Jumma Masjid Mercara Case Comment: Property Law Analysis

advertisement

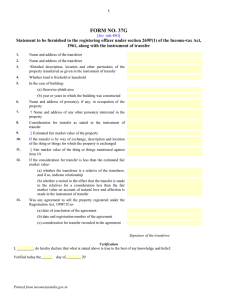

KIIT SCHOOL OF LAW CASE COMMENT ON JUMMA MASJID MERCARA VS. KODIMANIANDRA DEVIAH NAME: ABHIJIT MOHANTY ROLL NO: 2182003 COURSE: BBA LLB SECTION: A SUBJECT: Property Law CODE: LW 3019 SUBMITTED TO: MR. AKSHAT GAUTAM 1 JUMMA MASJID MERCARA VS. KODIMANIANDRA DEVIAH AIR 1962 SC 847: CASE SUMMARY Appellant: Jumma Masjid, Mercara Respondent: Kodimaniandadra Deviah The individuals passed away on the specified dates as indicated in the chart. Nanjundappa passed away in 1907, and his widow Ammakka, who survived him, subsequently passed away in 1910. Similarly, Basappa passed away in 1901, and his widow Gangamma outlived him. Introduction: The legal landscape often encounters complex property disputes, and one such intriguing case involves the Appellant, Jumma Masjid, Mercara, and the Respondent, Kodimaniandadra Deviah. At the heart of the matter is a property transfer that took place under circumstances that raised questions about misrepresentation, legal complexities, and the application of Section 43 of the Transfer of Property Act, 1882 (TPA). This in-depth analysis explores the multifaceted aspects of the case, examining key facts, legal concepts, court observations, and the final verdict. Overview of Facts: 2 The genesis of the dispute lies in the possession of a property initially held by Gangamma following the demise of several joint family members. As the next reversioners, Bassappa, Mallappa, and Santhappa emerged, representing themselves as the rightful owners. In a pivotal turn of events, these three individuals orchestrated the sale of the property to Ganapathi, who, unbeknownst to him, believed he was acquiring the property from its legitimate owners. Subsequently, Gangamma contested Ganapathi's claim, asserting her right to the properties based on the argument that they were the self-acquisitions of her late husband, Basappa. The legal proceedings became further complicated with the passing of Gangamma. Amid this legal quagmire, Basappa sought the transfer of the property in his name from the Revenue Authorities. At this juncture, Jumma Masjid, Mercara, entered the scene, asserting its claim to the properties based on two grounds. Legal Concepts: 1. Section 43 of TPA, 1882: - Section 43 addresses situations where a person falsely represents that they are authorized to transfer certain immovable property. - At the option of the transferee, the transfer operates on any interest the transferor may acquire in the property during the subsistence of the transfer contract. - The section also includes the Rule of Estoppel. 2. Rule of Estoppel: - This rule prevents a person from later claiming incompetence as an excuse after making a promise that exceeds what they can perform or is incapable of performing. - In the context of property transfer, if an unauthorized person represents that they have the authority to transfer a property and the transferee, acting on this representation, provides consideration, the transfer is deemed inoperative. However, if the transferor later acquires the property, the transferee is entitled to it under Section 43. Issue: The central issue, in this case, revolves around whether the transfer of property made by individuals representing themselves as owners but possessing only a spes successionis (expectation of succession) is within the protection of Section 43 of the TPA, 1882. 3 Observations and Legal Analysis: The court, while elucidating the significance of Section 43, made it clear that it applies whenever a person transfers property without having title but falsely represents having a present and transferable interest therein. In such cases, if the transferee takes the transfer for consideration and the conditions specified in Section 43 are satisfied, the transferee becomes entitled to the property the transferor subsequently acquires. Addressing the contention by the appellants (Jumma Masjid) that the sale was void under Section 6(a) of the TPA, the apex court observed that Sections 6(a) and 43 pertain to different subjects, and there is no inherent conflict between them. Section 6(a) deals with certain kinds of property interests and prohibits the transfer of those interests. In contrast, Section 43 deals with representations as to title made by a transferor who had no title at the time of transfer, and it provides that the transfer shall fasten itself on the title the transferor subsequently acquires. Section 6(a) is a rule of substantive law, while Section 43 is a rule of estoppel and falls under the category of evidence. The court emphasized that where the transferee knew as a fact that the transferor did not possess the title claimed, Section 43 would have no application, and the transfer would fail under Section 6(a). Importantly, the court clarified that the rule of estoppel does not apply to cases where the competency of the party to contract is in question. In other words, the doctrine of estoppel does not come into play when the issue is the capacity of the party to enter into a contract, as opposed to the title of the property. Court decision: The court concluded that when a person transfers property, representing a present interest while having only a spes succession, the transferee is entitled to the benefit of Section 43 if they took the transfer on the faith of that representation and for consideration. In this case, Ganapathi, who acquired the property in good faith and without knowledge of the true ownership dynamics, was deemed entitled to the property under Section 43. The apex court further affirmed the decisions of the lower courts, upholding Ganapathi's title. This ruling clarified the application of Section 43 in cases where a transferor falsely represents ownership, and the transferee, acting in good faith, relies on such representations. 4 Conclusion: The case involving Jumma Masjid, Mercara, and Kodimaniandadra Deviah provides a comprehensive illustration of the legal intricacies surrounding property transfers, misrepresentations, and the application of Section 43 of the TPA, 1882. It underscores the importance of good faith in property transactions and the consequences of misrepresentations by transferors. The court's nuanced interpretation of Sections 6(a) and 43 establishes a clear legal precedent, emphasizing the role of estoppel in cases where unauthorized transfers occur. Ultimately, the court's decision aligns with the principles of equity and fairness, ensuring that a transferee who acts in good faith and without knowledge of the transferor's lack of title is not unjustly deprived of the acquired property. This case serves as a reminder of the complexities inherent in property transactions and the need for a robust legal framework to address issues arising from misrepresentations and unauthorized transfers. It reinforces the significance of Section 43 in protecting bona fide transferees and upholding justice in property disputes. 5