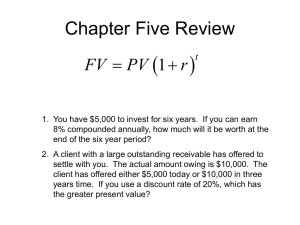

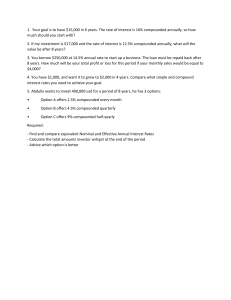

The time value of money concept ✓ also called the time preference for money ✓ value of money is time dependent ✓ value of a unit of money is different in different time periods ✓ one dollar today is worth more than one dollar tomorrow!!! ➢ value of a sum of money received today is > its value received after some time ➢ conversely, a sum of money received in future is < valuable than it is today ➢ shows that, all things being equal, it is better to have money now than later ✓ Why does one dollar today worth more than one dollar tomorrow? ✓ Why? ➢ consumption preference – a strong preference for immediate rather than delayed consumption ➢ inflation – erodes purchasing power of money (value decreases with time) ➢ uncertainty (risk) – default risk (‘a bird in the hand’) ➢ investment opportunities – cash received today can be invested to earn income ✓ interest ➢ compensation/cost of paying money in the future ➢ simple interest – payable only on the principal amount ➢ compound interest – payable on both principal & interest earned but not paid ➢ compounding period – number of times interest is accrued/payable in a year ❖ e.g., compounded annually, semiannually, quarterly, monthly, daily, etc. ✓ time line – a time frame to visualize issues related to the concept of time value of money ✓ symbols ➢ P = also called principal/amount of money loaned/borrowed now/today ➢ y = number of years P will be outstanding ➢ c = number of times interest is accrued/payable in a year (frequency) ➢ r = interest rate per period = annual interest rate/c ➢ n = number of periods P will be outstanding = (y) x (c) ➢ I = amount of interest per n a) simple I = (P) x (r) x (n) b) compound = P x (1+r)n ➢ M = amount to be collected/paid after n periods = P + I Note that r & n should be expressed in the same time measure (e.g., month) ✓ Time line Period (e.g., y) 0 Cash P 1 2 3 4 M Examples-1 On January 1, 2022, Mr. Ali deposited Birr100 in a bank saving account that pays 12% interest compounded monthly. He kept the money for 2 years. a) How much is the principal? b) How much is interest rate per year? c) How frequent does the bank pay interest per year? d) How much is interest rate per month? e) For how many periods will the money stay at bank? f) Calculate simple interest for 2 years. g) Calculate compound interest for 2 years. h) How much money will Ali get at the end of the second year of deposit? Periods (e.g., y) 0 P=1,000 4 FVp=? Example-2 On January 1, 2020 MCC Co deposited Br. 10,000 cash in a bank account that pays 12% interest. Determine the sum to be accumulated in the account after 2 years if interest is compounded a) annually? b) quarterly? c) monthly? d) continuously? Answer: P = 10,000 c=4 y=2 n=2*4=8 r = 12%/4 = 3% FVp=? In example-2 above, how long it will take MCC to double its Br 10,000 deposit with 12% annual interest rate and interest rate paid a) annually? b) quarterly? Periods (e.g., y) 0 PVp=? 4 FV=1,000 Example-3 What is the value today of Br. 10,000 to be received after 2 years if the market interest rate is 12% compounded a) annually? b) quarterly? c) monthly? Answer: M = 10,000 c=4 y=2 n=2*4=8 r = 12%/4 = 3% PVp=? ✓ Annuities – a finite series of equal cash receipts/payments at equal intervals of time with fixed interest (discount) rate ➢ fixed equal payment per period (R) ➢ fixed equal time interval between payments i.e., equal periods (n) ➢ fixed equal interest rate per period (r) ✓ Two types ➢ Ordinary annuity – due at the end of each period Periods (e.g., y) 0 Annuities (Rs) 1 2 3 4 100 100 100 100 4 ➢ Annuity due – due at the beginning of each period Periods (e.g., y) 0 1 2 3 Annuities (Rs) 100 100 100 100 ✓ Definition ➢ a sum to which a series of end of period deposits (R) will grow 0 1 2 3 4 100 100 100 100 FVAo=? Example-4 Ali plans to deposit Br. 500 at the end of each of the next four years in a bank account that pays 12% interest compounded annually. How much will be the balance of the account at the end of year-4? Answer: R = 500 c=1 y=4 n=1*4=4 r = 12%/1 = 12% FVAo ✓ Definition ➢ a sum that must be invested now to guarantee a desired series of payments (R) at the end of each future period 0 1 2 3 4 100 PVAo=? 100 100 100 Example-5 On January 1, 2020 BAC Co purchased equipment by signing a note promising to pay Br. 10,000 at the end of each of the next five years starting December 31, 2020. What is the cost of the equipment today if the market interest rate is 10% compounded annually? Answer: R = 1,000 c=1 y=5 n=1*5=5 r = 10%/1 = 10% PVAo ✓ Definition ➢ a sum to which a series of beginning of period deposits (R) will grow 0 1 2 3 4 100 100 100 100 FVAd=? Example-6 Ali plans to deposit Br. 500 at the beginning of each of the next four years in a bank account that pays 12% interest compounded annually. How much will be the balance of the account at the end of year-4? Answer: R = 500 c=1 y=4 n=1*4=4 r = 12%/1 = 12% FVAd ✓ Definition ➢ a sum that must be invested now to guarantee a desired series of payments (R) at the beginning of each future period 0 1 2 3 100 PVAd=? 100 100 100 4 Example-7 On January 1, 2020 BAC Co purchased equipment by signing a note promising to pay Br. 10,000 at the beginning of each of the next five years starting December 31, 2020. What is the cost of the equipment today if the market interest rate is 10% compounded annually? The present value of an annuity that pays A dollars at the end of each of the next ‘t’ years, assuming a constant interest rate ‘r’ compounded continuously, is: To calculate the present value of an annuity which pays A dollars a year forever, compounded continuously, is: Example-8 An investment offers a perpetual cash flow of Br. 1,000 every year. The required rate of return on similar investment is 8%. a) What is the value today of the investment if interest is compounded annually? b) What about future value of the investment? Assuming a 10 percent interest rate compounded continuously, what is the present value of annuity that pays $500 a year a) for the next five years, b) forever? Example-9 BAC Co purchased a multipurpose equipment promising to pay Br. 10,000 at end of each of the next five years starting December 31, 2020. The company has also agreed to increase the payment by 5% each year. How much is the cost of the equipment if the market interest rate is 8% compounded annually? Example-10 BAC Co is planning a fund for purchase of multipurpose equipment. It will deposit Br. 10,000 at the end of each of the next five years starting December 31, 2020. The company plans to increase each yearly deposit by 5% to accommodate for price increase over the coming five years. How much will be the balance of the fund at the end of the 5th year if the market interest rate is 8% compounded annually? Example-11 BAC Co purchased a multipurpose equipment promising to pay Br. 10,000 at end of each year starting December 31, 2020 for indefinite period. The company has also agreed to increase the payment by 5% each year. How much is the cost of the equipment if the market interest rate is 8% compounded annually? Example-12 BAC Co received the following interest offers from three different banks. Which of these is the best if you are thinking of opening a savings account? Which of these is best if they represent loan rates? Bank A B C Nominal interest 11% compounded daily 11.5% compounded quarterly 12% compounded annually EAR 11.63% 12.01% 12.00% 4. Finding R (regular payment) Example-13 BAC Co is planning to accumulate Br.100,000 over the coming five years to purchase multipurpose equipment. Determine the amount the company must accumulate at the end of each year if the market interest rate is 8% compounded annually. Answer: FVAo=100,000 c=1 r=8%/1=8% n=5years *1=5 R=? 5. Finding n (number of regular payments) Example-14 BAC Co is planning to accumulate Br.100,000 to purchase a multipurpose equipment. Determine number of yearly deposits of Br.17,046 which the company must make at the end of each year if the market interest rate is 8% compounded annually. Locate 5.8665 in the FVAo table under r=8% and its corresponding n value to the left 6. Finding r (interest rate per period) Example-15 BAC Co purchased an equipment for Br.100,000 on credit. It promised to pay Br.15,600 at the end of each of the coming 10 years. Determine the interest rate per period, if it is compounded annually. Locate 6.4103 in the PVAo table under n=10 and its corresponding r value at the top Example-16 An investment will pay Br.1,000 at the end of each of the next 3 years, Br.2,000 at the end of Year 4, Br.3,000 at the end of Year 5, and Br.5,000 at the end of Year 6. If other investments of equal risk earn 8% annually, what is this investment’s present value? Its future value? 8. Deferred annuity ✓ Definition ➢ an annuity where payments (R) are delayed until a certain period has elapsed ➢ usually it has two stages, namely, accumulation and payment stages Start of deferred annuity Single payment (P) End of deferred annuity Deferred period Accumulated stage FV of P nR R payment stage FV = 0 Example-17 ABC Co wants to invest an amount of money today (January 1, 2000) such that its employees can receive Br.5,000 at the end of every month for 10 years when they retire from work. If the initial investment can earn 9% compounded annually until December 31, 2010 and then 6% compounded interest when the fund starts paying out on January 31, 2011. How much money must the company invest today? Given: 5. PVAo = FV of single sum = 5,000[(1-(1/((1+0.005)^120))]/0.005 Ordinary annuity year=10 = 450,367.27 Single sum year = 11 FVp = 450,367.27 Annual interest rate – single sum = 9% PVp = 450,367.27/[(1+0.09)^11] Annual interest rate – ordinary annuity = 6% = 174,532.11 6. Compounding period – single sum = 1 7. Compounding period – ordinary annuity = 12 8. r – single sum = 9%/1=9% 9. r – ordinary annuity = 6%/12= ½ % 1. 2. 3. 4. R=5,000 10. n – single sum = 11*1=11 11. n – ordinary annuity = 10*12=120 12. P=? 1. If the interest rate is 10% how much money would one need to receive now to be equivalent to $1 million received two years from now if: 2. a) Interest is compounded annually? b) Interest is compounded semiannually? c) Interest is compounded monthly? d) Interest is compounded continuously? Suppose that the interest rate (r) is such that the present value of receiving $V2 in t2 years from now is the same as the present value of receiving $V1 in t1 years from now, t2 > t1. Assume that interest is compounded annually. a. Show that V2 > V1. b. Show that the present value of receiving $V2, (t2 + k) years from now is also equal to the present value of receiving $Vl, (t1+ k) years from now for any value of k. (That is, it is the absolute difference between time periods that matter.)