation

The 18th-century economist and philosopher Adam Smith attempted to systematize the

rules that should govern a rational system of taxation. In The Wealth of Nations (Book V,

chapter 2) he set down four general canons:

Although they need to be reinterpreted from time to time, these principles retain

remarkable relevance. From the first can be derived some leading views about what is fair

in the distribution of tax burdens among taxpayers. These are:

(i)

The belief that taxes should be based on the individual's ability to pay, known as

the ability-to-pay principle, and

(ii)

The benefit principle, the idea that there should be some equivalence between

what the individual pays and the benefits he subsequently receives from

governmental activities. The fourth of Smith's canons can be interpreted to

underlie the emphasis many economists place on a tax system that does not

interfere with market decision making, as well as the more obvious need to

avoid complexity and corruption.

Distribution of Tax Burdens

Various principles, political pressures, and goals can direct a government's tax policy. What

follows is a discussion of some of the leading principles that can shape decisions about

taxation.

Horizontal Equity

The principle of horizontal equity assumes that persons in the same or similar positions (so

far as tax purposes are concerned) will be subject to the same tax liability. In practice this

equality principle is often disregarded, both intentionally and unintentionally. Intentional

violations are usually motivated more by politics than by sound economic policy (e.g., the

tax advantages granted to farmers, home owners, or members of the middle class in

13

Taxation For Economic Development

general; the exclusion of interest on government securities). Debate over tax reform has

often centered on whether deviations from “equal treatment of equals” are justified.

The Ability-to-pay Principle

The ability-to-pay principle requires that the total tax burden will be distributed among

individuals according to their capacity to bear it, taking into account all of the relevant

personal characteristics. The most suitable taxes from this standpoint are personal levies

(income, net worth, consumption, and inheritance taxes). Historically there was common

agreement that income is the best indicator of ability to pay. There have, however, been

important dissenters from this view, including the 17th-century English philosophers John

Locke and Thomas Hobbes and a number of present-day tax specialists. The early

dissenters believed that equity should be measured by what is spent (i.e., consumption)

rather than by what is earned (i.e., income); modern advocates of consumption-based

taxation emphasize the neutrality of consumption-based taxes toward saving (income

taxes discriminate against saving), the simplicity of consumption-based taxes, and the

superiority of consumption as a measure of an individual's ability to pay over a lifetime.

Some theorists believe that wealth provides a good measure of ability to pay because assets

imply some degree of satisfaction (power) and tax capacity, even if (as in the case of an art

collection) they generate no tangible income.

The ability-to-pay principle also is commonly interpreted as requiring that direct personal

taxes have a progressive rate structure, although there is no way of demonstrating that any

particular degree of progressivity is the right one. Because a considerable part of the

population does not pay certain direct taxes—such as income or inheritance taxes—some

tax theorists believe that a satisfactory redistribution can only be achieved when such taxes

are supplemented by direct income transfers or negative income taxes (or refundable

credits). Others argue that income transfers and negative income tax create negative

incentives; instead, they favour public expenditures (for example, on health or education)

targeted toward low-income families as a better means of reaching distributional

objectives.

Indirect taxes such as VAT, excise, sales, or turnover taxes can be adapted to the ability-topay criterion, but only to a limited extent—for example, by exempting necessities such as

food or by differentiating tax rates according to “urgency of need.” Such policies are

generally not very effective; moreover, they distort consumer purchasing patterns, and

their complexity often makes them difficult to institute.

Throughout much of the 20th century, prevailing opinion held that the distribution of the

tax burden among individuals should reduce the income disparities that naturally result

14

Taxation For Economic Development

from the market economy; this view was the complete contrary of the 19th-century liberal

view that the distribution of income ought to be left alone. By the end of the 20th century,

however, many governments recognized that attempts to use tax policy to reduce inequity

can create costly distortions, prompting a partial return to the view that taxes should not be

used for redistributive purposes.

Challenges of Nigeria Tax System

Despite the potentials of taxation as a dynamic tool for sustainable national development,

Nigeria tax system has been unable to achieve its objectives due to the following challenges,

among others:

i. Lack of robust framework for the taxation of informal sector and high network

individuals, thus limiting the revenue base and creating inequity;

ii. Fragmented database of taxpayers and weak structure for exchange of information

by and with tax authorities, resulting in revenue leakage;

iii. Inordinate drive by all tiers of government to grow internally generated revenue

which has led to the arbitrary exercise of regulatory powers for revenue purpose;

iv. Lack of clarity on taxation powers of each level of government and encroachment on

the powers of one level of government by another;

v. Insufficient information available to taxpayers on tax compliance requirements

thus creating uncertainty and non-compliance;

vi. Poor accountability for tax revenue;

vii. Insufficient capacity which has led to the delegation of powers of revenue officials

to third parties, thereby creating complications in the tax system;

viii. Use of aggressive and unorthodox methods for tax collection;

ix. Failure by tax authorities to honour refund obligations to taxpayers;

x. The non-regular review of tax legislation, which has led to obsolete laws, that do not

reflect current economic realities; and

xi. Lack of strict adherence to tax policy direction and procedural guidelines for the

operation of the various tax authorities.

Theories of Taxation

The following are some of the theories of Taxation;

i. Diffusion Theory of Taxation

According to diffusion theory of taxation, under perfect competition, when a tax is levied, it

gets automatically equitably diffused or absorbed throughout the community. Advocates

of this theory, describe that when a tax is imposed on a commodity by state, it passes on to

consumers automatically. Every individual bears burden of tax according to his ability to

bear it. For instance, a specific tax is imposed on say, cloth. Manufacturer raises prices of

commodity by the amount of tax. Consumers buy commodity according to their capacity

and thus share burden of tax. The diffusion theory of taxation has never gained any

15

Taxation For Economic Development

importance in the world of reality. It has never been seen that a tax gets automatically

equitably distributed among people. It is true that in some taxes, diffusion or absorption

does take place but that too is not throughout the community. Accordingly, another

criticism of the theory of taxation is that there are few taxes like income tax, inheritance tax,

toll tax in which there is no absorption at all.

ii. Benefit Theory of Taxation

According to this theory, the state should levy taxes on individuals according to the benefit

conferred on them. The more benefits a person derives from the activities of the state, the

more he should pay to the government. If, in accordance with the “benefits theory of

taxation,” we conceive of taxes as payments in exchange for government benefits, perhaps

states should be obliged to confer personal tax benefits on residents who contribute to their

tax coffers. The benefits theory would imply that a resident should be able to collect

personal tax benefits to the extent that her tax payments to the source state exceed the

money value of any source state government benefits she already receives, including

infrastructure, regulated labour and capital markets, and so on. Although intuitively

attractive, the benefits theory of taxation suffers from several major draw backs. It would be

impossible to implement precisely due to the difficulty of determining the amount of

government benefits, including diffuse benefits such as military protection received by

each resident and non-resident taxpayer.

iii. Ability to Pay Theory

The adjudged most popular and commonly accepted principle of equity or justice in

taxation is that citizens of a country should pay taxes to the government in accordance with

their ability to pay. The ability to pay principle, people with higher incomes should pay

more taxes than people with lower incomes. It appears very reasonable and just that taxes

should be levied on the basis of the taxable capacity of an individual. The economists are not

unanimous as to what should be the exact measure of a person's ability or faculty to pay. The

main viewpoints advanced in this connection are as follows:

a. Ownership of Property

Some economists are of the opinion that ownership of the property is a very good basis of

measuring one's ability to pay. This idea is out rightly rejected on the ground that if a

person's earns a large income but does not spend on buying any property, he will then

escape taxation. On the other hand, another person earning income buys property; he will

be subjected to taxation. It is therefore absurd and unjustifiable that a person, earning large

income is exempted from taxes and another person with small income is taxed.

b. Tax on the Basis of Expenditure

It is also asserted by some economists that the ability or faculty to pay tax should be judged

by the expenditure which a person incurs. The greater the expenditure, the higher should

be the tax and vice versa. The viewpoint is unsound and unfair in every respect. A person

having a large family to support has to spend more than a person having a small family. If

16

Taxation For Economic Development

we make expenditure as the test of one's ability to pay, the former person who is already

burdened with many dependents will have to' pay more taxes than the latter who has a

small family. So this is unjustifiable.

c. Income as the Basics

Most of the economists are of the opinion that income should be the basis of measuring a

man's ability to pay. It appears very just and fair that if the income of a person is greater than

that of another, the former should be asked to pay more towards the support of the

government than the latter. That is why in the modern tax system of the countries of the

world, income has been accepted as the best test for measuring the 'ability to pay' of a

person.

Concept of Economic Development

Economic growth deals with an increase in the level of output, but economic development

is related to an increase in output coupled with improvement in the social and political

welfare of people within a country. Economic development refers to “a policy intervention

effort targeted at the economic and social wellbeing of people. The focus of economic

development is on improvement in the quality of life of people, introduction of new goods

and services using modern technological, mitigation of risk and dynamics of innovation

and entrepreneurship” (Hadjimchael, Kemeny & Lanadan, 2014). 'Economic development'

is a term that practitioners, economists, politicians, and others have used frequently in the

20th century. The concept, however, has been in existence in the West for centuries.

Modernization, Westernisation, and especially Industrialisation are other terms people

have used while discussing economic development. Economic development has a direct

relationship with the environment.

A country's economic development is usually indicated by an increase in citizens' quality of

life. 'Quality of life' is often measured using the Human Development Index, which is an

economic model that considers intrinsic personal factors not considered in economic

growth, such as literacy rates, life expectancy, and poverty rates. Having economic growth

without economic development is possible. Economic growth in an economy is

demonstrated by an outward shift in its Production Possibility Curve (PPC). Another way

to define growth is the increase in a country's total output or Gross Domestic Product

(GDP). It is the increase in a country's production.

In general context, economic development is the growth of the standard of living of a

nation's people from a low-income economy to a high-income economy, moving the poor

put of the poverty level. When the local quality of life is improved, there is more economic

development. “It is a process whereby the people of a country utilize the available resources

in such a way that the per capita income of the country increase”. This implies that the

17

Taxation For Economic Development

people in a country becoming wealthier, healthier and with a longer average life expectancy

following improved productivity, higher literacy rates, and better public education.

In real terms, economic development is measured by the Human Development Index

(HDI), which the United Nations Development Programme (UNDP) (2014) described as “a

composite measure of long-term progress in three basic areas of human development

namely: access to safe and healthy life, access to education and a decent living standard”.

“It is a process by which a nation improves the economic, political and social well-being of

its people.” UNDP (2014) went further to explained that HDI “is an index that measures key

dimensions of human development which are: A long and healthy life-measured by life

expectancy, a decent standard of living-measured by Gross National Income per capita

adjusted for the price level of the country”.

The aforementioned measures of economic development and the key features of Human

Development Index (HDI) justify the adoption of the variable as proxy for economic

development in this study. The implication is that if government faithfully and

purposefully channels tax revenues to socio-economic projects, it is transcending to a

higher standard of living among the citizens.

Economic Development Goals

The development of a country has been associated with different concepts but generally

encompasses economic growth through higher productivity, political systems that

represent as accurately as possible the preferences of its citizens, the extension of rights to

all social groups and the opportunities to get them and the proper functionality of

institutions and organizations that are able to attend more technically and logistically

complex tasks (i.e. raise taxes and deliver public services). These processes describe the

State's capabilities to manage its economy, polity, society and public administration.

Generally, economic development policies attempt to solve issues in these topics.

With this in mind, economic development is typically associated with improvements in a

variety of areas or indicators (such as literacy rates, life expectancy, and poverty rates), that

may be causes of economic development rather than consequences of specific economic

development programs. For example, health and education improvements have been

closely related to economic growth, but the causality with economic development may not

be obvious. In any case, it is important to not expect that particular economic development

programs be able to fix many problems at once as that would be establishing

unsurmountable goals for them that are highly unlikely they can achieve. Any

development policy should set limited goals and a gradual approach to avoid falling victim

to something Prittchet, Woolcock and Andrews call 'premature load bearing' (Pritchett,

Woolcock & Andrews, 2013).

18

Taxation For Economic Development

How Economic Development Works

Now we know that the goal of economic development is to improve the well-being of

everyone, irrespective of race, background or class, but how does it actually work?

As Britannica.com points out, there is no single definition of what constitutes the process of

economic development. But there are key indicators and learnings that have shown

success. It might sound like a pretty big project to try to improve the social and political

well-being of a country through economic strategies, and it is. That's why it's important to

not try to solve it all at a national or international level, but at the local and regional levels.

As Michael Porter, a professor at the Harvard Business School puts it: “While macro policies

and regulatory reforms set important conditions for growth and access to opportunity, it is

ultimately the role of local and regional actors and institutions to address the unique

market failures and opportunities in their community.” This is why local and regional

economic development organizations are so vital. Every metropolitan area has its own

unique set of circumstances, and there's no blanket approach that will work across the

diverse economic landscape of a country like the United States (or anywhere else, for that

matter).

Denver's challenges in providing affordable housing, for example, are going to be much

different than in New York City. Construction costs are different, timelines will vary based

on weather, and managing relationships between private and public sectors will be subject

to unique regional policies.

Economic Development Policies

In its broadest sense, policies of economic development encompass two major areas:

i. Governments undertaking to meet broad economic objectives such as price

stability, high employment, and sustainable growth. Such efforts include monetary

and fiscal policies, regulation of financial institutions, trade, and tax policies.

ii. Programs that provide infrastructure and services such as highways, parks,

affordable housing, crime prevention, and K–12 education.

iii. Job creation and retention through specific efforts in business finance, marketing,

neighborhood development, workforce development, small business

development, business retention and expansion, technology transfer, and real

estate development. This third category is a primary focus of economic

development professionals.

Development Indicators and Indices

There are various types of macroeconomic and sociocultural indicators or "metrics" used by

economists and geographers to assess the relative economic advancement of a given region

or nation. The World Bank's "World Development Indicators" are compiled annually from

19

Taxation For Economic Development

officially recognized international sources and include national, regional and global

estimates.

a. GDP Per Capita: Growing Development Population

GDP per capita is gross domestic product divided by midyear population. GDP is the sum

of gross value added by all resident producers in the economy plus any product taxes and

minus any subsidizes not included in the value of the products. It is calculated without

making deductions for depreciation of fabricated assets or for depletion and degradation of

natural resources.

b. Modern Transportation

European development economists have argued that the existence of modern

transportation networks- such as high-speed rail infrastructure constitutes a significant

indicator of a country’s economic advancement: this perspective is illustrated notably

through the Basic Rail Transportation Infrastructure Index (known as BRTI Index) and

related models such as the (Modified) Rail Transportation Infrastructure Index (RTI).

c. Introduction of the GDI and GEM

In an effort to create an indicator that would help measure gender equality, the UN has

created two measures: the Gender-related Development Index (GDI) and the Gender

Empowerment Measure (GEM). These indicators were first introduced in the 1995 UNDP

Human Development Report.

i. Gender Empowerment Measure

The Gender Empowerment Measure (GEM) focuses on aggregating various indicators that

focus on capturing the economic, political, and professional gains made by women. The

GEM is composed of just three variables: income earning power, share in professional and

managerial jobs, and share of parliamentary seats.

ii. Gender Development Index

The Gender Development (GDI) measures the gender gap in human development

achievements. It takes disparity between men and women into account in through three