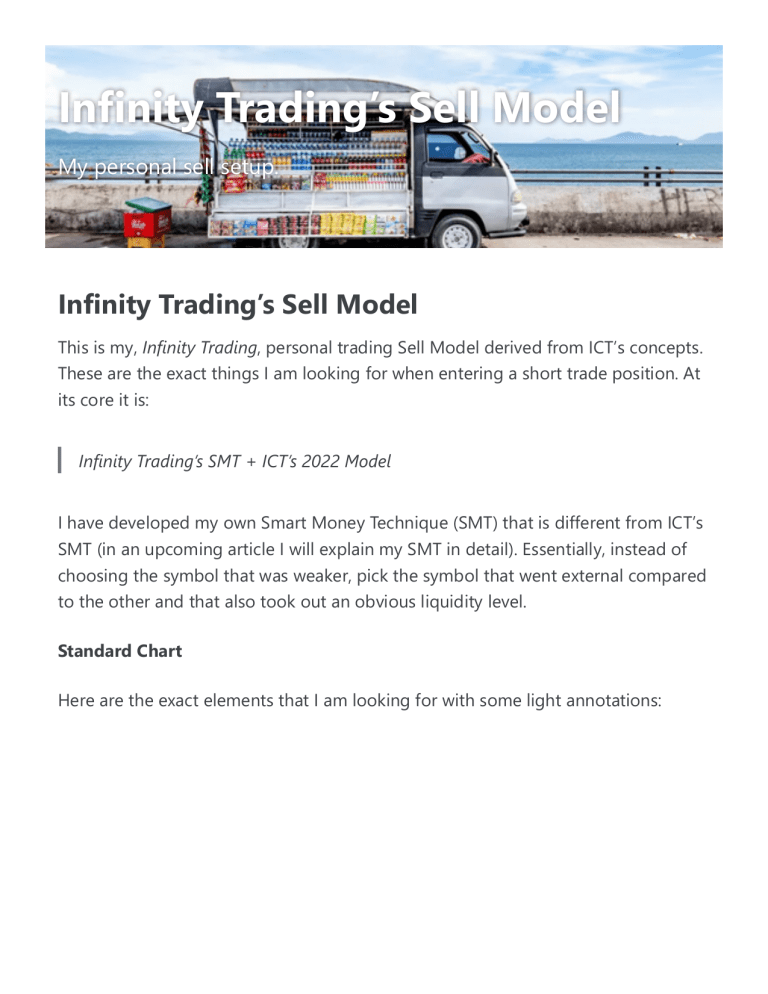

Infinity Trading’s Sell Model My personal sell setup. Infinity Trading’s Sell Model This is my, Infinity Trading, personal trading Sell Model derived from ICT’s concepts. These are the exact things I am looking for when entering a short trade position. At its core it is: Infinity Trading’s SMT + ICT’s 2022 Model I have developed my own Smart Money Technique (SMT) that is different from ICT’s SMT (in an upcoming article I will explain my SMT in detail). Essentially, instead of choosing the symbol that was weaker, pick the symbol that went external compared to the other and that also took out an obvious liquidity level. Standard Chart Here are the exact elements that I am looking for with some light annotations: Annotated Chart Here is the ordered step-by-step process with detailed explanations: Steps: 1. Obvious buyside liquidity (15min or daily) is taken out 2. SMT Divergence: pick either ES/NQ based on which went higher than the other AND took out obvious liquidity. If no SMT (ES & NQ in sync) then pick the one with the most clear price action. 3. A swing low forms AFTER the highest swing high that took out liquidity (The displacement in Step 4 makes the swing low a Market Structure Shift) 4. Fair Value Gap forms: a three-bar pattern where the first and third candles do not overlap. The FVG candles must have obvious and energetic displacement. ◦ One of the candles in the FVG must be exactly horizontal to the swing low MSS 5. Draw a 50% Fibonacci level from highest swing high (that took out liquidity) to the swing low below the FVG candles. The FVG is valid if the “gap” is at least on the 50% level or above it 6. If all the above steps are true, place a limit sell order inside the FVG and wait for price to come to your entry. Place stop loss above highest high Fibonacci 50% line Why is the Fibonacci 50% line important in ICT’s 2022 Model? Because the entire purpose of the Fair Value Gap (FVG) is to get a “fair value”. But how do you know you are getting a fair value? The Fibonacci 50% line, drawn from the high/low that took out liquidity to the low/high on the other side of the FVG, is on the gap in the FVG or is closer to the liquidity swing high/low. In the example below there was a FVG with displacement but it was on the wrong side of the 50% Fibonacci line. Therefore, it wasn’t a fair value and was not a MSS because price continued to go higher. (https://www.tradingview.com/x/nYRUARId/) Examples (https://www.tradingview.com/x/nLasSTIo/) My exclusive TradingView indicators (always 100% open source and free): • Futures Exchange Sessions 3.0 (https://www.tradingview.com/script/KLz4wKJm-FuturesExchange-Sessions-3-0/) Just • • Released! - pick the start & end times of the dynamic time boxes Streamer Watermark (https://www.tradingview.com/script/Dz0Nz25E-Streamer-Watermark/) makes charts look so fresh and so clean, clean Futures Exchange Sessions 2.0 (https://www.tradingview.com/script/XiyhP5gQ-FuturesExchange-Sessions-2-0/) - displays futures sessions as live dynamic boxes by time and price • Futures Exchange Sessions (https://infinity-trading.io/tv-charts/futures-exchange-sessions/) worldwide futures times, liquidity levels, time levels, and much more! • Intraday Power 3 Visual (https://infinity-trading.io/tv-charts/intraday-power3-visual/) - displays ICT’s Power 3 concept on the daily timeframe Tags: article Updated: August 1, 2022